Now, I’m not saying “Hey everyone! Go out and use your credit cards for everything!” cuz I’m not. For most people they cause more trouble than they’re worth. But if you have a budget for them and learn how to pay off your balances in full every month, they are an exceptional convenience tool! All your expenses show up on one bill, you never bounce checks or withdraw too much money, and you only need to pay once a month :) Basically, the opposite of using cash or a debit card. And actually, if you’re not tracking your cash who knows where it all really goes right?

So yeah, I love credit cards :) But only when used responsibly – kinda like alcohol. Having 2 beers a night instead of cramming 10 all on a Saturday is completely different. Both are admittedly fun, but one makes you feel a bit more $hittier than the other afterward. Ya gotta budget those PBRs.

That being said though, I wouldn’t be adverse to TRYING out a “cash-only week” or something. Maybe I’d learn something about myself? Or maybe I’d just get annoyed like crazy, haha…it would make for a fun experiment at the very least. I’ll just have to make sure I’m always around an ATM and logging into my checking account every day ;)

For those who use Cash or Debit only, how much of a cushion do you all keep in your accounts? Or do you use some sort of zero-sum method? I keep mine down to $100 so I know when all the bills are paid out and what not, but I’d imagine you’d have to have more in there if it was your go-to source. Man…is it weird that I’m getting anxious just thinking about it?

——

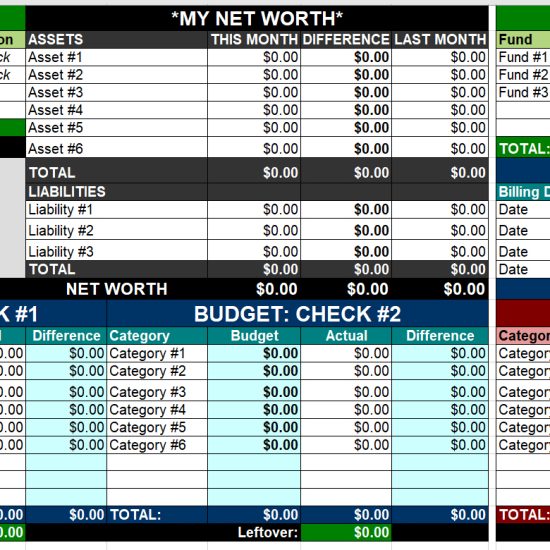

PS: Here is my old “Credit Card Budget” – A bit outdated, but you can see how it’s used.

Get blog posts automatically emailed to you!

Hmm, I’d love to get rid of my credit cards but it’s more of a ‘stick it to the man’ feeling than a rational sentiment. I use mine for online purchases–particularly when I want to pay for something in dollars and I’m not in the States. I don’t run a balance, so technically, the cards are working for me. . .still, once I was burned by credit cards and now I loathe them, yet still use them because of their convenience ;)

But I do have a very large ‘float’ when it comes to the checking account. Which may not be such a great thing actually. I basically have a sum in my two checking accounts (US and France) that is equal to my line of credit on the credit card . . .I should really invest that. It’s too much to just leave sitting in the bank earning 0 interest. I kind of leave it there as a security blanket, but I think I’m a bit too conservative.

I don’t actually keep much cushion in my checking account. But I do keep $5,000 is savings account that is attached to the checking account. These days with online banking it is easy enough to transfer funds between accounts, online, at an ATM, or even with a cell phone call to my bank. As long as you have liquid assets that can be moved into the account quickly, I wouldn’t worry about not having a credit card to cover those unexpected expenses.

Woohoo…. another real life experiment by J. Money himself! I think you should give the cash only thing a run for a month to let us know how it really works (not sure one week is enough to see any impact on funds, you could just spend different because of the annoyance for that long).

I am an all credit card kinda person, and keep my checking account sitting at $100 or so, my budget is not quite as air tight as yours is. (wow my grammar goes down hill when I am on blogs, good thing my sister does not see this, ending a sentance in “is” is horrible /rant) But really I use my credit card on everything that I can, like rebates and the extreme convenience of it all, and I hate having change in my pockets, jangling around annoys me, takes away my ability to sneak up on people like a ninja!

I heart the convenience of credit cards. I keep about $100 in the checking and $400 in the attached savings – but the bulk of savings is in an account at ING, and that takes several days for the transfer to complete.

I think if I were to try “cash only” for a week I’d be fine – realistically I don’t spend that much in a given week, and I probably would just take out the cash at the beginning of the week and work with that. And I suppose as long as I had a credit card as backup it probably wouldn’t matter at all. But it makes me uneasy, the thought of constantly monitoring my balances to make sure I don’t end up with fees and charges.

I also tend to leak cash – even when I really try to account for every penny, I end up stashing some in the console of my car or something and then spend two days periodically wracking my brain to figure out where that $20 went. I’d so much rather get the AmEx bill at the end of the month, review it for accuracy (and for where I could have done better, spending wise – I don’t think with cash I’d get the same review benefit, just knowing myself and how I work), and then pay one bill.

I am a faithful Dave Ramsey follower, so I have been trained to believe that credit cards are the devil reincarnate. That being said, if I could use them responsibly I can see the “benefits”. I just do not have that control over purchase just yet. For example, when I go to the grocery store with my budgeted $80 cash in my envelope, I know that I can’t spend more then that $80. Plain and simple, otherwise I risk looking like a dork asking the cashier to take items off my order. Now, if I were to take my credit card (which I do not even carry with me — ever) I am way more likely to go over said budgeted amount. Maybe I would only go over $5 or $10, no biggie, I can handle that. But it’s all those “overs” that do a person in. For me it’s a self control issue. Spending cash is way harder then handing over the plastic. I urge you to use cash only for one week, and see how it feels. See if it makes a difference in your budget.

I prefer to pay by credit card most of the time. It’s easier to have a record of what I spend (always get a receipt and the number comes on the credit card statement) and I get rewards. Sounds better than cash to me!

I’ve been using cash/debit card for the past 2 years and I have never yet encounter any bounced check/unavailable cash at all. I just keep $30 cushion, but I’m really into checking my account every week. I do that very diligently. I have an iPhone app which really helps me track the balance in my checking account -http://www.apptism.com/apps/homebudget – and a mobile access app as well.

Good luck on your experiment. You should try it.

I mostly use debit cards and cash, but I will whip out the Discover card when making a large (like $500) purchase. Especially when there’s a special 5% cashback promo going. I am on the debt reduction plan so I am only keeping $1000 in emergency funds right now which means that large purchase is almost always going to be emergency related.

I have always had a goal of totally ditching my credit cards… 4 years later and only god knows how much interest paid later, I still scratch that itch. They are so damn convenient! I got the CC debt to around $500 right now and I need to get it to $0 and keep it there moving forward b/c come July, my newly minted Wife will not be having anything to do w/ me carrying a revolving credit line every month (but thats a totally different story!).

I have removed my cards from my wallet, moving forward I am limiting myself on what I use it for. We see how this goes.

@Brian – I am with you on the large purchases too, for example. We needed to get a new refrigerator, and Home Depot was going to give me an extra 10% off if I used their credit card. Um, to save $130.00… ok. Then I immediately came home and paid off the card, just as if I was using cash. Made sense to me, but I refuse to carry a balance.

I’m a mix. I love the Cash/Debit and the Credit Card. I prefer the credit card for the larger purchases because I can rack up those reward points really quickly.

For my debit card? I have a specific cash allowance value for that. Usually around $600 biweekly. But I don’t seem to ever spend it to zero. So there is a cushion of sorts should I ever need it.

I can’t imaging using cash only. Especially at the gas stations. Too much effort to walk to the counter. LOL.

And CCs are not my friends. I don’t seem to pay them off everymonth. Cha-Ching for the banks. (I don’t want that).

I use my debit card with a credit card as a backup attached to that account. They are both Chase accounts.

Cash can be hard for me to keep track of and I love being able to use my debit card almost everywhere. I go on the Chase website daily and I can see where I am at with my money and what I am spending it on. If I am going to Starbucks too much, I can see it right there in front of me. I always know about what I have in the account.

After buying “$36 dollar hamburgers” (the cost of the overdraft fee and the cost of the fast food meal that did me in because I did not have enough in my checking account to cover it) I went to the bank to see what I could do. They suggested I get the credit card and if I ever go over my balance in my account, the remainder will go on my card. I believe there is a small fee when this happens, but much better than the penalty fee that I have had to pay in the past. Also, once you pay the small fee, it covers all the spending for that day. So rather than have $90 in charges because I went to 3 different places and bought things, I only have 1 small charge (I believe it is around $10).

Interesting topic! I love reading what others have done.

I don’t use credit at all. As far as a cushion in accounts that I regularly use, there’s enough for a month or more of its use at any given time. And money is always being added to those accounts. I don’t pay any bank for being its customer via fees, but I don’t bounce checks either.

I’ve been using my USAA rewards credit card for everything for the last month. I’ve been paying off the balance WEEKLY instead of monthly so I don’t go over budget. But, this past week I’ve gone waaaay over budget and I’m going to have to use funds from next week’s paycheck to pay it off. :-/ So I think next week I’ll take a break from the credit card to let things simmer down and just use cash for awhile.

I like using my USAA credit card for the rewards because I’m working on getting a plane ticket discount, so I hate it when I have to use cash because then I think about the rewards points I’m missing out on. But, that’s why I’ve started paying it off every week so that I don’t let things get out of control.

the only piece of plastic that i have is a visa debit card that i use only when i have to like paying bills over the internet or something that important. i think that this is working for me because my finances are not in the pits of hell because of trying to buy out the entire world as so many are prone to do with those wretched cards

I just did a whole post on banking cushion. We keep a couple hundred because the auto-payments from it are all very large (mortgage, student loan).

We’re pretty much an entirely plastic family. Everything goes on the cards, we pay them off in full every month and we reap the benefits (like $1,000 to put into our baby’s 529 plan). We’re very disciplined spenders though and hubby has no problem saying ‘no, we can’t afford that’ (he handled the bills) if I suggest we buy something that’s not going to work with the budget.

I use CCs for for absolutely everything that I possibly can so that I can maximize my cash back rewards. I track my spending constantly & enter all of my purchases in a spreadsheet daily. So for me when I actually pull cash out of my account (and deduct it from my account balance on my spreadsheet), it’s essentially already spent. So I have a hard time keeping cash around. I’m more frivolous with cash in my pocket.

I do not trust myself with credit cards. I frequently wish I at least had a gasoline card but then I think …er…. maybe not. I use my debit card for everything and I try to never carry cash around. If I have cash I spend it very quickly whereas, with the debit card, I consciously think about my spending. I always have at least a couple thousand dollars in my checking account so that I can cover pretty much any emergency immediately without having to wait for money to transfer out of savings. I really wish I had been more savvy with my management of credit cards but I found them to be a terrible temptation.

The more you talk about how much you love credit cards; the more I’d like to switch over to just using credit cards and paying 1 time at the end of the month. Right now, it’s probaby not smart for me. But soon it will be!

Right now, I basically have a “zero sum” method where my paycheck gets split up into different accounts (different savings accounts, 1 checking account for ‘house’ bills, and 1 checking account for my own personal expenses and living expenses.) And those 2 checking accounts are basically at zero right before my next paycheck. I should really check into getting a buffer in there. Where do I get one of those for free?? ;-)

I have a 0 balance budget, but I keep $20 as overflow in the checking account. I don’t use the main checking account as the main debit card though (I could get into trouble there).

I can’t WAIT for the day that I can get rid of my credit card. I am going to open a separate checking account that pays interest and have a lump sum in there ($3500) and open a “crebit” card at the Bank of Shelley. I will charge to it like a credit card and pay it back monthly, but I will never charge myself an outrageous fee for not paying back on-time or if I float something. I have to wait until I have my E-Fund in place and have the extra cash to stash there though. Until then I will hold onto my loan credit card (which charges an annual fee that has always been waived until last year).

Oh wanted to add that I do pay off my credit card monthly and I do not carry it around with me. I have been consumer card debt free for a little over a year. If I carried it with me, I could possibly damage my budget because I would get into some habit of floating a couple of purchases and then cry when the bill finally came in.

I use my card each month but for pretty much things in my budget that are autocharged.

i always use debit/credit….i put my cash directly into my bank account before i even get the chance to splurge. I don’t trust myself with cash…its a fear of mine.

Nice thing about ING is there’s no need for a buffer because the line of credit attached to the checking account will kick in if you overdraw. I was irresponsible with credit and am now paying down my mistakes. Perhaps I’ll consider using credit responsibly once I’m debt free and can stay that way for a while.

Woah. Credit cards bring out the discussion, eh? Love it. Here are some responses:

@Simple in France – Well, it’s certainly a good problem to have :) I almost always have too much in savings – it def. feels secure you’re right.

@Tea – $5,000 is what I used to carry in my savings too! Something about that number that I really like.

@philip – You’re always thinking Mr. Ninja :) Yes you are. (is that a bad way to end a sentence? w/ “are” cuz it’s like “is?” haha…)

@Karmella – “But it makes me uneasy, the thought of constantly monitoring my balances to make sure I don’t end up with fees and charges.” That pretty much sums up my feelings on all this. That, along w/ convenience and theft-protection….which I actually didn’t get into, did I?

@sarah – It’s great you’re not using credit card then! Good job knowing yourself :) I think I will give the cash-only idea a shot in the near future, just something that’s hard to get excited about – haha…

@me in millions – Exactly :)

@Ciawy – Well done my friend, that’s actually pretty impressive.

@Brian – Sounds like a smart plan.

@Doctor S – You can do it brother!!! When it comes to pleasing the ladies, you better believe we get better with things ;)

@sarah – Isn’t that awesome? I will do that if it saves me $20 or more. Anything less is too much work for me.

@Investing Newbie – No shame in workin’ both, if that’s what works.

@MoneyFunk – You don’t like supporting your banks? Weird ;)

@jenzep – Yes, I am a huge proponent in linking your c/c to your checking account – as long as it’s at the same institution. Some people say it gets you in even more trouble, but I have yet to see that happen personally. I’ve gone over 3 times in the past 3 years, and that c/c saved my a$$ each time.

@Yana – A month or more? Awesome!

@Heather – Yeah USAA! I use their cash back card instead of the rewards one, but both have it’s perks. I’m just glad USAA offers all of these

@kt – Keep doing your thing friend!

@Mama Geek – Pretty much the same as our family – minus the young one right now :)

@ashley – I like it!

@RMom – Hey, if it’s working keep on doing it!! :) Seriously, that’s so great that you know yourself like that.

@Meghan Fife – Haha….well, if you send me $100 I’ll get you one for free? :)

@Shelley – Ooooh I want to become a member of the Bank of Shelley! That sounds like an awesome institution.

@esperanza – I actually LOVE cash in my pocket (and always try to keep around $20-$80 in there), I just don’t like using it for anything other than random daily expenses.

@Keith @ LifeTuner – I think your next gig should be at ING, you sure like to pimp it ;) Not that I have room to talk, I get asked all the time if I secretly work for USAA…to which I respond every time, I WISH!

@J – Really? I didn’t realize I was pimping it that much! I DO like it, though. :)

Hey, even better! That means you truly recommend and love ’em! And it’s pretty hard not to really, I mean I go on and on about ING too. Only their my mistress to USAA ;)

You should do a comparison post between ING and USAA. I like USAA’s remote deposit feature. I’m a member of USAA for their insurance, but I don’t have any banking accounts there.

My boyfriend and I use the envelope system for our groceries and “fun money” each month. Using cash is easy when it’s pre-sorted into those envelopes…it’s a forced budget. All of my other expenses flow electronically through checking or a credit card, but because of the way I budget, I could easily transfer over to the envelope system and use cash only. So, I’m operating on a hybrid system…I like earning rewards too much to stop my credit card usage completely! (Although, I will be canceling one of them because they plan to start charging me an annual fee. I’ll have none of that!)

Wouldn’t you love to see credit card companies be forced to put disclaimers in all of their ads along the lines of “please enjoy responsibly”? It would look just like an alcohol advertisement, except the warning would come when the dude hands his card to the bartender, rather than when the bartender hands over the beer…

@Keith @ LifeTuner – I’ll add it to the list :) BIG fan of deposit@home too – esp on the iPhone!

@Jenna – You know, I like the sound of envelope budgeting but man I’d mess that up real fast! I am not that organized ;) but one day.

@Tim – Why yes, I would! Freakin’ awesome.

I keep no more than $200 in my checking after bills are paid. That usually last until next pay period

Man I have the opposite problem most people have. I can’t keep track of where I’m spending cash, every week I’m always “hey I thought I had another $20 in here, guess I spent it on something”. Then again I don’t have any credit card balances since I always pay it in full. It feels more ‘real’ for me to spend small amounts with my credit card, than with cash. If I’m paying with cash, my attitude is much more cavalier, but with my cards, every penny counts. Of course for my favorite local stores I like paying cash, since it saves them in merchant fees, so supporting them in that way is more worth it to me than getting those card points.

The way we handle groceries is we plan out meals so we have a shopping list. Usually I’ll scan through the weekly flyer (and browse through the fridge) for inspiration on what to cook. We pretty much stick to the list, and have a small budget for snack items. So even though what we spend varies weekly, it’s always what we need and meant to get.

Yeah, I will say that spending cash in mom & pop stores are def. hookin’ them up more, so I always commend people on that :) I try my best to do the same (and usually it works as I’m only picking up snacks or something less than $10 anyways) but every now and then I forget.

Thanks for the reminder!

We haven’t touched a credit card in…going on three years.We use our debit card for gas in the car.And try to use only cash on our other purchases.We write checks for our bills.It was difficult in the beginning.But it is the thing that works for us.Balancing the checkbook is easy.It makes you accountable for your purchases.We keep a $300 buffer in our account each month.On the first of the next month we transfer that amount to our savings account.It’s a small amount to most but it adds up quickly.We’ve only been tracking since January but we will be $900 richer the first of April.We haven’t set up a budget yet.Just tracking.We haven’t made any changes as far as phone or cable.We may in the future.We are taking small steps but steps none the less.I can’t remember anything else ever working like this system does for us.This is a great blog.I love reading here…Dena

Cool! Pretty interesting that it’s workin’ so well w/out a budget too – well done :) LOVE how you xfer out the extra every month, pretty smart. Thx for sharing!