This is kinda old news, but Quicken Online is getting thrown into the dumpster in favor of its new gem Mint.com (which Intuit paid $170 MILLION dollars for last year and has a gaggle of hardcore fans – myself included). But while many of us love the trendy ol’ Mint, there are handfuls of those who don’t. And unfortunately these budgeters have until this Sunday, August 29th, to figure out a new plan before Quicken Online shuts down forever (Yikes!).

Which brings us to today’s email from fellow reader Deb, who falls into that latter category of needing some other options. Here’s what she wrote:

J-Money, I need your help and the help of your awesome blog followers…

I’m at a loss because I’ve been using Quicken Online for about the last year and have had great success in getting my finances under control… but it’s getting shutdown at the end of August as Intuit is moving ahead with Mint being their online platform…

I tried Mint in the past, and I’ve tried going back to it now, and really, we’re just not friends. I can’t get it to categorize transactions with the perfection that QOL did (and many other people seem to have this problem, especially with the auto renaming that it LOVES to do.)

I’ve been looking for other online options because I like being able to know what’s going on with my money at whatever computer I’m near, be it home or work. I see that Wesabe is getting shut down too, so I don’t really know where else to go. Any suggestions? Thanks a bunch!

That really is the worst, isn’t it? When you finally find something that works great and then it gets taken away from you! I’m sorry to hear that. Especially since it has to do with money, and you keeping more of, it! :)

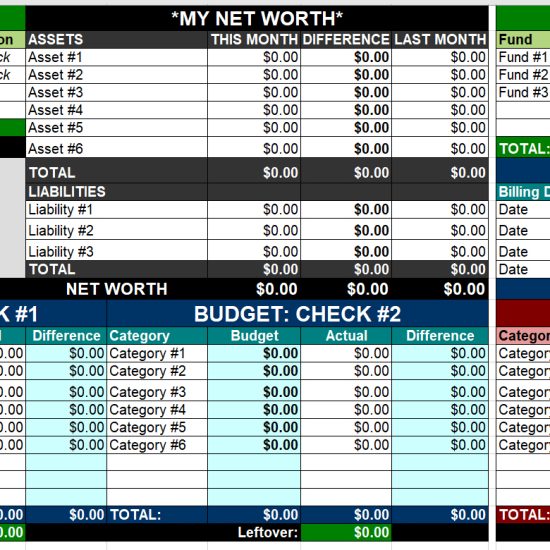

I’m pretty sure you’re not gonna like my first suggestion, but I’m going to say it anyways: Budgeting by spreadsheets (Google docs especially, and Excel a close 2nd). There’s something about manually keeping track of your money that seems to help you stick to your goals better. At least for me. Here are a few good ones I’ve collected over the years – including my own – to give you an idea of what’s out there.

Now my second recommendation is usually Mint, but obviously that’s gonna fly today ;) Luckily there are some other decent platforms out there that are kinda sorta like Mint (aka everything is pretty much tracked for you), but have much different takes on budgeting. Here are the others to check out:

- PocketSmith (free, w/ options to upgrade (not free)). This big pull with these guys is the unique way they set everything up – all via a calendar!

- Budget Pulse (free) – I’ll have to admit I’ve never used Budget Pulse before, but if their platform is anything like their Twitter/Blog persona I think you’ll be in some pretty good hands :) (You reading this Craig?)

- Pear Budget (online version: free for 30 days, then $3/mo.) Haven’t used this one either, but from what I remember they have a pretty good rep around town. They’re a husband and wife team who’s sole goal is to make budgeting as simple as can be. Gotta admire that!

- You Need A Budget (free for 15 days, and then 1 time cost of $49.95?) This is the darling of the bunch, at least before Mint blew up. Almost every blogger I know is a fan of theirs and I have yet to hear a complaint. Although I don’t really stay on top of them much, either.

- USAA Money Manager – (free) This one’s a bit different than the rest since you actually have to have a USAA bank account to use it, but if you’re looking for an excuse to sign up this is it. It’s perfect for the “average” budgeter, and will hopefully get even more tweaked for those of us who like to get into more complicated stuff. (you can see my mini-review and snapshot of one of my accounts w/ USAA here :))

Did I miss any, friends? Is there anything even BETTER out there that we should know about? I’d love to help Deb and the thousands of others with her land a good alternative before this upcoming doom day. It’s just unfortunate the J$ software hasn’t hit the stands just yet ;)

Get blog posts automatically emailed to you!

Odd question/thought: Can she still use Quicken software on her PC/Mac and just import all of the banking records. I still don’t trust the internet (ridiculous, I know) so that’s what I do. Please don’t tell me that’s going away too?!?

@A.B. – There are a ton of people out there who do not trust the internet with uploading their account information. I don’t see why not she could not just use the standalone native application on her PC. It just won’t receive any more updates?

I was a HUGEEEEE MINT.com person the last year or so but lately I have fallen off that wagon as well. It is a great tool, but I have been very careless with my spending, not holding myself accountable, I have just been going through the motions. Time for a rewind and a kick in the ass to myself. Unless someone else kicks me first.

I think that it was a good move for Quicken to partner up with Mint because it is more profitable for them

My fiance and I are set up with ClearCheckbook.com. It’s literally nothing more than a nice online checkbook, and you can access it anywhere, and even text in transactions! We set up our budget in their spending limits and we both have access to it anywhere, which is useful since we don’t live together yet. I give a hearty thumbs up for it, and it’s free!

P.S. It is completely manual, however. No automatic transactions. But I prefer it that way.

I have always been a big lover of Thrive (www.justthrive.com). I never really “clicked” with Mint either.

I was an avid Quicken online fan, and still am a user of the standalone PC version. It took me three weeks to finally ‘get’ Mint.com and now love it. I’m still working out a few kinks (like how to delete duplicate transactions that Mint has downloaded but aren’t truly duplicates) but otherwise, I enjoy it. Having a iPhone app in Canada (finally) makes it a neat tool to use on the go. I just wish they’d update their Canadian Bank list – they had it in Quicken, why not Mint?

Great online budget round-up! I am a huge fan of Mint.com as well. I like the perspective you gave on some of the others too. I am all for anything tech that will make my life easier including stream lining my funds.

@PerkStreet Jen I am a huge fan of all things Google Cloud too. I’m actually trying the same thing with a pretty basic budget and some of my doc’s for work. I know you probably wouldn’t do this with a budget (or you could if you share your household finances with someone) but the ability to share and have multiple editors gets to be kind of fun too. As long as everyone is on the same page though.

Manually with an excel spreadsheet for me. A few formula’s and some colors and you’re all set. Very easy to share when helping other too.

Another free option is http://www.moneyStrands.com. The site allows for both manual and automatic accounts. It also supports 44 currencies for those living outside the US.

-Lucia @ moneyStrands

Mvelopes is awesome! It’s not cheap, but I don’t know what I would do without it.

even though i sent a quick twitter response (DIY ftw :p), i’ve also started using pageonce’s personal assistant. you can’t create budgets, but you can keep track of balances and transactions (plus other stuff like netflix and twitter). i’m really liking it because i can view all my accounts online or on my blackberry. mint doesn’t have a blackberry app or a mobile page, which loses them a few more points. i know there is a paid pageonce option so there might be additional features i’m not aware of :)

Awesome list of resources you have here! Thanks!

I’ve been hearing so much about Mint and had to try it out for myself. It’s definitely taken online banking and financial planning/management to a new level with me. I’m a Bank of America user with a few credit cards, and a joint account at Chase, but it keeps everything in perspective on the screen for me. I also love the fact that it has goals for you. I’m hoping to get a better handle on my finances using the system. I haven’t tried Quicken but saw it in the store yesterday for a pretty penny. I think this will be a nice and more affordable, user friendly platform for people.

@Nunzio – Actually, I do share a similar document with my fiance for our wedding finances. I also use it to share a wedding checklist with deadlines and the guest list – that way we can both access the information from wherever we are. Super helpful.

I keep hearing good things about justthrive but never got it to work. Another mint fan here… We use google spreadsheet to put in day to day expenses (and share), but overall month-to-month planning is done via mint.

I’d say go with the spreadsheets. For me, this works the best in that when I have to manually enter all of the information, and add things up, etc., it really helps me to keep track of things more. I’d feel guilty looking over my individual purchases, and that would help me to curve my spending habits!:)

Good luck with the search!

Thanks for all the other sites guys! Never heard of Just Thrive before, or even ClearCheckbook.com, but these are all great – as well as the others mentioned :) I’m sure these will help Deb and anyone else looking around!

You guys rock.

I use pocketsmith.com I love the simplicity of adding expenses to my calendar to forecast how much money i will have in the future. At the moment my finances are looking ok, but I really want an Iphone which throws my budgeting out the window!

Thanks for the plug J. I don’t think my Twitter handle competes with the best, AKA Budgetsaresexy.

I’ve had a similar problem with Mint not letting me organize tags the way I want them for the budgets I have set up. So I have a spreadsheet & am starting to play with Toshl as a way of tracking my expenses – it is on my phone & I add in the item when I get my bill using whatever tags I like, and it spits it out as a spreadsheet on my computer for easy cutting & pasting into the spreadsheet. It also keeps a running tab of how much I’ve spent under each tag. Advertised as “mobile expense tracking.” So far, so good.

@Sam – Haha….I just sucked it up one day and got one :) Haven’t looked back since!

@craig – You gonna be at happy “coffee” hour tomorrow? hit me up on email if you want info… should be a good group!

@Kate – Haven’t heard of Toshl before, will have to check it out – thx :) And hopefully Mint is working on some of these changes people are wanting and talking about. Fingers crossed!

Don’t forget to check out GreenSherpa as an alternative!

Oh yeah! Forgot to include that one – good reminder Jacobs :)