It’s hard to believe it’s already been 5 months since our mortgage payoff plan went into effect! Just goes to show time keeps on tickin’ no matter what you try and do in this world :)

So if you’ve been putting off saving each month, or knocking back debt or anything else that you can really benefit from with TIME, ya better jump off the slacker train and get to it! Every day you wake up is another day your money could be working for you ;)

Another cool thing that happened this month was that I purchased a new snazzy website to add to my properties. (Remember how I wanted to use my Grandma’s money to expand my biz? Here I am starting it!) We’ll see if I can turn around the profit like I’ve been able to with some other projects I’ve “invested” in over the years, but if things go the way I hope I should be able to recoup the $3,500 price tag in a handful of months. And then any additional revenue will be pure profit :) Always gotta be diversifying those income streams, baby! It’s my side-side hustle, Haha…

(Unfortunately I can’t say which site I picked up yet due to contract stuff (sorry!), but I will say it has nothing to do with budgets and/or porn, haha… though you CAN make a lot of money in that too ;) And while I have your attention here, I’ll quickly throw in a self-advert that if you, or anyone you know, has a site or company or anything else cool that you’re considering selling or need a partner for, def. keep me in mind. I’m in super growth mode right now before the baby comes out, and I’d love to pick up another few properties if it makes sense for everyone involved. Okay, end of advertisement.)

February, 2012 Net Worth Break Down

CASH SAVINGS (-$178.90): Not the best cash-wise this month, but also remember that I just shelled out $3,500 for that website I mentioned above. A one-time hit that zapped my earnings for the month, but which should increase future cash flow if all goes according to plan…

EMERGENCY FUND ($0.00): Still the same $10,000 as it’s always been! Though really our “emergency fund” captures all the other cash that’s scattered around our accounts too. But I still like separating this out as it’s the place we’d hit first in case something really crazy happens all of a sudden (knock on wood). I should probably increase it to cover 6 months worth of living expenses too, now that I’m self-employed and have that J. Penny to look forward to soon :)

IRA: SEP (+$1,099.47): Nothing new added here, though in a few weeks there will be!! I’ll be meeting with our accountant this week to go over all the numbers finally (I’m sooooo over taxes this season!), and by the end of it I should have a good number as far as how much I can legally put into my SEP this year (it’s a % based off of profit, unlike other kinds of IRAs). Our guess is that it’ll be in the $20,000 range, which is kinda exciting not only cuz it means I get to skirt paying MORE in taxes this year, but it also means I can pick up some of my favorite companies now and give that ol’ theory a shot ;) At least with a good portion of the money this year.

IRA: ROTH(s) (+$1,411.30): Same story with this one too – nothing new added in lately, and nothing probably will until later in the year when I can tell if we have enough money leftover to invest more. And I’d finally like to be able to max out the Mrs’ Roth too if all the stars align (you gotta at least SHOOT for them, right?)

IRA: TRADITIONAL(s) (+$5,792.24): The only thing interesting here besides the nice increase this month, is that the non-managed account of the three IRAs here is back in the lead again for the billionth time this year ;) It’s too early to call it the official winner as it’s only been about 7 or 8 months since we stated this whole game (and it’s not winning by much, really) but I will say I’m secretly hoping for it to cross the line first whenever it’s time to wrap it all up. Which could be later this year, or whenever we end up getting bored – I’m not sure which will come first, exactly :) Here’s how it all currently breaks down right now though:

- IRA #1 (NOT Managed): $60,742.68 **In the lead

- IRA #2 (Managed, USAA funds): $59,903.27

- IRA #3 (Managed, ALL funds): $60,533.20

AUTOS WORTH (kbb) (-$143.00): Same ol’ same ol’ here too – just slowly losing value as these cars should over the months. Here’s how both are rides are shaping up these days:

- Pimp Daddy Caddy: $2,410.00

- Gas Ticklin’ Toyota: $8,929.00

HOME VALUE (Realtor) ($0.00): Nothing new with OUR house right now, but we have noticed quite a bit more signage going up throughout our neighborhood these days, which is GREAT! And hopefully means the market’s starting to pick back up again, and for once there won’t be foreclosures like there use to be all around our places these past 3-4 years, bleh. It’ll be interesting to see what kinda prices they’re getting once they’re sold off the market – maybe I’ll adjust our $300k valuation it’s been stuck on for the past 3 years, haha… fingers crossed!

MORTGAGES (-$2,571.69): Five months in a row now, and still pushing forward! Only 9 years and 7 months to go! Haha… *face palm* But as I mentioned above, that’s 5 less months now from keeping us from our dream :) So it’s a damn good thing we got the ball rolling when we did, or who knows how many more months/years we’d have been pushing it off for… gotta start things when you can!

- 1st Mortgage: $286,405.66 – 30 year conventional @ 5.5%

- 2nd Mortgage: $51,005.41 – Maxed out HELOC @ a variable 2.8%

That’s it for this month, how y’all doing on your end? Anyone else getting some good increases in your finances? Any big changes being implemented to help get you closer to your goals?

Hope so! If I haven’t said it already, it’s REALLY really REALLY important to keep tabs on your progress, and check in on yourself every now and then to make sure everything’s still going to plan. You’re your money’s #1 fan, and if you don’t pay attention to it no one else will ;) So keep it up!

———————

PS: I think I’m gonna buy my first real-life gold coin soon too… look out for a post on it if I do! :)

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

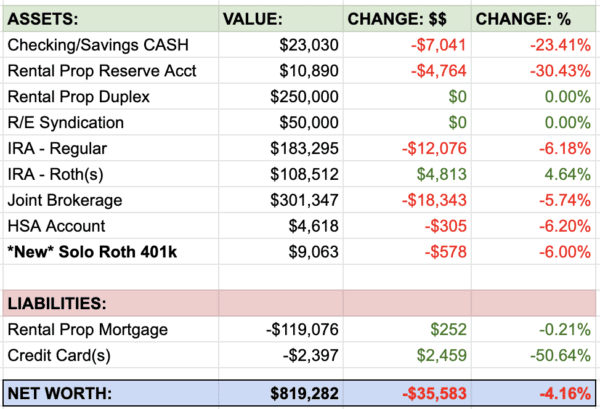

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

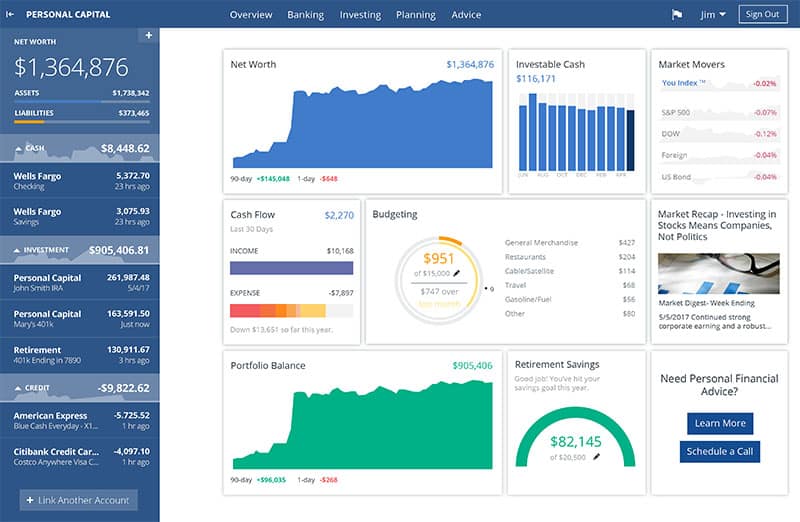

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Alright J$, It takes money to make money my friend. Personally, I am up $6K last month and over $20K since October! Boom!

Grab a cool antique treasure chest-like box for that class coin your getting!

Up $5.5k this month! We are still going strong with our mortgage assassination and have 26 months left until Freedom from the Mortgage Day 2014 (or “F the Mortgage” for short).

Wow good job. I had an increase of around $5K in February!

Awesome stats you got there!

My husband and I just reached $15,000 for our emergency stash (goal is $20,000 by August). Very excited about this!!

Then I’m going to start crushing a large, pesky student loan balance I have. Just signed up for a 403B account, which has been on my to do list since I started at my employer 4 years ago–better late than never!!

Wow 300K is a great accomplishment, Have you ever thought that separating your networth into two separate budgets might give you a clearer picture of networth. What I mean is a spreadsheet to include the mortgage, home value, cars and jewelry. The second to only include investments without the mortgage and car values.

I know you’ve likely talked about this before, but why do you have such a large cash reserve? Keep 6 months expenses total between your cash and emergency savings and spend the rest on your mortgage or better yet, investing in other projects, mutual funds etc.

Personally, I think you’re too risk adverse right now.

@Alex – Boom! $20k in 4 months is dope yo – keep it up!! That’s awesome :)

@Matt – WOWWW 2+ years and you’re done!! That’s incredible!! Can I borrow your weapons when you’re finished? ;)

@Michelle – Nice! $5,000 is no joke!

@Tanya – Yes, for sure :) I’m not sure how different 403bs are to 401ks, but def. make sure you’re investing as much as your employer matches, okay? That’s 100% free money just by investing which is good to do anyways :) And congrats on that E-Fund!

@Rich Uncle EL – Thanks man :) Every now and then I’ll do a mental calculation w/out the mortgage and cars in there (I’d be up $26,000 more right now, for example) but I like having it all in one simple spot for me. If I need to detail something out later for whatever reason, I’ll just do it on the side but keep this bad boy the same. Do you separate them out yourself for a certain reason?

@John – For sure, I agree financially speaking. But emotionally we love it ;) 1/2 of that $ is from profits from my biz which will be re-invested in it as time goes on, and the other 1/2 helps us sleep better at night knowing we have tons of options. That safety net – esp now that we have a kid on the way – beats out any profits that we’d get should we invest it or pay off our mortgage more. And actually a good $20k of it will disappear next month when I max out our SEP contributions for last year to save on taxes – which wouldn’t have been possible had it already been invested and/or against the house :)

You’re such an inspiration. We’re not in a position yet to make waves (still have no savings or retirement) but we did get our credit cards paid off recently. I can’t wait to see 4 digits in savings, let alone 5.

Congratulations on your upward progress. Would like to see that post about the gold coin. Do you know which one you are looking at? AGE? Krugerrand?

Congrats on the increase in net worth. This was the first month ever that we had tracked a budget and net worth. We are happy with the increase of $5380, our net worth is negative, but this month took a huge stride to making that a positive net worth. We are dealing with a refi right now that should get us into positive territory a lot quicker. Just hoping it finally goes through. Keep up the awesome job J. Money!

My Net worth went up in February only to have it dive at the beginning of March.

We purchased a different car and am taking an impromptu trip to NY next week (booked tickets yesterday). From the looks of it though our net worth will survive March, because I get an extra paycheck this month, just as long as I don’t go freaking insane in NY I should be fine :)

Congrats on the new business deal.

Awesome update! 10k is great increase for just one month. :-)

We had a 16% increase from last month, which is primarily due to my RISE plan, but that’s okay. :-) I’ve only been tracking our itty-bitty net worth since last May and it’s almost doubled in that time. It might not be increasing as quickly as everybody elses, but the small steps and effort are getting us there just the same; we finally made it into the 20’s. It all adds up!

Yeah, but nothing as dramatic as yours. We are doing fine but you; well you are something else. Good luck with the new site and I believe in you!

I’m totally stealing “you’re your money’s #1 fan” as one of my new financial mottos. Love it!

Over $300k — that’s gotta be a great psychological boost! Way to go, you’re definitely doing something right.

Congrats on the new acquisition!

Yes I like to see my actual cash position without including any liabilities or tangible assets, as to see a clearer picture of how many actual greenbacks I have. Which in turn gives me a motivational boost.

How exciting! We’ve had some great luck buying silver coins from our mint (Canadian). We don’t own any actual gold (yet) but silver has been good to us.

Net worth is negative this month. The woes of being a student. But I can’t wait until I graduate and get a job, so I can start tracking my real net worth! You are an inspiration. I started my own PF blog this week. It’s still pretty rudimentary but I hope I can make it better with time.

Awesome work buddy! I was up about a bit over 5% this month!

I think you are indeed on a roll. Expanding, growing, buying AND increasing your net worth. What can be better right? Oh I know! A baby! :)

J$, your stats show PPP, the Power of Proper Planning:)–congratulations! Re: your interest to buy/partner on new ventures, for several years we’ve had 2 “parked” dating websites that we would like to sell or develop: http://www.date4chat.com and http://www.neverhitched.com. Realizing that these may not lie in your preferred areas of interest, maybe you or one of your readers could be the catalyst to connect us with compatible investors/partners. Meanwhile, good growing in your chosen field(s)!

Way to go!

We are about 5 months ahead of schedule for having our 20% down payment fund in place. This means that we could potentially a) buy sooner, b) buy a slightly more expensive house, c) put more than 20% down (yahoo!) or d) some combination of the above. This has been due to some unexpected bonuses with both our jobs, our tax refund being larger than expected (I know I know, not free money, but it was still unexpected), being cheap (ha!) and picking up extra hours at my side hustle.

I’m so excited!

J Money, congrats on your net worth increase. I also think it’s great that you were able to add to your web properties. I’ll be interested to see how that progresses for you.

Congratulations on the net worth spike J Money! My February net worth increase was over $2,500, but looking at a $10,000 increase with $2,500 going towards a mortgage is definitely kicking my butt. I want to get there!

Woo at surpassing $300,000! I love those psychological boosts :)

@Miriam – That’s a damn good start, Miriam! Having no credit card debt beats out a good 50-75% of all other Americans, so great job! :)

@John | Married (with Debt) – I’m thinking of going through the Mint to pick it up – probably the Buffalo Proof as it’s what my good friend has been prompting me to do. And I don’t really care what kind really, as long as I don’t get scammed ;)

@DebtnTaxes – Awesome!! Congrats on starting to track it all now – that’s the hardest part to do! Now you can see all your progress every month and tweak as necessary :) Proud of you!!

@LB – Haha, well – we only do the best we can, right? :) I’ll be up in NY too in the next few months, used to live there and miss it.

@Jen @ Master the Art of Saving – Heck yeah it does! And we’re all in different phases anyways, so you can’t really compare it with others cuz it’s not apples to apples :)

@maria@moneyprinciple – Awww, thanks Maria – appreciate it. It’s only taken me 32 years to finally figure stuff out ;)

@Courtney – Good!!! Me too actually, haha, sometimes I forget about that but it’s SO TRUE! :)

@Kacie – Thanks! It’s a wonderful milestone indeed, and just a matter of time until everyone else reaches it too! We all go through the phases :)

@Flexo – Thanks dude! If only I could tell everyone it was *your* site ;)

@Rich Uncle EL – Hey, nothing wrong with that brotha. I think it’s smart to tweak the net worth system to fit what your goals are :)

@Marianne – Oh cool! I haven’t ventured down that path much either actually, I should add it to the list to look into though… I love currency stuff!

@savvyfinanciallatina – Awesome! I’ll go check it out after I post this :) And yeah, your financial life will dramatically change once you’re in the “real world” – but def. for the better!

@Evan – Great! That beats my 3.5% or so :)

@Aloysa @ My Broken Coin – Haha, that’s right!!! And he’s a comin’ in only a few short months – yikes!

@richard @ moneygraffiti.com – Ooooh I like the sound of new areas though, I’ll check it out with my business partner and hit ya up if we’re interested. If Money Graffiti ever needs a partner, you better come to me first ;)

@Hannah – Yeah girl! Rock it! That’s incredible :) And I’m def. more about option A and C, but NOT B. Unless it’s your dream home and/or you’re gonna be living there for a long long time. Don’t make the mistake like we did and buy more just because we could!

@BusyExecutiveMoneyBlog – Thanks :) Me too!

@Cassie – Oh you will, friend. It’s just a matter of time! This is the first time in my life I’ve been able to do this kinda stuff, so it’s all new to me too :) We all have to put in a crap lot of work to finally start reaching our goals, so keep it up!

@Leigh – Thanks! Me too :)

I love/hate your net worth updates. They make me feel so poor. But they remind me that it’s important to track your finances and pay off debt because I’m sure I would be equally excited even just to have a net worth that was in the positives.

Awww, well it’s just a matter of time until you’re up there too! We all go through the phases in different times of our lives, but if you keep pushing hard and staying on top of it you can get into the positives in no time :) Takes a lot of hard work!

J, congrats on improving your net worth! It’s steadily climbing since the fall.

I often use your budget and net worth posts as a template for my own budgeting, so I have a question about the emergency fund. Do you keep this as a separate account or simply leave 10K untouched? I have a basic checking / savings accounts system right now, and I’ve thought of the savings account as an emergency fund of sorts. Maybe it’s time to separate a certain amount of funds. Thanks!

Awesome! I’m glad they’ve been helping out :)

Currently, my E. Fund is mixed in with a lot of other cash in a Money Market Acct (to get a tiny bit more interest than a regular savings), but I’ll admit it doesn’t *feel* as nice doing it that way. Normally I suggest separating it all out completely so it’s nice and simple and you can see everything better, but the idea of opening up another account (on top of the dozen+ others I already have) keeps me from doing so myself ;) If you only have the two right now, it might make sense to just open up another savings or money market with the same institution (so you can have it all in one spot) and then keep it separated. Really a matter of preference though. And how you operate.