Dayuum… Market shut us down this month! Said – “Try again next time, beyotch!” Haha…

But that’s the way the game’s played, eh? Some months it’s up, others it’s down, down, down. What’s important is that we stick to it for the long haul and do our best to pick up some shares on these off months to get better deals! Easily done too with automatic 401k contributions and the like – something I’ve missed for years now, boo hoo…

(I invest in a SEP IRA instead since I’m self-employed, but usually have to wait as I’m not sure the amount I’m able to invest each year until I know my overall profit.)

Unfortunately this also snaps our 4-month winning streak, but considering we’re up a good $86,000 since September, I can’t really cry too much :) Here’s how the last four months went:

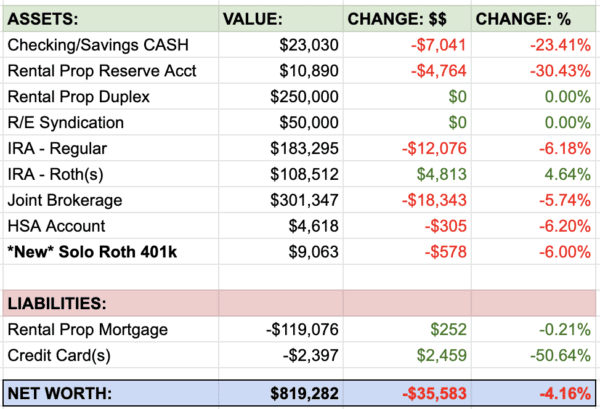

Here’s How January Broke Down:

CASH SAVINGS (-$708.91): This area could have been a bit better last month, but between extra health care bills coming in and biz income still remaining semi-low, it is what it is and we work on improving this next round. Another reason to have hefty cash reserves laying around too!

529 College Savings (-$113.13): I don’t think we’ve added anything extra into this account for a bout a year. When things started heading south and we were holding tight to all extra money coming in… Hopefully we can get back to this again, and then create *another* college account for baby #2- yikes!

IRA: SEP (-$2,435.24): Nothing new added here either, although the yearly Drop o’ Cash is about to hit as soon as we finish our taxes! Gonna max this bad boy out as I do every single year since it’s our main retirement vehicle now. If only my boss gave me a match! ;)

IRA: ROTH(s) (-$1,673.12): Same story with this guy – nothing new added so the changes are completely up to what the market is doing. Though, we are still considering maxing this out as well as the SEP this year, just can’t tell if it’s smart or not yet considering our cash flow problem lately… We’ll see. I’d hate to break a maxing-out record here too after all these years!

IRA: TRADITIONAL(s) (-$6,355.75): And same story here too – nothing added in, and nothing that WILL be added in since all our retirement money hits the SEP first, and then the ROTH. Though after reading a lot of articles on why Traditionals can be better for early retirement, I will admit it’s sort of intrigued me. Not that I’m anywhere close to retiring early, of course :)

Here’s how our IRA Test is performing these days. Which, as always, still needs to be shut down.

- IRA #1 (NOT Managed): $76,724.86 **Leader for two years now

- IRA #2 (Managed, USAA funds only): $70,953.74

- IRA #3 (Managed, ALL different funds): $71,636.37

AUTOS WORTH (kbb) (+$217.00): Don’t ask me why this went up, ask KBB.com :) But you’ll see my Caddy is still frozen there at $1,500 since it’s now too old to be tracked via KBB, haha… So all future changes in this category will be based off the Toyota’s value. Until we eventually get that minivan Escalade. Here’s the value of the two presently:

- Pimp Daddy Caddy: $1,500.00

- Gas Ticklin’ Toyota: $6,568.00

HOME VALUE (Realtor) ($0.00): Nothing touched here either, since I don’t use places like Zillow or Redfin or whatever to track our values since they’re too all over the place. Instead I ping my realtor every 6-12 months for a quick assessment which I find to be much more accurate. And he happily obliges since he knows he’ll be making the sale one day in the (hopefully near) future! :)

MORTGAGES (-$657.32): We’re getting sooooooo much closer to not being underwater anymore!!! Only $3,342.81 to go and we’re Even Stephen! :) The power of time and paying a little extra towards it each and every month. So damn excited.

Here’s how they both currently look:

- 1st Mortgage: $274,846.69 – 30 year conventional @ 5.5%

- 2nd Mortgage: $28,496.12 – Maxed out HELOC @ a variable 2.8%

And that wraps up the first month of 2014. Not the sexiest, but also not the worst either. And as you can see from that graph of the past 12 months up there, I can only be thankful and count my blessings over the years.

How did you guys fair? Anything juicy or exciting go down in your financial worlds last month? Either way, keep on tracking your net worth and paying attention to it all! You’re future self is gonna love you for it!

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

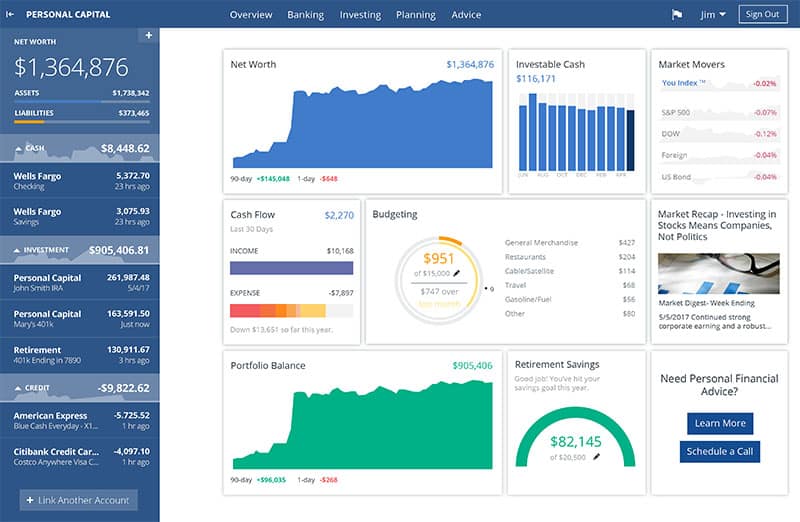

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Sorry and feel your pain. It is for the long terms though (and the market has been a bit mad lately…). It’s all come back eventually. Doing well, Jay; we’ll be cracking open this millionaire fizzy drink soon.

I’ll be taking you up on that one day ;)

The market tanked yesterday, but it doesn’t really matter to me because all of my stock holdings are going to be used decades from now. Hopefully the downturn doesn’t last that long (hint: it won’t) :D!

Hey, your boss gives you a 100% match! You put in 50%; your boss puts in the other 50%.*grin* cannot get better than that, though some companies are amazingly good (like the one I work for).

HAH!

I feel like all my investments are on sale right now. I wish I had more spare cash to invest! Our month wasn’t great…purchased a new computer (planned) purchased a new water heater (not planned). bye bye cash!

That’s because they ARE all on sale!!! Send me some money too if you come across a hoard somewhere! :)

What’s sexy is the way it’s all gonna look after this “correction” turns around. I’m loving that I am getting shares so much cheaper than in December!

I’m not really in the market yet (I just have $1,000 “play money”) so I didn’t feel this, and can easily say “just wait it out”. That being said, I know I won’t like the downturns, even when I’m not needing the stocks until decades later (like what Lance said).

You’ll have to blog about what it’s like once you jump in down the road :) Will be hard to amass some good money without investing in the market or things that are similar (real estate?).

2014 is going to be a FUN one. In 3 months, we can finally apply for loan forgiveness for my wife which should zap the final $17,500 she has in students loans (the government actually does SOME things right :-)). I finally got some public retirement accounts to roll over into my 403b, so that should be an additional $12,000. And, consolidated some final loans at 0% and am paying down a sizable chunk over the minimum payment so within 24 months we’re consumer debt free babayyyyy. If things go well, I might be able to get it all done by this December.

Nice man!!! That does sound fun!

Car went up in value! That is like finding gold right there! I too took a pretty good hit in the retirement accounts thanks to the market’s nose dive. But we’re young, so we’ve got plenty of time to make it up.

Yea, I don’t put too much stock in the “increase” of car values really, but I’ll admit it doesn’t hurt to look at when you’ve got months like this :)

Hope you’re getting all those beans counted okay…

Ouch! 2014 just punched you in the face! :) You’ll get’em next month.

We were down this month too…only by $200 or so, but we have way fewer investments than you. I had to buy a new car, so if that hadn’t happened, we wouldn’t have lost networth. (We bought below KBB value, but then had to pay taxes on it, so that put us over!) Oh well! We keep moving forward!

I’m sure this was tough to write, but thanks for sharing! It is a lesson to us all that not EVERY month (or quarter or year) will be positive, even if you try your hardest to watch your expenses and increase your income each and every month. As you save more and more and build your net worth, then your net worth can increase (or decrease) in a larger dollar magnitude each day/week/month/year.

You got it, brotha :)

I don’t mind if the market goes down. Perfect opportunity to buy!!!

I feel your pain – after a strong Q4, 2013 the market has been getting crushed in 2014.

I had never looked too much into an IRA: SEP (I just use a traditional IRA currently) but this seems to be a great option for those of us who are self-employed.

Look into a SOLO – 401k too. It wasn’t a good match for me according to my accountant, but it may be for you?

I think we lost some in the market, maybe $3K-$4K. I made a couple of moves that ended up ok, and of course a couple I’m kicking myself for not doing. Got a nice signing bonus this month with the new job though, and wife had an unexpected windfall, so cha-ching!

When should I expect a gift in the mail? :)

You need to walk into your boss’ office and tell him that, unless he starts giving a solid 3% match, you’re going to start applying for corporate jobs again. That’ll light a fire.

I need to! That guy’s workin’ me bone dry!

We were down about 23K for the month. Like J$ said, gotta roll with it… Its when the market is down that you should be licking your chops to buy. On the plus side, I started taking home an extra $650 a month 3 months ago and another $500 a month this last month. The wife told me last night her yearly bonus from work should be about 8K…. part of which will go towards a long needed new refrig. Any suggestions?

My suggestion is to KISS THAT GIRL! :)

Keep on keepin’ on! Here’s hoping 2014 is a great year for business. I had some high spending in January due to car maintenance, which was scary bc it was my first month of self-employment but we got through it and now I’m glad February is a short month so I can do a little better!

We calculate our net worth quarterly instead of monthly in part because of market corrections like this; we hate seeing the value go down (we’ve been calculating net worth quarterly since 2010 and there was only one quarter in there where it went down, which was because of the market). When we do it quarterly then there’s also three months worth of debt repayment factored into the equation, which helps our net worth even if the markets are doing poorly. Like you say, it’s all part of the game. But it’s still no fun to see numbers going down when you’re working so hard :-)

That’s a pretty good idea! Bigger “oomphs” you’re tracking over the months – I kinda like that :)

January was a rough month of spending between visitors and creating a little office for myself (going to start studying for the GMAT and couldn’t bring myself to spend hours perched on the stools at my kitchen table). My mutual fund and 401(k) haven’t been too badly battered — but they also don’t have a TON of money in them… I am looking into opening a traditional IRA and seems like now might be a delightful time to start. Just debating the route to take.

Our net worth is raising steadily as long as most of our savings go towards the mortgage :-)

What does your blog name mean? Kinda cool sounding!

Thank you :) Directly translated it means ‘money hoarder’. It’s kinda like ‘miser’ but has a bit less negative connotation.

Love it! Consider me a Pengepugeren then too! ;)

It’s all good. Long term investments will always beat out this tough month. Your net worth is still way up! Work it!

We’re doing okay. Not up $86,000 over the last 6 months though. ;-) We keep inching up $2000-$3000 every normal month…stock market changes affect us a lot though. Overall, our cash extra covers our losses in bad months though.

You stopped doing net worth updates on your site, yeah? Was looking for one this morning while working on a post for RockstarFinance.com… if you end up doing one soon let me know and I’ll link to it!

I stopped a while ago, but I keep up with it on Networthiq.com. :-) I did continue doing income reports, but they are in my newsletter now. :-D

Market is ON SALE! WOOOHOOO!

That’s how I see a downturn now :)

Nice work, and don’t worry, half-a-mil is coming soon!

Thanks a lot for the mention, J$! If I only “sort of intrigued you” though, I need to do a better job next time ;)

Well, unless you can a) invent a time machine for me to go back and do traditionals from the get go or b) handle all the conversions for me in the future (maybe you have a future time machine?), then you’re stuck at “sorta” pal ;)

Hello 2014! Not a fun financial month for us for us either – $2,300 in unexpected rental damages (go emergency funds!), $552.39 mistakenly taken from our account by our insurance company (finally got it back), quit my job, and of course, the Roth 401(k) took a little dip. However, I am way inspired by your net worth graph – I need to go back and see what happened to you guys in October.

Wow – that’s a lot of changes!

What you’ll find if you go back is me selling a handful of some sites I owned :)

I started tracking my net worth because of your posts. I couldn’t believe mine went down in the first month of doing this! Good to see I’m not the only one.

Oh no! Haha… but at least you’re started it :) It’s going to look much MUCH sexier as the time goes on, I can promise you that!

Ours went up, thanks to paying off a $4830 zero interest credit card, an increase in the value of our home (I use Homesnap every month), paying down the principal on our first mortgage and a few other things. My long term investments are in bonds rather than stocks, so I didn’t take a hit there. Next goal: savings property taxes of $4300 (plus or minus) by April 10. After scrimping to pay off that credit card, it won’t be easy, but I am using auto transfer to help me out. We’ll see if I make it without robbing the piggy bank to do so!

Work it!

The best part is that you have a great cash reserve that will weather you through everything! But what goes down must come up! January was an okay month for me…I’m going to see if paying a bit more on my student loans can help bring me a bit closer to breaking even!

Very true – emergency funds are GREAT for all areas in life :) And once you’re done w/ your loans you’ll be able to pump up yours too! (Or maybe you’re already doing that now, simultaneously?)

Problem with growth stocks is when the market turns they hit you in both the face and gut. We’ve lost the value of a nice car so far but I’m actually happy because it makes stocks actually safer. No bubble here.

Stock market took a dump on me as well. Although I’m not sure of the numbers since I only look at quarterly statements. Since I’m in it for the long haul it’s really all I need to do.

It’s good you know yourself well. I get too excited NOT to check it out every month, haha…. for the good or the bad.

Hey. The real measure is the habits which are still great. Sometimes the market knees us in the fancy parts. But over the long run it surely pays off.

That site sale seems like it could be a good way to lessen the market effect if you can replicate it, even in small chunks.

For sure. I have another one I’ll probably sell too in the near future, but my end goal is to really focus and stick to my own passion projects as long as it generates enough money (the hard part!).

If you aren’t planning on selling any of your equities, the drop ain’t nothing, right? It’s actually one of the reasons I track mine separate from the net worth, but I’m a total rebel when it comes to that. But a dip in the market might provide more of an opportunity to pick up some shares, at least that’s the way I’m looking at it.

Agreed. It only *really* counts on the day you cash out. I just like tracking it to give myself an overall snapshot of my money at any given point of time.

I just want to get a hand on that excel spreadsheet you show at the top. Is that shared anywhere?

Never mind! Just found the templates page. Rock on!

Hope it helps :)

Hey, J, I apologize if I’ve missed this but I am wondering why you choose a SEP IRA vs. a Solo 401k or Simple IRA.

Love to hear your thoughts!

Honestly? My accountant told me to :) I asked her which of the group she felt was the best, and she said SEP. I probably should have researched it a little more, but I’m one of those “as long as it’s 80% good I’m happy” type folks, and from what I’ve gathered it’s at least that.

Which do you use? Would love to hear other opinions :)

What’s up brother!

Thanks again for posting this and for starting so much trouble!

Are you going to make it to FinCon 2014?

-Derek

That’s what I do best!

And hell yeah I will be there – I hope to see your friendly face again as well :)

I’m impressed with this net worth, especially considering you are pretty young, if I remember things correctly. You may have already answered this several places elsewhere, but are these figires for you on your own or for you and your wife combined? Love your web site!~

Thanks for the kind words! This is my wife and I’s combined worth :) She’s currently in grad school so it’s mainly my doing (for the good, and the bad!), but it’s both of our finances.

Thanks for stopping by!