Another month, another loss! Not as bad as last month’s massacre thankfully, but dropping $7k instead of $22k isn’t all that sexy either, haha… Unless you’ve got a hoard of cash just waiting to be dumped into the market, in which case YOU’RE FREAKIN’ BRILLIANT!! Scoop up those investments while they’re all on sale – you lucky bastard! :)

I’d do the same myself, but we’re playing it safe over here and holding onto all extra cash until our sell vs rent dilemma is over. Which I’ve got to give y’all MAD thanks for btw as you’ve really helped us put things in better perspective! I’ve read every last comment and email and note y’all have sent, and can’t thank you enough for taking the time to pass them all over.

Thank you, thank you, THANK YOU!

I f’ing love our community here, and I swear I couldn’t do it without you… quite literally, as a blog without readers is pointless! :) So thank you from the bottom of my heart for not only reading all these years, but also being incredibly supportive along the way. I really can’t tell you how much it means to me.

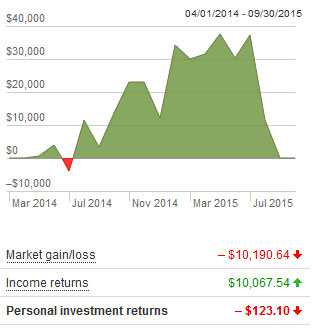

Getting back to the markets though, check out how our $$’s performed since moving it over to Vanguard last year (all in VTSAX – a total stock index fund):

You see how it goes way up and then crashes all the way down to baseline? That’s what this craziness has done to our pot in the past two months, haha… wiped away all earnings from the past year and a half – amazing! Thank goodness we won’t be touching it for decades to come – plenty of time to get it into the millions :)

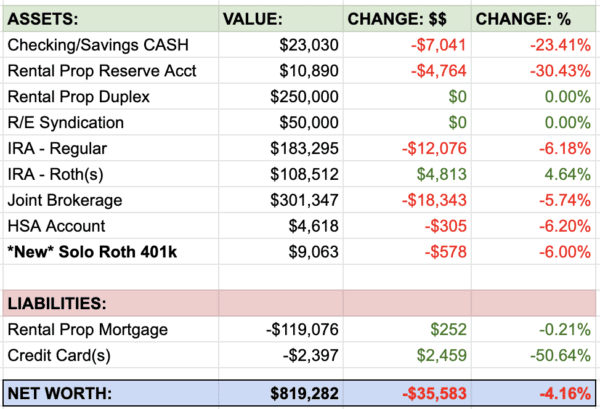

Here’s how the rest of the month broke down:

(FYI – you might notice there’s a few extra categories in our net worth now. They’ve always been accounted for, but I thought it would be fun to break them down and pay special attention to them so we can watch how they perform over the months specifically. You’ll now see our Digit and Challenge Everything money separated out from savings, as well as our two new brokerage accounts added this year – Acorns and Motif – instead of being lumped together. Hopefully this sheds more light on our finances and encourages you to experiment with your money too!)

EMERGENCY FUND (+$3,106.99): Our 5th month in a row into the positives – woo! And our 3rd into the thousands, actually. A nice change from The Perfect Storm when we were losing $2,000 every month while restructuring my business and getting killed by daycare. The daycare will come back at some point, but at least a 2nd income will too along with it. It’s crazy to think we’ve been living off my one income for over 5 years now more or less. You guys better never stop reading my blog! :)

DIGIT SAVINGS (+$111.83): The digit robots continue to save money for me. Quite literally! Every few days they analyze our spending and pushes little amounts of money aside that it thinks we won’t miss or need. $5.00 here, $20.00 there. All totaling over $1,500 in the past 9 months since signing up. For doing absolutely nothing! They’re definitely worth a peak if you haven’t checked them out yet – here’s my full review. I’m so obsessed that I’ve since become an advisor to them and can’t wait for them to drop what’s next… they’re totally disrupting the industry!

CHALLENGE EVERYTHING (+$253.31): Bye bye $5,484.07, hello start of Challenge Everything II! :) As much as it stung to dump the cash and start afresh (we used the money to max out my Roth IRA – woo!), I’ve gotten re-energized over the past few days to go again here and see if we can beat out our old record. And looks like I have some catching up to do since I took a month off from selling anything! Though I did find $0.53 in more change…

ACORNS (BROKERAGE) (+$10.11): I don’t know why, but this is one of my favorite accounts. It only goes up by a few dollars every month, but I love watching it grow! All Acorns does is round up my purchases and other financial transactions (like my digit xfers – hah) and then dumps the difference into my investment portfolio they’ve helped me create. It hasn’t grown that much outside of my monthly deposits, but it’s all money that would have normally not been invested anyways, so to me it all feels free. And $253.53 in spare change is pretty good after only 8 months! Here’s my full review on Acorns too if you want to learn more.

MOTIF (BROKERAGE) (-$7.57): This account, on the other hand, is one of my least favorites. Not because it hasn’t grown over the year or I don’t think Motif is cool (it actually is if you’re an active trader)), but just that I’ve realized how much of an index guy I am at heart now. If you recall, I set this account up during a blogging challenge at the start of the year (currently 16th place – hah), as well as to learn more about dividend investing, but so far I’ve just let it sit and not really paid attention to it much. So it’s totally my fault I’m not learning anything, but when the interest isn’t there anymore you move on, eh? I’ll probably end up shutting this down at the end of the year and moving the $$$ over to my Vanguard account. Here’s my full review of Motif if you want to see what they’re about. Def. creative!

IRA: ROTH(s) (-$2,468.42): Back to our normal categories now, our Roths take a dip again due to the markets and us not contributing to them this month. I’ve thought about breaking up the year into 12 installments instead of maxing it all out in one swoop at the end of every year, but my conservative side keeps me nervous since blog income constantly fluctuates. And the Roth comes second to maxing out our bigger investment account – the SEP IRA – which we want to hit every year no matter what. This not only saves us a ton in taxes every year, but the amount wan invest is much higher – usually $15,000+ depending on business profit.

IRA: SEP (-$9,943.90): OUCH! Just the markets doing their thing as always, but never fun to see regardless. Again, unless you have that stack of cash just itching to get back into the game :) As I mentioned last month though, none of this really matters until it’s time to start cashing these in way down the road. So we ride alongside and keep building up our stockpile! There can’t be lows without having the highs, right?

AUTOS WORTH (kbb) (-$4.00): The best loss of the whole month, haha… A whole four dollars! What will we ever do?? :) Here’s the current values of both our cars… one based on the Kelly Blue Book, and the other a rounded down $1,000 due to its uniqueness, haha…

- Plain Jane Toyota: $4,285.00

- Frankencaddy: $1,000.00

HOME VALUE (Realtor) ($0.00): As I mentioned last week, the range of reality can span anywhere from $280,000 to $320,000, so we’ve kinda just settled right in the middle there at $300,000 as a more realistic number. But if we do indeed go through with the sale of our place, we’ll find out once and for all the REAL value as the offers start coming in! It’s funny how that’s the only time you can guarantee what it’s worth, haha… When it’s time to sell.

MORTGAGES (-$713.05): In the meantime, we continue to chip away $700+ through normal (and extra) principal mortgage payments each month. So at least every month we still own our house the debt is being chipped away! It’s not all bad! Here’s how our two mortgages break down:

- 1st Mortgage: $263,910.31 (30 year conventional @ 5.5%)

- 2nd Mortgage: $25,702.68 (HELOC @ variable 2.8%)

Our Net Worth over the past year:

We’ve reverted all the way back to January – d’oh! But I’m not stressing… just the way it goes, my friends. And hopefully you’re taking advantage of it a lot more than I am :)

Here’s what my kids’ net worth look like too:

And that wraps up September! A great month for cash savings, but not so much in the investments territory… How did you guys do? Anything fun or juicy to report? Anyone pay off their debts or come across an insane hustle?? I want to hear about it!!!

As always, if you want further motivation or just feel like stalking, here’s our updated list of now 180+ personal finance bloggers divulging their own net worths. Spanning from -$123,446 all the way up to $2,282,462. Pretty interesting to sort through.

You can also see all 93 of my net worth updates here: J’s Net Worth Tracker

Here’s to a great October!

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Yes, you’re right, September was still a great month for cash savings! Mine was not pretty good, but I do hope so that this month would be better.

Not a great month for most people, but you’ve done great turning around the cash situation! My husband and I keep debating if we should hold onto our cash to max out Roths at the start of the year or buy now. We’ve decided to play it safe, and hope for a strong stock market rally in February

As long as it gets invested at some point you’ll be fine for the long haul :)

Wow, your stock market graphic really says it all! Fortunately, this will just be a tiny blip when we look back on it decades from now. I can’t understand why people freak out and sell stocks after a mini-crash; it makes no sense at all!

I’ve recently started contributing each month to my Roth IRA — somehow for me this works better than waiting till the end of the year. I think making monthly contributions also helps balance out market fluctuations to some extent, although there would also be something to be said for trying to time an approximately-annual contribution to when the market is as low as possible…

Agreed! I think it’s totally best to invest incrementally over time. Not only is it easier to do, but the dollar cost averaging is great. Especially during times like now when you can buy cheap when the rest of us are sitting on our cash :)

September was a “painful month”….It should be interesting to see the how the mutual funds do this year as they tend to peak toward the end of the year. Wonder if that will happen this year? Good Luck on the home ….sale/rent…IMHO just get the CMA …study it …make the decision and move forward…My vote is for remaining a “reluctant landlord”….

Haha.. if only I could hire you to deal with it all for me :) (And never heard of the peaks towards the end of the year? Interesting…)

Ever heard the expression “Sell in May, go away and play. Come back in October when the selling is over”

nope – can’t say that I have!

But now I’m at the cool table with y’all :)

I love these updates – can’t wait till you hit 1 million baby! Also, after reading these reports from you for 1+ years, I finally calculated my net worth. I knew it would be super negative bc of hubby’s med school loans but I never knew the exact number. It’s pretty brutal but at least we know!!!

YES!! GOOD FOR YOU!!!

It usually always sucks the first time, but now every month you get to watch it improve as you slowly (or fastly?) chip away :) And then a year from now you can look back and literally see all the progress you’ve made! I’m so excited for you!!

My net worth always takes a hit after paying quarterlies. I have the money in a separate savings account, but it shows as part of my net worth in Personal Capital till it comes out. Always a sad day ;)

ahhh…. yet another reason I like manually tracking my $$$ – I can separate them out and not watch it as it affects my worth :) though the pros to personal capital and automation in general probably greatly override the annoyances.

Damn market! Hopefully the rest of the year is better. It’s nice to see the actual breakdown of how much use save from each app, too.

Oh good, I’m glad. Wasn’t sure if I’ll do it once or for the future ones, but maybe I’ll continue for a bit if people like them :) Do you track your net worth over there too?

I like seeing the breakout of the savings by app too.

Keep up the great work!

thanks! for letting me know!

Investments are on sale! Investments are on sale! Investments are on sale! How come you never hear anyone say that? Killing the cash saving. I wish I could say the same.

You hear a lot of us financial nerds say that on our blogs / twitter / facebook :)

But that’s about it, haha…

I have a hard time deciding to build up cash savings or invest heavily right now with stock market being down. I’ve decided on investing this month, but next month regardless of how the market does I will be adding more to our emergency fund.

That’s a good way to do it I like that.

Uff, the market ‘crash’ was indeed serious, but, fortunately, you should be OK in the years to come. You’ll probably have more high and lows (though I wish you only highs :)).

Our networth has grown a bit, since husband really ‘killed’ it on his side of the business, this allowed us to recover some of the savings we had to spend in the previous months and also get ourselves a new bed + mattress. Pretty stocked about this

Congrats! You picked a good husband :)

These posts always inspire me to keep “challenging everything” and selling stuff I don’t need!

Good thing we’re invested for the long haul.

Yep, September limped along for me too, another down month (but not as bad as August). Hopefully the market will turn around towards year end.

It’s such a roller coaster ride, but it’s great that you always keep the end in mind. I love how you track your kiddos’ net worth, too. What great insight and financial literacy they’ll have at such an early age!

Haven’t run the numbers, but I am hoping to see some neutral returns in the market. Sold my car this past month and reinvested it into the market so thinking it may balance things out a little bit with some of the monthly contributions I have made.

Hoping we stay at the levels we are at or go even lower into the end of the year. Would love to dump my year-end bonus and some more monthly deposits into the market before another rally but we will have to wait and see.

Haha…. I kinda hope that too since it’ll be around when we max out our SEP hopefully :)

Great job on continuing to invest and save! You are an inspiration!

Stock market has been brutal these last two months but it’s all part of the game!

Yeah, we got crushed in September ($36k loss!) but nothing like the $74k loss in August. A few months of losses like these and we’re talking about real money, sir.

We crushed it on the expense front with $927 in monthly spending. Most of that was food, which was delicious. Burp.

holy damn! i pay that alone in health insurance, ugh…

We did our quarterly net worth update yesterday and we were done since July. Sucky feeling to see downward net worth but considering how the markets are doing and that we’re heavily invested in stocks, that’s kinda expected. As long as the long term trend is upward, a few months of downward trend is OK.

Ok.. so you might have sold me on Digit. I’m usually not a fan of automated savings, mostly because I’m a control freak, haha, but I KNOW that I keep too much cash in my checking account as a crutch and this would help funnel it away without me even noticing… definitely going to look into it more…

Also wrt your home value, are you calculating the value based on what you’ll net out of the sale? For instance if you choose to have an agent sell it at $300,000 – you’ll actually only net $282,000 or so after commissions are taken out (and even less if you offer anything like closing cost assistance to the buyer, etc.) Just something to keep in mind.

yup – I was calculating all that stuff (conservatively) in my # range… but if we list it and it’s looking like the -$40k range we’re going to take it off the market and go for renting again haha… that is just cray!

(And cool about Digit! Let me know if you end up doing it and then what you think!!)

Being a corporate employee, the best advice I ever received is to increase your 401(k) contributions (I typically double them from 6% to 12%) once the market falls 8%-10% from the high and then go back to the initial contribution rate once the market returns to pre-correction levels. Over time this will drastically boost your retirement savings as you are taking advantage of the market being “on sale” by investing double what you ordinarily would at reduced prices from the week/month prior.

Compounding on this approach makes it even more miraculous!

Hell yeah!!! Great strategy! As long as you’re still getting 100% of your company’s match. There’s def. nothing better than double/50% increases :)

I have a nice pile of cash that I’ve been slowly investing over the past two months, but when do you know when it is time to go all in? Since it’s impossible to time the market, it’s hard to be patient with your cash so that you still have some to invest if the market is down 20-40%. Sometimes it’s easier just to be fully vested and not think about it; however, having sideline cash definitely makes stock market declines a more positive, exciting experience.

Exactly – you can’t. So you’re better off just doing your thing as if nothing around you is happening and if you happen to look and have extra money then even more power to you :) As long as you’re constantly investing you’ll be good regardless of when you buy or don’t. (At least if we’re talking long term here)

I always have to look back 1 year and see where I was at this same time 365 days ago or I lose all perspective. Then to make myself feel even better I look back 2, 3, 4, 5 and then realize I am kicking butt. Hard to tell where you’ve been when you only look forward and see the mountain in front of you, but then I look back and see I’ve already climbed up 75% of the mountain and I’m doing amazing. Then it motivates me to keep going.

That’s a great point!

Second that!

Very well said Lance

I was (thankfully) able to take advantage of the stock market this year. Everything is on sale! :)

Great blog. Very inspiring. Reading these always helps me feel like financial organization is possible. It’s like peeling back the layers of an onion, every time I learn something new, feel inspired, and take a micro step forward. September was a great savings month for me because I started a digit account and ACTUALLY started saving. So here’s to micro step number 1!!

Side note: I just realized publishing and openly discussing your finances is a great way to take the shame out of the situation. Once the shame has been removed we are free to be more honest with ourselves about our situation and our choices that got us there. And from there we can make conscious changes. I like this shit.

Hell yeah girlfriend! You are getting wiser by the day ;) And much easier btw to divulge online and with a generally positive community too vs the haters around us in the real world… Though that becomes even more powerful when you find the good ones!

I love reading the perspective of experienced investors in times like these. I’ve only been investing for a few years, and it kills me to see my tiny little retirement account (and net worth) take such a beating. But I know, logically, it’ll all be fine in the long run, and hearing someone else say it reminds me why I do this!

We had a great September and fared better than most from a Net Worth perspective.

Income was up 38.7% vs. August @ $28K

Net Worth increased $7K to $249K (up 37.1% YTD)

We still have a large percentage of our investable assets sitting in cash, which has allowed us to escape the market correction relatively untouched. We were also lucky enough to deploy some of that idle cash near the August 24th lows.

Also our savings rate is at a point where any market losses are more than covered by new capital every month.

We know this won’t always be the case. But it has been fun watching our net worth grow in a linear fashion this year.

We originally set a goal to increase our net worth by $69,000 and we are 92% of the way there as of September. Our new stretch goal is $100K by the end of the year. We will see, it’s going to be a challenge. But we are up for it.

Love these reports. Fantastic job as always J. Money!

Well look at you go!!! You’ve found the secret sauce we’re all looking for! Haha… Congrats my man, I’m bowing to you over here behind the computer :)

September was a great month for us!

Despite losing a few grand in the market our net worth shot up 10% due to aggressive savings rate and a fat commission check!

Was able to snag some VTI @ $97/share which is fantastic considering we were buying @ $108-110 just a few months ago!

SO SMART!!!

Yikes, dropped almost 12 large! Good thing I don’t plan on taking my chips off of the table for another 10 years or so. :)

I have to admit, those dips that the market takes make me a little weary of investing. Being new to the game, I have a lot to learn. I think once I get rid of my cc debt, I can concentrate on learning more about investing to understand the markets in greater detail and take away (or lessen) my fears! Thank you so much for sharing, and I really like how you broke down each category – it gives a fuller picture.

Great! I think I’ll continue doing them for a while :)

Investing is def. scary/weird/confusing/etc until you figure out what you’re comfortable with and what you’re not (and also what your goals are long term). Once you get a better grasp of that and pick your poison, it’s all just a matter of dumping it in and continuing on your merry way. You should always have a plan for your money whether it’s to be used to pay debt or invest/etc. That way when you win the lottery you don’t even have to think about anything ;)

We fell again too by $2700, so now we’re at $475,780…

All the smart investing people are down right now, because Mr. market, has a cold. NO worries I rather be down now, instead of not in the game. The dividends we get will buy us some cheap shares.

We had a negative September too due to the stock market. I’m OK with this because I’m finally buying some stocks at a lower value for once! We still had our regular 401k contributions, I upped my wife’s 457 contribution and we got rid of PMI on our house! BAM! Good month even though the market went down. :)

Well done, sir!

We have been so busy this past month, I don’t think we took notice of our net worth losses. Just trying to stash as much cash as we can, and keeping consistent with our 401k. Vee did get a 600.00 a month raise, and we have been selling our eBay items like hotcakes lately so hopefully we will have more money to invest if the downtrend continues. I was also able to get $175.00 paycheck by being a SWAT team extra in a new TV series, not much, but hey I’ll take the free food and TV time :-).

WELL THAT’S COOL!!!

Will you be letting us know when it’s out so we can look for you? Sounds like a juicy blog post in the making :)

Of course we will :-) The show doesn’t start until January so it will be a while considering I took part in the final episode.

Looks like almost everyone’s net worth has been dropped and they including myself and you care less about net worth drop. The reason is simple. We know time is on our side and as long as we keep save and invest wisely, the net worth will easily grow like there is no tomorrow. Mine dropped by 0.6% even though I have been growing my cash position for next year’s tax deferred investment room. Thanks for sharing!

Cheers!

BSR

I refuse to look at my investment accounts right now. I know the money is for long term but these short term losses are a punch in the gut. Like you said though, this money won’t be touched for years so it’s all good.

As long as you know where your $$ is and on track to improve, you do your thang :)

My husband also loss 9,000$ these past few months, but the market is going up again.. he is now only down 4,000$…

Dam Market! I also feel the pain. Lost quite a bit these past two months and it shows on my net worth too but I am looking forward to the day when the market returns and my so called on sale investments shoot up.

Do you have a link where I can download the excel sheet you’re using to track net worth?

Yeah, I use my budget spreadsheet to track it all (I built in a net worth section up top):

https://budgetsaresexy.com/budgets/j_budget_template.xls

Though the picture you see above is a bit different as I extract the #’s and then pretty it up for y’all :) You could easily change the colors and what not in the spreadsheet though for yourself.

I hope things are looking up for you this month! I just checked my balances, and things appear to be going in the right direction. Looking forward to your next update. $500K is in sight.