(Article by Brad Chaffee of Enemy of Debt – who as you can tell from this post, REALLY hates debt! ;) J$ will be back in action pretty soon now that he’s getting a bit more sleep these days, but he’s still pretty shocked he created a whole new human being to watch out for now! Haha…)

I recently received a reader questionforwarded on to me from J. Money himself, so I figured why not do a guest post for him to show off my awesome answer? :D This guy can’t be alone here so hopefully it helps anyone else over their heads with debt right now.

Here’s what the email said:

“Hi, I came to your site from budgetsaresexy.com and you seem to have good resources to get my debt in check. I’d like to know where you would suggest I start reading. I know this is a general question, but you gotta start somewhere.

I have over 15 credit cards and $30,000+ debt not including 2 cars.”

Here’s what I responded with:

Hey Reader,

If you are serious about getting control of your money, you are likely going to have to step outside of your comfort zone which includes changing your debt mindset. Learn about why debt is bad for you and how you can benefit by not owing anyone any money ever again — with an exception for a future mortgage (15 year fixed rate w/ 20% down) and possibly credit cards as long as you can pay off what you spend each and every month.

You might not be ready to go extreme like my wife and I did by cutting up all of our credit cards, but for now I think stopping any further accumulation of debt on any of those cards is essential to turning things around. If you have car payments you’ll want to learn about why having car payments is one of the worst and most expensive ways to own a car. Forget leases too and just look for 1-2 year old cars that are reliable and pay cash.

My wife and I started with a hooptie after selling our “car payment” and have upgraded little by little. Last year we spent $6500 cash on a minivan for our growing family.

If I were you I would put both cars up for sale. I would sell one at a time. I would borrow about $2,000–$3,000 plus the amount that I’d need to cover the remainder since the sale price will not likely be as much as you owe the bank. I would do the same for the second car. Extreme I know, but we did this very thing except we didn’t have to borrow any money to cover the difference or to buy the replacement car. Right from the start we knocked out $8500 off our debt tab which felt super awesome! We’ve never regretted that decision.

I would then start looking for things around your house to sell at a yard sale, or on eBay/Craigslist, or local consignment sales and work on tracking your spending by starting a zero based budget. (There is one available on Enemy of Debt for free to those with MS Excel.) I would then start following Dave Ramsey’s baby steps (detailed in the Total Money Makeover) by setting aside $1,000-$2,000 in a baby emergency fund which enables you to focus like crazy on starting your debt snowball and eliminating all of your debt except for the house. (The house comes later in baby step 6)

After your debt free you’ll have more money to plan for retirement, plan for kids college if applicable, paying off the mortgage and building real wealth. Without minimum payments you are unstoppable as long as you truly change your money habits.

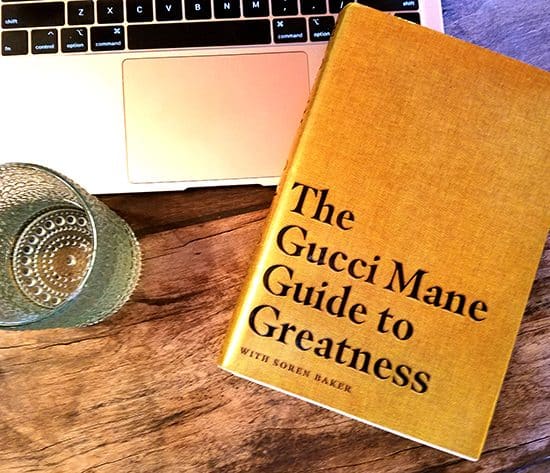

As far as reading, I would highly recommend Dave Ramsey‘s Total Money Makeover and I Can Teach You How to Be Rich by Ramit Sethi. Ramit has a different approach to money management but definitely has a debt free mindset. What you want to focus on in your reading is how you can change the financial behaviors that got you where you are today. Dave Ramsey deals with the Psychology of Money and Ramit also has some great stuff on psychology on his blog as well.

For motivation on becoming debt free, The Dave Ramsey Show is the best to listen to on Fridays because ordinary people call in to the show and scream “We’re DEBT FREE!!!”. It’s crazy inspiring!!

My wife and I have not borrowed a single penny since January 1st, 2008 and we have no credit cards. We don’t play the credit score game and our life has been super simplified (and less stressful) as a result. We feel that the credit score game encourages debt because debt is the only way you can “build” your credit score. It’s not for everyone but we love it and fully intend on paying for our next house with cash money in full. We’re happily renting until that day comes. :)

COMPLETE debt freedom has CHANGED OUR LIVES COMPLETELY! We have the ability to take advantage of more opportunities because our money is not pre-spent on interest and minimums before we ever earn it. We also don’t have to make as much to cover necessary expenses. We live on (rent, utilities, food, etc) $2,000 a month and my wife only works part time (24 hours a week) at the hospital. We even have a little extra at the end of the month for fun stuff.

Our plan is to now focus on raising our income by growing two businesses — Virginia Printing Company, a company I started where I print shirts, apparel, and promotional products AND recently my wife and I started a Health Coaching business (Optimal Health Pro) where we coach and help people lose weight for life. As we raise our income to 6 figures we’ll continue to live off of $2,000 and save the rest which will make buying a house 100% cash down so much easier and faster.

Anyway, our way isn’t for everyone but it ROCKS for us. You can modify this approach to fit your needs — but be careful — us humans have a way of justifying stuff in order to not have to sacrifice as much, but it also takes us longer to achieve debt freedom because of it.

I like to compare my debt free journey to pulling off a band aid. GET IT OVER WITH and RIP IT OFF! Forget about the slow and painless approach — IT TAKES TOO LONG! haha! :D

Hope this helps.

———–

Brad Chaffee founded the blog Enemy of Debt where he has enthusiastically shared his debt free message since 2008. Brad also uses his passion for helping others as a Certified Health Coach where he coaches and supports his clients to optimal health for life. Debt freedom has given him the chance to live the life he wants where work isn’t work at all and family time is cherished and enjoyed daily. Connect with him on twitter @brad_chaffee.

(Photo by mlinksva)

Get blog posts automatically emailed to you!

Brad that is a great response. The hardest thing the person who asked the question will have to deal with is accepting the new lifestyle needed to cut back expenses and quit accumulating debt. If they can do that they’ll be well on their way. Best of luck to the reader who asked the question. If you ever need any help or support I’d be more than happy to help in any way I can as well. Brad offers some good advice and it may seem like a shock but it’ll be the fastest way to get out of debt responsibly in my opinion.

Overall, I’d say great advice, with one exception: Credit cards can be wonderful IF you use them properly. My husband and I just saved more than $100 on a fence because we used a Lowe’s card and opted for the 5% off the materials cost rather than the 0% financing. Then we paid the whole thing off when we got the statement. If we’d paid cash, it would have cost us MORE money. But the key here is paying things off in full, or if you go for a 0% financing offer (I did this with my laptop – it’ll be paid off next month, 5 months early!) making sure you are organized enough to make those payments on time – otherwise you get slapped with all those financing charges that were waived up til that point.

Of course, if someone has significant credit card debt, that may be a sign that credit cards aren’t the best option for them. But for me, between rewards programs and special discounts, credit cards have saved me more than they’ve cost me!

I’m not afraid to come forward, I’m the person who reached out to J Money and EOD. The one thing I can say is that I haven’t put anything on a credit card in probably 3 months…simply because I can’t. I’m so maxed out that any minimum I make gets wiped out with the next round of interest. I’m in the process of calling as many CC companies I can to get my rates reduced but it’s hit and miss. What I would love to do is get a debt consolidation loan to get this all down to one big chunk and then hammer away on it. The problem is most (read that as all) banks won’t give a loan to someone without collateral despite a nearly flawless payment history. The life style has changed, unfortunately it’s just a matter of getting back on track. Medical bills, minimum payments, utilities, etc. There’s hardly any assets to apply to this debt. It’s a matter of chipping away at it, but it seems to be like hitting a rock with a plastic hammer. I don’t trust these debt counseling programs, too many seem to have bad raps. I’d just love to find a bank that would loan to someone in my situation. Alas, I think I’m on my own.

Most debt consolidation loans will probably be at the average interest rate, plus some extra interest for the cost of the risk. For this reason I suggest you don’t worry about getting them consolidated. In fact, having your debts broken up as they are, allows you flexibility:

You could “debt snowball” and pay the lowest balances first the way dave ramsey suggests.

You could pay the highest interest rate first and save yourself some actual money.

I suggest option 1 “debt snowball” as it will provide you with the best/quickest gratification, especially in light of your comment that its like hitting a rock with a plastic hammer.

Keep calling to get your rates reduced, there is no “negotiation” company that can do any magic that you can’t do. Just keep plugging away at the companies and ask for every bit of help you can.

Good luck

First of all good job so far asking for help and NOT using credit cards. That is a big step and I think you should pat yourself on the back. Small steps help in the long run. I know this seems like nothing and you are buried alive, but like all of thos bulling commercials I see I have to agree with the slogan “It get’s better”. Right now I am sure you feel trapped and helpless, but people get out of debt all of the time. Question is how bad do you want it and what are you willing to do to get out of it? Then once you figure that out: Find things around the house to sell (yes $5 helps), get a second job (excellent side-hussle series from J. Money), cut down on all unnessary spending (do you need that big cell phone plan or cable TV?), and above all value what you have. Enjoy the things and people you do have in your life especiallly family and friends, because even in your darkest days they will be there and can be great help getting out of debt.

Paying cash for a house would be awesome! We don’t have any consumer debt, but we do have mortgages. It’s tough to pay off 30k+ debt, but you have to start somewhere.

I think the best possible thing he could do would be to earn more money.

Freelance, do yardwork for people, ask for a raise, sell stuff you don’t use, etc.

And if you think you can’t do it, check out No More Harvard Debt for MASSIVE inspiration. The guy paid down $90K of debt on less than a $90K YEARLY salary. http://nomoreharvarddebt.com/

The Freelance idea is something I’ve been kicking around for a while, just need to make sure I do it properly. I’m a tech support rep by trade but have lots of computer and electronic hardware experience. That may be something I need to bring to fruition.

Thanks for all your ideas and comments, it’s really appreciated. Feel free to keep discussing!

Lance – Thanks, I appreciate your kind words! :D

Stephanie – I agree with your statement. If used responsibly credit cards can become a useful tool. My family has decided it’s not for us but we understand that it might not be right for everyone. It’s why I listed the exception to having a mortgage and credit cards above. Like you pointed out the key is to pay them off every single month no exceptions. :)

Tom – Glad you asked for help dude and there’s no shame at all in that. I think that by putting yourself out there you have enabled an entire community of caring people to offer suggestions and advice. Soak in what you like and devise a plan on paper. Set goals and do something everyday that will push you one step closer to your goals. You can do this and you really don’t need to consolidate. Actually consolidation really does nothing but make you feel like you’ve done something when really you’ve given yourself a disadvantage by consolidating low interest debt with high interest debt. It’s a shell game.

Here’s another idea that I think will help tremendously. As I’ve been on my journey to optimal health I have learned some great tips for staying motivated. The problem is that we usually tap into the wrong motivation. What I mean is that we generally react to problems which put us into action but it’s usually short-lived because the emotional conflict that caused us to act in the first place is reduced even if nothing has changed at all. This causes us to revert back to our old behaviors and it some cases makes us believe our situation is hopeless.

Instead focus on what you want to create in your life. If you want to create healthy finances let that be what motivates you. Ask yourself important and challenging questions. What would your life be like if you had healthy finances? Where would you live? What would you do? How would you get there? Then focus on creating that in your life and set achievable goals to help you get there? You’ll have a better chance at reaching your goals if you are intrinsically motivated. Don’t focus on what you don’t want, focus on what you do want. Becoming debt free will happen naturally as you do the things that bring you closer to your goals and desires.

Keep your head up brother! You’re not alone! :D

Adam – Great advice! I definitely agree with you on using the debt snowball over paying high interest debt first and for the same reasons. That motivation is so important when taking on something as overwhelming as debt especially in the beginning when it is most overwhelming.

LB – Great advice! A side-hustle is always appropriate. :)

Joe – Awesome indeed Joe! It will be a challenge but that’s precisely why we plan to raise our income while living off of what we’re currently living off of. Either way it’s just a matter of time and how long will be determined by how bad we want to accomplish paying cash for a house. Our goal is to do it by 2014-15. The rest depends on how fast we can increase our income but we want to do it by working from home. We are really close to bringing my wife home from her part time job at the hospital and we have a good revenue stream that we expect to grow quickly over the next two years. we have some work to do but we are confident it will happen. Perhaps when we do, I’ll write a guest post on Budgets Are Sexy! :D

Leah – Earning more money is definitely a part of the solution. Combined with changing his financial behavior he could really make some great progress towards becoming debt free and changing his life.

Brad, I’d add one more motivation: stay angry at the debt. I’m still mad at debt I got rid of years ago. I’m mad at myself for allowing myself to get sucked into it, and mad at the people who seduced me into it. The more people I’m mad at :) the more motivated I am to stay the heck out of debt! When the temptation to do something that involves debt, I’ve found that a hot anger outweighs the enticement. Joan Otto at Man vs. Debt follows the same strategy. Different strokes for different folks, but the anger thing really worked for me. You might try it :)

I’d recommend picking up a second job delivering pizza.

I also think that getting a second job is a viable option for people in debt. Obviously-people have a lifestyle–having a second job cures you real quick of needing to spend money to “keep up with the jones'”. Some people may not be able to take on a second job, but you’d be surprised how quickly debt can come down if you put ALL of your second paycheck towards the debt.

Brad, I admire you. Personally, I think your take on cash only and forgetting about the credit scores/game is a huge step that I can really appreciate since my hubby and I are currently trying so desperately to rebuild our credit after paying off all CC debt a few years back. We’re extremely frustrated with it, and I’d love to try your take on it; however, we don’t have a huge cash emergency fund {GASP!}, so I think I’ll start there…. :)

Tom – My hubby delivered pizzas at Dominos 3 nights a week for about a year so we could pay off all our CC debt. It sucked….don’t get me wrong….I worked full time and had 3 kids to take care of on the weekends alone while he was gone and he had two jobs….but after a year, we had 0 balances on all cards and only one car payment at $233/mo left, at which point I got a raise, so it evened out and he was able to quit the pizza biz. It was a sacrifice but, trust me, worth it in the long run. You’ll be so happy to start seeing “$0.00 amount due” on those bills. Best of luck to you!

William – Hey man I’m right there with ya bro! Great advice!

I’m wearing a shirt to FINCON12 that says I STILL HATE DEBT! haha!

I’ve never stopped hating it. Borrowing money is NOT in my future and neither are credit cards! :D

In my opinion, most people don’t hate it enough. LOL

Good lord! I just wrote an awesome post and it said it was spammy! Grrrrr…

Brad, excellent reply. Love the 15 year mortgage with 20% down. Too many go for the 30 year, minimum down.

Tom C, sorry to see you learn your lesson the hard way but at least you really know how tough credit can be. Credit should be only used as a tool and paid off every month avoiding interest and collecting rewards :) Also there is another avenue which many would disagree with me, bankruptcy. Depending on your exact situation of course. Many are jealous of those who “get away” with bankruptcy, including me, but I have no love for the credit card companies and they deserve what they get if they push too much credit on those who become addicted to it. You would think credit companies would have learned what happens when you give out too much credit to those who can’t pay it back. Screw them I say.

Jen – Thank you Jen! :) My stance is certainly not a very popular one for most people but we have dramatically simplified our life as a result of this stance. If you can lay the groundwork to make it happen then I highly recommend it but having an emergency fund is definitely important.

Even if I didn’t forsake any and all debt, such as having a mortgage, the only way I recommend anyone build their credit score (after they insist they need one) is by using credit cards responsibly, buying stuff they would already be paying for monthly like gas, utilities, and groceries, and then paying them off at the end of the month without exception. The problem with this is that there is still RISK especially if you have no emergency fund because you’re almost forced into using your cards to fix any emergency that comes along.

One day you have no debt and then all of a sudden you have debt. I would rather just avoid that and figure out an alternative. It’s crazy how inventive and creative we are when we need to be. There’s always plenty of options and alternatives to using credit cards in an emergency but unfortunately it’s the easiest at the time for most people — until the bill comes due that is. :)

I admit our way isn’t for everyone but there is absolutely no way we’d ever go back to using debt or even credit cards in our life. We are free on so many levels and not only is it empowering but it has simplified our finances so we have time to focus on other things that are important to us. :D

Now I’m focused on achieving optimal health and experiencing the freedom associated with that! The theme in our life is freedom so all of our decisions are focused on achieving that in all aspects of our life.

I have lost 50 pounds in 14 weeks and because we’re using the same approach (behavioral change) I know I’ll keep it off this time. My wife has lost 40 pounds so we’re doing it together which makes it even more rewarding. :D

Thanks for taking the time to share your thoughts and especially for the kind words. sorry about the long response. haha!

I absolutely refuse to file for bankruptcy. My payments are getting made, they are just taking a long time to pay down the balances. Bankruptcy is off the table. Period. I refuse to stoop to that level.

Stacking Cash – Exactly! The 15 year mortgage only costs a little more a month and saves you THOUSANDS of dollars. The banks have literally been laughing all the way to the bank on that one. It makes no sense why anyone would ever get a 30 year mortgage. If the monthly payments are too big as a 15 year mortgage then the right thing to do would be to find a smaller (and/or) cheaper house and some people might have to wait and save a little more money to make it possible. The problem in this country is that people aren’t willing to wait for their dreams –they want then now no matter how much it costs them.

Tom C – Right on Tom! You owe the money and you should pay it back. It’s the right thing to do, but that’s not to say some people aren’t forced into bankruptcy by executed judgments. You’re clearly not in that position and most people aren’t. It’s so refreshing to hear people respond to the possibility of bankruptcy the way you did. Congratulations for having integrity even when it’s not the easiest option!

I believe that unless you are absolutely forced into it because money is being garnished from your paychecks and you cannot afford to live, there is no reason people should file for bankruptcy.

People just need to take responsibility for their actions and mistakes and suck it up. That’s precisely how we learn not to make the same mistakes again. That’s another one of my views and opinions that isn’t too popular — especially amongst those that have filed bankruptcy even though they weren’t bankrupt. It’s the truth though and sometimes the truth hurts.

I understand people that don’t have a choice. I have a choice. I choose no bankruptcy.

Love these conversations going on!! This is what is awesome about finance blogging – real people and real situations!! Thanks so much again Brad for doing all this for me while I’m out, and thanks to the Tom, the reader who sent this in and for all you commenting so far! I hope it all helps! :)

I think this is going to help me out. I think I can make a “small series” of this if I can get started and keep the momentum going. So I think I’ll check in with regular updates.

Curious what the reader’s follow up email was.

This is a tough spot to be in. I give the reader major props for coming forward. That was the tough part. Now it’s time to hustle!

If you come to my site Tom and send me an email, I would love to shoot you a copy of my eBook that deals with credit.

Dear Reader,

I envy your guts for getting that much credit cards and car loans without sufficient thinking of their effects to your finances. It is high-time that you make necessary changes in your lifestyle to pay off your debts. Why do you need two cars? Is it possible to sell one or both cars and get a second-hand car instead? I suggest that you also need to spend less and look for additional sources of income to pay off your credit cards one at a time.

Ok so good news and bad news. The bad news is I still have 15 credit cards. The good news is my count was off and I only owe $25,000. So that’s good. My smallest is $230, my largest is $9000. I’m going to start with the snowball method and get rid of the smallest ones first. I will be visiting the various websites posted and making sure I have all the best possible methods to achieve this.

Work it, bro! I think that’s an excellent idea – it def. helps with motivation :) People will say to go with the route that financially makes more sense with the numbers, but ultimately you have to do whatever feels the best for you in your situation. And I tend to go w/ the smaller snowball route too over the factually correct way cuz it makes me more excited…. I’m currently doing that right now w/ our home mortgages – I’m paying the smaller one off first, which has the lowest interest, and then I’ll tackle the bigger one. Gotta do what’s best for you!

I think its really great (and also kind of scary) to put yourself out there like this! Bravo. All of us have had junk and debt we have to pay back. I personally have 6 figures of student loan debt, so we are working hard to knock that out! I can’t wait to read more about your journey and I hope you rock it out!

Best,

Cat

aka

Budget Blonde

I know! All y’all who share your dirty details with us get major points in my book too :) Just shows everyone’s working hard to dig deep and work their way out as best as possible!