As with everyone last month, we took a big hit in the investment sector of our net worth. Totally out of our control, of course, but the same goes when times are good ;) Last month we were up $15,000!!! Haha…

Plus, it’s not like we’ll be *touching* any of these stocks and funds of ours anytime soon. We’ve got at LEAST a good 30-40 years before we’ll need that money, so def. no need to get our panties in a bunch just yet. We just keep our heads up high and go with the flow, baby! (and keep investing away while the prices are low!) Here’s how last month shaped up…

Net Worth break down: May, 2010

CASH SAVINGS (+$3,950.94): The was the one category we killed this month. All the travel expenses haven’t been factored in just yet (although most was already paid for with our tax refunds), but we should be pretty good w/ it all. Holding onto my 9-5 has def. helped the mission here ;)

EMERGENCY FUND ($0.00): Same ol’ $10,000 here as it’s been for the past 2 years. And hopefully another 2 years too which would mean we’re not going through financial difficulties! Or any disasters…

ROTH & TRADITIONAL IRAs (-$1,806.72): Bleh. Once we start contributing again these numbers will look sexy as hell…been almost a year since our last deposit!

401(k)s (-$10,536.47): Bleh x 5,000. But as I’ve already mentioned above, it’s all a part of the game! You have high months and you have low months – and hopefully one day in-between months like normal ;) I’m still chippin’ away at Operation Max Out my 401(k) too, but w/ the whole work drama going on it’s been a bit wonky lately. I’ll be writing a post on this stuff soon… Here’s how our 401k breaks down this month:

- Contributed: +$875.00

- Company match: +$0.00

- Market fluctuation: -$11,411.47

AUTOS WORTH (kbb) (-$135.00): Makes much more sense than last month’s increase of $200 something! haha…this time around it was my caddy who dropped a bit in value. As long as he’s still kickin’ Daddy’s happy though! Here’s how our car values break down:

- Pimp Daddy Caddy: $2,745.00

- Gas Ticklin’ Toyota: $9,250.00

HOME VALUE (Realtor) ($0.00): Still @ $300k as our realtor set it at a while back. I should actually write a follow up post on my neighbor’s house for sale I touched on the other week. There’s been some pros and cons to it so I’ll be sure to update you soon :)

CREDIT CARDS ($0.00): Another month at $0.00! I’m 99.9% confident it’ll stay that way too for a while. I leave that .01% open for me in case something sexy comes along ;)

MORTGAGES (+$4.79): Still haven’t paid extra toward any of our 2 principals yet – just can’t bring myself to do it. I know we SHOULD be paying at least something off every month, but w/ the vacay and me wanting to work for myself one day in the near future, it’s just not a priority. It really is the one area in my financial life that I hate thinking about. Here’s how they break down:

- Mortgage #1: $286,818.64 – 30 year fixed, interest-only @ 6.875%.

- Mortgage #2: $62,558.98 – Maxed out HELOC w/ 2.8% interest.

There you have it. A dip in our net worth due to the crazy market… But at least our savings and budgeting goals are on point :) And that’s really the whole idea behind these monthly updates – to keep track of your personal progress and to make sure your headed in the right direction. As long as you’re pimpin’ the stuff in your direct control, you’re doing well! And if you slip up here and there – well, that’s okay too. Being perfect is boring ;) Now get out there and make June magical!

—————–

PS: My budget has also been updated.

PPS: And so have my sidebars.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

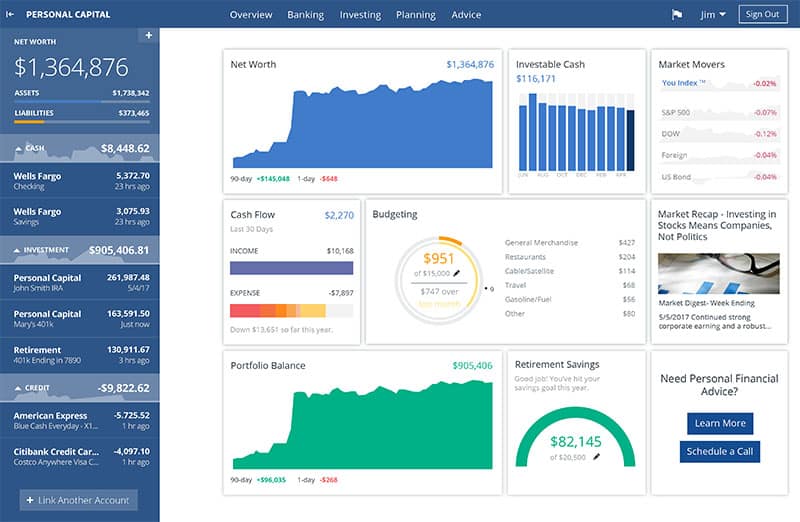

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Just a question J$, why don’t you use more of your cash to payoff your mortgage? It might decrease your monthly payments and hopefully you will speed up the repayment of your mortgage if you maintain your monthly payments.

Ditto to Home Loaners Q…if you pay off some more of your mortgage then each regular payment has an even larger impact on your overall net worth. Maybe I’m missing something (like you need the cash for something else…but that’s what the emergency fund is for, right?) Plus, you cash can’t be earning much on cash…

Also, question on the Emergency fund…do you take the interest out of it each month and put it in your general cash fund, or are you earning no interest on that cash (tin can in the backyard or something like that)?

It seems like a lot of people got hammered in the net worth last month. I escaped, but that’s just because i’m young and dont have a large position in the stock market (my “earnings” were flat last month) but my net worth went up because I paid off some debt! Im looking forward to next month.

Also, while you may say you SHOULD start paying down principal balances with your spare cash, It sounds like you want to start a business more. Good luck!

My net worth is down too, and it’s all the stock market’s fault. Well, mostly. I also spent about a thousand more last month than I normally do, so that may have something to do with it…

J, your mortgage balance is bigger than your home value. :-)

Got hit here as well in my retirement portfolio, but that comes with long term investing. On the plus side, I knocked some extra dollars off our CC debt.

Thx for that Pinyo ;) It blows!!!

RE: Paying off mortgages w/ our cash – I know it’s financially better to go this route, but emotionally and practically it doesn’t fit for us. If I ever want to work for myself 100% I’ll need a big a$$ cash cushion to make sure we’re a-okay. Plus, It’s much more exciting (and feels GREAT!) having so much cash stored away like that. You can always pay off your debts with it at anytime anyways if you really have to/want to.

And no – it’s not in a tin somewhere in my backyard ;) We have a majority of it in a money market account, and the rest in plain ol’ savings accounts…which, I guess is the same thing as putting it in your backyard really, but it works. The handful of dollars we lose in interest is WELL made up for in peace of mind and happiness. And yup – our emergency fund does accrue interest, I just don’t account for it here in the Net Worth as it’s mixed in w/ lots of other monies and I’m too lazy to break it down.

Hope everyone else’s worths are up!

The most impressive things that I saw are that you have $0 in CC debt, $10,000 in emergency savings and you saved almost $4,000 this month! Very impressive.

Question – Do you have a goal for cash savings? If so, will you aggressively pay down your mortgage after you reach it?

I know that you’ve mentioned that your company isn’t doing the best. Is that why they stopped matching your 401k contributions?

From 100% to 0%… that would not be pleasant!

Congratulations on a zero credit card balance. Keep it that way!

Hi. I’ve got a question that maybe somebody can help me out with? I’m sitting down this month to look seriously at our finances and work at making wise investment, savings, etc. decisions. Which is something my husband and I have been lackadaisical about. We just bought a house, though and a lot of our cash savings went into that. Anyway, its kind of the wake-up call we’ve needed to get in action re: personal finances.

Anyway, my question is related to 401Ks and IRAs. My husband is able to contribute to a matched 401K through his employer, which he does. We need to up it to maximum matched, I think, but otherwise ok. I work for the city and do not have the option of a matched 401K. I do contribute each month to a pension plan and the city contributes to that on my behalf as well. I have a 401A (or somesuch) that is not doing very much at all. I don’t even know if it is worth it to continue or if it makes more sense to focus on an IRA for myself? Or perhaps I should be pursuing both options? Does anyone have any suggestions? I am a total newbie at this and reading all the net worth accounts recently have made me think…

Thanks!

Wow dude, you losing over $10k in your 401k last month makes me feel much better about the $4k I lost in mine. It sucks and I know it will eventually come back but patience is not one of my strong points.

Money ain’t a thing J! It’s all an illusion except for the cold hard cash.

After today’s 2% move up, you’re back big bucks!

Sam

The market is on an emotional roller coaster right now, so I suggest everyone just steer clear! I’m just going to watch from the sidelines and cross my fingers that the markets go back up again.

Laura, most financial advisers will tell you to contribute to your 401k to get your companies match and then fund a Roth IRA. Please be careful about what specific types of investments you pick in your retirement accounts, they can make you or break you. Even though I’m anti investing these days, I would probably recommend one of the 3 big mutual fund companies for your Roth IRA, Fidelity, Vanguard, and/or T.Rowe Price. Oh, depending on the interest on your house, it sometimes is a good idea to pay it off faster than the typical 30 years most people do.

J. Money, like you there’s nothing like looking at a fat savings account. Especially after your recent work drama. I forgot where I saw it but someone mentioned having a 360 month emergency fund. That’s what I’m working on :) You should too!

Nice Recap. Seems as though almost everybody has been taking a hit in their 401k’s lately. For you and me however, I actually view this downturn as an extremly positive thing. The market could be down for the next 5 years and I’d be happy. Why? Beacuse I have (like you) 30-40 years until reitrement…All the down market means is that I am getting stocks for cheaper!

Also, Impressive emergency fund! That takes some true discipline to hold an emergency fund of that size for so long!

I wouldn’t pay that mortgage down aggressively either just because your goal/dream is working for yourself. It just makes sense to keep those cash reserves, and dreams are more fun than paying off mortgages :). Just don’t look at the interest section of your mortgage statements or you’ll feel the pull to pay it down!

@Khaleef @ KNS Financial – Thanks :) As for our cash sacing goals, I kinda and kinda don’t have a plan there. In general I’m trying to save save save for when the time comes to go 100% on my own & work for myself. So in theory, we’ll stop saving that much until that occurs. Now, if I don’t go down that path one day then no – no plans on what to use it for. Probably paying off the mortgages more than we are now, but def. not trying to do it aggresively. I’d much rather have $300k in the bank than $300k less mortgage debt, at least for now :)

@Darren – Yeah, it’s actually kinda convuluted right now but in a nutshell the 401(k) matches will be disappearing for sure. I certainly took advantage of it while it lasted :)

@Donna Freedman – Thanks! We certainly plan to.

@Laura – Hey Laura! GREAT questions indeed, and I’ll have to echo what StackingCash has already said – it’s always best to first contribute up to the company’s match in the 401(k) plan first. Then, if you have the leeway, usually the Roth is the next avenue but it depends on people’s personal situations.

To be honest, the first thing I’d do (after the 401k match) is build up a nice fat Emergency Fund. A few months worth of expenses, or maybe a nice round figure like $5K OR $10K, and THEN back to the investments. If you guys dropped a lot into your house, it’s more important to have liquid money you can touch NOW if needed rather than money in the future – does that make sense? Either way it’s great you’re looking into this stuff now!!! I started myself once we bought our first house so I totally get what you’re going through :)

@Single Guy Money – It’s a good thing we don’t need that money anytime soon ;)

@Financial Samurai – Haha, whatever you say big man. If I cash it all out now it sure turns into cold hard cash ;)

@Investing Newbie – Yeah? Oh man, if I had the money I’d invest as much as I can while it’s low again…a dream for those waiting to jump back in – at least I think so.

@StackingCash – Hah! 360 months? So basically the same as owning a home ;) Quite an accomplishment though! And great answer to Laura’s question too.

@myfinancialobjectives – Yup! Exactly. Our nest egg may go down a bit but we’re picking up future stocks cheaper! Pro and con to all, eh?

@Brian – “dreams are more fun than paying off mortgages” Love it! haha…I may have to tweet that ;)