“I’m bringing budgets back (yup)! Them other non-budgeters don’t know how to act (yup!)”

Mr. Timberlake got nothing on me ;) What, you don’t think that’s the same as bringing sexy back? Well check the calculation my friends:

Budgets = Confidence = Sexy!

Aww yeahh! Okay, so maybe YOU wouldn’t swap it in, but this frugal ba$tard sure will. After all, it’s what got me started blogging! Well, that and buying a house and all, but it definitely kept me on track. And to this day I’ve been a good little boy and continued to stick with it month after month. I mean, you *have to* know where all your $exy money goes, right?

What I haven’t been doing, though, was keeping it updated here on the blog for all to see. So going forward my budget will be updated the first week of every month! [Update – I no longer share my budget every month – but we still do our net worth!]

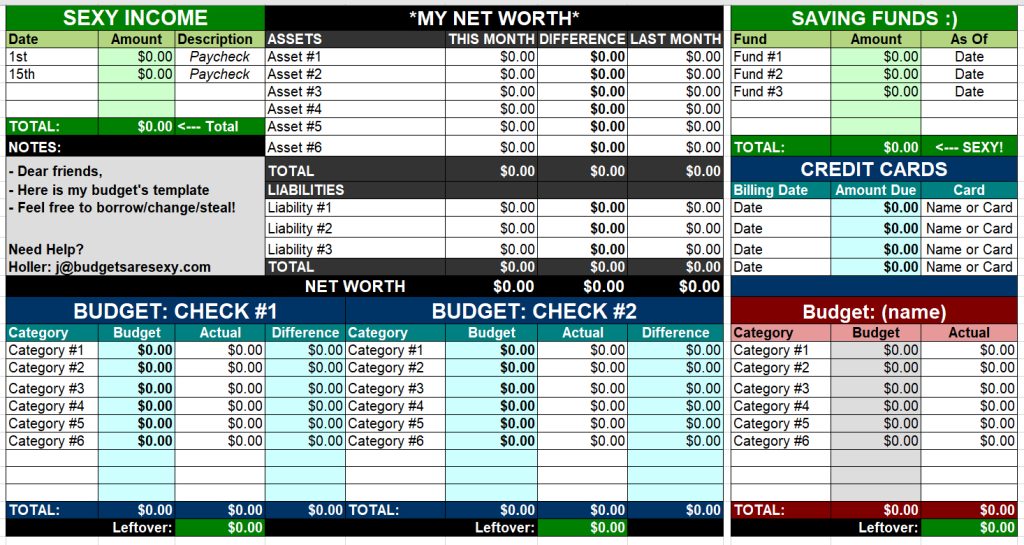

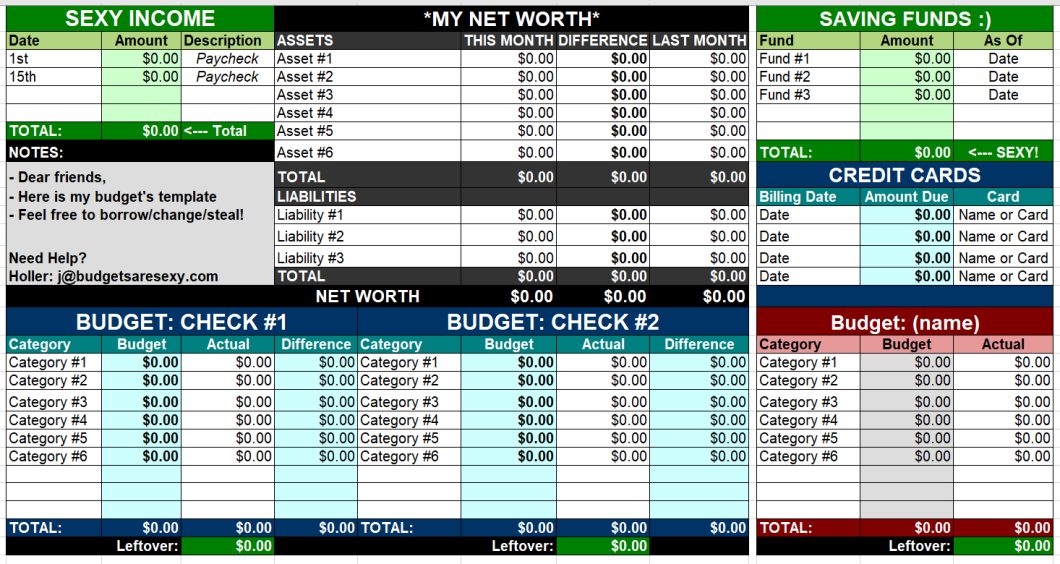

And as always, you’re more than welcome to borrow/steal any part of it:

- Download via Excel: J. Money’s Budget Template

- Download other types here: Other Awesome Budgets

I tend to be budget happy up in here, so it has plenty of room to track a few different budgets – like one for your paychecks, “house”, credit cards, etc. I also like being able to see my net worth and any other cash funds I may have laying around, so that’s also included.

The whole spreadsheet is really like a “financial snapshot” if you will. It certainly won’t satisfy everyone’s needs, but it’s a great starting place for anyone who’s ready to get down and dirty.

Here’s the paychecks portion above. It took me a while to figure out what works for me and what doesn’t, but keeping it updated and refreshed every month helps to nail it all down. You can find the rest of the spreadsheet here, but this is the most important portion of it in my opinion…

If you can come out in the positive every 2 weeks, you’re awesome as hell! Here’s the average breakdown of what’s included in my personal “paycheck budgets”:

Paycheck #1 ($2,249.18):

- Mortgage $$ ($848.24) – 1/2 of my portion of our mortgages. We have a 30-year fixed, along w/ a maxed out HELOC as a 2nd mortgage.

- House $$ ($300) – We tracked and averaged our other house expenses (utilities, groceries, etc) over a good 4-5 months, and eventually came up with our own “house budget”. This $300 covers 1/2 my portion, and the Mrs. puts in the rest (you can see the breakdown in the spreadsheet).

- J’s Credit Card ($638) – Like the house stuff, I tracked everything i spent over a handful of months (clothes, gifts, work lunches) and then averaged them together to come up with my own “c/c budget” that gets paid off in full each month. It doesn’t work for everyone, but I freakin’ love it! I get mad cash back rewards, and it’s super easy to manage.

- Cash Withdrawal ($100) – I *have to* have cash on hand all the time :)

Paycheck #2 ($2,249.18):

- Mortgage $$ (848.24)- the other 1/2 of my mortgage portion.

- House $$ ($300)- the other 1/2 I contribute to our “house budget”.

- Insurance: All ($143.42)- homeowners, auto, computer, and bling insurance for the Mrs. and I.

- Insurance: Life ($55.56)- life insurance for both the Mrs. and I.

- Cash Withdrawal ($100)- to cover the next 2 weeks ;)

In a perfect world, I’d like to ALWAYS have my expenses budgeted below or at least even to what I bring in every 2 weeks (but sometimes I go over in one paycheck, and over in another). Luckily I’ve been able to come out in the positives each month, but when I don’t I just pull the difference from my savings account and throw it into my checking to make up for it….not the worst thing in the world to do, since that’s why I have that padding there to begin with, but it’s still a dirty habit that I should get out of.

So there you have it – J’s new & improved budget :) Again, feel free to steal any part of it!

It may look a bit confusing at first, but it’s totally cool once you get the hang of it and I’ve included short directions at the bottom of the spreadsheet for you. It’s all a matter of finding what works for YOU, so if you already have a great method down, then by all means keep rockin’!

*******

PS: For a list of other great budget spreadsheets from the community, try these: Best Free Budget Templates. Maybe you’ll find something even better? And less colorful? ;)

Get blog posts automatically emailed to you!

Hi sexy, The budgets are very cute (color coded etc.). I’ve used quicken forever. Have you tried any other templates? It seems kind time consuming to input all the data by hand monthly.

yo yo yo! I actually have tried a whole bunch of other programs and spreadsheets before, but I always ended up coming back to this & then just tweaking the set up to do exactly what I wanted :)

It does take a while to fill in the first time (esp. if you’ve never tracked your finances or budgeted before), but after that first go at it it’s a lot more smoother and quicker. The only thing you really need to do each month is duplicate the tab (so you can keep a history of your progress) and then just plug in the numbers for that month. I literally spend 15 mins at the first of the month, and 15 mins around the middle of the month adding the numbers in – then I look around and see what I’m doing right/wrong :)

I will say though that this isn’t the right tool for anyone who wants it all automated….for that I refer over to the almighty awesome Mint.com! But if you like to manually keep track of things, and customize it 100% – then my budget spreadsheet, or any of the other budget templates I’ve collected over the years, should work out nicely. Just a matter of finding the tool that works the best for ya!

Just wondering what you do with that leftover amount every two weeks? I don’t see savings on the list so I’m not sure if it’s already come off before you show the income amount, or if the leftover becomes the savings.

We have deductions done at work before we receive our pay, and then every Friday I skim off all the excess and either dump it in our retirement accounts or make an extra mortgage payment. I always leave $1000 in the account so we never pay bank fees, and it serves as an easily accessable emergency fund should the need arise. But everything above that is removed from the account on a weekly basis. The if we didn’t need it I find it’s best to put it where I can’t get at it and it can start working for us.

oh that’s a pretty good idea. I like that :) I kinda do that too, only with $100 being left in the account. which has worked pretty well for the most part, but every now and then i get a bit too close to comfort. $1,000 seems much safer.

and you’re right, I don’t show where that extra money goes every 2 weeks in that budget above – but I can assure you it’s going straight into our savings accounts :) and also my newly formed “$50,000 until I can quit my job if I want to” fund. I’m pretty obsessed about saving right now, but I go into my moods. In a perfect world I’d just save and travel around the world at the same time ;) And blog. W00T.

I am completely confused about making a budget. It seems easy in theory, but for some reason I freeze and it makes me feel incredibly ingnorant.

I save nothing, I’ve no 401 or IRA… I am a single mom of 6 kids, however, only 2 are under 18. I am 50 and I will be working forever, if I don’t get my money under control! To say I live paycheck to paycheck would be generous.

In addition, all examples seem to come from people who make a very good living. I cannot even imagine being able to put some money from my paycheck into a 401, or a savings, how would I live and pay bills.

I am at my financial ropes end….

awwww i’m sorry to hear that :( but you can always start now! maybe if you don’t call it a budget and just think of it more like a challenge or game it would be easier to tackle? it’s hard to shoot over ideas since we don’t know your particular situation or personality, etc, but you can ALWAYS change your path if you truly decide you want to do it. it’s not going to be easy but it’s most def. possible. And I wish you nothing but success!!! Keep trying new ways until you find a solution that works :) You can totally do it!

J. Money- I loved what you said to Too Ashamed, I totally agree. I might add that when we committed to look at our finances on Sunday every week that it totally turned everything around for us. Since we have a little one too sometimes we have to wake up in the middle of the night on Sat. to do it :). But just setting the time aside and being there is half the battle I think.

Best,

Katy

Amen to that :) I think that’s a killer idea.

Too Ashamed, please talk to your Human Resources person and tell them you need to start contributing to a 401k and how much would that effect my paycheck? Most companies will MATCH what you contribute, so you are throwing money out the window! Go look it up, email, ask, do something. Even if it is 25.00 a month.

J Money! I’m a brandi new freshman college student starting this fall. Is there any specific budget template you could shoot my way? something simple and college kid-like? I wanna get this financial thing right from the beginning!

Thanks!

Hmmm… to be honest, I’d go w/ the same one I talk about in this post :) It’s super easy, and all you have to do is swap out the categories that don’t work for you with those that do. There’s nothing much to it, really. And getting into the habit of tracking your net worth, which is featured in there, is a VERY good thing to do starting young like you are. It’s probably gonna be ugly for a while, but the more you see the hard numbers now, the faster you’re gonna rock it out later. Give it a shot! And congrats on *thinking* about this stuff right now at your age – I was out drinking and making sure I had enough to eat every day, that was the extent of my budget ;)

The budget won’t load in google docs. Any way of fixing it? :( I want to use it.

Oh, weird – never seen that before, I’m sorry. I’ll see what I can do. In the meantime, why don’t you try downloading the spreadsheet into Excel, and then just uploading that into Google Docs? That’s what I originally did to get it up there :)

https://budgetsaresexy.com/budgets/j_budget_template.xls

Hi J

I’ve left a note on some other page, not sure if it went through. Back to budget:

I will have 350 a month extra that I want to use for extra house principal and savings, {CDs,} What amount would you recommend for each? Thanks for the input!

David

Hey David – congrats on having a nice amount left over every month! And even better than you want to apply it to better your finances :) It’s tough to say which is better for you since we don’t know each other, but I think either way you go you’ll be fine. If you have no emergency fund set up (3-6 months worth of expenses), I’d probably put more into savings than the mortgage, but if you have a nice cushion and/or your mortgage rate is incredibly high (over 5-6%), I’d probably push that side higher instead. All depends on what makes you most comfortable :) But again – either way you’re on the right path!

I am in my early 40’s. My husband and I have just started to track our spending and made our first real budget in January. In the past we didn’t really make a budget, we just wrote down what we spent without a plan and were really ashamed at the end of the year. I want to proudly say that we have been on track and under budget for two months. We have a 401k but I want to invest a small amount for “fun” meaning something that is more emotionally based. I opened an e-trade account with a small amount ($1000) and have kind of froze up with uncertainty. Any advice for an amateur investor? Thanks

Awesome! Congrats so much on getting a budget up and running, and taking control like that – it’s an incredible feeling, huh? :)

RE: Investing — it’s hard for me to advise on anything like that since a) I don’t know much myself about it, and b) I don’t know your personalities and/or risk levels, but I do know that a lot of first timers enjoy going with mutual funds or those that track the S&P 500 or other indexes (Or even “target date” funds that adjust depending on the year you guys want to retire). I’d Google a bit to get some ideas, and then maybe check out Vanguard or other highly respected places that give out good info :) You guys will be fine though. I’m a big believer in doing your best whether it’s 80% “the right” choice, or 100%. The point here is you’re working on growing your nest egg, and that’s half the battle. So keep it up!!

I am a major budget nerd and have been one my whole life! I so glad it is now ‘cool’ to be in control of one’s financial goals and spending plans. I just get a cold chill up my spine when I meet someone who tells me that budgets are too hard to stick to, too hard to plan and the kicker of all excuses is they don’t think they make enough money to bother with a budget. I say the less you have, the more you need a budget, a spending plan or even a rough idea of how much money you do have compared to what it costs to live inside a building WITH utilities, eat every day and somehow get from point a to point b, without having to walk or take a bus.

So, I will sit contentedly by, willing to help anyone who asks for help setting up a budget and keeping them motivated and on track towards some type of goal.

I wish Washington DC would get bit by the budget nerd bug, they need to, FAST. Joey

HAH! You’re right on that one, good sir. And the people of DC need one too, which I’m quite aware of living here ;) Awesome that you’re a huge fan of them though, hopefully if enough people spread the word there’ll be less stress in the world. You’re def. right in the importance of tracking it even more when you make less too – thanks for stopping by!

Hello! Just wondering if this is the same budget spreadsheet you still use? I have actually tried to download the google doc several times and it always shows me an error message.

Hey Crystal :) Yeah, I still use it all these years later but I don’t update it anymore online because I ran out of time. You can view it on Google Docs/Drive still with all my details (I just checked and it worked) but you’re right in that you can’t download the one posted *here* because it’s just for show.

Use this one if you want to use the budget template from Google docs (make sure you’re logged into gmail when you do it):

http://docs.google.com/previewtemplate?id=0AphtcNd0RXTEcEpHQkZHV21TVUhNd3ZWcmdNUkZKWnc&mode=public

You have to click the “use this template” button in the upper left corner and it’ll go into your own area :) And then from there you can download if you wish.

Or, you can just download the excel spreadsheet and go from there:

https://budgetsaresexy.com/budgets/j_budget_template.xls

Hope this helps!