We’ve gone from one of our lows in recent history, all the way up to our new personal record! I love it :) Check out this horseshoe pattern:

Apr: $315,258

May: $301,195

Jun: $284,665

Jul: $296,797

Aug: $300,032

Sep: $331,530 (Now)

Six months to get our net worth up by $15Gs – doesn’t seem as impressive as this month’s $31k jump, eh? But that’s the way the game is played sometimes. We have our ups when everything seems to be going our way like crazy, and then we have our terrible falls where everything just seems to spiral down and down no matter what you do. If there’s one thing I’ve learned throughout the past 5 years of tracking this stuff though, it’s that it’s always a phase and it’ll change one way or the other no matter how hard you try to contain it The key is to keep pouring your heart into the game so you have more AWESOME phases than opposite! ‘Cuz then you don’t mind the wild drops as much – it’s only temporary.

That’s my take on our financial lives anyways… Head down and full speed ahead! The rest of life will happen all around you, as it should :) So we’re taking the day to sit back and enjoy our new milestone here before it changes again… hopefully for the better!

Here’s How September Broke Down:

MONSTER CASH ($23,709.30): All that money from selling one of my sites the other month? It all went here. Plus a few more thousand that we were able to earn on the side as well… I totally still plan on throwing it into our retirement accounts to max them all out (my ROTH, her ROTH, and my SEP), but for now it looks too pretty sitting there in our cash account :) It just seems harder to “spend” right now since sooooo much effort and energy went into EARNING this big chunk, ya know? I guess I’m kinda enjoying the nice infusion as I have it… I’ll eventually pull the trigger.

PHYSICAL GOLD ($86.30): Right now this department only holds my 1 oz. gold coin from earlier in the year. I plan on including my other precious metals I have on my physical self here too, but I just haven’t had the time to sit down and calculate ’em all yet (I’m making a killer spreadsheet to track everything so I can watch them go up and down in value each month! I’m such a nerd! :))

IRA: SEP ($681.98): Haven’t put anything new here since maxing out for the 2011 tax year, but we will soon when the 2012 wraps up and I know how much my “company” made for the year (as the amount I can put in depends on the total profit made). Part of that $23k made in cash this month will be assigned to this area when it’s time.

IRA: ROTH(s) ($1,048.26): Same here – nothing added yet, but we will in a bit as soon as I finally maxing out both the Mrs. and I’s accounts at $5k a piece (the legal maximum for 2012). Then the fun part comes in on figuring out *what* funds exactly to put it all in this year ;)

IRA: TRADITIONAL(s) ($4,887.99): A decent return for doing nothing here too. Though I still need to write up my thoughts on how this whole IRA Game has gone so far – esp now that it’s already been a year! Jeez… Time sure does fly, eh? Here’s how they all break down right now:

- IRA #1 (NOT Managed): $62,940.25 **Still in the lead

- IRA #2 (Managed, USAA funds): $61,020.31

- IRA #3 (Managed, ALL funds): $61,721.84

AUTOS WORTH (kbb) (-$234.00): Normal droppage as to be expected. Nothing new really to report here as we still haven’t looked into getting a newer car/suv yet which we def. need to do sometime soon… I just don’t want to go back to car payments again! I like paying $0.00 a month for perfectly working cars :) Here are the current values of them right now:

- Pimp Daddy Caddy: $2,066.00

- Gas Ticklin’ Toyota: $8,521.00

HOME VALUE (Realtor) ($0.00): Same ol’ as it’s been the past few months – we’re not gonna touch the $285,000 value until something big happens or the market changes enough for it to make more sense. (Like someone in our neighborhood selling again which has a comparable place). I don’t mess with Zillow or the other type sites anymore – they fluctuate too much for me…

MORTGAGES (-$1,318.08): Our mortgage paying plan is starting to slow down a bit :( Haven’t been able to justify plowing that extra $2,000 a month towards them when business is a lot slower here lately. Despite one-offs like selling that online property the other month and what not… As soon as things pick back up, I’ll get back into the groove of murdering them again. I’m not too worried just yet :) Here’s what the remaining balances look like:

- 1st Mortgage: $282,974.56 – 30 year conventional @ 5.5%

- 2nd Mortgage: $39,001.49 – Maxed out HELOC @ a variable 2.8%

And with that, another month down on the books! And a record setting one to boot :) Definitely looking forward to uncharted territory here in the future as we’ve never made it out this far!

How did you guys do this month? Anything exciting or juicy to report? I really hope so. I genuinely love hearing how you guys are doing too as it helps to keep ME motivated as well! If I were the only person talking about and tracking this stuff, it would be real damn boring up in here! Haha… So please, share your own numbers if you’re comfortable with it, okay? Us nerds like hearing ’em :)

Here’s to another great month,

———————

PSA: Just a quick note that if you’re NOT tracking your net worth as yet, get on it!! No matter how much money you have, or don’t have, it’s a good practice to get into so you can always know exactly where you stand. And it’s super easy to do too: Just add up all your assets and then subtract all your liabilities – voila! You’ll have your total net worth in one condensed number :) Good luck!

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

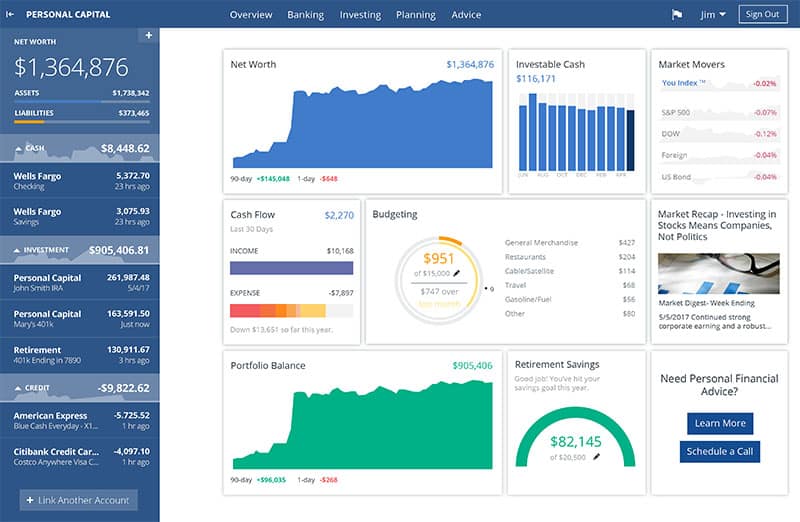

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Congratulations! That is a pretty hefty jump. I’m gonna have to get on owning more than one site, I guess. Love me some money making, net worth building, wealth increasing tools!

Looking good! I’ve been having fun paying down my mortgage. I’ve paid down almost $20k in the last three months :)

Congrats on the big jump. I’m nowhere near 300k but I did go up a few percent between 8/15 and 9/15. Next analysis is at 10/15… not that I post the information anywhere. Don’t know how I feel about sharing that much info yet, especially since I am not exactly anonymous…

Wow you guys did great! Congrats! We did pretty good last month also. Hoping for an even better October.

Everything green except the cars – looks pretty great! I wish we had a nice $30K boost in our cash position, but at least we still had another pretty good month, too – we were up over $12K!

I haven’t run the total yet, but I feel like I just gained $55,000 since Anthem decided (Yesterday) we were right and they paid the claim for our little guy’s NICU stay.

Grand total to give birth to him (including all appointments and such since Oct 21, 2011):

$116,027.78! BOOM! Thank God my wife has good insurance. Now I wish I kept track of all my spending on him like you are sir!

We probably just about broke even, net worth-wise. Our cash took a hit, since we put a big ol’ downpayment on my car. But we paid about 2k less for it than the KBB value, so there was a net increase in our net worth from that, even if it is a depreciating asset. ;-) Our IRAs did fairly well and our home value actually went up a tad, but we had to do our usual dip-into-the-savings-account routine that happens at the end of each summer, before the husband’s income goes back up with the start of the school year (it’s the reason we save extra during the school year, but I hate doing it every time!!). Planning to do some SERIOUS saving over the next few months while we wait for baby to arrive!

Good job! That’s an impressive amount of money you sold your website for. Was it difficult letting go of it at the time? I’ve sold a couple myself and every time I didn’t want to do it because of the hard work it took to grow them.

I love these posts. Since you inspired me to start tracking my net worth too, back in June, it’s gone up about $14k. Seeing the progress really helps keep me motivated. Feels good man!

Nice. Your net worth increased this month by the total of all my assets combined!

Mine went down this month due to some unsexy medical bills. :(

That’s so awesome! My 401K account only has $2800 since I just started this year :(

We did save $2500 last month :)

Nice job! Feels good when you can see the increase. I stared getting back to checking and reporting mine as well and was pleasantly surprised to see a jump in my net worth as well, especially seeing the house starting to go up again.

Great job with the cash account!

Our net worth went up quite a bit, but that’s because I updated our home price.

Our neighbor sold her house and the sale price is much better than zillow’s estimate. So I updated our home price to reflect that.

Why on EARTH would you not pay cash for that new SUV?? You HAVE the cash. I promise you leaving it in a saving’s account while you pay interest (or even just go in debt at 0% interest) on a car loan is absolutely ridiculous. (End soapbox, sorry. lol)

Congrats! What site did you sell?

This month was pretty good. Feels good to be breaking even with the house and getting to really enjoy it.

Thanks guys :) Love hearing how you all are doing! Keep ’em coming…

@Greg@ClubThrifty – It’s a lot of work, but the tradeoffs can be huge as you see above ;) Just depends on what motivates you, and how you enjoy spending your free time!

@Leigh – HOLY SHIT! You are killing it, wow!! How much longer do you have now?

@Lance @ Money Life and More – It’s def. tough not being anonymous w/ that kinda stuff, but maybe you an just share % increases/decreases or bits and pieces and make up your own kind of “review?” That would still be pretty interesting for your readers I bet.

@Michelle – Awesome! I hope you double your September’s increase :)

@Mrs. Pop @ Planting Our Pennies – NICE!!! And honestly that beats ours by a landslide if you take out the selling of one of my online properties :) So really you did better! I’d rather have continual $12k increases than a big one-time chunk (or even both at the same time! THAT would be the life! :))

@Brian – Woahhhhhh insane balls!!! And you just reminded me that I still haven’t figured out our total yet for giving birth the other month, huh… I need to research that and put it all together, thx man!

@Stephanie – Ain’t no shame in that! Your baby will suck up a lot of cash but they bring so much joy too! Well done on that car deal of yours :)

@Veronica @ Pelican on Money – It was indeed tough, but it went to a really good home so it was fine by me in the end :) Plus I still help manage it so it’s really a win-win scenario all around. What types of sites have you sold in the past?

@Randall – GOOD!! That’s what I want to hear, brotha! Way to stick to it!!

@Edward Antrobus – Hey, we’re all in different phases right? And sometimes things are totally out of our control too – like those unsexy medical fees :( Sorry to hear about that bro, let’s hope the next few months more than make up for it!

@SavvyFinancialLatina – That’s great though! You’re off to a killer start, congrats!! When you’re old and gray like me, you’ll see how it’s all added up over time too ;) Keep it up!

@Jeff @My Multiple Streams – Nice!! Btw my brother LOVES that tattoo chick calendar I bought from you last year. It’s hanging on his bedroom wall :) If you ever want to do a Side Hustle post on photography for $$ let me know! I don’t think we’ve done that one yet? (Or is it your “real” job right now?)

@Joe @ Retire By 40 – That’s one of the only times I’ll edit ours too – I think that’s fair. And always better when it goes UP than down, that’s for sure! Ours dropped by another $15k the other month cuz of lower prices, ugh… Just a part of the whole game, I suppose.

@Sarah Fowler – Because it feels a lot better having the cash in my account than in the car ;) Financially it makes no sense whatsoever, but I always go with what makes me FEEL better over smarts with this stuff. What’s the point of going the more savvy route if it stresses you out the entire time?

@Jenna, Adaptu Community Manager – Good! I’m sure you will start enjoying it more – it’s a nice new phase of your life :)

Well, it’s certainly no 30k increase, but I am up by about $2.5k this month :) Nicely done on the increases, I’m envious! Even the mortgage payoff, even if it is slowing down a little.

Hey J Money! Is it not worth refinancing into a lower interest rate? Since you are at 5.5% and rates are down in the 3% range? When my wife and I purchased we got a 4.375, I checked Monday and rates were at 3.375.. its crazy how low they are getting.

Seems like you would be in your home awhile? value $285k / mortgage $321k

We had a flippin’ fantastic September and our net worth went up by $50,000 this month. We’ve been in Operation Mortgage Payoff as well. My new year’s resolution was to pay off 20% of the remaining principal on our mortgage and we’ve paid off 24.9% so far this year. I’ve been trying all I can to increase our savings, even foregoing our a/c all summer, which stinks since we’re currently having an Indian summer heat wave.

I need to start tracking monthly. I track quarterly but that is only because my budget is set a quarter per spreadsheet page. I think I might add a column to note the net worth as of end of month.

Nothing like a whopping chunk of cash to make you feel good about your finances!

I might have asked already, but what site did you sell? (or is it a secret?)

I’ve sold a few sites for big money. Annoyingly, I sold one for $4000 back in 2008 and the guy (who was obviously an experienced flipper) sold it almost immediately for $25,000!

I know better now! :)

J. Money,

Have you considered putting your internet assets on your balance sheet? I’m self-employed and put the value of my business on balance sheet (accounting practices always sell within a tight multiple range). I can see how calculating a conservative value for website may be difficult.

I enjoy your site.

Thanks,

Neal

Thats great J Money. Some of you guys are really rockin’ it, impressive stuff. No where near as impressive but I did hit an all time high and crossed the $50k mark for the first time. I’m still young and I’ll be up there with you guys some day. Anyone else ever feel like they don’t make enough money to support their savings habits? I guess if thats all I can complain about then I’m doing alright.

@Cassie – That works! $2,500 is a ton of sexy money! Keep it up :)

@Derek @ ThePointsGuide – It would most DEF make sense to refinances, though as you’ll notice in those numbers you just laid out our house is WAY underwater still :( Which means no one will allow us to refinance unfortunately… On the plus side, we DID get lucky with our same mortgage holder last year who had a CRAZY deal going on we took advantage of, and was able to drop our rates from 6.875% down to 5.5% which helped a ton (And also moves us from “interest only” to a “traditional” mortgage). Other than that though, I’m afraid we’re $hit out of luck until we pay more off… I like where your head is at, though :)

@Jennifer Lissette – HOLY CRAP!!! You killed it!!! What changes this month for y’all to be able to go up so much?? Or are you now going up that on a regular basis?? (How hot would THAT be!! :))

@Adam Hathaway – Yeah, go for it dude. Even if you just did it every other month it may help you keep a better pulse on your finances. Though if you’re current quarterly system works now, you may not want to mess too much with it if you think you’ll just abandon it altogether.

@Ian – Hah! That’ll def. get you to learn for sure :) I think it’s awesome that you went out and built something and then turned it around like that though – that’s great. And was one of my main reasons for selling too – I wanted to go through the whole process of selling a site and experience it :) And of course the money didn’t hurt either, haha… Unfortunately I can’t disclose the site per our contract, but I doubt it’s one you’ve heard of before. Keep on hustlin’ bro!

@Neal – Ooooh I like that! And no – I’ve never thought of that before actually? It does make sense though. Even though they’re online they’re still income-producing “properties”… Hmmm… It also makes me wonder about accounting in general too – like if they’re supposed to be considered “assets” when filing taxes for a small biz, etc? I should probably ask my accountant on that :) Very interesting stuff though for sure – I’m gonna think more on this and see if I end up including it or not down the road. Thanks for sparking some new brain waves!

@Will – Dude, $50k is nothing to sneeze at – the fact you’re GROWING and going after your goals like that is great! I don’t know how old (or young) you are exactly, but I can tell you I didn’t start paying attention until I got into my mid-late 20’s and it would have been a WAY diff. ball game had I started even earlier. Not that I have much to complain about now, but you know what I’m saying. The earlier you start, the better you’ll be for the rest of your life! So keep rollin’ with it brotha!

I love it when you take a step backward for a few months and then take a giant leap forward to surpass your old high. Great work! Looking forward to seeing your progress in uncharted territory.

Thanks! I hope you’re taking giant leaps forward too here and there :) It let’s you know that you’re on the right track!

Wow a 10% month!? That is unreal. I did well this month but not that well. Any thought about killing off the mortgage #2 instead of #1? I know it is a low 2.2% but how much would it lower your monthly nut? Would that lower your DTI to refinance #1 since 5.5% is WAY too high

That’s what I’m currently doing actually – killing off #2 first cuz I like to see it dwindle and dwindle more :) And then yup – hopefully be able to then refinance to a normal rate for that 1st, jeesh… but we still got some ways to go until I can fully squash it. Business has been low overall the past couple of months, so we’ll need it to go back up again to start paying off extra again… fingers crossed!

@JMoney: Can you shed some more light on the website you sold?

PS: I was looking at a way to subscribe to replies, but could not. Can you reply to me by email.

Sorry my man, it’s confidential. And yeah – I had a “subscribe to comments” section here but the plugin kept breaking so I had to remove for no :( I’ll try and get it back up again soon – thanks for the reminder.