What’s poppin’ y’all! Welcome to a fresh new month to make that fresh green dough! And what a better way to start it out than the last go around, jeez… I can take a $50,000 hit once, but back to back? I think I’d faint :)

Though is it me, or is it super eerie that the markets almost completely broke even this entire month after the crazy that occurred back in Jan? Perhaps the quiet before another large storm?

I actually wouldn’t mind that at all, if I’m being totally selfish here. This is the month we max out our main retirement account (SEP Ira) and would love to scoop up more of that precious VTSAX while on fire sale… We don’t dollar cost average since the amount we can invest is based on my businesses’ fluctuating income, so I’m always super anxious and excited to jump right in as soon as our taxes for the year are completed. Which if all goes well should be about this time next week – woo! And yes – I cheat and use an accountant! :)

We’re now into month #2 of not owning a home anymore too (SCORE!) and to say I feel free is an understatement. It’s so great, in fact, that I still keep both sides of the equation there in the net worth just so I can keep salivating! Haha… Isn’t it so damn pretty? :) No mortgages or debt or anything?? I’ll cut it out next month just to move on with my life, but man – still counting those lucky stars we found that buyer in the dead of winter. Could have gone the opposite way for sure!

And speaking of debt, you’ll also notice we haven’t activated my parents’ kind offer yet to shore up extra savings while we transition into new territory here (offloading the house gave our cash reserves a serious beat down). We’ll be finally making a decision on that too as soon as our tax stuff gets wrapped up… I know it sounds silly to take out a loan just to keep more $$ in your reserves, but similar to our Would You Rather last week it all comes down to personal decisions in the end. And in some cases, maybe even keeping your significant other happy ;) Is there a way to factor that into your net worth?

Now on to February’s $$$ break down!

(FYI – To all new people here, I do these every month to not only hold myself accountable, but to also share real-life snapshots of someone’s finances since you hardly ever see it in the “real world.” We’re all in different phases with this stuff, but hopefully it motivates you to keep on pushing hard, and at the very least to *start tracking your net worth* as well. You can check out the tools at the end of this article if you don’t know where to begin.)

CASH SAVINGS (+$2,239.13): Yes! Finally going in the opposite direction for once – love it. A dual combo of great business income mixed with not pouring our money into our house anymore… And while March doesn’t look *as* promising for income as yet, it’s now nice knowing we automatically save a good $900ish each month we no longer own. I should start putting THAT into our Challenge Everything account – hah!

DIGIT SAVINGS (+$64.30): A nice little bump here as well. Just my Digit robot friends doing their thang and pushing over small amounts every few days knowing I won’t even notice they’re gone. That’s the best part of it all – your savings grows without even lifting a finger! You can check out my review of them here if you have no idea what I’m talking about…

CHALLENGE EVERYTHING (+$555.33): The biggest of Round II! We got a couple of unexpected checks this month – one from Ebates (thanks wife!) and one from our mortgage’s escrow accounts (thanks J$ for getting rid of it!) – so in true fashion we forwarded it all into our Challenge account before we were tempted to place it anywhere else.

I know I’ve said this before, but one of the best things about separating out *extra* cash is that it only goes UP over time since you’re not touching it! So stupidly easy, yet hardly anyone ever does it. So if you’re looking for new ways to try and save more, give opening up a separate account a try and see how it goes. And a quick *hi* to all those coming over from my Business Insider article! This is further proof of how powerful experimenting can be! :)

ACORNS (BROKERAGE) (+$16.65): Nothing too exciting going on here, but always nicer to see a green change there than a red one. So we’ll take it and hope to watch as it continues to grow over time by rounding up all our purchases for us… Another excellent way to save without doing a thing! (Full Acorns review can be found here)

IRA: ROTH(s) (-$71.90): See what I mean about nearly breaking even? We have $60,000 invested and it only moved by $70! Haha… I’m telling you… the quiet! :)

IRA: SEP (-$137.18): Same here too – but even more drastic. We’ve got $330,000 invested into this bad boy and only watched it tick down by a mere $130 bucks… Excited as hell to dump more cash into it this month and help turbo charge it some more! Here’s how our $$ has performed since moving over to Vanguard almost two years ago:

AUTOS WORTH (kbb) (-$205.00): Down down down as cars tend to do… Nothing special to report here, other than my Caddy still working despite its age and the random wintery storms that come and go on a whim (so freaky right?). Here’s what our two cars are roughly worth via KBB.com:

- Plain Jane Toyota (wife’s): $4,203.00

- Frankencaddy (mine): $1,000.00

HOME VALUE (Realtor) ($0.00): Bye bye house!! Hope you’re having fun in someone else’s net worth now! :) I suppose it’s a little misleading though saying the home’s value is worth $0.00 when it’s actually still worth $300k whether I own it or not, haha… (either that, or I just ripped someone off!). Regardless, we’ll see a clean new slate next month here and officially wave goodbye forever… Awww….

MORTGAGES ($0.00): I am going to miss that sight, though :) One more time for good measure:

- 1st Mortgage: $000,000.00 (30 year conventional @ 5.5%)

- 2nd Mortgage: $00,000.00 (HELOC @ variable 2.8%)

Later on old friends!

And now how the past year has gone…

And the net worths of my two darling boys who will one day be embarrassed that I call them Baby Penny and Baby Nickel to the world here :) But that’s what dad’s are supposed to do, right?

By the way, you can see a list of all my net worth updates over the years here.

And also 200+ other personal finance bloggers’ worths here.

And that wraps up net worth update #88! The mission to a million dollars net worth – and beyond – continues forward, woop! Hopefully yours is humming along nicely too. Would love to hear about them and all the tricks you’ve got up your sleeves! Share ’em below so we can all learn!

See ya in the comments,

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

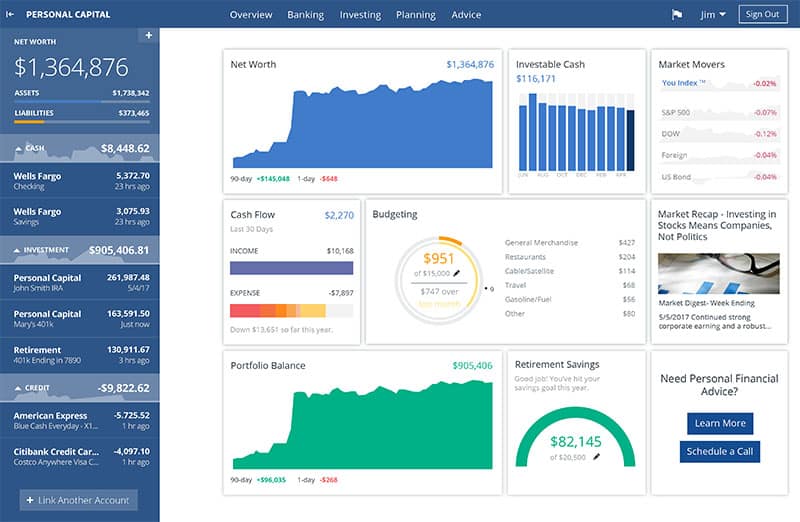

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Wow – that’s not as scary as I thought it would be. I can’t even imagine how awesome it must be to have NO DEBT in the liabilities column. Well done you!

I was so inspired by your Challenge Everything series that I’ve begun to separate all the extra cash and you’re right – it’s really rewarding because it only goes up. It motivates me to get rid of stuff I don’t need just so I can build up that account.

I plan on updating my net worth tomorrow, after skipping the past 2 months due to lack of time. I know it’ll be bad, especially with a vacant rental property and recent retirement account performance – but I have a roof over my head, food on the table, enough money to survive my worst case scenario and most importantly I get to spend time with the people I love most every single day. Can you tell I’m trying to focus on my blessings? Haha, life is a trip, that’s for sure.

YES!!! Many blessings over there – very smart to focus on :) None of the retirement stuff really matters much in the short run anyways since we’re not gonna pull from it for forever… Just an overall good thing to know, particularly for $$ nerds :)

Let it sink in, you don’t have no Liabilities! Damn wish I could say that. Let the savings roll in! I happen to see the BI article when surfing around the interwebs. I saw the headline and said to myself that sounds like J$ and sure enough it was.

Haha, yeah – it was pretty random that it went live now after being like 6 months old, but hey – we’ll take it! It later got placed on the front page of Yahoo which was crazy for stats!

Will be ready to crack a beer open for you once you hit $0’s in the liabilities section too :)

We went from $145,667.12 to $148,773.62, a net gain of $3,106.50.

BOOM

Wow, having absolutely no liabilities must feel incredibly freeing! Someday I might really enjoy not owning a house, but for now it’s my way to afford living in East Nashville. So thankful I bought back in 2009 because I’d be priced out of here now :)

No shame in that! You’ll be building equity while I’m still paying rent ;)

Keeping your significant other happy…maybe there’s no way to figure it into your official net worth, which is pretty numerical. But, ya know, if you consider what marital problems can cost you, it’s still an important consideration. You might consider it a form of insurance, keeping you safe from catastrophic loss. (pretty sure you got an interesting blog topic there.)

Hahaha… INDEED!! Brilliant! :)

Congrats on a great month!

Thanks Amy – hope yours is going well too!

Awesome! I am pretty young so my current net worth is on the low end so paying off debt should increase my net worth every month. The hardest will be probably going up when I have no debt. Thanks for your post! I look forward to these every month!

I love that part about paying off debt – immediate return on your money :) Just do your best to automatically xfer the monthly payments over to savings/investments and you’ll be just fine!

Wow that’s awesome. No liabilities :)

As someone who’s still in a house she owns, I envy you. Nothing has broken around here for a couple of months, so I’m just waiting for the other shoe to drop. That’s what we get for buying a late ’60s house with older appliances. But it serves us well and was cheap (at least initially, ugh), so I put up with it.

I know – that’s the worst part :(

Nice job! We were basically flat in February. Our digit is now almost $1,500. It’s amazing how much we’re saving without noticing. I haven’t tried Acorn yet. Will keep them in mind.

Rock on!

Nice to see that net worth number bumping up again (and considering their ages, your boys are doing quite nicely too). I’m excited to see how much you manage to dump into investments come April. Good luck!

So many green items! Love seeing all that green! And congrats on the BI article.

We’re still down this month by a little bit but no big deal, it’ll come back up as the market evens out. I’m a little disappointed that I didn’t move more cash into our TradeKing account in time to take advantage of the market dip. ;) I’m making a big push to get more invested for dividend growth and income.

Don’t worry, it’ll all crash again soon :) And again later… and again after that, haha…

Great update J. Money! You have inspired me to start keeping track of my net-worth and blogging about it as well. I really enjoy your site and your posts. Thanks for keeping it real!

I also really enjoy your podcast! Keep up the great work.

Thanks so much Nick! Congrats on the blog and for tracking your net worth – love to hear that :) I guarantee it’ll grow a lot faster now that you’re paying attention to it more… It slowly creeps into all your micro-actions throughout the month. Like a disease! But a good one! :)

Good news! And thanks for sharing, it really does provide motivation to get my finances together and set high goals for my family.

Yes, they will be embarrassed, but it is your job :)

Congratulations on another article for BI! :D

We were down $5K because it was time to pay the tax man. We owed about $10k in federal and state tax this year over what was withheld from our paychecks, largely because we moved some pre-tax money into a Roth (and our income was high enough for the year to start phasing out personal deductions, which I hadn’t calculated in — d’oh!). This all means I’m going to have to figure out what to pay in estimated taxes this year, too. Oh well, on to March!

Overall good problem to have! :)

Impressive! I’m looking forward to March. Bonus time in the working world. We are going to be upgrading to a micro van Mazda 5. I can’t wait!

Definitely something I would miss if working on my own though.

Bonuses! Forgot about those beautiful things… and that sweet paid time off, 401k matches, comped healthcare, damn. Doesn’t sound too bad working for The Man again! Haha…

Awesome! Great to see it go back up and nice cash savings:). AND no house debt!

Glad to see it moving in the right direction again. My investments are pulling out of the red as well and it is very satisfying thing to see.

Thanks for sharing this each month. It reminds me that I should be doing this. It’s hard to start when you know your net worth is going to be negative. It will suck now but will awesome to be able to look back and see it go from negative to big whopping positive. Ugh! Reality is holding me back.

I just figured mine out. It’s about as bad as I thought. Definitely have some work to do with -$71,277.21.

Don’t worry. 4.5 years ago I was -$141,000 (with $158,000 in student loans). Now I’m +$61,000 ($71,000 in student loans). Small and medium changes lead to a life overhaul. Plus a company 401k match sure doesn’t hurt. :)

Good job!!!! You’re gonna feel SO MUCH more empowered knowing exactly where you stand now! And if you think about it, this is actually the hardest step in the process – facing the facts. It only gets better from here so long as you keep working on improving things :)

Great month J. Money!

I was thrilled last month when I was finally able to convert my VTSMX account with a 0.17% expense ratio to VTSAX with a 0.05% expense ratio because I finally had over $10,000 in it.

I have a looong way to retirement, but these little steps help!

Hell yeahhhh it does – congrats!

I’m constantly being tempted to seriously look into selling our house and investing the revenue from the sale (we have a nice buffer of equity) All the reading on opportunity cost has me running the numbers constantly plus I think either buying a smaller home or renting a home will cut my housing expenses significantly. My largest dilemma right now

As for the Vanguards on “fire sale” , I transferred all my cash holdings and allowable transfers over from other RRSP accounts into my Vanguard ETFs over the last month plus buying extra for the end of my tax season. So with the shuffle and dumping my savings into the account I just added nearly $89K with the good people at Vanguard. Of that $65k was moved that took me from a 1.45 MER to the vanguard 0.19 !! That alone show net me 1% growth this year and love the projection of now of $4400 in yearly dividends to reinvest as the year grows.

Let’s wait and see how the world oil markets perform and of course the US election can always play with the numbers too.

Great job on your part J and look forward to seeing the changes in your assets now that your liability side is offset

Way to go man! Love hearing about cash infusions into Vanguard – one of the best feelings there is :)

Totally hear you on the house stuff too, obviously. You’re definitely right on the opportunity cost part, though mainly for me it was more about cutting off the responsibility and mental attachment of something I no longer cared about. It would be an even bigger win coming away with $$$ or even downsizing and saving $$ there too! So of course count me in on the side of you making moves :)

Hey J. Congratulations.

I am listening to your podcast and enjoying it. I love the one about blogging. I have been blogging for two years now and this year I am planning to take my blog to a higher level.

Here is my net worth as well. I went up by $1,025… http://www.alainguillot.com/net-worth-march-2016/

Thank you for keeping me accountable.

Congrats Alain! So glad you’re enjoying the podcast too! Really trying to go out of my comfort zone there with that project, it’s a whole new/weird medium to me :) Keep pouring your heart into your blog over there – the more real and fun you can have with it, the better shot of success!

I really like your monthly net worth reports, particularly that screen from Vanguard that shows how your capital values fluctuate like crazy, while your total dividend income is just super chill and stable, and just keeps accumulating..

Would you be interested in sharing your quarterly dividend income from now on? ( since your VTI pays quarterly dividends, it may make sense to do so). You may find that income stream to be super stable relative to the stock prices ;-)

Interesting! As odd as it sounds, I rarely pay attention to that part? But you’re right – it’s sexy as hell and I should! :)

Sweet post buddy! Thanks for sharing so much info.

Do you think you’ll ever own another house? Or are you a renter from now on?

I’ve owned a couple of houses but currently rent. I’m torn on whether or not to ever own again. I’ve seen some pretty compelling arguments for renting vs. owning.

Thanks!

I would if the stars aligned, sure. I’ve learned over the years never to say never :) (Or to block out any opportunities even if you weren’t on the hunt for them!)

The biggest factor in it all will honestly be my wife and kids… it can very easily be 3 against 1 so might not matter what I want deep down anyways, haha… And if we’re staying in one spot for the long term? Sure – might make sense. But as of right now I’d rather punch myself in the face than get another commitment going like that, ugh.

Can’t help myself from checking in every now and then to see how you’re progressing. There’s something compulsive about progress reports. I don’t know how you can resist having zero liabilities. I’m always looking to increasing our leveraging and loans. Not to extreme levels but to comfortable levels. The greater the gross amount of assets you have working for you, the great the potential returns. Has worked amazingly for us so I hope you’ll do something too and then I can see in a few months or a couple of years time that your net assets are at $1m. That would be cool.

I’m not opposed to leveraging debt for growth – I did it for 3 years while growing my old blog empire! (well, not debt, but scooping up online properties for better returns) – just don’t have any decent opps to take advantage of it right now… Always have my eyes open if you want to pass something interesting my way? :)