“If you want to be broke, do broke people stuff. If you want to be rich, do rich people stuff.” – Chris Peach

Gooooooood morning my fiscally conscious friends! How’s your money saving, investing, clearing away debts this week? Anyone kill any credit cards or student loans?

We had a major weight lifted off our shoulders this week when we found out our tenants are going to renew for another year – whew! And with our additional $25 raise in rent too! (The first time we raised it in 3 years) My wallet started having convulsions when we found out they might need to deploy being in the military… And as much as I love using a property manager, they cost a pretty penny finding renters. Another reminder that home ownership is no joke! I hope you never rush into it like we did all those years ago… It’s easily the biggest mistake of our financial lives. (But since this blog came out of it, it’s hard to complain all the way :))

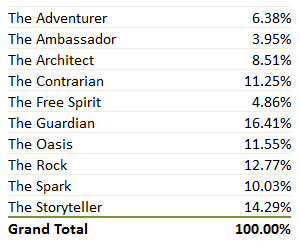

In other news, remember our Financial Personality Quiz we did last week? Well, the team over at Payoff tracked where y’all fell in terms of each of the personalities, and were kind enough to shoot over a snapshot of it:

I said hell yeah, and here’s a portion of what he wrote back:

Your readership shows a lot of similarities with what we see in the general population. Foremost is the fact that the two types seen most frequently are Storytellers and Guardians. Storytellers are your classic leaders: adventurous, social and outgoing. Guardians are much more cautious and traditional, yet they are every bit as comfortable taking a leadership role. Other groups that are present in your readership at the frequencies we see in the general population are Adventurers (thought leaders, creatives, novelty-seekers), Ambassadors (nurturers, hosts, people-pleasers), Rocks (stoics, emotionally controlled, hard to rattle) and Sparks (emotionally expressive, dramatic, anxious).

Now for some interesting areas where your readership differs from the general population…

There are many fewer Architects among your readers than among the general population. This is particularly interesting because Architects fit the classic profile of financial planners. They are organized, they enjoy planning, and they fit well into the “system” as it were.

One possibility that may explain the underrepresentation of Architects is that you may have a particular appeal to people who do not really want to fit into the system. However, we can reject that notion out of hand because your readership is also low on Free Spirits. These are the folks that enjoy a healthy dose of chaos in their organizational approach and also like to challenge the system. You would expect that these folks would have a hard time committing to the structure needed to budget and all of the good stuff you provide information on in your blog, so it is no surprise that you are low on this group. But again, the point I want to make clear is that your low frequency of Architects does not seem to be coming from any messaging on your part that appeals to the folks who are not comfortable with the authoritative aspects of our financial system.

So now that you know who is underrepresented in your group, the blooming obvious question remaining is who is overrepresented in your group. The largest overrepresentation is with Contrarians followed closely by Oases. Contrarians are the question-askers, the people who like to work within the system but serve the purpose of making sure the group does not avoid the hard questions. As we have been diving more and more into the functioning of these types, I have been rather stunned by how essential Contrarians are to the successful functioning of any group…An Oasis is a person who glories in their internal dialogue, a thinker, a critic. Much focus on this broad personality type is on their preference to avoid social situations, a preference that is often incorrectly portrayed. Oases don’t fear social situations; in fact many are highly effective speakers and even bon vivants. They do find that social situations take energy and they need both prep and recuperation for big social events. They do not tend to be as naturally effective with finances as do Architects, but when they focus on a problem they tend to solve it.

So there you go, J. Money, a few personality-based insights into your awesome readership. It is super diverse, just like every successful community must be. They tend toward being highly inquisitive yet collaborative. One suspects that may reflect their fearless leader as well.

Neat, huh? :) You can read the entire report in full here: BudgetsAreSexy Readership Analysis. It’s two pages long. (Thanks guys for doing this! Very cool to see!)

Here’s how the rest of our week went…

This week in money (and gifts, apparently!)

- The wife got a graduation gift of $100 I finally cashed

- Then another graduation gift for $100 too – woo!

- And then ANOTHER graduation gift for $100 … (This almost covers the costs just to graduate ;))

- I sold another item off Craigslist for $25 (monthly recap coming soon)

- Digit saved us $174.77 – quickly funneling out all those graduation gifts!

- Acorns invested an additional $6.82 for us. (Hard to be much when you don’t spend much)

- And we spent $135.65 on our anniversary getaway the other weekend: Gas ($24.38 ) + hotel ($128.75) + lunch ($41.33) + dinner ($41.27) – an anniversary gift from my mother-in-law ($100). This is the real purpose of money :)

Cool stuff going on around the web…

- More Money = More Freedom – an interview I did with the fine folks at Haven Life. I think you’ll like it, especially those new to the site here as I get into a lot of my favorite tips and tricks with $$ :)

- Holly and Greg from Club Thrifty are giving away an iPhone 5s courtesy of Ting Wireless. Another cool wireless company out there like my beloved Republic Wireless.

- Kathleen from Frugal Portland is working on the launch of her Planner/Calendar/Motivational Coach dubbed “The Remarkable Year”. A place to hold your thoughts, dreams, and accomplishments that will help you realize just how much you can do in one remarkable year. If you like the idea of that, click that link up there to help fund it and get one in return!

- My boy Matt Becker from MomandDadMoney.com just dropped his new book: The New Parent’s Guide to Financial Independence. It goes over setting goals, savings targets, the best accounts to use, investment basics, investment strategies, and staying the course. If you enter the code “sexy” you’ll get 20% off the book (normally $14). It expires on Monday though.

Want to see the first ever credit card?

Cait from Blonde on A Budget snapped it while visiting the Smithsonian National Museum of American History’s “Stories of Money” exhibit in DC the other week. The story’s pretty fascinating behind it. (And now you know who to blame for all the debt around ;))

“In 1949, businessman Frank McNamara forgot his wallet while dining out at a New York City restaurant. It was an embarrassment he resolved never to face again. Luckily, his wife rescued him and paid the tab. [In] February 1950, McNamara returned to Major’s Cabin Grill with his partner Ralph Schneider. When the bill arrived, McNamara paid with a small cardboard card, known today as a Diners Club® Card. This event was hailed as the “First Supper,” paving the way for the world’s first multipurpose charge card.”

These 3 new reality shows are casting – know anyone?

Show #1 for Spike TV (shoot me an email if interested and I’ll connect you):

We are looking for a couple who lead the lives of millionaires but are at risk of losing it all. They make a very generous combined income, yet are unable to save any of it. Whether they are living way above their means or keep making poor investments, this couple needs serious help… To be clear – we are not looking to shame this couple. We want to help them. This experience for them could prove to be invaluable. We would be shooting with them this summer and obviously, there will be monetary compensation.

Show #2 for not sure…

Casting families who have dreamed of living in paradise but don’t know where to start! Do you think you and your family could retire today if you wanted to? At the rate you are going, are you worried that you won’t be able to retire in the future? Do you make a good living, provide for your family, but wonder if that’s all there is? Is quality time with your family and kids nonexistent? Is stretching your budget only providing your family with the basics? If someone told you that you could cash out, take what you have now and live a much better life with your family somewhere else, would you do it? We are seeking FAMILIES who dream of greener pastures. Does paradise await you?

Show #3 for not sure… (more info here: coaching movie)

I am working on a documentary seeking business execs and entrepreneurs who want coaching to take their business to the next level or to turn around a struggling business.

That 2nd one reminds me a lot of that show “Cash In Your Life” we blogged about in January, remember that one? And how I’d be the worst person to be casted?

Lastly…. JUST DO IT!!!! Make. Your Dreams. COME TRUE!

[Click here to watch the video if you can’t see it]

Have a great weekend, everyone! Keep saving that $$ and living your own life!

—–

PS: I took that photo up top while sorting through 469 old silver coins for a family member… They’re all pre-1965 dimes which means full of silver! $500+ worth actually :) Always check your change!

Get blog posts automatically emailed to you!

My daughter’s mentioned the LaBeouf video to me. The Star wars one is hilarious. Enjoy the weekend!

Anniversary getaway = the real purpose of money. So true!

I find the financial personality analysis of your readership fascinating. Regarding the under-represented categories, maybe people are inclined to answer according to what they want to be or think they should be? Not saying people are dishonest, but it’s hard to be entirely objective about ourselves, don’t you think? Or maybe his analysis says it all.

Yeah, maybe the quiz takes account for all that to double check everything? :)

Those tv shows sound so intriguing (I would rather pull my eyelashes out one by one than be on them…but I will most certainly watch! It’s sad though, I can think of at least 10 people who would fit into the “living like a millionaire without the means” profile. Why is it so hard for people to be good at money?

‘Cuz they don’t understand the full potential of HOW AWESOME it could be! At least I never did so I just went about my business until it finally dawned on me :) I think there needs to be a new campaign that literally says – “Save your money and you don’t have to work for the rest of your lives” haha… That would catch everyone’s attention!

I’m on it! Do you think http://www.saveyourmoneyandyoudonthavetoworkfortherestofyourlives.com is still available?

Haha… not anymore! I just bought it for you for Xmas :)

That diner’s club card is pretty sweet looking. Although, if he forgot his wallet, he still wouldn’t be able to pay.

I’ve always wanted to be on a reality tv show, but I don’t really fit the bill for any of those. Unless paradise means building a custom house right next to my husband’s school; in that case, I do dream of paradise :)

HAH! Didn’t even think about that…. so true through – you would need your wallet. (Although something tells me it’ll all be in our fingerprints or eyeballs one day so you never need anything again! Whatever it takes for people to spend their money faster, haha…)

“JUST DO IT, MAKE YOUR DREAMS COME TRUE!” – LaBeouf

Yup, that pretty much sums it up on what we all should be doing.

Shia is a disaster and I love every minute of it. Also congrats… everyone loves cash gifts!

That video single handedly make me actually like him, haha… he’s a bad ass in it.

“Luckily, his wife rescued him” – HA! That made me laugh. So glad to hear you guys did go on a little trip for your anniversary! Interesting comments on the Architect (me!). Don’t know that I’d ever be a financial planner, but I am organized and do love a good plan. ;) Happy weekend, friend!

And what a helluva plan you are working on too now, friend.

SELF-EMPLOYMENT FOR THE WIN!!!!

I LOVE the analysis of the readership. Totally awesome.

That’s cool how the first credit card got started. Very neat to see the quiz analysis.

The analysis of your readership was interesting – thanks for sharing that snippet. Congrats on your anniversary! :)

Ha ha ha…I LOVE that video!!! Every time I feel like I am running out of steam, I am going to play that and have Shia yell and me. JUST DO IT!!! :-)

Really gives you a jolt when you first hear it :)

DOOD. That analysis is the bee’s knees — I wish I’d taken the quiz! Thank you so much for linking to my project — you’re remarkable.

Take the quiz now and see where you fall! It’s not going away :)

Every time I hear about Shia I think back to an interview he did where he mispronounced the word “epitome”. It was classic. He put the wrong em-PHA-sis on the wrong syl-LAB-ble, haha.

https://www.youtube.com/watch?v=j5j3jypUCo8

Haha… that makes me miss The Soup all kinds of bad. Great show!

I still need to look into Digit. I keep forgetting!

Don’t apologize to me, apologize to your savings account :)

J$,

I saw the “TED Talk” version of the LaBeouf video the other day and almost lost it. That was seriously one of the craziest and funniest things I’ve ever seen. I didn’t know the backstory on that, so that’s cool. I just thought it was Shia pulling another LaBeouf. That’s like Tony Robbins after drinking like 10 Red Bulls or something. JUST DO IT!!!! Ha!

Have a great weekend.

Cheers!

Hah! You saw a spoof first before the original one – that’s kinda cool!

The Oasis pegged me correctly. I do have to psych myself and recover from big social functions but I can really do well if I have to speak or interact with people I don’t know very well. Funny how that works!

We killed a car loan this week! My husband had it when we met, with a nasty 14% interest rate. Two years ago when we got married we rolled it over to my credit union at 2.25%…but then it was our lowest interest rate loan and it didn’t make sense to go after it before other things! Finally it got low enough that I just decided to get rid of the darn thing. Progress!

Nicely done! On the cutting of the interest rate, and then the entire debt! Well played.

I tried the link from your previous post to that financial personality quiz, and it brought me to a dead zone that included “Take my family to Disney” and a “Continue” button that didn’t continue : ( (I suffer with technology!) Very interesting analysis of different personality types. Very cool history of the credit card too. I wish that guy hadn’t forgotten his wallet that evening!

Well that’s weird, sorry to hear :(

Here’s the direct link if you want to try again: https://www.payoff.com/quiz

Just tried it. Same thing : (

sorry :( I have no idea why that would be happening…. only other things I could suggest are trying on your phone or clearing your computer’s cache and trying again. Or even on a different computer. But it’s probably not at the top of your priorities so maybe just don’t bother, haha…

Ha! Funny you should ask about student loans. I just finally finished paying mine off last month! WOOHOO! :D

It took “only” about 8 years to pay off about $30K. *grumble, grumble, grumble*

Hey, $30k is no joke! I tip my hat to you, good sir.

J, I have already paid off my credit card (last pay, $220) and I am so happy about it and feel that I wouldn’t want to put myself in that situation ever again because it kinda stopped me from fulfilling my goals, it’s already June and feel like I am a bit behind my goals. Gotta keep up.

Congrats man! No credit card debt beats out millions of people :)

Ah, the first Credit Card looks totally cool! And you’re right about Shia LaBeouf, haha. I’m currently watching the full version since that clip was too awesome :3

Glad you liked :)

Not sure if I’ve ever told you before, but I love your name so much. So beautiful!

“This is the real purpose of money” – loved hearing you say that, and so glad you guys had a great weekend away for your anniversary! (but still a relatively inexpensive weekend!)

And I’m kind of pumped now after hearing the LaBeouf inspirational pep-talk! (was good to read about the back-story too – people are usually just too interested in finding reasons to make fun of celebrities to understand the context!). Any thoughts on doing a series of similar J-Money budget pep-talks??

“BUDGET!”

“Just get a piece of paper. Write down your expenses. AND BUDGET!!”

“DO IT!!!! What are you waiting for!!!!!!”

We’re sending our tenant a renewal with rent increase too, hope it goes as well as yours. Rental property – probably our worst financial mistake.

Good luck!! On the plus side, we’re now learning what it’s like to be a landlord, eh? Maybe that’ll make up for our mistakes down the road :)