But as you can probably guess, there is a reason for such silliness – I finally booked EUROTRIP! And I didn’t want to dip into our cash savings ;)

Financially it’s not that smart because we’ll now be accruing a few dollars in interest fees, but I’m totally cool with that. I know myself well enough that if I just xfer cash from one spot to another I won’t work as hard to get that money back. But if it’s on our credit cards for all to see, you better BELIEVE we’ll be focused to get rid of it ASAP! :) I don’t recommend this for those who have trouble managing their cards, but for us it works. I know it’s temporary and that it will be cleared away in 2-3 months, if not sooner.

That’s the biggest difference in Feb’s net worth update. The rest has to do with me throwing 90% of my paychecks into 401(k) and just waiting for it to hit. It’s kinda off-balance right now and makes us look all spendy-spendy, but I assure you that’s definitely NOT the case ;)

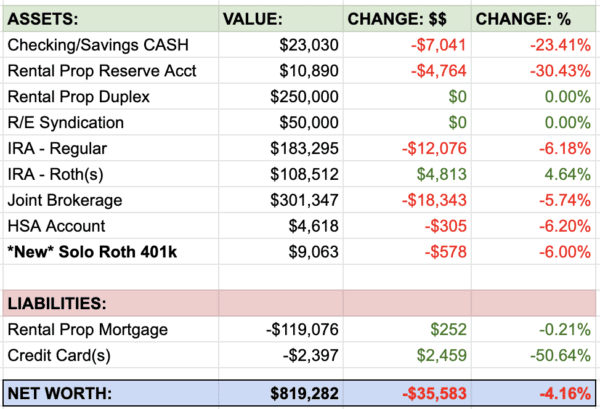

Net Worth break down: February, 2010

CASH SAVINGS (-$1,984.48): Still getting my $75 paychecks until I max out my 401(k) for the year! When your company matches 100% up to 100% of your contributions (up to the legal match), it tends to change the way you invest ;)

EMERGENCY FUND ($0.00): Same $10,000 this month as it was last month, and the month before, and the month before that. I think we’re rolling on 2 years of having this $10k fund, haha… The good thing about reaching your goal here is that you can then concentrate on all the others you’ve got brewing!

ROTH & TRADITIONAL IRAs ($373.40): Just the market doing its job here, we haven’t increased any extra funding this year yet. We’ll do that once the 401(k) is maxed out.

401(k)s ($2,624.50): Nice to see it up again! And one day soon it’ll be even BIGGER once all my deposits hit (I can barely contain myself!). It’s so crazy to me, though, that you can do absolutely nothing and your investments can ear $2.5k just like that. Of course, last month it lost $5k “just like that” but you get what I’m saying. Your money is out there working for you even while you sleep :)

AUTOS WORTH (kbb) (-$75.00): A little more off the ol’ car values, but nothing unexpected. MUCH better than back in the day when my SUV was losing $900 a month! Bleh… Here’s where our car values stand right now:

- Pimp Daddy Caddy: $2,995.00

- Gas Ticklin’ Toyota: $8,885.00

HOME VALUE (Realtor) ($0.00): This will remain @ $300k (the price our realtor set it at) until I hit him up later for another review. He’s the master in our particular neighborhood, and has been selling (and living) in this area for 20+ years. I keep an eye on Zillow & Redfin.com as well, but they fluctuate so much that I never can tell what’s real and what’s hype.

CREDIT CARDS(-$2,480.20) : No longer at zero! But one day soon ;) As I mentioned in my summary up at the top, we put our 10-day Eurotrip package on our credit card instead of paying in all cash. We lose a little with the interest charges, but it’ll motivate me a lot more knowing it’s up there for everyone to see. (don’t try this at home, kiddies…)

MORTGAGES (-$4.48): We stopped paying off principal to deal w/ the above, and have already paid $400 of it off! It doesn’t bode well for this section of our net worth, but we’ll be back to chip away at it soon enough. As for refinancing, we’re still pretty much screwed on it. Here’s the breakdown:

- Mortgage #1: $286,818.64 – 30 year fixed, interest-only @ 6.875%.

- Mortgage #2: $62,554.62 – Maxed out HELOC w/ 2.8% interest.

—————–

*My budget has now been updated.

**And so have my sidebars. And my excitement for Zoolander II

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

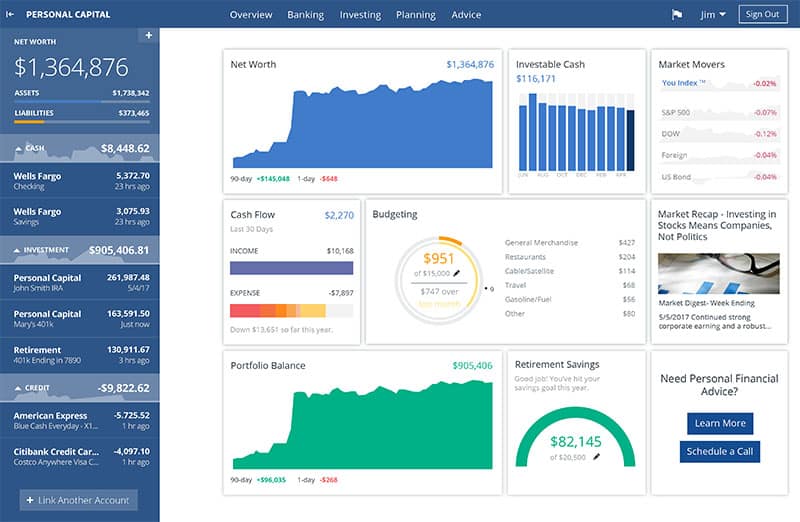

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

ooooo Europe! You're going to have so much fun!!!!

I am working on the last $1800 of my consolidated loan. If the good fairy smiles on me a couple dif ways, I could be done paying this one off around March 30th of this month. wheeeee

"We lose a little with the interest charges" how? if you pay the balance in full when the bill arrives, there shouldn't be any loss!

Man, everyone is going on vacation except me. Granted, I'm 9 months pregnant, but I'm still jealous.

With you throwing 90% of your paycheck into your 401Ks…(and boy are you gonna be livin large in your 70s!), how do you meet your day-to-day expenses without touching your E-fund?

I'm actually confused as to why you choose paying interest fees over taking from savings and then paying yourself back… Why wouldn't that be just as motivating?

Yeah, I don't understand why its a good thing to be motivated to stop paying extra toward mortgage principal to pay to a credit card instead, and how that is not just a "transfer of cash from one spot to another".

If this is how you're going to do things you should just go ahead and invest all of your cash savings and emergency fund and not lose out on the opportunity cost of it not being in the market (the only reason I "pay" this opportunity cost and keep it in cash is so I don't have to revert to credit cards if/when the time comes I need it).

Yay for Europe, have fun! I know you'll pay yourself back ASAP.

Congratulations on booking your trip to Europe!

I'm frugal in most areas of my life, but I always leave room in the budget for travel; and in my experience, it's been money very well spent!

OOOh, J's got credit card debt. I'm telling your Mama! Just kidding dude, no big deal, you'll knock that out in no time.

@Jolie – You can do it!!!

@Anonymous – I already know I won't pay it off in full this month, so that's why we'll have interest charges. All other times though I pay off 100% :)

@Mama Geek – Woah, congrats!!! You'll have an adventure of your own here soon ;)

@Investing Newbie – I'm pulling my day-to-day expenses out of my personal savings account that I stored up the last 3-4 months of '09. Since I'm now used to living off less every month, whenever I get a FULL paycheck I can store a good $400-$700 away. So once I max out again this year, I'll go back to those full paychecks and to putting more away into savings again. If, of course, all goes as planned – you know how crazy life can get!

@Budgets are the New Black – If I just xfer out money it's as if nothing ever happened in my eyes. But seeing that large # on my credit card like that reminds me that I now have to pay it off and work extra hard to do so. It's just the way I'm wired, I guess :)

@Anonymous (2) – It's just the way that makes the most sense for me. If I invest all our extra cash into the mortgage, stocks, etc, I lose all my options (you can't take out all the money you plow into your mortgage). The lost opportunity costs aren't that important to me here – the safety net is (even if it's all in my mind).

@Sallie's Niece – Thanks!!! We don't leave until May but I'm crazy excited :) Working towards paying it off by then!

@Frugillionaire – Hell yeah, you know how it is! Traveling really opens your eyes as to how the rest of the world lives, I love it.

@Single Guy Money – Haha…if you told my mom she's probably say I was crazy ;) Which is why I'm not telling her…

Confused. Why is your goal to max out your 401K in just a few months as opposed to dividing the $16.5K maximum by your annual # of paychecks and having that amount deducted from EACH paycheck throughout the year? Is there a benefit to doing it the feast/famine method you are using?

That's a great question actually. To be honest, in "normal land" I'd break it up over the year, but w/ this economy I just never know if this benefit will end, ya know? So by working it in super fast and early, I know I'll maximize the rewards in case something happens.

Also, and this is more of a personal opinion, I feel like the markets are going to rise by the end of the year. So the more I invest now, the better ;) But who knows what lies ahead, all I know is that I should max out this opportunity while I can…

Stupid budget question..regarding your spreadsheet above.. Do you keep a separate tab for each month or just update the same 'month' tab? Just curious..

Well, I wouldn't exactly call it juicy but, hubby is just finishing up his second quarter of grad school and everything is paid in full so far!

Trina

Wait… there is going to be a Zoolander 2???

You are going to have so much fun. I hope you blog about it after because I really want to go to Europe I'm just not sure how much it really costs. I better start saving after my vacay this month!

@Anonymous – Not a stupid question :) I keep every month as a separate tab so I can easily track my progress over time, and usually hold 1-2 years worth per spreadsheet (or google doc in this case).

You can find my entire budget filled in here if it helps:

J's Budget (Google Doc)

@Trina – Excellent! That's pretty impressive, I hope every quarter gets taken care of like that :) Although no shame in taking out school loans if need be.

YUP! Zoolander II baby!!!! cannot wait :)

@JB – it can be as cheap or expensive as you want it really, just depends on how you want to live it up over there ;) i've gone for under $400 a week (crazy air tickets and $10/night hostels), but this time we're going to stay in nice places…probably going to be a few Gs but it's all good. 12 of us going! I'll blog all about it I'm sure :) Start saving for yours!

Interesting strategy with the 401k – hard to argue with free money though!

EUROTRIP should be a blast! I did something similar with our recent Disney trip. I charged the trip to our credit card and paid it off when we returned (and before the bill was due). No interest, and the cash back rewards paid for our Mickey ears!

I'm considering scaling back my emergency fund to $10k as well because I'd like to do more investing with the money above that. How many months of expenses does that $10k represent for your household?

Oh yeah, mad cash back rewards for that! I actually forgot we get the same so thanks for the reminder ;)

$10k will last about 3 months in our household, maybe a little less depending on why we're living off it :) We should probably get it up to $20k, but we have so much other savings in both our "do as we please" accounts so we still have that extra padding. Unless, of course, we just do whatever we want with it and then don't fill it back up! haha…

Oh yeah, mad cash back rewards for that! I actually forgot we get the same so thanks for the reminder ;)

$10k will last about 3 months in our household, maybe a little less depending on why we're living off it :) We should probably get it up to $20k, but we have so much other savings in both our "do as we please" accounts so we still have that extra padding. Unless, of course, we just do whatever we want with it and then don't fill it back up! haha…

Knowing yourself is important! We did a similar thing for our vacation this year, we put it on the credit cards (worked out to give us rewards for the vacation itself too!) and paid it right away from a general savings fund, rather than our vacation fund.

The thinking behind it was that I would be much more motivated to replace the money in the general savings fund as I hate when it gets low and could probably replace it by the time we return from the vacation. But if I dumped out the vacation fund, I would think about how I have all year to replace it, and not save as much, and then have this mad dash at the end of the year.

This way by the time we return from the vacation if things stay on track:have the vacation paid off, we'll replace the general savings fund,and the vacation fund will be intact for use next year.

I think some people wonder why I don't just leave the general savings alone, empty the vacation fund and replace it slowly, but I just know I won't do that and it'll hurt our interest as well as give me less money for savings projects later in the year.

Are we twins?! I know exactly what you mean :) that's why it's important to do whatever's best for YOU. all this finances stuff is wonderful and great, but if you don't cater it to your own personal situation it can work against ya.

so well done my friend!!! I enjoy hearing stories like this :)

Where in Europe are you going? I;m going to Turkey & GReece in July and I cannot wait!!!

Nice!!! I think we’re going to Prague and some other places :) LOVED Greece when I went a few years back, soak it all in!!!

I don’t get it. Why carry credit card debt when you have that in savings? For instance, we splurged and got our house painted earlier than we wanted to – the money was “borrowed” from what we were saving for a new truck. I’m just as motivated to get that truck so we’re paying extra into that pot now, and not throwing money into the wind by carrying credit card debt. Moving money from your savings into that credit card debt is the same as investing that money at the interest rate of your credit card.

yeah for sure – i know it’s the same thing, but i’m just weird in that it has to be on the credit card for me to really work on wiping it away ;) if i just xfer money from savings to checking or wherever it’s not that “real” to me. but that’s what i like about the personal aspect of financial management – we all have our own ways that work.