(Guest post by Laura Adams)

Just because I’m a personal finance author doesn’t mean that I’ve never messed up when it comes to money. You can be sure that I’ve made my fair share of blunders over the years, but I’m grateful that none of them ever put my financial security in jeopardy. I want to share them with you because it’s so much easier to learn from other people’s mistakes than it is to learn them the hard way. If I could go back in time, here are seven slip-ups that I’d fix:

1. Not contributing to a 401(k) sooner

When I was in my twenties, any information I got about retirement plans offered at work went right into the trash can. I mistakenly thought 401(k)s were only for “lifers.” You know—the employees who plan to work for the same company until the day they retire. I was committed to my jobs, but didn’t see myself staying in any one of them for more than a few years. If I had known how portable workplace retirement accounts really are, I would have signed up and made contributions much sooner.

2. Not funding an IRA earlier

I can’t remember exactly when I opened my first IRA, but I know I could have done it earlier. In fact, I could have done it when I was in high school because I had a part-time job during my junior and senior years. As long as you have earned income you can open up an IRA and contribute an amount equal to your earnings, up to $5,000. You’re allowed to fully fund both an IRA and a workplace retirement account in the same year.

3. Accumulating credit card debt

In the introduction of my new book, Money Girl’s Smart Moves to Grow Rich, I talk about how I got in trouble with credit cards right after I graduated from college and started working. Shopping for clothes and shoes became a compulsive obsession that I couldn’t live without. It took years to pay off the debt and to realize that buying stuff is a short-term thrill that has no connection to real happiness.

4. Overspending during the good times

When times are good and you have plenty of discretionary income it’s easy to inflate your lifestyle. I’m guilty of letting my spending match my money instead of being diligent about investing extra income for retirement or using it to pay down debt more quickly.

5. Dipping into emergency savings

It’s important to have an emergency fund that could get you through a financial rough patch, like getting laid off. Ideally you need at least six months’ worth of living expenses saved up. But the challenge is to never touch it for anything other than a real emergency. I’ve rationalized dipping into emergency money for non-emergency purposes on several occasions. Try keeping the money in an FDIC-insured brokerage account that makes it less convenient to transfer funds into your checking account, so it’s not so easy to spend.

6. Being too greedy

Investing is all about getting a return on your money. In most cases, the riskier the investment the higher your potential return. That can make it awfully tempting to put your money into shady investments or to try to time the market to make a quick buck. Sometimes it works out, but many times it won’t. I’ve lost money in high-risk investments that I could have saved if it weren’t for good ol’ greed. Never put more money into a risky investment than you can afford to lose.

7. Procrastinating saving

It’s easy to tell yourself that you just don’t make enough money to start saving. You think that you can catch up and save huge amounts later on when you start making more money. The problem is that you don’t set good financial habits for yourself right now—kind of like the proverbial diet that always starts tomorrow. Nor are you taking advantage of the power of compounding interest that allows you to save less for retirement and end up with more, when you put time on your side. Stop procrastinating and take control of your finances now, rather than later.

———-

Laura Adams is the author of Money Girl’s Smart Moves to Grow Rich, and she also hosts the Money Girl weekly podcast over on Quick and Dirty Tips. Thanks Laura!

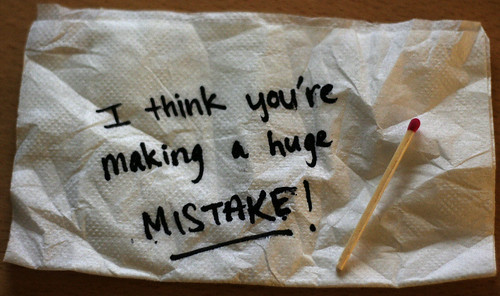

(Photo by doobybrain)

Get blog posts automatically emailed to you!

Unfortunately these things are all too common :(. But the more I browse personal finance blogs, the more I realize that people are beginning to change, little by little. Every time we share our finance experiences, we help to further that change.

The best tip I can offer is in regards to dipping into emergency savings. My wife and I are funding ours now, and in order to mitigate the temptation of dipping into it, we are putting the account into a separate bank from our regular account. The debt card for this bank is locked in our safe at home as well, so we have to go our of our way to even use it. Luckily I feel no urge to touch it, which is even better. :)

Just remember…these aren’t mistakes if you get something out of them…they are learning opportunities!

EXCELLENT post. I agree 100% on all of them. I wish I was more educated in personal finance as teen or young adult. At 35, I feel like I am getting the crash course now, and playing catch-up.

I think a personal finance course should be REQUIRED in high school and college.

Great guest post Laura. I’m 27 and work at a financial company and I learned first hand the benefits of starting a retirement fund right when I started. Compounding interest is an amazing thing isn’t it?

I think with all 7 of these tips, the common denominator is that you need to understand yourself, what you want, what you require, and what you would like to do. When those ideas are not clear, we tend to get off track. While there is nothign wrong with falling off track, we tend to get ourselves into trouble when we do so.

I think this is more like 4 money mistakes and 3 things you could have done sooner. I think it’s the better-late-than-never. I think you’d have 7 mistakes if you never had an emergency fund, never contributed to retirement, and never had any savings. Getting to things late isn’t a “worst money mistake” though. Never doing them is.

I agree with the not contributing to a Roth IRA. I wish I would have started doing that sooner too.

I made a similar post on my blog a few weeks ago. I think we all have some secret money past lives ;)

@ Bridget – or current ones!

I don’t think it’s being too greedy to want high return. It’s just that most people don’t understand the risk associate with high return. My dad is like that, he bet on high risk high reward and it never got him anywhere.

I think I struggle most with contributing to my Roth IRA. I have yet to fully fund my $5,000 in my Roth IRA in one year. Any advice?

@ Matt – are your contributions made automatically? If you can set it to an automatic contribution, then your Roth will grow without you needing to intervene.

The reason our company went down down down (in a burning ring of firrrrrrrre) was due to #4 – Overspending during the good times. That’s the easiest to fall for in my opinion – if you can lock that down you’ll be in calmer waters :)

@Jonathan – “these aren’t mistakes if you get something out of them…they are learning opportunities!” yes!!!! love it.

@Mysti – Oh man, that’s a whooooooole other topic ;) Every time we blog about more education in schools it’s like a free-for all here! haha… but I def. agree that we need to be taught much much better than we are. I’m like you, I didn’t really get started until just a few years ago. At least we’re on it now!

@Doctor S – How awesome would it be if I ended up working with you one day? You and I running a financial company? Shooooooot… or better yet, a blogging empire ;)

@Charlie F – That’s true, “never doing them” would be horrible. Although if these are the worst that Laura has ever experienced, then more power to her! :)

@Bridget – I love secret lives :) Esp when people spill them…

@retirebyforty – I think your dad and I would get along well :) I’m a big risk, big reward type too – and it doesn’t always pan out the way I’d like it . Sure is exciting though!

@Matt – Charlie’s right on the money w/ automating it. If you can stretch it over a year like that, there’s a MUCH better chance of you maxing out than in big chunks here and there. Although that’s certainly a way to do it too! When I got some extra cash this year I just deposited it right away into my Roth and knocked it out in a few hits. Of course, that was when the money was flowing in and I could max out my 401k too ;) Not sure what this next year will bring.

Thanks Laura for your honesty. It is comforting to know that even the role models aren’t perfect and slip up sometimes. Blogs are so great hey…we can encourage each other and learn from our mistakes. Best of luck in 2011.

I agree, J. Money – this is a great scenario of “worsts.” …maybe I’ll post mine someday when I’ve gotten a Roth started (I’m ineligible for 401k because of being part time, afaik). I’ve got some pretty bad ones… like I have no idea how I ended up with $60k in student loan debt. Well I do, but I don’t.

My first business when down when I did #4, too. I invested too much money into restocking product and when I needed the money to pay the bills during a slow month… well, it wasn’t there. Eventually I caved in the summer of 2008 and had around $3,000 in losses. BUT! this time will be better. Not focusing on products will be a big help – less investment.

And to add onto J.Money regarding Matt – figure out how much you want to contribute to your IRA yearly, divide it by 12, see if that monthly payment is doable, rinse and repeat till you find something that works. Automate the transfer of money from your checking/savings to your Roth monthly, and you’ll get your investment made totally hands-off.

Love it that you went out there and DID it though! Most great business owners I know had to fail a few times… although I’m hoping I don’t start off that way myself ;) But if I did I better learn from it!

J. Money and Laura Adams,

Great post! My biggest mistake was getting into debt to the tune of $275k +++ (still hurts to say it!) but I’m so f-ing proud to say that in March, I’ll pay off the last credit card and all that remains will be my car which will either get sold or paid off by the end of 2011.

Debt Free is SEXY!! :-)

Thanks for the comments, everyone! As much as we regret mistakes, or wish we had started sooner with good financial habits, it’s about what we do going forward that matters. As you mentioned, mistakes should be powerful learning opportunities. If you’re stuck making financial blunders over and over, you may need help to break counterproductive habits. I do one-on-one financial coaching in this area and you can learn more here: http://www.smartmovestogrowrich.com. I’ve found that coaching (for finances or for any life skill) offers a unique opportunity to see your situation from a fresh perspective and allows you to learn the fastest ways to make positive changes. Thanks for reading and here’s to making 2011 your best money year ever!!!

Debt Free is TOTALLY sexy!

Wow!! Great list!! I think about all the money I blew and all the money I could have saved. Heck I started a Micky D’s when I was 14 years old. I’d probably be a serious thousandaire or at least close to a million by now…IJS. Thanks for breaking this down, its definitely worth a re-post!

I’m totally guilty of getting too gready. Too much leverage in my stock portfolio has had a massive impact twice in 10 years now. Lesson – don’t leverage. Debt is dangerous.

Thank you for being so honest about some of the mistakes you’ve made. I’m relieved to know I’m not the only one who’s made some gaffes.

Laura great post. One mistake which I think I have made initially is not taking the Health Savings Account option. It works out much better for me than a regular Insurance plan. I would also like to point out that some companies offer commuter / parking benefits by way of pre-tax contributions and one should make use of those.

I will share this article with our readers at The Money Mail.

Glad you all enjoyed it :)