But as luck (or hard work?) would have it, I got a few extra projects thrown my way which REALLY brought in the big bucks. Even though I had to put in an extra 60-70 hours of work that month, on top of all the other stuff I was doing (aka I had no breaks whatsoever, except for Christmas day and my Bday). But I’m not complaining :)

You know that saying about when preparation meets opportunity? Well, working for yourself comes in handy when things like this cross your path, and you have the flexibility to work on whatever it is you want to at any given time of day. It doesn’t mean you don’t have to do your “normal” work (which for me, is blogging here and upkeeping some other projects), but it means you can hit pause and come back to it later when necessary. Something that you really can’t do at a 9-5. (Or at least the ones I worked at.)

Just all the more motivation to continue on the 50/50 New Year’s goal! Work 50% less, and make 50% more ;) Or rather, work 50% less of the stuff that I *have to do* so I’ll have more time to take up whatever it is I want to at any given point in time. Like more career opportunities or baby hanging-0ut jaunts ;) Step by step, though – it’s always a work in progress!

December, 2011’s Net Worth Break Down:

CASH SAVINGS (+$21,268.80): The second best cash increase we’ve had, outside of when my grandparents passed away the other month. Which is still being stored safely for when it’s time to expand my business – something they would have loved to seen :( Needless to say we’ve been blessed with cash infusions this year though, and we’re doing everything in our power to make the best of it to protect our future down the line.

EMERGENCY FUND ($0.00): Filled up at $10,000 for worst-case scenarios, this hasn’t (thank goodness) moved very much over the past handful of months. It gains interest, but it’s mixed with other funds too and I don’t take the time to divvy it all up to report :)

IRA: SEP (+$1,182.96): Nothing new added here – just the markets doing their thang. And while it looks good going up, we’re still way below where it used to be earlier in the year… it’ll be pumped up in a little bit though, as soon as I max out the limits this year once my taxes have been looked over. The more I can put in, the less taxes I’ll owe come filing season!

IRA: ROTH(s) (+$2,299.62): Same thing here, nothing added, though nothing planned for the future either. I’m sure I’ll max it out come 2012, but for now it’ll stay where it is after maxing out for 2011.

IRA: TRADITIONAL(s) (+$4,837.52): Oh man, this LOOKS good, but we’re still farrrrr off from our $180,000 amount this year. But of course none of us can control the stock market, or foresee what’s about (or not) to happen, so we do the best we can and hold tight. I firmly believe the markets will trend upward over the long haul, so I’ll continue dumping into it as much as I can for whenever that fateful time hits when it’s time to dig in. Like, when we all have computers imbedded into our arms ;)

Here’s an update on our Ultimate IRA Game, haha… so far the actively managed accounts sure aren’t impressing anyone!

- IRA #1 (NOT Managed): $55,825.11 **Took a BIGGER lead!

- IRA #2 (Managed, USAA funds): $54,872.71

- IRA #3 (Managed, ALL funds): $55,328.65

AUTOS WORTH (kbb) (-$49.00): Nothing new to report here, other than it’s much better seeing this go down by $50 than it is $500 like last month ;) Here are the KBB values of our cars believe, as if we were to sell it privately (which we would, if or when the time comes):

- Pimp Daddy Caddy: $2,462.00

- Gas Ticklin’ Toyota: $9,060.00

HOME VALUE (Realtor) ($0.00): This is stagnant at $300,000 too. Not gonna update it until we talk to our realtor again down the road, which may or may not happen anytime soon (I don’t want to bug him unless we want to take action on either selling or renting. And I don’t trust Zillow or the other programs very much, though they are entertaining to watch ;))

MORTGAGES (-$2,877.28): Going strong THREE months in a row now! Operation Mortgage Payoff is picking up steam and I’m over the temptation of putting the money elsewhere! The more I keep chipping away at it, the more I’m reassured that it’s one of the best moves I can do at this moment in our lives. I keep thinking that if the world goes to $hit, or my sites blow up and there’s no way for me to make money anymore, as long as I own my house and have enough to eat off of, we’ll be okay :)

It’s quite the change in mentality from all these years of investing and saving 100%, but as I get older/more mature/more scared, I’m focusing more on the definites than the probables. Paying off your mortgages is a locked deal – the money 100% pays off your debt! Investing on the other hand is more than likely to pay off in the long term, but it’s never guaranteed. Nor is the rate of return, no matter how promising or not it is. Again, I’m still gonna invest like crazy outside of paying off this house of ours, but right now the focus is most certainly on the definites of life. Especially as a new one is debuting in July ;)

Here is what we owe still on both mortgages:

- 1st Mortgage: $287,277.46 – 30 year conventional @ 5.5%

- 2nd Mortgage: $55,177.98 – Maxed out HELOC @ a variable 2.8%

And that’s that! I know it probably doesn’t need to be said as we all know each other pretty well by now, but for all those new to the site, please take updates like this as ways I convey my own lessons with personal finance, and what works (and sometimes doesn’t) with things I’m constantly working on. It is *NOT* in any way intended to be braggart, or to show off all my luck and hard work. Yes, I work my ass off more than most people I know, and get “luckier” as the time passes, but I only put it out here to show that success really IS possible with money, no matter what stage in life you’re in.

5 years ago I was bumbling around without the slightest clue about money stuff, but it was blogs like this out there from people like you and me who where sharing their own stories with us, and it really sunk in and got ME to do something about my financial life. The concepts behind money itself really isn’t that hard, but getting MOTIVATED to do something about it is. And my hope is to inspire just like they did, so that we can all live our lives as happily as we can all dream up :)

So take from this what you will, but always know I’m trying to help. And if you ever want to contact me separately, or have questions you’d rather ask offline, feel free to reach out anytime. I live and breath this stuff, and always up to share my opinions and ideas. This is fun for me! :)

Hope you all had killer months too!

———————

PS: My newest “thing” I’m getting into right now is home design and sustainability stuff. If you follow any blogs out there that fall around this category, will you drop the names in the comments for me? I’ve got a few I’ve just started paying attention to (Re-Nest, Design For Mankind, Young House Love), but I’d love to have a half-dozen or so more to keep me inspired :) Thanks!

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

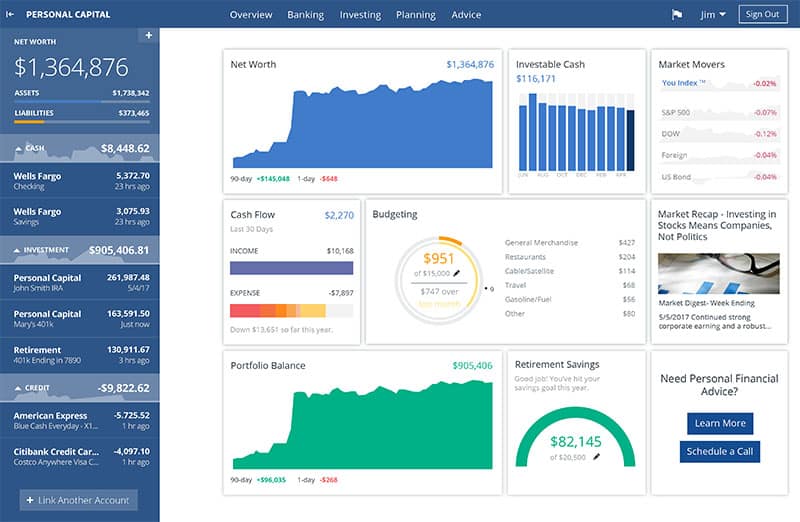

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Im thrilled the hard work has paid off for you with some increased flow, Nice work! Im up only $1800 but didnt undertake anything extra.

Nice attack J!

I think I have an idea where the money is coming from ;-)

Great stuff J. Amazing how much progress you made since losing your 9-5er. Now if only the other folks who lost their gigs in the last few years worked as hard as you to make it rain…

Nice net worth update! I don’t track mine. I mean I have a budget with all debts and credits, but I don’t see the point of adding the value of my home and cars. They don’t change all that much. I did try once before, but I became obsessed with the values of all my investments, so I stopped.

For Design inspiration I follow ikeahackers.net, dwell.com, architecturaldigest.com, and my fav on PBS “This Old House”.

Great work J!

I can attest to the fact that your truly trying to help others and that it goes beyond the blog. Thanks getting back to me and the words of encouragement as I am starting out in blogging.

Congrats man it’s going well! I can”t add any to the list of home design sites, but I can say I love Young House Love!

On a completely unrelated note: I was looking for advice on how to go indy and become an RIA, and one of the results that came up on Registered Rep was a thread started by “J-Money” from like 2007. Coincidence or was that you? :)

I’m really happy that you’re doing this ‘experiment’ (and not me). It takes some brass ones to put your money on the line, but you seem to be up to the challenge!!

In regards to active vs. passive, study and study confirms that the more “actively” managed they are the poorer they perform. It’s not so much the funds they choose, but the expenses that are incurred on the funds (expense ratio, turnover expenses, management fees, etc) that drive down your return.

If you read the diehards.org blog/forum, they’re main purpose in life is to educate the non finance community about all of “this” stuff.

Good luck in 2012

* “study and study confirms” = study after study confirms

* “If you read the diehards.org blog/forum, they’re” = If you read the diehards.org blog/forum, their

So, um, you’re going to tickle us with fact you made $32 grand last montth and NOT tell us what kind of projects you worked on?! Did it invole a pole and maybe some dancing? Hehe.

These posts are such an inspiration. I was plodding along, racking up the credit cards, totally clueless until 6-months ago and WOW it’s a whole new world now. Your blog was one of the first PF blogs I discovered (who knew there even were such things?!) and aside from being a great motivator, I’ve learned a lot from your posts too! Keep it up in 2012 and keep that net worth growing!

This looks great :)

Home design and sustainability?

How about http://www.naturalhomeandgarden.com/ and http://www.motherearthnews.com/

I always get home inspiration from these.

You’re doing great!

Check out http://www.mrmoneymustache.com/ He gives tips on how to live cheaply and cut the fat from your budget. Everything from cars, adding more insulation to your house and cutting down your grocery bill.

How did you manage to get your net worth that high? I’m working on mine. Any tips? I see you’ve got a LOT of money stashed towards your retirement. Maybe I need to find an employer who matches my contributions. You also have a lot of cash savings. I’m guessing this is from your projects?

Impressive, you make me jealous! :) I really enjoyed your thoughts you put down regarding your mortgage and investing for the future. I like how you realize that rate of returns are never guaranteed even though they are “advertised” that way by the financial institutions. Or rather those who need YOUR money in the market so they can pull it out for themselves ;) Sometimes it’s best to do things that you can control and have that certainty you are progressing. BTW congrats on your new baby :)

Thanks everyone! Keep workin’ hard and focusing your energies on what *truly* matters to you! :)

@Alex – “Only” – haha.. that’s awesome! A positive increase w/out putting in more work is a dream ;)

@The Financial Blogger – Haha, *some* of it ;) Let’s try and make this bigger, eh?

@Nick – It’s been 15 years in the making ;) You really have to *WANT IT* and put in the hard work to make your dreams happen, and I think most people just like the dreaming part.

@LB – Yeah, while I think it’s important to track it all, even just once a quarter or year, you def. have to get something out of it all. For me, watching it grow (or not) is important each month as it helps motivate me and show me that things *are* indeed working. Whether you put in cars or house values or whatever, I personally like seeing the immediate impact of my financial life every month. Whatever works though!

@KC @ PsychoMoney – Any time, my friend! We’re all in this together :) And anyone smart enough to ask others who have gone through it all for help, is always someone I’m willing to spend some time with. I got helped from others before me, and they did from before them, etc etc. The circle of life, baby!

@Brendan – Hah! Nope – no way in hell it was me ;) I don’t know what “RIA” means, and didn’t even know what blogs were until later 2007, early 2008. Great name though! ;)

@me – Thanks friend, yeah – it’s all an “adventure” to me that doesn’t have a real losing side here. None of these routes are killing the other, and the knowledge learned will more than make back the difference of $ lost (assuming I’d had picked the winning option in the first place). I def. think you have a point there w/ the managing fees and what not, though. We’ll see what happens as the time goes on, but I’m gonna keep that little nugget of theory in the back of my head the whole time ;) Thx.

@Jerret – Haha, sorry – I was hoping you wouldn’t catchon to that ;) It was really a mixture of different gigs involving a few online projects, as well as some out of nowhere consulting. What it was doesn’t really matter as much as the point of being able to *take on* new opportunities when they come open to you. Something I’m positioning myself to do more of, since my plate of required work should in theory be going down w/ my new 2012 goals.

@Bob – That’s wonderful, Bob! Thank you SO MUCH for telling me that – it makes me incredibly happy! :) I had no idea blogs like this was around either a few years ago, but it’s damn good we all came across them, right? Just a matter of changing that mindset of ours, and allowing all this stuff to soak in… I’m glad you’re on track now, and sharing your own stories on your site too :)

@Miriam – Great, thanks! Adding them to my reader feed to start checking out :) You rock.

@Michelle @ Making Sense of Cents – Thanks Michelle! I hope YOU are doing great, as well!

@Christine Wilson – Oh, cool – I love the name! Adding it to my list, thanks :) RE: Net worth — Yeah, I’ve been pretty much working my ass off 24/7 for 3 years straight. At first it was taking advantage of all my 9-5 job benefits, and then it slowly shifted towards this blog and into a handful of other gigs that’s come along from it since. And throughout it all I just saved-saved-saved and haven’t looked back since :) It’s def. Do-able for everyone, no matter what their situation, but you have to trade in a lot of time and energy to get the results faster. Some people (like me) want to do that for 5-10 years and then “retire,” whereas others are fine with achieving it in, say, 20 or 30 or even 40 years. No right answer, just the one that works best for you :) Hope this helps!

@StackingCash – Exactly! We can only control so much, so focusing a ton on it can do wonders :) And thanks! We’re soooooo excited for the chance to have a child. We were a bit frightened that we might not be able to do so, so getting this news was a huge blessing. To a great 2012!

Amazing how the hard work leads to “luck” isn’t it? My husband and I are having a similar experience this year! A blog you might like is House Tweaking – not sustainably focused exactly, but it’s written by a family downsizing into an older home that they’re making their own – one of my faves lately. Enjoy!

Bravo, J! Always love reading your net worth updates. Happy for you :)

Do you ever do comparisons of the overall years? I would love to see how things changed from, say 2007 to 2008 to etc. Whether it be credit card debt, aggregate retirement savings, or net worth in general.

I love reading your posts – you’re one of the few PF bloggers I’ve stuck around with for the long haul. You’re definitely a “there’s hope out there” influence on my life!

Wow you are doing great! I wish I had $21,000 in monthly cash savings!

D@mn you had an awesome month; it’s nice to see hard work pay off. :-) Great job!

I just posted my net worth update yesterday, and I’m up $2,031.21. It’s nowhere near your increase but I’m thrilled and have only been tracking it since last May (which was inspired by you).

Wow! Excellent work J. I can’t wait to pay off our other small debts first and dive into that mortgage. You’re absolutely right when you say it is one of the best moves you can make. Having your mortgage paid off completely gives you absolute freedom, especially for those close to retirement.

Noticed you went with SEP IRA, I stumbled across this today and figured you may find it interesting:

https://www.fidelity.com/retirement/small-business/self-employed-401k

Haven’t heard you mention anything about a self employed 401k and it sounds like a much better option, at least from this site. Something to checkout.

Congrats J, on an inspirational blog! I totally love your writing style and your forthrightedness (that’s a word, yes?) in how you are plowing your path. I echo the sentiment that you are one of the few PF blogs I stick with, and not just because I was a contest winner :)

I’ve spent the last year tracking receipts, seeing where the giant sucking hole is (eating out), and have spanked myself into better attitudes and actions for the future. Also, not beating myself up over the past and looking forward with excitement and energy.

Design blog rec: thenester.com — plus she’s hooked into a lot of others that are fun (color, refinishing furniture, living smartly, some eco/green stuff, and great style, which is now aspirational for me). Less is definitely more!

Cheers to all of us JMoney-iers in the coming year!

haha, funny coincidence!

Anyway, thanks for all you do, I love your website!

I don’t track my net worth now mainly because I know how much debt I owe and how much savings I have. I’m hoping that eventually soon these numbers will flip flop on me and I’m working to that affect now. (It does help that I just got a nice pay increase and I’m trying to not increase my standard of living but instead increase the amount of debt payment and savings I have)

J, Can I ask what spreadsheet is that? any way I can get a copy of it? thanks :D

$21k +?

When I grow up, I want to be you.

Dude, your posts are like financial crack for me, the more I read, the more I want to do with my own blog/finances/future plans (and for the record, I dabble in running and beer…not the snorting of illegal substances; but you know what I mean!).

You, Mr. J. “Mortgage Killah” Money, are a hero to all of us. What I like most is the positivity, which is what I promote through my efforts as well. Life’s way too short to be wrapped up in things that have no true value to us.

Young House Love is incredible. I’m in the works of launching a design consulting service, but I don’t blog about it yet on the HH. If you’re ever up for combining forces in your new arena, hit me up!

Good work, J. for adding 21k into cash saving in just one month.

However, it drives me nut whenever I see you are having only 10k in emergency fund. Seriously, 10k for 3 people!???? Congratulation once again for being a daddy.

J$,

You’re blogging is such an inspiration! I’ve been following your blog for years now because you keep it interesting and you keep it real :)

Kinda wondering though, what’s the difference between your cash savings and your emergency fund? I’ve been calling my cash savings my emergency fund (because I refuse to touch it) but aren’t they technically the same thing?

@Katie – Awesome! Glad to hear you guys are doing well too – all that works sure does pay off, literally! :) Gonna go check out House Tweaking after posting this up, thx! Happy weekend.

@Sarah L – Aww, thanks friend. I hope you get some good stuff out of it :)

@Amber – Thank you so much! Wow. You totally just made my night, thank you :) And agreed! I will for sure do some sort of comparison like that over the years – I have no idea what that would look like, but would be fun :) Thx for the idea!

@Squeezer – You will one day if you keep at it! 4 years ago I would have laughed if you told me I’d be getting that in one month, just goes to show hard work pays off :)

@Jen @ Master the Art of Saving – Great! $2,000 is nothing to be ashamed of, that’s dope. I have months of negative $8k and $15k, so that looks damn good comapared to those ;) Glad you’re tracking it now, you’re gonna love it!

@Long – Yup! It’s annoying and really REALLY hard to start paying it down (at least it was for me – took me 3 yeras just to start :() but in the long run it’s TOTALLY worth it. We just gotta make sure to stay motivated ;) Thanks for stopping by my man.

@Ryan – Thanks dude, yeah you’re right – I haven’t blogged much (ever?) about self-employed 401ks. I pretty much just asked my accountant what she thought, and for whatever reason she said the SEP was a better move for my particular situation. I’m sure both are great for you, but it’s def. good to do your research if you’re contemplating one or the other. I’m not so good at that sometimes ;)

@Carol in Mpls – Haha amen to that! It’s always a work in progress for all of us, we just gotta keep our heads up and continue to work hard and remain energized :) Thanks for always making me smile! Gonna go check out thenester.com soon, thx. Sounds like something I’d love.

@Brendan – Thanks man :) Appreciate you always stopping by and chiming in. Really helps our community grow.

@bogofdebt – Hey, whatever works for ya :) I found that I got SUPER motivated even more once I saw the numbers next to each other every month, esp as they went up. Now I keep trying to beat them like a game :)

@Aaron Hung – Sure, it’s just an edited version (in color) of my main “financial snapshot” budgeting spreadsheet. You can find it here (at the top): Best Budget Templates & Spreadsheets

@jesse.anne.o – *blush*

@The Happy Homeowner – You got it man! Thanks so much for the kind words too, I’m totally saving that somewhere whenever I need a reference, haha… love your energy all the time! It’s def. infectious :)

@Nicole C. – Thanks! What do you mean it drives you nuts though? You think we need more? Or less? In reality, we have over $100,000 for emergencies ;) But only $10k that is “assigned” to it. If we were to invest all the rest, or put it in something non-liquid, then we’d def. pump it up more as it would be the only cash we’d have on hand. For now I think it works though, no?

@Juliette – Hah! Good timing, I literally just commented that on the commenter before you ;) But yeah – in the grand scheme of things it’s pretty much the same thing. You can call it whatever you want, or separate it out in diff accounts/etc, but at the end of the day if an “emergency” happened, wherever you’d stick your hands in to get money would technically be your emergency fund. But there’s no right or wrong ways to do it really, just whatever way works for you. We have a $10k E. Fund, but obviously we could touch the other $100k+ if needed anytime. But that stuff I’m always touching and moving around, thinking about, etc – whereas the E. Fund just sits still and stays quiet ;)

Hope this helps! Really glad you enjoy my “keeping it real” style – I try my best to stay like that, but sometimes I wonder if I’m still “street” since I now blog for a living, haha… that’s my goal though, so I’m glad you feel that way! :) Have a blessed weekend, my friend.

PS: Love your blog name!

PPS: And YOUR name for that matter :) It’s beautiful.

Congrats on the mortgage payoff. You are doing great and your blog is an inspiration to others.

If only we could all do what you do.

You can! And you will, if you keep staying on top of it and pushing forward :)

Wow! 21K In Cash that is AMAZING. I was up 5% or so for the month of December.

Thx bro, it was def. a good month! 5% ain’t too shabby too, as long as it’s going UP more than not, I’d be happy with it for sure :) We’ll see what next month brings!

Nice job J$. 100k liquidity is a lot of cash. What do you do with those cash? Do you put them in CD or some kind of interest bearing checking account? How do you maximize interest in this low rate environment?

Can you answer me through email so I don’t miss it?

Haha, sure – but it’s nothing too crazy. I just put everything into a money market right now until I figure out what exactly I’m gonna do with it. I’ll be paying some good taxes here shortly w/ parts, and then dumping a pile into my SEP for the year, but then the rest will be unknown until the wee baby comes along :) I don’t know what happens after that! Haha… I’ll go and email this to you now – happy weekend, bro.

I’m up over $5000 this month! And even broke it down J Money style.

Cool! Going over now to check out :) Congrats on the nice increase!

Congrats to you and the other posters with success for Jan. I have to say that I wish I had a fraction of the inflow that you had this month!!! Regardless — keep it up. With this kind of cash coming in you should be able to retire in no time.

Thanks man :) It all goes in phases, so we gotta take advantage when we can. Every one has the potential to bring in additional revenue streams, they just gotta put in the hard work and time.