Mornin’, y’all!

Lots of great comments going on with our $500 Christmas Stimulus so far – if you haven’t entered yet there’s still a few days left! Five of you sexy readers will win $100 to play with!

Today I want to pose a different question to marinate on though, and one that according to my friend Derek from Life and My Finances will tell you exactly how wealthy you are ;) No fancy calculators or formulas needed!

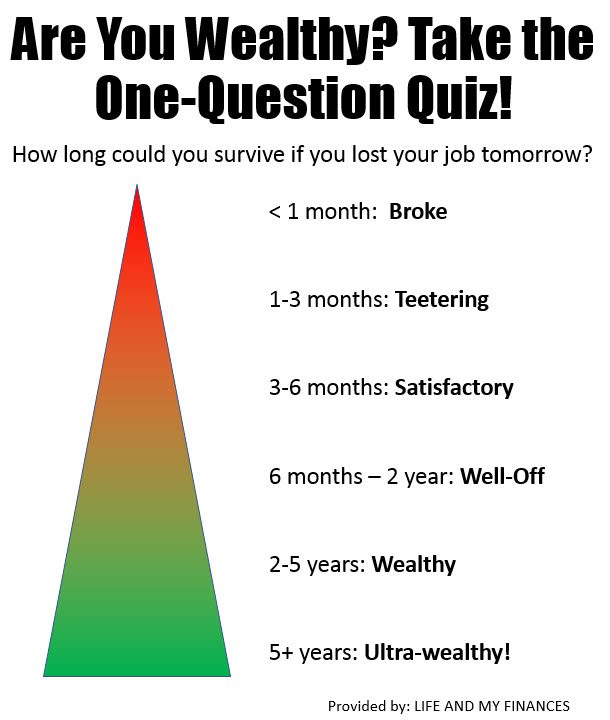

If I want to know if you’re wealthy, I’m not going to ask where you live or what you drive, and I won’t even ask about your job or your income. All I have to do is ask this one simple question: “If you lost your job tomorrow, how long could you survive?”

BOOM! Ever thought in terms like that before? How long do you think you could go off the top of your head before running the numbers?

A freaky exercise for sure, but a good one to take on. Especially because it hits at the heart of two main factors in finance:

- Our expenses

- Our assets (savings, investments, etc)

All the income in the world is great, but if you don’t ever KEEP any of it what does it matter? Similar to spavings, what’s important is what’s banked – not what’s earned. And in terms of a worst case catastrophe or a random blogger playing the “what if” game with you (hah), both of these areas are vital to pay attention to.

Here’s where we currently stand in each department:

- Expenses: $6,200/mo (I know I know…)

- Assets: $677,637.82 (savings + investments)

So going with this super simple calculation here and dividing the two together, it would mean we could last approximately 109 months – or 9.1 years – if we never earned another cent again.

Pretty fascinating!

And then if we were really being cheeky, we could max out our $55,000 credit card limits too and tack on an additional 9 months to the chaos ;) Which is another fun calculation to try one day actually – tallying up the total lines of credit you could access if the $hit really DID hit the fan! And it would have to at this point because it would mean both my blog here AND my wife’s federal government job is gone, and we all know how hard it is to get fired from that one, haha…

Of course, there are a slew of variables and implications with liquidating all your accounts/assets/credit like this, and you’d force yourself to downgrade your lifestyle as well if need be, but for the sake of simplicity we’re just going to ignore all of that since we’d never put ourselves in that position anyways, right? RIGHT???

But if that exercise wasn’t enough, Derek also came up with a measuring stick to translate exactly how this relates to wealth… And it’s very scientific ;)

It looks like I’m now Ultra-Wealthy – sweet! Haha…

Like I said, super scientific :)

In all seriousness though, knowing how long you can last in a worst case scenario is super empowering. Even if we’re simply talking about weeks here and not months, you have to be sure to count each of them as a major WIN as it’s one more week/month than the old version of you once had!

Remember – the point of money isn’t to die the richest man in the cemetery, it’s to be used while you’re very much alive and ready to live out your dreams. Whatever that may look like. For some it will mean having $5,000,000 stashed away to accomplish this, and for others “only” $500,000.

The two main variables here are expenses and assets. The wider the gap between these two the longer your money will last. Simple math.*

So today’s task is easy – tally up these two numbers of yours, and then find your own place on the wealth-o-meter chart. If you like what you see, great! If you don’t like what you see, also great! The point isn’t to see who’s “bought” the most time here (although secretly that’s going to be fun too ;)), but more so to know roughly where you stand. Not unlike the reasons we’re so obsessed with tracking our net worth here too.

So calculate away, my friends! Then come back and share your results w/ us below. Or at the very least, whisper them into your sweetheart’s ear like the sweet nothings they are, haha… After all, nothing says I Love You more than freedom! And we should all be so loved in this world :)

XOXO.

********

*We’re also ignoring cash flow from assets, taxes, pensions, debts, social security and on and on and on… Bonus points for anyone who wants to run the extra 108 calculations to ensure accuracy ;)

Get blog posts automatically emailed to you!

I could survive for 5+ years but that means liquidating tax sheltered accounts with a very high penalty. Since I am a miser, that means I will probably die of starvation first.

you just made me spit out some of my coffee!

Love this wealth meter. We would last:

-Forever if we include our side income

-5 years if we include credit lines & credit cards

-3 years if we include none of the above

Ooooh is this side income passive or active? (wait – if it was passive you’d be retired right now right? Haha… and since this exercise means *no* more income it’s off the table anyways :))

This is a question I ask myself all the time and I always come up with different answers or many variables… The most important one – if I lose my career, can I get a part-time job? I may be the only person who is actually looking forward to quitting their career to start waitressing!

Back to the question – If I were to live exactly as I am living now, I could live my normal life now for at least 2 years off cash before liquidating any assets. After that, I have a little over 14 years saved (which actually would last longer if factoring in compound interest)! ULTRA WEALTHY!! Can I quit now??

“I may be the only person who is actually looking forward to quitting their career to start waitressing!” – hah! It’s like me with wanting to be a teller at the bank :) Everyone says I would hate it and you have to deal with customers all day long, but you also get to deal with CASH MONEY all day long too and would only increase my coin collection even more! :)

No, you are not the only one! That’s so me!! I’m a lawyer but dream of being an assistant, a clerk, or in retail!! Or better yet – going back to my old job on a national park maintenance crew! One day ;)

As for the question, I’d only last a month and a bit on cash alone, but with investments, I’d last over 7 years (without interest), so yay me!

national park – good one!

almost as cool as your blog name :)

Mr.Wow always talks about wanting to get a part-time job at a brewery or at the airport or something like that. If money wasn’t a factor, he could use his “job” to learn a new skill like brewing beer or to indulge in some benefits like travel miles/ discounts.

He would be SUUUUUUCH a great bartender too. Always entertaining everyone there as they drink :) I bet the tips alone would cover a decent full-time salary! haha…

18 years! That’s an eye-opener. 28 if I get nerdy and factor in 3% inflation and 6% growth. (using https://www.calcxml.com/calculators/how-long-will-my-money-last)

BOOM. Killing it.

Just over 5 years, but my expenses would drop rather dramatically if I lost my income, as I did in 2009 & 2011. Maybe that’s a question we should all answer: what’s your bare-bones budget if you couldn’t make another dollar for the rest of your life? Stretch out your accumulated wealth into an extended hibernation…

Yup yup – tons of stuff you would *actually do* in reality to extend the money and/or not even have to dip into it at all…. You could probablby make 13 different types of spreadsheets out of this one simple question haha… (and enjoy doing so!)

Maybe 3 or 4 years, but things would change for my son. Only 2 years if my son stays in college. Not working for 2 years and spending all my savings would guarantee better college financial aid for my daughter in 2020 though.

It is decided. Must get the wife and I fire today.

I was unemployed for a while in 2015. I scaled back on some things, and on the other hand cobra was a LOT more expensive than health insurance through work. Just using that as an estimate I’m in the “well off” category.

I went to an off site training for work earlier this month and had to put it on my card and be reimbursed so that would skew a quick glance at my average expenses without more math. I also recently took yoga trainings I would have skipped if money was tighter.

I know I’d be fine, because I’ve done it before, but I’m in my wealth accumulation phase on my path to FI, so I would be looking for work.

Good point on some expenses maybe going up, like with health insurance…

Mine came to 39 years so booyah! But I’m pretty confident that my expenses will go up in the future, so that number would shrink for sure.

Tell me you’re already retired??

Currently, we are only at about 8 months if we kept living as we do right now. But we just started, and it is growing fast!

Phew, was in this situation 8 years ago, as I lost my job and had some pretty ‘thick’ debt as well. Fortunately for me, I just worked like crazy to make my web design freelancing ‘career’ take off and never looked back. It wasn’t pretty though, 16 hour work days for 3-4 months almost put me in hospital.

Yup, the dark side to self-employment and hustling – there are no limits/rules to keeping balance in check! Which is good or bad depending on how you look a it :)

Taking your super scientific calculation of Assets (or net worth) divided by expenses….. I can survive for 18.3333 years.

This does not factor in maxing our credit cards. That would add another ~3 years.

In reality – it may be much longer or shorter. I have a lot of cash flow from real estate. BUT that also comes with a lot of overhead. With great cash flow comes great responsibility. Real estate is sexy like that.

“With great cash flow comes great responsibility” I love that a lot… you should consider a personal store w that on mugs and tshirts. Also probably why a lot of people don’t “make it” in real estate.

That would make a great mug or even bumper sticker :)

In two weeks, I am returning to work after 9 months of unemployment. In all fairness, I took the first six months off and didn’t start looking for a job until September. I only used half of my 17 week severance pay, as my DH’s pay covers most of the bills and insurance. I didn’t really expect much of a degradation of lifestyle…but with one kid headed to college for the first time in Sept and the other very active in several activities, you know… We have no debt, a 9 month emergency fund that we never touched, and our expensive summer trip and college (for both kids) is already saved for.

I think, with the rest of the severance and emergency fund, I could have lived for three years. But using your formula of assets/monthly expenses, I could go for 25 years! And that was using my generous monthly expenses of $6k, when reality is we could easily live on $5k, and probably survive on $4k.

We look at this number often, as we’re in our early 50s and hoping to retire by 55 or 57. The biggest and most terrifying unknown for us is medical insurance. Who knows what that will look like in 2 or 3 years, let alone 20 or 30! In fact, we’re staring down this reality now as we compare my new insurance with hubby’s company’s change of carriers and options. Ugh.

I know, it’s horrible :( There’s a TON of $$$ bloggers now moving over to the more religiousy medical programs out there, could be an option to consider? Lot of the FIRE bloggers talk about them as it’s certainly a concern in financial planning.

Interesting question! I would say 3-6 months since most of our net worth is tied to our equity.

We want to eat, but we also need a place to live. We would probably rent out the rooms in our house or something. But yes, we would frantically they to look for a job.

I would last about 15 years if both my wife and I quit our job today. If we max out all of our loans, we can push to about 17 years. It’s great to know that I will be able to last that long, but I am pretty sure I will be quite miserable because I will be constantly reminded that I will run out of money before I die.

I think that the ultra wealthy meter should be increased to about 35 years. If you have that much money, you will most likely never have to worry about money again.

Agreed – the bar is set pretty low there for “ultra” wealthy status. I’d be stressed to the max myself knowing every single day the pot was diminishing!

Looks like I’m up to 23 years, ignoring liquidation expenses (trading costs, taxes, etc) and ignoring stock market gains (realistically, I wouldn’t cash out everything when I wouldn’t need it for decades).

The major advantage is that I got my spending down to about $16,000 a year.

That’s it right there! Changes the entire game living off so little – well played.

3 years and some change, that feels pretty good actually. Not as good as 25 years will feel though.

I think a better measure of wealth is the inverse of this. Instead of net worth divided by spending, take spending divided by net worth. That’s your yearly withdrawal rate. If it’s less than 4% or so, it lasts forever.

If it’s significantly less (e.g. 2%), not only does it last forever, you get a healthy raise every year from the compounding of what you did not spend the previous year. Far from outliving your retirement, it gets better the longer you are retired.

That’s a cool one too :) Provided of course you’ve got most of your net worth in some sort of *investment*. Lots of people include all types of property that doesn’t go up in value or return any cash.

Another blog post right here! I like this approach a lot.

Calculated from today, we can survive for 8.3 years (so, surprisingly ‘ultra-wealthy’ given that five years ago we would have been able to survive for a month at best). If we take into account some changes pending in 5 years, we could survive forever. Wow! Thanks for helping me see…

What a fantastic metric. For the first time in my life, I can say I’m Ultra-wealthy. I certainly don’t live or feel that way. Thanks for doing the simple math and not making me calculate penalties for early withdrawals from qualified accounts. I think there should be one more bucket at the bottom of the triangle for lifetime wealth. When you are still young, 5 years is not necessarily enough.

Agreed. Although I suppose if you’re smart enough to hit “ultra wealthy” when you’re young, you’d be smart enough to keep making it last and/or turbocharge it even more pretty simply :)

Yes! I read about this idea in some blog post (don’t remember where) a few years ago. You can boil your whole financial situation down to this one number and then track it over time. When I started tracking I could last 3.4 years. It’s now up to 6.5. When you hit 25-30 you’re free. Really interesting!

If I lose my job: Forever, if we make adjustments to her 401(k) and ESPP contributions.

If my wife lost her job: Forever.

If we both lost our jobs: Around 3.5 years

The nice thing about being DINKS is we have a ton of flexibility with our income/spending since we’re just living off of my income and essentially saving my wife’s entire income. That means if she loses her job, we’ll still be fine.

Of course, a job loss will hit us right in the milestones though – not being able to save as much obviously means retiring later, etc. But hey it feels pretty damn good to know that we can live pretty much indefinitely if at least one of us is working.

Helll yeah it does!!! Now don’t accidentally have children now and become a DIK! ;)

Haha no worries there. They’ve got procedures to ensure that doesn’t happen :)

Fascinating exercise. Thanks to the 401k money I built up in my early salaried years, I could get 5 years down the road. And that includes paying mortgage and property taxes, etc. If I sold the house, it would be even longer. What a nice thing to know!

it is, right? kinda a silly exercise, but really puts everything into perspective :)

Reminds me of London – “MIND THE GAP”!

Wow, I just ran the numbers. Net worth (excluding Home) / Spending = 21.7 YEARS!

Guess I’m about ready to FIRE! 192 Days to go (not that I’m counting).

it’s gonna be a damn good day, sir. I will be drinking in your honor :)

Nice post! I’ve thought about this often the past year as I’m in the middle of a 2 year challenge to get my taxable investment account back to $100K (Right now I’m at $62K). For me, a $100K would mean 4 years of living expenses, which would be a huge buffer. I’ve learned being debt free helps the savings rate significantly :)

Haha, that’s what I hear.

Less time than I would like… My wife became a stay at home mom probably earlier than we should have agreed upon as a couple… That pretty much ended all of our progress forward for around 8 years. During that time I had to step up my game big time to start getting ahead again. I was making $135k by myself, which is a good salary, but feeding 5 mouths (6 now) pretty much sliced through all of that leaving us with $0 extra per month. I have more than doubled my take home by going self-employed, but that is not without a significant amount of volatility and risk. The numbers sound high but in reality they aren’t. It just means I can put away 55K per year in my 401k, max my HSA and IRA. That’s all well and good but it still means working till 59.5. I like that my wife stays at home, but in hindsight I wish we would have delayed it till we had at least 100K non retirement funds we could tap. You live and learn I guess… Anyway, Without tapping my retirement or credit cards I could only survive 3 months before I put my house up for sale, then we should have an additional 125K in equity to work with, so about another year or more if we significantly scale down. Wiping out retirement would be an additional 1.5 years, but probably longer as we would be buying nothing but essentials during that time. I’m going to say roughly 3 years before we are sleeping in a car. The reality is probably better than that with family near by but 3 years is probably my worst case.

Hey now, $55k stashed away is pretty damn good! I know the rest isn’t as optimal, but outside of bloggers I literally can’t tell you one person I know that can do that :) So really just a matter of letting compounding work for you as $55k a year will just be bonkers later – especially when everything crashes and you’re scooping ’em up on the cheap!

Yeah I just need to maintain this level for about 5 years and I should be at least be able to retire at 59.5 worst case. the longer I can sustain this the better. I’ve done the math and at the 12 year mark I’ll have 0 mortgage and at least $100k in a taxable index fund. I can keep putting money into so that I can stop work in my early 50s. Aggressively my goal is to be able to stop working at 45, but that will require stepping up my game in a big way, like $500K a year or more big. Then the real question hits, if you can scale that large why would you stop as long as you can stand it mentally…

Haha yup… would be a pretty good problem to have though :)

Good Question since we are all just one life event (car accident, natural disaster, Korean attack) away from possibly being unemployed. In 2012(before my path to FIRE), I went 7 months with 0 income due to a motorcycle wreck. I changed my spending and survived without taking on any debt.

Currently it would be 5.5~6 years by your simple math. Its not enough to live forever on but boy does it give a relaxing feeling when your job gets stressful. (Imagine going to your supervisor and requesting “I’d like to take the next 250 weeks off unpaid please”).

wow – 7 months without going into any debt is pretty impressive! amazing how adaptable we really are when we’re forced to be :) are you still riding motorcycles cuz it’s in your blood, or never again?

We generally spend around 2,500 a month. I live in Oklahoma. It is cheap overall here. For example, my mortgage is only $435 a month and HOA fee is $99 a month. Anyway, I have 340,000 + in cash and investments and another 60,000 or so in retirement through work. I think I could easily make it 10 or 11 years. I am not counting the retirement money since I will not have access to it for many years.

Dammmmn!!! Super cheap – love it!

Interesting since it’s a question that I’ve pondered recently. Not that I will likely lose my job…I work in a stable government job. I wonder about it because the golden handcuffs of my job and its benefits keep me comfortable but I question whether I should do something else. Maybe I could be a freelancer or maybe a full time blogger!! I crave flexibility now with 2 little kids and my job has none plus I have a long commute. I could last a few years if I didn’t work but I’d deplete most of my savings including retirement savings. Actually I might be even able to last a little longer if we cut some more costs since my wife still works.

The perfect scenario for a side hustle/blog like you’re already doing :) If you can get it up to a certain threshold you’ll feel a lot more comfortable making the transition. Although while you do have ultimate flexibility as a full-time blogger, it doesn’t mean you’d actually be working less ;) I work gobs more than any job I’ve ever had in my entire life haha… It’s really just *moving around* the times when you work. Unless you’re a master efficiency expert.

I actually just lost my gig and have been living off of non-retirement assets. I am in the teetering portion of the pyramid. I am good for a bit longer. Thankfully, I have an interview for a similar gig on Monday.

Ugh, sorry to hear!! I hope it went okay and you got the gig! :)

We’ve got probably a good 2 years. 5+ if we are still renting out the humble homestead. It doesn’t make unemployment any less scary though ;( my opportunity cost!!

Looking at just 2 numbers seems to over simplify it a bit. We’d be able to survive 43.3 years. That’s darn good. Probably won’t live that long.

Throw in some gains and we should be able to live off our investments indefinitely. That’s financial independence, baby!

Life changes, though. Healthcare cost is going to be expensive and it will increase our COL quite a bit when we get older.

Nearly all of our savings is in my 401(k), so I’m sure we would incur fees to withdraw that, but our monthly costs are around $4,000 and our savings total (including 401k) is $68,000 which would give us about a year and a half at our current monthly costs.

But if I take in some other factors, it would stretch longer. Some of our bills could be cut. We pay over $100 a month for cable, we could switch to a cheaper cell phone company, we could move into my parent’s rental house for free and rent out our mortgaged home to cut some expenses. That would probably bring expenses down to $3000 or so. We could also cut coupons and eat out less, which could bring expenses down a little more. Even with all those cuts, it would probably only stretch to 2 years or a little more.

So I guess either way, I would fall into “Well-off” which is encouraging because sometimes month to month it feels like we barely scrape by :(

We all barely scrape by some months :) As long as you’re up way more times over the years you’re good!

If I did it calculating my retirement minus any debts I am well off. Could survive for a year.

If based on cash on hand, broke.

Max my cards, well-off.

Both 1 and 3 would leave me broke after.

Sum up: I’m broke. Not good.

Hustle Hustle Hustle I need.

It’s funny because I just did this calculus a week ago. Conservatively I’m just a tad over the six month period, based on the rules presented above. More as I would probably cut my expenses more than I already have (but then, maybe that means I should cut them now?). And even more if I increase my side hustles/ take on a part-time job. And, if I moved to Mexico or Colombia, and rent out my house, I could last even longer. Probabaly a couple of years, depending on where I land.

Of course I would rather not find out. I want to keep building my savings so the answer becomes “in perpetuity.” But I think there is a huge psychological component to figuring out the answer to the question you posed. When I did a little bit of math (not my strong suit; there’s a reason I became a writer) coming to the realization that if I had to, I could survive for at least six months with no income coming in was a big relief. If tomorrow my boss told me to jump in a lake, I could take a little time to do the backstroke and enjoy it, with a good buffer to figure out my next move. That keeps me calmer at work, which probably helps me do my job better.

“I could take a little time to do the backstroke and enjoy it, with a good buffer to figure out my next move.” – I like that, haha…

Great post. I have always viewed my finances in similar terms. Based on your metrics, I am wealthy. I still better hold off on buying the Ferrari California. In my mind I classified rich as having 10 years of living expenses in savings. To be financially independent, 25 years of living expenses. Any amount beyond 25 years, I classified as wealthy.

My husband did lose his job over 3.5 years ago (before we discovered FI) and even then we were just fine. We could have easily made it on just my income for a couple of years even though he always made more than me. Now we are pretty close to our FI coasting number so if either of us was unemployed we could make things work, if we both lost our jobs we could make it quite a while. It’s such a great secret knowing that we have this security. :)

Stealth wealth at its finest, baby!!

Wow, I never thought about it this way. I am looking at 7 years as of today. I am thinking my life would change a little and I might even get 9 years!

You are so right to say that money is to enjoy here because you cannot take it with you! Finding that balance is the journey of your life and happiness :)

12.5 years before we’d need to sell the house or put it on our credit cards! It’s amazing how quickly we increased our savings since we discovered FI a few years ago. When things get stressful we joke that we can always sell our house, buy one for $30k-ish and be FI. But I think that dream sounds better than the reality.

Well the nice thing is that if you ever *did* try that and it sucked you can always just go back to work again :) Prob worth it to find out! Haha…

J$, this is an interesting question indeed. I run 2 budgets anyway; 1 for normal (employed) spending, and 1 for bare bones (no job, or retire early, or other income source) spending. The bare bones budget is always my backup plan budget and gives me a little security knowing I can survive on way less. It also lays out a path to cutting some current unnecessary spending to help increase my savings rate. Current spending shows I’d only survive for about 4 months, and bare bones shows about 8 – neither of which I agree are satisfactory or well off. These numbers do though encourage me to increase my savings and lessen my spending, so thanks for posing the question and giving me more to think about. – Brian

Fascinating!! Saving this for a future “good ideas” post as you don’t often hear people keeping two budgets like that simultaneously but it’s so smart! And prob doesn’t take that much additional time anyways.

Thanks. It’s really not a time consumer. It’s pretty much a “save as” and strip away the unneeded items, decrease a few amounts like rent, and drop the income down.

We would be in the “ultra-wealth” bracket of +5 years, its not that we’re super rich but instead we’re really frugal with expenses in an emergency situation.

We have an emergency budget that we can put into action if something like this were to happen. Our emergency budget is more than 30% less than or normal budget (and we could go even more extreme in dire circumstances). This quickly makes our cash last longer.

This is a fantastic metric! I used my net worth given that I still have some low-interest student loan debt. I get around 123 months or a titch above 10 years.

Am I the only one that doesn’t feel that much different being “wealthy”? Aside from a better sense of security and flexibility (priceless), it’s not like I’m making it rain in the French Riviera.

The only models and bottles around here are Excel and Fiji Water (kidding, I have a water bottle…more frugal).

Haha… I def. don’t feel wealthy at all either. Just more confident and not as worried as much anymore :)

RE: Your comment on federal employment –

Fellow Fed here – I wouldn’t get too comfortable with the belief that your wife can never get fired. In the past, this was definitely the case, but there has been a cultural shift among many managers in the federal workforce. It happens quite a bit at my agency- new employees that are still considered probationary will be let go if they aren’t picking up the skills fast enough. The powers that be are trying to make it easier to fire the longer tenured employees as well.

Anyway, all the more reason to keep saving!

Yup yup, always good to do your best at work regardless!

Hopefully around 50 years or so at this point. :)

I would hope so Mr. Retired man!

Right now 7 months with out touching stocks. add another 3 months with the stocks. That’s without adjusting budget at all. If we both lost our jobs our budget would quickly change though. The extra principle paid each month would stop. The allocations to things like vacations, gifts and future home improvement projects would stop. That would stretch the existing cash on hand another 6 months. Then we starve until one of us hits 59 and a half to tap the 401k with out the extra penalty. Then we’re good for another 7 years. It shows good progress, but also reveals there is work yet to be done.

Love the comment about whispering the info into your spouse’s ear. I do text her numbers when she is having a bad day at work. Little reminders like the mortgage balance just dropped below a milestone, the house will be paid off in x number of days (currently 1,432 or less), or our mutual fund is up by some percent since January. It makes her smile.

HAH – Love it!! I should try that too as my wife never knows how much money we have or don’t have or anything even though I tell her all the time… Maybe texting it to her will help it soak in more :)

We would last for 2 year in the US. But if there is no job prospect for a year, then we would just move to Vietnam where I’m from and everything would be cheaper :). And we would last longer!—Would that be considered cheating?

Not cheating at all – adventurous! :)

This was fun!

20.8 years without counting any Pension (as here in the UK there is no way to take any of your pension out before you are 55, as far as I know…unfortunately).

And this doesn’t account any sort of return ever! And also no changes in lifestyle at all! I mean we are frugal, but we could do much better. I bet we can easily reduce our spending by 30% if we have to (fewer holidays, not travelling around as much etc.)

By then, we will be able to get our pension, which should give us at least another 6 years if we don’t contribute to it ever again and assume a conservative 5% return.

I’m impressed you haven’t retired already by now! You’re killing it!

I could get by for 9 months to a year on my emergency fund; I could get by for another one or two years by pulling some other assets that wouldn’t be hit with early withdrawal penalties. I’d have to be looking at living in my car before I touched my retirement accounts, but they could get me by for another decade or so.

If I factor in other things like getting a roommate, or renting out my house and using the rental income to pay both the mortgage and rent on a smaller living arrangement, I could get by almost indefinitely.

(Hi — I’m returning to actually reading blogs again!)

I love this question because it makes me feel kinda rich despite the fact that I am…not rich. I just have super super low expenses. Cash savings, ignoring retirement accounts, I could go 26 months without any significant lifestyle degradation. If I only paid rent in cash and put everything else on my credit card, it would be 62 months, or a bit over 5 years. I also have a backup plan that involves living in an intentional community, which is a situation where I could live for nearly free (rent and food included) in a group house in exchange for labor, so in that case, allowing $200/month for incidentals, it would be 10 years on my current savings.

There you are!!! Hello! :)

…28 years… at our current burn rate.

Of course, that ignores that a lot of that saved money will be paying for College. And we could be wiped out by a single big medical expense.

Sadly we don’t have enough to buy a house in the place we want to live. We could live indefinitely in DH’s hometown. But we don’t want to.

Rockin’ it over there!

6 months if we were only to include our emergency fund.

You said it well: “The two main variables here are expenses and assets. The wider the gap between these two the longer your money will last. Simple math.”

I love the idea of calculating this but I’m a bit tougher on myself with the formula. I like to do the ‘Liquid Survival Calc’ (sounds like a night out at the pub right??!) I only like to do liquid assets (cash, stocks, precious metals) in the calculation for if I lost my job today, I would hope to keep my real estate intack and not run up credit cards as they will require repayments every month adding to my expenses.

I would only survive for 7 months (42K liquid / 6K expenses) this way which is not acceptable to me (need to hit at least 12 months), but I celebrate every time I save 6K more to my liquid money!

(I would survive 27 years including assets)

Love your blog!

Aussie

I love the way you think!

Well, if we:

1)sold the rental properties

2) cashed out any retirement funds (and factored in the penalties)

AND

1) we kept the house we live in

2) kept the paid off cars/jewelry/”stuff”

3) kept the kids

4) assumed we had to still pay for medical/car/homeowners insurances and not go on any state assistance, collect any unemployment, or find a part-time job

5) Not have a major illness/hospitalization/surgery

THEN

we could last 5 years. Give or take a few months.

what would happen if you *don’t* keep the kids? ;)

As per my calculation, about 166 years or forever.

If the worst comes to the worst, I can just use geographic arbitrage by moving back to the Philippines where I can buy 1,000 bottles of beer for $500.

I hope you’re retired right now :)

I’d probably last forever at this point, but I do have to include my pension as I’m already receiving it. Also in 5 years I’ll be taking my Social Security.

Like others here, I would like to be a clerk and deal with the public again. I’m pretty tired of staring at a computer all day.

This calculator provides the probability of how long you can make it when you keep the money invested. https://www.firecalc.com/

Yes, GREAT calculator!

Here are some other ones too for anyone looking:

http://www.cfiresim.com/

https://www.ontrajectory.com/

I don’t think of myself as ultra-wealthy by any means, but Firecalc tells me I have more than a 90% chance of my money lasting 30 years if I stopped working today. :-)

I was planning on working another year or two, but a lot will depend on the next month. I was supposed to end my engagement with my current client at the end of Dec. and start something new. Yesterday, my firm asked me on behalf of the client to stay “for just a few more weeks”.

I said “OK. End of January, but no longer.” If they come back in Jan and try to cajole me into “just a few more weeks”, I may just say “Sorry. I just retired.”

GOOD FOR YOU!!!

I’d def. stick around to for a few more weeks or even months if asked, it’s when it starts turning into “one more year” syndrome that it’s really too much.

If we earned no money, no interest, stock growth or dividends we could last ~8 years and potentially indefinitely if we got dividends and interest and stayed on a beans and rice budget forever. Great question to pose. We look at it all the time, but that might be because FI is our ultimate goal.

Sounds like you’re well on your way to it too – congrats :)

Total assets $1.54 mil, which includes

Home equity $325k

529s for he kiddos $90k for college

That leaves assets at $1.125 mil

We owe $45k on the mortgage, leaves us at $1.12 mil no mortgage

Spending is $30k per year on leveryday life

We spend $24k per year on ridiculous vacations

We’d make it 20.7 years, or 37 years sans vacation

Adding expenses like health/dental insurance supplemented be my employer, I’m looking at 16.97 years

So my best guess is 203 months without any lifestyle adjustments

So you can pretty much retire at anytime then? :)

If me and my wife quit today, we could make it for 30 years. But we are currently renting and searching for a home so once we have a mortgage I’m guessing that we could make it for another 10-15 years.

Nice! I bet it’s going to feel soooo good finally finding a home to settle down in!

Interesting analysis. If I assume I can kick all my kids out of the house by 18, that would definitely add a few years to my calc.

If just I or my spouse lost a job, we could go indefinitely, if we both did just over 5 months. We only just got to these income levels so recently started saving at a higher level.

Just finished studying. Got around 3k cash, and 1k in stocks. Luckily almost no student debt left. I just started working 4 months ago. My fixed expenses are only 1k a month, so i would be able to live for approximately 4 months. Striving to make it wayyyy more :)

Oh $hit- and if you can keep your spending at $1,000 for awhile, you’ll be banking that money in no time!!! It’s when your lifestyle keeps creeping up that gets us in trouble!

We could live on what we have for 7-8 years, but that would leave us sooooo broke. Funny…I don’t feel ultra wealthy, lol.

If I lost my job tomorrow, I would only survive by the favors of the Most High. I am at the tip top, the reddest part of that pyramid. Well, I am now learning the value of saving. Hope it’s not too late.

Never too late!!! Keep going!!

$410,000 in 401k. $150,000 in house equity. $40,000 cash. $38,500 in pension from my 1st career. $9600.00 from rentals after all expenses. Living on about $2500.00 a month. If it wasn’t for health care I could easily retire now. Just can’t stand the thought of spending 2000 + a month for health care. Plus I still like my job and we’re putting away about 6,000 a month deferred. I think I’d last a few years.

Hot damn – not a bad position to be in at all!

Tim, I feel your pain with health insurance costs.

My wife and I are both 29 (gonna be 30 on Tuesday). She’s a teacher, I’m in the private sector. Household income about $90k, though we’ve been around $70k most of our late 20s.

We finally have all student loans paid. 2% interest loan on her car that we could pay off in 3 months. NW of ~$45k if you consider home equity of $12k on a house worth $85k (we owe $71K), ~$3k in cash.

Retirement accounts: Her pension is worth roughly about $25k, my retirement accounts about $10k (I slacked so we could pay off debt).

Anyway, what I’m getting at is that our living expenses for a family of 3 are right around $2,500/month.

We will be able to start socking away about $4k+ a month starting Jan ’18. My goal is to be done at 40 if not more soon, barring any unforeseen life catastrophes.

My fear is that health insurance is going to start eating away at our savings, and will certainly hinder us from retiring early if there is no end in sight to the health insurance increases we’ve seen the last few years.

I’m also dealing with the dilemma of whether to leave my $38k a year salary job for a straight commission job selling solar systems, which could be anywhere from $0 – $100K+ annually.

If you don’t mind me asking what was your 1st and 2nd career path?

I just want to do work that is more meaningful, and lucrative ain’t a bad byproduct.

I’ll let Tim respond to your other stuff, but just wanted to chime in real quick and say that having $4k/extra a month is pretty damn incredible!! Well done!!

The only important thing to me is paying the roof over my head. So with my savings, we could pay the mortgage for 13 months. After that side hustles/side jobs would take care of the rest. We pretty much live on 1700.00 a month now and that’s with chronic illnesses between us both. We would make it work without touching the retirement accounts.

Huh, I could last for about 5 years on current budget and about 8.3 years on a more reduced budget. This exercise is making me feel better about my net worth.

Good :)

Monthly living expenses are at $4000 per month, really $3758.58, but I rounded up for miscellaneous. With $214,895 in cash and investments I can survive 53 months, but in reality less because of taxes and penalties on liquidating those assets. Looks like I’m sitting squarely in the wealthy bracket. I thought being rich would feel different.

I got 10 years on the nose. It’s not because I have a ton saved up though, it’s because my living expenses are <$1500 a month (closer to 1200-1300 actually). Pretty cool exercise. I also like the post about dividing your expenses by your net worth to get an approximate sustainable withdrawal percentage (ignoring returns, inflation, and so on) never seen it put that way before.

Daaaaanggg!!!! Crazy low expenses, you are The Man!

What a question to ponder about!