Saw this on Twitter and couldn’t pass it up:

In a nutshell: After you answer 20 super easy questions, it’ll spit out your rank and roughly where you stand in your journey towards financial freedom right now :)

It comes from a newer blogger on the scene, Cashflow Cop (such a good name!), who was inspired by posts from Joel at FI 180 and JD Roth at Money Boss.

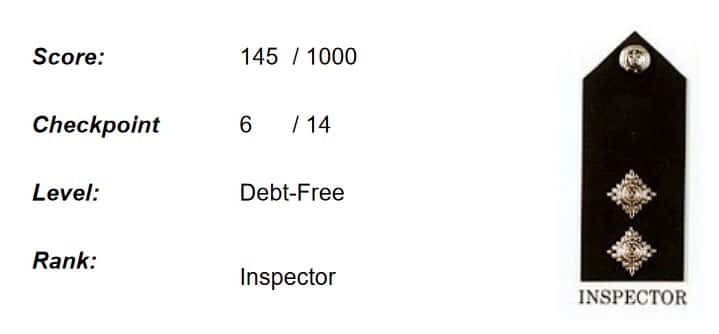

Link to take the test below, but fair warning – it may get depressing as I scored a paltry 6 out of 14, and that’s with a net worth of almost $900k!

All those investments banked and all I get is a “Debt-Free” rank?? Haha… Maybe this poll needs to be “inspected”!! ;)

The questions are copied/pasted below if you want to eyeball it (followed by the key), or you can take the test directly over at Cashflow Cop and have your score and ranking spit out for you:

FI Checkpoint: Where are you on the journey?

(Doesn’t work on mobile fyi, and a bit glitchy on Safari and Firefox, but works great on Chrome)

FI Checkpoint Questions:

- Do you have a regular income?

- Is this income greater than your expenses?

- Do you have a three-month emergency fund?

- Do you have any rolling credit card debt?

- Do you have any overdraft debt?

- Do you have any vehicle finance?

- Do you have any other consumer debts excluding mortgage?

- Do you have a six-month emergency fund?

- Do you have a one-year emergency fund?

- Do you have an emergency fund of two or more years?

- Do you have any student loans?

- Do you have any mortgage debt (excluding income producing properties)?

- Is your passive income at least 25% of your expenses?

- Is your passive income at least 50% of your expenses?

- Is your passive income at least 75% of your expenses?

- Is your passive income at least 90% of your expenses?

- Is your passive income at least 100% of your expenses?

- Is your passive income at least 1.25x your expenses?

- Is your passive income at least 2x your expenses?

- Is your passive income at least 10x your expenses?

Checkpoint Key:

Checkpoints 7 and up are basically dependent on how you answer all the passive income questions in that second half of the list there.

Which is the point I failed to advance since the only truly passive income I get comes from my retirement accounts that don’t quite reach 25% of my expenses yet… And apparently you’re not allowed to tap any of the actual *funds* to live off in this game ;)

Now I could just stop blogging here and watch the pennies trickle in over time without ever lifting another finger (if anyone tells you blogging is passive, punch them in their keyboard!!), but for now I’ll embrace my Checkpoint #6 and consider it a challenge to rise up the ranks…

It’s no fun being perfect anyways, right? :)

If you wanna give it a shot here’s the link again, and then be sure to come back and let us know how you did… Maybe it’ll give you some much needed motivation over the weekend? Or a nice pat on the back?

‘Till Monday…

Get blog posts automatically emailed to you!

Stability Sergeant, just one rank below yours, I can live with that :)

I order you to fetch me a beer – stat!

Stability Sergeant here too…..trying to advance to Inspector level in the next 2 years.

you’d be sitting pretty if you can advance to each level in 1-2 years! though I surmise it would go much faster towards the end with all that compounding working in your favor.

I’m not sure I entirely understand the passive income part? Any insight?

Money that comes in without you doing any work for it :)

Example: dividend income from stocks, rental property profit (even though you still do work), royalties from stuff, etc.

In theory if you can cover all your expenses with passive income you’re technically “financially free” – ie you don’t have to work anymore because everything’s covered! but of course it’s a bit more complicated like that, and doesn’t account for other variables or assets too you can tap that doesn’t pay dividends (cash, stocks, real estate, etc).

Oh ok that makes sense. My result was 52 Stability Sergeant. Feeling pretty good about being there at 28 and really only becoming somewhat financially knowledgeable (still so much to learn) in just 1 year.

Totally! I didn’t start my journey until I was 28 either – it’s a great place to finally start paying attention to this stuff :)

I also got stability sergeant.

You can be my guest at all the Inspector parties :)

I got 405 with no rank. I guess I found a bug.

This test uses passive income too much. I think if you get to 125% passive income, that’s more than good enough. Probably should take into account nonmonetary factors too. :)

I think he had to take down/edit the tool because a ton of people went over at the same time and I guess made it wonky…

Hopefully it’ll be back soon, but in the meantime you could prob guess where you land :) Probably somewhere in the Commander/Commissioner range? The cop was at Superintendent with 225 points.

I need someone to give me some tough talk. I am at a career crossroads, and don’t know what to do.

We have significant non-mortgage debt. We are doing fine month-to-month and have no trouble making minimum payments, but we are years (8-10) away from eliminating the debt at our current rate.

We live overseas as expats, and I am the trailing spouse. We move every 2-3 years for my husband’s job, sometimes back to the US, sometimes to other overseas posts. Here at our current post, I was surprised to be offered a part-time job in my speciality (nursing) that pays an okay salary and would keep my certifications and license active. It would pay down some of our debt and make it easier to find nursing work at our next post, assuming a job is available (honestly, it’s pretty unusual in most overseas locations). It’s only 25 hours a week (once you add in commute time). We’d incur some added costs for childcare, but otherwise, it would give us some immediate breathing room. Seems great.

But my dream is to pivot into being a full-time writer and homeschooling mom to my two very young kids. I used the first six months of our time overseas here to draft my first novel, and I’m ready to continue editing, studying, and refining my craft. I’m aware that this is a long game, but my writing teachers say that if I am willing to really invest my time for the next 3-6 years, I could likely make a full-time career out of writing, and one day, teaching online writing classes. That would be my dream! While I was writing my novel, I couldn’t remember ever being happier. In the short- to medium-term, I want to blog about homeschooling as an expat to provide income, but I estimate it would take at least a year to get off the ground. I am confident I could make a reasonable income from blogging, as I have a solid business plan, strong market research, a list of products I could provide, and a target niche. I honestly believe I could make the same amount of money from blogging as I could in this low-paid nursing job, but it would be a dicey year in the meantime, and it means letting my nursing resume lapse.

I’ve done professional editing in the past, so I know my needs in terms of writing successfully.

Based on my performance writing my novel draft, I need about 15 hours a week to write in order to maintain momentum and 10 hours a week (minimum) to get my blog off the ground. Add in another 15 hours for the actual homeschooling (so I have something to write about), and that’s easily a full-time job right there (not to mention providing just basic daily care to my kids). We’d save a little money because we wouldn’t be paying for private school overseas. I’ve looked at the schedule every which way, and something has to go — either the nursing job, the novel, or the homeschooling/blogging.

But it feels irresponsible to pass on this nursing job, when it’s such a rare opportunity overseas and would help pay down immediate debt. We’re only overseas for a few years, and there’s no guarantee that I could delay the writing goal until our next post — after six tours in this lifestyle, I’ve learned that some tours allow for cheap childcare/low cost-of-living and others leave us scraping by. (Note: we are currently in a VERY low-cost-of-living country.) We never know where we’re going until just a while before we leave.

We also anticipate having another baby in the next year, which always slows down the income stream for a bit, so I basically have this next year to really make headway on two of these three goals/options. If I take the nursing job, we pay down immediate debt, but I give up either the novel dream or the homeschooling/blogging dream, and since we move every 2-3 years, there’s no guarantee that this nursing job would actually help me get work in our next assignment (many overseas posts don’t allow US nurses to work locally). If I homeschool/blog and write my novel, we continue to carry this massive debt with no solid guarantee of making a good income from the blogging/writing down the road; however, I will have (hopefully) set up a viable online business that could travel with us and (ideally) provide a more stable income than my stop-start nursing career. Instead of one year of income from the nursing job (with the assurance that in a real pinch, we could move back to the US and I could get a nursing job), I am trading a scary year of debt for the HOPE of long-term stable income from writing. (I am aware that “stable income from writing” is a bit of an oxymoron.)

I’m a hard worker and I course-correct quickly, and I know that whichever course I choose, I will be successful, barring an unforeseen act of god (huge medical emergency, etc.). But I have to let something go, and I feel paralyzed about the decision. Choose the safe route, take the nursing job now, and hope that life will make space for my writing dreams…one day? Take a risk on writing and homeschool/blogging, with the possibility of the dream life (SAHM, part-time career online that travels with us, pursuing my dream job) BUT the risk of a growing gap on my nursing resume and continued debt in the meantime?

What’s a responsible person to do? What about the side of me that wants to show her kids that it’s important to take risks and follow your dreams? My homeschooling friends encourage me to pursue my passion. My nursing colleagues are aghast that I’d turn down such a rare opportunity to keep my resume filled in the traditional way. I need some advice from someone outside of those two biased groups. Side note: I’m so angry we have this debt, as it wouldn’t even be a debate if we were financially stable — I’d write and stay home. Husband just wants me to be happy, but is terribly worried about the debt (as am I).

So, yea, if you could just make this life-changing decision for me, that’d be great. :)

haha….

well as a blogger living out his passion you know what my answer will be (TIME TO GO ALL IN ON YOURSELF!!!! YOU NEVER KNOW WHAT CAN COME OF IT!!) but seeing how this is a $$$ blog I’m sure you’ll get some responses more aligned to the “responsible way” as you say :) And we all know what the answer to that one is.

to me it’s really about what hurts your soul more – carrying loads of debt or not chasing your dreams? if your anxiety is through the roof on the debt then it’s prob better to just do what you have to to finally get rid of it forever, but if the idea of not pursuing your dreams is the worst thing you can imagine, then hopefully you can figure out a way to deal w/ the debt until you make enough to put dents in it.

Maybe you put a timeline on your goals (say – 1 year) and then if you don’t hit whatever reasonable goals you give yourself you hit pause and tackle your debt once and for all?? knowing you gave it a shot and can feel better about yourself? that’s what I do at least with things… Put limits in so I don’t go overboard one way or the other…

my two cents anyways, but i agree it’s time to pick one and get going because the “what if” game will drive you to insanity.

let us know how it goes!!

I offer a very sober perspective on the “responsible” (I guess we’re calling it that!) side of things. I have multiple friends doing the homeschooling route which I think is very cool. But one of them with many kids has run into a terrible home situation which, I won’t get into details, is the equivalent of the loss or disability of the earning spouse and she’s been out of the workforce for many years. Lots of bills, lots of kids, and they’re losing most of an income. It’s a really tight and scary spot to be in.

If you were my best friend, I would encourage you to eliminate the worrisome debt first and then do the heart thing when you’re in a more stable position to lower your risk.

The phrase “you can have it all, just not at the same time” comes to mind:) I would not want to have a new baby with so much financial insecurity, but that is just my perspective. You went through so much sacrifice and work to get the nursing degree, seems a shame to let it lapse and lose such a great vocational skill. I am older now and I see in hindsight a lot of times in my younger years I was in such a hurry to do things, thinking I would lose the opportunity, and now I see that there was plenty of time to do everything I wanted if I just had more patience and foresight. Try using Everydollar.com to craft a budget (it’s free) to help with your immediate financial concerns. I wish you the best!

“We have significant non-mortgage debt”

“I’m so angry we have this debt”

“…it wouldn’t be a debate if we were financially stable”

There’s your answer.

Score 335

Checkpoint 9: Lean FI

Chief Superintendent

Though I’ve been officially “retired” for about 12 years now, I carry the unofficial title of Chief Caregiver. =)

Not bad for starting at $20K in the hole in 2002. I paid that off in 3 years and never looked back.

Damn straight!! You’re on FIRE over there!! (See what I did??)

I’m at Sergeant right now but am selling my house, which I do own outright, and moving into a beautiful apartment complex. Kids are grown and I am a widow and am just not into this suburban life anymore – so far from everything I do and the neighborhood is on a downswing – so I am moving into a city center-like area with lots and lots of trees, by the river and all its activities (farmer’s market, restaurant, dog park, etc), parks, trails, in a much nicer area of town and less than 10 minutes from work. It was a big decision to do this but it is right for me now. Any condo or townhome I could buy just didn’t appeal to me because of locations. So, apartment life it is, just me and the husky, and I seriously can’t wait to get out of this place. I will be buying a new car with part of the house money but otherwise it will be tucked away (which is why I came here, so I can develop a plan to make that big new lump grow). I also actually have a pension (from my deceased husband) kicking in this next month which will mostly pay for the apartment, making most of my income free other than electric, water, insurance, yeah.

So I guess I will be stepping down to Constable because technically will have a dwelling payment again, right? Otherwise would be in the debt free zone.

I am so excited about your new journey over there!!! It sounds so magical!! Good for you for taking chances and giving yourself a better matched lifestyle :)

Well, getting back to the game – I got 9/14 – Chief Superintendent.

that’s a nice position to be in!

Stability Serg here! I left the mortgage debt as yes because I am (by choice) a renter; I figured that probably counts as yes and ran into the same dilemma as you with the investments. Fun game an interesting idea though. On the serious side, it gave me a little more appreciation at where I am. I mean ‘overdraft debt’? Is this something people actually track as a debt? I can’t say I haven’t had my BAD blunders over the years with money, but overdraft debt? Ouch.

I know – there’s a lot of nonsense going on out there :( so glad i’ve learned from all my fails too!

Why does Suzy Orman not like FIRE??

she thinks everyone is going to run out of money unless you have $5,000,000 saved up (true story)

Checkpoint #5 ::cries::

But are they tears of joy or sadness?

Actually, as someone who has never calculated her FI number (THE HORROR!), this was fun and painless…and actually insightful.

But mostly I’m just swinging by to say thanks for sharing this and getting more eyeballs on it. You inspire me so when it comes to supporting new bloggers and spreading important money messages.

Thanks for playing along! :)

Thank you, everyone, for giving it a try and being so positive about it. I know it is not perfect and I’ve taken all your feedback on board. I hope the test at least put a smile on some faces and help those new to this to start thinking about how they can improve their financial position.

A major update is coming soon.

Thanks again.

CC

That’s what it’s about, my brother…. Just trying stuff out and coming up with ways to motivate people! I had a lot of fun with this!