I can’t believe it… two full years of working toward this goal and we finally did it :) MAN it feels good.

It also feels like we cheated (it’s obvious it’s all due to the stock market!) but I’ll take it nonetheless. Someone had to put that money in there, right? Haha…

And now the tough part comes – growing it. I was going to say “maintaining” it but that seems pretty lazy, even if it is kinda what I’m thinking ;) I’ve been in money-hungry mode for so long that I really just feel like taking a breather for a bit and letting it ride. I won’t because I need to be on my game now more than ever, BUT I think it’s important to take a step back and soak it all in. It’s a milestone, baby! All that work paid off. Literally!

But when reality sets back in again, it’ll remind me that my solid paychecks are no longer a comin’. And if I don’t hustle hard enough, there’s a good chance those numbers will start going down. Obviously a path I want to avoid as much as possible :) I don’t mind even-steven, or tiny gains per month, but I don’t ever ever ever wanna see steady declines or plummets. Those things are scary, and I give you permission now to bitch-slap me if you ever see it happening. *shiver*

On with the show!

Net Worth break down: December, 2010

CASH SAVINGS (+$287.13): Gone are the days of multi-thousand cash gains ;) When you lose a salary of $70,000, you can’t expect to have a superfluous cash flow anymore. One of the trade offs of changing your lifestyle… but would I take it all back if I could? HELL. NO. I’m much more happier now with less than I was with way more :) Although I’d be even MORE happier if some ASSHAT would give me my last paycheck! Arghhh….

EMERGENCY FUND ($0.00): The wife and I were talking last night about taking part of this and just knocking out those pesky credit cards once and for all…. I honestly didn’t mind it before (in fact I preferred it), but times have changed and now I gotta be a lot more frugal. So don’t be surprised if this number goes down next month – for the first time in 3 years!

ROTH IRAs (+$1,412.34): The last time I can say I have fully maxed out all my retirement accounts :) The new year has set all the clocks back to $0.00, so it’s a whole new ballgame, folks! (and one I’ll be sitting out for a bit)

401(k)s (+$9,119.17): Same with this guy. All maxed out and starting back to $0.00 again. Only I’ll have to find a new tool to invest in now that I’m self-employed… I wanna say I’ll be looking into a SEP instead? I need to do more research on that one. Once I get the extra funds rolling in. For now, it’s operation stay afloat!

AUTOS WORTH (kbb) (+$1,140.00) : Yeah, don’t even ask. I swear Kelly Blue Book just jumps like CRAZY sometimes! I doubled, and even tripled, check this one. KBB is telling me our cars are worth a lot more this month than last. I don’t buy it, but it’s how I track it. So…

- Pimp Daddy Caddy: $2,945

- Gas Ticklin’ Toyota: $9,655

HOME VALUE (Realtor) ($0.00): Same ol’ deal here – keeping it at $300k as our realtor set it at a while back. We think it’s still in the ballpark since our neighbor’s house had an offer of $297k not too long ago, but it’s certainly possible it’s gone up or down since. We’re fine with it here for now.

CREDIT CARDS (-$1,800.57): Whelp – looks like it’s time to finally pay this off! No more saving for my “work for myself” fund since the day has already come! Haha… Although I feel bad taking the one thing you all liked to give me crap about away ;) I know how much you enjoyed that!

MORTGAGES (-$308.83): Continuing to knock some off every month… our trick of rounding up to the nearest $100th seems to be working. Not sure if we’ll keep doing this or not, but for now the plan shall remain. Here’s the breakdown of our remaining mortgages:

- Mortgage #1: $286,499.88 – 30 year fixed, interest-only @ 6.875%.

- Mortgage #2: $62,160.30 – Maxed out HELOC w/ 2.8% interest.

There we have it. 2010 all wrapped up and stored away. My apologies in getting this out so late this month, something more interesting kept coming up! (at least to me :) haha…) Shout out to LaToya who got me to finally sneak it in.

Hope all of your Net Worth adventures are paying off too!!! Keep working hard and tracking those numbers – it all leads to being smarter! (and richer)

—————–

PS: My personal budget has also been updated, and you can download it (and others) here.

PPS: And so has my sidebars…although they probably need to be changed out now.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

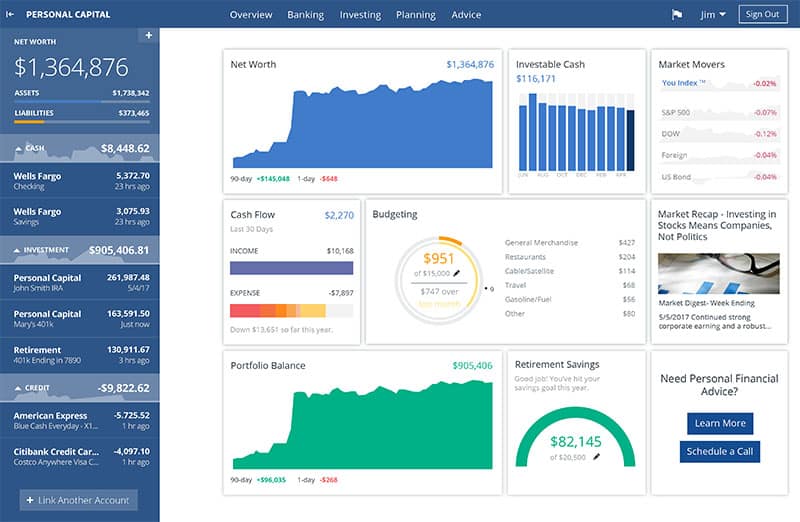

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

I checked KBB too…here is what happened. They defaulted all the cars to “excellent” condition, and I can’t figure out how to change that. You can look at the trade in value, which gives you excellent, good, fair, etc. But the actual value is set at excellent. I know neither of my cars are “excellent” by their standards. When I ran into this, I didn’t know what to do about tracking my net worth. Seemed “wrong” to use their numbers now.

Congrats on the 200k….

KBB seems to do a reset of values around the flip of the calendar year. When I look at my net worth history, I’ve seen the biggest changes around the Dec-Jan timeframe.

With KBB, I personally use the ‘Private Party Value’ as my benchmark, which after you input your mileage and options will give you the values for all conditions including Excellent and Good (which is what I use).

Hopefully this helps.

Great job on the net worth. But gosh get rid of those credit cards! Nothing but money down the toilet ya know? :)

And to think I was happy that my net worth was close to $20k. Congrats on hitting $200k!

Can I get a Woot! Woot!

All that discipline hard work has really paid off! Someday I hope to hit that number as well.

Congratulation! I predict 2011 will be another great year and net worth will jump again.

Nice!

J, can I ask how old you are? I feel so behind your numbers on the 401k and am hoping you are older than I am. (Plus that is where a lot of your 200 comes from).

Btw my goal is to be at 0, I know that is sad but right now I’m at -4k so could be worse considering like 58k in student loan debt. Hope to be there by the end of March.

Wow, what a milestone! Congratulations with that and good luck with your new goals (although luck has nothing to do with it!). Cheers!

Nice! Congrats!

I can’t wait to get to that point

Wow! Congratulations J$! I wish I was able to max out my 401k just ONCE! But I think I’m going to have to wait for a few pay raises for that to happen… Good luck in saving for the coming year!

Congratulations J! Definitely a huge accomplishment. Keep up the excellent work. And don’t worry about the E-Fund dropping; that’s what it’s there for!

Thanks everyone :) A nice change from yesterday’s mood, eh?

@Mysti – That could be it, but I know when I looked every time I still chose the # that was “good” even if Excellent was clicked. 3 times and no change, so weird.

@Money Beagle – That’s what I do too :) “Private Party” cuz that’s how we’d sell it if we ever did.

@Jonathan – Not necessarily, but yeah they’re def. gone soon.

@Kevin @ Thousandaire.com – I started before you did ;)

@Steph – Thanks! And you will!

@retirebyforty – I’m going to hold you to it :)

@Brian – Sure, I just turned 31. And you’re right – it’s mainly 401k cuz all I did was max it out year after year – and it also helped that my employer was putting in 100% too. In fact, I’m still missing a LOT of that too, but that’s for another day — can’t get fired up yet ;)

@DoNotWait – haha, thx.

@Techbud – thx!

@Blue Spyder – Anyone can do it :) Just lots of time and patience and hard work. And then when you get to this point, you’ll want $300k and then $400k, etc. Always goes up over time, which is why I’m soaking this all in while it’s fresh and exciting!

@Mercedes – Yeah, making more money def. opens up more opportunites to save more. But we do the best we can with what we have!

@20 and Engaged – Thx :) It’s def. hard to still tap it, but you’re right.

I dont understand the 60k in savings?? wouldnt that just be emergency savings? or should it be the other way around? 60k in emergency and 10k in savings? and if u have 60k in savings, why not just put 2k to the credit cards? Am i missing something as to why this $60,000 is in the savings? Im guessing its more than just some savings account lol

You’re not missing anything, it’s all just 1 big pile of extra money saved up :) We put some into a money market account (emergency fund), and then others in savings for easy access. The reason we have so much money saved up is/was for me to quit my job and work for myself – I wanted it 100% liquid. (plan was to pay off c/c bit by bit while it didn’t affect my super goal of the $50k work-for-myself-fund).

And now that I’m on my own, we gotta figure out if it still makes sense or not. There’s def. more ways for us to make more money off this money, but I have no problems sitting on it and making myself feel better. Just personal choices.

Congrats on the 200k J!

I just started tracking my networth this month even though I always had a pretty good number of what it was. It’s nice to have it official though.

Congrats on hitting $200,000+! Here’s towards years of it growing!

Congratulations, J!!! And even though you feel as if you should maintain it, the motivation of seeing this goal come true will push you to bigger objectives. Besides, what you now call a “money-hungry mode” has very likely changed the way in which you take financial decisions for good.

Congrats on hitting 200k! Without your job, how come you haven’t tapped your emergency loan? Or do you make due without?

That is too cool. What a great accomplishment.

Wo0t!! That is awesome! Congrats!

@Bobby – Well you’re lucky too that it’s close! Most people (myself especially) think they have much more before they start tracking. And then they jot it all down and give up before they finish cuz they’re too afraid of what that number’s gonna be! haha… so good work. Month 1 down, and lots more to come. Keep watching it and comparing as the months go by!

@Jenna – Thanks Jenna :) I hope yours is going well too!

@Finanzas Personales – Ooooh that’s a good point. I do think of money WAY differently now than I did when all I wanted was LOTS of it ;) Good point! (note to self: add this to your future blog post ideas)

@twentysomethingmoney – Because of all my side hustles aka my new jobs aka my saviors! I’d be F*cked without those lined up (although I would have found a better job long ago too – I remained cuz it was comfy while I was pimping my other stuff!) But I’ll probably have to dip into my E Fund soon anyways to pay off those credit cards once and for all, and to float cash when I’m waiting for certain checks to clear. But the overall plan is to at least break even every month – with the idea that my projects would start bringing in more and eventually replace my salary completely.

@Niki – Thanks Niki :)

@Jess – Thanks Jess :)

Congrats on breaching 200K$!!!

Saving it is step 1, multiplying it is step 2 … Looking forward to see how you will grow your net worth further.

Multiplying IS a big step! And not as solid/easy as saving XX amount ;)

6.875% fixed, interest-only mortgage….Yuck! I’m not trying to be negative here, but that has to hurt. We’ll have to talk about fixing that some day. Great blogging, as usual!

It does hurt ;) But at least we can afford it! And it’ll have to do until the market picks up or we pay off more of our 2nd mortgage… too underwater to refinance – and don’t plan on sticking around for too long anyways.

Hey J. . .

Let us know what you choose for a retirement account. . .like if you go w/ a SEP or what not. My girlfriend is a hair stylist and I got her going with a Roth IRA but I know she would probably be better served to have additional space to save for retirement once she maxes the Roth. Congrats on cracking the 200k threshold. . .I hope to make it there myself. I cracked the 100k threshold 3 or 4 months back. . .felt pretty good, but I imagine 200 feels even better hah : )

– B

You’ll be at $200k soon enough my friend ;) And you got it – will holler once I get that part sorted out… right now I’m not making enough to save extra – gonna be an interesting ride!

CONGRATS!! I am impressed!! I love how you break it all down for us too. (What can I say – I’m a bit voyeuristic.)

Have you checked out Zillow.com (which is now part of Mint.com) for your home’s value? I don’t know how accurate it is compared to a realtor’s estimate, because they obviously don’t look at the condition of YOUR particular home or any improvements you’ve done on it. It’s all based on neighborhood and other houses in it, etc.

yeah, i used to use Zillow but it would fluctuate a good $100k every other month – couldn’t rely on it much. since our realtor knows these places inside and out, figured his #’s are much more accurate :) I did not know about Mint & Zillow though – very cool!!