So I just came to a pretty shocking realization this morning: This is the first time in my life where I’ve been 100% completely debt-free since I was a kid (!!!).

No credit card debt, no car loans, personal loans, Bank of Mom and Dad loans, no mortgages*, nada. Pretty wild to think about, and even more so considering it took 20 years to get back to that point!

But before we get into all that, just have to take a quick moment to thank you guys again for all your support and encouragement from the Big News we dropped on Monday! You never really know how any of it will play out in the real world (even after weeks of thinking and obsessing and planning!!), but to say I was overwhelmed by all the responses would be a huge understatement…

YOU GUYS WERE SO POSITIVE AND UPLIFTING!!!

THANK YOU FOR MAKING ME FEEL SO GOOD!

I’m not sure if anyone was holding back the hate, but we literally didn’t get a single piece of negativity across the entire board (Budgets Are Sexy, Rockstar Finance, ESI Money) which just blew me away..

So thank you! And if you’ve been waiting to tell me how you really think, now’s your chance while I’m feeling strong and confident! Haha.. Only a 1% chance of me going off in the corner and crying about it ;)

But speaking of going in the corner and crying about it, << enter smooth transition here >> how about that DEBT y’all? How much does that suck having? ;)

Have I ever told you I’ve been carrying some around for the past 20 years?!

It’s true.

Check out this official breakdown of my life:

- Ages 0-18 (kid): no debt

- Ages 18-21 (college student): little credit card debt (damn free t-shirts!!)

- Ages 21-27 (young adult): little credit card debt, little car loan debt

- Ages 27-37 (“adult”): no credit card debt, little-to-big-to-medium-to-none-to-medium-car loan debt, tons of mortgage debt!

- Ages 37+ (adult): no credit card debt, no mortgage debt, and now no car loan debt, officially making me debt-free for the first time since being a kid :)

What a ride…

When you’re done reading this you totally need to copy these bullet points and do the exercise yourself :) But might wanna make sure you have a pail around in case the desire to throw up arises!

Gotta give a love/hate shout out to USAA too real quick as their loan repayment center had me screaming at the computer screen there for a hot second!

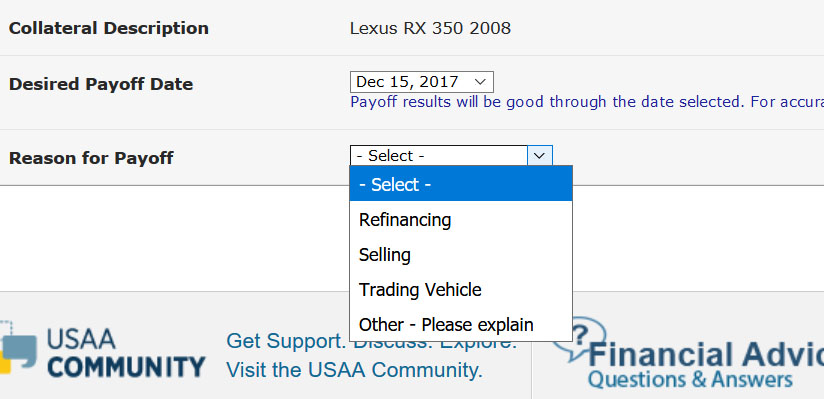

I went to pay off the remaining $11,000 of my Lexus loan with my new found money, and came across this gem of a screen after selecting “pay off the complete balance” or whatever it was…

See if you can spot my concern:

Notice anything?? Let me help you out…

THERE IS NO OPTION FOR JUST WANTING TO BE DEBT-FREE!!

As if it’s totally normal to carry around loads of debt, and the only way to get rid of it is by paying it off in order to secure even more of it!

What a joke!! An accurate one, but still – lame.

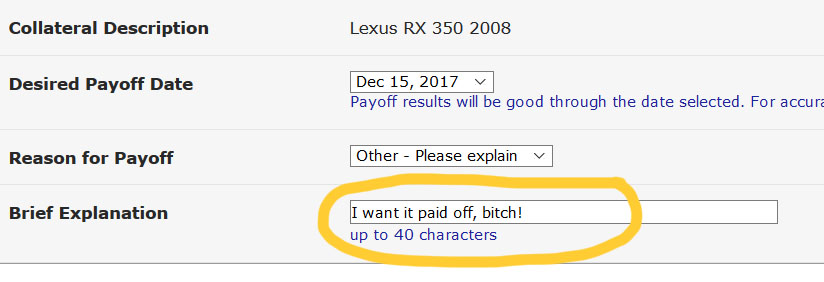

It took me everything not to submit this over :)

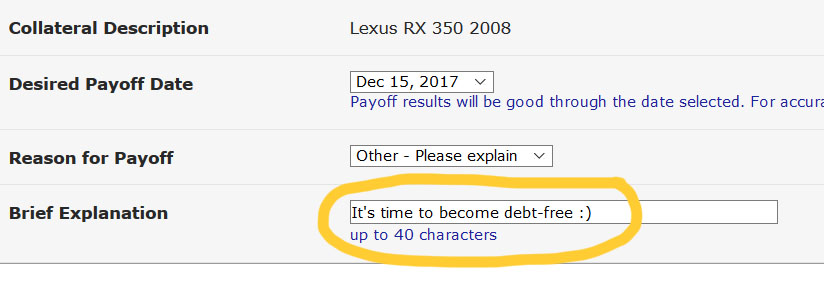

Haha… But I settled on this. Because you know, manners:

Maybe if enough of us puts “DEBT-FREE” into notes like this though, they’ll actually start listing it out, thereby encouraging (and motivating!) others to do the same!!

And I’m not just poking at USAA here – I love them and trust them with over 10 of my financial accounts – but this is more so a jab against the entire industry that’s notoriously bad at this stuff…

I’d like for just once banks to put some thought and human touch into such big occasions like this for their customers, as you know for DAMN sure any of them would be celebrating their asses off if it were them on the other side of the screen killing their debt! And we’re really not that picky!! We’ll take a stupid little gif and be THRILLED about it!

Here – just take this one and run with it:

I would DIE LAUGHING if I saw this after hitting submit! Haha… And then I’d share the $hit out of it to every last person I know until they all switched banks ;)

Wouldn’t you???

It really doesn’t take much…

Though I applaud the effort, guys ;)

(It’s something!)

Anyways, all this to say that getting out of debt is huge, and if you’ve been fortunate enough to reach that point again in your life since being a kid, I give you all the props in the world and hope you realize what a fantastic accomplishment that is.

I know I can be blasé about it from time to time on the blog, at least when it comes to consciously choosing to hold onto debt for one reason or another, but deep down I really do think most of the world would be better off not even messing with it, and I wish nothing but a debt-free life for all y’all :)

Think about copying my stages of life up there and comparing it to your own debt journey, and if you’re feeling good about it all you’re on the right track, and if you’re not, it’s a good time to make some tough choices and re-position yourself in the new year…

In the meantime, I’ll be out launching my Congratulatory Gif Campaign so it’s all set up and ready to go for you! Pass this note far and wide so all your bank CEO friends see it! :)

——–

*Something to note: we don’t have mortgages because we paid them off, it’s because we sold our house and went back to renting ;) So if you’re in your 30s and still have mortgage debt, that’s perfectly okay!

[We’re not broke / We’re pre-rich from @SmartsNCents]

Get blog posts automatically emailed to you!

Huge congrats J! I love their menu “please explain”, as if the concept of “finished” is foreign to them.

I was last debt free when I was 30, then I bought my house which is my only debt. I don’t mind carrying my small mortgage, I could easily write a check and pay it off any time but at 3.25% interest it’s not the optimal thing to do. That money is much better put to use replicating like rabbits in the market, up 21% this year!

I hear ya man, can’t argue with someone who can pay off their mortgage at any time like that! Pretty solid position to be in :)

Congrats, BITCH! (said like Jesse from Breaking Bad.) Yeah that little comment you made in the “Brief Explanation” is why your writing hits notes that others don’t.

Pretty impressive. Not even mortgage debt? You have that much more cred now with your platform.

Haha… thanks man. Although don’t give me too much credit – the only reason I don’t have a mortgage is because I sold my house and went back to renting ;) Though I’d like to think I’m baller enough to have the cash to buy one straight up one day!

Congratulations J. Your post made me teary a little bit :-) Glad to hear the transition went smooth with 0 negativity:-)

The last time I was debt free was when I paid off my $40K student debt a couple months before graduating. But it didn’t last long bcz I bought a condo a year later :-)

And 5 years later, we upgraded to a detached house and doubled the mortgage to $550K. Hope to pay it off by 2020, will pop some champagne then :-)

HAH! Pretty impressive to be able to pay off half a million in debt within a handful of years! It would take me close to the full 30! Haha…

We are so close too ever since the fire. Took the insurance money and paid off my school loan. Sitting on mortgage debt but may pay it off with money needed to rebuild as we figure out building costs, timeline, what we want to do, etc. I did take out a car loan to replace the one that was melted in the flames but it is 0 percent so not itching to get rid of it.

Anyway congrats! Super congrats! We are joining you in the world of adults who choose to rent. Something about the flexibility speaks to us and pretty soon mortgage deduction won’t be so great anyway.

“Melted in flames’ – haha.. you guys are in the thick of EVERYTHING over there! But what a chance to start over and do things however you want! $hitty way to go about it, but what a perk at least eh?

Congrats!! That is an awesome accomplishment.

We still have a mortgage and will for some time, but the rate is just so low and you know, we need a place to live. haha. We have a car loan for the first time in our 15 year marriage. Yep. I decided I needed something reliable for a change, since I am the primary driver and we have two kids. The loan is driving my husband crazy, but I won’t let him pay it off since the rate is so low. We can pay off the car loan, but not the mortgage. Our money is mostly tied up in retirement, though I think that might change in 2018.

Unfortunately, our country thinks its okay to take out a loan for a nice car. The mind set is terrible.

Hey – no shame on that, I had a car loan too even though I had the $$$ to pay it off! I think that’s the key vs being up to your eyeballs in debt with no padding in the bank :( And the only reason i picked up a new-to-us car was for exactly your reasons too – kids and reliability.

Congratulations on being debt free!

Thanks Megan! Hope your journey is going well too!!

Super nice! I’m kind of surprised that they didn’t make it even more difficult for you since lending money is their business, something in the order of “are you sure you want to pay this off?” or perhaps “do you really want to drain your savings account just to pay off this measly amount”.

It does feel good though. I remember the high I got when I finally paid off all my debts about 10 years ago so enjoy that warm feeling!

Hah! I actually forgot to mention the part where they DID upsell me! Had a couple of messages show up throughout the process telling me I’ve been approved for a new low rate if i want to take out another auto loan ;) So they’re on it, don’t worry!

Congrats Jay, that has to be an amazing relief. I still have debt (mortgage) in order to invest the money elsewhere, but i think I agree with you – the juice may not be worth the squeeze. This is something I’ve been spending a good time considering – remove the debt shackles completely or continue to chase further returns. Any way that you can quantify how much better the “debt free” world is for you?

Hard to quantify it, other than just to say that you gotta do whatever MOST EXCITES YOU in life. And especially in money :)

Yeah one way is always better than the other in terms of the numbers or “right way” to do stuff, but at the end of the day it’s our lives and we gotta make sure to make the calls that better helps us sleep and relax at night. If that means no debt but less investing, so be it, and if it means maxed investing and maxed leverage – then that works well too for people!

The only thing I’ve come to realize over the years is that our minds and lives are constantly changing, so you just gotta go with what make the most sense *right now* and then know you did a good job even if Future You gets pissed about it later ;) We’re human! We don’t have all the answers!

Debts, assets and net worth, they are all just numbers to me. Of course, when you debts are zero, it’s pretty special.

I would consider being debt free, but I will be paying a bit more income tax than I would like to. It’s kinda odd to say, but debt is actually benefiting me financially, I don’t think that I will feel as freed as you if I become debt free one day.

Debt can be a great wealth building tool if you use it responsibly.

Yup yup, totally… gotta do what makes the most sense for you for sure.

1. Congrats!

2. Agreed with Accidental FIRE above; it might be tempting for one to want to pay-off the mortgage early but the capital might be “doing more” allocated elsewhere.

3. On your question, we currently do not have any debt (and have never had any). We’ve lived in New York and Chicago the last 10 years, so we’re still renting; I haven’t owned a car since May 2007; I think I shared previously we considered taking out a loan for Mrs. BD’s grad school @ NYU, but we opted to go for another school in the city which we were able to cover without loans.

Congrats again!

Pretty impressive! Especially in such high-cost areas too!

When I paid off my car (in 86 days) last month, I had to go to a physical branch location and give them a paper check, as they wouldn’t allow online payment for the final payment.

The branch teller had to go ask someone how to process this payment, because so many people just roll loans into their next loan or do one of those 0% credit card refinance things to buy them some extra time and wiggle room.

Happy to be down to a reasonable mortgage payment now (way less than rent for a comparable unit) now, just before bday #35.

INSANE…

Good job with it not deterring you in your mission! I’m sure it’s all by design!

We’ve been debt-free (except for mortgage) since 2009, and I actually ran out of stuff to blog about then! And for our mortgage, we’ve paid off 61% (considering we financed 100% 13 years ago). We’re on track to pay it off in under 20 years, which would make us complete debt free!

BOOM! Nice! I guess that’s why you ended up selling it to me all those years ago, haha… Are you still blogging over there btw? Haven’t been to it in a couple of years…

Congrats on getting out of debt! It must feel pretty good after 20 years!

We’re in a different camp — instead of paying off our mortgage we are choosing to invest those dollars instead. It’s been a hell of a ride the last 8 years and we’ve definitely more than doubled those funds.

Oh I bet… and I give all y’all mad credit for leveraging the crap out of it too – not sure I’d have the cajones to do it myself!

Congrats! A solid choice for the influx of money. Can’t wait to see the next net worth update with those line items gone :D.

Ages 0-18 (kid): No debt!!!

Ages 18-21 (college student): No debt!!!

Ages 21-27 (young adult): GET ALL THE LOANS!!!!

Ages 27-37 (“adult”): DUMP ALL THE DEBT!!! (paid off everything except we still have a mortgage)

Ages 37+ (adult): We shall see :O

GET ALL THE LOANS!!!

Haha… almost spit out my coffee on that one ;)

I always bring this up when we put popups into our apps, but I always get voted down :( The only company is Sumo which I have seen using these.

Congrats man!

Not sure I know what you mean? Were you putting ads in the popups or something? (Or you mean gifs? Like at your 9-5?)

Congrats J$. I feel like I’ve been saying that a lot lately. New Baby, selling Rockstar, Being debt free. It looks like it’s all working out for you! Well deserved. Just don’t go selling this site on us. I need a little mohawk in my life.

Haha… just one of those phases right now where I’m changing $hit up :) This blog is here to stay – you don’t have to worry about that… It’s literally the only thing I’ve got left!

Congrats on being 100% debt free! I am sure it feels real good. We were 100% debt free for a bit after paying off tons of debt but then got a mortgage. It is funny how paying off your mortgage early is now considered the irresponsible thing to do if you can invest that money instead since mortgage rates are so low. I don’t know though, I want our mortgage paid off in 10 years so we’ll start at some point even if it is the irresponsible thing to do ;)

Yup yup – an age ol’ debate here in the $$$ world :) But really that’s *ONLY* the time you’ll ever hear that haha… no one in the real world gets as nerdy as we do about it all.

I fell for the zero percent credit card trap this year… at 36… like a damn fool… Was so tempting to buy materials to finish basement, then charge and worry about over 15 months. But then a nice $16k HVAC replacement charge came into play and kind of F’ed things up. I guess we all need a reminder sometimes, I doubt I’ll be able to pay it off and may need to keep rolling to 0% cards to avoid a massive interest bill. We will see how the year plays out. I haven’t paid CC interest since I was 27 it was a glorious decade but my streak might be coming to an end… Its mainly because I was dumping money into my house. I finally got to the point I can get my FHA MIP taken off, which for me was an ambitious task given I put the minimum down on the house and have had to pay 130K in principle on this loan in the last 4.5 years. 6 months to go and I can get it removed. that will free up 570 in cash flow each month!!! Its been a rough road but I’m glad its almost over…

Oh man, haha, well the only good thing about *time* these days going by fast is that you’ll get to that free $500/mo in no time! and if you happen to pay a little interest debt in the meantime, so be it… It’s boring being perfect all the time anyways, who’s got time for that? ;)

Congrats on being debt free! We have 14 years left on our mortgage, and that’s our only remaining debt! I still claim the debt free status, but I think it will feel more real once the mortgage gets paid off! (Or I convince my hubby renting would be better for us!)

And crazy, I signed up for almost $10k in student loan debts at 18, so I’ve been in debt since then!

Woop woop! “Debt free” in the real world really means no credit card debt anyways.. It’s only in our nerdy obsessive *online* world where we include EVERY LAST THING in there for it to “count” haha…

Congrats on being debt-free, J! I can’t imagine anyone being negative about the change of ownership of Rockstar Finance. It’s still a great site and a great community!

I became debt-free (paying off my student loans) after getting married when I was 26 and got into another debt (mortgage at 29). 3 years of being debt-free! :D

Thanks friend :) yeah – unlike personal finance blogs the leader of Rockstar doesn’t matter *as much* provided the core of curation and what not gets done well… Which was all built by design in case I ever were to leave one day – who know it would come now out of all the years?

Congrats, Debt free should be permanent at this stage. Now you can take your car loan payment amount and send a check to yourself to bolster the college fund and/or new future income stream and watch that grow.

I’m gonna use it to finally automate my ROTH every year instead of always waiting until the last minute ;)

Is being debt free something you REALLY want to celebrate? Gotta borrow money to make money! I think we owe $4 or $5 million. All of it out there working hard for us. We’re over half way to an eight digit net worth.

Congrats on being debt free (I know you meant consumer debt – I was just yanking your chain).

Haha yup – you know what I’m talking about! Though i still don’t have the balls to pull off that much leverage out there. Too much for my minimalist mind as well! I give you mad respect.

Whoop whoop, congrats J$.

Thanks, A$!

(That’s A-Money… not “Ass”, haha…)

I carried a three-digit credit card balance in my early 20s because clueless, finally wiped that out around 24 or so (right when I got into a 5-year car loan), and then at 30 my wife and I bought a house that we could afford to keep if one of us lost our job. Couple years ago we refi’d to 15y/2.6%; I realize some folks have different priorities than I do, but paying that off seems a bit silly when it’s equal to a conservative bond yield. I’d rather plow money into VTSAX until I find myself 50 years old with a paid-off house and fat wad of equities. :D

Awww yeah! I can get down with some VTSAX! That’s where all my ROTH money is going when we max that out next :) And smart to only pick up a house that you can afford with just one income! If only everyone did that!!

Congrats!!! Although I considered you debt free before since you could have kicked off that car balance easily ;)

Oh those screenshots are hilarious – refinance, selling, and just pay off isn’t even an option in the drop down??? That’s hilarious. That’s some clear motive they’ve got, eeesh!

Haha yeah – I thought of myself as debt-free too even with the loan, but at least it’s more official now ;) I’ll miss all the comments from other bloggers telling me I’m a dufus for having it! #NOT

Congrats! It’s the perfect Christmas present to yourself!

Haha indeed :) Hope things are well with you too, Alaya!

Love your name every time I see it.

Things are going well, thanks! Not sure if you mean my name, name or my blog name. I’ll go with both; don’t correct me. ;)

Both it is then ;)

Congratulations

This is an awesome accomplishments! Aaaand yeah I was once debt free but now I’m stuck, still finding a way out!

I enjoyed reading this!

I enjoy your blog name! That’s clever!

It’s a beautiful feeling not owing anybody anything. Congrats on the payoff. I’ve had varying levels of debt since I was 18. I tried spelling it all out but your filters kept thinking it was spam. Anyhoo, I was debt free for 2.5 years between Jan 2010 and Sept 2012. Now I just have the mortgage and student loan. I think I finally, once and for all figured out the credit card game and it all starts with a budget.

I have about $333,000 of debt between my mortgage and student loan. Interest rates are under 4 percent and the monthly payments are pretty low. Although freeing up $1750 a month in cash flow actually sounds pretty nice when I think about it. Alas, funemployment requires my cash to stay with me for the time being. However, this post definitely has my wheels turning toward debt freedom again.

That’s good!! And don’t forget we’re all in different phases with this stuff too – so good to focus on your own journey even though it’s hard sometimes when it seems everyone’s doing big things around here :)

Omgosh… “I want it paid off, bitch!” just cracked me up LOL! You should’ve totally sent that one and imagine the look on their faces (probably be laughing too)… haha just kiddin’… and yes, polite manners.

Anyway, congrats on becoming debt free!! My fiancé and I just paid off our $20k student debt on Sunday. It’s pretty lame how we kept dragging it though because we viewed it as a way to borrow money to invest.

Again, congrats! Btw, the RX is one of my favourite models! I love that SUV!

Woot woot! We’re both making moves!

And I’m glad you appreciated that *bitch* part – i was crackin’ myself up over here thinking about it and was like ‘MAKE SURE TO TAKE A SCREEN SHOT FOR A BLOG POST LATER!!!’ haha… Got some hate from people who were a bit offended by it already, but hey – just trying to keep it real!

I read that line in Jesse Pinkman’s voice. “Yeah, bitch!”

LOL you should have kept that first reason!

that’s awesome though. I do remember – it was just over two and a half months ago, lol. Now only $385k or something to go. :) I can’t wait to knock this sucker out but it’s a lot of debt to be staring down.

Who knows, maybe we’ll sell some day and move into a small home (my dream) or rent or something else.

Being debt free is an awesome feeling.

Nothing’s ever permanent! The beauty and frustration with life :) But fortunately most things are in our control so if you ever get sick of it you know what you have to do!

Lots of congrats to give you! First off, congrats on selling RSF! I think you brought up an interesting point about the feedback you received. The best part of this community is that we all support each other, share tons of ideas, and it’s infectiously positive.

That said, congrats on making into the debt free club! As a fellow member of the DFC for the past year, its been incredible and has freed up so much of my income for savings/other ventures.

Haha awesome – thanks for the warm welcome! Is there a secret DFC handshake I should be aware of now?!

Was thinking a next level handshake like this one Haha!

hollllly $hit haha…. THAT is a handshake!

Congrats! I was debt-free for about 3 seconds in November until I paid some medical bills on my credit card. I have a little more to go ($880) and depending on Christmas and December House Utility bills, I may (crossing my fingers) be debt-free this weekend.

Ugh, I’m sorry to hear that… and obviously medical debt is totally out of the Debt-hating/shaming stuff! In fact, it goes right into the “THANKS FOR LETTING ME LIVE!!” department! I hope you get better soon and don’t have to deal with it again!

Congrats again. Man, you’re killing it. No debt is awesome.

We still have mortgage debt. It doesn’t make sense to pay it off right now. Someday…

Congrats on baby #3, selling your other baby (RSF!), and being debt-free!! What a great run you’re on!!

We have no consumer debt, but we do have a mortgage (currently owing around $215K). Unfortunately, I only got serious about our finances after we’d ‘upgraded’ our house 5 yrs ago… Otherwise, we would have stayed in our old house and likely would be completely debt-free today (in the meantime, we are considering downsizing, and on the lookout for the right house). Oh well, no sense regretting that decision… Net-worth-wise, we’re ever so close to reaching the double-comma club so all in all, we’re doing very well and I’m grateful for that!

Happy holidays and continued success to you and your family!

Yeah you are!!! And just be glad you had the epiphany 5 years ago and not 5 years from NOW! That’s really all you can ask for… We’re all lucky to have “figured it out” whenever we did or who knows where we’d be i this world! Thanks for all the kind wishes! :)

If you exclude mortgage I’ve oscillated in and out every three years since high school. Mortgage comes off in three more years. Then again I use debt strategically so it can be different.

Ages 0-18 (kid): no debt

Ages 18-21 (college student): little credit card debt but mostly paid off each month, in the meantime racking up the student loans!

Ages 21-25 (young adult): little credit card, BMW car loan (i NEEDED it), student loans, heck why not add a mortgage?

Ages 25-31: Wake up call! Let’s start living right! Pedal to the metal to pay off debt!

Ages 31-forever (“adult”): Debt Free Baby! Now what do we do? WHATEVER WE WANT.

Awww yeahhhh!!!!

Sing it lout and proud, sister!

Congratulations on becoming 100% debt-free!!!! Totally should’ve kept the first response but maybe change bitch to biotch so it didn’t seem so harsh ;) I would’ve laughed my ass off if I was the person receiving that response on the other side of the screen!

My husband and I just became credit card debt-free this month and it feels oh-so-GOOD! Just the car loan left and we’re doneeeee!

Congrats again! Cheers!

Way to go!!!

You’re totally right – should have just tweaked it a little :) I’m sure working in that department gets pretty bland over the years!

Great to hear you get your financial life in order;) with the sale of RockstarFinance!!! It’s still a website I check to see what’s going in the blogging world. Debt free……what a place to be! I think 18 is the last time I was debt free, still carrying the mortgage/heloc combo today but it may all be gone in the near future. Cheers to you sir!

And cheers to your upcoming 2018 too it seems like! Get ‘er done!

Cheers to this mate!!

Congrats my man!!

“If you’re in your 30’s and still have mortgage debt, that’s perfectly ok!” I am in mid 40’and still have mortgage but that’s it! Been that way for about 6 years and hope to keep it that way! Love your blog but sometimes feel like an old timer reading it .

Don’t worry, I get comments all the time from people in their 20’s saying they can’t relate either, only in the opposite direction ;) You mention Roth IRA or “retirement” and they’re like whaaa?? I thought this was a *cool* blog? Haha…

Funny you write this and I read it today. I just paid off our mortgage today 12/20/17. 100% Debt Free @ 41. I am going to tell my wife on xmas. Our best/biggest present ever.

BOOM!!! BEAUTIFUL!!! Best present ever!!

Congrats J$. You have some great things going on in your life. Your family is growing. You sold a business. Now you are debt free. You are living the good life. Thanks for sharing your blessings and success with us.

Thanks man! it’s not always like that of course, and hopefully it comes across in a way that helps people vs bragging! I don’t ever want to become “that guy”, so if you ever catch me down that path please punch me in the face… or just email me, whatever you’re in the mood for :)

Think I about died at the “I want it paid off B**** ” lmao. COngrats on youre new found freedom.

Thanks man – I was pretty proud of myself for that one :) Happy holidays.

Congrats J$$. How exciting for you!

We have a car loan. We have $$ in the bank anytime to pay it off but at 0% interest it’s a no brainer for us. Mortgage 3.75% interest. Around here paying a mortgage is cheaper than paying rent. No credit card debt (pay them in full each month, all give cash back).

Continued success to you in 2018 & thanx for a great blog!

Happy Holidays to you & your family!

You too, Debbie! And like the way you roll with that car loan – I was doing the same thing before this fateful day :) (Only my loan was around 2%’ish I wanna say…)

We have USAA too, and I truly love them. BUT when we paid off our car loan last Spring, they just kept the “My Auto Loan” in our on-line banking screen accounts. It is at $0.00, but the category “My Auto Loan” is still there, bugging the crap out of me, every time I go to check my finances. I’m getting a little OCD about it at this point…I don’t have an Auto Loan USAA! I don’t want to see that anymore USAA! Why you keep remindin me USAA?? Ha ha, hope it doesn’t happen to you!

CashflowKat,

On the “My Accounts Summary” pane of the USAA website, look for a “Reorder and Customize Groups and Accounts” option with a little gear icon. Click it. Find your Auto Loan account. Flip the little horizontal Account light switch icon from “Shown” to “Hidden”. From one OCD USAA member to another.

Yup yup – what Pete said :) Exactly what I’ll be doing once I’m tired of looking at that sweet sweet $0.00, haha…

Hm I was actually debt free from 0-19, then had a car loan from 19-23, then nothing until 32 when I picked up a rental house, then compounded that debt several times with our mortgage that felt like a kick in the teeth. I’ve done my best to cut that thing down this year as we settle into the new place so we save something like $230k in interest alone over the life of the loan but you know I’m gonna do everything I can to kill that loan off ASAP! The rental can stay for now since it pays for itself ;)

I like the way you think – as always :)

Congrats on becoming debt free J. I’m trying to be like you when I grow up. The last time I was debt free was when I was 18. That was way too long ago.

We’re gonna have to get your #hustle shirts out the door faster… let me see if I can come up with something that will make them go viral :) People need to rock those!

As of yesterday we are 100% debt free! We sold our house and are currently (happily) renting something much smaller. We do plan to take on a mortgage soon but it feels so good to be debt free!

Woo!!! Soak it in!!! Renting or not, it’s a nice position to be in!

Congratulations! We are working towards this ourselves and I can’t wait until THE DAY we are debt free!

WHOOT! Wicked awesome being totally debt-free! Be proud of yourself for a while before buckling back down. I have a way’s to go, but my plan is to be free of everything but my mortgage this year, and to pay that off in the next two. Don’t be like Lisa, Don’t keep going to school and have student debt just starting at 50. I WILL pay that off by the end of this year. Again, Congratulations on becoming debt-free, just in time for baby #3!

Hey, nothing wrong with snatching up more education!! There are worse things you can be spending your money on, and word on the street is it helps your income skyrocket too :)

(and you’re right about trying to enjoy milestones while they come – always hard for me to do!)

Congrats J., that must feel awesome to be debt free!

This post really made me think and I came to the shocking conclusion that I haven’t been debt free since getting that first $500 limit credit card in college 20 years ago. I’ve paid it off several times since then, but in between reloads there’s been auto loans, student loans, and mortgages. I just started my financial journey, but I can’t wait to be debt free sometime soon too. Congrats again!

It’s a pretty eye opening thing, isn’t it? I’ve been obsessed with my finances for the past 10 years and it only just occurred to me now as well! Last week it had been 20 years for me too not being debt-free. Crazy.

We are debt free. I absolutely love it! No mortgage either.

Awesome. That’s debt-free on a whole other level :)

My final piece of debt was paid off last May when I paid off our small SUV which was the first time in 20 years I was finally free of car financing!

I do have a mortgage but I do not consider that debt in such that the monthly cost would be there wether it was renting a home or owning a home. Not paying it off as the usual debate goes works best with my FIRE plan.

Way to go buddy, stoked for ya

You too sir! Makin’ moves!

I sold some of my crypto currencies and paid off my wife’s vehicle! It was our biggest monthly payment other than our mortgage. Next will start on the student loans! I did this 3 days and I’m trying to hold off until Christmas Eve to tell her. Such a good feeling!

Love it!! I hope you sold them right before they crashed by 30% haha… I don’t even dare mess with it – too insane!

Yes, it was a few days before! Still took a big hit from that though, have recovered some of it so far! It is very insane, but I really like it since I have a background in poker!

Ahhh, you got the perfect personality for it then!

I have had debt since I began college. After graduate school was the first time I had non-educational debt, and that was a credit card. Most of the credit card debt was a result of opening a business and medical bills, but not all of it. In the next few months I will be able to erase all of the non-educational debt. Not a full win, but it will feel excellent regardless.

Yeah it will!! One step at a time :)

Congratulations! It must be a nice feeling.

We do have a mortgage, but at 2 % I can’t defend paying it off early. That money is doing a much better job in our investment portfolio.

Totally. Especially this last year!

Congratulations on becoming 100% debt free!

Having ZERO mortage payments must be such a relief! My fiancee and myself became debt free about a year ago, and it has drastically improved our financial situation. We are beginning to build wealth at a dramatic pace, and we couldn’t have done it if we were still throwing our money at payments.

Keep up the great work, and I look forward to your future posts!

Yup yup, pretty amazing! Though you’re probably amassing wealth much faster than I since we cheated and just sold our house vs paying off the mortgage :) Though I feel *free* with renting! haha…

Congrats, debt free is a fantastic idea. I’ve been hammering it out for quite some time. We’ve still got about 28k to go on the house. I think I’ll continue to hammer that down until the next market downturn, at some reasonable ratio. When it’s done, the wife will probably be interested in replacing her car though… Ha!

Haha… all good problems to have :)

Been reading some of your older posts. The last time I was 100% debt free I think I was 7. I started my first business at age 8. Bought magazines with celebrities addresses. I wrote to them asking for autographed pictures. Showed these to classmates & started selling them the celebs. addresses for $1 each. While I made $$, I had to invest in various mags. to get the addresses, paper, envelopes & stamps to write to the celebs. No computers back then, LOL

I was always doing stuff like this to make extra $$. Bought my 1st car at age 16. $1200 debt. Always kept finances under control but seems there was always one debt or another to pay. Enjoying reading some of your older posts!

Look at you go! Haha… I’m going to have to save this little clip here for a future article on hustling :) I bet you learned so much doing that early on! Hoping my kids inherit the entrepreneurial spirit as well… It’ll be fun following along and encouraging their wild ideas!

Huge congrats man! Huge weight off your shoulders for sure.

We paid off our mortgage April 2014. Life struck back and I got sick for two years. I am fully recovered now but let me tell you that being debt free during a shitty life event helps immensely. You’re in great shape.

Oh damn man, I bet… Hopefully things are looking good on ALL fronts now and you can fully enjoy your financial feat? :)

Isn’t it awesome?

I can’t remember the last debt I had. I think it was a bridge loan when buying a house or maybe for a surgery center investment, but it has been more than a decade. It still feels awesome.

People who carry debt and debate whether it is better to invest or pay off the debt underestimate the emotional aspect of this. They don’t realize the psychological weight they are carrying around until it is gone and they feel FREE!

Congratulations! That’s amazing! My theory is banks don’t want to encourage debt freedom, which is why it probably won’t be an option anytime soon. After all consumer debt is what they live off of. Haha. I’ll be debt free this month from all consumer debt, with only the mortgage left and then I’ll be attacking that to get it paid off in about 5 years.

Woop woop!

Being debt free is awesome. Congratulations. We have been for some years now. My favorite moment was when we built our custom home and the construction was finished, I went in to pay the final construction loan installment and our account manager said “we’ll have to get started setting you up with your permanent mortgage financing….” I replied, no thank, we won’t be needing a mortgage. We’re paying cash.” His jaw early dropped to the floor. But my bank was very nice and supportive, I imagine since we have lots of money in it.

BAD ASS!!!!

I can only hope we’ll have the funds to do that when/if ever we go back to owning again haha… that is slick.

i want it paid off, B****! Thanks for making me laugh, man! Congrats on getting rid of all your debt!

Congrats. This is hilarious because I had the EXACT same situation with USAA website recently when paying off my Jeep loan. Only I put in the comment “Because I don’t want to pay you any more money!” “DEBT FREE” is better.

HAH – really??

That is too funny… I wonder how common it is or not and if they’re just ignoring us the whole time ;) A reader of this blog works there and said they’d put in a message to whichever team manages it, but I’m certainly not holding my breath, haha…

No negativity because this community is all about promoting a common cause, hitting that FIRE.

Congrats on eliminating the liabilities on your balance sheet!

Yes, we are currently debt free and it feels awesome. Sold our house last summer and paid off our last remaining student loans. No mortgage, car loans, student loans or credit card debt. Now it’s just finding away to get my monthly income to a point where I can quit my job!

Hot dogs! You’re living the dream!