You multiply that by 3 and we’ve hit $1 Million dollars son! :) Something I never would have guessed was possible 4-5 years ago when we were pretty much breaking even every month.

(That was one of the first lessons I learned with money – it’s hard to grow it if you don’t have anything *extra* to add up at the end of every month!) And while it looked like we slacked on the cash front this month, we actually did pretty well over all but a couple nibblers got in the way and took out some of the zing.

1) Our cat, Bob, got sick again (twice), and we finally made the decision that we’re not bringing him in again as it’s best for both him and us at this point (we added $1,300 to his bill which by now is probably reaching $5,000-$6,000 in the past half a dozen months). He’s now got 3 serious diseases, and while we can revive him w/ every 5-6 day vet stay, we’re pretty sure his quality of life is finally going way way down. So we’re spoiling him as long as we can from this point forward, and as soon as it’s time to go back to the vet he’ll be sent away to the Heavens above. We’re appreciating every day we have left with him though, and so far he’s 30+ days w/out much trouble! :)

2) We had to cough up an extra $8,000 more in taxes this quarter cuz of my last bump in revenue I got in December. I should have just not included it in last month’s net worth update really, but of course it slipped my mind and I forgot to take it out ;) It’s all good though, it’s all the same thing in the end, right? I’d happily make an extra $25k again and pay my due share of taxes…

Other than those two big changes, the rest of the month hummed along nicely and the stock market took care of the rest (well, besides us keep moving forward with Operation Kill Mortgages! Another $2,000+ wiped away – woo!) Here’s how the other parts of the equation broke down.

January, 2012 Net Worth Break Down

CASH SAVINGS (-$1,027.96): A negative number this month, but only because I goofed up on our net worth tracking last month ;) As I mentioned above, we had to shell out an additional $8,000 in taxes last month (which shouldn’t have been included in the last update), as well as $1,300 to heal our sick cat which took us down a little. I’m expecting Feb’s numbers to look a lot more prettier now that I’ve gotten a good grip on my post-Love Drop lifestyle. It’s amazing how much more time you have to hustle when you’re not flying all around the country every other weekend ;)

EMERGENCY FUND ($0.00): Still at the same $10,000 we’ve hit, and left alone, for the past 3-4 years now. Some of you have mentioned that we should pump this up a bit now that I’m self-employed and we have a baby on its way, but I also consider some of that other $99,000 in cash we have stored in various places partly to help in emergencies too ;) That $10k will just be the first to be hit (and hopefully the last!).

IRA: SEP (+$619.04): Nothing more invested in this bad boy last month, but in a little bit we’ll be REALLY pumping it up as soon as I get the go ahead from my accountant on how much I can legally put in (we’re expecting around $23,000 so far). Not only will that cushion the tax blow for 2011, but it’ll allow me to invest in some more loveable stocks too! Woohoo! :)

IRA: ROTH(s) (+$1,697.26): This guy will remain stagnant when it comes to us putting anything more in, until we get a good grip on what the baby costs are gonna be in the second half of the year… we’d love to max out BOTH our Roths this year (at $5,000 a piece) but it’s def. at the bottom of our priority list for the time being. We’ll see what happens though…

IRA: TRADITIONAL(s) (+$9,360.44): Pretty damn sexy for just allowing the markets to do their thang! Of course, I’d like to believe it’s all because I’ve brilliantly picked the right funds to invest in and what not, haha, but we all know the whole thing’s just a crazy game. Most of these companies’ core business never changes, but so many investors sell and buy based on the latest news from talking heads and/or weirdos, ya just never know what’s gonna happen with these markets month after month… as long as we’re inching upward over time though, I’m happy to stay on board and play by the rules ;) If I sold it all now I’d be up $10k for the month for just doing nothing!

And here’s an update on our Ultimate IRA Game too. It looks like one of our adviser-managed fun has sneakily taken the lead! We’ll see how long that lasts for…

- IRA #1 (NOT Managed): $58,608.95

- IRA #2 (Managed, USAA funds): $58,100.49

- IRA #3 (Managed, ALL funds): $58,677.47 **The new leader, by a hair

AUTOS WORTH (kbb) (-$40.00): Nothing too worrisome in this department. Just our cars getting older and losing value as to be expected. Here’s how they break down this month (we use KBB’s “private party” estimations as that’s how we’d sell them once/if the day ever comes)

- Pimp Daddy Caddy: $2,410.00

- Gas Ticklin’ Toyota: $9,072.00

HOME VALUE (Realtor) ($0.00): This is stagnant at $300,000 too. Not gonna update it until we talk to our realtor again down the road, which may or may not happen anytime soon (I don’t want to bug him unless we want to take action on either selling or renting. And I don’t trust Zillow or the other programs very much, though they are entertaining to watch ;))

MORTGAGES (-$2,472.68): Up to FOUR months now! Man, time goes by SO fast, right? I’d like to say paying down these mortgages are getting easier over time too, but I’m not gonna lie – it’s tough. And we’ve still got like 1 billion more months to go! Jeesh… I’ll be writing a big blog post about it all soon – too tired to get into it all right now ;) At least we’re still pushing forward though! Here is what we owe still on both mortgages:

- 1st Mortgage: $286,886.91 – 30 year conventional @ 5.5%

- 2nd Mortgage: $53,095.85 – Maxed out HELOC @ a variable 2.8%

That’s it for this month! How’d you all do? Anything exciting or scary come out in Jan for you? As you know I only wish the best for you guys, so feel free to ask questions or talk about some awesome game plans in the comments below! :) We’re all in this thing together, baby.

To a great 2012,

———————

PS: For those who have asked recently, I’m starting to put together a 4-year net worth review since I started tracking all of this stuff back in the day. It’s a lot of info to take in, but I’m hoping to share a nice summary post w/ y’all soon on how things have changed over the years… if you guys have something similar yourself, I’d love to see it! Drop me a link or an email sometime so I can marvel at all your progress and/or pretty graphs :)

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

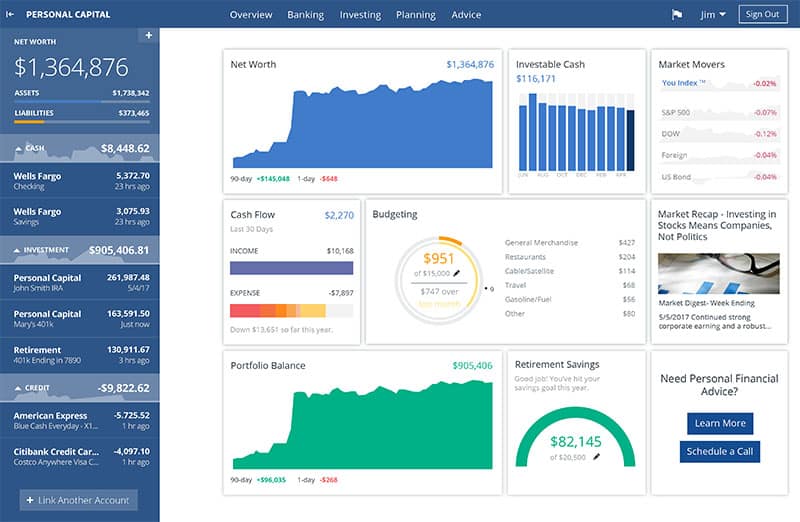

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Time does fly J! I was up 3k last month and am quickly approaching 100k despite living in Australia being paid in US$s!

Wow, you are doing amazing. It has been my experience that once you learn to save money and then use that money to make money as you have done, things start growing quicker and quicker, somewhat exponential. It will take you less time to make the same amount again knowing what you know now.

@Alex – Nice! It’s all about taking advantage of that time and playing the game month in and month out – congrats :) Is the US dollar bad compared to Aussie’s? Not up on my conversion rates lately.

@KC @ PsychoMoney – That’s the plan :) It’s def. true too – it took me 26 years to start paying attention, and as soon as I did it was all good from there. We all just gotta *start* right? How did you do this month, my friend?

Congrats! Always great news to see that number rise so much :)

I post a pretty graph every month of my net worth when I update my Race to $1 Million. And I also have the spreadsheet free to download on my site if anyone else wants the pretty graphs! :)

http://www.thousandaire.com/blog/race-to-1-million-february-2012/

“You multiply that by 3 and we’ve hit $1 Million dollars son! :)”

Forgive my ignorance here, but what is the point of this line? Multiply by 6 & it’s $2M. Muliply by 333.3333 and it’s $100M. What significance am I missing here?

Ah, this is great, J. Money! You’re so close to that 300k! I’m sure by next month it’ll be yours!

Sorry to hear that your cat’s not doing so well, though. Hopefully you can enjoy the time left with him.

HOLY CRAP THIS IS AMAZING!

I love the start of a new month cos it means super inspirational net worth updates to read from the PF community! Totally agree with KC @ Psycho Money – it feels so much easier to find extra money to pay down debt or add to savings just by being aware and keeping track.

Finally, so sorry to hear about Bob. I’ve been there with many dogs over the years and its heartbreaking but you know when the time comes.

Oh man, I’ve been waiting for a week for you to post this because I’m so excited this month. After a year and a half of the house value plummeting and my net worth staying flat, I am finally gaining some positive momentum. Net worth is up $23k this month and the actual number is just shy of six figures. It should hit six figures next month and I am so freakin’ excited.

My husband is finally excited too and he created a chart out of my spreadsheet. It looks exactly like the net worth chart on Mint, if you know what that looks like. We haven’t posted it online anywhere, or I’d share it with you.

Wow, awesome January, J. Money! I also managed to increase my net worth by over $13,000 in January, woo!

I’m really sorry to hear about your cat :( I hope he passes his remaining days in reasonable comfort.

Reducing your mortgage balance by $2,400 in one month is pretty inspiring! That’s amazing! (And that’s coming from the person who saves $2,000-$4,000 per month :D

Congratulations! The net worth looks great, especially considering where you were a few years ago, which is where I am now. It is inspiring to watch how quickly things can improve with discipline and hard work.

Wow that is really impressive. I need to actually go through and determine mine. At least that way I can see what litte growth I’m having (I know I will be in negatives though)

I’m really sorry about your cat–at least he will know he has been loved.

Well done, J$. We are doing fine but compared to you we are like a snail and an express train. Keep going – I have set up things so that they are going to accelerate loads by the summer.

I just started seriously tracking my net worth. I new it was bad, but… wow. And I knew my wife had gotten ripped off on her car loan, but… with a year left on it, she’s underwater. Car is only worth 60% of the loan’s remaining value. And this was a used car!

Wow you’re doing great. Good job!

@lora kathleen – Thanks :) Hope yours is too!

@Kevin @ Thousandaire.com – Haha, nice! I’ll go and check it out after I post this :) Can I join your race?

@Maydog – Just that I’m getting that much closer to $1 Million which is my goal. When I started tracking all this I was like 20x a way. Also, 1/3 of a million dollars also sounds better than $300k in my opinion ;)

@Melissa – Thanks Melissa, we’re def. enjoying every day we have left. Some days are harder than others, but overall we’ve been very very blessed to have had him in our lives for so long :) They can’t live forever.

@Economically Humble – Thanks! How is your plan coming along? Better this month than last?

@Ten Bob Millionaire – Yup, every day is an extra day :) Hope you’re net worth is going up too, my friend!

@Jennifer Lissette – COOL!!! That’s awesome news Jennifer! We’ll both be reaching our milestones next month together – woo! :) All that hard work is paying off, baby. Keep it up! (And sorry for the delay in posting here, I’ll try and get it closer to the first few days of the month next round – someone called me out on it on Twitter too ;))

@Leigh – Haha, awesome! Congrats to you too on rockin’ it out :) It’s def. getting harder to keep my $2,000+ momentum every month on the stupid mortgage, but I’m not backing down anytime soon! Just gotta get used to it and then make it habit… for 10 years, ugh.

@bogofdebt – The first time putting it all together is always the hardest (and scariest). After that though you KNOW what you’re dealing with and it should start trending upward over time :) Which is inspiring! And hopefully motivates you enough to keep working on it so you reach your end goal there. That’s why I track ours to be honest with you – to stay motivated. (And also to make sure we’re not f’ing up, haha…)

@maria@moneyprinciple – GOOD! It’s all about a great foundation to build on, I’ve got faith in you friend! :)

@Michelle – Thanks! Are you doing well too over there? Hope so :)

That is an amazing number, J.! I’m still working to get our number up to the $100K mark.

Sorry to hear about your cat, even when their quality of life is declining, sometimes it is hard to let go. I hope you get some more quality time with him.

OK, I FINALLY figured out my net worth, since I got out of debt. I had figured it out before, when I had debt and didn’t like seeing so many negative numbers and I was always obsessed with it.

Now that I have no debt, I still don’t like my net worth. Yes it isn’t negative anywhere, but wish it was at $1,000,000 already. :)

Aus $ beats the US $ pretty handily these days and there’s a very high cost of livin’. Sorry about Bob bro. Maybe when Money Jr is walking around the Money fam should go to their local ASPCA and help give another kitty a great life.

Why would you have more than a third of your net worth in cash? And, similarly, why bother with an emergency fund if you’re holding close to $100k in cash?

@Melissa @ Little House in the Valley – Thanks! You’re so right too – a lot of hard work and discipline NOW goes a loooooong way in the rest of our lives. It’s an incredible feeling :)

@Kris @ BalancingMoneyandLife – Thank you so much, tonight he’s actually not looking so hot :( He was fine this morning so I don’t know what happened… sad…

@LB – We’re always wanting a lot more no matter what stage we’re in ;)

@Alex – I like the way you think, my friend :) It’ll hurt going through the last of his days now, but later on we can provide a nice life for another little furball… maybe Money Jr can pick it out too?

@Financial Uproar – For a number of reasons: 1) I’m self-employed and money fluctuates a lot, 2) We’re about to have a baby, and 3) we like knowing we have a large cushion for whatever may happen down the road. I’ll agree it’s probably too much for the average person, but for us it feels right. I’ll actually be using a big chunk towards my IRA pretty soon though, which will lower it a bit.

Great job J. 13k is great progress is one month. I’m sure you will break 300k next month!

Check out my net worth vs SP500 post. :)

http://retireby40.org/2012/01/net-worth-sp500/

Up 13k is just awesome! I’m so sorry about Bob, that’s gotta be hard. I could never imagine anything like that happening to Roxy (my doggy), it’s just sad to even think about. :-(

Our net worth went down this time, but I’m strangely okay with it. We did our saving and contributing, but I took a lot out of savings. I went FinCon crazy when registration opened, plus I booked airfare and hotel (7 nights). It’s money well spent, so I can’t be upset. :-)

It is amazing to see how a little bit of savings each month can go a long way. Keep it up.

I’m curious what Zillow estimates your house to be worth…

Congrats on your progress!

And I’m sorry to hear about your kitty. One of ours needed daily IVs last year, until we made the difficult decision to put him down. But we knew it was the right choice, his health was declining so quickly.

CONGRATS!! That is awesome progress! It’s fun how things start really compounding once you have more savings. I went back and looked at some of your other reports — impressive, my friend…

Looking good, J! Have you considered refinancing that first mortgage? You can get a much better rate than 5.5% right now (we’ve just locked in at 3.75%) that might save you some money even with your accelerated payoff plan. Just a thought. Looks like you’re rocking the financial plan though! And by the way…babies don’t cost nearly as much as some people think – especially if you don’t let baby stores tell you what are the “necessities.” Honestly, they require very little when they are tiny. =)

@J. Money- I have to admit I have been relaxing a bit more lately and enjoying life. Passive income is more than enough to pay the bills. I am kind of in that complacent lately. I plan on buckling down more and working on the blog though going forward.

@retirebyforty – Haha, okay will do – as soon as I post this up ;) Your brain is always thinking!

@Jen @ Master the Art of Saving – Yeah it is! Will be GREAT to see you there too and chill – I booked all my stuff too! :)

@Jeff Crews – You know it brotha. Hope things on your end is going well too :)

@StackingCash – Wonder no more –> $340,000 ;)

@Earn Save Live – Yeah, I guess they gotta go at some point, right? We literally thought last night was “the end” – but he somehow came through and is now feistier than ever?! Haha… we’ll take it for now, but the end is very very very near… just enjoying the last hours/days with him :)

@Mrs. Money Mustache – Hey, thanks! I keep meaning to put together a “total” progress chart, but just haven’t yet… I like looking back to see how things progressed too – pretty crazy how much happens in just a matter of a few years, yeah? I’m sure you guys are experiencing the same too :)

@Kaye – We’re def. gonna try and refi again here in the next few months if we’re allowed to (we just did it last year, but we’re too underwater for most banks). We went down from 6.875% though which was nice for now :) We’ll see tho! (And roger that on babies, I hope you’re right! :))

@KC @ PsychoMoney – Hey, no shame in that my friend. We all go through the phases – sometimes I WISH I could relax a bit more, but I keep reminding myself that in a hanful of years I’ll be a-okay and it’ll all be worth it ;) Plus I’ve been working a lot less these past 30-40 days or so now w/ Love Drop paused, so it’s been a nice change… We just do what we can, right?

Question J: Do you have a cap on the cash savings amount? For example, will you do something differently once you get to 100k in that account or will you just continue adding to it?

Excellent question. The answer is: “I’m just going with the flow” :) I tend to go in phases with where to put my money, and how much, etc, but as long as the money *keeps coming in* I think it’ll be a safe bet no matter where I end up storing it all. And life will change that too, like how we’re about to have our first baby this Summer. I’d much rather have too much cash in the accounts than the opposite problem ;) But for right now $100k seems to be a nice mark.

J Money, you are so close! I’m getting pretty close to, although my current goal is slightly less than yours, about $300,000 less, but still a huge achievement compared to a year ago! Didn’t have a great month this month, but high hopes for March!

GOOD!! Every phase counts, my friend – and you have to start hitting them from the beginning :) So great work! I’ll go over now and check out your last update… keep it up!