Got a great email last week from a reader, and think a lot of you may feel the same way about this budgeting stuff. My response to her isn’t necessarily a “right” answer for everyone, but it is the one I strongly believe in ;) What do you think?

Miss Almost-Perfect’s email:

Question for ya….I’m the sole breadwinner (by choice) for my hubby and two kids, expecting a third in April. We are on a TIGHT budget but making ends meet with NO debt but our mortgage and a $2,000 balance on a student loan. We are currently not saving any money each month because we’re having trouble sticking to our budget in just two categories: entertainment and household expenses. I honestly think household expenses is set too low for our family, but entertainment needs a lot of help. We just spend a lot out of convenience. I have a meticulous spending system with 10 categories, and we do wonderfully on 8 of the 10. We also do very well with our regular monthly bills.

Do you have any advice on sticking to our budget in our “problem areas”? How about a cash/envelope system? I did that when I was in high school…worked GREAT back then; however, I don’t know how practical it is at 30! :) I know that it’s probably a lot of will power that I just don’t seem to have after being so tight everywhere else…I guess I feel like a lot of times we deserve it because we work so hard at everything else (especially me who is the only one going to work everyday!), but I certainly need some motivation/ideas…something…to get us to save some money every month!

My response, copied and pasted “as-is”:

(which is why you see lots of errors… I email like a 3rd grader!):

i’m probably going to tell you the opposite of what you want to hear – haha… and that is, if you are rockin’ 8 out of 10 categories and your debt is on the low, it is OKAY to go over budget here and there! i know it’s not financially smart, but i do believe you have the “right” to splurge a little on entertainment and stuff like that when you are working your a$$ off and getting everything else down pat. you can’t be perfect, and i don’t think you want to be honestly. if you’re nailing everything 100% well it means you’re either stagnant or not challenging yourself/working toward the next big thing – ya know?

and plus, you can’t be ON all the time and always come within budget because you’ll drive yourself crazy and always think you’re not doing well enough :( which you guys are!

now, would it be better if you were saving extra every month instead of breaking even? of course. but i think for that to happen it’s more about finding ways to bring in a little more money instead of cutting out the rest of your happiness in your current budget ;) at least in my opinion. for example, i love eating out and not worrying about buying lunch/dinner anytime i want. 4 years ago it kept making me go out of budget and i hated it thinking i sucked when in reality i didn’t but that one category kept eating at me (no pun intended). then i decided to take up side gigs to bring in more $ so i can do all the things i want to do and not have to worry about it. so i switched my time for the peace of mind of being able to splurge on food whenever i wanted – does that make sense?

it seems like you’re pretty slammed already w/ working, but maybe someone else in the fam can bring in an extra $100-$200 to cover the difference? maybe make a family contest or something to see who can raise it? i dunno…. hard to say w/out knowing y’all ;)

but the point is – i def. think you’re on the right track and that it’s okay to treat yourself to stay sane. i’ve known a lot of people who keep trying to be perfect and then burn out and end up blowing their entire budget and just giving up. you def. don’t want that. but then again if you’re not happy w/ your current situation, we def. want you to find a plan to be more comfortable ;) maybe you do try the envelope method and see what happens? people do say that by spending cash instead of plastic that you end up saving more in the end? i think there’s something to be said for that.

anyways, i hope this helps. sorry if i’m rambling – if i don’t write this way it’ll never come out and will never be sent to you ;) just know that you are doing an EXCELLENT job and that there’s always a way to fix your problems if you keep trying new avenues.

What do YOU think? Should she be stressin’? Did you like my lack of grammar & punctuation? ;)

—————-

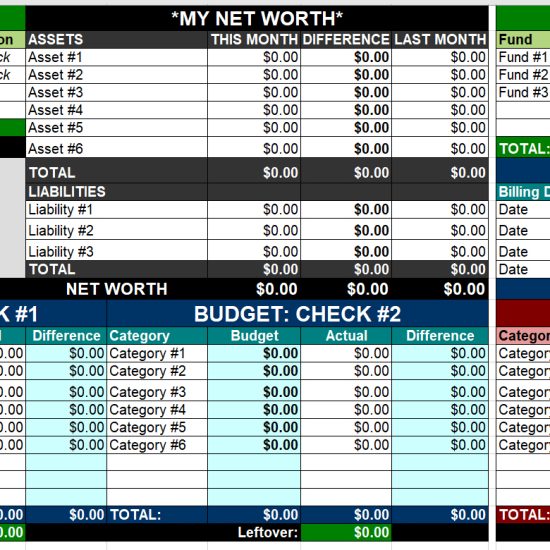

PS: For anyone who hasn’t seen them yet, here’s my list of favorite budget templates.

(Awesome photo by Conor Lawless)

Get blog posts automatically emailed to you!

Stressing won’t solve her problems so yes, stop stressing!

Can she cut back in a different category and make up the difference?

I’m all for trying to make extra income but be careful that it won’t create more costs like childcare, travel costs, clothing, etc.

My boss would like me to come on full time right now but it makes no sense because I would have to pay for childcare. I’d end up making only a few more dollars!

Your advice is lame to terrible. Did you not read the line that starts “We are currently not saving any money each month?” The most self-indulgent and discretionary spending category – entertainment – is the one they are not managing. That sets a very poor pattern for future behavior. The argument “you are working hard so treat yourself” is what got millions of dumb-ass Americans in trouble. Hard work does not justify poor financial decisions.

I’m with Mr. ToughMoneyLove. What’s the point of a budget if you aren’t working hard to follow it completely? It could be a different story if she said, “I’m maxing out my Roth IRA and contributing 5% to my 401k.” She’s already 30 and looks like they have zero retirement savings. It’s time to buckle down and start getting it right.

Oh, and tell hubby to get a part time job or something. It’ll help their money situation and probably make him happier.

Yeah I kind of agree with ToughMoney. Don’t get me wrong, I LOVE your answer, I just don’t think its the right one. It’s basically the same answers my hubby and I give ourselves every time we justify going over in the same 2 categories. We’ve cut back in other areas, and work responsibly in others – but I completely understand. We’re BIG justifiers over at our house. We’re thinking about starting the envelope system at the beginning of the year and making a goal to stick to it for 3 months or 6. We’ve gotten the advice that things don’t work for us b/c we don’t have an emergency fund for stuff that creeps up that we didn’t budget for (1,000).

Love you blog but this morning = thanks but no thanks :)

Hey, that’s why they call it “personal” finance ;) I just know it’s not possible to be perfect all the time, and if you get too stressed and give up (or give in) altogether, you’re f’d. I don’t think spending an extra $100 or whatever each month – or breaking even for that matter – got “millions of dumb-ass Americans in trouble” – there’s nothing wrong with treating yourself responsibly. Splurging on more real estate than you can afford is different than going over an entertainment budget. But again, just my thoughts…

Keep all the opinions coming! I’m sure it’ll all help our reader out :)

Sometimes things are worth it. I think sometimes we think too much about money and too little about the fact that other things matter in life besides money. If you want something in your life and you don’t do it because of money will you regret it?

Shakespeare in King Lear said, “Even the basest of beggars are in their things superfluous.” (I’m not sure if I got that thing right). Saving money is great, but sometimes it’s just not worth it when you realize you’re missing out on something that really mattered to you. And I know, maybe it’s just entertainment here, but I don’t know what she all includes in her entertainment category. Maybe it’s going to see that special show with her kids and husband – a great memory and experience that you’re not going to have with that money sitting around. Memories and experiences, as long as they are happening in moderation, should come before money. Especially sometimes I think when you have kids because they are only young once. You only have the time to make those special memories once.

In some situations I might think it’s ok to splurge a bit, but in this one I’ll have to disagree. I think far too many people fall into a cycle of “I deserve it” buying decisions, where they justify making poor spending decisions on the fact that they work hard – and that they deserve it.

In reality if they’re not saving any money each month and not saving for retirement, they need something to change. Whether that’s finding an increase in income, or working a better plan via a cash envelope (highly recommended by the way, especially when you’re trying to tame wild categories), they need something to change.. And I just can’t see how splurging in this situation is going to help anything. Plus, there are a lot of free ways to “entertain” yourselves – and I’d much prefer people did those while trying to get their financial system on track.

My suggestion is for these individuals to think about how much they want to SAVE each month and immediately start a CD ladder, so they can’t just pull the money back out at the end of the month to pay for splurges. Then re-address the budget to see how to make do on a little less.

Maybe they can try suspending a data package on a cell phone for a month or knocking the cable package down a tier. Have they tried knocking their internet service back? It’s amazing how you may not notice that extra bit of speed is gone. With the holidays and new year its a good opportunity to sit back and re-evaluate things. If entertainment is important to their family, they should cut back on something they don’t care so much about.

My general rule is that if I overshoot in one month on an expense, I have to make it up the following month somewhere. If I pick up a new suit that isn’t budgeted for, I cut my entertainment numbers the next month. Month to month budgets are good, but also look at your composite (YTD, 3/6/12-month snapshots), as those are Just as important. If you find out that over time you’re still on budget numbers, then you’re already compensating and it works out.

The rule in grantmaking (another budget heavy field) is that if you’re variance is within 10%, just note it and keep going (just don’t go over the project budget). Generally speaking that seems to work pretty well in my personal finance world too.

Hey J Money – I think you were halfway there…..happiness is important too!

How about a compromise….they can increase their entertainment budget a little bit (and then they can enjoy spending it without guilt) but they could also start a savings fund that gets a regular deposit….they can feel good about saving while also addressing their happiness.

I have to say that I find Mr. ToughMoneyLove’s comment extremely disturbing and just all-around horrible. “The argument “you are working hard so treat yourself” is what got millions of dumb-ass Americans in trouble.” — Probably one of the most self-righteous things I’ve heard someone say in a while. So you NEVER treat yourself? Ever? Oh, wait, you can if you are PERFECT with money. Right. So again, nobody can treat themselves ever. (Nobody is perfect, right? Even saving for retirement you CAN always save more, can’t you?)

I hate blanket statements like that. Generalizations are only ever partially true. Not everyone has the self-control to give up ALL fun things for a period of time. Yes, I can exercise enough self-control to not splurge on anything for a month or so at a time. My husband cannot. He DOES work hard and DOES deserve to have nice things and to go out to eat and all that. (He’s given up his life to serve the country, after all.) So while I hate having a small credit card balance (small = $1k) it’s easier to take care of it in a few months than have a moping guy who can’t spend the money he worked hard to earn on a video game. And anyone who trades a huge amount of their time for money should be able to get treated for that sacrifice every now and then.

Besides, there are NO numbers here, how can you judge so harshly not knowing ANY of the hard numbers? I think she’s far from that “stupid American” because she not only realized there’s a potential issue and wants to fix it, but reached out for help. Lets not bust her chops considering what she’s done already.

1. 8/10 is really great.

I mean, that’s awesome that it’s only just entertainment and going out (hello easily-cut variable spending!) that the family is going over.

2. The (lack of) savings gives me concern only for these reasons:

a) What if you lose your job, get sick, or whatever else? Bad stuff happens to great people.

b) Savings can give you peace of mind, you are clearly concerned about NOT saving and you should re-examine why you feel insecure about not saving.

c) I don’t know your money situation but if you have a retirement plan in place (already saving money into it), and an emergency fund fully funded at 6 months or more, .. .and you’re just stressing about not saving MORE or for the short-term, then I say relax. :) Enjoy life.

I only say this because there are so many stories circulating out there (I’ve written about some on my blog) of people who don’t think about the saving aspect and really, REALLY regret it when the main breadwinner is out of commission.

They go into debt, they rack up on cards they never thought they’d use and they’re stressing over feeding their kids for even the next WEEK let alone month.

I wouldn’t want anyone to ever get into that situation, so perhaps what you need is just to re-evaluate, shift spending over from the 8 awesome categories into entertainment and/or find the motivation to spend less on entertainment and start saving. Even just a little.

Good luck! Enjoy your money :)

Sorry, not going out. What was I thinking? “Household expenses”.

Sorry!

There’s no cookie cutters for finance that work for everyone. What works for me ma not work for you.

I have agree with FB @ FabulouslyBroke.com – there should be a saving for emergency. How you accomplish that is up to you, cutting back on expenses is one way, bringing in more income is another.

@Meg After reading your comment I can understand why you find mine disturbing. Like you, I treat myself occasionally. Unlike you and the subject of the post, I use money that I’ve saved for that purpose. If favoring saving then spending over instant gratification is self-righteous, I plead guilty as charged.

The grammar and punctuation was overlooked due to the disclaimer hehe. I think you’re right; if you’re doing well in all your other categories, heck, sometimes you deserve to go over. Also, it depends on what she’s going over. To me, entertainment is something you CAN cut back on. Everyone (myself included) raves about Netflix. There’s always coupons available for movie theaters. Heck, there’s coupons for all forms of entertainment. You don’t have to cut it out, just have to spend it differently :) It also depends if by over budget, if she means in the red or strictly breaking even to the point where they can’t afford to save

What is it that is messing up your entertainment budget? You can try to find alternate/cheaper entertainment. Personally, we use cash allowance to control problem area.

Maybe you should try the cash in envelope and see how it works out.

Hi, All! I really appreciate everyone’s comments since it’s ME who has the problem. :) I LOVE to hear everyone’s opinions and ideas….I’ll take all the advice I can get! And maybe I can make a few clarifying points here, and it may change some advice…may not…but worth stating…

1. My husband has a decent retirement from when he was a union electrician for quite a few years, and we add to that as a monthly “expense” b/c we know he’s not working now and don’t want to be up the creek later on. In addition, I have a nice government pension that I put into every month with my job, so no worries on the retirement front. It’s certainly not ideal, but we feel it’s enough for our current situation. When the kids go to school and husband goes back to work, we plan to up those contributions accordingly.

2. We considered a part-time job for the hubby, and my work schedule is the big problem with that. My regular hours are 8:30 – 4:30; however, I work in the court system, so there are MANY times (that are extremely inconvenient and unpredictable) where I will be in court late….5:30…7:30…9:00…I’ve even been here til midnight before! He also can’t work 3rd shift b/c there’s no way he could run around after the kiddos all day. We considered weekends; however, we’re having a hard time finding something where he can ONLY work weekends. We also have no family in the area to watch our kids, and paying a sitter is very counter-productive. So that’s our dilemma there. :)

3. Our “household” category in our budget is $200 a month…that’s for tyical family stuff…diapers, soaps, detergents, tissues, OTC meds, toothpaste, shampoos, etc. We are only going over that by ~$20/mo…I think I may need to up that budget amount b/c, in looking over our receipts, it’s not like we’re frivllously spending in that area. I even clip coupons. Our true, true problem is “entertainment” which includes going out to eat and family activities with the youngins. Our budgeted amount is $70/month, which for a family of 4, literally means one meal out a month and a little extra for activities. We have been going over budget in this area by ~$80/mo….we’ve been spending closer to $150/mo rather than the $70 allotted.

There is no current monthly budget for savings. I make extra money based on work product, but it’s unpredictable and VERY sporadic. I average between $7,000 and $10,000 a year with that money…but you never know when it’s coming. Therefore, our budget is such that we safely budget within my salary, and then when I get the extra money, that goes straight into savings…it’s actually a separate income that goes straight into our ING savings account…so it’s not spent on anything. Then we dip into savings for emergencies.

So I guess the ultimate questions is: Should we seriously be concerned about the difference of $80 a month? I’m totally OCD with this budget in every other category, so I am stressing about it. I guess I feel like I’m not doing the best I can when we’re going over budget in entertainment; however, it is true that that’s ONE area of our budget that’s over and that’s it! And I do not make a ton of money. We are living off a very modest salary. That’s why when J$ gave the advice he gave, I saw it as really hitting home. I didn’t feel like I had much left mentally, emotionally, or even physically to stress over $80/month. But who knows, maybe J$ will change his opinion after he sees this further elaboration of my initial e-mail! :)

@ Molly on Money…I have picked the budget apart looking for areas to cut back. I appreciate that idea. The only category left to cut back on is satellite TV, of which we currently pay $60/month for. We considered an antenna and digital converter box (b/c neither of us really want to give up our sports); however, we recently found out that since we live between two lovely mountains, there’s no chance in hell we’re gonna pick up any stations from Philly. :( So we are still considering just giving up DTV and putting that $60/mo towards savings…again, not sure if it’s worth it. Any opinions on that?? :)

I look forward to anyone’s ideas/advice/comments! I know this is long (sorry)…I can babble on just like J$ sometimes…however, I am skilled in the use of capital letters and punctuation. LOL!! j/k J$!! I know you have a good sense of humor……

Thank you all for your thoughts! :)

Okay, I’m really struggling with one thing Mr. Toughmoney whatever his name is…he immediately makes the assumption that they have no retirement…um, where exactly was that mentioned in her email? she states that they are spot-on for 8 out of their 10 categories, as far we we know, 1 of those categories could be retirement.

I have to agree w/J. Splurging every now and then is NOT going to put this family on the streets…I guess if they can’t stick on budget on their entertainment, then they might want to consider what they are spending their entertainment money on…if they are going to the movies, let’s say, and going to night showings, how ’bout waiting for the weekends and going to a matinee…OR! renting movies and having a movie night at home! There’s so many ways that this family can make changes…

One thing, though..(and I’m not talking about you, J…).don’t make assumptions about a person and their “personal” finances based a few sentences, Mr. Toughmoney whatever!

Dropping the guilt is a good first step. Because feeling guilt can lead to feeling the need to go out and “break the rules” even more.

I’ve also found that if you don’t have the desire to change, then you won’t. So the key is finding ways to make yourself motivated, which will be different for everyone. Motivation won’t happen over night either, but it comes eventually if you work on it.

Splurging is definitely good for the soul…as long as we don’t do it every day, then it’s not a splurge anymore.

And making more money on the side is always a good idea. Even if you think it can’t be done, if you’re creative, it can. Good luck!

OK Jen, we were commenting at the same time, but now that I’ve read your explanation, I say, don’t stress so much about that $80. That is a tight budget for family entertainment. You’re doing a good job!

But maybe there is a way for your family to make extra money that doesn’t involve your husband clocking in at a traditional job. The internet has endless possibilities if you start opening your mind to it – it’s worth a thought.

@Trinnie I made no assumptions about anything. I just read that Jen was not saving any money and was overspending her budget. Then in response to your little rant, I read the additional sentences from Jen. Doesn’t change a thing about my assessment of the situation. Folks who are living paycheck to paycheck with one of them unemployed should not be “splurging.” Dining out is not an emergency. Is that hard truth really so hard to accept?

J – I think you have a lot of “splurgers” who read your blog.

As far as going over budget with household expenses and thinking it’ mainly due to the budget set too low, you will save yourself a lot of stress if you increase the numbers to the realistic level. My wife originally set the grocery budget for $100/month and, if I did the shopping by myself, we could do it, but there would never be any snacks, soda, or dessert in the house. So we were constantly going over budget by about $40/month. By increasing the budget amount, we saved ourselves a lot of fighting.

By the same token, maybe you should do the same thing with your entertainment budget, increase it to include one more meal, and then stick to that.

@Mr. ToughMoneyLove-

Again, making assumptions…I’m not a splurger…I live well within my means, have no debt, other than my mortgage…pay off my credit cards to $0.00 each month, contribute to my savings, my son’s college savings, my 401k, my addt’l Roth IRAs, and life insurance…and still have money left over…

Call that splurging?

“I guess I feel like a lot of times we deserve it because we work so hard at everything else (especially me who is the only one going to work everyday!)”

This is such a common justification – I’ve used it myself, in deciding to pay for basic cable TV (way overpriced) because my husband is a hard-working man and deserves to watch football ;)

We each have our own values, as far as what is important to spend money on, but if you work hard, you should not be doing it to throw money away. You should think about what is worth giving up that money for. Personally, I see entertainment spending as wasteful. However, that could be because, 1) The internet is entertainment enough for me, 2) I don’t like movies, and 3) Spending money does not in itself make me feel good. I have to get value for the money.

I would suggest logging every penny spent, preferably for 3 months initially. And then you should do it forever. Ask yourself if it was worth it to spend it, or would you be more pleased seeing that money build up in savings month after month. As far as household expenses, if they are actually necessary expenses you won’t easily be able to cut them out. However, “necessity” is subjective, and you may be able to either cut out or delay certain expenses or find a better value in fulfilling the need. Delay is a great tool in saving money.

As far as envelopes, I use banks instead. I may change my ways on that, considering the positions of banks, but I’ve liked doing it that way. Certain accounts serve specific purposes, and one is not spent out of at all. If money has to be transferred from it to another, double the money must be put into it first, increasing its bottom line.

Personal finance is a money game. It’s your game, and you have to make your own rules to serve you.

I definitely don’t think she should be stressin’ over this. I just wrote about this recently and maybe it’s something relevant to this situation, maybe it’s not, check it out: 10 ways to realistically cut spending without budgeting,

http://www.pennywise2pennyworth.com/2010/11/ten-ways-to-realistically-cut-spending.html

Basically I agree with J, if you’re meeting all your other goals, like savings and investing it shouldn’t matter what you spend in your budget categories (or if you’re budgeting at all!), as long as you aren’t going into debt every month.

Good luck Almost Perfect

Did everyone else miss the part where they’re expecting another child in April? That budget is about to get a lot tighter…

To Jen: I think you’re doing an excellent job, living on one salary supporting 4 people! Not many people can say that these days. That said, I think there is room for improvement to help you feel more financially secure:

You are sooooo close to living within your salary!! If you are spending $100 more a month than you predictably take in, you are living in debt because you don’t know if you can afford to pay that extra $100, right? A total of $100/mo really isn’t a big deal, unless it is $100 more than you take in a month. If that means cutting cable, do it! It’s a zero-sum game.

It’s obvious that you are trying to very hard to get this under control, but that your spending is nonetheless pretty stable in each category. You’re a good calculat-er of your regular spending, since you know pretty much exactly how much you’re going over in each category. So, bump up your budget in the two categories to reflect that reality–and figure out a creative way to take in as much as you’re spending with the new total. Can hubby take in another child during the day once in a while to make more money? A little bit more predictable income would really solve a lot of the problem.

Good job on the retirement, but I didn’t see where you mentioned an emergency fund, which is very important, given that you have 3 dependents and another lil one on the way–what if (God forbid) something happens and you need to stay home for a while? You do mention socking $7K-$10K a year in unpredictable income away–AWESOME! But does that money stay in the savings account for any length of time, or does it get dipped into regularly to pay for your $80/mo budget overage, car registration, etc.? The fact that that $$ is unpredictable worries me–& you need a definite plan for every penny! It sounds like it gets spent in the long run rather than ‘saved.’

That extra money each year is the key–it could be what saves you or what breaks you. What does it normally get spent on? If it gets spent on predictable items like car maintenance or similar expenses, you’re actually spending way more than $100/mo overbudget and that needs to be reflected in your budget.

Your first priority for that $7-$10K, save up your EF–6 months worth of salary–is that possible? Do you have that already? The rule is to not dip unless it is for unpredictable emergency medical care or you need to feed your family with it.

Second, when that extra money comes in, can you put a little away (say…$100/mo worth?) in an ‘entertainment fund’ in ING and use that to cover your monthly overages? When it runs out, you aren’t allowed to go out, it’s that simple. Pay for your extras upfront…

Next, when will that student loan be paid up? Would it make you feel better to pay it off totally with some of that unpredictable income, and then save that money each month instead? Is that an option right now (ie do you have an extra $2K laying around on top of your EF?)?

Good luck! and congrats on the upcoming bundle of joy!!

She’s doing GREAT! She needs to cut herself a break. Striving for perfection is overrated. (this one’s good-going in my round up)

First Jen, please let me congratulate you on supporting a family of four. The numbers don’t look that bad.

Now I don’t know what the 8 out of 10 are but with what you stated you have 2000 on a school loan and a mortgage. The others I’m assuming are Food, heat,electric, household items entertainment monthly expense. I need help with the rest.

What it sounds like to me is you need goals.

Hear me out, Your retirement budget is covered for now. But you may want to look at how much your putting into retirement and if what you are putting in will meet your future goals or will it overdue what you are expecting. Seek advice from a retirement specialist. Not a Salesmen. Someone you trust. Take a look at what you are saving now verse what you expect to put in when the kids get older.

Your Philly fanatics so if it fits keep it.

Personally, Working weekends puts stress on a marriage and cuts down on quality time. Plus the games are on during the weekends. Not a solution.

Especially with your unpredictable work schedule.

So with the new child coming (again congrats) Can you see six years out, when all the kids are in school, being the time I would figure that your husband would then get another job, can you make it on the budget you have now guessing that food and gas prices will continue to rise probably faster than your salary. Just a thought.

Now all that being considered here are some options that I see, (not professional by any means)

I would look at the 2000 dollars first. Is there a way that you can put more money on that bill to pay that off faster and get it down to nothing. Thus freeing up I’m guessing 75 a month that you could split between entertainment and savings.

don’t know, again just a thought.

Best Wishes to you and yours,

I’m coming at this from a slightly different angle, since we’re on a really tight budget and can’t let two line items slip by $100 a month without incurring debt.

Check out Groupon and restaurants.com for entertainment and dining out. Groupon and similar sites like Living Social are great for saving on entertainment. I recently bought a gift certificate for 4 rounds miniature golf, water slides, arcade tokens, and buy one get one rounds of mini golf and arcade games, for $21. That will give my family at least three days of entertainment. Another great deal was a family zoo membership, including parking, for $40 for the year. Watching for deals like this, we’ve been able to make a lot of family outings for very little money.

Similarly, my family of four generally is able to go out to eat for about $20, including tax and tip, by buying gift certificates on restaurant.com at the end of the month when 80% off coupon codes roll around.

I also do mystery shopping to extend my budget, get free stuff, and make extra money. We routinely go bowling, get the oil on our car changed, eat out, and get household and personal care items for free this way.

Household expenses like diapers and shampoo can be sourced cheap and even free if you follow the sales and use coupons. It’s not too hard once you get a system down, and there are plenty of websites that do all of the work for you; just show up with your list and coupons. I particularly like iheartriteaid.com, iheartcvs.com, and iheartwags.com, where they post the weekly ads in advance and tell you which coupons to match for the best deals, and weusecoupons.com for previews of the upcoming coupons. My family of four has a $50 budget for household items, which is almost always sufficient, and we have a child in diapers.

It takes creativity and a little time to sleuth out the deals, but they’re out there and can save a good deal of money if you’re careful. You may feel like you deserve a treat, but you don’t deserve to have the stress of going over budget, so make sure you can afford your treat! Cash may make you feel like a teenager, but the method works! Give it a try and see if it helps you to stay within your goal.

I agree that it is great that she can live on only student loan and mortgage debt with her, a husband, and soon to be three kids. Now to the question at hand, I actually agree with J. Money on this one. I actually feel fine about going a little bit over budget once in a while, as long as I know that I am enjoying my life. I would find it difficult to stick to a strict budget that did not allow room in dining and entertainment. I also liked the idea of trying to make a little more money on the side (by any family member). This is what I am trying to do to increase my family’s ability to save. In the end, it’s all about personal preference and it is great that many of you want to nail the budget 100% all of the time.

Exactly. You have to be able to ENJOY life and have some fun or what’s the point??? I’d much rather go over budget here and there than have a perfect balance sheet and be miserable. And with a family of 5? Shooooot, she’s totally doing a great job in my opinion.

Good call, J. Money! Budgets are like diets … you have to have some wiggle room.

By the way, as a copywriter, I’m typically annoyed with improper grammar and punctuation. But you can definitely get away with it. :)

Did warning you up front help? Or are you talking about my daily posts? haha… either way, much obliged.

Lol, I guess it was the combination of the warning beginning followed by the disclaimer in the end. Nice touch.

If she’s tried and can’t make the budget then one of two things is happening 1) The budget for that category isn’t realistic, 2) they’re not paying close attention to everything that they’re spending 3) the budget for the other categories is too high.

With kid #3 on the way, she def. does not need to stress but it would be one less thing to think about if they could get a handle on it.