Lots of crazy fluctuations going on this month. As you can see our cash reserves took a big nose dive as expected, but on the other hand our retirement accounts were freakin’ on fire! And that’s without some big news that’s about to hit in that department (I’ve actually got a post drafted up just waiting to come out and play- debating if it’s legally smart of me to do so though unlike the last news I just spilled :) We’ll see…)

Overall I’m pretty happy. I haven’t watched my money this hard since back in the college days! Here’s the latest roundup:

Net Worth Break Down: February, 2011

CASH SAVINGS (-$7,566.35): This one LOOKS pretty scary, but don’t let that big ol’ number fool ya. $5,000+ of it went right into my new SEP IRA account! So it’s technically not cash anymore, but it’s not like I went out and spent it or anything ;) Although as I mentioned I did have to give up $7,000ish due to taxes from last year too. And that was def. thrown out the window… all in all we lost about $2,500 this month. Not good in a general sense, but not too shabby due to the circumstances.

EMERGENCY FUND (+$124.33): We’re slowly building it back up to $10,000! As you know from last month, we decided to take out a chunk and finally wipe out the rest of our pesky credit card charges I had been failing to do for the last few months. My plan to re-pay with extra money saved from good budgeting just wasn’t panning out like I’d expected ;) Which, looking back, was only a matter of timing. We beat our budget by over $600 this month!

*NEW –> SEP IRA (+$5,107.01): Woo! LOVE me some new retirement accounts. Esp ones that come out of nowhere and HELP me, haha… I gotta give my accountant mad respect for that one. Not only did she save me $2,000 after all the tax stuff was done, but she gave me something exciting to look forward to again. I was just starting to miss my old 401(k)!

ROTH IRAs (+$3,201.79): Win-win-win! Did nothing, and got money for doing so ;) I’d like to think it’s my awesome ability to pick out great stocks, but I’m pretty sure the market just had a great run last month. Either way, the end result’s the same.

401(k)s (+$8,898.25): Same here! With the minor exception of that little ditty I mentioned in the second paragraph up there from the top. I really don’t know how much longer I can keep that in…

AUTOS WORTH (kbb) (-$275) : Nothing too out of the ordinary here. Just glad it’s reflecting negative again and not some crazy increase of $500 like last month! I wonder if KBB just fools with us sometimes for the fun of it? That would be hilarious :)

- Pimp Daddy Caddy: $2,720.00

- Gas Ticklin’ Toyota: $10,155.00

HOME VALUE (Realtor) ($0.00): No change again here – still set at the same $300k our realtor appraised it at a while ago. We still dream of renting it out and moving back into a smaller place closer to the city, but with everything that’s going on lately it kinda remains at the wayside. I bet by Spring/Summer we’ll be energized and ready to get back to searching again.

CREDIT CARDS ($0.00): Nada mucho in this department anymore. Scrapped it all last month and now feeling back to our normal selves…

MORTGAGES (-$52.57): Well, this number SHOULD actually be in the positives, but due to the timing of the way I did things this month I guess it just wasn’t accounted for in time. We’ll see a nicer difference come next month though – gotta keep up my record of paying a little extra off every cycle!

- Mortgage #1: $286,338.40 – 30 year fixed, interest-only @ 6.875%.

- Mortgage #2: $62,222.09 – Maxed out HELOC w/ 2.8% interest.

And that’s that. Another solid month banked away. How did you guys fair this time around? Anything new and exciting happen to your accounts? Anything crazy? If you’ve learned anything cool, let us know :) Gotta keep taking in that knowledge…

—————–

PS: I’ve updated my “Sexy Goals” over in the sidebar to include my newest aim for the SEP. I’m not sure if $10,000 is a realistic number to hit just yet, but figured I’d set it high and then see if the powers to be make it possible :) Still getting used to predicting my income.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

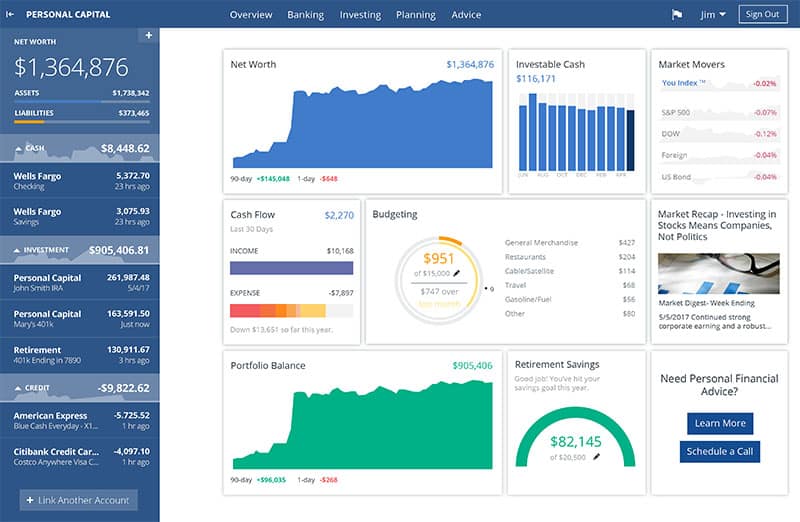

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

How do you calculated your net worth? You count your car and home in it?

Sorry the engineer in me is trying to figure out your numbers for the month.

Congrats on a good month. It’s better to park more of your emergency savings in ROTH IRA’s for both you and the Mrs. if either of you can still make contributions for ’10 and ’11. You can take the amount that you contributed tax free but not the earnings without penalty at any time.

Can’t think of any compelling reason why you wouldn’t do that.

I’m curious, when you put extra money towards your mortgage, do you put it on the first one due to the interest rate, put it towards the second one to bring down the debt utilization, or split it between the two?

Holla atcha money! That’s a great month – we, too, had a nice increase in net worth. Now we’re just waiting for time to pass to see how it’s trending. Great post, man.

AT

Dang, nice goal on getting your emergency fund up to $10,000! I’m trying to hit $5,000 next week, then it’s time to save up for the ring! Yes, I did just say that. Thankfully, I’m not dating a gold-digger haha.

Nice work on the 401k and Roth! It was a good month for me also, but it seems like the market did take a nice little run for a while, the correction is around the corner. I’m investing regularly, but I got a nice chunk of change waiting for another market crash :) Keep up the good work J. money.

Wow, congrats on the retirement growth! I’m freaking out about our retirement. I have the better retirement plan between the husband and I, however, he’s the older of us and probably will be retiring earlier. MUST CALL USAA FINANCIAL PLANNERS TO HELP ME ASAP!

Well I’m going to be $1,000 poorer after today thanks to a lovely phone call from my mechanic… Other than that I’m right on track.

@Rachel – Well, technically its “Assets” minus “liabilities” but everyone tends to calculate their worth depending on their own situation. Which I like :) Cuz the whole purpose (in my opinion) is to give you a good overall sense of your own finances. And then use it to track your progress over the months.

Some people don’t like to put their cars and homes in it, but I do since there’s usually a “debt” that comes along with it too. It wouldn’t make sense for me to not put in my home’s est value, when I owe $350k on it ya know? Unless I take out both sides of the equation (which some also do). Same goes with cars and anything else you want to put in there. IN fact, some people don’t even put their investments in there because they say it’s not “real” – so really it comes down to personal preference.

I just add up all my accounts and major property, as you can see in that graphic up there, and then deduct all my debts. To me, that’s exactly what I want to focus on every month. This help? :)

@Too Funny – Yeah, I think you’re actually right on that one. Only thing that I pause on is if I need to pull it back out for whatever reason… I know you CAN do that (at least the parts you put in), but I try my best to never touch any of those accounts once the money’s in there. I don’t like tempting myself, so if it goes in, it’s in there forever ;) This is why I keep it more liquid in a savings or money market acccount — it’s my “everyday” money if needed.

@Cassie – GREAT question! I *should* put it toward the highest % rate every month until that one dies, and then switch over to the lesser rate, but that just doesn’t motivate me for whatever reason. I like to knock out the lowest amount first cuz it feels easier (and faster!) so instead I just round up BOTH payments to the 1st and 2nd mortgages and do them at the same time. Financially smart? No. Emotionally smart? Yes. To me at least ;) There’s no point in me doing what’s technically right if I end up quitting due to lack of motivation.

@Austin – Holla holla! Congrats to you too, sir. I think our monies shall keep on trending up! :)

@Jon the Saver – Ooooh la la! Going for the big commitment, eh? Congrats dude – don’t forget to invite me to the wedding! I’m good at drinking beer and dancing like a white boy ;)

@Trinnie – Haha… so you’re just gonna call YOURSELF then? :) Oh wait, you’re in another department…. just walk over there!

@Jenna – Balls! Sorry to here Jenna :( I hope it fixes whatevers broken for good! Car troubles are the worst.

Looking good there for an unemployed guy. ;)

Last month was pretty flat for us. Our portfolio had a good chunk of international and emerging market funds so that took a beating from all the unrest around the globe. Hopefully, things will quite down and everyone get on with the business of making money soon.

$9k increase? WAY TO GO J. MONEY! Luckily the markets are heading in the right directing and the 401k is looking better and better.

First of the month is always the best (other than having to pay for rent). I love doing up the numbers and checking out my net worth.

It’s nice to finally have an emergency fund set up and making me money.

This is a great idea – I need to calculate our net worth on a simple list like this. I use Mint, but I don’t always trust their net worth number.

That said, I felt like commenting so I could toot my own horn – I just paid off my first student loan today! It didn’t really affect my net worth (I pulled $300 out of savings to pay it off), but it was an awesome psychological victory :) Now I just have another $100k or so left to go…

@retirebyforty – Gotta happen sometime!

@Mercedes – Thanks! Are you investing too?

@Bobby – Oh yeah, running the numbers is like the highlight :) Good job getting that e-fund set up.

@Jen – Yayyyyyyy! Congrats! that’s def. something :) I never checked out how Mint’s net worth stuff goes, but yeah – once you find a method that WORKS for you, as simple or complicated it is, you just gotta roll with it and start tracking that progress. It’s fun! Esp when it goes up ;)

Just a quick note… KBB is known in the auto industry for inflating resell prices of an Auto of about 3-5%. Not to put a damper on your finances, but just something to be aware of. Regardless, great job this month :)

Interesting, really? Never heard that but I wouldn’t doubt it. Although, if the car seekers and sellers are both using KBB to buy & sell, then it doesn’t really matter in that regard :) That’s the only tool I’ve ever used but it’s def. good to keep in mind. Thx for the insight my man.

I know it doesn’t matter in the long term, but that minus 7K would freak me out! Why not dollar cost average into the SEP

I had to throw it all in before the tax year ended for 2010 ;) This year I’m gonna throw some in over time and hopefully get it maxed as far as I’m allowed… but we’ll see. Still only been 3 months since being on my own so gotta make sure I’m playing it safe.