Guest Post by Tahnya Kristina

When two people decide to take the next step forward in their relationship and move in together, it can be very exciting. However, the merging of two homes into one also means the merging of your separate finances into one budget!

This can be a great decision for couples, or it can be a disaster. It has been reported that finances are the leading cause of divorce. Money is a sensitive subject for some individuals but unfortunately couples do not have that luxury. As a couple you share most other things, so you should also be able to share your money too! or at least be open to discuss it with your spouse.

My brain as a Financial Planner tells me to merge only the necessities to ensure an equal share in the participation of monthly expenses. There is no need to merge all of your individual money into joint accounts, just the essentials for food, shelter and related expenses. However, my heart as a girlfriend who has been with her boyfriend for 10 years, and still doesn’t have a ring on her finger (!!!), tells me to keep everything separate. If he can’t commit and sign on the dotted line for our happily ever after, then he can’t be allowed to sign on the back of my credit card.

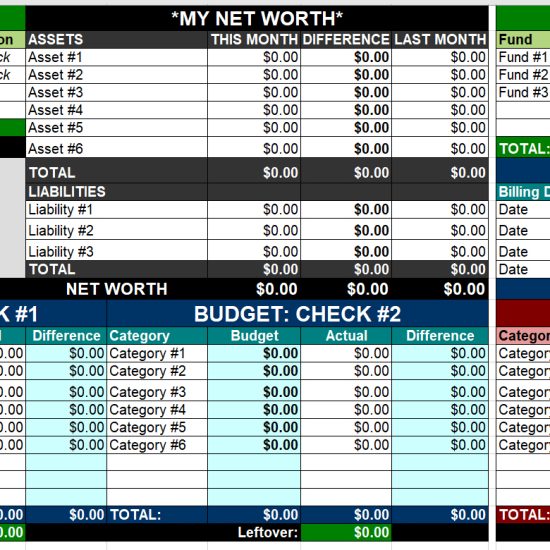

Don’t forget that even though you are in a couple you are still an individual. You should have both a personal budget as well as a budget as a couple. This will be easier to keep track of monthly expenses. First you should determine your total monthly bills as a couple. Then add those bills as an expense into your personal budget. What you have left over at the end of the month is yours to keep individually.

It is very important to include joint savings as a part of your couple’s budget. Each person should contribute an equal amount into a savings account in both names. This account is not for monthly bills but for other joint expenses such as a couple’s vacation, new furniture, or a weekly eating out budget. Budgets work best when the overall monthly goal is broken down into shorter periods of time such as a weekly or daily budget.

You don’t have to share everything in a relationship. So if one of you has more left over at the end of the month don’t be embarrassed and don’t be ashamed to spend it if you’ve got it! Of course just like any aspect of a good relationship, it is always best to be open and honest about money. If you are short one month, communicate with your partner. That is a benefit of being in a couple. You always have someone to pick you up when you trip and fall.

Another benefit of merging two budgets into one is that now you are now paying half of all the monthly expenses that you were previously paying all alone. This is an added bonus to your disposable monthly income. Unless, you are coming from your mama’s house ;) Then you will be ADDING expenses, not cutting your expenses in half!

———-

Tahnya Kristina blogs over at Dinks Finance – a personal finance blog by, and for, couples where she gets to practice her Financial Planning skills :) Tahnya also recently launched a Media and Creative Services company called Media Madam – wish her luck!

(Photo by Rose Robinson)

Get blog posts automatically emailed to you!

OK so I don’t entirely agree with this. I like the basic ideas behind it but as far as actual percentages, I think this is more of a couple discussion.

When I lived with a now ex-boyfriend, he made three times as much money as I did and owned the house we lived in. 50/50 for expenses, are you kidding? If I was paying half his mortgage, I not only couldn’t have afforded it but would have resented it since my name wasn’t on the paper. Also we were in the house because he had bought it, I wasn’t part of that choice. So an even split wouldn’t have been fair to me. What we decided was that the equivalent of 25% of my salary (ie what his last roommate paid for rent) went toward the mortgage, we split groceries, and he paid everything else. We were both fine with this arrangement.

That said, I am never living with a boyfriend again. I will live with a husband or a fiancée though. ;^) If you like it, put a ring on it!

I like it!! Great advice!

Now…if only I could find the man to really try this out one….

*sigh*

I agree in part and disagree in part.

Agreed : Separate Budgets, but plan together. My experience tells me that typically one person takes the “lead”. I might watch our budget like a hawk, but my wife collects the receipts and organizes our statements, because those are our respective strengths.

Disagree : Like Nicole pointed out, incomes in relationships can be very different. When my wife and I first started dating, she was making 3 times my income! (In my defense, I was a broke graduate student). Splitting expenses 50/50 wasn’t even mathematically possible! Both people in the couple need to have some side pot money. The same thing goes with a joint savings (assuming you are married) account…expecting 50/50 isn’t a SHOULD, its a COULD, and likely varies between couples.

Psychologically, if one member of the couple has a very different bottom line than the other, then splitting up the bills will lead to one person having alot of blow money and the other none. That will likely not bode well for the relationship.

(Also, what happens if one person stops working?)

Interesting article. We are currently dealing with this situation. Getting married, just bought a house. While we’re renting we’ve been calculating joint expense contributions by percentages of income. When we move into the house together, however, we are merging everything 100%. We will not have separate accounts. This doesn’t mean we won’t have separate discretionary income, it will just be built into our joint monthly budget.

We are merging everything because our incomes, school loan amounts, and other debts differ. Our goals, however, are the same. So for us, looking out our income and debts as one will help us achieve our mutual goals more quickly and easily. I think this works well for us because we are of similar financial mindset. I could definitely see problems arising in couples whose spending habits differ greatly.

I forgot to mention that we are budgeting for us to have equal monthly discretionary income because we feel that we are equal partners in the relationship. One may make more money than the other, or have more school debt than the other, but to us that doesn’t mean that you bring less to the table or deserve less for your hard work.

For us, looking at our finances this way really brings a team feeling to the relationship.

I agree and disagree with this post.

This is probably the the touchiest subject anyone can face in their personal finance life. I’ve had one sibling get divorced over finances, and while I’ve not moved in with a girlfriend, I have been in the spot of coming out of pocket to pay for daycare, groceries, utiliites…yes, young and dumb. ;-)

So I agree that you have to sit down and have a discussion with your significant other about your finances, and hammer out a plan that will be beneficial to you both.

My only beef… 10 years?!? But I’m going to leave that be, I don’t want no problems. ;-)

I like your take on this. I would have NEVER EVER joined any money with my husband before our marriage, but that’s just me. I wouldn’t have a joint account with anyone I wasn’t related to by blood or by law.

I agree with Nicole above. The percentages based on monthly income should be equal, not the actual contributions. Plus, communication is everything, and I mean it. Things should be talked over in gory details, otherwise surprises may follow.

As someone who spends a lot of time thinking, writing and helping young couples with marriage, I have to say that I’m a big believer in *unity* when it comes to couple/family budgeting. I think this can work fine with separate accounts (if that makes it easier to track), but I strongly believe that once your married, it all becomes “our” money and should be budgeted that way. Of course, “our” money can (and should) have some individual fun cash, but taking a united stance on your finances is one of the best ways to build a great marriage.

I actually wrote a post recently on the topic of Joint vs. Separate Accounts and Budgets in Marriage, and it generated around 80 comments so far with varying viewpoints. If you’re interested, you can check that out here: http://www.engagedmarriage.com/finances-careers/should-married-couples-have-joint-or-separate-bank-accounts

And I should add, my thoughts above only apply to *married* couples. Until you’re married, I think everything should be separate since you don’t have the legal (or spiritual) basis for combining all of your financial stuff.

Yeah, I think some people may be missing the part here that Tahnya and bf are NOT married yet – def. makes a big difference (at least I think so). But certainly everyone should manage their finances the best way that works for THEM.

Personally, Mrs. BudgetsAreSexy and I have the following set up:

1) MAIN “House” checking: Covers mortgages, utilites, groceries, maintenance, etc.

2) MAIN “House” savings: Everything that’s left over. Used for vacations, splurges.

3) PERSONAL “J. Money” account: My do-whatever-the-hell-I-want-with money ;)

4) PERSONAL “Mrs. BudgetsAreSexy” account: Her do-whatever-the-hell-she-wants-with money ;)

We’ll probably tweak it as time goes on, but this has been working GREAT for us for about 4 years now. More details here

Right on Dustin!

Those of you planning on -not- staying together, what’s the point of even moving in together much less merging your finances? And for those of you who think “well you never know,” that’s planning to not stay together. Finances should never be merged outside of marriage, and married couples should never separate their finances. I highly recommend Dustin’s blog (posted above) for those interested in getting it right.

Deacon Bradley/Dustin – You don’t think it’s cool to have a small side savings (like a “whatever” account) at all? Like, say if I want to blow $100 on baseball cards and the wife wants to buy a $400 purse? I get the importance of combining in theory, but it’s hard for me to see why having a little separated money can be that bad.

Yo J-

I definitely think each person should have some separate “whatever” money! We budget for that together and we each get an equal amount each month. We can spend that immediately or save it up for some bigger bling. ;)

The key is that it is part of our joint budget and it’s NOT pro-rated based on what we each earn. That takes the selfishness out of it and keeps it “our” money that we’re spending individually however we want.

It may seem like semantics, but I really think it’s important. A lot of couples get caught up in the “yours, mine and ours” approach and try to keep a % of “their” income. But what happens if one of you doesn’t work and stays home with your kids under that scenario?

J. Money,

That’s a great point! In an attempt to not write 1K words I did not elaborate. My wife and I each have a misc fund that’s ours for the month. The key part though is that it’s a SMALL portion of our budget. The danger is when people try to separate everything like roommates instead of spouses. Thanks for pointing that out!

That’s exactly what we’re doing! We’re eaching getting an equal amount of *our* money each month to spend on whatever we want. I don’t want him getting less money because I bring in more, and I don’t want either of us to have to ask permission from the other to buy a treat for ourselves.

i LOVE that it’s equal, though. it’s OURS. i’m not entitled to any more than him or vice versa. LOVE IT.

Communication is the key to success in any facet of a relationship. I think the main point here is that no matter your relationship status (married, unmarried, choose not to marry, can’t marry), no matter what the individual incomes are, and no matter whether you keep accounts together or separate, if you’re going to be living together, you should plan together and ensure you’re both comfortable with your joint budget. I think the actual logistics of it is really up to the two people involved. If you’re uncomfortable joining budgets 100%, don’t do it. If you would both prefer that, go for it. But you both need to talk through it, compromise until you reach an agreement, feel completely comfortable with it, and revisit it as changes need to be made.

And it’s always wise advice to live well within your means and have that emergency fund ready to go in case something happens. Whether the relationship falls apart or someone loses their job, you’ll need to readjust your expenses to fit in your new budget. That’s much easier to do if you weren’t strapped for cash to begin with or have that emergency fund to fall back on as you get back on your feet.

I’m with Dustin and Deacon on this – this is an extremely touchy issue to address. A person’s persective on combining finances in a cohabitating living arrangement is rooted in their worldview and philosophy on marriage.

Mechanically, I believe it’s essential for unmarried and engaged couples to keep their finances separate. I’ve seen boyfriends and girlfriends get wrapped up in mingling their finances and cosigning for each other on loans, then the relationship goes south and they break up. Yikes! That’s a messy web to untangle.

In a marriage, it’s essential that both spouses have a set amount of money to do with whatever they want. That amount needs to be the same and should be accounted for on the budget. This assumes that the money is being managed out of the same pot together (who cares if it comes out of one pot, so long as it’s earmarked on the budget?); division of finances breeds division in a marital relationship.

Ultimately, though, the pitfalls of co-mingling finances in a cohabitating relationship reinforce the data that shows divorce rates are higher among couples who lived together before they got married. There appears to be a statistical disadvantage to “playing house” before the commitment level changes (or at least is supposed to change) when a couple says “I do.”

So, I guess I’m with Beyonce on this, too: if you like it then you better put a ring on it.

I wouldn’t/didn’t merge a thing until the ring is on my finger and the paper is signed as God stands on as witness. But thats just me! :)

The thing that jumped out at me is that she’s been with her BF for 10 years, isn’t married and isn’t happy about it (at least that’s how I interpreted the !!!)

She may want to think about why she’s still with him….

Do the people commenting really read and then think about what they write? You don’t have to merge all of your money together, that’s not what the article is about. The two of you open a joint account, and each paycheck add the necessary amount of money to cover monthly expenses.

Some of you make it seem that your significant other is going to leave you high and dry. Sounds like some people don’t have trust in their significant other.

This is all great feedback guys! I’m sure Tahnya is pleased that she’s generated this buzz – pretty damn good for a guest post, eh? Whether you love it or hate it :)

I’ll have to keep this one on file the next time someone asks about combining money or not…

@Dustin & Deacon – Thx for clarifying! Makes sense for sure :) Although I must admit the wife and I do have ALL our stuff pro-rated at the moment (% towards house, “do whatever” funds, etc). The more one of us makes, the more one of us puts into the house as well as the more they have to splurge on bags of marbles….although I see this changing in the future.

Hey Everyone,

I wanted to say thank you for having me as a guest poster on BudgetsAreSexy. Money between couples can definitely be a touchy subject but I think we all agree that any potential conflicts can be averted with open communication :-) I hope to come back soon and post again…maybe with a ring on my finger :-) LOL. I hope my bf is reading.

Personal finances is a touchy subject for couples and each couple should do what works for them. I personally will not be merging my finances with anyone besides my husband. If we aren’t will to get married, then there is not need for us to move in and combine households.

This is an interesting topic and on some points I agree. My BF and I have lived together, un-engaged, un-married for three years now. We have separate budgets and split our rent 50/50. I actually make more than him, so it’s really his pride that’s keeping that arrangement going. For the rest of our bills, we dole them out between each other. I pay for electric, he pays for cable. I do the grocery shopping, he fills the car up with gas. We each haev our individual expenses (cell phones, subway cards, etc.) and individual savings accounts. I’ve been wanting to do something joint together for a while but he doesn’t want to combine until we are engaged. It’s fine with me. Every situation is different and whatever makes you happy should be the direction you go with. And I don’t want him to put a ring on it until there’s enough money saved up for some considerable bling! :P

Haha…you girls! :)

I agree that if there’s no ring, there’s no joint accounts. That’s cart before the horse. I’m the planner in the relationship, so all the money goes into my account to pay the bills and the remainder gets divvied up between saving and spending. We’ve been married three years and we open and update to joint accounts when necessary. We don’t go out of our way to make everything even Steven, because it just is by virtue of being in our marriage.