Are you willing to get rid of all your things? Move back in with your parents? Sell your car? How about give up a left testicle?

Before you laugh at that last one, check out this comment we just got here:

I need around $35,000 give or take to get me n my wife out of debt if u have anything in mind please feel free to contact me I willING to give my left testicle to save our marriage

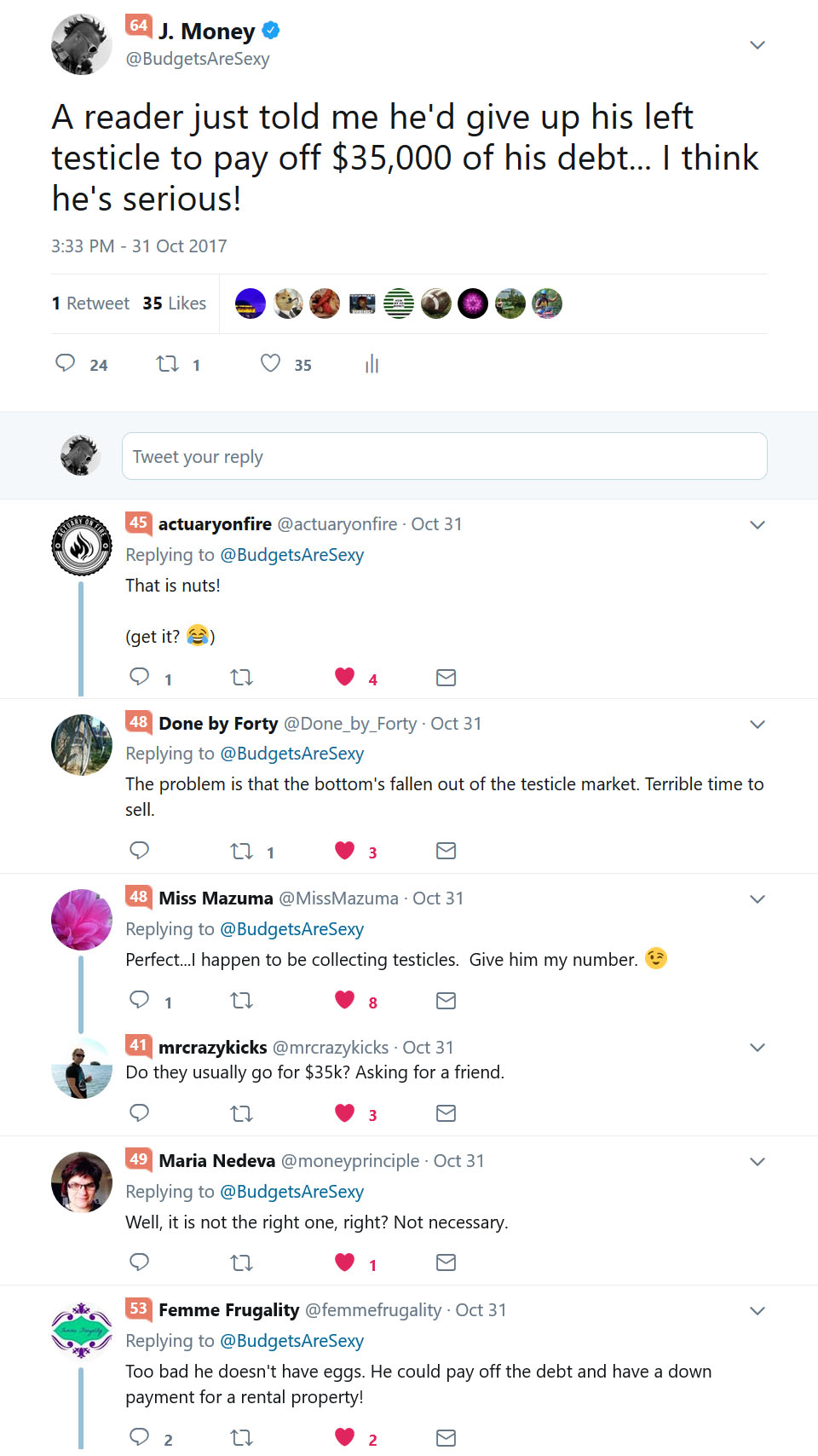

It was left on an older post about making money doing science experiments, and if it wasn’t for the “save our marriage” part I would have written it off as a joke! But of course I still couldn’t resist sharing it on Twitter to see what my friends would say ;) They had a ball!

And people think finance people are a boring bunch ;)

All kidding aside though, debt is no joke and some of us are just drowning in it and would do almost anything to get out. But how far are you willing to go? And how far SHOULD you be willing to go?

I don’t have any real answers for you today (I was just DYING to get out that testicle comment, haha…) but it is something to really think long and hard about as you’re going through the journey.

How important is being debt-free really to you?? Are you willing to FIGHT hard for it?? What would it mean to your family or friends or even your future dreams to be completely rid of it all? Would you do anything *illegal*? (That’s where I would draw the line)

I saw another tweet come in a few hours after my post, and that one was a wild one to think about too:

Giving up your rights – wow!

But here’s the thing – paying down your debt doesn’t have to require such drastic measures. It may be faster, but what if you just ramped it up an extra 1 or 2%? Or took an extra hour a week negotiating down a bill or scouring your house for more items to sell? What if you did something crazy like going down to only *one* car or not buying something new for a month or two or even 12 months in a row? What if you allotted all future raises and bonuses and other “found” money right over to debt which you aren’t even used to having anyways?

I think we all have way more hustle inside of us than we tend to give ourselves credit for, and there’s no shame in sticking to a slower but consistent pace if that’s all you can muster right now. It’ll just make the finish line that much sweeter to cross!

Just like there’s no shortcuts to getting rich quick, there’s (usually) no shortcuts to paying off all your debt fast either. Watch for the big wins, then just keep your head down and keep pushing yourself the best way you know how.

Debt is not forever, unlike snipping of your body parts or any other cockamaimy ideas!

******

PS: I was originally going to share a bunch of random “would you do this to pay off your debts?” type questions for you to consider, but I ended up scrapping the idea because it just got more and more ridiculous the longer I went, haha… But if you’re not ready to go back to work yet and wanna play along, here were a few of my favorites I came up with ;)

- Would you give up two full years of your life to pay off all your debts? (Think: coma)

- Would you jump into a pond of crocodiles for 30 minutes to pay off all your debt?

- Would you go to work for an entire day naked, provided you didn’t get fired?

- Would you eat your most hated meals for an entire year if it meant having no more debts?

Get blog posts automatically emailed to you!

Hilarious !

I’m in the midst of my great wat of debt and it definitely requires sacrifice.

A new 4k tv would be great with a new xbox, is that a crime if your ahead your debt plan in the PF world?

I haven’t shopped much this year and have focused on keeping groceries down.

It has been a rough battle but I definitely agree with you on it being just the small wins totalled up towards a big one, then celebrating it !

Haha! When I was in college the guys talked about the option to pay off their debt this way! At least to my knowledge nobody chose this path :)

Fortunately, we embraced frugality to pay down our debt. And as a millennial, I would like to add a vote to NOT giving up my right to vote to be student loan debt free. But I fortunately only had the average amount of student debt. Voting is important people!

1. The 2 year coma doesn’t appeal to me. It takes away from the struggle that’s necessary to appreciate what you accomplish. If I just blanked out and all of a sudden it was done, it would feel like playing Super Mario Brothers only once and using warp whistles to beat the game in 20 minutes yeah you reached the goal, but you missed the journey.

2. Crocodiles are really aggressive and territorial. Alligators not so much, if it were baby alligators I would probably give it a try, but not crocs.

3. That would be quite the awkward day, and I work in a giant freezer, so I think I’ll pass on that one, maybe if I could just hang out in the office all day.

4. This is a tough one, my most hated meal…every single day. Perhaps if I had more debt lol. I’m on schedule to be debt free (2 houses) in 3.5 years. Maybe if I couldn’t see light at the end of the tunnel.

The most “extreme” thing I am doing to pay off debt is driving around in my $800 2000 toyota corolla. I get a little ribbing at work for it, but driving a modest vehicle is certainly helping me pay off the house early.

As for trading a testicle for $35K in debt, you can actually save WAY more money by trading both in (well just their functionality). No kids = probably north of a quarter million in lifetime savings, and you feel a lot more comfortable taking risks in your career without kids.

haha very true about kids cost!! I remember tracking it for like 18 months w/ the first child and it got scary fast :) also have no idea between the difference between crocs and aligators? always thought they were the same thing, but apparently not! (my guess is it’s a difference of water? ie salt vs fresh maybe?)

Not sure all of the differences, there is an Alligator Sanctuary in Michigan that I visited with the kids this summer. The guy has dozens of Alligators and was explaining why he normally doesn’t take in crocodiles (he has 1 young croc). The main reason being that Alligators can play nice with each other in shared ponds, and with trainers, Crocodiles not so much.

I don’t think any body part or life-threatening dare is worth debt payoff to me! And voting… yikes! I’ll keep my rights, thank you.

ah! no coma, no crocs, but hey! I would accept to be naked for a day in the office AFTER the whole year of eating your most hated food and therefore having lost all the extraweight! ahha

Haha… you’d win DOUBLE debt pay off for doing both ;)

OMG!

No need to do all of that :-) What he should do is reign in their expenses and find ways to increase income by finding another job, doing paid overtime and/or starting side hustles.

My first entry-level job only paid $40K but with paid overtime and bonuses, I brought in $70K and was able to pay off my $40K student loans before even graduating.

No other debt since then, except for the mortgage which we hope to pay off within 5 years.

Holy $hit, *before* graduating?? that’s incredible! i hope you’re blogging about all that for your readers!

Yes, def planning to do a post about it this month and hopefully it will be good enough for a RSF feature.

Hey, did you see my other shameless plug in my today’s post? Make sure you check it out :-)

Hah! I did not but I see it now – very clever ;)

(we will be keeping our eyes out!)

I saw your tweet and I was like “book I.” When it comes to debt payoff, weight loss, getting rich or pretty much anything else in life, there’s the shortcut, and there’s a longer route.

The shortcut can get you to where you want to be fast, but it can leave you scarred for life. The longer route might take longer, but it might be more sustainable. I’m impatient, but I do t want to get burned either >.<

Willing to give up his testicles but was he willing to get an extra job or give up his conveniences? Amazing what that will do for debt!

I “donated” plasma for two years in college and that is the closest I will get to selling body parts.

It was a pretty sweet gig though.

Pays pretty well too, right?

When I went back in the day it was anywhere from $60-$90/week if you went twice (each appt was about 1.5 hours)

No wonder so many folks have those emoji’s on their face. Must be a deformation they got after receiving your plasma…

Hilarious post, J$. Still laughing.

Okay, now THAT is funny haha….

A few drastic examples…especially that last one you highlighted by a reader. Ouch.

We’d go pretty far to pay off any debt. But we have gone – and will continue to go – far to not get into any debt in the first place. Admittedly, no one knows why life may bring (health matters, loss of income, etc.), but you can’t worry about things you can’t control. We can at least prepare to the best of our ability. A few examples:

– an emergency fund

– insurance

– living within your means

In a proactive example, Mrs. BD was deciding where to go to Graduate school while we lived in New York City. She could have gone to NYU – a great school no doubt – or one of the state schools in the city. She opted for the latter because it was nearly 1/5 the cost of NYU. We would have gone into debt to finance the Masters, but we were able to avoid debt by going with the other school. No one at any of her employers since then has cared that she opted for one vs. the other. And it saved us probably $60,000.

On your direct questions (1-4), I don’t think I’d do any of those. I’d try to prevent getting to that place well before having to ask that of myself.

BD Mike

You married a smart woman :)

Would you give up two full years of your life to pay off all your debts?

As of right now. I am about 7 years from FIRE. If all of my debts are paid off today, that means I will gain 7 years of freedom because I will reach FIRE. In return, I would only be sacrificing the last two years of my life, I would do it.

Trading seven years now for the last two of my life, I don’t think it’s a bad trade at all. I have about $900k in debt. To me this is a great trade.

interesting! do you have kids?? I wouldn’t be able to do it mainly just for that – I fear leaving them without a daddy for any amount of time :( Although technically you’d be able to make it up for the rest of your life if it *did* bring you financial independence when you woke up from that coma like in your case, so it is rather interesting!

I do have two kids. When I was thinking of the trade off, it was mainly a financial and time trade off. I had not really put too much thought into the emotional and kids factor into this. It’s definitely making the decision tougher. I am glad that we are only having a discussion and I don’t have to make this decision.

haha yup – way more fun to think about than take action on :)

What if giving up the last 2 years of your life meant you’d die today?

Exactly!! That’s what makes it tough!

I think he will need his testicles to keep his wife happy! I have always been a budget minded person so I usually live within my means. The most outrageous splurge was my children’s education from Pre-School to College…I paid out almost $100K and that put my retirement a little behind. I am working for the last 15 years of my life for my retirement and I am missing out on a lot of compounding years but I am not supporting my children now that they are young adults. So….I think I will be happy with my decision and just keep pressing on…..

If there was ever something to spend on, I’d say this goes right up there :)

This is an interesting think experiment. However, they are not obligatory to live a full life and also you are able to have kids with only one maybe it is not that much stupid as it sounds. Still, I would keep them inside. I could imagine a size of debt and seriousness of a situation when this could be an option (like the mafia or something).

Answers to your options:

1-2. Nope

3-4. I would do this sacrifice without a blink of an eye

It is very interesting how different is your point on giving up your voting right? Maybe just the different historical experiences let me tell this, but I have voting rights in two countries and I would give away both without a second thought to erase my debt. Maybe ever for half of that.

The right to vote question is fascinating. On one hand, it’s this amazing to have a say in our government. On the other, there is almost certainly no impact I can have with my lifetime votes that would add more value to my life than paying off my mortgage. I’m sorry to say that if given the choice, I’d take the paid off mortgage.

Hey – that’s the beauty of blogging here, it’s all around our opinions! and honestly most of my votes go the same way as the states I live in anyways (usually) so it often feels like there’s no point in it as well.

I don’t mind having the debt we do have. We made a conscious decision to keep it and invest instead.

I’m assuming retirees don’t get any bonuses for hanging out at home naked. But if I could go streaking at my old work with out any repercussions, and make some money…

I never said there’s no repercussions, just that you wouldn’t lose your job ;) Although in your case maybe you would have to *go back* to your job! haha….

Wouldn’t (and didn’t) do any of the options listed.

Paid off $177,650 in just under 3.5 years (3 rental property mortgages). It required focus, determination and sacrifice, but no crocks, nakedness, or bad food, and I kept the two years of my life to boot!

Being debt-free is so stinking wonderful! I highly recommend it.

Haha, glad to hear it brother.

If I didn’t know Mr. Crazy Kicks was already out of debt, I would say he was looking to sell. ;)

So would you trade years of your life to wipe the slate clean not really knowing how many years you have to live? What if you gave 2 but died 2 years later? I don’t think the risk is worth the reward. Also, I think the amount and type of debt are important to consider. If it is credit card debt, you are likely to get yourself right back into the same issues having taken the quick fix. A band-aid doesn’t change the cause of the wound.

Still in debt! I have a mortgage and student loan. I’m OK with keeping them… The loans that is.

Ahhh – so you ARE looking to sell… In that case, forget the money – I will trade you for a years supply of vegetables from that insane garden of yours!! :)

This is such a fascinating topic. My only debt is my mortgage.

1) I’d prefer the two years to having my mortgage paid off. Not really a question here.

2) I think crocks are awesome. I once went canoeing in a swamp with a bunch of gators (it was supposedly safe) and it was an amazing life experience. That said, I would not put my life in that kind of risk for any amount of money today.

3) The naked thing is interesting, it’s a lot of money for just one day. I still pass. I’d do it if it would hit my FI number though!

4) I really want to say yes to this one but I can’t. I’m not sure I could choke down my most hated meals. If you’re talking about regular food that I don’t like today, sure, I’d do it. If you’re talking about the types of things they eat on Fear Factor, all day, for a year. No thanks!

The interesting part of this question to me is that there are so many ways people can save money easier than cutting off a testicle. Spend a year or two living with a family member or friend. Get rid of a car for public transport at the same time. If you have a decent job, those two alone should get you pretty close to paying off $34K.

Yup!! Guess it’s just too much work for some people :(

The testicle thing is intense. I’d give one up to pay the house off though that’s for sure LOL.

Would you give up two full years of your life to pay off all your debts? (Think: coma) – Nope. I love life too much, and a lot happens in two years.

Would you jump into a pond of crocodiles for 30 minutes to pay off all your debt? – ALL THE NOPES.

Would you go to work for an entire day naked, provided you didn’t get fired? – Heck yes. I might alienate some coworkers out of embarrassment LOL but totally worth it.

Would you eat your most hated meals for an entire year if it meant having no more debts? – I don’t really have any most hated meals but yeah I could deal with it.

I’d probably do 3 even without the debt ;) During my last week of work I went around eating a hotdog and saying “this sausage is HUGE”!!! No response. Yeah super fun place to work.

So no to 1 and 2, but yes to 3 and 4.

Anyway…funny that someone would write in to say that nut thing. We had reader who was considering becoming a manwhore to become FI. hey, if you want it bad enough…

That’s another good scenario! Would you have sex with a stranger in exchange for wiping away your debt?? We can come up with these all day long, haha…

Woot! Our comment made the post!

We used to be crazy debt averse, to the point that we used money to pay off our mortgage that really should have been used to invest (and defer taxes in the meantime). The opportunity costs are huge.

So while paying off debt is a good thing, there’s a cut off point where investing (especially in tax advantaged accounts) is better. I have a flowchart/post in the works on this. Anyone out there good at making flowcharts look nice?

“to the point that we used money to pay off our mortgage that really should have been used to invest” – hah! You do realize that it very well could have been the other way around right? if you paid off your mortgage when the stock market was crashing vs growing? :) I know it sucks with the opportunity cost and all, but still – i’d never regret paying down your mortgage as there are far worst ways you can be “wasting” your money haha…

#3 would certainly make for some awkward talk around the water cooler, especially if the entire company was offered the same deal.

Hahahhaha this is the most interesting post…omg it’s never a boring day with you, is it?!

1) Yes! We’re already sleeping 7-8 hours a day

2) Um… no I would die and death is perms.

3) YES! I do it for almost free if it’s not cold! Naked = freedom!!! Pfft hahahaha

4) Yes! That’s going to be a lot of licorice…yuck..sick…puke…but I’ll do it.

It’s a good thing I listed all those questions at the end or this comment section would have been pretty scarce haha…

Depends, how big is the pond with crocodiles?

Since the only debt we have left is our house, I am going to have to say no to all 4, unless the crocodile pond was huge and only 1 crocodile to avoid :)

I clearly don’t hate my debt enough to spend 2 years in a coma, swim with crocs or eat my most hated meal for 1 year (though, I might finally lose weight. Can I have a beer with it?) I might consider going to work naked, but I work in a university so not sure if that would put me on a sex offender registry.

I would consider selling my eggs to pay off my debt, though. I am 32 so there probably isn’t much of a market for them. Since that’s not an option right now, I’ll just keep hustling and spending way less than I earn.

Moved in with my mother in law to pay off all our debt in one year while teaching her about finances as well! It’s been a month and so far no regrets!

YES!!! LOVE!!

This is totally going on my “smart hacks” list for a future post :) Way to make moves!

While I didn’t get out of debt.. We have a little at extremely low rates. I did get run over by a car for $15k. No residual damage (Mrs. Wow might argue, and brain damage makes a good excuse when I don’t listen :))

But yeah… run over by a car on a bike. Make $15k. If anyone’s up for a side hustle. I’ll show you how to take the hit.

Somehow that does not surprise me in the least with you :)

Which, btw, I had a BLAST hanging out with you and your wife there at the end of FinCon… you’re a fun person to party with!

Those are some wild questions. I wouldn’t do any of those things. That person who would give up his testicles has lost his damn mind.

Don’t really have anything to add – except it reminded me of that classic MasterCard commercial back when the Red Sox won the World Series (https://youtu.be/d-WhIpdqrNk)

Oh, if you don’t trust the link (no offense taken :-), just go on Youtube and plug “Red Sox MasterCard ad” add in the search box and you should find it easily.

I already clicked it before I read your next comment :) Good one! Hadn’t seen that one before.

No. No. Yes. No.

Wait.

No. No. Probably. No.

Okay, how come no one has made a joke about meeting his “monthly nut”?

We were reserving it for you :)

No one can claim to be totally free with debts hanging on his debts.

Hahaha! I love it. Those twitter responses are great.

Personally I hate debt and would do just about anything to get out of debt. Two years in a coma is a bit too far though…. although…. how much debt are we talking about….. crippling debt or somewhat manageable debt? Maybe if it was crippling debt then a two year coma would start to sound appealing.

I’d like to keep my testicles, everything else being equal. However, we have considered drastic things such as selling our home, car, changing jobs and cashing out retirement, etc. In the end, none of those made sense for us, long term, but when you are neck deep in a crisis it is tempting to just hit the giant reset button and start over.

Good point on the “crisis” mode – that changes everything, you’re very right. And probably (but hopefully not!) why we got this “left testicle” comment which sparked this post :(

I wouldn’t do any of those things except maybe the naked work part.

I have worked two jobs even though it strongly contributed to the demise of my <2 year marriage. Wasn't much worth saving anyway.

Now I've let my boyfriend move in with his 4 kids because it helps us both out. Turned out to be incredible! #gofigure

Oh wow – fascinating!

That’s a pretty funny comment. I do think debt really bogs people down! I live in one of the most expensive cities in the United States (San Francisco), and lived in a car/tent to pay off my debt! I was the only way to do it around here. I’m so glad I did! The freedom is so worth it. I don’t know about giving up a body part, but for sure people can think of ways to save and downsize!

Dayuuum that’s some dedication right there! You win the frugal award for the day! Haha…

HA! This clearly has sparks some debate, and some laughs. “The bottom has fallen out of the testicle market” – who knew there was one.

For me, no, never. But it can be sad that folks can/do resort to desperate measures such as this. Cheers. Tom

I am willingly eating office meeting food (which is oily and unhealthy, low quality ingredient that I would never buy). But it’s FREE and I would save the meal cost to buy only free range chicken for my other meals.

As for debt, I am a person that jumps into any low interest loan and use that for safe investment. So debt doesn’t fear me, as long as the cash flow is intact.

I have considered selling my eggs. I don’t intend to become pregnant myself, but I have some nice DNA and it could be put to use. I wouldn’t give up something I couldn’t replace though. I like my body. Money is not that important.