The funny part here is that our net worth is back to where it was a year ago in June of ’08! A lot of changes have occurred since then (the crazy economy, the combining of our finances, the plummeting of our house value), so I’ll take being in the $70k range again a good sign.

What’s also cool is that everyone should now have all that crap above factored into your numbers! So instead of being pissed about losing $100k+ myself, I can’t help but smile for the fact we’re staying on budget and doing our best with what we have control over :) We can’t change the market or the economy out there, but we sure as hell can stay on top of our own finances.

On a side note, I’ve also updated those sweet & sassy sidebars over there on the right. Two of my goals for ’09 were met early on (paying off car loans & reaching $10k in our emergency fund – woohoo!) so I figured it was about time to update them with some new challenges. You’ll now see I’m working on maxing out both my 401(k) and my Roth IRA in their place. Not sure how easy this will be, but it’s certainly worth a shot. Now onto last month’s stats!

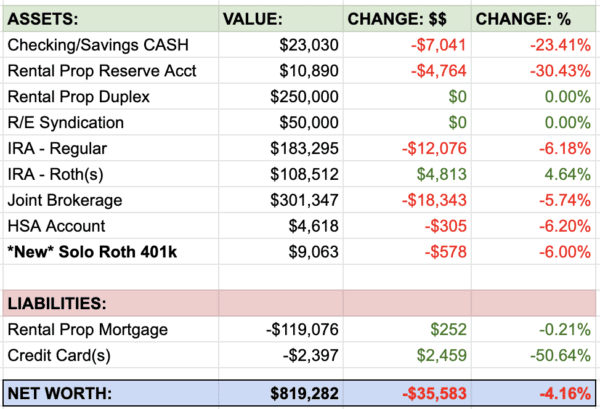

Here’s how May’s Net Worth breaks down:

CASH SAVINGS (+$568.39): We’re still going through a good $1200 a month while the Mrs. is in grad school (this covers her mortgage and housing-related portions) but luckily we still have that pay-it-forward chunk set aside for exactly that :) All the rest of the money that would normally be pumped into our savings here has gone into my recent stock picking adventure which will be ending as I get ready to jack up my 401(k) contributions again.

EMERGENCY FUND ($0.00): Our $10k is still sleeping away nicely in our Money Market account. It’s mixed in with other funds so I can’t determine exactly how much interest is accruing on the Emergency Fund in particular, but I promise it’s adding up.

ROTH IRAs (+$1,823.68): Another fan-f’ing-tastic month! I’d say about $1500 of that was deposited myself, with another $300 courtesy of the market rebounding and Mr. Buffett’s stellar recommendations ;) These jumps won’t last much longer though as I get closer to maxing it out.

401(k)s (+$3,106.87): What comes down, must come up right? Seems to be the plan of the stock market lately at least, which is fine with me! Haven’t contributed a single dollar here lately (long story) but I’m hoping to start doing so in the near future, esp while everything is still so cheap.

SAVINGS BONDS (+$3.28): I still haven’t taken up Ishan‘s recommendation of unloading these and finding a better place to store the cash, but it’s still on the list! I’m gonna do my best to knock it out this month…just takes so LONG with the way the Treasury has it set up online. What happened to the days when your friendly local bank still handled them? Jeesh.

AUTOS WORTH (kbb) (-$50.00): As to be expected – no one ever said these piles of metal were income producing ;) A little will be knocked off every month for sure. Here’s how our cars line up :

* Pimpin’ Daddy Caddy –> $3,620. Down the $50 buckaroos.

* Gas Sippin’ Toyota –> $10,435. Stayed the same? weird.

HOME VALUE (Realtor) ($0.00): This will remain @ $300k (the price our realtor set it at) until I get more word from him in a few months. He has a fantastic eye in our particular neighborhood, and has been selling (and even lived at one point) in this area for 20+ years. I also keep an eye out on what Zillow & Redfin.com show it listed for every month, and the $300k is usually where the average falls.

CREDIT CARD (car loans) ($0.00): Still at Zero! And should be stuck at that amount for a while…I might have to get rid of this category at some point, but I’m just not tired of staring at it yet! haha…The previous debt here was an “auto loan” that I happened to charge on my credit card – effectively setting my interest @ 3%. I don’t recommend this for everyone, but the method works well if you know what you’re doing and don’t have outstanding debt lined up.

MORTGAGES (-$73.81): We actually knocked off around $280 from these mortgages this month, but the #’s don’t always match quite well depending on the days I check them. We’re still eager to refinance as well, but unfortunately we’re just too under water to do so right now. It won’t stop us from using our leftover House Budget money to chip away at ’em though! Here’s how they breakdown:

*1st Mortgage: $287,612.32 – 30 year fixed, interest-only @ 6.875%.

*2nd Mortgage: $62,818.33 – Maxed out HELOC w/ 2.8% interest.

That’s it for this month. Hope everyone’s seeing some pretty numbers on their side as well! Don’t let these Summer months distract you and steal all your money ;)

—————–

*My budget has also been updated.

*And here are all the Net Worth Updates.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

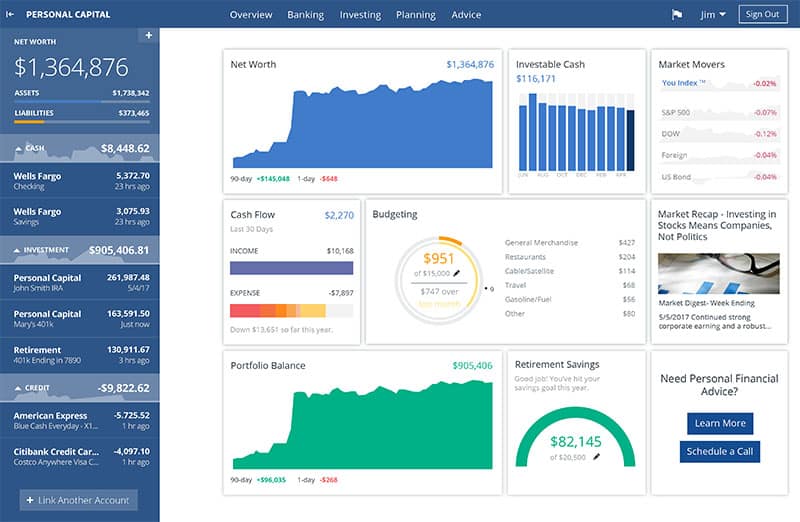

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!