Happy Monday, all!

Good day to sit down and update the ol’ net worth! (But when is it not, really? ;))

Nothing too crazy went down for us last month, but I did have fun opening up a new 529 account for the youngest and plopping in $5,000 to help him catch up with his brothers… It turns out I picked the wrong day to start and I’m already down by $130 – hah! – but hey, what are you gonna do? It’s the time IN the market that counts – not TIMING the market! Heyo!

Here’s how the rest of our finances played out last month:

June’s Net Worth Breakdown:

[This is Net Worth Report #126 where we share the ins and outs of our money – regardless of how well or not we’re doing… But here’s the trick: the longer you pay attention to this stuff, the better your money tends to get! ;) And I hope you’re tracking this all at home as well as it really is one of the best things you can do for yourself.]

CASH SAVINGS (-$2,885.63): Almost down as much as we were up last month, but not sweating it as this was the bucket we pulled from to get that $5k for the new 529 investment… So looks like we actually brought home an extra $2,100 or so before it all got siphoned away! (Though the 529s don’t get tracked in our personal wealth, womp womp)

SPAVINGS FUND! (+$116.22): Got some good cash back rebates this month, as well as a SUPER sweet $20 gift card to Panera Bread this month from a regular I usually see there who wanted to wish me a happy father’s day :) But get this – she gave it to me on her birthday!!! How beautiful is that?? (If you’re new to the site, you can learn more about what this “spavings” fund is here.)

THRIFT SAVINGS PLAN (TSP) (+$500.01): Another nice increase here as the wife continues to automatically invest without thinking about it… Looks like we’re getting close to her 2 year anniversary already, so you can see how fast it accumulates in a relatively small amount of time! Now over $12,000!

BROKERAGE (-$45.57): I’m not sure how this went down when it holds the *exact* same fund as our retirement accounts (which went up?), but regardless, nothing too interesting to dwell on anyways. Overall we’re up around $2,000 from our initial $50,000 deposit the other month, so as long as it continues trending that way daddy will be happy :)

ROTH IRAs (+$809.16): Nothing too crazy going on over here either, but better seeing green than red no matter what the amount :) Similar to the brokerage account above, as well as my SEP account – all $$$ here is invested in VTSAX w/ the exception of my wife’s IRA which is in a Target Date fund at USAA (for now).

SEP IRA (+$3,271.64): Same going on here as above, only higher % gain since there’s more money sitting in this account… Cool to see the overall performance over the years since switching to Vanguard though!

CAR VALUES (-$102): Lastly – the cars, which will always go down over time, unless you’re into restoring classics! :) Here are their values according to Kelly Blue Book – all fully paid off:

- Lexus RX350: $8,828.00

- Toyota Corolla: $2,718.00

Total change in net worth this month: +$1,663.83

Here’s our monthly snapshot of how the trailing 12 months have gone as well. Relatively stagnant the past 6 months:

And then lastly, BABY NET WORTHS!!!

Along with a pic, to put the #’s in better perspective ;) It doesn’t hurt as bad throwing money into accounts when you know who they’re benefiting in the end! Haha… Maybe we should slap pics of our kids on all our *credit cards* too to make us double think future purchases?!

And that’s June! How’d you guys do? Anyone hit any good milestones?

In non-money life, everything is still revolving around baby, but we’re starting to ease back into “normalcy” again and adapting as we go… 3 kids isn’t nearly as drastic as it was going from zero to one, or even one to two – the worst! So knock on wood, I think all will be well here, and Baby Dime continues to grow and be healthy which is really all you can ask for :)

What’s new in your worlds?? Money/life/love good? Anyone doing something wild this Summer? Anyone want to COME BABYSIT??? 🤞

XOXO,

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

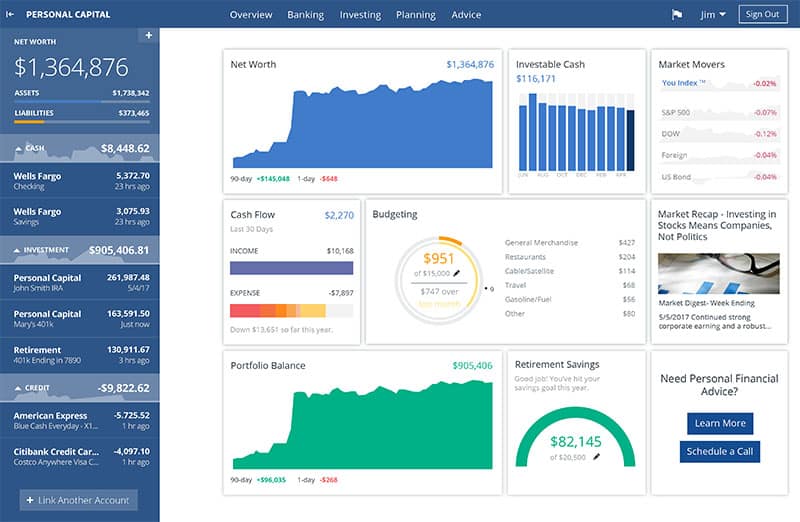

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Slapping photos of our kids onto our credit card to prevent impulse and frivolous purchases sounds like a great idea hehe.

In Vietnam, we usually say someone is so broke to the point where they have to eat white porridge every day to get by. Maybe a picture of a bowl of plain white porridge might work too. This is not intended as a joke. ;)

hey – whatever gets the job done ;)

YEAH! He just gave us a million dollar Etsy hustle idea and he doesn’t even know it!

Make it happen and i’ll give you 75% licensing profits! ;)

I love the idea of putting the kids pics on the credit cards! It reminds me of a story I read where a young woman wanted to put Terry Crews on her credit card, due to his role as a frugal father on Everybody Hates Chris. The bank refused,saying they needed his permission. She posted it on Social Media and Terry Crews came across it and gave her permission!

Sounds like a great quarter overall!

SHUT UP!!! That is awesome!!! Was just reading about him speaking out on sexual harassment stuff the other day – I was super impressed.

J –

Nice job! Pumped that you fueled the new baby’s 529 plan already, they’ll be thanking you much later on, for sure. Also – did you receive some nice quarterly dividends from the funds that you have? It was a solid month overall, on my end, as the employer I work for only matches one time in June for the 401k based on the salary from 4/1/17-3/31/18, so that was a nice jolt to the portfolio and forward income from it.

Thanks again for posting and talk soon J.

-Lanny

nice! Christmas in June! :)

I always forget to check dividend stuff on my funds, so it’s possible I got some! It’s all automatically re-invested.

I was up for most of the month, but with the market going crazy, I ended up just a few hundred above last month. Basically, break even. I’m hoping the market will break out of its funk, and I’ll get back on track. Spending and net income are trending well, and the rest is out of my control.

Keeping all that cash is a solid choice and seems good you haven’t gone nuts back into investments with uncertainty in the markets/environment.

Played some golf this weekend with Dad and this week, am excited to go to my 3rd and 4th yoga classes as well as get outside more on my bike with Gwen :)

Onwards and upwards!

Hey – that’s cool! I’d love to try Yoga one day but afraid of going by myself :)

I’ve “only” put $250 into my 3-month-old son’s 529. It’s mostly money he’s made himself, though. Basically he got some gift money for his baptism, plus he’s taking part in a vaccine study (little guy’s already got a job!) and we’ve gotten paid maybe $125 for that. Since he earned it, I put it in his account.

Excellent use of his money – I like that :)

I think it is a HUGE ERROR to have 100% of your dough in one fund that only invests in US stocks. At last count there were 195 countries in the world. Some broad diversification would eliminate much of the systematic risk associated with what I contend is a narrow approach. I think you would be better off adopting a less risky strategy by buying Vanguard Total World Stock Index Fund Investor Shares (VTWSX). The 10 year compound annual return has been 6..2% (versus 10.33% for the one you are invested in). It’s only a matter of time that there will be a reversion to the mean in US stocks, particularly in the current geopolitical situation, with the Trump administration bent and bound to alienate every other country on earth.

Totally – I think it is more risky to go all-in w/ U.S., but I also think it’s not *as* bad since the world is so united w/ businesses right? Admittedly I haven’t spent the time researching it too much though so I could be mixing apples with oranges here :) At any rate, at some point I will diversify more and go into some international as well as little bond action, but for now I’m content w/ the VTSAX approach.

Very cute baby and he’s doing better than half the US population already! Pretty awesome. :)

June was okay for us. Our networth looks similar to yours, flat… At least it’s not down.

This is a great post. If my husband weren’t so private, I’d do the same on my website. I think it’s amazing that you are saving up for your kids. Mine are 9 & 13 and we’ve got a combined $45k-$50k or so in brokerages for them. We did not do 529s, because I am not sure they will want to go to college, so I wanted to keep it open in case they wanted to purchase a rental property or a business at 18 or later (give the $$ time to grow.) I am hoping they will both get scholarships to college. We just purchased an investment property and took a HUGE rehab loan, so our net worth took a big hit, but our goal is to pay it off in one year. Let’s see what happens!

Excellent strategy as well w/ the kiddos :)

If you ever want to share your net worth anonymously, just give me a ring and we’ll gladly showcase it! Just started a series around other people’s money – love seeing :) (or if you ever want to share privately too – hah)

https://budgetsaresexy.com/a-look-at-other-peoples-money/

I looked at your other people’s money post. I love that. My favorite posts are income/expense/net worth posts. It gives me the ability to relate to the writers when I can see actual numbers. It’s also nice to see their commentary on what they think they are doing well, where the can improve, and so on.

I also get to be super jealous when I see someone’s entire budget is less than my mortgage. My numbers probably aren’t as interesting to others now.

I think they were more exciting last year when I was living in an apartment in DC and receiving per diem (travel expenses) in addition to my salary, Lady Kit was living in an apartment in Monterey, CA and no one was living in our house in SoCal (at least I hope no one was). We were also dropping 5k+ a month on Lady Kit’s student loans.

Now we are just have normal DINK numbers.

Net worth is creeping up, and even though it goes up and down, the more shares you build the great potential for it to compound.

Man, seeing the spreadsheet for the babies makes it real that it’s a lot of work and financial responsibility! This year has been a tough year to make easy money. But tech has been good so far. Just hoping to and that you’re positive.

Sam

Your life just got a ton more interesting though, right?! Nothing like putting life into perspective than creating some :)

Net worth basically flatlined. I had some cash put aside to buy things I needed, furniture and furnishings mainly, which I did so my cash is down a couple thousand, so the flatlined net worth is actually quite nice. I was expecting it to be down that much.

Still settling in to my new abode and starting to throw more cash aside for some other savings goals. My emergency fund is at 3 months (yay!) and I’m pushing for 6 months now.

My bestest, most favoritest news is I helped a friends 23yo son set up a Roth through Vanguard! How cool is that?!?!? We had an hour long talk on money, I showed him a compound interest calculator with bare bones numbers, and he was floored. He grabbed his laptop, we moved some investments around in his 401k and then he got right onto vanguard.com. There is hope!

NICE WORK!!!! Imagine what a world you just opened up for that kid later on! Forever changed – well done :)

Doing good, bud!

June was not too shabby for us! I made myself sleep on some clothing buys last night but our old school PF blogger friend SingleMa reminded me that I’ve had these on the list for a year now. Apparently that means it no longer counts as an impulse buy! :D

We’ve had a couple small sales of clothes and on Craiglist, which is great. I’ve been agonizing over our money for a bit but I’m excited that I embraced a change in mindset this last weekend and can’t wait to write it up to share.

Haha yes – I’m with Single Ma. If you still want something after all that time, you are definitely allowed to get it :) (Provided you actually *have* the money, which we all know you do!)

I totally do have the money. I just don’t want to give it up yet hehe. Also: lemme babysit! :D

Hit me up if you need a babysitter! Totally wouldn’t mind watching the kids if you need a night off plus I’m relatively close by! :)

Could the one account have gone down while the others didn’t due to dividend payments that went out in June? Just a thought though not sure if that would be the reason.

Just hit the first 100K milestone myself so June was a month of celebration!

As a hobbyist accountant, I’d love to see the Liability and Equity section of your balance sheet. You show the Assets here, but I can’t see the other side of the equation A = L + E. If your Liabilities are equal to 0, then it doesn’t make the story more interesting, but for your readers, many of whom this isn’t the case for, it might be insightful to see how the full equation works. If you tracked both an income statement and a statement of cash flows, I think those would be interesting for readers to see also (for example, if you made $10,000 this month before spending $8,332 in expenses to arrive at $1,668 in net income before this would show readers how revenue is offset by expenses before the remaining net income converts to retained earnings helping to boost your Assets). The statement of cash flows would add more perspective, while showing that not all cash outflows are created equally — an expense (say a utilities payment) is significantly different from a conversion of assets (say a car payment) in terms of it’s effect on the balance sheet and, ultimately, one’s net worth [Note: a utilities payment decreases assets while assets remain the same for a car payment, though an interest expense will occur at some point on car payments).

I’ve talked too much. I always enjoy seeing these posts. My net worth reached 6 figures last month, and a large part of that is due in part to reading this blog and realizing it is something that I should be planning and tracking. Thanks for your help!

Agreed 100%! I used to share our full budget and expenses for the first couple years of this blog, but over time have stopped tracking every penny once we got a good handle on things (and once kids came into the picture too – hah!).

To answer your question though, we don’t have any debts or loans or anything like that. We do pay off a credit card in full every month (which is accounted for here), but outside of that we’re 100% debt free.

Maybe one day I’ll take the time to lay out what a typical month looks like us expense/income wise to better fill out an overall picture. I agree it would add some good perspective here :)

Good looking kid there, and he is lucky that his parents are already investing into his future. Looks like another awesome month, even if it was a bit uneventful.

I was curious to why you keep a large amount of 75k in cash? Also, is real estate factored into your net worth? Keep on trucking to that mil!

We keep a lot because I’m self-employed and we like having a nice safety cushion :)

No real estate in our worth because we happily rent!