I’ve been lucky enough in recent past to come out 50/50 with these types of loans (big props to my brother, and negative nellies to my uncle), but I personally try to avoid it whenever possible. “Whenever possible”, however, can be tricky when it comes to relationships. Which is why we need your help today!

Fellow reader Bob recently got hit up by a friend in need and he’s asking for a little guidance:

“A coworker/friend called me tonight in a rough spot so to say. Due to either mismanagement, or addition of step kids, he is in a serious budget crunch in the field of $400. I initially agreed and told him to call me tomorrow, but as time progressed I kept thinking of all the horror stories of loaning money…

Is it inappropriate to ask for a collateral item, a signed document with both signatures, or do half now and half in 15 days? You just always hear stories of getting burned.”

Here was my response (via iPhone, so it’s kinda short):

Oh yeah man, whatever u do DEF get it in writing so everyone’s on the same page and understands the situation :)

As you mentioned, the reason your friend is in trouble is something to keep in mind. How is he going to get out of this “budget crunch” to pay you back? Usually it’s best to consider all money loaned to friends a “gift” just in case (worst situation, right?) cuz family and friends come first over money. And there’s nothing wrong with saying no too!

Just be honest with everything and make sure you’re happy with whatever decision :) And keep every last bit of it in writing.

Re-reading this I now see that his friend is also a co-worker which adds another incredibly big element to the pot. If this deal goes sour it now affects a bigger part of your life (friendship & career), making it even MORE important to make sure both parties are on the same page and communication is crystal clear. Friends understand and respect rules like signing a contract – esp if it means you are saving them from a world of hurt. And if they’re shady about it, then it makes your decision much much easier.

I don’t think I’d have the heart/balls to loan out $400 for X amount of months in this case, BUT I would certainly consider some sort of other arrangement. Perhaps a $200 revolving line of credit? I loan you $200 and if you pay it back at the end of the month, I’ll re-loan it out to you again? (Or maybe even start with $400 if you have the cash?) That would at least help him out for a month and hopefully establish some good rapport to gauge what you’re workin’ with.

It’s kinda hard to advise on limited information, but with all that we’ve got so far what would YOU suggest? Any other ideas to help our good brother out?

Get blog posts automatically emailed to you!

If you can afford to lose $400, don’t loan it, gift it; if you can’t afford to gift it, don’t loan it. Make it clear that it is a gift, and never has to be mentioned again; but add the condition that he has to read a book (of your choosing) on personal finance or attend a class on personal finance (that you’ll buy or pay for) — my suggestion is Total Money Makeover or FPU.

Loaning to family really changes a relationship, instead of being brothers, your now “master” and “slave” (“The rich rule over the poor. The borrower is slave to the lender.” – Proverbs 22:10(?)) when ever you loan money.

i wouldn’t lend a specific amount on a regular basis. if i could afford to help the person out i’d give them a lump sum now and i’d think of it as a gift (but i wouldn’t tell them that). if they paid it back i’d be pleasantly surprised.

I have a friend I have given money to twice. The first time was several hundred dollars to pay for her tuition for a semester. Without paying the tuition, she would have been deported from the country. I directly paid the university in this circumstance and told her it was a gift. A few months later, she handed me a couple hundred dollar bills. It wasn’t enough to repay the money, but I really appreciated the thought. The second time it was several thousand dollars. She had a couple obligations with really bad timing and needed the cash to hold her over. Cash was given on a Tuesday and returned to me on that Friday.

In both situations, I asked for a thorough explanation of what the situation was and why it came about. While both situations could have been avoided by better planning, who hasn’t screwed up a time or two? As a born American citizen, I can go to the bank and draw on a line of credit, etc. in those situations. My friend didn’t have that luxury.

When gifting/lending money, I always expect a good explanation and that person usually gets to enjoy hearing my two cents worth on the topic. I also expect to know what their action plan is for the future. If it’s only a few hundred dollars, I suggest that the money be gifted. If you can’t afford to gift the cash, don’t give it out.

That coworker/friend can’t get money from a bank, peer to peer lending website, payday loan store, or a family member? What does that tell you about the credit worthiness of that individual? Unless you can gift the money, lending is best left to those who can afford to lose it.

The only way we do the lending/loaning is with immediate family. And, to be honest, it’s usually us doing the borrowing. Not due to lack of budgeting – but like this last spring when our AC went belly up ($3800) and the car broke down ($400) at the same time. We had about $2000 in savings for emergencies, and were using the rest of our cash for our debt snowball. So we borrowed what we were short from our parents and paid them back as fast as we possibly could with any extra cash and taking out our overflow from our snowball temporarily.

And even then we usually say, “We will be able to pay you back using x amount from each paycheck and that should take # of weeks.” But we never lend to friends, or if we did it would be under $200 and we would make sure we didnt care if we didnt see it again.

Oh and one other thing – in college I had this great opportunity to go on a trip to Europe as a chaperon for a HS tour group. The trip cost about $3000 and I knew I could only raise about half of it by the deadline.

I had an aunt who made a very good living and had always talked about how her uncle had sent her on a trip to Africa in college and how much she appreciated it. Well, long story short she funded the other half of my trip. BUT we had a very specific, in writing, understanding that this was to be a one time gift of $1200 for a completely frivolous trip and it was not to be paid back.

But, man oh man, I wish I would have just saved up the money and given it to her long ago. It is used against me and my whole family at every single occasion it can be. If I thought it would help, I would just pay back the $1500 now – but it’s been so long and with the supposed ‘understanding’ we had she would never accept it. Apparently, my payment back was to eternally live in the shadow of the-great-and-mighty-gift for all of eternity.

Looking back it really wasn’t worth it.

I would definitely not expect it back in a lump sum. I just loaned $140 my brother’s girlfriend, and she’s already hard set for cash, so I told her that I would take $35 from each of the next 4 paychecks. That way, she won’t go broke and have to borrow more, and I still get paid. Fortunately, she has made good! We wrote it down, and both signed it, as well.

We try to consider any “loan” we make a gift – of course, we don’t tell the other party that! If we can’t afford to part with the money for a long period of time, then we don’t loan it out. The bible tells us that we should loan to close family and friends with the attitude that we are giving them the money – and we really try our best to stick to that.

If the situation is compelling and we can’t afford to give it out, a loan may work but we would have them sign a contract and ask for installments if it is a large amount.

Yeah, I get the mindset with the “gifting” over the loaning, but man I’m not sure I could do that for anything over $100 or $200. Unless it Really REALLY helps someone out and they truly need it. I think loaning back and forth (with paperwork, of course) can really help certain people manage their money better too – like loaning practice or something?

For those who gift the money instead of loaning it, do these friends or family members then request more down the line? In hopes of getting “free money”? I feel like some would take advantage of that or think they can now get it easily w/out having to do much work (to pay it back, etc) like in the real world.

Not trying to rile anyone up or anything here, esp since I gift money too at times, but trying to understand more and continue the convo :) Esp how $400 is a LOT of money to gift in my opinion.

Well for me, I never tell the person that it is a gift. They are always under the impression that it is a loan. I just have the mindset of a gift, so if they have a tough time paying it back, it doesn’t ruin the relationship. So, in this case I find that they will not come back to ask for more because they still owe me from the last time – unless it’s a REAL emergency!

If it is a lot of money, I would insist on a contract, but I would budget and plan as if I would never see the money again.

My wife and I have talked about establishing an account with the purpose of making these loans/gifts for people who are in real need. Because I want to be a full-time financial advisor, I would suggest that we sit down for a free session to determine how to avoid these “tough times”.

I like your idea of a recurring line of credit – I never thought of that before. That might be a good way to go as well.

Oy. Sister-in-Law borrowed $200 from hubby 3 months ago. All good sense pointed to not lending, but hubby felt like he should since she helped him out before. She’s going through a divorce. Since the loan, she’s never mentioned anything about repayment. Then last week hinting that she would be broke until mid-August (3 weeks! she gets paid every 2 weeks!). Hubby pointed ignored that hint. Lesson learned.

I have had good results with loaning/borrowing money to family. I loaned my mom and sister money to move back to Florida (years ago), we had a promissory note and everything was paid back. My mom loaned me money to repay a 401(k) loan that came due after I left a job (paid back, with interest), and I just loaned my sister $10K for some home repairs, which is being paid back monthly at 4%. In our family, we don’t stiff people! Before we were married, some friends of ours loaned my husband $30K when he was a single dad, bills out the proverbial ying-yang, horrible financial situation. We insisted on 4% (they tried to offer 1% or something), it was amortized over 5 years and we paid it off 1 year early. They are still our wonderful friends….and I have to say, I would have never done what they did!

you never lend money to family: you give them a gift. Maybe you’ll get it back but you don’t give away money you need to count on having.

-d

I agree with what so many others are saying. Borrowing/loaning money is a very sticky situation, especially if you don’t draw up a contract with payment terms (though I have friends who have done this for other friends). It can ruin relationships. My rule of thumb is, if someone asks for money, and you care about them enough to consider loaning it, just give it to them.

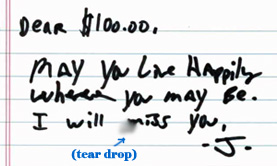

First of all, I love the tear drop lol. Classic!

I have no qualms lending money out to friends and family.. or coworkers. I have done it many times in the past, even paying for a friends vacation altogether. He lost his job, and it took him a year to pay me back. Was I mad that I did it? Nope? Am I crazy? No, just in a position where I can do without for a while. I figure that because I know my personal financial situation the best, I can make a wise decision on whether or not to loan someone money. If it takes them longer than expected to pay me back, that’s fine, I love to help people out – it’s also fine because I won’t loan someone money unless I am able to do without it:)

It’s kind of weird that this is happening in my life right now, with a twist. My husband and I have never missed a payment in our marriage (over five years), and have developed a total loathing of banks. My folks have a bit of cash, but are making zero interest on their money. They are considering paying off our credit cards, and then we pay them what we would’ve paid the credit companies. It doesn’t feel like a personal loan, more like we’d rather our folks make money over BofA. Even though it’s my parents, we will have everything in writing, including penalties for non-payment. It’s because we all love each other enough to look out for each other’s best interest.

This one hit close to home. I am new to blogging and just started one to share my thoughts and just had to give props to J Money for this post and add my thoughts (which are probably too long for a comment anyhow – below is a link). It’s getting into trouble. I agree that if you can just give the money and it is not a lot to you then go for it. But – for me – the first time for anything sets the standard. Saying no on the first call can prevent a lifetime of “loans.” I, for example, spent a lot of time in school and spend a lot of time and effort earning my money. I work hard and believe that hard work leads to money. If someone I care about works as hard as me and runs into a real emergency, I may consider helping them out of a bind. There is no “right” answer to this one IMO. Here’s my take in a little more detail – and my family loan story:

http://www.stepawayfromthemall.com/2010/07/lending-money-to-friends-or-family-good.html

AB if I were you I would be very careful. Unless you completely stop charging on your credit cards and carrying a balance, you risk ending up with credit card payments/balances and parent payments that you may not be able to afford. It happens a lot with home equity to pay off credit cards and then ended up with more credit card debts because they didn’t stop their spending habits. It sounds like you’re responsible with your payments generally – that’s great. Maybe literally give your cards to your parents to hold until you pay them back… or cut them up (but don’t cancel unless you are comfortable with (or don’t care about) what it may do to your FICO score).

I personally won’t loan to family or friends anymore. I let my mom borrow money and, while it took her over a year to pay it back, it was frustrating for me to keep hounding her for payments. I also let my younger sister borrow $675 for moving expenses (I was proud of her that she saved up enough for first and last month’s rent for the new apartment), so I assisted her. I have received exactly $60 back in payments, and its been almost two years. It is stressful for me, as I am sure it is for her, when I have to ask her when she will be making another payment. I try to avoid having to ask her but I want my money back at the same time.

When did “gift” become a verb? Gift me a break.

I think it really depends on the relationship between Bob and his colleague and their ability to talk about difficult things. Depending on my relationship with the person, the amount requested, and the purpose of the loan, I might just give the money, loan it informally, loan it with some understanding, etc. If I give the money, I make sure I really feel okay about it, don’t want to hold them in any other way like Rachel’s aunt.

I had given a friend a significant amount of money and I don’t regret a bit of it because what it was for and because the character of my friend. I have given a small amount and regret it a lot. The first one, we talked a lot about it before we loaned it. The second one, it was an impulse giving since she was a family member.

Having recently been on the receiving end of a loan, this is my take on it. It is very much dependent on the situation. For example, I am currently in South Korea through my school. However, when the first payment was due, didn’t line up with my paycheck schedule and it was either miss the payment and not go or find some other way to pay it. My friend Austin knew of my situation and knew that I was too prideful to take a straight up gift of 250 dollars (which is what he wanted to do) so he agreed to loan it to me on my payment terms with zero interest. I paid him back before I left and got him a really nice gift while I was here.

Miss Lissy

I lived in South Korea too!!! So cool :) Was right in Seoul at the American Base there – freakin’ loved it. Are you enjoying it so far?

I like the 0% interest rate idea too. I’ve taken many of those from the Bank of Mom & Dad over the years ;)

Good comments. Some of you need to learn a lesson that took me a long time to learn. Money is a thing and nothing more. Wealth is a state of mind. Money has very little to do with true wealth. Some say you worked hard for your money. Good for you, job well done! A computer programmer works for their pay. A ditch digger does as well. Fast food workers also put in the grind for their pay too. Who works hard for their money?……..They all do.

Are any of the abpve wealthy? It depends on how they view wealth. If the programmer makes $60,000 a Yr. and is in an unhappy Marriage, deep in debt. Ah, he may not feel so wealthy.

And if the ditch digger makes $15.00/ Hr but is in constant pain with his knees and back he may not think about wealth at all.

The Fast Food worker makes minimum wage. Works 32-40 Hrs per week. She married her H.S. Sweet Hart. has two beautiful kids, and gets free day care from a very happy Grand Mother. She looks around at their small, tidy, comfortable house as her Husband get’s home from work. And she knows God has Blessed them with Great Wealth! Wealth is a state of mind. It’s not abundance, it’s enough. It’s not having the best, It’s being with the best. I wish I would have learned this when I was young. I know now! It is fum to buy for someone who has nothing. If someone is in true need and you have the means to help them, you should. It makes you feel real good about yourself, and perhaps you will begin to see just how wealthy you are!

“Wealth is a state of mind. Money has very little to do with true wealth” – love this!! Really really appreciate you dropping your thoughts here, the more people understand this the better off they’ll be forever :)