I swear it feels like yesterday that I just updated this. Yet another reason why putting a game plan into motion is key!

Time will continue to go on and on no matter what we do, so you start saving that money and cutting that debt week by week and eventually you’ll be wealthy without even realizing it :)

That is if these stock markets don’t crash to oblivion. But we’d have much larger problems than our finances if that were to happen. I just watched the movie 2012 and THAT would be scary! All the global warming and nature stuff is what freaks me out – no money in the world can stop a world-wide tsunami from hitting you! (*shiver*)

For now though, we just keep doing our best to manage our money and pump up the stuff that works, and cut out the stuff that doesn’t. Here’s what August ended up looking like…

Net Worth break down: August, 2010

CASH SAVINGS (+$9,120.28): Still stashing as much cash as I possibly can! This includes anything extra from my biweekly paychecks, side projects, and anything else I can get my hands on too. I won’t stop until I reach my goal of $50,000! (which is currently at $30,000 right now – the other $20k in this “cash savings” number includes this “going solo” goal among other funds from other places.)

EMERGENCY FUND ($0.00): Nothing added or subtracted – Only for TRUE emergencies!

ROTH IRAs (-$1,111.62): Nothing much going on here – all maxed out for the year so it’s totally in the hands of the markets. (Not even Buffett is helping me! ;))

401(k)s (-$4,869.10): Same with this bad boy. All maxed out and just chillin’ now until the next year’s fresh start (although I have a horrible feeling all my matches are out the window…at this point just hoping our company KEEPS the 401k plan! It’s getting rough over here….)

AUTOS WORTH (kbb) (+$265.00): Don’t ask. Every other month these numbers fluctuate, but it’s what KBB is reporting.

- Pimp Daddy Caddy: $2,735.00

- Gas Ticklin’ Toyota: $9,800.00

HOME VALUE (Realtor) ($0.00): Still @ $300k as our realtor set it at a while back. Our neighbor’s house had an offer of $297k a few months ago on their house, so I’m thinking this is a reasonable estimate.

CREDIT CARDS (-$200.00): I’m gonna admit this is taking longer than I like. I know I could xfer over cash from my $50k goal, but in this point of the game the “going solo” part is just more important to me right now. I don’t mind paying a few bucks interest every month until it’s all wiped away, go ahead and make fun of me if you want ;)

MORTGAGES (-$4.78): Nothing new to report here. Just like our credit card, this is currently taking a back seat.

- Mortgage #1: $286,818.64 – 30 year fixed, interest-only @ 6.875%.

- Mortgage #2: $62,554.19 – Maxed out HELOC w/ 2.8% interest.

And that wraps up August! I don’t foresee anything crazy happening in September, but you never can tell in this beautiful life of ours. I’ll be taking a trip out to Poland soon, but as long as I watch my conversion rates and stay away from the bars I should be fine ;) Here’s to success!

—————–

PS: My personal budget has also been updated, and you can download it (and others) here.

PPS: I finally watched Inception! And now I keep trying to plant things in my wife’s dreams… I don’t think it’s working.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

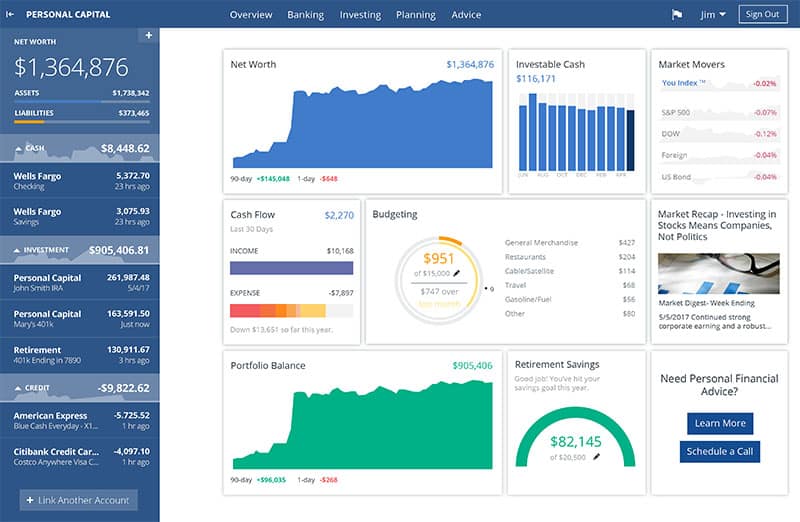

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Still looking much better then mine. :(

Dropping 9K in saving is nice, sure the credit cards are taking a back seat but it all part of your plan.

This month was brutal. I’ve been using zillow for my home’s value and it’s dropped $37,000 in the last two months. Our net worth is pitiful right now.

@Techbud – Sorry to hear bro :( Is there anything you can do to get yourself back on track? Pick up a side gig by chance? If you need anything let us know and we can see if we can help you :)

@Momcents – Same to you! Holler if we can help. And I’ve given up on Zillow – that thing fluctuates more than anything I’ve ever seen. I’d think about settling on one number you think is fair, and then maybe updating it every 3 months or so. You’re gonna drive yourself bonkers and it’s not even all that accurate :(

As always, you are looking better than me, and you have seen my picture!

The balance sheet is looking great, I am really interested in your cash savings jump of almost $9k. Big ups to you. I am going to have to msg you and get in on the secrets of J. Money. My motivation/morale is low at best, but reading your success boosts me a little bit.

As for the KBB rubbish, I have been experiencing the same stuff the last 3 months! It is quite brutal I must say. Stay tuned from this guy, you might just un-follow me on Twitter!

Interesting, seems like a lot of people’s cars are appreciating in value lately, wonder why this is.

@Jenna: I think used cars are in high demand right now because fewer people can afford new cars. Makes me want to sell mine and get a new one :)

Zillow is screwy, especially here in Las Vegas. However, after our big property tax reduction, I think Zillow unfortunately got a more accurate reading of housing prices here. Suffice to say, my home is worth as much as I bought it for 10 years ago. It doesn’t matter much because I did a 15 year loan :) Having some equity and knowing I will have a house paid off in 5 years is awesome!

I was wondering if it would be a good idea to pay your mortgage down to get an instant 6.875% rate of return? Probably a better rate than your cash savings is giving you.

@StackingCash – Good insight. Although I think I’ll always drive a used car. I can’t justify buying something that looses about $1,000 as soon as it lives a parking lot.

I’m fairly new here and maybe I’ve missed the whole discussion on the savings, but why are you accumulating $50k not in a retirement account or anyplace you’d get a benefit? Have you maxed out all types of contributions? Is this in anticipation of a major purchase and you need it accessible? I see you’ve got the emergency fund in place so it’s not for that. Sorry, but why wouldn’t you pay off the credit card asap?

@Doctor S – We’re all gonna make it to our first million in different ways, my friend :) Just gotta find our inner secrets of getting there! (but yeah, shoot me an email)

@Jenna – Don’t know myself either, but I’m sure the economy has something to do with it like StackingCash mentioned. Used IS pretty smart, even if it’s only 30 days used! Or even 1 day used! The second new cars go off that lot it loses mad money. I’ve seen people take a $5k hit before, it’s crazy (granted, it was a more expensive car too).

@StackingCash – 15 year loan?! You are a rock star!!! Man that is impressive, seriously. You have impressed the pants off of me ;) And I’ll agree on the “better rate” if I paid off the mortgage(s). Only problem there is that everytime you pay off the debt, your cash goes out the window! No getting it back if you need it for whatever reason – even if you turn around and sell your house ASAP in this market. Well, at least MY house :) Your payments now = equity. (I’m also saving $50k to start my own venture – so I need to keep it as liquid as possible in case that day comes sooner than later)

@JMK – No worries, I get asked this every month it’s all good ;)

RE: $50k in savings – I’m working towards a huge cushion for when I start my own company/work for my self. I could put it in stocks and mutual funds and cds, etc, but since this day may come sooner than later (hopefully and not hopefully at the same time! haha…) we feel much more comfortable having it in the bank within 24/7 reach. Once I hit $50k, I’ll go ahead and invest anything on top of it, and maybe even part of this $50k if I get out on my own and realize I don’t need to tap it real soon.

RE: Investments – Yup, maxed out both 401(k) and Roth already this year.

RE: Credit Card Debt – It’s all about priorities for me, and right now saving $50k is the #1 goal. I could easily pay off the c/c debt but I’d rather concentrate on the big boy at hand right now – as stupid as it sounds, I don’t mind paying the $10 or so extra interest every month while it’s there.

Keeping the balance also reminds me that I need to work harder and find new ways to come up with extra cash squeezed from my budget! If I just paid it all off asap, I wouldn’t learn/do anything different and I just let myself get away with it ;) Does that make sense? In a way I’m punishing myself for not staying on top of it, and since it’s not the #1 priority I only knock off portions when I get *extra* non-accounted for money. At least for now.

Great stuff! Good luck w/ the 50k! A lot of folks will tell you what they think about CC debt and other things like that, but do what works for you. But what about the “other 20K” in the cash savings account? If you wanted you could take the $$ out of there and it wouldn’t slow you down from the 50k savings, right? It may actually speed you up a tiny bit because you could put the CC payments into the 50k fund instead of the other funds. Just a thought.

But it’s “personal” finance, so do what works for you. As long as it “works” you’ll be fine. And we’re not talking about a ton of money anyhow.

Good luck!

Thx dude :) Yeah, the other $20k is set aside for other specific things too (grad school, house stuff, etc etc) but I def. see your point. I’m gonna keep going my own way here for a couple more months and then re-group and see if it still makes sense. Who knows, maybe I’ll just hate seeing that c/c debt there one day and just wipe it clean!

Wow, that’s a huge cash savings bump! How did you do it after your expenses and with a 75K income? You need to make around $11,000 gross to put away $9,200 net no?

Hustlin’ baby! Work my a$$ off outside the 9-5, you know about that ;)

Gotcha! Big bucks! Another positive anecdote for the economy. I agree with you on that other post… anybody can do it and make money, they just have to try!

Exactly. You just have to REALLY want it. Gotta sacrifice sometimes right?