Here’s a fun exercise to add to your net worth reports every month :)

(Or just RIGHT NOW – because who doesn’t like playing this game??)

Hey J$,

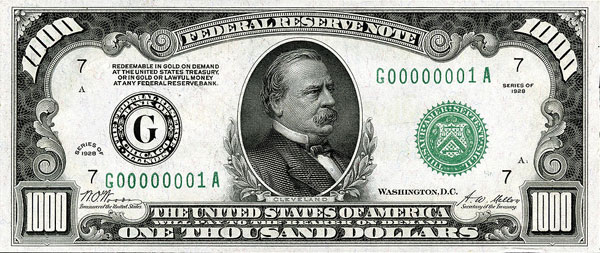

Today is the day for me to track my net worth (up 5% from last month!), and I started a little exercise where I think about what I would do if I just received $1,000. How would I want to split it up? Here is how I think I would split it this month. I think it’s an interesting exercise to see what my current priorities are.

If I received $1,000 what would I do with it?

- I think if $1,000 dropped in my lap I would want to save at least $500 immediately. I think that would all go into my Roth IRA so I can easily forget about it.

- With the remaining $500? I think I would want to put some towards ski/snowboard season. So lets say $150 goes towards that (gear, gas etc)

- With the remaining $350? I would want to take my girl out somewhere nice so lets say that’s $75.

- With the remaining $275? Some towards knowledge, lets say a low $30 because books are cheap.

- With the remaining $245? Let’s say $45 towards chain mail stuff (I started creating chain mail after visiting a ren fest for the first time)

- With the remaining $200? New socks, let’s say $20 (I really like socks and I like to wear crazy socks during my sporting events)

- With the remaining $180? Gifts, lets call it $50 (gifts for no one in particular, but probably just family and friends. Maybe something for GF’s cats)

- With the remaining $130? Here’s where charity can come in. I’ll call it $100

- With the remaining $30? Goofy juice.

I think I’m going to continue to do this exercise every time I do my net worth calculations.

– Matthew

A few things about this:

1) Always fun to play with imaginary money! Helps bring out our inhibitions more, which some of us (tight-fisted budgeters) can use!

2) Our priorities/goals are always changing. And you’d def. see that occurring the longer you do this exercise (though maybe better doing quarterly or bi-yearly since not that much changes on a monthly basis?)

3) That 50/50 balance of “pleasure” vs “responsibility” up there is great. You sock away a chunk up front to help you feel better about what’s to come, and then you splurge away, haha… And even better when it involves other people too, like Matthew’s girlfriend and the charities.

4) Though did you notice all the I thinks there in the beginning? He was probably just writing in the flow, but it’s always interesting to see how you *think* you’d spend new money coming in vs how you would *actually* spend it. Unless you’re the complete opposite of me and feelings don’t get in the way at all ;) A much better indication of how you’d spend an extra $1,000 would be looking at how you just spent your LAST $1,000! Haha… Though I know that kills the thrill of the game…

and then lastly, 5) What if this prompted you to actually go out and EARN AN EXTRA $1,000?! Turning these “what ifs” into reality? Seeing all that fun stuff it could bring would certainly motivate me to hustle more than a vague wad of cash would… You never want to chase money just for the sake of “having more.”

So yeah – I approve of this! Anything you can implement to try and trick yourself into being better with money is always a win in my books :) So thanks Matthew. Would love to hear if it sparks any new changes for you over the next handful of months?

As for what I’d do with an extra $1,000 right now? I’d probably apply it towards furniture for two rooms in our house which are still completely empty despite moving in over 4 months ago, haha… I hardly have the desire – or energy – to go shopping these days, but maybe it would buy me a magical fairy that could do it all for us so we don’t feel like failed adults? On the plus side, my kids sure love using them as soccer fields and wrestling mats, so at least they’re getting something out of them :)

What would you do with an extra $1,000? Think it’s worth an exercise every month?

Get blog posts automatically emailed to you!

I love these games!

My very first thought was, “I’d buy that really fancy and expensive vanity unit and really fancy and expensive old fashioned style taps that I have my eye on for when we get the bathroom renovated next February”. No saving or investing or donating or anything else in the $1000 fantasy today. I just want this!

Then… I remembered that every Monday I diligently tick off my Money Saving Chart, and save whatever number in the next box is, and by the time it comes around to buy bathroom furniture next year I will have $1000!

I don’t know if I WILL get the really fancy and expensive vanity unit and expensive old fashioned style taps but it’s a nice feeling to know I can.

That last line is the best!

“It’s a nice feeling to know I can.”

All about the options :)

Most of it would be “reinvested” back into the rental property we recently purchased. We would split the cash to be an extra loan payment and pay for some of the planned repairs/improvements we will be doing as cash comes in.

Sounds very responsible of you :)

Love these thoughtful activities.

Well, I kinda don’t need the $1,000 so I would invest it and get myself four days closer to FIRE as we are budgeting about $240 a day when we do blow this popsicle stand! 4 days of additional freedom!!! Woo hoo!!

So awesome you know how much every dollar gets you!!

Gonna have to add that to my “to do” list to find out… Excellent metric, thanks.

I’d stick it in our vacation fund, which we recently drained to near zero on a fantastic family vacation.

Nice! Where’d y’all go?

This is easy. My sister is jobless and needs $500 per week to stay afloat. So that buys 2 weeks of helping her survive without a job.

Or I wish I could use it for replacing my front steps.

And still trying to save for a new car. -sigh-

Such a good sister!! That’s a lot of money!

The responsible side of me would put it all toward our mortgage. 2 more months off the final pay off date!

The other side of me would split it 50/50 with my husband and add it to our fun money funds to do with as we please.

Or buy 1 extra month of freedom and split the remaining $$$ with your husband :)

We have been HEMORRHAGING moneys lately. New tires for both cars, a raincoat to replace my old ineffective raincoat, a pricey Christmas gift for my wife, a $880 vet bill for our poor dog who needed two teeth extracted yesterday, and a $10k bathroom reno starting in January.

But due to luck, savings, and planning, we manage to afford this stuff.

So a surprise $1k would probably go half into an IRA and half toward good causes to help those who can’t.

Woah – that’s a lot at the same time!

It would all go toward my car loan, which is the debt I’m focusing on paying off. Yes, that was my knee-jerk reaction. And that actually is where my last $1,000 went too, since I did my loan payments for the month last night!

However to make it more interesting, if the money came the condition of a 50/50 split, what would I do with the $500 for fun? Hm, I’d buy the writing supplies I’ve been looking at ($30), and I’d use the rest to buy a bed frame that won’t slide away from the wall every night, “eating” our extra pillows.

The last $500 I spent not on loan payments or bills was on groceries, cash for a donation and lunch out with coworkers, a gift for my sister, gas, and– hopefully an outlier!– paying my mom back the cost of a plane ticket to visit my family for a very urgent and sad reason.

You must be having fun in that bed every night, haha…

Normally, I’d put it in my money market account. But if I get it now, I’d buy a new TV. Black Friday! Our TV is 13 years old. It’s time for a nicer set.

I can get down with that…

Much bigger bang for your buck with how technology has changed too.

I just bought a new TV at Costco, 55″ and only $ 370. Samsung too! Ultra HD 4K

TVs are so cheap nowadays!

WOW! That’s amazing!

The problem with having reached FI many years ago (I’m maybe your oldest fan, J) is that getting more money loses its appeal. I never realized that I would someday get to the point that additional money is meaningless but I already spend as much as I want to spend, so if you gave me $1,000 or $100,000 or $1,000,000 it would just go into my investments. I kind of miss the way it felt to get a bonus at work because unexpected money meant something back then. It would take a million dollars to make me feel the way an unexpected $1,000 did when I was just starting my career. It’s kind of a strangely negative feature of winning with money, money stops mattering. It’s like throwing another spare tire in your trunk when you already have two of them in there.

I can see that :) And one day hope to feel it too! Haha… (though certainly I have over the past few years, to a lessor degree… Once we hit around $400,000 the extra money didn’t nearly affect us as much…. And on the plus side, *losing* similar amounts of money (whether for unexpected bills or market crashes) doesn’t either! It’s only when the amounts are much larger, as you mentioned, that it really makes you stop for a second… A good problem to have, indeed.)

I’d probably go for furniture too. My couch is getting on in years and has acted as the scratching post for my cat for so long that I have to cover up the shredded arms with throws. A thousand dollars would do a pretty good job of replacing it!

That is the sucky part about having cats :( All of ours are all scratched up too…

I would put $700 to my debt and $300 in my emergency savings just to add a little more of a cushion!

I nice balance there :)

We can afford our needs and still save and give at a respectable clip, so I would treat all this money as blow money. If my kids learned about it, we would definitely buy an annual swim pass at a pool that has a water slide and splash pad ($830). If I get to spend it in secret, then I’ll buy myself a new bicycle.

Haha…

I’ll put in a good word to get you $2,000 then so you can have both ;)

This is one of my all time favorite exercises…and it’s amazing what happens when you think about different levels–like, what would I do with $10,000? What would I do with $1 million? $10 million…beyond that is just stupid. (A related fun game when you visit a museum is “if they told me I could pick one thing to take home today, what would it be and why?” But I digress…) I think $1,000 is interesting because it’s such an attainable amount. And, if I were given an extra $1,000 out of the blue right now, I’d buy a pimped out ergonomic desk chair. Because, #soreback and #adulting. My tendency is to just save…that’s what I always did with bonuses (long time since I got one of those). It’s almost fun to think about what you’d do with it for only fun or only to improve your career or only to improve your health. Cool way of looking at priorities though!

Love that museum idea!!

Been going to a few lately and can totally pick out the *one* I’d bring home when I think about everything I saw :) Fun game!

I’d pay my dentist. This is exactly what i will owe him for him putting in an implant. Not very sexy…but.

… but probably life changing! :)

Ugh! I am far too practical for these games. I am no fun. I would use all of it to pay off debt. We are currently in crazy pay off mode. I just got a refund check for overpayment at physical therapy (about $575). I immediately deposited it and paid $600 toward debt. It’s boring but I was thrilled.

No one here will hate you for that ;)

As I’m satisfied with how my savings is going now, I’d put it towards one of these…

https://almostheaven.com/salem-barrel-sauna/#tab-1

Oh $hit, that’s hot!

Literally! ;)

Id use it to pay for my son’s next hockey season and save the rest.

Ugh, all this sounds so wonderful.. I can almost remember feeling kinda secure like this.

Unfortunately I’m here bc I found myself married to one of those abuser types. In a short few years, I went from finally buying my 1st & 2nd house b4 him (having any kind of property to rent out is so lucrative!), to now w/o a place to lay my head.

I was clueless; giving up my career to be a SAHM, letting him handle all the finances (he was just too angry and I thought it would lessen the harm – despite me having an acctg biz), and allowing him to invade my brain were my downfall. Trusting your partner is good, as things should be, but never, EVER take your hand fully out.

So now, I’m on the torturous CPTSD climb out of misery. Sure I broke free, but am being punished for it at every turn. He won’t ‘allow’ me my babes, and now that he forced me out of my second house, I have little argument for bringing them ‘home,’ when there is none. It’s debilitating knowing what they’re going through, but is simultaneously my reason for trying again tomorrow.

He demolished my credit, and the piddly few thousand I am to get every few months won’t cover me ahead to buy my way into even renting anywhere for us. I’m blown away at rental prices – 2 or 3 times both mortgages.

With an extra $1k, I’d see if it could possibly go towards getting us in an apartment somewhere… so that maybe, just maybe we could pick up what’s left of our pieces, I could start working again, and we could start all over.

What I’d REALLY like to do with an extra $1k? Sign my 4 babes up for equestrian therapy.. so that they could begin to have hope again.. and maybe not repeat their mama’s mistakes. You just can’t trust every soul that says you should.

I realize this isn’t the forum you’d like to see this sort of thing. But I am as real as the next person, trying to find some way to make ends meet.. or I guess make something out of nothing. If I want to get through this (and I do!), I have to work with what I got.

I never – not in a million years – would’ve believed these things do happen to actual ‘innocent’ people. I always figured there had to be two sides, and cringed at what I perceived to be ‘sob stories.’ What I know now doesn’t feel worth the torture, but perhaps if someone else can take just something, anything from this…

Financial abuse ALWAYS exists beneath any other kind. Please, if you know anyone that you just get an inkling about – please – INTRUDE away. They may have no one else, and you may just save their life.

God bless you guys. It IS good to see that others do succeed; maybe I can again too.

Thank you for sharing this even though my heart breaks to read it!!

So SO sorry you have to struggle like this :( I don’t know how or if I can help with anything, but please feel free to reach out and ping me anytime you’d like: j (at) budgets are sexy (dot) com

Will keep you guys in our daily thoughts in the meantime – please stay strong!! I’m rooting for you!!