Already onto month #2 with these Challenge Savings! How fast is time going, eh? Yet another reason to start whatever it is you really want to be doing TODAY as we’ll just be back here again in another 30 days before you know it… Remember that old Chinese proverb?

The best time to plant a tree was 20 years ago. The second best time is now.

Print that out and stick it to your computer monitor until you’re ready to take action :)

Back to our Savings Account though…Looks like we’ve been steadily adding in $200 each month so far. Pretty good for basically doing nothing! “Passive savings” you might even say? ;)

A reminder as to why we’re doing this: First and foremost to make sure we’re actually saving all the money with these cuts (you can tell people you’re saving on things until the cows come home, but until you actually DEPOSIT IT SOMEWHERE it’s not really saved money, now is it?). And secondly, to help motivate us and put things in better perspective. While our quality of life hasn’t been that affected since starting this challenge, there are certainly days we miss our iPhones or ESPNs/MTVs/etc.

Our hope is that by watching this balance grow over the month, it’ll continue reinforcing all the smart moves we’ve been doing. And so far so good :) I’d much rather have $400 cash money than a few more TV channels or sleeker phones, so no turning back yet!

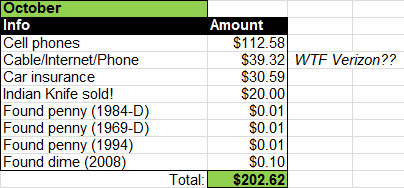

Here’s the breakdown of October’s $$:

Cell Phones: The difference of our old wireless bills w/ AT&T and our new ones w/ Republic Wireless.

Cable/Internet/Phone: Either Verizon think I’m an idiot again and have stopped paying attention to my bills, or they’ve grown an even bigger sack and is trying to stick it to me after my $50/mo savings I snagged the other month, ugh…. Either way, WTF? How do you raise someone’s bill by $9.27 after they just called to complain and get stuff situated again? What am I getting in return for this $9.00 I’d like to know???

I’ve tried calling them twice already to find out, but each time the wait has been over an hour and I just haven’t mustered the energy to stay on the phone and fight again… But I’ll be back to it tomorrow to figure it out once and for all, those F’ers. Which just reminded me – I totally forgot to do our WTF Wednesday series today, oops! This kinda sorta counts though, right? ;)

Car Insurance: The difference of our old car insurance bills with our new ones – both with USAA (I had changed the monthly mileage they had on record for our two cars as we don’t drive them as much as we used to, as well as dropping some coverage on my Caddy since it’s practically an antique now. Still drives incredibly well despite it’s looks though!)

Indian Knife Sold: I blogged about this sale last month, but here’s a different picture of it below. When it was in its prime acting as a decorative display :) I liked it, but I liked $20.00 more… Especially as I originally paid $3.50 for it! #WINNING

Found Pennies & Dime: Pretty self-explanatory… People hate money ;)

Sadly all other items I’ve since listed in our Weekly Craigslist Listings haven’t sold yet. Getting a few nibbles here and there, but nothing that’s been able to move them out of my house yet. It’s slowly becoming a habit though! And since I’m not in a rush to sell anything, I can play the patience game and try for the values I think they’re worth. Or at least slowly drop the price over time until they’re sold.

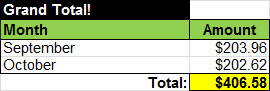

Total Savings Since Challenge Started:

- Month #1: September, 2014: $203.96

- Month #2: October, 2014: $202.62

- GRAND TOTAL: $406.60

[The total is a bit skewed due to the interest our account is accruing.If you can count $0.02 as any real accruement, haha… But hey, that’s two found pennies on the ground! ;) And plus, this is just a 12 month experiment. Once it ends we’ll be diverting this money into something hopefully much more lucrative. At this rate we’ll have at least $2,400 in it!]

So there you have it. Our Challenge Everything Savings account is working its charm and becoming more impactful. If any of you are playing along, I’d love to see what your accounts are showing :) Or start your own today and move all your “saved money” into it as well! You’ve already done the hard work of saving it, now make sure to keep your grubby hands off it and store it somewhere so it counts.

You can learn more about our Challenge Everything Series here. Hope this helps!

——

PS: I think it’s time to start tackling another bill now… Any suggestions?

[Pirate bill by J. Money. Which he may have copied from this person.]

Get blog posts automatically emailed to you!

Nice catch on the Indian knife..I don’t have a knack for spotting things like that. I might have overlooked it and paid more attention to the glasses! haha

I love this Chinese proverb, “The best time to plant a tree was 20 years ago. The second best time is now”. I also cut off my cell phone plan because the company announced that they need to increase next month, I decided to shift to prepaid.

Suggested bills… ways to save on credit cards is to not let them accure.

** water bill, electricity — no way to really change – except looking at home equipment and usage.

I know people who completely unplug all equipment they can at night because it still grabs a trickle even if not on – I have not researched the veracity of that…

** trash – do you pay extra for recycyling? do you recycle much? that would be something to look at, and it not – would it make more sense for a once-a-month drive by the nearest public recycle bin.

** child care: losing a day a week can make you actually pay more. If it is not a chain, have you asked about a bulk rate with them for a discount? (If I pay ahead for twelve weeks, can that be for fourteen?)

** car payments – I assume you have looked into refinancing. another way to pay more now, but less ultimately is the biweekely payment. (extra month a year)

** food bill – are you an amazon prime member? are either of you going to school? (college students get a hefty discount on the price) prime members not only get a lot of entertainment value, and “free” two-day shipping… there is also the non-perishables grocery subscription service. Got something you buy two boxes of every two weeks? if you subscribe to buying this from Amazon, they usually have a 15% or so discount on it.

What other bills do you have?

Great ideas up there – thx! The biggest of them all for us is child care. It’s almost as much as our mortgage! We’ve looked into alternatives but so far nothing that compares to what we really want… And not an area I was to “settle for” since has to do w/ our kids. I’ll be glad when they’re out of it though and into school! :)

Good reminder about Amazon Prime too. My wife’s still a student but haven’t tried the food ordering yet. We def. want to try it out and test it.

I suggest you call your trash provider next! Where I live there is apparently a war on trash business and our trash provider keeps dropping their rates to stay competitive. Of course they do not advertise this! But by calling I’ve managed to snag better rates THREE TIMES in the last year. We started out at a monthly trash bill of $32 and as of this week (when I scored the most recent discount), we are down to $18! My plan is to keep calling every month or so until one day it’s free :-)

Related to this, if you live in a development with an HOA – ask to see if there’s a negotiated rate for trash pickup – our “negotiated rate” was almost half the published rate. The HOA did it because there were complaints about trash trucks coming through the neighborhood almost every day – they negotiated with one provider to encourage everyone to move to that provider and reduce the number of large trucks going through…

We don’t pay for trash at our place (renting) but loving the tips :)

Congrats on the found $$$! Once in college, a girl I knew admitted she threw away change all the time when cleaning her dorm room. I replied, (only somewhat jokingly) “I’ll take out your trash for you if you’d like!”

I love this concept! And, WTF Verizon, indeed!!

Loving these updates! And, I totally feel your pain with the whole Verizon things – we’re going through it too with AT&T. We called and got some things reduced, but then they somehow found a way to tack on more fees. So frustrating! Thanks for the motivation to keep going :-)

Gotta watch those guys like a hawk – it’s incredible. And one thing I do NOT miss with Republic Wireless – it’s the same flat fee (+ tax) every month! Love it! And everything’s unlimited so no worrying about going over yada yada yada

Loving these updates. Keeps me motivated. Thanks! :)

Nice work J$, especially on the knife turnaround! We had a similar WTF with our internet recently – they upped our bill by $6 or $7/month just for kicks and giggles. We got them to discount it for another 6 months but said it would only go back after but you better believe I’ll be calling once the 6 months is over for another discount :). As for other bills, I’d echo the thoughts on taking a look at your grocery bill to see if there’s anything there you can cut.

Perfect item to put in google calendar to remind you so you don’ forget :)

$2400 a year is nothing to shake a stick at!

I find that our stuff we sell online either sells the first day or it takes a really long time to sell, if ever. We actually just give a lot of the stuff away now, I know, not frugal, but less clutter!

I don’t see a link to your budget, so I don’t have any suggestions for more ways to cut. I just wanted to say keep it up!

thanks Emily! and I find the same thing too with selling online. though sometimes I can’t tell if it’s a good thing or bad thing when stuff sells really quickly – always makes me feel like I priced them too low! Haha…

LOL trying to bring #winning back? LET IT GO MAN!

Never! One of my favorite sayings and now it’s cool again cuz no one uses anymore! #WINNING! :)

I’m going around the house doing another push on Craigslist items. I keep thinking that maybe with Christmas coming up it will help? I also need to call cable again and ask them about lowering my internet bill…you know, without lowing the speed. :)

Great post! Definitely motivating me to take a look at my spending and see where I can/should be saving. Thanks!

Nicely done! Please let us know when you open the can of whoop ass on Verizon.

The separate line items for each penny killed me. That’s dedication & accuracy, friend. Keep it up!

Figured the coin lovers out there would appreciate the details :) Happy to mail them to anyone who’s missing those dates in their blue Whitman folders! Haha…

If Craiglist doesnt work out try Ebay. I went through my closet again and some more clothes went up one Ebay for me to sell. And I am glad I am not the only one that stoops down to pick up pennies, dimes, quarters etc. I have a change jar in my house and it adds up quickly.

Nicely done! And, totes agree, you have to actually save the money you save :). You’re inspiring me to think about selling stuff on Craigslist… I need to get myself organized and do it!

Electric/gas bills are the next best place for looking for savings – although hard to quantify the savings since they’re so variable. But turning down your furnace (or your AC off), you can save quite a bit.

Yeah, I’m hoping to be able to do more of this once our kids are little older. Right now we’ve got all kinds of heaters and stuff going on for these dang babies, haha… Not to mention tons of clothes washing loads/etc, they eat up a lot of electricity! :)

Last week, I asked my homeowner’s insurance company if there was anything they could do to lower my bill. We didn’t adjust my deductibles/limits, but for what ever reason, my garage was listed as unattached (which it’s not), and the following week I got a check in the mail for $75. Boom.

What to tackle next? This is one-off, but you can start searching for crazy holiday deals…stupid discounts are being thrown at the consumer, even right now, to get us in the mood to shop. All of your extra “savings” from this category can be added to your account.

Nice work man! $75 for a quick call – not too shabby!

Check your utility company websites. Many of them offer rebates for things like switching to CFLs or composting.

We made $40 on eBay last week. My husband has a hoodie overstock problem that I’m sure you can relate to. His thinning them out, so I can’t complain too much. This also reminds me to call the internet company. Our promo is ending this month and I need to find a new one before the price goes up. Don’t want to negate my $40!

Yes! Call those mofos up! (And you’re right – I do have a hoodie problem too :) Though I am proud of myself for donating 10 of them last year during our move… I try to play the “one in, one out” game with them but never works!)

I love these challenges (and seeing a USAA savings account :P). This does remind me that I need to call and negotiate on my Internet package. It’s gone up $20 in two years which just really ticks me off (not unlike how banks mistreat existing customers). That would be an easy extra few bucks to tuck into a challenge everything savings fund.

Yes, and most importantly it’s RECURRING money every month that can be banked!

Great second month :) thanks for the update!

I love all of this, but especially the Found penny 1969-D, etc!

Just last week while we were traveling to various locations my 11 y/o son found a silver dollar 1969, and a $5 bill (with no apparent owners anywhere near by or he would have gladly returned them to their rightful owners like the good Boy Scout that he is!)

I told him about when I was a starving college student I could walk from my house to the Student Union and along the way usually find $2 to $3 dollars worth of change if I just looked down! So needless to say, he is totally enthused about seeing how much he can collect.

He has also found some other various “treasures” like the Ace of Clubs from a deck of cards (which was cool to him because he has been learning some card tricks – it was like a “sign” lol)

I told him he should start posting on Instagram the things he finds everyday, for at least a year and make it an official challenge/treasure hunt.

YES! Brilliant idea! If I didn’t have enough projects going I would have started the same months ago too :) I find all kinds of random stuff on the ground – it’s fascinating.

RE: That silver dollar – Are you sure it’s 1969? Cuz there weren’t any silver dollars made by that year. So either the date/denomination is off (could be a half dollar? is Kennedy on it? or a 1979 coin w/ Susan b?) or he found an incredibly rare coin worth a ton more than $1.00 :) As a rabid coin collector, you’ve not got my interest piqued!

I drained the $768 I’d saved w/ my shopping ban so far to buy a new bed, but am back up to $120.60! I’ve been saving $60/month for what I don’t spend on takeout coffee. Might boost it to $100 during Nov/Dec, when I’d usually get a million red cups from Starbucks, haha.

I think that’s a smart idea :) And pretty crazy to see how much $$ adds up from that coffee ban alone, isn’t it?

I missed the start of the fun over here but I actually fought the good fight with AT&T 2 months ago, dropping their attempted 50% increase down to about 10%. Not a shining victory but that still made a big difference!

We’ll see an insurance rate drop in Feb when one of Dad’s dings on his record finally falls off *sigh* but that might to be offset by the increase in driving we’re seeing right now. Rats.

Still, with all our purging, PiC should be bringing in a tidy sum via Craiglist to offset our baby spending! I’m going to have another spin around our expenses to see what else I can cut down to size :)

Do it! Anytime I look at something and REALLY ask if I truly need it, the answer is always no. Though I still keep a lot of them because I really WANT them, hehe… Still, it’s a good habit to get into :)

*hah* I’m ruthless culling through stuff and PiC is finally getting on board. At first he was like BUT I WANT THEM.

Now it’s all about racking up the Craigslist sales ;)

J$,

Awesome job here. That’s $2,400 in positive cash flow per year. Adds up pretty quickly.

I need to start scavenging for loose change around here! :)

Best regards.

And knowing you it would go right back into dividend stocks so the “free money” here would be making “free money babies” which in turn would keep making more babies forever and ever and ever, haha…. Perhaps I’ll have to consider doing a dividend test w/ all the $$ in the end? I would need your supervision however for that.

The best time to plant a tree was 20 years ago. The second best time was 19 years ago. The third best time was…

How about scrap metal? Rather than recycle take it to local scrap metal place every couple of months and cash it in. I was surprised at the things that you can scrap – soda cans, electronics, christmas lights – you name it. If it is good – sell it, if it is not – scrap it. It adds up.

That’s a good idea…. I know a lot of people do it with silver and gold things, especially with coins (I’m a collector so I love this stuff!), but I know other metals can fetch some $$ too… unfortunately/fortunately I don’t have a lot of random metal stuff lying around haha..

Love this post! This past week was the first time we cashed in our change jar and deposited the money ($61) into a separate savings account instead of just taking the money and spending it! It felt so great. We even decided all of the money that would go in there from now on ~ change jar money, scrap metal money, craig’s list money … little extra cash finds like that. You’re so right. We may wish that we’d started doing this ages ago, but looking back just trips you up. And you’re so right that saving a couple of dollars on this or that isn’t a savings if you just end up spending it elsewhere. Seriously, super post! Love it! :)

Good job! That savings account is going to grow like crazy too, especially if you don’t touch it for a long time – the 2nd half of the equation :)

I really like the idea of your challenge and how you’ve been able to save so much! This motivates me to get some stuff out of my garage and on Craigslist! Also, I cut cable a few months ago since I was going back to school and although I borrow my boyfriends Xfinity login here and there, I don’t miss it!

Congrats on the progress….I’m with ya on Verizon….it’s a constant battle. Couple of things…TRASH …Private pay here and it ain’t cheap. We opted for no service and made a concerted effort to recycle because it’s free. I seperate “burnables” to be used in the wood stove for heat, food scraps are placed in the compost bin, metal & aluminum are saved and cashed in for $ . One trash can full of metal cans = about $5… To this end we have about a plastic grocery bag of trash every 2 weeks which I deposit at the Aldi trash can when I shop. My BIG question is have you made moves to take on your health insurance coverage and reduce costs? Just got my renewal notice WITH a 13% increase in our premium…What the #@&*##!!! Any ideas…?

Ughhhh we just got a notice saying we have to leave our insurance and go to Obamacare…. Haven’t looked into it yet cuz it makes me want to punch myself in the face, but we will be soon. It ends at the end of the year I believe. I’ll be blogging about it once I figure it out.

I just realized I forgot to send you my numbers. We are at $431.33, not as good as last month but that’s because the childcare savings we had last month was used on actual childcare this month. Kids, those pesky net worth drainers. :-) We are thinking about joining the Craigslist challenge, though, to beef up this account more.

You’re gonna have to as I’m on a Craigslist roll right now and will have quite the nice increase going into month #3 :) I need a sparring partner with this challenge!

Verizon…shaking my head. I haggled my bill down some time ago and it crept back up. I couldn’t understand what those chargers were and was told “government surcharges and fees.” The lady on the other line couldn’t explain how my bill was reduced but the fees (which apparently you can’t negotiate) has increased incrementally too.