The hard truth is that you’re not going to get out of debt or save $XXXX amount of dollars if you don’t have a surplus at the end of every month. It took me yearrrrrrrs to realize this, but I’m so freakin’ glad I did. And it’s not like I didn’t already KNOW you had to do that or anything, I just didn’t really pay attention.

Up until 2 years ago all I did was tread water and do whatever I wanted. Which was fine for someone who didn’t really care much about their future finances, but once that someone realized he DID care about it some changes needed to be made ;) And as boring/repetitive as it sounds, the only way I got a handle on it all was to start tracking my money to find out what was going on.

You see, we always THINK we know how to manage our money and that we’re not “one of those” crazy people, but a lot of us are because we don’t really KNOW what we’ve got coming in and going out. If you track it though, you can prove to yourself that you are on the right path and that you’ve got it on lock. But if you’re like the old me and say everything’s fine without being able to prove it to yourself, I’m gonna have to doubt you ;)

Tracking allows you to see that hard number at the end – that extra cash flow you’re bringing in every month. And once you know what it is, you can then plan to pay off debt or save X amount of money or whatever else you want so much easier. Because then it will be TRUE – not just a number that you *think* you have left over.

——–

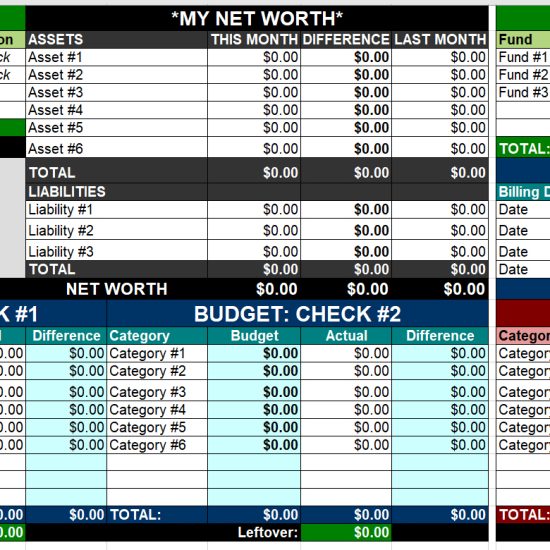

PS: Feel free to steal my budget, or any others I’ve collected over the years… all you need is something to help get you started!

PPS: That painting up there? I made that… with the surplus in my “hobby” budget ;)

Get blog posts automatically emailed to you!

I really enjoyed reading this article.

It is interesting to see how different people talk about money, since it is such a huge commodity in our world, especially in Western culture.

A few months back I went through my bank statement and tallied up everything I spent my money on. WOW I EAT A LOT. I spent soooo much money on food, I had no idea how much I was EATING! Since then I have come up with a few money saving techniques to save me some money on food. But the activity was very helpful, as you proclaim! Great post!

Food always gets me too ;) It’s definitely hard to see the numbers hit you in the face the first time, but once you get over the shock it’s so much easier to concentrate on fixing.

Tracking money is so important! I also spend money on food a lot….since I cook a lot and we eat pretty healthy. Tomatoes are beyond expensive! I’ve actually decided to do some gardening… I’m going to track this months expensive to determine if I need to look into a part-time job or not, hopefully Not! :)

Oh man. I was just thinking to myself I needed a kick in the ass on the budget front. And here it is right on your blog.

Consider my ass kicked.

I have been really lack-a-daze-a-cul (i have no idea how to actually spell that word so I’m gonna do the phonics version haha). I haven’t been going RED per say. But I have been doing a lot of random purchases that weren’t originally accounted for and just using my roommate’s bill money for them. WHICH IS NOT WHAT THE BILL MONEY WAS INTENDED FOR!!!

Bill and rent money is for BILLS AND RENT so I don’t have to pay it all, and I can put more towards debt.

Brandi Brandi Brandi…get your SH*T together :)

I work with Personal Trainers to help their clients manage their weight and what I’ve seen over the years is that people UNDERESTIMATE the number of calories that they consume. So they eat too much and don’t lose weight.

The same is true with finances. Many times people think about their ‘big’ expenses and think that their cash flow is fine. But they OVERLOOK the ‘small’ expenses that add up and consume the rest of their money.

But our biggest expense is taxes, so it helps to have a home-based business, to be able to leverage some of the tax deductions to reduce your overall tax bill. And it will help you generate an additional income stream.

And when the increased cashflow from tax savings and home-business income are applied to a debt-elimination program, it frees up your cashflow even more.

Oh man, you are seriously targeting me on this one. I know that I have some saved at the end of each month but no matter how much I watch this site I have not kept a real budget in a long time (since I got this job). When I do that I never like the numbers I see so I ignore it and go back to knowing that I am saving some.

@falling Into Favor – I would love more than anything to figure out how to grow some veggies & fruit in my backyard (or kitchen, for that matter!). If you figure out how to master it, please let me know! Or come over and show me :)

@Brandi – Ooooh it felt great kicking your ass! haha….haven’t had to do that since 2nd grade ;) I hope it gets you to act! If not, I’m sure another post of mine at some point will…at least I hope so, or else all my writing just goes out the door.

@David Wilcoxson – Hmmm…well not entirely sure that Taxes are the biggest problem here, but yeah it’s certainly something to keep in mind! And I LOVE the losing weight analogy too, how true that it is.

@philip – Haha…so what all of you are trying to say is that you know better but you just don’t wanna listen to your dear friend J, is that it? Do I have to come over there and force you to drink a beer with me? I know that has nothing to do with budgeting, but we’ll have a helluva lot more fun figuring it out w/ some ;)

I try and keep track of my expenses with a budget but at times it gets pretty tedious.

I chatted with my brother about money and knowing where it was going last time. I knew that knowing where his money went was the last thing on his mind when he said “i’m good, everything is current and I am not in the red”. The fact that this is good enough for him is kinda scary for his future.

haha….indeed. at least he’s not in the red, though ;) he’ll grow up one day….if I can do it anyone can!