Woohoo! Even IF it’s only by $32.81, haha… But none the less it’s nice to feel on top again :)

And I hope it’s a sign of much more goodness to come, esp. now that our finances are more streamlined and we’ve got at least 5 less accounts to check and maintain every month. I already save 15 minutes just updating our net worth this time around! :)

Though it has made for a funky “cash” update this month since we combined all our savings into one main “monster” account (including the shedding of our old Emergency Fund), thus making it looks like we EARNED an extra $3,500 this month. Which is certainly not the case. In fact, we actually LOST a few thousand this time around due to a much slower business month :( That should pick back up after the Summer finally ends… We also haven’t seen our $20k profit from my dealings the other month, so needless to say I’m PRETTY excited about re-calculating our next net worth update ;)

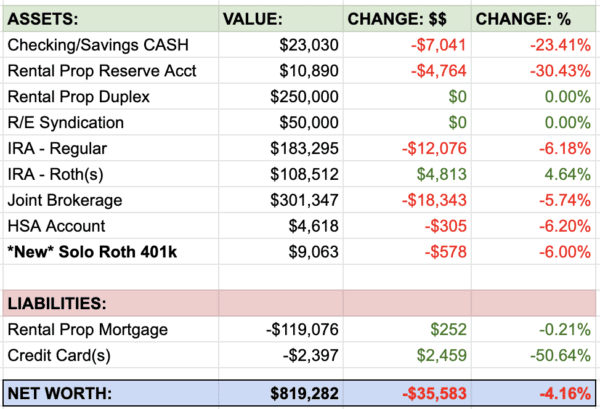

Here’s how it all broke down last month:

MONSTER CASH ($3,564.64): Again, this should actually show a loss of money since we’ve combined a ton of accounts and had a slow month of business… REALLY hoping it gets back up to normal next month and/or I come across the next big idea ;)

EMERGENCY FUND: No longer around! We’ve pushed this money, along with all other minor accounts we had laying around, all into our one main monster savings account now. And while I’ll miss not having this guy separated out from the pack, it just doesn’t make sense to keep her around anymore merely for nostalgic reasons. Any and all future emergencies, along with anything else that requires money randomly, will all pull from our main savings account going forward… and if it ever dips down below $66,000 (which is 12 months of expenses), all other money-sucking projects will be paused until we top this guy back up again… which really means no more paying extra off our mortgage – which would blow. But I promised the wife! ;)

PHYSICAL GOLD ($61.80): I don’t pretend to know why this goes up and down all over the place, but I do enjoy having a shiny gold coin around if/when the world ever goes to crap ;) And I meant to look up and calculate all my newer silver pieces too so we can have a “gold/silver” category here other than just gold, but unfortunately small babies and other awesome things with life got in the way, haha… So I’ll try and get my act together for the next round up.

IRA: SEP ($791.40): Nothing new added here (yet), but hopefully by next month! I’ll be able to invest around $22,000 for the entire 2012 tax year if all goes similar to last year’s numbers (the amount’s contingent on the year-end profit of my small biz), and in a few weeks I plan on plopping down a good $10k to get the party started :) And then the rest incrementally over time.

IRA: ROTH(s) ($967.64): Same with this guy – I’ll be maxing out both mine, and the wife’s, Roth IRA once that $20k check hits my account later. Infusing another $10k into this dept…

IRA: TRADITIONAL(s) ($3,339.77): Crap. I’ve been meaning to do an in-depth review of this IRA Game and I keep forgetting, sorry! I’m making a note now though to do it within the next couple of weeks. Which I’ll then need your help on to determine if I should keep on rolling with this test, or just call it a day and merge everything into one. Here’s how they all break down, in the meantime:

- IRA #1 (NOT Managed): $61,468.42 **Been in the lead for a while now

- IRA #2 (Managed, USAA funds): $59,382.74

- IRA #3 (Managed, ALL funds): $59,943.25

AUTOS WORTH (kbb) (-$480.00): Normal depreciation, as always… Though we’re now on the search for a bigger car (probably an SUV) since I don’t ever want to spend 2 hours packing all that baby stuff up again the next time we go on vacation :) It was a good lesson to be learned – kids take up a lot of space! And I apparently like to learn the hard way, haha… I’ll keep y’all updated on how that goes as well. The current values of the two cars we have now:

- Pimp Daddy Caddy: $2,065.00

- Gas Ticklin’ Toyota: $8,756.00

HOME VALUE (Realtor) ($0.00): This is gonna stay put for a while until we either move out (which we plan on doing in the next 6-10 months), or we come across our realtor and he says something different. We updated it for the first time in 2 years the other month, and it was a hard pill to swallow watching it drop from $300,000 down to $285,000. On the other hand, it feels great not fooling ourselves with inflated numbers either!

MORTGAGES (-$2,593.36): We’re still skyrocketing forward with our extra $2,000 payments each month! Though I’m cautiously anxious on what the future will bring (like business remaining low or the baby funneling more money than expected, etc). I figure we just knock away as much as we can – while we can! – and then do our best to adapt when things come up. Even if we stopped now, we’ve already gotten our 2nd mortgage down to the high $30ks from the low $60ks! That’s hot!

- 1st Mortgage: $283,471.47 – 30 year conventional @ 5.5%

- 2nd Mortgage: $39,822.66 – Maxed out HELOC @ a variable 2.8%

And there you have it. Another month down, another small forge ahead! Remember that no matter what happens, time will continually run and there’s nothing you can do about it except keep making those baby steps forward. Before we know it, it’ll be September 2022 and we’ll be looking back to see how far our money has grown! So make sure to keep tracking it so you’ll know!

Here’s to another fruitful month, everyone – hope you guys kicked my ass last month! ;)

———————

PS: For any newbies out there looking to get started, try out my budget template which incorporates a simple “net worth” section. It’s super easy to use, and you can always tweak it and/or upgrade to something fancier later once you get going. The hardest part is just starting!

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

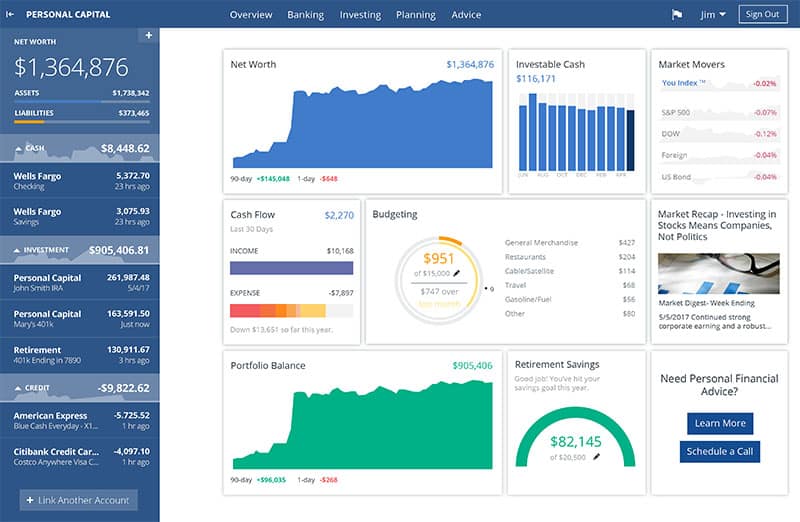

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

September 2022 sounds so futurey but it is really right around the corner. Can you believe baby $ will in school then?

Congrats on another positive month on the net worth! I think I should be in the positive range too when I calculate mine mid month (although I don’t share like you do).

That 20k should be a nice boost for sure next month. Hopefully the business picks back up :)

Are you ever tempted to use Monster Cash to pay off mortgage # 2?

I remain jealous of your HELOC rate every time I see it =)

Oh, J Money, your net worth makes me feel so inadequate!

We’re in the market for an SUV as well. My husband drives a 4-door sedan, but at the moment I still have my inherited Cavalier coupe. Not very carseat compatible, plus we want to be able to cart the baby and the dog places at the same time, so being able to put Elvis in the back of an SUV would be the ideal scenerio. Totally bummed that I’ll have to take out a bit of a loan to do it, but if I get my way, I’ll have talked the dealership down on the price so much that it’ll make up for the interest paid on the loan, especially since the bank offered me a ridiculously low rate!. :-P

Baller man!

What about dumping $25K to your 5.5% mortgage? 5.5% is a good return!

Congratulations. If the house market will rebound again, you will get another $40,000 : -)

I can not wait to see you next month update, with the extra $20 K in : -)

For the late 20s’ I am jealous of your exciting start! Keep in touch!

Congrats!!! Keep on hustling!

Why are y’all moving?

Also, what do you mean by an unmanaged IRA?

Great update! I stumbled across your blog a month or two ago and have loved it.

I thought I’d pass along a quick note on cars from our experience, for what it’s worth. We had a Jeep Grand Cherokee when our twins were born 2.5 years ago. We traded it in 2 years ago for a Chevy Impala. I’m 6’3″ and actually have more leg room in the Impala and the trunk space is huge. Probably not quite as big as the Jeep, but really, really impressive. We now have a 7-month-old too and line the 3 car seats up in the backseat. The cost savings in gas (10 MPG better than the Jeep) and the lower price of the car versus SUV’s I was looking at were huge. My brother, who has 2 kids 2 and under, loved his Impala so much he bought a second one. Obviously there are numerous options other than Impalas if you don’t like them, but we’ve had great experiences with them.

Anyway, take it with a grain of salt since everyone’s situation and preference is different, but I thought I’d throw it out there since I think the savings you get by staying away from an SUV are well worth it. Of course, my wife still wants a minivan, but that’s another story…

Great job! $32 positive is still winning. I have to calculate my September net worth too. I think we did ok.

I saw your post on Facebook today for the first time in what seems like forever… must not check in there often enough. But I must say that it must have been in some “grand plan” because yesterday I looked at my overall financial status and I just about cried. 3 years ago I was nearly debt free (with the exception of the mortgage)… and today I feel like I’m being “drowned” by all the bills.

I’m going to work my way out once again… but just had to say that you are an inspiration to me. I hope I can be in the same place as you in a very short time.

Congrats! Damn…reading this post makes me realize how far behind I really am compared to where I should be at 35 y.o. But it’s motivating nonetheless.

Congrats on the increase this month J$! Don’t worry about getting an SUV, I think you should go with a Mini Cooper, they have roof racks that you could strap your stroller to.

Congratulations! I definitely agree with you. $32.81 makes a big difference to the motivation and sense of fulfillment you feel when you go over your target net worth. At the very least, you know you are in control.

Congrats dude.. Although I think you forgot to add all those coins you found with the metal detector…

Thanks for all the love y’all – I sincerely hope you get a lot out of these! I do them of course to keep myself on track mostly, but also to share the stuff that’s working and not working in hopes it helps you guys too. I’m not just throwing out my sexy numbers for show ;)

@Lance @ Money Life and More – I like it that you do them mid-month and against the grain like that :) Now if only you’d post it up for everyone to see! (Maybe you can do %’s or something?)

@Slackerjo – I am. Like every other day :) But I promised the wife we’d have at least 12 mos of expenses in there at all times ($66k) so that stops my hands from poking into the

cookiemortgage jar@Mrs. Pop @ Planting Our Pennies – Sorry! If it makes you feel better, it used to be at 6.875% until we refinanced? :) And we *barely* got that refi in too as real estate was just about to crumble all over the place, man…

@Stephanie – Hey, sometimes you can’t avoid loans, ya know? I can tell you that whenever we get this new car I’m sure as heck getting one! I like having my cash reserves on hand and don’t mind paying a little interest for borrowed cash. Donald Trump says leveraged debt is good ;) Not that a car is that *good*, but you get the point.

@Financial Samurai – Nah, cuz I won’t actually *feel it* until it’s completely paid off anyways. I’d prefer to throw it against the 2nd mortgage to be honest with you so I can see it dwindle and then watch it go bye-bye :) Will be nice to finally meet you in person btw at FINCON – see you soon!

@Financial Independence – Thanks so much :) But where I am, you can be too my friend. I started with $0.00 a handful of years back and only applied myself really (and hustled my ass off) to get here. Anything’s possible if you throw your heart into it!

@SavvyFinancialLatina – We wanna move to another state just for a change – I’m not good at living in places more than a few years (military blood in me) and the wife hasn’t left the state much herself. So we’ll see where we end up going later! RE: “unmanaged” – just means I bought the funds that was recommended to me in the beginning, and then I don’t touch them. Whereas the other IRAS have the USAA team always monitoring the funds that the money’s invested in, and will make the necessary changes as time goes on. If something bad happens – let’s say, with gold – and one of my unmanaged funds is invested in it, then I’m screwed cuz I don’t see it and don’t act on anything. Wheras the managed funds people will see it and make the changes for me :)

@Joey – Haha… Let me know if you ever go down that route ;) I swear I’m not, but who knows what the wife will convince me of later… I def. think we need an SUV though also because of my thrift store and storage unit auction love – which I’m about to start testing out :) Gotta have room for all my treasures! Appreciate you stopping by and reading (and commenting) too – thanks man. Have a great weekend over there.

@Joe @ Retire By 40 – You guys are always doing okay :)

@juliemae – Awww thanks! And yes – you can TOTALLY do it! Especially if you’ve done it once :) You just need to re-energize yourself and come up with that next game plan. Check around my site, and others in my blogroll, for more motivation to keep on going too – you’re gonna be great!

@Debtkiller – Hey, better to get motivated now than later, right? It took me 25 years to finally wake up :)

@DebtsnTaxes – But do they hold my yard sale antiques? ;)

@Cherleen @ My Personal Finance Journey – It sure feels like it on months like these :) Hope things are doing well on your side too!

@Ryan @ Budgetable – Haha… those are included, don’t you worry ;) Although my REAL old coins from the 1800s and early 1900s aren’t, but that’ll come next month.

Nice increase in the net worth this month, glad to see you’re back over 300k. :-)

$66k is 12 months expenses, so $5,500 per month? Are your monthly expenses really that high? Like, say the internet stopped working forever, would it still be so much each month? Sorry, I’m just not sure I’m following.

We’re up $2,658.21 this month, which is HUGE for us. It’s mostly due to the “pretend mortgage and bills” and the transferring 50% over our root income, but that’s fine with me. :-)

I was wondering if you can tell me what you use to track the value of your house? We just bought our first home, and had it appraised, so we know what it was worth in December, but I have no idea how to monitor how it changes from month to month?

@Jen @ Master the Art of Saving – Haha, whatever works! Yeah, it costs us $5,500 right now to survive (pay the bills, eat/etc), mainly cuz of our mortgages ($2,200) and new baby costs and my ridiculous $600 health insurance premiums. In the next few years a lot of this should change (we’ll go on wife’s future job’s insurance, pay down much more of mortgage/etc), but for right now it is what it is.

@Lindsey – Yeah, tracking all that is super tricky – and everyone has their own preferences. Some poeple rely on Zillow.com (I don’t) and/or Redfin.com (I don’t there either), and then others like me just move it when they get it appraised or a similar house next door sells. That’s what we did recently with our loss of $15 Gs since it’s “market value” ya know? But as far as monthly increases or decreases, you’d have to use one of those house tracking sites (like the ones I just listed) if you want changes like that. If you’re cool with only once a year, or twice a year, updates though, I’d just leave it alone for now. It’s a personal preference :)

Congrats! Great job on the retirement funds. House values really fluctuate but eventually it will pick up

I hope so! I’m over home ownership right now ;)

Congrats on breaking through that 300K mark! I am inspired… I’m going to start posting my own net worth updates. Maybe one day I’ll get to where you are!

Great! Please do it. It’s one of the best things you can do with your finances as it really holds you accountable and shows you where you’ve been in the past! Even if it goes down some months, it’ll still motivate you more than without tracking it :)