[Hi guys! Super excited to share this guest post with you today, as it comes from a personal friend and new blogger on the scene – Pie Lady FI. If you know anyone this could help, please pass it along as I’m sure we’ve all experienced one or two things from this list over the years!]

*******

In any given day, it seems like there is a new article talking about the millions of people who live paycheck to paycheck having little to no savings for retirement. Let alone a rainy day fund.

More often than not, next to that article is a “how to” get control of your financial life.

So why is it that year over year, millions of people still have no money banked, even though there are more tools than ever to achieve financial freedom?

It got me reflecting about my own FIRE journey…

I didn’t start focusing on my own financial independence until 2008 (at 40 years old) and even then I spent the next 5 years educating myself on what financial independence is and how I was going to achieve it.

During this time I was in and out of temp jobs, money was not plentiful but time was. I didn’t even calculate my net worth until 2009, and only then did I realize I had about $255,000 of debt (~ 50% mortgage). Truth is, I didn’t want to know.

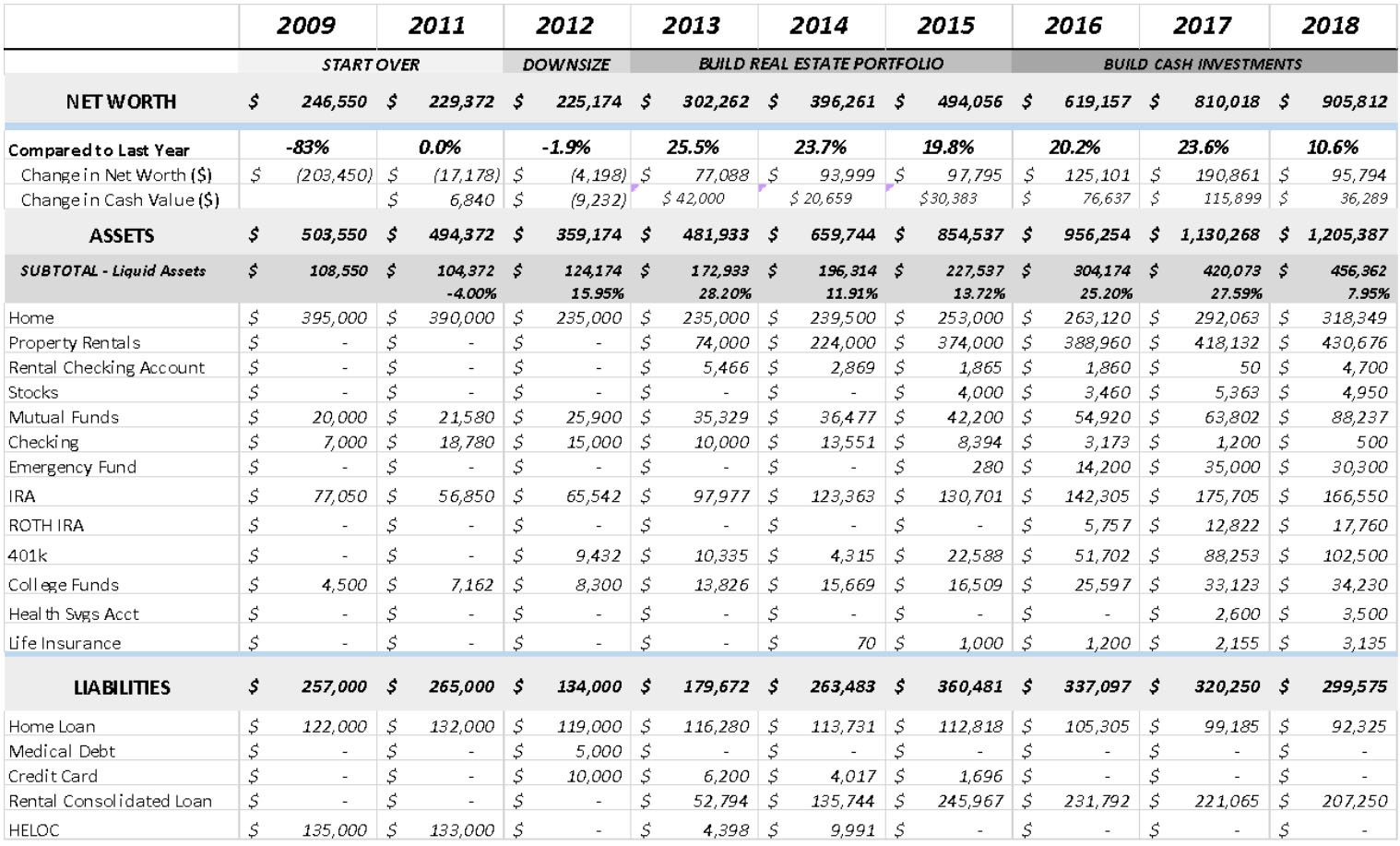

Once 2012 rolled around, I was able to downsize. In 2013, I had an opportunity to invest in real estate and took it. Fast forward a few more years to today, and my net worth currently hovers around $900,000.

(See addendum below for a break down of this net worth)

Why was I sabotaging myself all those years before 2008?

#1. Fear of Success

In my younger days, I always played it small. That is what I was taught. I did not live life to my full potential, and I never spent time thinking about what I wanted or ever put my own needs first. To switch that mindset was a tough mountain to climb. I was scared and felt selfish to think about myself in that way. Thus, the 5 years of reading and educating myself. To an extent, procrastination was my companion.

No one expected anything from me and so I never had to try. It’s not that I enjoyed living like this but it was familiar. Then I was on my own with two kids relying on me. It was no longer about me and my comfort. It was the rock bottom I needed to open my eyes and overcome my fears. I could no longer afford to hide, and that meant change. No more procrastination. I started with baby steps and the rest, as they say, is history.

#2. Feeling Undeserving

For most of my life, this is where I squarely lived. Growing up, I was put down and told that I was stupid and not worthy, along with a few other nasty words I am not going to repeat here. My self-esteem and self-worth was low. When I told my mom I wanted to go to college, her reply was, “Why? You need to learn to cook, clean and take care of children. I can teach you that.”

Eventually I moved away from my family and ended up marrying someone who treated me the same. Just watching my own parents, I thought the “M” in marriage was to be miserable. Being unhappy in my own marriage was a familiar life. Then I hit a turning point and started to see myself differently, that I am worthy. I was starting to change.

People will treat you no better than you treat yourself. In those 5 years of self-educating and planning my road map to financial independence, I also read lots of self-help books. I lost a lot of friends during this time and while it hurt, it also made room for new like-minded friends. Friends who accepted, supported and valued me.

#3. Unlimited Time

In my 20s and 30s, retirement age seemed like a thousand years away. It’s easy to put retirement planning aside in favor of other more immediate goals and priorities.

This is the beauty of the FIRE movement and why I fell in love with it. It takes away the unknown future and puts the future within reach – if you want it.

If we think about life in terms of simple math, the average person lives to be in their 80s. The first 25 years of life is school time, giving us about 55 years of living ahead of us. If we spend just 10 years focusing on our financial independence, that would still leave us with 45 years of life ahead of us! A life with less risk, more flexibility and (my personal favorite) peace of mind.

Does it require sacrifice? Yes. Ten years of focus on financial independence is better than 20, 30 or 40 years of partially trying. In my short years of being on this journey, I can’t say that it was easy or there weren’t setbacks. Big change doesn’t happen in a day. But each setback was an opportunity to learn, grow and stretch.

As I reflect on my life, I have come to realize one very important thing. Hitting rock bottom was both a blessing and necessity in that it was the proverbial “kick in the ass” I needed to get my life back on track.

What I realized is that my “financial picture” is just a snapshot in time, and I always have the power to change that picture.

As my kids say, “mom, you may not be perfect, but every day you try your best.”

That is all any of us can ask of ourselves.

*******

Pie Lady FI is a FIRE blogger committed to educating women on how to go from financial couch potato to super star, by leveraging 10 years of her own personal experience and inspiring others to Grab Their Slice too. She can be found at ThePieceOfThePie.com.

*******

**ADDENDUM**

Along with this guest post, Pie Lady FI also passed along a screenshot of her current net worth, as well as a timeline of how she was able to turn things around these past 10 years.

Rather than include these in our Other Peoples’ Money series it was originally intended for, I thought it would be more helpful to pair it with this post here to give a more overall picture.

Huge thanks to Pie Lady FI for being so open and willing to share!! I hope you’ll visit her site afterwards as she’s new to blogging and eager to start helping people! :)

2008: My marriage ended

2009: Calculated my net worth for the first time after being too scared to see. Realized I had about $255,000 of debt (~ 50% mortgage).

2008-2012: Did a lot of temp work, opening up a 401k account with each new job and putting some money into it (without matches). At the end of each of these jobs I would roll the 401k money into an IRA. I also spent a large portion of my unemployed days reading about budgeting, financial independence & real estate investing, and perfecting a budget format that to this day I still use.

2012: The housing market took an upswing, just enough for me to sell my house and downsize with a smaller mortgage payment.

2013-2015: Used my HELOC to purchase each rental property for “cash,” and then would turn around and take a loan out for 80% of the purchase price. Since I was already preapproved and knew exactly what I had to work with, I hustled and purchased 5 properties within the time span of 3 years.

From 2015 to present I have maxed out my 401k every year, and finally got around to opening a Roth IRA and Health Savings Account which I now max out as well.

*******

UPDATE: Pie Lady Fi returns to the blog 3 years later to share an update on her finances and mental journey :) Check it out – it’s pretty impressive! –> How I Stopped Sabotaging My Own Financial Independence [Part Deux]

Get blog posts automatically emailed to you!

I thought I was the only one that thought about “fear of success.” I thought about it when i was younger. What are people going to think? Then I thought to myself again “stop worrying about [what people think].” I’m building my business to achieve success and a new way of thinking, in addition to being a future side hustle millionaire and earn passive $ gUaP $.

And to stop sabotaging my own financial independence nowadays, I’m learning to adapt to the “frugal spending mindset.”

Thanks DNN! You are not alone. I love how you changed your mindset. Took me a long time.

Okay, awesome advice. Fear of success is huge. I think you need to be able to take some risks. It’s all hard work, but it pays off in the end!

Fear of Success was huge for me… Could I handle it? I didn’t know. Everyday was a baby step. Baby steps were less scary. 10 years later… those baby steps sure did add up. :) Thank you for your feedback.

That’s an amazing story. Great job building your wealth. It’s amazing how much things can change in 10 years if you just keep working on it. Thanks for sharing your story.

Thanks! It was a lot of hard work and all very worth it. :)

Love this story so much. It speaks to two very powerful financial limitations that are so common in women –

1) we’re not enough or not deserving of better

2) we can defer our financial health to our husbands who will “know better”.

You’re a true testament to what’s possible for any of us. Thank you for sharing your story and your numbers! this is awesome.

Caren @ Funding Happy – So true. Thank you for your kind words.

What. An. Amazing. Post. I can relate to this so hard. Well, with #1 and 2 especially. I too was bullied at school, abuse at home, and racism at an incredibly young age where it stuck with me. So the feelings of not feeling worthy and deserving were things I dealt with for years. Took years of work with a therapist to change that mindset and now I’m finally getting out of my own way and changing my financial story/picture as well with other life stuff. In what I’ve read, some PF/FI blogs don’t talk about how self esteem and self worth play a big role in getting started.

Thank you so much for sharing your story. It’s good to see that there are others got in their own way at some point during their FI process.

Cathy – What a beautiful and strong person you are. I absolutely agree, if we don’t feel worthy, we will never do right for ourselves. Thank you for sharing!

I’m so glad you enjoyed this Cathy!! And I agree – we tend to not talk about this stuff in our space. Might be a good focus if you ever want to try your hand at blogging too ;) You know there will be people who can relate right away!!

Many people are quietly becoming side hustle millionaires alone from blogging :-)

Thank you for sharing your story – it’s great to hear about someone who started their FI journey with a few years of experience! I also struggle with feelings of undeserving so it’s good to know others do as well. I can’t wait to check out the blog!

Amber – Thanks so much for your feedback. :)

Wow, you’ve made a huge comeback!

Many times I see others who are my age (27) or younger and have a huge net worth. This tends to get to me at times, but in the end, I’m on my own journey. To say that I finally have a positive net worth is great from my previous situation.

You made a wise choice in spending 5 years learning. Although this may have seemed counterintuitive in the beginning, I’m sure it saved you time in the long run. Congrats on making your comeback, despite your challenges.

Great job getting to positive territory! There’s a whole bunch of bloggers (and readers) on the scene who are all shooting for a $0.00 net worth :) (mainly due to student loans and c/c debt). They should make a club or something as there are certainly more people who can relate to that than the opposite!

Chris – I completely understand where you are coming from. Sometimes, I would feel the same. Its a humbling thing to ask mom for money when your 40!! As for the 5 years learning – it did feel counterintuitive. I felt so behind. But the going slow in the beginning very much paid off, especially when things went a little sideways, I was able to quickly get my footing back. Thank you for your feedback! Lastly, I agree, its YOUR journey and every step forward should be celebrated. Sounds like you are on the right path! :)

Good post! Getting over the fear of success is a game changer.

Congratulations on that and everything that followed!

MonkWealth – Thank you for the kind words. Agreed, getting control of my fear was a big part of my success. To be completely honest, its a work in progress. Every year with new goals, I have the same conversation with myself about fear. In the end, if fear is the only reason I don’t do something, well then that is not good enough. :)

Such a great post. Congratulations on your amazing achievement. Yes, our mindset is almost always the thing that holds us back. You’ve nailed it!

Thank you Debbie! I appreciate the feedback and support!!

Thanks so much for that post. I read and re read it because I sense there’s a lot more to absorb than what’s on the surface of your words and journey. Also, thanks J for posting the charts and commentary BEHIND her story. It gave me much needed context. I immediately went to her page by the way. Well done Pie Lady.

I have my own struggles and also worry about my adult children ( as single parents tend to do) but I’m hoping leading by example will remedy everyone’s mindset a bit. Thanks again.

Really really glad you got something out of this, Craig. I give all y’all single parents mad respect as that’s no easy feat!

“In my 20s and 30s, retirement age seemed like a thousand years away. It’s easy to put retirement planning aside in favor of other more immediate goals and priorities. This is the beauty of the FIRE movement and why I fell in love with it. It takes away the unknown future and puts the future within reach – if you want it.”

Just wanted to say it: with this you pictured why I’m here exactly.

I have been lucky enough not to suffer from #2 in the long run, but I’m still stuck with #1 – mostly because no one around me expects from me anything else than what I’m doing already, so I have to motivate myself to do more and I’m not there yet.

The steady growth of your net worth within the last 6 years is absolutely impressive.

Nita – Thank you for sharing. Its tough to self motivate. I wish I had a magic formula to share but if there is one, I haven’t found it. For me, it started with wanting better for my kids (and that meant not relying on child support). Once things started falling in place, I would challenge myself to do better than I did the year before. The first few years I was surprised at how much I could do. Sadly, I also learned that I should not share my success with my friends. It put a strain on many relationships (friends & family). I learned to be proud of myself, quietly. You will know when you are ready and that is personal for each of us. Do I wish I started earlier? Sure do. But I am also glad I didn’t start any later. :)

Excellent point. Your kids are lucky ones.

I know there isn’t, and “buck up” is surprisingly not efficient, how about that ;)

It’s baby-steps, like you, one after the other. In an effort to rethink work-life balance, I went part-time a month ago (I work 45 fewer minutes a day), and it’s helping me move forward with other things.

I hear you on the stealth wealth. Where I live, what you make in a month is deep in hush-hush territory, even with close ones. I recall my aunt’s reaction at Christmas when I told her about going part-time… Not doing that again anytime soon.

I’m glad to start now, as well

Just getting around to reading this post. Really appreciated this post. Sabotaging myself has been and continues to an issue with me. I have “mindlessly” managed my financial (and to say manage is a real stretch) throughout my adult life. Often thought i’d Make for a good study case. Latter half of last year after discovering The budgets are sexy blog I calculated my net worth and found I was pleasantly surprised that it was not zero. Since that time have been mindfully spending time on my finances. Haven’t been a complete zero over the years but certainly could have done a whole heck of a lot better by making better decisions. My journey continues.

Indeed it does! And once you have that epiphany it goes a lot smoother too :)

I’m rooting you on!

In my case, my biggest sabotage was to invest a lot of money in a business in which I had no experience …