Over the years I’ve been counting all money that’s in my accounts on the day I run these net worth reports – whether it’s money in savings or money in checking that may or may not be used in the following weeks. So while technically I *do* have this money on any given date, I’ve decided to stop including the amounts that I know for a fact will be going out the door in just a matter of days/weeks.

This may sound like I’ve been doing it the wrong way the entire time, but another point I should make is that I also pay all our bills 30-45 days out :) So really all that money set for expenses aren’t due until the next month anyways, making it all fine and dandy while tracking it in the current month – if that makes any sense?

When I was getting paid bi-weekly and paying bills like a normal person this wasn’t all that necessary, but now that I pay myself once a month (on the 1st) and then future pay ALL my bills that very same day, it started feeling weird keeping all these amounts in my calculations. So now all the logistical money (aka money set aside for bills) are completely out, and the only thing that’s left is pure cash savings or investments/etc. Which feels more “real” to me now.

Beyond these hard numbers and changes, though, there’s an important point to this today :) And that’s to:

- Make sure your *reasons* for tracking your net worth align up with how you’re currently doing so.

- Make the necessary adjustments to get things back on track when they’re not.

It’s perfectly normal (and smart!) to adjust your calculations when your goals for something aren’t matching up anymore. And I was reminded of this last week too when someone left a comment on my net worth update from Feb, 2008 when I wasn’t listing my mortgages as an expense (I only listed the “equity” in the asset column). Back in the day that’s all I really cared about and knew, but as time went on I realized that it was more important for me to show BOTH sides of the equation to better track my future progress (and I was also oblivious to the game of real estate).

So just like your budget or savings goals/etc, it’s always good to re-visit your game plan and make any necessary adjustments to better fit with your current purposes.

And Now, The Breakdown of December’s Money :)

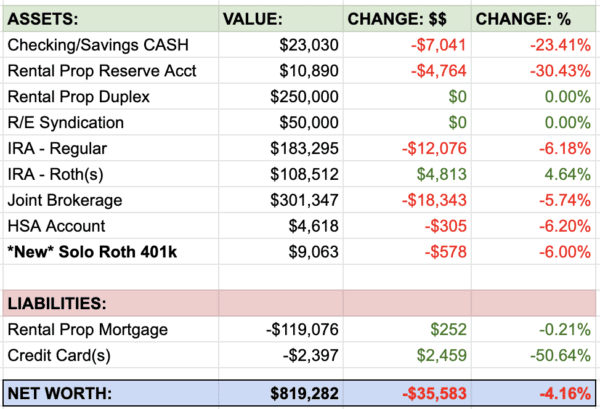

MONSTER CASH (-$6,335.96): Skewed again because of this accounting change I mentioned above… Without that, we’d have been UP $1,500! But wouldn’t have sat all too well with me :)

GOLD & SILVER (-$112.63): I thought metals were supposed to go UP when the markets crash? LAME… I pretty much took the month of December off from coin/bullion collecting, so this is just an adjustment from the last estimated value of everything. I’m hoping to start dabbling again shortly :)

529 College Savings (-$12.28): Up the last month, and down this one. All to be expected when you invest money into mutual funds though… when thing go up, all yours go up and when they fall yours fall! But we have plenty of years to grow this bad boy, so for now we just sit tight and keep pumping money into it…

IRA: SEP (-$893.31): Nothing new added to this guy either – just waiting for all those investments into stocks I love to blossom more and keep proving it’s a great investing strategy! Haha… but only time will tell on that one. It’s only been what, a year?

IRA: ROTH(s) (+$51.92): These IRAs are packed with more conservative stocks and funds, esp. in the wife’s account, which is probably why they tend to fluctuate only a little as the months go by… But you can’t be too risky with ALL your investments, right?

IRA: TRADITIONAL(s) (+$1,834.08): We’ve left these guys alone too – mainly cuz we invest everything into our ROTHs first, and then followed by my SEP IRA for reducing self-employment taxes. But one day we’ll condense all these once we figure out which is the best route to go. These have been humming along for over a year now when we started this IRA Test.

- IRA #1 (NOT Managed): $64,153.24 **Still leading the pack

- IRA #2 (Managed, USAA funds): $61,692.84

- IRA #3 (Managed, ALL funds): $62,290.55

AUTOS WORTH (kbb) (-$678.00): A big loss this round! Which makes up for *increases* over the past few months, haha… this stuff is so weird to me, but whatevs. It only starts to matter when it’s time to offload ’em :)

- Pimp Daddy Caddy: $2,179.00

- Gas Ticklin’ Toyota: $7,927.00

HOME VALUE (Realtor) ($0.00): The same $285k as we adjusted it to in early-July… Unless we refinance soon and find the “true” value of the place, which may or may not happen within this next century, haha… (we’re too underwater). But even then it’s not 100% accurate anyways as you only know the real value the day someone makes you an offer ;) Supply and demand, baby!

MORTGAGES (-$2,888.68): Operation Mortgage Payoff continues in full force! Over $2,200 extra paid off this month, on top of the principal that’s already built into our main payments… Something our original mortgage was lacking when it was an interest-only one! Hah! I don’t miss that at all…

- 1st Mortgage: $281,470.14 – 30 year conventional @ 5.5%

- 2nd Mortgage: $33,947.78 – Maxed out HELOC @ a variable 2.8%

That’s it folks! A busy busy month, with another busy one to come. Always gotta be on this stuff though if you want to watch it continue to grow! It’s not gonna earn and manage itself – it needs YOU to do that ;) Now lemme know how your month went!

Much love,

———————

PS: Did you see my Redskins whoop the Cowboys Sunday night?? We’re going to the playoffs, baby!! First time since I was a kid! Haha…

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

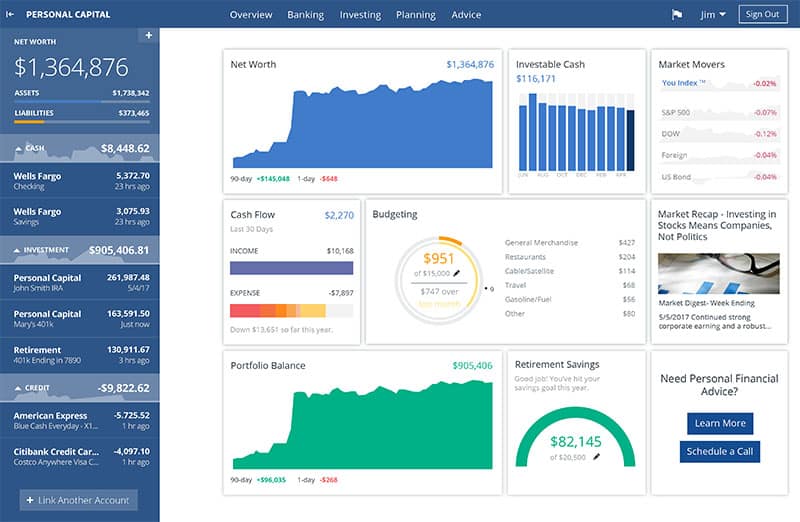

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Making adjustments to be more realistic for your personal situation is always good. It can be tempting to use the highest values to inflate your net worth but being realistic is important.

Just like it is good to be realistic with the Redskins’ playoff aspirations :) I used to live in DC but if they have to play the 49ers (my team) I don’t know how far they’ll make it :)

Not quite sure what you mean in terms of your accounting change, but if you felt like your old way was over-estimating by a month’s worth of expenses, then it’s definitely a good idea to back them out.

We always make sure to include the credit card balances as liabilities (even though they get paid off every month), and they usually have about a month worth of spending on them before they get paid off.

I am attempting to figure out my net worth. Tracking it is one of my goals for 2013.

How did you arrive at the value of your home? I was considering using comparables in my area. Is that what you are doing?. You must live in one of those American cities where house values have plummeted.

I am Canadian and if my house value has decreased it is bcause the dogs have dug up the lawn.

What you are proposing makes no sense from an accounting POV. If you want to report on an accrual basis then you should also include outstanding receivables billed but not yet in hand.

Me, I do everything on a cash basis. What is in hand at the moment I report it.

@Lance @ Money Life and More – BOOOOOOOO!!!! It’s all about the underdogs this year, baby!

@Mrs. Pop @ Planting Our Pennies – Oh that’s interesting, we pay them off every month too but we don’t include them in ours because of that. Which actually makes more sense NOW – since we’ve taken out “operations” money – than before, haha… But we do what’s best for us! Always gotta be tweaking as life changes :)

@Jane Savers @ The Money Puzzle – HAH! It’s a good thing those dogs are pretty cute ;) (At least I’m guessing they are?) We used to use Zillow.com and then Trulia.com a bit too, but since those numbers always seemed way off for our area (I hear they’re good for others), we’ve been just using the number our realtor suggested to us when I asked him. I ping him every year or so to get an update and he’s pretty good about spending a little time figuring it out for us, knowing tha we’ll use him whenever we go to sell/rent it out later ;) So that’s how we usually do it, but our last change was based on a neighbor house of ours selling recently for a LOT lower than we thought our places were worth, so I adjusted down to be on the safe side. It’s all really a guessing/estimating game though, so I’d just do whatever makes the most sense to you when calculating :) The only time you’ll know 100% is when you go to sell! An excellent goal for 2013 though for you, I hope you keep it up!

@Diane – Yeah, that’s how we were originally doing it all these years too, but now it just feels funny and like I’m cheating or something… And since the amounts I’m not including cover all future bills/etc too, I feel like it evens out well. But that’s just my personal opinion at this particular point in time – I’m sure it’ll change later, it usually does :)

Have you considered starting a taxable brokerage account? Just wondering.

December was pretty rough on us. And it was more or less all self-inflicted. We decided to buy gifts instead of gift cards for our family this Christmas, and it ended up putting us a bit over budget. And then baby stuff… at some point it’s got to stop right?! I keep trying to tell my wife (and myself) that people 100 years ago (let alone cavemen) didn’t have any of this crap and they all turned out okay. But that’s a losing argument against a pregnant woman for the time being.

We’ve done a pretty good job with plain ol’ budgeting the last few years, but I’m excited to start doing a better job tracking our net worth this year.

Go Redskins (and 49ers and Broncos)!

I agree that adjustments are necessary in order to get a clear picture of where you stand. Just to be curious, do you have a taxable brokerage account in order to gain some taxable diversity as well? On a side note, being a life long Cowboys fan, I did not even bother watching the game Sunday night. I figured that Romo and the boys would find some way to shoot themselves in the foot and saw no need just get myself upset. Of course, as being the case with Romo, I was right. I just wish I could pick stocks that well. ;)

Considering that I over the past two months, I’ve gone from full-time to part-time to no-time and haven’t received my first unemployment check, I’ve done reasonably well. And I was surprised to find out that my wife’s 401(k) was up 10% for the year. Over the past two years, the only moneymaker in that sucker was the employee match. :)

December wasn’t a stellar month, but I’m still up by $1,400 over the month before. I’m really itching to hit the 6 figure net worth (goal by 30), and I’ll be stoked if it happens before I even turn 29 :D

You are way ahead of me this month already! New Years resolution for me to get going haha.

I am not looking forward to my net worth at all. I thought I was ahead when I purchased all my gifts in advance and even saved on buying a computer for school. Then the IRS said income wasn’t correct and another couple of hospital bills showed up at the very end of December. After running the numbers in my head, the guess is I will be negative $1000ish. Will see when I actually run the numbers soon. blech.

Update: I did my net worth and I am negative $10.58. I don’t know whether to laugh or be annoyed, but whatever it is what it is.

My husband and I hit a major milestone this month. We broke $300k. We hit $302,000 as a matter of fact. We’re up $15k this month, though it mostly came from our house’s value on zillow going up. I feel more comfortable trusting zillow now because we had our home appraised recently, so I use a multiplier to bring zillow’s appraisal in line with the actual value.

It’s kind of amazing because I started tracking our net worth in June ’10 and it was $10k. Reading your site and tracking our progress has really helped us to stay on budget and on target.

Looks like you are on point. Congrats!!

@SavvyFinancialLatina – Yup! I’ve thought about it but nixed right away once Operation Mortgage Payoff came into play ;) I’m all for investing tons of money for tons of return, but I feel like I was putting *too much* into that category of finances and wanted to pay off that damn mortgage debt instead. So we pour all extra money into that over more investments. Plus, I HATE dealing with taxes on stocks so we get to avoid doing that as well (one of the perks to investing in retirement accounts as you never have to report losses/gains etc when you’re not dipping in!)

@Johnny @ Our Freaking Budget – Haha, smart man. Pregnant women get whatever they want :)

@John S @ Frugal Rules – HAH! Believe me, we’ve had plenty of our shares of Romos over the years – this is the first time I actually have hope for the ‘Skins! :) But to answer your question on outside brokerage accounts, no – we do not. See above for more details.

@Edward Antrobus – Oh wow, yeah you have. If you can rock it with no unemployment checks that’s crazy good man! Way to go. And hopefully you’ll be back to the full/part time arena here too shortly :)

@Cassie – COOL! That’s a great milestone to hit too :)

@Financial Black Sheep – Oh jeez, haha… but -$10 is a lot better than your guestimate of -$1,000! Way to go on just jumping right on it and knocking it out :) Hope your water issues at home have started drying up! Literally!

@Jennifer Lissette – WOOHOO!!!! You guys are killing it, that is great!! And I like that you have a multiplier for Zillow too – I find it is def. needed :) Though the trick is usually coming up w/ that number for people, so it’s awesome you figured it out. Here’s to hitting $400k by the end of the year! Then on to half a million! (Wow)

@Tony – Thanks! How did you fair this round?

How do you have such bills ie mortgage and such cash ie 77k handy? Somewhat new to your site, but what am I missing? Couldn’t you take 67k and throw it right at the mortgage?

Thanks for condsidering this.

Not sure I understand the question all the way.

Why do we have such high bills? And lots of cash? We bought a house that was way too expensive than we should have years ago, and I hustle my tail off to save up a lot of cash :)

If the question is why we don’t use the cash to pay off these high mortgages, it’s because we use it as a large emergency fund since I’m self-employed and the wife likes feeling secure. We may use part of it in the near future to pay off part of the mortgage, but that’s why it’s the way it is right now. Hope that helps!

J,

Why not just create different accounts for outgoing bills and money that is being kept? This way it is stable?

It wasn’t really the logstics that was bothering me – all that is fine – but more so me *including* that money for future bills in my net worth… now that it’s out, I feel like it’s more REAL which I love… totally stripped down to real money saved/invested/etc outside of all other things :)