Another day, another dollar! Or, rather, *tracking* of dollars :) And today marks that beautiful day where we get to share the ins and outs of our finances to all the voyeurs out there. Just as we did last month, and just as we’ve done every month before going all the way back to Feb, 2008. When it first clocked in at $58,769.65 :)

In fact, that was one of the main reasons this blog even got off the ground back in the day. I couldn’t believe people were just throwing out their numbers like that for the world to see, and I thought to myself – “Damn. What a great way to hold yourself accountable! I should totally try that.” And now here we are 6 years later without missing a month!

I thought I’d take a few secs to answer a handful of questions I get all the time too, as a nice review:

What’s the point of tracking this stuff? Everyone’s different, but for me I like seeing an overall snapshot of where all my money is on one page. Which I can then track throughout time to gauge how I’m doing whenever I need/want some motivation.

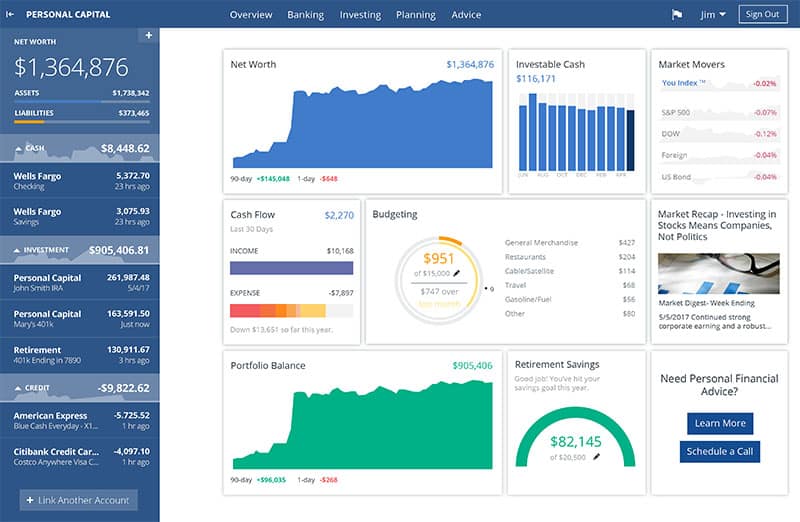

What do you use to track it? I use an excel spreadsheet I created years ago aptly titled the “Financial Snapshot & Budget” which ties in both my budget, and, well, this “financial snapshot” area ;) But I’m also poking around Personal Capital to see what they offer, and if I should switch, since everyone and their mom keep raving about them… So far the coolest feature I’ve found is that they automate your net worth so it’s all live and calculated anytime you log in, but it seems to be heavily focused on investing vs. overall finances. I haven’t finished adding in all my accounts yet, but so far it is pretty accurate compared to what I track manually. So we’ll see!

Why do you put such and such in there, and not other such and such stuff? Everything I track goes back to the main purpose I mentioned above: to give myself a solid overall look at my money. I’m personally not too concerned with taxable vs non-table, liquid or non-liquid, passive income vs real estate, etc, but if that’s important to you I advise to tweak it accordingly (Whenever I’m interested in that stuff I just create a one-off net worth spreadsheet to give myself an idea for that moment of time).

The nice thing about all this stuff is you can track it to your own liking and goals, so if one category doesn’t make sense for what you’re going for, then just nix it altogether! We all track our worth differently depending on what’s important to us, so don’t get bogged down in what others are doing or what’s technically “right.” What’s right is when your calculations are matching your goals.

Here’s a list of other bloggers’ net worths I put together if you’re looking for how others track it: The Ultimate Net Worth Tracker. It covers over 40 bloggers and is ranked from highest worth to lowest (I’m #15ish), and you’ll notice they’re all different. And they’re all in different stages of life too (and age, occupation, location, family status, etc). I put it together mainly to learn and get inspired by others vs just mere comparisons which’ll drive you crazy. So hopefully it helps :)

Okay… now finally to last month’s details!

How February Broke Down:

CASH SAVINGS (-$2,363.42): Overall F+. With the plus just being that some of the income I’m still due hasn’t hit my accounts yet. I still have a ways to go to get this puppy corrected, which is mainly due to business income continuing to be lower than usual. But at least my expenses are still leveled off and not rising? That counts for something, right? ;)

529 College Savings (+$178.49): Nothing new added here in the past year – just the market having its effect. I reckon this will be paused for quite some time until the cash instinctively flocks again like the salmon of Capistrano.

IRA: SEP ($1,852.24): Same here – just the market doing it’s thang. (But soon we’ll be maxing this out once we finalize our taxes and figure out how much I can pour in from business stuff!)

IRA: ROTH(s) (+$2,401.34): Same here as well – nothing new added in. We’re still debating on whether to max this out for the wife and I this year even though cash is in scarcer supply than usual. The logical side of the brain says “don’t do it idiot! you need your cash!” but the emotional side says, “What are you waiting for? Don’t break your record of maxing it out for the past 4-5 years! Suck it up, wussy!” Haha… I’ll let you know which side wins ;)

IRA: TRADITIONAL(s) ($7,880.50): Nothing new added here as well. And more than likely nothing will for a looooong loooong time either, unless I’m convinced to drop my other retirement tools and switch to this one for some reason. Ya never know though…

Here’s the latest on our IRA Test which I’ll be shutting down as soon as I make the move to Vanguard.

- IRA #1 (NOT Managed): $79,519.67 **Leader for two years running

- IRA #2 (Managed, USAA funds only): $73,373.87

- IRA #3 (Managed, ALL different funds): $74,301.93

AUTOS WORTH (kbb) (+$41.00): My caddy is locked in at $1,500 still (too old to be tracked now via KBB.com!), but the Toyota seems to keep growing in value over the months, haha… I don’t pay it much attention of course, but it is what it is and I’d be listing it that way if I were to go put it on the market today, so that’s why we keep tracking it as so. Here’s the breakdown of our cars’ worth:

- Pimp Daddy Caddy: $1,500.00

- Gas Ticklin’ Toyota: $6,609.00

HOME VALUE (Realtor) ($0.00): Haven’t updated this one in months, but probably will soon now that the Spring is around the corner. I use my realtor to tell me what he thinks it can go for (vs using Zillow or Redfin/etc), and I don’t like to pester him much when I have no inclination of selling it anytime soon. He’s a nice chap though and hooks me up full well knowing I WILL be tapping him when that fateful day comes ;) For now though, it’s set at a cool $300,000.

MORTGAGES (-$659.76): Only $2,683.05 to go until we’re no longer underwater!! I can’t wait!! Here’s how our mortgages currently break down (no, I can’t refinance yet):

- 1st Mortgage: $274,324.00 – 30 year conventional @ 5.5%

- 2nd Mortgage: $28,359.05 – Maxed out HELOC @ a variable 2.8%

And just like that month #2 of the new year is now officially over. Damn time goes fast. And even more reason to start tracking this stuff! Every time you do, it’s one more benchmark for the future-you to review and compare to. And my benchmark tells me we were at this almost exact same spot 2 months ago, haha… Check it:

- February Net Worth: $443,799.65

- January Net Worth: $433,149.74

- December Net Worth: $443,561.57

We’ve gained $200 in 3 months! Ack! But see – good stuff to have so you always know the deal…

By the way, you can see all my previous net worths over the years, just click here.

How did you guys do last month? Anything cool or opposite-of happen? ;)

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Sweet! Love that nice big September-October bump in the chart. Last month was great for us, too. Market did it’s thing. We saved a bit. Nothing too exciting. The exciting stuff is coming up… :)

You tease!

Nice work there J Money. I was just curious, why SEP IRA and not Solo 401K?

Take care!

Dividend Growth Investor

PS I maxed my SEP for 2013, but I also have a 401K at my day gig ;-)

You dirty bastard :)

Answer to SEP ira vs SOLO – My accountant told me to :) I probably should have researched it more, but everything she said seemed to make the most sense at the time so I just ran with it… I’ll ask her in more detail this month when we wrap up taxes here in a bit. I’m kinda wondering too!

I’m glad your net worth started heading up again! You really need to consolidate your IRAs with Vanguard and quit paying the fees you’re paying. Vanguard’s fees are pretty low and over the long run it’d probably save you a ton of money. It’s pretty easy too, just give them a call and if they need to they’ll bring your other brokerage’s on the phone and take care of it, at least thats what they did when I started a few years ago.

Yup! On my list! Other priorities keep getting in my way so trying to nudge them out one of these days and plug that one in ;) It’ll happen.

What is your PF number for this month? I am now tracking this number and can’t wait until I am a positive number for PF and net worth.

I will never reach the numbers you have achieved and as a single person in my late 40s I never will. I am planning a simple, comfortable retirement at age 59 or 60 with what I will have together by that time.

Never?? That’s a strong word. I’m willing to bet you could, but only if you prioritized it :) So maybe you don’t want to reach these levels because of what you’d have to do or miss out on or whatever instead? Either way if you’re happy w/ the way things are it doesn’t matter :)

My PF number is prob the same’ish as it was last time. I’m gonna run it again after a while to excite myself (as long as my $$ goes up! haha…)

My lack of financial success has more to do with the fact that I am in my late 40s and had to restart my life after a divorce. Going back to school while raising children and working for a low wage left me with debt.

I live a very frugal life and I don’t spend much on anything but my income is not high either. I take home $1,350 every 2 weeks and own my own and have helped my sons with their post secondary educations. I am convinced that it is harder to make it as a single person.

Possibly :( There are a lot of variables that go into this stuff though too. Like occupation, where you live, etc etc… You seem to be doing damn good though with what life has brought you! Keep going, friend!

IRA newbie in the house…do you have a post that covers the three different types you have & why?

C-

Catina,

To cover the IRAs J Money has:

– There’s the SEP IRA, which stands for SimplifiedEmployee Pension IRA. See http://en.wikipedia.org/wiki/SEP-IRA Generally speaking this is for small business owners/self employed and the limit is 25% of your income with a max cap. Typically you can stuff a lot more in here than a “normal” IRA, or even a 401k. The simplest way to think of this is a like a self employed person’s replacement for a 401k plan, with a much higher cap.

– A Traditional IRA, which is the original. You can find caps here http://bigdaycoming.com/ira-contribution-limits-2014/ With a traditional IRA, you pay taxes on withdrawal (tax deferred) and you get to “deduct” contributions from your taxable income up front. The same sort of tax advantages as a 401k.

– a Roth IRA, where you pay taxes up front and pay no taxes on withdrawal.

There are all sorts of little extra conditions on these as far as qualifying for contributions and withdrawal loopholes (i.e. you can withdraw principal contributions to a Roth IRA after 5 years, but must wait until 59 1/2 for withdrawing any gains/interest).

Thanks Chris!

Catina – listen to him :) The details bore me really so I rarely blog about them (and when I do it’s not in one main spot). But that should get you started!

Thanks Chris! This was super helpful!

And J….will do! :-)

Need to sit down this weekend and recap our February. Got hit with a little Murphy so its not going to be pretty,

Nice job, J! I too saw pretty much the same track for net worth over the last three months. I think that’s going to generally be the case for people in our position. We have similar net worths in terms of raw numbers and breakdown of allocations, and ultimately the stock market will determine the overwhelming majority of our swings – so the January sell off hit us hard and the February recovery brought us right back.

Yup! The market holds our future in its hands :) But luckily we want it that way and trust it!

Hey J,

Our cash reserves went down last month due to invoices not yet being paid, too. It’s one of the frustrating parts of being self-employed. But the markets had a great effect on our net worth last month, too! I love putting money in investments and just letting it ride.

Great job being up $10k and incorporating Personal Capital into your updates!

We still haven’t tracked our networth yet this month. Whoopsie! I’m excited to look at that list of bloggers. I like seeing other peoples’ finances, but I prefer to take a look at people with numbers that are similar to ours…otherwise it’s hard to relate!

Totally. And over time when you get curious, or move out of your current “section” and into a higher one you can then start following their progress too to help motivate you. It’s pretty interesting to do, but not *focus* on all the way before you piss yourself off, haha…

J.M,

Article suggestion… How about soliciting your readers on their thoughts for your planned IRA migration to Vanguard? Combine the amounts, keep it in thirds or more, how do USAA funds translate into Vanguard funds, plans to rebalance, etc…

Good idea indeed :) Though I’m probably going to just copy what the others are doing in the Financial Freedom blogging niche. Picking one or two funds and plowing it all in there. And then condensing all my accounts to as little as possible (ie – no more handfuls of IRAs!). I’m all about minimizing and concentrated effort now – the rest just stresses me out.

Nice progress since 2008 J! If you can keep up that pace, you will have a cool Million in 5ish years. Question for you. How do you decide how much to keep in cash? My initial thought is I would use some of that cash to refinance into a lower rate for all of your home mortgage. Do you have a need for that cash soon or do you like to keep it as a certain level (based on a percentage or some other determination)? Seems to me you could take $10k in cash to increase your cash flow after a refi.

I have two answers for you:

1) I do what my wife tells me :)

2) Stashes of cash is most important to me right now vs refinancing/investing/etc since biz $$ is down and we’ve got a 2nd kid coming. It’s only a temporary phase right now (the wife will be going to work full-time again after 5-6 years of being off for schooling) and once that ship is set straight I’ll be concentrating on growth again vs. staying afloat.

To answer your question on a % or anything else, no – we currently don’t pay attention to any of that. It’s just “save as much as we can and don’t spend it all” right now :)

You could have stopped after point number one, but I appreciate the additional insight. ;-)

We are up $16k this month. No major cash infusions, mostly it was just the market having a good month, plus the usual automated savings. My husband is due for a raise with this next paycheck, but I don’t know how much we’ll feel it. Baby #3 is due next month, so we need to up our HSA contribution. Epidurals are expensive!

I bet! Funny how that works too, doesn’t it? The second you start getting more money coming into the door, something else happens to help suck it away ;) Congrats on the new baby though!! Ours is due out in May!

That graph really illustrates the huge progress made since the latter half of 2013. Well done, J Money!

We’re up slightly, we’ll do better this month after paying off the last credit card.

I did utilize an online valuation engine for the house, and it’s become problematic since every sale alters the valuation (up or down). I’m not certain how I’m going to proceed, I’m thinking possibly stick with the same number from January until December? Doesn’t seem that realistic, but if we’re not selling anyway I don’t see how it makes that much difference.

Chugging along, with the last credit card out of the way I’m going to increase our emergency fund from $1000 to $5000, then really hit that HELOC with everything we have (after a well deserved vacation somewhere warm).

AWESOME!!!!

And yeah, I’d probably stick with the same house value too for a while. It’s true that every sale DOES/CAN affect the house value, so in that sense it’s okay to update it when it changes, but I’d probably go with a quarterly or bi-yearly update if it were me. Either way you’re right that it doesn’t matter until it’s time to sell :)

Way to keep it on the right track boss! 10k ain’t nothing to sneeze at!

We were up $24,790, for the same 2.46% gain. I only track cash, stock investments and home equity. Most of the gain was in the stocks. Had a really good run the last 3 weeks of the month.

Rock on! Crazy that the more you have plowed into it, the more you sway both up and down doesn’t it? Even though you and I don’t do a thing ourselves to actually make that happen? (Other than picking stocks/funds initially?)

Up about $7.5K this month. That is a 1.5% gain.

Just under $4K was from my company’s contribution to my retirement. They do that once a year in a lump sum.

Net Worth is now $479,745

I can’t wait to see it tick over a half mil.

We all have our little milestones. :)

Yeah dude! Looks like you’ll cross that faster than I will too – but I’m chasing you!

Congrats! I haven’t checked ours yet, but I am happy that our cash savings is growing. That was the main plan for this year. I’m not too worried about market changes for another 20 years or so. :-)

You are so close to a half a mil!!!! Wahoo! I’m interested to see whether or not you max out the IRA. :D

Me too! I go back and forth on it every day, haha… I guess I should just get it out of the way and ask my wife what she wants to do since she’s gonna be the game changer anyways ;) I guess I’m enjoying the freedom to think of it while I can, haha…

PS: IT’S ALMOST BABY TIME!!!

Gotta love a market correction in the right direction! It’s amazing how far you guys have come since you started. It’s definitely motivating for a newer blogger like me.

Wow. It’s crazy to see where you guys were at in 08! It reminds me of my wife and I just last year. We really started tracking everything and have doubled our net worth over the year even though we had a baby. Tracking is what allows us to do it (we use YNAB). When you don’t track, it’s hard to improve!

Agreed! And it really does give you motivation to keep going strong too – even if you have down months (those give you even MORE motivation! :)). It can feel like all your word doesn’t amount to much on a daily level, but seeing it in monthly chunks is powerful. So glad y’all have started tracking it!

Yay for the house soon being back above dry land! :)

I don’t think it ever has been in the 6+ years since owning it, ugh.

J Money – congratulations on the increase!

I’ve started going back through your old posts and you can see how much your hard work and planning is now paying off. You’re an inspiration to a lot of us!!

$10k in 1 month is nothing to be sneezed at!

I’ll race you to $1m!

Thanks man! Glad you’re enjoying the site so far :) I’ve literally spent *thousands* of hours on it, haha…

And you’re on for that $1 Million. But you haven’t told me where you are on that track yet? :)

I’m a whopping $200k behind you, but m always up for a challenge.

If you have time, check out my net worth udate on my blog.

I’m a very aggressive investor, so I will either catch up or blow myself up!

Haha, at least you’re aware of your risk tolerance :)

Just added your net worth & link to my Net Worth Tracker over at Rockstar Finance – check it out! http://rockstarfinance.com/blogger-net-worths/

I imagine you have considered the pros and cons of liquidating a big chunk of your investments and pay off the house, making you debt free with 141,000 socked away. What made you decide to keep the mortgage?

1) I’m self-employed and the only income maker of our household (aka very unstable and need tons of cash as back up)

2) I like having tons of investments working on our behalf while I do nothing :)

3) We don’t live in the house anymore (it’s now a rental) so it’s not as exciting to have it paid off. More like a business now which we don’t want our cash tied up in.

I love the Roth IRA and always max mine to the full $5500. But if I needed the cash cushion instead, I would hold off on investing this year. In the next year, I would make it a goal to fulfill my 2014 contribution as well as 2015.

I’m such a Roth IRA fan boy!

Haha… I am too – which makes it hard to fathom that I’d not participate this year! :)