We’ve been saving and managing our money better than ever, but we decided it was about time to man up and accept the loss in home value now, rather than pretending it doesn’t exist and dealing with it later. (as you may have recently read).

It sure ain’t fun, but it’s all about keeping it “real” and tightening the grasp on your financial situation! Much easier to do in small doses, overtime, than with a powerful punch down the road. Plus if the market miraculously recovers, we’ll be able to enjoy the nice spikes in our total worth! But def. not holding my breath there ;)

You’ll also noticed we’ve added a cple new categories too, while ditching some older ones. We’re now tracking our Emergency Fund, Home Worth, and Mortgages – and we’re unloading Condo Investment, and Home Equity just because it doesn’t make sense anymore.

Here’s how Jan’s Net Worth breaks down:

CASH SAVINGS: Well that’s a nice jump! $11k extra certainly won’t hurt us. he he….although i’ll have to admit that at least $10k of that is earmarked for the Mrs. remaining grad school costs and “her portion” of the mortgage/house stuff – $1200/mo. This is the money we got from selling some of her oil stocks, as well as that Pay it Forward amount we got last year :) So in reality, it just prolongs the time where we need to pick up some side money to pay for our quality of life next year…but maybe by then i’ll be a professional blogger! (100% kidding).

EMERGENCY FUND (*New!): Yup, this used to be factored into our “Cash Savings” account, but I much prefer looking at it as it’s own category here :) Plus, it’s technically in a Money Market account anyways, which is close to cash, but not all the way ya know? And now that we’ve hit $10k between the two of us (she brought in $6k of it!) we’re @ a good stopping point.

ROTH IRAs: Up $4k! Thanks again Mrs. Budgetsaresexy ;) Her Roth is actually much better off than mine these days as it’s in a CD gaining a bit of interest every month, whereas mine dropped $2k in the last 2 years due to mutual funds tanking…but soon enough i shall have my glory!

401(k)s: Even WITH her extra $1k we still dropped a good $3,000. How crazy is this market, eh? Again, I’m still missing a good sized chunk of money that still hasn’t showed up here yet, but It may be a blessing in disguise as I’ll be able to pick up even MORE funds once it hits my account since they’re all so low. Definitely more fun last month though!

SAVINGS BONDS: Keep them dollars coming baby! (You can check out the breakdown here.)

CONDO INVESTMENT: Outta here! My brother paid me back the entire $1200+ loan, and we’re now all settled up. 1 for 2 in loaning my family money ain’t too shabby :)

AUTOS WORTH (kbb): Zero loss again for my pimpin’ Caddy ($3,595), and a first time checker-checker on the Mrs’ Toyota @ $10,610. Unlike her though, I still have around $1700 to pay off still. Hers is all paid off baby! (whew)

HOME VALUE (Zillow & Realtor) *New!: I ditched the “Home Equity” category and finally owned up and threw our home value and mortgages out there to show a more precise (and honest) picture of our finances. It really just made better sense doing it this way, and now I can track the 2 amounts closer and work on improving our situation!

As some of you know, I am now calculating our “Home Worth” by taking the average of what Zillow shows, and what our Realtor is saying he can get for us. This way I can still monitor the value every month through Zillow without bothering my Realtor every 4 weeks ;) Right now Zillow has it valued at $307k vs the est. $300k per Mr. Realtor. It sucks overall, but at least we already paid a good $10k off the original amount!….even if it WAS by accident.

CREDIT CARD (car loans): This amount is from buying my Caddy and selling my Highlander (i owed more than i sold it for) last year. While it’s technically ON my credit card, it’s really just a loan @ around 3% interest. No consumer debt whatsoever. And to keep on track with paying it off by May, I’m still applying my old $443 car payments (plus any other leftover amounts from my budget) towards the balance every single month!

MORTGAGES: 1st Mortgage @ $288,000 (30 year fixed, interest-only @ 6.875%), and the 2nd Mortgage a maxed out HELOC @ $62,818.15 with a measly 2.8% interest! The game plan is to start knocking away more of this now that the budget is back on track.

So welcome to our newly formed “Family Net Worth”! It took some time smashing them together, I won’t lie, but now it’s all in one sexy little spot (and will be much easier to update now). I finally did it! And it only took me 8 months after getting hitched ;)

—————–

*The sweet & sexy side bars have been updated.

*And here are all the Net Worth Updates.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

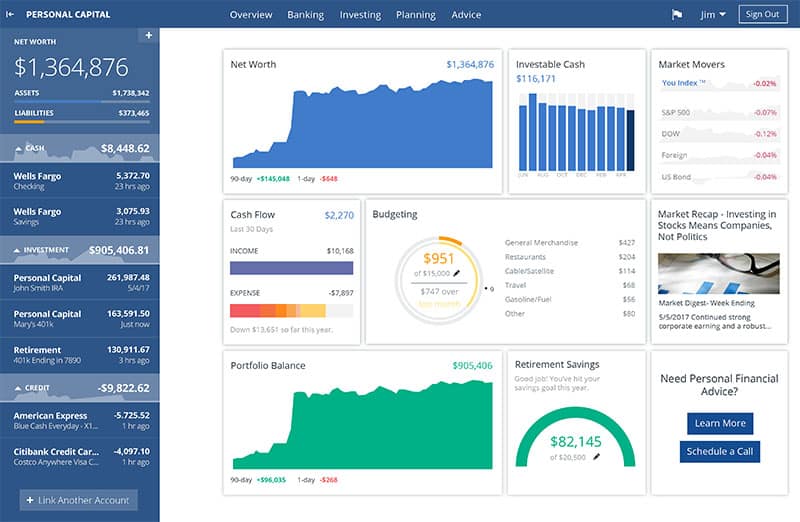

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

What’s your opinion on our financial situation? It’s confusing, because you’d think we’re in good shape financially, but we do sometimes worry!

I have about 1.2 million in investments and savings (a mix of stocks, bonds, and annuities, and money markets). Our home, bought in 2007 for 950k is now probably worth about 875. (We live in a suburb ten miles outside NYC, where the housing bubble has burst, but homes in our town still sell quickly, and there are few foreclosures.) We have no mortgage. My parents give me a “gift” of 26k per year, tax-free. I also earn money from being a shareholder in a family company–about 50k/year, though that will end soon, as my parents are retiring and folding the company. (It is a small media company, so does not “produce” actual merchandise. It’s sale will not result in a huge influx of money.) My husband earns about 150k in his work, and has a 401k worth about 400k. (He also has a pension–he has worked at the same company for 25 years.) We have saved a total of about 200k in our kids’ college funds (429s)–they are 6 and 9 years old. We have no debt, except what is currently on our credit cards (we pay in full monthly). Our annual property tax bill is probably our biggest expense–16k per year.

I have a masters in education, but no longer teach. I previously was a writer and editor, and do occasional freelance work; I’ve also recently taught some college courses. I am currently writing a novel–something I’ve wanted to do my whole life.

My husband has an MBA and works in marketing.

Recently, we decided to splurge, and are taking 3 rather expensive vacations over the next 6 months, totalling about $13k.

We will be 50 in a few years.

So, what’s your view on our situation? Now that my youngest is in kindergarten, do you think I should go back to work full time? Or is it okay for me to indulge my writing dream, if only for a year or so? (I take a writing class and have been told my work is promising.)

Woah, well I can tell you this – it seems like you guys are on a most excellent track! Especially for a) not having any more mortgages, and b) having a decent net worth already saved up – well done :)

I’m certainly no expert here, but the first thing I thought when you said you wanted to write a novel was “GO FOR IT!!!!” Whether you had $5mil or $5 in the bank I would advise trying to fulfil your dreams :) Plus, your dream of writing a book could potentially even bring in income down the road, so in that case it would be Win-Win.

The nice thing about have an education – in education – is that you can always go back to it whenever you choose. Maybe you do it on the side, or maybe you start your own blog teaching others something, but you can do it at pretty much any point in your life. That is really important to know because it means you have options.

So what do I think? I think you both are doing an excellent job and you should pursue your dreams and be HAPPY :) What I will recommend though, just to be on the safe side, is to find a good financial planner in your town and set up an hour or two meeting to make sure everything is on track. It might cost you a cple hundred dollars (maybe less?) but THAT would be the ultimate way to lock down a true report on your finances. I seem to think like a 20-30 year old so my brain is a bit skewed when it comes to those in older situations :)

Regardless though, keep us updated on what you end up doing!!! And if you write that book, I would like to get a signed copy please :)