But yeah – not a pretty site this month. The only category we’re continually doing well in is paying off our mortgage more each month. And I have still yet to unveil my master plan too! I think I have it all figured out now (hearing your thoughts on it all def. helped), but now I have to put it all down on paper. Which can be hard for me at times ;) This brain of mine can be tough to wrangle when I need it!

The other category for us to watch over the next couple of months is our cash. We’re still doing a pretty good job budgeting, and allocating our money in the right areas and all, but w/out the Mrs’ part-time job over the summer, our reserves have started to slip. We could still be cutting down our expenses more, but honestly the only things left are the *fun* stuff I don’t feel like changing yet ;) When you’ve cut down on all the rest, you gotta keep some for yourself or you’ll go bonkers! But now that her school has started back up again (she’s a Grad T.A.), the extra money will start flowing in and we’ll be back on the up and up again. And if not, then at that point we’ll hunker down more and change it up. Hopefully it won’t come to that, though.

Here’s how August’s Net Worth breaks down:

CASH SAVINGS (-$2,844.21): Not a pretty number, but we should be back on track again going forward. The Mrs. will have her job back up and in action, and I don’t plan on doing any more cross-country road trips anytime soon ;) Or family vacays for that matter. Though having pets can usually throw curve balls your way – those are the worst!

EMERGENCY FUND ($0.00): Sitting tight, just waiting for an emergency to happen. Though really, I don’t know what constitutes a true “emergency” for us anyways these days as we’d normally just dip into our cash reserves first. Back in the day this was all we had though, which def. made us feel secure. I guess something HUGE would have to happen and really throw us for a loop to start digging in here – not that I want to find out ;)

TAX FUND (+$1,860.00): This will be gone in about 3 days ;) Literally just sent in our quarterly tax bills so the counter will start all over again! I know there’s a better way to account for this (as to not show the constant ups and downs every 3 months) but I still like seeing the “sting” right now. Makes it more REAL to me, if that makes sense.

IRA: SEP (-$381.60): No extra funds added here this month. Just deleted from the daily courses of the markets ;) I still plan on pumping it full toward the end of the year though. Maybe sooner if everything remains super cheap?

IRA: ROTH(s) (-$1,900.42): Same here – nothing added. The only way I’ll be giving this guy attention is if I get an *extra* influx of money somehow down the road, and my SEP is already maxed out. Word on the street is that you can actually contribute to BOTH accounts each year, so if I get lucky then I’ll be investing like a mother up in here!

401(k)s: My 401(k) has gone bye bye!! The 401(k) madness has turned into an Ultimate IRA Game ;) With the total of all funds being shown below in my new Traditional IRA accounts.

IRA: TRADITIONAL(s) (-$10,754.38): Yeah, pretty drastic difference from last month’s $17,000 bump, eh? It’s months like these when you start to wonder a little bit, but I know that in theory it should all work out in the long run (and THEN some). So for now, I remain patient and excited to watch it grow grow grow at some point down the line. Gotta have faith, baby!!

AUTOS WORTH (kbb) (-$580.00): Meh. As to be expected, right? I still haven’t looked into my Caddy’s AC yet, but I have a note to call my mechanic friend who sold it to me back in the day. I have a feeling it’s going to be an expensive one, but at least I’ll then know 100%. And it’s also good that Fall is right around the corner!! My favorite season, I love it!

- Pimp Daddy Caddy: $2,470.00

- Gas Ticklin’ Toyota: $10,825.00

HOME VALUE (Realtor) ($0.00): The same $300k our realtor set it at last year. I considered calling him up to ask about rental prices, etc, if we went down that route later, but figured I’d wait until I was more serious as to not waste anyone’s times. As a former realtor, I know I’d certainly appreciate that. So for now, we leave this at $300k until we get an update later. Zillow is too crazy for me…

MORTGAGES (-$430.36): Operation Refinance continues to do it’s job! Every month an extra $300+ gets knocked off the principal just by paying our normal mortgages each month :) Then with our rounding up to the nearest 100th on each loan, we are adding in a little more as time goes on. Still not enough to get rid of them a lot faster, but when my master payoff plan is in effect that’ll change real fast. Coming soon, I promise!!

- 1st Mortgage: $288,821.93 – 30 year conventional @ 5.5%

- 2nd Mortgage: $61,859.24 – Maxed out HELOC @ a variable 2.8%

And that’s that. Another month, another chance at improving our situations. How did you all do? Anyone beat the markets last month? Anyone working on something SUPER awesome that we should all pay attention to? If you got any tips, we’d love to hear ’em :)

In the meantime, keep on watching that money!

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

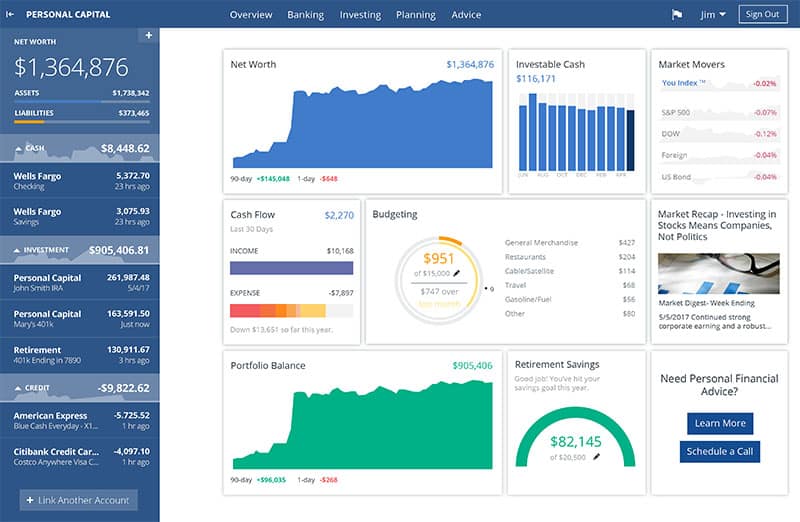

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

I think that I am going to have to take a break from looking at my Roth IRA and Traditional IRA account balances for a while. I just wanted to absolutely throw up this month. I think that I’m going to start tracking my net worth on a quarterly basis instead of monthly to help calm my blood pressure. What do you think, J? Have you ever thought about giving the update a rest for a month or two and not looking at it? Or, do you like to focus it brings to your situation, goals, etc.?

It is hard. I haven’t started tracking my Networth yet (at least more than what’s in my head as I see evaluate my success with my budget), but the market can sure put a damper on things. I almost agree with Hank that it might help to not look at it. On the other hand, it sure makes the months that it goes up feel really good.

Nope, not beating the market here, although my 401(k) DID go up over the last month. However, I am actively contributing, so that helped counteract some of the badness in the markets. I still track my net worth, but I’m not letting the bad news derail me. I celebrate the successes, like how my total debts have decreased every single month this year!

What IS depressing is the Zillow value of my house. I’m thinking I should do something like you J$, and hold it constant at some number rather than let it sit where it is now. Based on a neighbor’s house that sold a few months ago, I think my value should be about $30-40k higher than what Zillow estimates. Not planning to sell for at least another couple years, so it doesn’t really matter, but still!

@Hank – I don’t blame you brotha, it def. gets feisty up in there! Personally, I don’t mind the ups and the downs cuz I know to expect it every month. And honestly I’d probably just give up on tracking it if I switched to quarterly cuz I’d just get out of rythm and turn lazy (and/or forget). It’s worth it to me to keep tracking every month so I can watch the progress and easily look back and compare any months I want :) It’s annoying, and scary sometimes, but it’s all a part of the game. I’d be singing a different tune though if I couldn’t stand the crazy. (so you should def. do what works for YOU, my man)

@20’s Finances – Haha, that’s true :) And that happy feeling lasts all month too! Do you think you’ll start tracking your net worth soon? I always *thought* I knew my overall worth in my head, and where all my money was, but when I sat down to start recording it I was wayyyy off. And not for the good! Haha… at least you’re budgeting though, I wasn’t even doing that a few years back ;)

@Jenna – YES! That does help – incrementally adding in every month – ESP when things get lower! Buy cheap, baby! :) (and I hear you on Zillow – it literally changes every other day. I don’t think it’s accurate near me, but really it all depend on what you’re tracking it for.)

Just posted mine again on the 1st, it went up $2,998.68. That’s mainly because I started counting the ‘Operation SUV’ money. We also saved some, put some in our Roth, invested a little and paid off about $250 on the Evil Credit Card (whose balance is now under 1k). 401k is constantly losing money and it’s hard to think “long-term” sometimes—especially when all the money you contribute each check is kinda just disappearing and then your balance STILL drops. But I’m happy it went up at least. :-)

Nope, we are hurting pretty bad with the crazy stock market. It’s all right though since we’re in for the long run. I took the opportunity to pick up a few dividend earning stocks so it’s not all bad. I tend to ignore net worth when the market is down though so I don’t know how much I’m down by.

Sorry to hear about your drop in net worth. Hopefully you’ll bounce back soon!

I did my net worth a couple days ago:

http://www.myjourneytomillions.com/articles/september-net-worth-updatenominated-for-plutas-edition/

I still grew but like you my retirement account got SMASHED! So frustrating, but like you said it should eventually work out

Much like your update, mine involved a nice chunk of stock market-induced loss. The hardest part to swallow was that I paid an extra $1,300 to my mortgage and put over $2,600 into savings but I still didn’t see an increase due to the tanking of my retirement funds. All I keep telling myself is, “buying when it’s low, oh yeeeeah.”

Sorry to hear J$. However, don’t play just stay – in the long run it will be OK. I don’t have this – conservative pension schemes have their advantages; particualrly in bad times. Look after self and wife.

You’re a former realtor?? I learn something new about you everyday, J. Mo …

Anyway, if you want to know rental prices, just hop on Craigslist and look for some comps. 5 minutes — done! That’s how I figured out what to charge for the triplex that I own. (I actually dug a little deeper and toured a bunch of rental units in the area under the guise of a prospective renter, but everything I saw corroborated the conclusion I reached after a 5 minute Craigslist search for comparable rental units in the area).

You’re not being honest with yourself if you don’t update your home value. None of us want to admit it, or accept it, but the fact is values have dropped. You’re not doing yourself any favors by continuing to use an inflated number to determine your networth.

I feel better knowing that I am not the only one whose networth is going down despite diligently continuing to save!

I make it a point not to look at our investment net worth more than quarterly, as the markets in the short term are characteristically volatile. with a smart asset allocation, in the long run you should grow your wealth nicely. Good luck.

@Jen @ Master the Art of Saving – Yeah, that’s great – you guys are really on a good roll there :)

@retirebyforty – Long term thinking is where it’s at. I don’t dwell on the craziness too much, but I still like updating these every month to see how its’ going as time moves on. It’s fascinating stuff at the very least.

@Jenna, Adaptu Community Manager – It always goes back up at some point ;) And until then, we can always buy low!

@Evan – Congrats on paying off your car – that’s awesome!!

@Happy Homeowner – haha, yup! that *does* suck when your overall worth doesn’t go up like that though – I TOTALLY get it ;) imagine how much lower it would have been though w/ out those bumps?

@Maria Nedeva – Yep, always do my friend!

@Paula @ AffordAnything.org – haha, nice. yeah, once we get super serious I’ll def. be doing that for sure – just not in our immediate plans yet.

@Ludlow – I agree, except that I don’t think Zillow or the other tools out there accurately reflect it. So I’d rather have it at the price my realtor said he’d sell it for than marking it up down $15k-$45k as Zillow likes to think it fluctuates. I already dropped the value down $60k as soon as I got word from the realtor, so I think we’re fine for now.

@brooklyn money – We’re all in this together, my friend :)

@Barb Friedberg – Yeah, I’m too impatient to look every quarter ;) I get the reasoning behind it though, whatever works.

I love the transparency. It really helps people (like me) who know I need to start budgeting better – but need a solid step to start at.

I think there should be a Personal Finance Makeover (like HGTV) and I volunteer to be the first guinea pig.

Anyhow, thought you all should know that you’re all inspiring.

-Soam

Thanks dude. It’s really good to keep myself on track (and accountable) too ;) See you the blogger conference?

It’s good to know I’m not the only one going through the down turn. @Jenna. To ease your mind a bit on real estate prices. There are always the highest during the summer, then drop for the winter and go back up again the next year. Just hold tight.

Stock prices tend to do the opposite, dropping during the summer when people go on vacation, then coming back up over the winter. Unfortunately, they seem to be full of flux this fall. But once again fear not, the will go back up, now’s a good time to buy!

Heck yeah it is! Stocks and homes are cheap as hell!

@Soam, OMG, Personal Finance Makeover, that’s a great idea! There’s nothing like that out there that I’ve seen. Now how do we make it sexy… hmmm….

I think we all know how to make it sexy ;)