So I’ve learned that when you’re self-employed, there’s no such thing as a “steady paycheck.” At least as a full-time blogger and entrepreneur wannabe ;) The money comes in when it comes in, and the idea of a bi-monthly influx of cash is now something of the past. All of a sudden my 2 paycheck budget no longer works! (eek!)

At first I just went with the flow and spent money whenever I needed to – knowing that I had a decent amount coming in every few days, and still keeping track of everything like I usually do. But after a while it just got weird. Mentally it really threw me off. I mean, there was never a starting or ending point?! Or even a “payday” for that matter? Something I’ve planned my entire life around since I was 13 and pimple-faced! I didn’t like it, and I really didn’t know how to budget for it, either.

So I decided to start paying myself just like a normal employer would. It took me 4 months to figure out HOW to do that, exactly, (initially I kept the “every two weeks” system going until I realized it was just extra work) but I think I’m now on the right track and finally up to sharing my new process with you ;) Maybe some of y’all do this too? Or maybe there’s an even BETTER way to do it? I’m sure it’ll evolve even more as the months go on…

The Company Pot

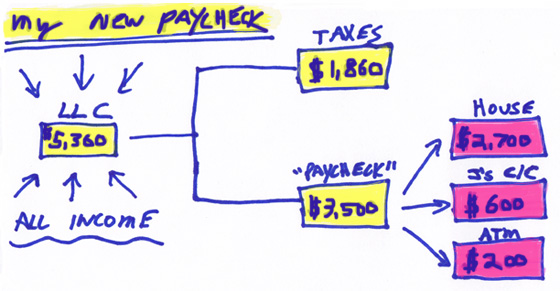

Okay, so the first thing I changed was diverting alllll my income into one main “company” account. (Did I ever tell you I set up an LLC for all my projects? Well, I did :) And it’s even more useful now!) All revenue, ad $, side hustle money – everything. It all goes into one main checking account until it’s time to be dispersed on the 1st of the month. In theory, I should *always* have at least one month’s worth of “paycheck” in there – $5,360. Anything over that stays in the account in case I fall short one month. Or heaven forbid, multiple months (!!!).

My LLC is pretty much my new “employer” – set up to keep some structure around here, as well as a little legal protection. I needed a way to pay myself on a regular basis so that I can continue living a “normal” life! :) And especially for tracking my progress. If money just comes into my personal account whenever it feels like it, and I spend it whenever I need to, there’s never a clear cut paycheck or budget. And I don’t like that (not that I’d never track my income/expenses anyways, but you get what I’m saying). I basically have to trick myself into receiving a salary so I can better understand my situation! No salary = messed up brain.

The Paycheck Breakdown

So. The 1st of the month rolls around and it’s time to pay myself. YAY!!! All I do is log into my main personal account at USAA (who doesn’t offer “company accounts” btw – arghh), and hit xfer. Twice. One lump sum of $3,500 into my checking account, and another of $1,860 into my “tax account” – the one I like to bitch chat about all the time ;) I initially had it all coming into one main personal account, and then dividing up the taxes accordingly, but now I just throw all the tax money right into my LLC’s savings account to keep it separated. The company stuff stays w/ the company stuff, and my personal money stays w/ my personal money. Nice & easy.

Then once I get this “paycheck,” I do 3 things:

- I transfer my portion of the “house” budget ($2,700) into our house account — to pay for all our mortgages, utilities, etc like we talked about last week.

- I pay off my personal credit card — budgeted for $600, but lately around $400.

- And then I take out $200 in cash for whenever it’s needed. Usually for food and other random stuff I don’t think too much about for the most part (on purpose – it’s my “whatever” money). If I have money left over by the end, I’ll just keep on going and see how long it takes until I need to hit up the ATM again ;) I’ll probably skip 2-3 months this year.

And that’s my new payment plan! :) I now have a system in place that I absolutely love so far, and one that I think should be able to scale as needed. (Like, UP, when I start making more money! Haha…) But the best part of it all? That everything now MAKES SENSE. I know when to pay myself, HOW to pay myself, and most importantly, what I can expect going forward. My mind is clear again and I’m finally back on track, baby! My full-time job feels like a full-time job again. Pretty funny ;)

Get blog posts automatically emailed to you!

*Mumbling to self*: Why the heck didn’t we think to set up a separate “give the devil— I mean IRS — his due” account?!?!

Such a brilliant and so-much-less painful way of parting with that cash as an entrepreneur. To be frank, the income coming in doesn’t warrant giving Uncle Sam a large piece of our pecan pie, but that’s not always going to be the case. This is a nice way to lessen the cash-separation-anxiety.

By the way, what magic formula did you use for calculating the taxes owed?

Also, love the way you give yourself a paycheck from the LLC. It really does make a difference when you keep those dollars distinctly separate.

J — Loved this post, as our family originally struggled with even trying to keep a monthly budget while getting paid every two weeks. The struggle was that the paydays were different days each month, moving farther and farther back in the month, until they were getting behind our house payment’s due day, etc… I finally figured out how to do it, which ends up being almost your exact plan described above! Great minds think alike!

Check it, if you get bored:

http://realfamilyrealmoney.wordpress.com/2011/04/17/having-a-monthly-budget-while-getting-paid-every-two-weeks-aka-why-we-got-a-month-ahead/

Thanks!

Hey J,

This is a great post! It helps people like me that are just starting out with this form of entrepreneurship. I look forward to the point when I can create this type of budget. Also, it’s very smart of you to be able to set aside Uncle Sam’s portion of your paycheck.

At the end of the year, will you clean the LLC account out (transfer the appropriate taxes) and get a year end “bonus” if you gross more than your “monthly” paycheck?

Yip. Great plan and it’s good that you shared it because people in similar situations can also use this method.

This is exactly the kind of thing I’m doing, I just haven’t collected much revenue yet, so that paycheck part isn’t happening. I also need to reimburse myself for some up front home office expenses. BUT, I did set up my LLC (pretty easy to do actually) and I opened a free business account at my credit union. They even linked it up with my personal account so I can transfer money easily. Since I use a credit union, they require you to have a savings account which I’m going to use on the business account as tax savings, then keep my personal savings for that eventual ER fund. Every freelance thing I do goes into the LLC account. Hopefully will pick up some more regular clients and work and the freelance will become the gravy!

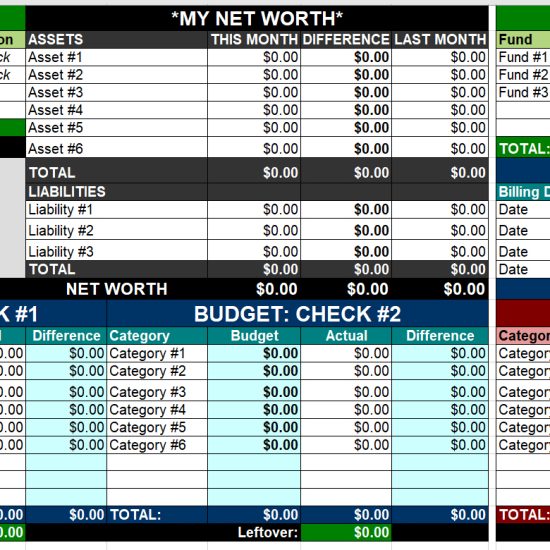

What are you using to keep track of your revenue vs. expenses? I found some free spreadsheets online at the KS Business Center website. They actually have some pretty good resources there. I imagine that at the end of the month, I’ll start recording everything brought in, paid in expenses, then paid in income to myself. I’m learning as go.

J…my burning question for you is WHY are you paying yourself so much on a monthly basis. Now that you are working from home surely your expenses are less than when you drove in to office every day. I am just wondering why you get such a big (to me) paycheck.

Congrats on finding a system that works for you. It’s not as easy as it sounds with an irregular income. My trick was simply to have a big slush fund which came in handy when the leaner months came, as they always will. Sounds like this is similar to the money you’ll retain in your LLC. I also erred way too high on my estimated taxes with a better safe than sorry attitude. Not optimal, but a lot of peace of mind.

It’s interesting how we all love a little structure at the end of the day. You have the best of both worlds, you know what to expect and have structure…. but you’re not working for The MAN!! Nice work!

Nice and simple system.

But I have some questions about insurance and savings. You have split up your “paycheck” into four ways. Do you pay for your own insurance from these buckets or is it with your wife’s plan? And will you be able to invest in your Roth or IRA next year? And are there any side savings being accumulated? It just seems your monthly “house payment” is pretty big at 2,700 per month.

I had that problem when I first starting bartending. It took about 6 months for me to figure out how to work it… but I basically just started saving everything I made one month to pay the bills for the next. So, everything I made in January was for February bills. It made things so much easier – I actually knew how much money I was going to have available to budget! (Getting “paid” everyday is weird!)

Now I am back to getting paid every two weeks – but I still find myself using the once a month system. It’s just easier for me to use.

It is great you are pulling in over 5k each month and you don’t have to report to anyone but yourself!!

Your system sounds like a good one, and I am sure you will tweak it over time. It is nice to have a plan though.

@EIRIC – Yeah, it def. helps me get things *straight* in my head, that’s for sure. We’re going on month 2 of this now and so far so good :) Hopefully it’ll work for you too if you end up going that route. As for tax calculations, it’s pretty much what my accountant advised me to do. I have to pay quarterly taxes, so basing my “project” income on last year’s gives us an estimated benchmark to try. Then we’ll adjust later if it’s looking higher or lower (but hopefully higher!! haha…).

@Brian – Cool, yeah I will – thanks Brian :) Glad you guys figured it out too!

@Budget Ranter – Hey, thanks :) It sometimes takes a while to get down a good game plan, but once you do you just ride with it until life throws changes your way.

@South County Girl – Oooooh I hadn’t thought that far but that’s kinda sexy!! Haha… I guess it depends how *much* is leftover. If it’s just a couple of thousand, then I’ll probably leave in there as a cushion for the bizness. But if it’s like $5k, or $10k or even more (!!!) then yeah, I’ll most def. take some out as a nice rewarding bonus :)

@Rafiki – I hope so! I like sharing what works for me cuz I learn so much from others doing the same too :)

@Ray Martin – Oh yeah, the income part is def. the most important! haha… but we hustle and hustle ’till it starts flowing in more ;) Congrats on setting up the LLC too – yeah not as scary as I originally thought. And it helps with separating things a lot as well. I’ll have to check out some of those spreadsheets – right now I’m doing everything in Google Docs ;) Haha… and I print out every receipt, and scan in every check, and then put everything in one main binder. So anytime I need anything it’s all in one spot. Google docs are working out well so far, but I imagine I’ll eventually be going with Quickbooks if things pick up a lot. We’ll see though, I take it day by day…

@Lulu – Haha, it’s actually over $1k less than before ;) I’ve cut down almost every single thing in my financial life at this point, but the one BIG thing that still gets in our damn way are our mortgages! When you’re spending $2200+ every month, your salary gets eatin’ up pretty fast. Although even if we went back to renting in this area (DC), we’d still be spending $1500+ every month. Just the way things are here…

@No Debt MBA – Yup! I’d much rather give out too much in taxes too, and get some back later than end up screwing myself. Taxes are no fun when things go awry. And you’re right, I’m using the LLC account as my “slush” fund too every month. I just hope I never have to transfer too much INTO it from my other money! Yikes.

@Kathryn C – Haha, damn straight ;)

@retireby35 – All great questions, sir. And that “house payment” is just MY part too – my wife throws in $1300 so it’s the bulk of our expenses (mainly our house, as you can see in my previous comments…. I hate it)

RE: Health Insurance — Yes, we are on my wife’s plan at her schoool for now (she’s in grad school), and that money will come out of our “house” account when needed (I think every 6 months?). If we don’t have it in our budget, then we’ll both throw in more of our personal money to cover it. All other insurance (Cars, property, etc) still get paid from our “house” account as it always has too.

RE: Investments — No, currently I’m only making enough to break even every month for the most part. The major downside to working for myself right now. The first 5 months I’ve been focusing on getting systems in place and learning how to adapt to this new lifestyle, and now I’m switching into GROWTH mode. I need to start making more money so I can start saving and investing again! :) (And the more I can dump into my SEP IRA, the more I’ll save on taxes at the end of the year!!!)

RE: Savings — Pretty much same as investments, only sometimes we do have some left over after all expenses are paid. For now, that extra just sits in my checking account to cover the months that may not go as well. Again though, not optimal. I’d like to start bringing in $1,000 extra every month on top of what we’re already doing to go straight into savings/investing.

@Katie – OH man – that WOULD be so weird! Getting paid every day??? Haha… love that system though cuz you’re always ahead of the game. That’s impressive :) Thanks for sharing!

@Everyday Tips – Thanks, yeah it’s def nice :) There are downsides too of course (like my comments above on not SAVING any money) but in the end it’s totally worth it. At least for now, haha…

Thanks for sharing your new monthly pay check plan with us.

That’s pretty cool man. Once I start making more money I’ll set up an LLC too. ;)

You seem to be doing pretty well with self-employment. :-) A lot of people I’ve known didn’t pay themselves and putting everything into their biz. It didn’t work out for any of them.

I guess it’s New Budget week or something, between your new plan, a friend I helped out on Sunday and I just did a new one yesterday. I decided to be a bit more agressive since I need to save way more. If you wanna see, it’s on my blog, it’s called “Getting Naked!”

Anyway, congrats on finding something that works. :-)

Welcome to the fold (self-employment, aka no-steady-paycheck). We’ve been doing approximately the same thing, but with separate accounts for each of our businesses. (My husband has one, I have … kind of … two.)

I’m interested in how you came up with that amount for taxes. Your taxable income will be reduced by your business expenses, so you may find yourself switching to a percentage method of saving for taxes at some point.

It’s easier with some businesses: You collect the money, you buy materials, pay contractors, etc. for the job, you take a portion of what’s left over and save it for taxes, you pay yourself, you leave some in the account to cover incidental business expenses.

With some businesses, you really don’t have expenses directly related to one job, so it’s harder to figure on a monthly basis. The important thing, though, is that you leave some money in that business account to pay for them. (Examples: printer, ink, hosting, client lunches… :) )

Sounds logical to me man! I think if you didn’t do it this way, you might risk overspending so it’s good you’ve got this set up!

This makes so much sense I’m not sure how it didn’t occur to me before! I’ll definitely use this when I get to your point.

That’s pretty much what we did too when we were in your situation. I would pay myself a regular salary every two weeks when I paid our employees. Then every couple months I would take a lump sum as money built up in the account.

Also on the getting paid every day when working for tips. I did exactly what Katie did and have been living on the “one month ahead” system ever since. It’s so nice.

J, just realized, where’s the line item for saving/investing?

I like this method. My dad owns and runs a “real” small business (like, with employees!) and he pays himself a salary from that business, so why shouldn’t a solo entrepreneur like myself and J. Money (I keep good company!) do the same?

I think setting up a paycheck is very important when you are self employed. I like your idea and will be implementing it. I don’t have a separate account for my tax accrual, I enter it into quicken as a misc expenditure until I actually write the check.

@Jenna, Adaptu Community Manager – Thanks for reading about my new monthly paycheck plan ;)

@retirebyforty – Go for it! But be sure to talk to a few people first to make sure it make sense for you. I know others who’ve created them when it wasn’t necessary.

@Jen – Cool! LOVE that name too, haha… will go over after posting this and check it out :)

@Carolyn – Yup! All good points. In fact, originally I thought that’s exactly what I’d be doing. Receiving money, paying for my expenses, then dividing up the profit between myself and the tax man. After talking to my accountant though, and larning more about quarterly taxes, she said might be worth trying to estimate what I’d bring in and then divide taxes by 4 and pay them throughout the year so you know what to expect. So for now that’s what I’m trying out :) But we’ll see how off I was by the end of the year! (and I’ll revisit too if I get major increases or decreases in income at any point)

@Financial Samurai – Thanks dude :) Wanna share with us how you’re currently set up?

@Jeffrey Trull – Cool! Glad you find it helpful!

@Ashley @ Money Talks – Yeah, maybe one day I’ll try that if I ever fullfil my desire to be bartender! I swear one day I am :)

@Sam – See my post today ;) Is a Dream Job worth it if you can’t save any money?

@Paula @ AffordAnything.org – Haha… I like how you say “real” company ;) I say that all the time too – def. different than companies back in the day with real employees!

@Debbie Beardsley – Hey, whatever works and keeps you rolling smoothly! Hope you’re having a good week so far, friend :)

Great post! It’s great to read how you’ve started to implement what works for you. I like to tell entrepreneurs, especially those in internet marketing and blogging that the key to financial success in business is being organized with the financials. The number one key to starting that is keeping the personal and business stuff separate! It helps the solopreneur to keep track of what’s going in their businesses and allows for better decision making. Additionally, it keeps you in compliance with the IRS and shows that you are a serious business owner.

Having a system and process in place like you’ve done is very important! Also having a budget that determines the amount to pay yourself and the amount to put in savings for taxes is critical!

Loved this post!

Totally! And thanks ;) You know, it’s funny too – I actually now some PF bloggers who make decent money from blogging but actually aren’t good at keeping their advertising and stuff straight. Like, they could be making even more if they just organized what they already have better! I think once you get that squared up, you can focus more on growing the business too. Here’s to success!