What up what up $$ lovers! You been tracking your net worth over there like good little boys and girls? You know it’s the best way to measure how well you’re doing financially right? Whether you’re paying off debts or saving or investing or building a mini hustle empire?

Well if you don’t, now you do. And don’t make me reach through the screen and shake it outta you ;)

As for myself, this marks month #87 in a row we’re tracking it and it’s been quite the ride so far. Here is what it looks like in a picture:

A damn good way to keep motivated, am I right? And it wouldn’t exist if I stayed lazy and never started tracking… To say it’s been a complete game changer is an understatement.

Anyways, this month wasn’t as sexy as the last one when we gained $17k (!!), but nonetheless it’s all a part of the process and you keep doing the things that you have *control* over and brush the rest off. In the end it’ll all trend upwards if we continue working hard at it!

When you track your worth you can also calculate other fun things such as:

- Your Early Retirement Number — As of today, the calculations say I can quit working if I want to when I’m 53. Similar to last month, but an entire year LESS than where I was the month before that. Which I know because I check once a month!

- Your Lifetime Wealth Ratio™ — This one gives you an idea of how good you are at saving/growing wealth. You divide your net worth by the total $$ earned in your lifetime as reported by the Social Security Administration (it’s not 100% accurate but that’s fine) and it pops you out your %. The higher the better. Right now I’m at 57.5%, which is better than the 55% it was at last November when I first made this ratio up. Granted the SSA website hasn’t updated 2015 earnings yet ;)

Point is, when you know where you stand financially you can forecast your life and goals a lot better. And more accurately, for that matter. So make sure you’re keeping an eye on it! Whether it’s in the negatives or in the millions!

Okay okay, I’ll stop harping on you now… :)

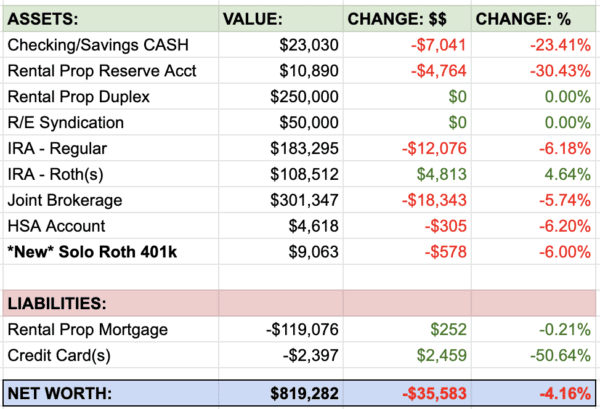

Here’s how March broke down…

CASH SAVINGS (-$12,927.36): This looks damn scary, but it could have been scarier had we not dumped $11,000 of it into maxing out my SEP IRA for the year ;) I finally got around to doing my taxes (or, rather, having my accountant do them – best $$ spent EVER!) so it was time to pump that IRA up and save thousands that would have gone straight to Uncle Sam. So our cash reserves gets sliced even more, and now we’re really starting to get to shakesville. Which is good that my wife will be all done with her dissertation this month and can go back into the work force after 5 years – OMG!!!!!

BROKERAGE (+$124.24): This one is up, but only cuz I started using Acorns to increase my non-retirement holdings of which $140+ was invested and dumped in here. We actually lost money in this department return-wise, but of course it’s all about the end game…

Here’s how my two accounts/experiments here now break down:

IRA: ROTH(s) (-$348.47): Nothing new added here unfortunately, though I am debating on whether or not to take out another $5,500 from our cash reserves to max it out before the 15th hits?? It’s not the safe thing to do right now, but I haven’t missed maxing it in over 5 years! Ack…

IRA: SEP (+$9,963.31): BOOM! That’s where all our savings went :) Although similar to our brokerage accts and Roths above, we actually lost money return-wise but dumped in a lot to max this guy out for the 2014 tax year. Something I wait to do until my biz profits is finalized so I know exactly how much we can invest here (SEPs are tied to profits). Still, it’s nice that we have another $10Gs now actively invested vs sitting in my savings account waiting to come out and play. Looking at our Early Retirement Spreadsheet again, you can see how much of a difference it can make!

Here’s a snapshot from our Vanguard account that’s now almost a year old, wow! That was fast!!! And of course all of this $350,000+ is in the index fund, VTSAX. Which I’m still very happy about.

AUTOS WORTH (kbb) (-$493.00): A sizeable drop in value on my wife’s Toyota, while my pimp daddy Caddy stays flat at $1,000 which I just keep at and have stopped tracking with KBB… It’s been dinged up quite a bit these past three years, but it’s still driving strong!

Here are the current values:

- Frankencaddy: $1,000.00

- Plain Jane Toyota: $5,398.00

HOME VALUE (Realtor) ($0.00): This still remains the same @ $300,000 as we only update it when we talk to our realtor and ask him to run comps for us… I’ve tried using Zillow and other places but it’s too wonky for my blood. And it doesn’t really need to be exact until the time it comes to sell anyways :)

MORTGAGES (-$695.64): Never gets old seeing these numbers! We round up to the nearest $100th with every payment (or, actually, the 2nd nearest $100th so it adds even more!) and it’s become such second nature that we don’t even realize we’re paying extra. Until we run these net worth reports and I’m happily reminded so :) One of the best habits we’ve taken up.

Here are the balances left on our stupid mortgages:

- 1st Mortgage: $267,303.40 (30 year conventional @ 5.5%)

- 2nd Mortgage: $26,536.11 (HELOC @ variable 2.8%)

And that wraps up another month of $$$ tracking!

Here’s how we’ve done over the past 12 months… some ups, and some downs:

And here’s how our boys did ;)

You’ll see some similar cash to investment ratios going on there too… That’s because we take out a chunk of their savings from over the year and invest it into their college 529 plans to better grow over the years. Better in the markets than sitting there twiddling its thumbs! And great for tax benefits too :) (We go directly through our state who fortunately encourages this stuff)

So there you have it. Net worth #87 on the books now. If you’d like to see #’s 1-86, you can do so here: J’s Net Worth Tracker. And if you don’t like the way I track my money, you can see how 150+ other bloggers do it here: Blogger Net Worth Tracker ;) It’s not scary once you get started!

Happy April,

——–

PS: As always, my favorite ways to track this stuff:

- The “Money Snapshot” spreadsheet – a simple Excel template I created for my money clients

- Mint.com (free) – If you’d rather have it all automated for you

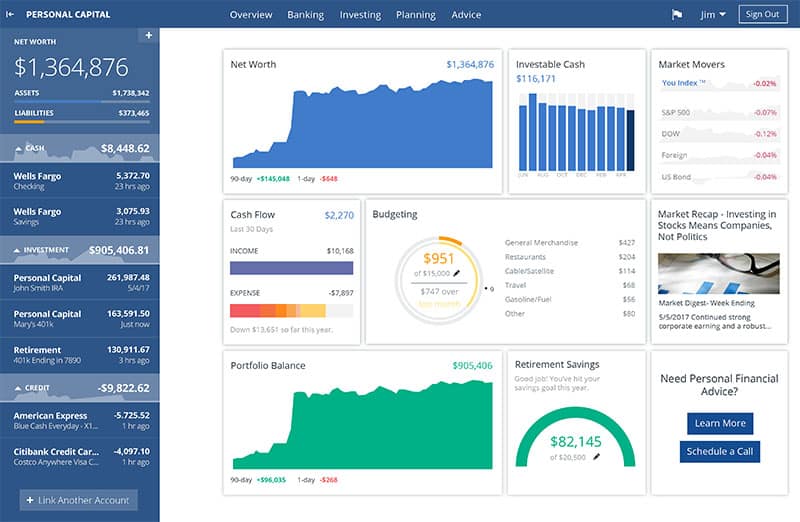

- PersonalCapital.com (free) – If you want Mint, but on steroids :) Check out our in-depth review of PC and see how bad ass it is… Lots of tools and pretty graphs to excite your inner nerd.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

I love reading net worth updates, so thanks for sharing :) it’s interesting that a slight loss overall has little impact on your retirement goals – just shows how it’s better to think long term and not sweat the small stuff :)

Yeah, though also small additions seem to have little impact as well as it gets bigger, haha… Even though we know that’s not true! :)

Looking good! I’m betting you shave a few years off that 53, thanks to the power of compounding! Nice :-)

You really have a perfect number J! Thanks for sharing your net worth, it really do inspire me especially your kids savings.

Not bad! I’m really surprised there wasn’t more “down” activity in the stock-based funds. March was a rough ride for the markets.

I don’t even dare guess why this stuff goes up or down anymore :)

Great job. We’ve been tracking our net worth for the past 4 years and understand what you mean when you say that you don’t even pay attention when it goes up or down anymore. We feel the same, the upward long term trend is what’s important.

Yup!

And going now to check out your blog – can’t say I’ve heard of “Enchumbao” before :)

J

I’m a big fan of maximizing investment accounts and minimizing your taxes. You’re using a SEP ira, if you had a solo 401k you can defer another 18k this year plus 25 percent of profits.

I would recommend putting as much as you can into retirement accounts first, max out all ira, hsa prior to contributing to a 529. Reason is when your kids go to college 529 counts as their asset, reducing financial aid. Also parents assets are counted in determining financial aid, however all retirement accounts are exempt. If you had 1 million in retirement and your kid had 10k in a 529 you would get more financial aid than if you have 500k in retirement and 100k in a 529. Also roth ira earnings can be tapped to help fund your kids college, which doesn’t count against you.

However 529 distributions will reduce financial aid. Just a thought to maximize your wealth and reduce your future cost of college

Definitely good to know, thanks man! I don’t know jack about financial aid and that type of stuff so we’ll have to reconsider this one at some point. Though right now I plan on paying for my kids’ tuition as my parents did for me, and theirs did for them. While still shooting for scholarships, of course :)

I like your graphs over time–I always find it so valuable to track our net worth on a long term basis. As long as the overall trend line is rising, I don’t sweat the small dips here and there. It’s a much more holistic, sane approach for me than stressing every month :).

March wasn’t as good as February, but still making good progress. Currently, we’re hoarding cash in anticipation of home buying. We’ll be staying put for the foreseeable future and want to trade flexibility for stability.

We’re at -$66,797.51 (+$2,707.06) overall.

Breakdown:

Assets: $66,280.25 (+$3,996.80)

Car Values: $8,023 (+$290)

IRA: $12,906.79 (-$208.44) No new contributions, so this rides the market.

401(k): $30,729.12 (+618.31)

Cash: $14,621.34 (+$2,896.93)

Liabilities: $133,077.76 (+$889.74)

Car Debt: $4,464.17 (-$179.88)

Unsecured Loan: $7,346.90 (-$326.55)

Student Loans: $104,782.72 (+$228.69)

Credit Cards: $16,483.97 (-$1624.86)

Loving the assets side! The Liabilities are scary though so glad you’re on it now and trying to kill them :) Esp that c/c one. If you haven’t called them recently to try and get the %% lowered might be worth a shot. Sometimes 10 mins can save you hundreds/thousands down the road!

My net worth has been a little stagnant. I reinvested a lot into my biz at the start of the year so any gains were kind of a wash.

Great numbers. I have a question that has always plagued me: how do you know how much you will want/need in retirement? I can’t contemplate early retirement because it seems like no matter how much I’ll have at 60 or 62 I would want more. Did you pick 80% of current income, or did you factor in extra vacations, etc?

There’s definitely not an exact science, that’s for sure :) Especially since we all have different lifestyles and expectations, etc.

Check out this post here where I talk about the variables we’re personally considering which plops out this “early retirement #”

https://budgetsaresexy.com/2015/02/early-retirement-fi-spreadsheet/

I based it on a lot of the factors that retirement blogs preach, including those who are *already* retired so I feel like they know what they’re doing vs the rest of us? :)

Like MMD said, not bad at all, especially with the market being down last month. Which, is just another good reminder where our focus needs to be. We were able to put a little more into our SEPs after getting our taxes back, but looks like we’ll be making the switch to Solo 401(k)s starting with this year which means the possibility of even more money being socked away!

I love when our taxes are finished and I can see the prior year in terms of total income and total amount saved. I keep track of all of it on spreadsheets and then try to outdo the prior year. It really helps along with monthly networth updates to keep us moving towards our goal of early retirement.

Our March was solid since I got a bonus. You should really talk to your boss about bonuses for you. You deserve one! ;)

I wish! My boss is a real a**hole sometimes ;)

We were up about 3k this month, mainly due to getting a nice tax refund and investing that into retirement accounts. You’re right to think big picture, although it’s easy to obsess about the little losses as long as the curve is generally moving up everything shall be fine.

Question for the hive mind – we have started tracking our net worth, and keep getting stuck on what to track. We have a spreadsheet and a couple of painted bulletin boards so we can track on the wall (discreetly labeled so we know what we’re doing but visitors won’t)… But what to track?

1. Current net worth.

We were doing like you, current value of all our accounts together. But we found that stock market variations were throwing $10k up or down *per month*, obscuring our savings and retirement contributions. It was feeling disheartening rather than pride inducing. I’ve always been able to feel zen about stock market fluctuations – set it and forget it for the most part, for now. Tracking has been messing with that zen, and is reflecting market rather than effort.

2. Our monthly savings. We’ve been considering tracking what we put away each month. We have auto retirement, auto savings, and “reach” savings that can be used for monthly expenses if needed. That loses all the power of compound interest and market though.

Any ideas on how to track without getting fixated on market fluctuations?

That’s a tough one indeed since of course stocks are a huge part of this stuff…

Maybe track it quarterly? Or update monthly but keep stocks the same and update everything else until the next quarter comes?

I don’t know how you can ignore it other than flat out ignoring it, but that’s what I do with our house value. I get it checked about once a year and then update it and keep it the same throughout.

Another route you can do is to just track all the savings and extra investments/etc you’re talking about instead – like a “savings worth” so every month it’ll get bigger and bigger and THEN at the next quarter update your net worth and compare the two? So you can see how your hundreds or thousands actually became (hopefully) MORE in reality? Since you’re just tracking the actual amounts you shot into the system?

An interesting predicament indeed… and actually probably why I LOVE my “challenge everything” savings account so much because I just watch it go up, up, up since it’s not plopped into the markets yet :) Good for zen but bad for long term growth – hah. (Which is why I’ll be moving it into investments once this experiment is over)

A bit of market correction is healthy, as US and European stocks have increased way too much compared to the economy during the last couple of years.

Why not diversify your portfolio a bit? Personally I mainly buy world wide funds to benefit from the global wealth increase. Don’t Vanguard offer some DJSI World ETF or similar?

Yup – they def. do. I don’t worry much about the diversification cuz most companies ARE global too and doing business, but perhaps I’m missing something?

I’m curious how much in tax savings the SEP IRA saved you. I am all for saving money and planning for retirement, but until I was back to the safety of the double income, I would want to keep as much in cash as possible. This is a big debate with a number of my clients, how far should they go to avoid Uncle Sam but how much flexibility will they give up along the way.

I think it saves us $3k-4k if I’m not mistaken (I don’t specifically ask anymore since I know I’m going to max it out regardless ;)). It would be more comforting to have the extra cash banked up, but in a weird way it’s MORE comforting knowing I maxed it out and will be contributing to the overall early retirement plant. You’ll have to ask me in a few months though if I’m singing a different tune, haha…

I figure it’s a lucky thing to buy on the dips. It sucks seeing your net worth go down, but it usually means you’re getting a better value on your investment purchases.

Great progress over the last year, too. I am tracking via a line chart…but I really like the look of yours.

If you look at it this way, your still up 14 over the past two months and that’s cool. Good advice from Charles, I would also fund retirement accounts, and brokerage accounts in your name first before funding 529 plans, due to future issues. I would also just earmark an account in your name for their school because if they get scholarships they might not need the money. Peace out J.

The miilion dollar journey continues! Bravo!

I’m up 27% for the year, thanks to a rebound in housing market, solid but unspectacular gains in precious metals, and living almost entirely off of my side-hustle (Uber) income. That has helped me to save 90% of my paycheck from the day job. I should join the ranks of 6-figure net worth before year’s end!

But as for you, I would definitely suggest maxing your Roth. YOU know why you did the past 7 years, so why stop now?

Living off Uber money – BAD ASS!! That’s awesome over there, love that :)

Don’t regret it – do the 6th year in a row! you won’t regret maxing it out, and that wife wwill replenish your cash savings for ya :-) :-) :-)

That’s what I’d be banking on! The trick is *when* that will happen :) If she locks in a job in next few months, we’re golden, but if it takes her 6 mos or even a year?? I’d be in deep doo-doo. At least if none of my other biz efforts build up by then (which I’m hoping the do anyways)

I’m also up a nice sum this year because using Betterment has me globally-diversified. Foreign markets are doing much better than S&P this year, so far. I love that every dollar they get from me or dividends goes straight to re-balancing my portfolio.

Another excellent update J$ – hiring a tax pro, especially if you have a lot of weird income from random side hustles IS TOTALLY WORTH the few hundred extra to have someone who knows how to save you the max do it all for you. I know people want to do it themselves, but I am on the side of pay an expert to make 100% sure Uncle Sam doesn’t come after me because of a mistake or stupid code that I didn’t know about.

Keep it up!

We are down per say since $1750 went into a new transmission for our old car and my ‘new’ car continues to depreciate argh! Plus side, paid some extra to debt and started monthly investing with Betterment. It is small but need to get started since debt will take a while and we aren’t getting younger. Hope by 50(41 now) to be closer to where your at! You are certainly rockin’ it!

Ugh, car stuff sucks… but at least that $1750 is still cheaper than buying a brand new one! Or even used one! :)

Keep up the good work, J! I love reading these updates. Always tricky about trying to balance cash reserves vs maxing out the IRA. We just maxed ours out for the year and seriously depleted the cash reserves, but we still have a couple months of expenses in cash, so we should be fine. Hopefully you can keep the streak alive!

Looking good. Is your cash saving and e-fund one in the same? That’s a big chunk of cash to drop in the SEP, now sit back and watch that retirement money grow!

Yes – cash fund and e-fund are same. Definitely not the $80k+ it used to be a few years ago, but such is life :) I’m starting to get nervous, but not at the point of anything too bad quite yet. The big question now is how long it’ll be until the wife picks up a job. But if we shave $2k off daycare every month that would also help out a ton too, so we’ll see!

We’ve only been tracking our net worth for one year, but it is incredibly motivating to see it grow- it’s too bad we can’t have those 17K growth months more often.

Way to take the plunge on that SEP; I’m rooting for you to max out the Roth too, but I’m into risky business.

Hehe me too. Just trying to figure out how risky is too risky with little kids in our house now! :)

Congrats on another month of tracking, J$– awesome as usual! You rock!

I do have a(n unrelated) question for you and the others. My husband is getting snippy with me when it comes to finances; he is apparently miffed b/c he apparently thinks I’m wanting to “save our money for retirement and do nothing all the time.”

How do people walk that fine line– spend some $ in the present yet still save for retirement? I thought I was doing a good job sending an overall vibe of FIGMY$HIT (lol), but apparently I am wrong… sigh…

Ack – tricky one indeed! I take it our husband doesn’t like doing *free* things such as walks or hanging out with friends or any of that nature? ;) That’s one thing I learned quick after going down this path – I amazingly have just the same amount of fun whether I’m spending or not spending! Though of course allowing a nice dinner out or splurges here and there help with the balance too.

If you don’t already do it, try giving him an “allowance” of blow money every month so he can do whatever the hell he wants with it but still allows y’all to move forward w/ the retirement plan. Having $100 or $200 a month to do as you please with no questions asked is huge, believe me :)

I’m in the same boat with the Roth. We just got our taxes back and are eligible to contribute. I wasn’t sure with the sale of the business how things would turn out, but rental property saved us this year. I’m just not sure whether to put money into a Roth right now or continue putting it into my solo 401k. Good problem to have but not sure which is the better way to go. Thoughts?

Good problem indeed :)

I feel like most people would say Solo 401(k) first until maxed and then Roth but I’m not too sure to be honest – esp since I don’t have a Solo 401(k). I do know that you can’t lose either way so maybe go with the one that excites you the most if one does? That’s always the deciding factor for me :)

Like you, one of my favorite numbers to view monthly is the small vampire that is my mortgage slowly being punched in the face. Looking forward to that beast being killed in the not to distant future.

Keep killing it J$!!!

Small vampire? That bitch is huge! :)

I love the graph from 2008 to 2015. Hopefully mine will look similar come 2021.

*Motivation restocked*

Mr Z

I would max out your IRA. Don’t miss out on the opportunity to max out your year’s contribution. You can’t get it back.

I know, I realllly want to do it! Just that oz of fear that we’ll blow through our remaining cash before wifey gets a job or my hustles grow more… I am feeling feisty though today :)

Very impressive! Congrats! I’m curious–are you concerned at all that you’re overexposed to US equities with having only VTSAX? Ever considered diversifying into foreign equities?

Nah, not really. Maybe I should be, but most US companies have business all around the world so I feel like a lot of it is already covered? I’ll probably tweak the strategy as time goes on, but I wouldn’t be averse to adding foreign or bonds or anything like that. I kinda just like it all streamlined now and know I’m at least 80% golden :)

It’s really cool to see your progress on the graph, definitely see a few drops on the graph but the overall trend is upward. An upward trend is always good.

Daaaay-ammn, son. You are doing might fine with those numbers. Even with the losses you mentioned, you’re still looking pretty sweet. I’ll have to start tracking net worth, I bet the psychology of moving towards a positive instead of away from a negative might be a game-changer. Cheers!

It really is a psychology play. When it goes up your motivated, and when it goes down you’re motivated to make it go back up again :) And the beautiful part is that it doesn’t matter what stage of the process you’re in. If you’re in debt you get a boost from watching a little more paid off that month, and if you’re trying to hit $1 Million dollars you see the boost get you that much closer too. It really is Win-Win.

Wow #87 reports in a row. I just published #3 :)

A slight decline that will hardly be noticeable over the long-term in your net worth chart tracking your march to $1M.

Cheers!

You have to hit #3 before you can get to #87 :)

For the sake of at least a little dollar-cost-averaging, what if you put just a fraction of your projected contribution into your SEP each month or so? Or, what if you over 12m maxed out your Roth so that baby is averaged out, and then if you put less in your SEP due to cash flow, well at least there is some in there.

Just some ideas to kick around, I’m positive you have considered this already!

I have considered it, but I also get stuck in my own ways and don’t always challenge these ways as often as I would like :) So I’ll consider your note a solid poke to reconsider!

Thanks for sharing the results. Boo to the -$3K though. March was a bit of a downer in the market. Our portfolio also saw some loses but we also did a lot of buying last month so hopefully that will translate into long term gains down the road. :)

I’m with you on the mortgage decreases…it certainly never gets old seeing the numbers drop each month. We have a 15yr fixed rate at 2.875% so you can imagine how fast it is dropping for us…with our very first payment, more went towards the principal than the interest!

By the way, love the tracking of baby nickel and baby penny! AFFJ

Thanks :) It’s fun to track my entire family’s net worths!

J$,

Still sitting really pretty for the year after last month’s epic march upward. Two steps forward, one step back. Keep marching upward and onward! :)

Best regards.

It’s still looking good J$. Keep on doing what you’re doing! The first reaction to your subject heading was “Yay!” Now, to clarify that’s because my eyes immediately went to the “womp, womp,” which for whatever reason (maybe it was too early for me to be reading) I took as a positive. lol

Then after I saw your cash savings decline I rushed to find out why. Was hoping it was nothing horrible, thought maybe the Cadoo finally gave out and was happy to see where it went.

A little too much action for me today, sir. :)

Hah!

I think you have your Woots confused with your Womps :)

Not looking too bad J$, I would have seen a decline in my investment accounts were it not for my bi-weekly deposits, but as you have told me a few times, its a long term play. I recalculated what I recording in my net worth calculation, I dropped my vacation property as I will NEVER sell it, and any future benefit from stock options and RSUs because the voilatility in the oil patch means I probably will never see the money. All in all it ended dropping my NW figure my over $31k but I am still happy.

If you adjust my figure to USD from CAD you have taken over a strong lead on me. Congrats on this, I will be working on catching you again by year end!

A little “stealth wealth” action going on there I see! I’d personally track a vacation property if I had one as I use my net worth for an overall snapshot of where all my money/property is (even if I never use/sell any of it) but that’s the beauty of this stuff – you can track it however it makes the most sense to *you*. You’re the only one who cares about it anyways :)

Yea for net worth updates! Always fun to see how you do every month!

This month we went up a bit too:P Though got dinged on taxes and had to pay monies to Uncle Sam. Oh well, even with that our net worth is steadily going up!

J-

Regarding your internal debate on whether to fund the Roth or leave it in cash: Why not make the contribution? Any contributions can be distributed without tax or penalty as long as you don’t take out earnings. And if you don’t need the money, then great, at least you didn’t miss a contribution opportunity.

Great great point – and one I often overlook because I have a “never touch this money EVER!” mentality when it comes to investments so to me it’s a black or white thing :) Even if I lost all my online income and had to start all over I’d go and take out a loan to live vs deplete my investments – as crazy as that sounds. Whenever $$ is accessible it’s a downhill slope for me… I wouldn’t be able to keep my hands out of it :(

Wow!! Your IRA: SEP is pretty high, kudos to you! I think growth becomes much faster with bigger numbers. Thanks for sharing! :)

Well, that’s my old 401k which got converted to a Traditional IRA which then got merged with my SEP Ira – which I didn’t even know was possible? (But love it cuz it makes accounting that much more simpler!)

I’ve heard you and others plug for net worth tracking, but I’ve resisted it. I think it’s because I’m really clinging to the debt-repayment track we’re on. I’m scared to look to the left or the right for fear of “falling off the wagon”. But once we’ve paid off our business debt (under $10,000 now from a starting point of $80,800), our game plan will change, and there will be savings and investments as well as mortgage-debt repayment. Time for me to wrap my head around this new stage, and to think in broader terms than simple debt-reduction. All the best to Dr. $ in her job search : )

At least you’re tracking your debt #! In fact, you already see the power of motivation behind that, so why you think it would be different tracking your net worth # – which includes your debt! – wouldn’t do the same I’m not sure, haha.. Every month your net worth would go UP since you’re paying off debt! :) But if it’s working for you just keep on going, sister. You can change it up later when you celebrate that debt pay off part for sure – woo!

i love tracking this. up 8800 from last month! =) paid my g/f’s car off.

Hot dogs!

I think y’all are doing awesome.

We ended up $6600 up last month. I’m aiming for $500,000 by the end of the year but it’s only 90% realistic, LOL.

I’m aiming for that too!!! Let’s do it!!!!

J Money.

With mortgage rates where they are, have you recently thought of refinancing again? At 5.5% I know you can save big. We are in the process of moving and we are looking at 3.625% on our loan.

Just a thought to help your hustle.

yes indeed, J. Nizzle – very smart for sure. unfortunately the last two times I tried we were told we’d have to bring $90k to the table to do so cuz we were underwater (not anymore, but still not much equity) so it wasn’t worth it. And we’ve already gone through one of the gov’t programs a few years back which disqualifies us for another. We used to have a 6.875% interest-only loan! So we did improve, but nowhere near your sexy 3.625 :) Congrats on that!

Glad to see your numbers are continuing to grow as usual. Also glad to see you’re still happy with your “one fund to rule them all” investment strategy. I’m shifting towards a similar lazy-man approach by using Wealthsimple to do all the work for me (the Canadian version of things like Betterment). Fees are a bit higher up here in the great white north (.35%-.5%), but I suspect that’s partly to do with the fact that most of the investments are in the US/Foreign markets. Still a relatively small price to pay, especially compared to mutual funds and such. The best part is it covers all my transaction fees, and there’s no contribution minimums, so I can continuously dump money into it whenever I can, which I love since I hate having idle cash just sitting there… staring at me wishing it had a greater purpose in life besides earning me 1% interest. haha!

you get 1%? Lucky you! Haha…

I hear ya though brotha – gotta put that money to work cuz unlike us humans money never gets sick or lazy or stops hustling! they just keep reproducing as we sleep and making larger and larger $$$ families for us! Keep on pouring it in :)

What do you do with your cash savings? Do you just put it into a high yield savings?

For the first time I have $40k cash, which I want to hang on to in a fluid state. I hate the idea of a 1% return but equally don’t like the idea of investing it at potentially “peak market”. I have $125k in 401k and an investment property. Kind of rambling, but anyway, was just curious.

yeah, I just throw it all in my savings account with USAA where all my other accounts are. It’s probably not the highest interest, but I’m not one to yield chase just to earn a few more pennies. I’m totally cool leaving the $$ as is and ready to be accessed anytime I need it. Which is the point of these types of funds, really. Once I decided I was okay with it I just started focusing more on where all my *other* money is to make sure those are growing nice and sexily since they’ll be there for the long haul.

I think a better question to ask yourself is *how much* you need/want put aside like that to make you comfortable. Some are good with $1,000 and others need $100,000. But once you find that #, regardless of what it is, just cap it off and divert all the rest into the wealth game. Sure you could make a few more bucks if more of your cash is invested, but focus on the goals for each of the accounts. Cash on the side for emergencies/rainy day/etc shouldn’t be handled the same way as the other departments.