‘Sup voyeurs!

How’s your wallets looking this month? Anyone break any new records? Anyone hit early retirement and want to share all their secrets with us??? :)

We got pretty darn close to one of our major milestones – barely missing $500,000 by a few Gs – but it feels good to be back on top again after 6 months of wild swings in both directions… Our worth’s fluctuated by $60,000 over the past four months – pretty crazy!

But we’ve got a new high on the books now @ $496,016.17, finally topping October’s $495,297.66, and we’re ready to move forward into (hopefully) newer territory as we go… I pretty much feel like this guy right now :)

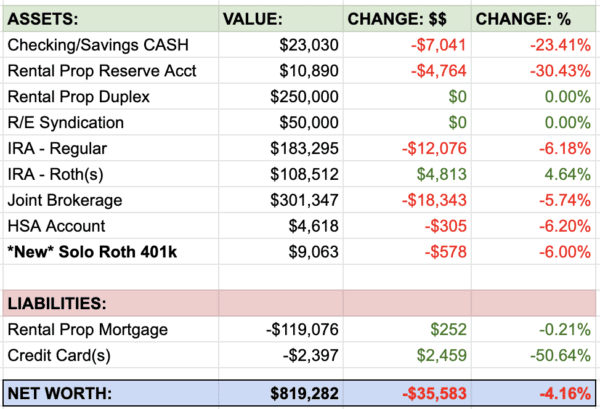

Here’s how the month of April broke down:

CASH SAVINGS (-$1,468.85): We took another hit this month, but on the flip side it was due to maxing out my Roth IRA for the 7th or so year in a row :) So we’d really be up $4,000 if it weren’t for that… And just like last year, I have to give y’all some major thanks for convincing me to do so despite my hesitancy with our low cash reserves going on. While we’re not in the best position in that department lately, I think ultimately it was the smart thing to do at least growth wise. But we’ll see how we’re feeling about it over the next few months ;)

DIGIT SAVINGS (+$607.85): We cashed out all $3,474.95 saved last month to help max out my SEP IRA, so this month marks a fresh start of filling it back up until it’s time to re-release it into the world again. Though I’m finally considering for the first time in years just funneling it right over to my Roth on a *monthly* basis and getting back to the dollar cost averaging route. Something I used to do before self-employment, but have since hesitated on since my income fluctuates so much. But hey, I always say that nothing has to be permanent so why not test it out again and then switch if need be, right? For those new to hearing about Digit, btw, here’s my review on them and why I love them so much. Digit: The Easiest Way to Save Money – Ever?

CHALLENGE EVERYTHING (+$236.89): Same deal here as with Digit – we cashed out all $2,103.45 previously saved via our Challenge Everything mission, so this month we’re back to filling it back up again and getting ready for re-deployment. Probably towards the Roth in hopes of maxing it out faster. I haven’t done anything new w/ our bills/Craigslist lately, so this $200+ is mainly dividends being paid back from work we did over a year and a half ago… Pretty freakin’ sweet!

BROKERAGE (ACORNS) (+$14.19): Nothing too exciting going on here, just Acorns doing its thing rounding up all our transactions throughout the month and dumping the difference into our brokerage account for us. You can learn more about them here if interested, especially if you’re new to investing and just need a bump to get started: Rounding Up Change + Investing It = Acorns App!

IRA: ROTH(s) (+$5,985.59): A nice jump considering the flat market this month! And again due to throwing in $5,500 to max out my Roth IRA for the 2015 tax year… It wouldn’t have been as exciting had that not happened ;)

IRA: SEP (+$2,440.30): See! Nothing too juicy when you’re not dumping anything in, haha… Of course, better being up $2,000 than being down $2,000 – though in the grand scheme of things it’s literally like only a half a percent difference.

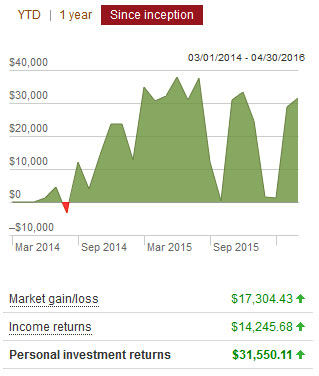

Here’s a snapshot of how our investments (VTSAX) has performed since dumping it all into Vanguard:

AUTO VALUES (-$17.00): Nothing crazy going down in this department either… Just what you’d expect in depreciating assets. Here’s what the values of both our cars look like – taken from KBB.com:

- Wife’s Toyota: $4,343.00

- Jay’s Frankencaddy: $1,000.00

LIABILITIES: No sir, not here! Been debt-free for the past few months since offloading our house (and mortgages that come along with it), and despite one hiccup of taking out a loan from the Bank of Mom and Dad and then paying it right back, it’s been a great feeling over all :) And also very weird only having to fill out one side of the net worth equation too… You just get so used to having stuff in those debt columns that it throws off the rhythm when they’re not there! Something I’m very much okay in getting used to though, haha… And hopefully you’re experiencing it – or will be soon – too!

Here’s how our finances have looked over the past year:

More humps! More humps, more humps, more humps! :)

Here’s how my two boys are doing as well… Never too early to start them on the habit!

(The extra $5.00 in baby #2’s account came from my darling mother who gave me a jar of change she’s been saving for our boy for a few months :) She picks a different grandchild to save for and this round was #2’s turn. How sweet is that? And yes – she’s been loving early retirement lately!)

And that wraps up net worth update #90!

Hard to believe how much can change over the years when you really hunker down… But you can’t fully appreciate it unless you’re keeping track of it all! So I hope you are!

If you’re new to the game and need some help, here are a few resources:

- The “Budget/Net Worth” spreadsheet – the colorful Excel template I personally use :)

- The “Money Snapshot” spreadsheet – a simple Excel template I created for my old $$$ clients

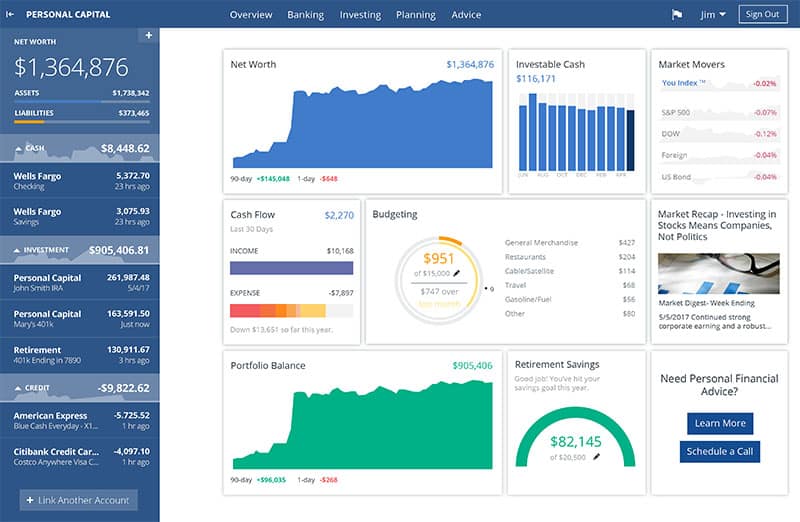

- PersonalCapital.com (free) – a great way to track your net worth AND investments. You can see our full review of them here: Why I Use Personal Capital Almost Every Single Day

- Mint.com (free) – the original lazy way to automate your budget/net worth

And as always, you can find every last net worth update we’ve shared on this blog here, as well as 200+ other bloggers’ worths on our ultimate net worth list here.

Everyone’s trying to grow their wealth in different ways, but the eventual goal at the end is always the same: financial freedom. Just a matter of figuring out the best routes for you, and then harnessing time!

Hope you guys had a great month too! Would love to hear any new ideas you might be working on over there :) XOXO,

——–

PS: Have you heard the joke about the jump rope?? Ahh, skip it…

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Nicely done! So if you included the 529 plans you’d be over the $500k mark?

Baby Penny and Nickel have great starts!

The Green Swan

I guess so, yeah!

I used to include them in there, but after a while it felt weird since it’s really *their* money at the end of the day… Even if they don’t end up needing it for school, I’ll still be handing it over to them to help out in life, so figured if it’s never going to me it probably doesn’t belong in there :)

So close to the $500k mark! And your baby’s pots are looking great as well :)

Great job J. You’ll get that $500k barrier this month.

Yeeeeeaaaaa buddy, excited to see you hit the half mil!

Any celebration plans for that milestone?

Probably some cheap beer at home!

I’ll pour some out for you… ;)

I have a question for ya. Are you able to calculate how much money you have earned vs how much interest you have accrued in the 90 months you have been tracking? Would be cool to see in a blog post for the 500k milestone

Hah – I like the way you think!

I don’t think I’d have the patience/know how on how to do that, but I would very much like to know that answer indeed :)

Kinda unrelated but not, I have calculated how much I’ve saved over my entire lifetime vs how much I’ve earned :) I called it the “Lifetime Wealth Ratio,” and while it’s definitely not scientific, it does paint an overall picture of how well you’re doing financially…

Check it out and run it yourself!

https://budgetsaresexy.com/2014/11/total-lifetime-earnings-wealth-ratio/

Nicely done, J! Slow and steady progress wins the game in this business. You’re a testament to how saving money and building wealth actually works, and you do it all without commuting into a drab office working an 8-5 job.

Well done, my friend!

Inspiring…if you can do it I can do it too! I have really just started working on the retirement slow and steady in the pass few years and love to see the growth. I have just reached a milestone with empty nest and expect that in the next 15 years to have a growth that makes retirement and some financial freedom within reach!

Congrats on your accomplishment & I love the boys savings pots too!

Thanks Lisa! You most definitely CAN do it indeed. I’ll be cheering for you on the sideline :)

Nice work J! Seeing your monthly net worth updates reminds me to check my account balances and update my spreadsheet as well. I just hit one year’s expenses in my 401k! And I saved up my 6 month emergency fund last month, so now it’s time to pay off my student loans. It will be nice to join you with 0 liabilities soon ;) Thanks for posting! You’re a real inspiration.

Wow, nice work! You’re doing better than me in the cash department right now – I salute you.

Pretty awesome, especially when you’re close to a milestone. Almost to half millionaire status! One difficulty I have with calculating my net worth is that I have a vested pension. If I stay until like 55 it will be pretty significant. However, after reading about early retirement/FI I day dream about leaving even earlier. I’d still get a pension at 55 but there will be big penalties. So while my net worth doesn’t look too impressive, if I add the pension in it, it would be a big boost. Just not sure how to value it.

For sure – a tricky one!

I agree w/ keeping it out of the net worth since it’s more of an *income* than it is technically an asset (though of course it IS an asset), and once/if it’s activated it’ll have a direct affect on your money/net worth at that point :) Most people would even say it’s better to have the cash flow than a high net worth since the point of everything is the cash flow to live forever and ever!

Hey J,

I tend to disagree a bit here. If you had a house you were renting that provided positive cash flow you’d view the net equity as an asset.

I’d do the same for a pension. Most people receiving a pension have the option to take it one lump sum (though that wouldn’t be too smart) so it’s definitely an asset. I use the 4% rule. If you were getting 40k a year from an invested 1 million one would say you’re a millionaire (whoo-hoo). A pension is just like that. And though you can’t touch the principal you can pass it on to a living spouse if you exit this earth. Pensions are extremely valuable and probably one of the reasons they are under attack by many people.

Totally agree it’s an asset for sure.

How would you track it in your net worth though? Do you include it in yours?

Andrew in regards to the pension I’m in the same situation. I use the 4% rule. If you had a million dollars and deducted 4% every year you’d get 40k. So if your pension is 40k upon retirement I’d value it at a million.

Congrats on getting this far! If you include the 529 plans you will be over 500k but then again that defeats the purpose of savings for your child’s education huh? Thanks to you I have actually began using Acorns to round up my money every month, I must say it is a pretty cool app. Nice to also see your retirement funds growing and your liabilities, oh wait you have none never mind :p. Good luck crushing that 500k mark this month! Look forward to the next post.

PS. Your rope joke actually made me laugh haha.

I’m glad someone appreciate it :)

Well done on utilizing Acorns too – I’m all about the simple easy wins.

Looks like in VA you can deduct up to $4k a year on state taxes for 529 contributions. That’s pretty decent, Maryland sucks at only $2500 a year per kid. Although its just state it still saves you a few bucks come tax time.

IDK how old your kids are but front load the shit out of those 529s (as much as is reasonable). Guilt your parents and in-laws into helping out as much as possible. Thanks to my Dad my 3 boys are sitting at ~85K combined. The Goal is to contribute 25K before they turn 5 and then coast at like 50 bucks a month there after. Whatever they get, they get. Hopefully, Ill have influenced them enough by that point in time so they realize in state schools are the way to go for undergrad. School name only matters for a professional degree and even then it depends on the field.

I am also going to provide them a (mostly) judgement free place to live when they are done schooling. My only Caveat is I will charge them rent, and that rent will be proof they are Maxing 401k and IRA and investing 50% of their net pay. As long as they do that they can live here till they get married.

WOAHHH!!!!

I am loving that idea w/ the rent/401k/investing!! So smart on many different levels… Those kids are gonna be killing it by the time they reach our old ass’s ages! Haha…

Yeah man, now I just need to figure out how to legally show income for them this year so I can open a Roth for each of them and let it compound for 60 years. I cant even fathom 60 years of compounding. Generational wealth here we come!!!

You are rockin’ it!

Nice dad joke – can’t wait to make my kids groan and get an eye roll from the wife with it. :)

Here’s to #500kinMay!

Great job and thanks for the continued inspiration.

We’re looking into starting 529 plans for our kids. My work doesn’t have those plans, so we would have to find an external provider, but we could still set up an automatic transfer from my paychecks.

And, I’m a huge fan of corny jokes :)

Corny? You meant “Awesome” right? :)

Congrats!

Downloading Acorn now :)

Let me know how you like it Sticky Wicket! (boy that’s fun to say)

good job and keep crushing it

Congrats! So close to 1/2 a mil!!!!!

We had our highest net worth ever in April. Planning for retirement before 55 (less than three years)! :)

You tease you!

Any chance of ever divulging it on your ANONYMOUS blog?? ;)

Are you going to celebrate the 1/2 mil mark? Thanks for sharing!

We don’t include the 529 in net worth either, as it isn’t really “our” money. I have started including the HSA account, though, since we have $10,000 of it invested (and growing tax free!).

I keep LB’s money as part of our net worth because until ze grows up and learns to be financially capable, ze doesn’t get it. I don’t want hir to grow up assuming ze gets hir paws on a huge stack of money as a reward for aging. If I’m doing my job right, that won’t be a problem but JUST IN CASE! I’m a cruel and ruthless mother that way ;D

In happier news, because I got an official appraisal, we passed a A Major Milestone number this May. Ten more of these and I may just relax and retire.

I’ve got some good ideas cooking right now that may change the course of our lives again, wish me luck!

GOOOOD LUCK!!!

But make sure you blog about it all so we can point and gawk! :)

Looking good. A little short of the big milestone, but you’re getting close. We are thinking of abandoning our 529s for our oldest two, who are about 15 months away from college and just piling cash in savings.

That must be a nice feeling!!

Some very decent progress!

Hos does that feel to have no liabilities at all? Must be great.

Nice work jm! Working on that liability portion myself. Things cleaning up for me and the Mrs. soon :) our combined 401ks will then be maxed yeehaw! Do you have an article you could recommend about tax and fee saving steps to take when early retirement happens? (How to get the money we’ve been slaving for all these years)? Keep up the good work

Yo!

Not smart enough to figure out all that myself, but fortunately two of my favorite $$$ bloggers have :) Check out these guys who go over allll the different ways to save on Taxes and invest better, and possibly even never pay taxes again!

http://www.gocurrycracker.com/

http://madfientist.com

Here’s a list of all my favorite Early Retirement bloggers too if it helps:

http://rockstarfinance.com/best-early-retirement-blogs/

Nicely done, should be crossing that magical half million mark pretty soon. :)

So close! Great progress! Your boys are doing impressively as well :)

Well done, J! Almost a half-millionaire! That’s super awesome! :D

Quick question. Does that graph from Vanguard actually show the value of your holdings in your IRA? Or does it measure something else? If it measures the value of your holdings, It seems weird that it’s almost gone to zero more than once after being over $30K since inception. This has always perplexed me. :/

It measures the *performance*. I.e. how well it’s done since moving money into it.

So in the two years since investing w/ Vanguard our investments went UP by $17,000+, and we’ve received “income” as well (in forms of dividends) of $14,000+ since. So in total, looking at that last line there of the graphic, our investments have “earned” $31,000 on top of what we’ve put into it over the past two years. So about $1,300/mo.

Now if only I could figure out a way to live off this amount ;)

Goooooot it! Thanks J. That makes a lot more sense.

If you figure out how to live off of ~$1300/mo., let us know. :p

Congrats on the net worth increase! I do have a question for you though. I understand the benefit on maxing out all retirement accounts, but when do you get to the point where you feel uncomfortable with your lack of liquidity. Right now you have 97% of your net worth locked up in retirement accounts. What if you need to buy a car, or your business isn’t going too well, or your kid gets really sick? I guess you could pull your Roth contributions penalty free and then pull any other retirement dollars and just take the penalty? Maybe I answered my own question. Just thinking out loud. What are your thoughts?

Very good question indeed, and one my wife tends to worry about a lot more than I in our recent stage here :)

But if either of those cases ever did happen, the short answer is that I’d just go out and get a loan/take on debt for the short term and then hustle hard to pay it off. While it would be annoying to do and cost more than using straight up cash, I don’t DARE pull anything from our investments as it’s 100% off limits in my head. I don’t trust myself crossing that line, and it helps me – at least in theory – be better about NOT trying to get into that situation to begin with. But again, if it does as life throws curve balls, I don’t have a problem at all going into debt and much prefer it than tapping retirement funds…. Those guys need time to marinate!

We’re moving in the right direction over here too (still in the negative, but creeping toward zero). When I first started on March 1, it was so depressing to see the big negative number. Now, it doesn’t really bother me at all that it is negative; as long as we’re doing what we can to move it in the right direction. That’s exactly what we’ve been doing each month.

Congrats Tonya!! That’s the right mindset to have too :)

I second the celebration! We celebrated for our first 100k (that first one is a bugger!) and when we hit half a million. We went BIG for half a million. I think it is so great to take the time, drop a bit of cash and look back on all the hard work that went into it.

Woohoo! Is there a half a million club? You’re almost there!!!! Stock market is finally in the positive (if only by a little) so I did well this month too!

Hey J.Money!

That’s a great result for the month . What happened in Jan/Feb to make your net worth drop so much? Did it have something to do with selling your house? Just curious…

Anyways congrats

Ray

Yup – getting our house ready to sell, taking a hit once it did sell, and then a MAJOR market crash on top of it all…. We “lost” $50k within a month – pretty crazy.

Kudos to you for the discipline and bravery to reduce your cash position to max out the Roth. Ten years from now, you will definitely be glad you did so.

It is pretty fun to read your past net worth reports and see how far you have come. Very impressive progress!

J. – This was my first week of retirement at 57. Not extreme early retirement but earlier than I had originally planned. I provided a guest post at The Retirement Manifesto that explained how we successfully closed the gap in the 5 years before retirement “Red Zone.”

http://www.theretirementmanifesto.com/journey-red-zone-true-story/

Great job on your net worth progress. It will just keep accelerating even though there will be some scary bumps along the way as you’ve already realized. Keep it up.

oh wow man, congrats!! that’s huge!!

going now to star this so I can read it later – sounds like a fun one :)

Congrats! You’re so close to that half a million mark that even I can taste it! :)

Very nice progress J Money. The re-allocation of cash/savings to income producing assets in your Roth IRA will pay some nice dividends in the future (See what I did there). Man you are so close to crossing $500k. Let’s have the market swing up for you so you can leap over that mark by the end of May!

Bert, One of the Dividend Diplomats

Niiiiice work dude. I predict full millionaire status within 2-3 years. Your money is going to work harder and harder for you!

Also, do you know of any other tax deferred way to save for kids? A 529 is a great option, but I’m trying to orient my kids to the idea of saving up for FI, so an account with a big spending goal (and spending requirement) is a little different. Thanks!!

Hmm…. I know some people opt for a Roth IRA instead for their kids? Can’t recall the exact rules off the top of my head, but other than just a normal brokerage account the IRA is the most often one I see.

Great job. You are getting very close to $500K mark. :) My goal is to reach $200K by the end of this year.

Keep up the great work and cheers!

BSR

You rocked it, J Money! You’re such an inspiration for so many.

Great job on your current financial progress! One question, is there a limit or income threshold on the amount you can contribute to both a roth IRA and sep IRA per year?

Yes to both!

There’s a limit AND a cap to how much you can invest into a Roth IRA depending on how much you make.

Info on income limits here: https://www.irs.gov/Retirement-Plans/Plan-Participant,-Employee/Amount-of-Roth-IRA-Contributions-That-You-Can-Make-for-2016

And info on the max amount you can contribute here: https://www.irs.gov/Retirement-Plans/Plan-Participant,-Employee/Retirement-Topics-IRA-Contribution-Limits

SEP IRAs are a bit different in that it’s tied to the amount of profit you business makes, but there is a cap to how much you can invest in it. More info here: https://www.irs.gov/Retirement-Plans/IRA-Based-Plans

But the nice thing here is that you CAN invest in both during the year :) So long as you’re following the rules.

Hola J,

Nice progress! Can you remind us again what the income cap is for being able to contribute to a Roth? I remember there was some limit, but I guess goes up a decent amount if you are married? I’m a no Roth guy largely due to not wanting to pay taxes up front.

Thx,

Sam

$5,500 max per person under 49

$6,500 max per person 50 and older

For single filers phase-out starts at $117,000; ineligible at $132,000

For married filers phase-out starts at $184,000; ineligible at $194,000

More info here (I cheated as who can remember all this stuff?? :)):

http://www.rothira.com/2016-roth-ira-limits-announced

I just broke a thousand dollars in savings this month!!! I know I have to get that about 500 times larger but it’s celebration worthy at my house.

And across about 95% of the entire country too! Congrats man! Gotta hit your first $1,000 before you can cross that $1,000,000 mark ;)

That’s one hell of a month. I love seeing success stories like this, especially when all but one of my friends thinks I’m crazy if I think I’ll be retiring by 50. Just goes to show how much they know really! Thanks for the tools man, I’ve been saying I’ll do this for over a month now, it’s time I got it sorted!