Two years ago when my mom was on the verge of retiring early, my dad and I got to talking about his journey of employment, and why he didn’t think he was quite ready to throw in the towel just yet.

I don’t recall the full conversation, but there was one line he said that I’ve yet to forget:

“It’s strange going from saving money your whole life to spending it!”

Woahhh….”Yes!! That sounds horrible!!” I blurted back. “All that hard work and then bam – time to start unloading it!” My dad nervously laughed back, and ever since I stopped jabbing him as much :)

Logically, of course, I know the point of all this saving and investing we’re doing is to be able to use it later for a better future, but something about that convo was so real and raw that I never really stopped to think-think about it until right there in the moment.

How DO you get okay with spending money after decades of saving and skimping by? How do you break a habit that’s 20, 30 or in my father’s case – almost 50 years old in the making?

It sounds like the opposite of everything we’ve been trained to do, right?

I still haven’t come to terms with it if I’m being honest, but two years later I’m proud to report that my father has finally overcome it and officially had his last day of work just last week :) At 60-something years old he has stopped hustling for that almighty dollar, and is now on a mission to soak up what he hopes is an even almightier life of leisure.

I haven’t had another heart-to-money-to-heart talk with him yet, but I can safely say that he seems to have gotten over it when I asked why the reception was so bad on our last call, and the answer was “because we’re on the boat.”

It was 2pm on a Thursday afternoon :)

And good for them. 80+ years of combined working and raising three mighty fine (if you ask me) grown up children, why shouldn’t they be living up the good life now? Money be damned!

Although, I must say, in the past two years leading up to this point I’ve learned a LOT more about my parents’ finances, making me realize just how conservative they actually are. It’s no wonder why their financial advisor asked why they weren’t retired years ago – check out these income streams!

- A full military pension after 20+ years served

- A civilian pension after another handful of years served (what is a pension anyways??)

- Another full pension from my mom’s last working career

- A rental home that brings in income

- A handful of additional retirement accounts

- And lastly, another brokerage account on top of it all! Which I may or may not have “accidentally” seen one day years ago and almost spit out my diet caffeine-free substitute coke (really guys, you can afford the “good” stuff now!!)

I basically learned that my parents were the millionaires next door, and really had nothing at all to worry about. But what do I know – I don’t even know what a pension is ;)

It’s funny looking back over the years though, because I could have sworn my parents were poor at times. I mean, what mother doesn’t let her kids rock the new Air Jordans every single year? (Or, *any* year for that matter?? They should have bought stock in Payless!!). And why couldn’t we have the SUPER Nintendo instead of the lame regular Nintendo mom? Jeez, gosh….

Following “I love you” and “goodnight,” the next popular phrases in our house were “we can’t afford that,” and “Money doesn’t grow on trees.” And then of course, “be thankful for what you have – there are kids in Africa with nothing!”

It didn’t stop us from wanting more, unfortunately, but as a reformed money lover I can now certainly applaud the attempts. And I’m sure I’ll pay for it dearly when my own kids start tormenting me in a few short years!

But my parents DID love me and make sure we were always provided for no matter what, and for that I am eternally grateful. I’m not sure what would have happened if we knew just how well they were doing towards those later years, but I’m glad we were forced to make our own idiotic paths despite them trying to keep us on track. Have I ever told you the story of how I was so proud of contributing to my 401(k) for an entire year, only to realize I actually hadn’t and my balance was still at $0.00??

Sometimes we just gotta figure stuff out on our own :)

So well done, parents! You have reached the pinnacle of financial success, and now it’s all good times and leisure for you. I may not have appreciated any of your tips growing up, but I sure see the light now and I thank you for being two of the best role models a mohawked kid can have.

I love you guys from the bottom of my heart, and I’m so excited for your new journey together!! Go enjoy that boat and motorcycle and travel camper, and don’t forget to take my kids!!

********

To see my parents’ theory on money and life, check out this interview I did with my mother right before she pulled the plug: Interview w/ My Mom Who Just Found Out She Can Retire Anytime She Wants :)

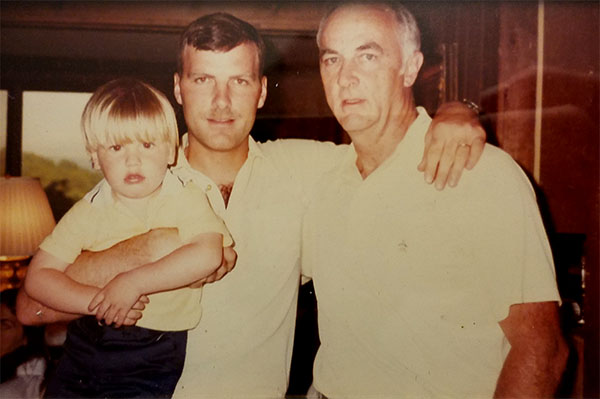

[Pic up top is three generations of us men. Pic below is the retirement present my dad earned ;)]

Get blog posts automatically emailed to you!

Wow it sounds like your parents really don’t have anything to worry about between the pensions, rental property and retirement account. Never mind the brokerage account :) Sounds like they are the epitome of stealth wealth. Now they just need to learn how to stealth spend and enjoy some of the good life :)

This is the one area I am pushing my parents as well. Spend and enjoy the money while you can. You never know when something will happen and I want them to utilize the money they worked so hard to earn!!!

Yeah, that it crazy to think about. I’ve thought about it recently as my mom is getting ready to retire.

Your parents have so many income streams — that’s awesome!

I hope to have as much passive income as they do when I retire. Right now, I’m on my way to having the 20+ military retirement, and I have a rental property, so I’m close! lol

The best news is that your parents were responsible, so YOU don’t have to spend your money taking care of them. A lot of people aren’t so fortunate!

Hah – didn’t even consider that, but you’re right! They also made me their designated person for their will and stuff, all nicely stored and organized in a safety deposit box. Something I need to follow in their footsteps too and do for my family – it’s so smart!!

My parents are the same way — they have “enough” for retirement but they do feel a little uneasy when their spending exceeds their income. Good for the next generation(s) :)

Congratulations to your Dad & Mom! I’m with you, what’s a pension? Let alone 3? Nice! What great role models. Thanks for sharing their stories!

Congratulations to your parents on their retirement!

It is hard for me to imagine not saving money. I am such a saver that I can still see myself saving money during my retirement :)

Right?? And here’s something that will REALLY blow your mind – if you stop saving/investing extra money, your expenses actually get lowered even more because you’re no longer saving anymore – woahhhhh! Imagine that? :)

Ditto here…. In addition to adjusting to the change of spending/saving habits, my Dad continues frugality to make sure my Mom has enough money in the event she outlives him. It is an irrational thought based upon their savings, but one he holds on to.

How cool that your parents are well set-up for retirement. I love hearing stories of how people can grow wealth without doing anything crazy. Even in such a way that others wouldn’t know about. I’m sure it would feel weird to start spending that stash–the stash that’s there because of their habit of aversion to spending.

Too bad pensions are going by the way side. My husband was grandfathered into a pension program since he started working at his last employer during the last years of the program. It’s not a lot, especially after thirty years of inflation will decrease the buying power, but it’s kind of funny to think of being one of the last to receive a pension.

Yeah it is :)

Congratulations to your parents for doing a wonderful job building their future and on teaching you the value of money. Now it’s time for them to enjoy!

Compared to your parents we’re flying by the seat of our pants. One small pension covering about half our expenses and investment income. We’ve been great at saving and now that we’re only spending, I have to tell you — it doesn’t feel strange at all! Maybe it’s because the market has been complying or maybe it’s because we were meticulously preparing ourselves mentally for retiring in our 50s, or a combination of both. But I ain’t questioning it because it feels great!

Congrats to your parents! That’s great!

I am 100% on board with the struggle switching from a saving mindset to a spending mindset. My goal in reaching for FI was to create options for myself and my family. Now we have a bunch of money saved up and accessible and I am struggling with even making myself consider a lower-paying job even though I think I would be happier doing work that directly helps more people. It’s hard going from that scarcity mindset into a mindset of abundance.

Congrats to your parents! Sounds like they were stealth wealthing so well they tricked their money blogging son!

I have thought about withdrawing from our nest egg and can’t imagine it – I have a hard enough time taking from our Emergency Fund when an actual emergency happens. The other one that keeps me up at night is walking away from FT work at peak earning potential

Haha yeah – I think that’s the efficiency in us or something. It’s like we’ve worked so hard to get to where we are where we can make much more money for much less effort, and then to just shut it off and stop the income faucet?? So hard! Although I suppose not so hard if you’re retiring TO something vs to nothing, but still… Messes up your mind for sure :)

Love that mug!

It’s amazing how much we really learn from our parents. It’s such a blessing to be born into a family like “the millionaire next door”. The way of life (frugal) and the responsibility with money will most likely stick and change your entire life.

It’s quite the proud moment when one of your parents full retires and never has to work again. It’s a great time to sit down and reflect on how much they impacted your life in a positive way.

“Goodbye tension, hello pension”.

That’s awesome for your parents.

I just read this article (https://www.thestreet.com/story/14142750/1/getting-an-inheritance-don-t-make-these-mistakes.html) that basically says 1 in 3 Americans can expect an inheritance. A lot of this is because we are learning that most retirees don’t spend their money. It is probably due to the fact you spent decades saving and it is emotionally hard to spend it.

Also, I don’t know your parents end of life plans, but if they have a significant nest egg, they might want to talk to an estate planning attorney so they can make their last wishes for what ever they may or may not leave behind known. I know no one wants to talk about this, but better now than when people are grieving.

Oh, they are already all over that – been planning the paperwork/will/estate stuff for a few years now. In fact, it was going through all that when one of the planners said they’re more than safe to start retiring, haha…

Super interesting on those inheritance stats though – I never think about that stuff nor count on any of it of course, but it’s true that if something should happen we’d be talking about a substantial amount of money. And then what a responsibility to preserve it after all those decades of sweat that went into it!

It’s amazing your parents have taken the final step to retire after all those years of hard work and financial responsibility. You have such great examples to learn from!

I watched a TED talk the other day that said something like Freedom is the friend of natural happiness. This reminded me of that.

I’m sure the fact you are living the way you do, your parents much feel validation of the example they set too.

Always happy to hear people taking it easy.

My parents also are afraid of retirement. They can’t stop working since it is all they’ve ever known. At least my dad is getting better at letting go. He has been getting into his hobby farm more and leaving my sister to run his business more. Mom keeps talking about retirement but she still hasn’t figured out what she wants to do during it.

I think that’s the most important part to it all – having a plan for how you’d spend your freed up hours afterwards! If you don’t have anything to do (or want anything else to do), then it totally changes the picture. I can’t imagine that since the world is soooo open to cool stuff!, but I’m sure as you get older things change as well… Either way, I hope they’re able to come to terms with it all soon! :)

Glad to hear they are making the leap. I can definitely see how years of building habits one way would be very difficult to suddenly switch off. I hope they are finding joy as they move into this next chapter!

Your dads statement about how strange t is to flip gears is exactly what I think about. Going from saving to spending?! I can’t even wrap my brain around it. Its nice to see after all their years of work they are relaxing into retirement. Boating on a Thursday?? Sounds great to me!!

Oh man, I didn’t think about this. It would definitely require a shift in mindset. I personally think I’ll be even stingier in retirement, since I don’t know how long I’m going to live and how much of the money I’ll need to consume. Hmmm.

Congrats to your dad on his retirement! It sure looks like your parents have done an amazing job securing their futures! Let the party begin, or the babysitting of the grandkids. :)

My dad had both a full military pension and civilian pension which my mom is still collecting since he passed on. Great planning on his part.

Oh damn, yeah… the pensions that move over to the spouse are even more incredible (and something most of us will never see! :))

Triple pensions! Nice. It seems that your parents did right by raising you. To have money, but never let you know that they were so well off. Plus, they probably did not feel that well off. Spending their entire life saving to then start spending….seems tough.

Congrats to them! Hope they are enjoying retirement.

They definitely don’t feel – or act – like they’re well off at all. My mom still coupons and shops at thrift stores and gets a high from finding treasures at discounted rates haha… guess that’s where I got it from :)

I could have written the exact same blog about MY parents, except Dad retired more than a couple decades back. One month ago, Mom and he moved to the nicest senior community in their area. They have plenty of money and only live on interest, not the principle. Still, the prospect of now paying rent and amenities ($6,000) each month after not having a house payment for 30 years was freaking my Dad out. My brother, co-executor of their trust, continually reassured them and tried to get them to relax. They have more than enough for these last few years of their lives, yet to two people who grew up in the Depression and through WWII it is never enough. My Mom’s concern with the move was that the salesperson hadn’t told them everything and they’ll “nickle and dime us for everything.” I asked what she meant. She was referring to the laundry room down the hall. (They have housekeeping that wash sheets, towels, etc. but residents wash their own clothes.) Her most pressing question for this major life transition: Do they have to pay to wash clothes? It astounded me that she was hung up on whether they’d have to pay an extra few bucks each week for laundry. And that’s when it really hit me, how they are in such excellent financial shape, because they questioned every single expense, big or small.

Oh man, so fascinating to hear… Probably more of a ‘value’ thing going on here too – the thought of having to pay for laundry and all these other things that you’ve been avoiding for decades would totally jack me up too. Like it would feel like it was *wasting* you know? even though you can afford it?

I can see how the shift from saving to spending would be difficult – even scary! But, it sounds like your parents had savings in their blood. And it’s great they’re enjoying the fruits of their labor now.

We were fortunate to be grandfathered in to one pension. But, several years ago, we had the option to funnel the pension money into the 401k – so we chose to do that. The pension is pretty small, but we’re adding more to the 401k each year, which is an amazing option to have!

Congratulations to your parents! I hope they’re enjoying their retirement!

My parents are farmers and my dad who is in his 80’s, still farms (with a lot of help from my brother). My mom really wants them to quit, but my dad is stubborn. Every time I bring up my own retirement my dad always says something like “what are you going to do with all that time. You have to do something.” Ummm, I can think of plenty of other things I’d rather be doing!

HAH! I was just telling my 4 y/o all about farmers and how hard they work.. have never known one in real life though :)

Great story and love to hear that your folks are set up… but I must hear this 401k (non)contribution tale?

DO TELL!!!

Basically, my dad harped and harped and HARPED on me to contribute to my very first 401(k) plan when I started working for the airlines. After 3 or 4 months of this I finally told him I’ll commit to doing it just to get him off my back :) I visited HR, set it up, and that was that.

At the end of the year he asked me how much was in there to prove how smart it was that I listened, but for the life of me I couldn’t find the #’s on the end-of-year statement? Or, any statements for that matter? (mistake #1: always pay attention to your statements!)

I went back into HR to ask about it and they told me I never set it up. I promised them I had, but as the minutes ticked by I suddenly realized that I actually played out all those steps of visiting HR earlier *in my head*. Somehow once I committed to telling my father I was going to do it, my brain checked it off my “to do list” before I actually did it in real life.

\so basically, I never signed up for it, had a bit ol wopping $0.00 invested after almost a year, and then to top it all off had to sheepishly tell my father what had happened and that i was a bit fat moron. I felt pretty disappointed in myself, and i’m sure he was too :(

fortunately I never made that mistake again and the 401(k) ended up being a game changer for me over the years :)

You must have an incredibly vivid imagination to have fooled yourself that you had actually waltzed into HR. Oh my goodness, why isn’t this a blog post for beginners!?! I’m cracking up! The best lessons learned are learned the hard way. Have you calculated yet how much you would have put away, and how much it would have grown, if it weren’t for your error?

I think it’s great that your Dad harrassed you–not only in the beginning to DO IT, but also to see how much you had saved. Imagine if he hadn’t followed up? Maybe all parents need to harp on their kids more (I know, kids everywhere–myself included–just groaned). None of our three work (yet!) at a place that offers 401k, but they should at least be doing a Roth. Oh, to be young and frivolous again…

Haha yeah, probably all that partying back in the day that messed me all up :) Never calculated what I missed out on, but seeing how I was only making like $7/hr at the time I doubt my 3% would have amounted to much, haha… Plus I had all that partying to do! Which eventually forced me to move back home for a while as I ran out of money (turns out living in NYC is pretty expensive – who knew?)

Nice!

It’s a tough change around going from saving to spending. Income is friggin addictive! If there is anything I miss from work, it’s the community of friends and getting my stupid paychecks. It’s tough going to a different mindset, although the beautiful days spent fishing and mountain biking help distract me from thinking about missing paychecks :)

Sounds like your dad is doing a good job of focusing on enjoying his retirement. Let me know if he needs a fishing/wakeboarding buddy to help him enjoy that boat :)

Oh man, you guys would actually hit it off pretty well :)

Following “I love you” and “goodnight,” the next popular phrases in our house were “we can’t afford that,” and “Money doesn’t grow on trees.” And then of course, “be thankful for what you have – there are kids in Africa with nothing!”

Haha. That’s Awesome! I used to be one of those kids so I’m grateful where I am today. :) I’m trying to teach my kids who have no knowledge of that life.

Awesome parents you got there, J.Money! Thanks for the post!

Congratulations to your parents and may they have a ball in retirement!

It is funny to think that our mothers, bringing up their children in different countries on different continents had such similar things to say. My mother’s line was “Think of the starving millions in Africa”. I still don’t know why I had to think of the Africans, we had plenty of starving millions in India too!

I know, right? I wonder why people added in the international element like that? It made it even harder to relate to too, because what kid has been to Africa to witness any of that?

Congratulations to your parents, J$!

It’s awesome to see the amount of passive income they have from their pensions to rental homes.

That’ll definitely help out a lot!

Great article! I have grandparents on both ends of the spectrum and if I ever need a kick in the butt to get my budgeting back on track, I can get it by watching them and seeing the difference in their qualities of life. And regardless of how much money you have, it never hurts to tell your kids that something is out of budget…. some of the wealthiest people I know still make their kids do chores and save their own money for ‘extras’.

It was a weird shift for me as well in ER. One day you’re busy piling up the dollar bills in neat little stacks, and then next day they start walking out the door.

Every instinct I had said “this is wrong” and “I’m going to be living on the street soon”. But of course that didn’t happen.

I don’t feel like I’ll ever give up some of my frugal habits, but at least I’m a little bit more relaxed about money heading the other direction now.

Wow, your parents did great. Congratulations to them. Now they can enjoy retirement without having to worry about money.

I worry about spending money too. Our income still exceed our expenses so it’s good right now, but that will change when Mrs. RB40 retires. It might take a while to adjust from saving to withdrawing.

My mom had a ‘spendy’ year in retirement last year, so she’s flipped the switch. :) She is planning to dial it back this year. Most were unavoidable like dental work, and repairs to her summer house that both came due the same year. Then there were 2 “if not now, when?!?” trips that happened to be the same year. More so with my aunt who can’t walk quickly to keep up on the family trips, and then my uncle broke his wrist, them + my mom are getting older, so we’re trying to not put off these trips too long. (We went to Hawaii last year, Alaska in 2009.) On the flip side, is myself, my sister & cousin trying to make sure we have enough vacation time & funds for the family trips, so we can’t go every year. (One more of my reasons for FI!)

When my mom was revising her will she initially wanted to set aside money for her 3 best friends to take a trip. But realized #1 she wanted to go on the trip and #2 what if her friends were too old to enjoy it. It turned into a trip last year and now they’ve got plenty of time to cherish those memories instead of only going once she’s gone.

The dental & house repairs are good reminders for people like me to have an emergency / ‘hey it’s bound to be needed but you don’t know when’ fund. My goal is to not touch my HSA, but if I did have epic medical / dental bills, I’d use it. I have had some dental work the past few years, where I hope I’m good for the near future at a more maintenance level. *fingers crossed*

It sounds like with the boat, motorcycle, RV your parents are finding ways to spend. :)

I think I’d be thinking/doing the same things as your mother is too :) that’s the hardest part about getting older – all our bodies start falling apart! If everyone’s even still alive to have one :(

Honestly my mom is going to be saved from herself by her pension in retirement. I have a small pension as well but it certainly is a different world. Congrats to your parents on the well earned rest. Perhaps like my in-laws they will learn to spend money through travel and grand children, as they do sound similar to my wife’s family.

Great tribute, nicely done! I had to laugh at the “money doesn’t grow on trees” and “be thankful for what you have”. My parents said the same thing and I find myself saying that to my young kids now!!! Haha

haha… I’ll probably default to them too, but going to try REAL HARD not to! we need to make up some cooler ones or something :)

Congrats to your father, and kudos to him for all those income streams. That’s the ticket right there: income diversity.

Well done. And I see where you get it from. :)

I feel like this exact scenario is like so many older people I know as well! My parent’s & grandparents and other family friends you would have guessed had no money what-so-ever. But they saved so hard that now they are able to live the good life but have had a hard time spending some of it.

My grandparents still try and find the best deal on pizza when we are all over….like a $5 difference is going to make any financial hardships.

I guess that why they are at where they are today!

Congrats to your father on being able to retire and now enjoy some retirement! They sure sound like they are set up for an ok life in retirement!

J –

I’m just tying to picture saving, saving, saving some more for SO MANY years and finally saying – okay, all health is okay, family is okay, no big emergencies – time to spend and do what we want! Sounds bizarre and far away, but happy as heck for your parents at the same time. That’s quite the cash flow and nest egg they have!

-Lanny

Mmm, I know it’s just a saying but , I hate that it ” kids in Africa being hungry” Like Trevor Noah say ….” Americans don’t have hungry kids , only in Africa are they hungry, must be a lot of American kids in Africa then”

Hah – i won’t disagree!

My mom officially retired this very month and my dad has little time left until I start making senior jokes :D (just kidding!)

However, I never really thought about the spending aspect of retirement. My family has always been living frugally, ever since I can remember. My other half and I continue to make plans for when we get old and grey, yet we’re also so used to living frugal lifestyle, spending our savings all of a sudden will surely be incredibly weird!

Congrats to our mom!!

AWESOME read!

So happy for your parents. My folks were Millionaires Next Door, but my dad wouldn’t quit working. He died the year he said he was retiring for good. He never did get to enjoy what he’d worked so hard for. :-(

At least my mom enjoyed her last years.

All the best to your folks!

oh $hit man, i’m sorry :(

I love it, well done JMoney-parental-units!! What an awesome thing to have at least three streams of income as a result of their hard work.

I hope that we’ll be those stealth wealth parents for JuggerBaby someday. I spent my entire adult life supporting my own parents and as a probable only-child, I don’t want JuggerBaby to bear that burden so early in zir life if there’s anything we can do about it. Which there is! So we have our living trust set up already and we’re working on making it to our own financial independence. I’ll always have a love for bargains and couponing, but I will also love not *needing* them if I can’t get them.

You are one of the strongest people I know, Revanche – always in we of what you do for your parents! Your kid is so fortunate to have you as a mom :)

Congrats to your parents!!

I’m sure some very relaxing times are ahead for them! I can’t imagine what it would be like making the switch from saving for many years to spending and not having to worry so much about the future.

Thanks for sharing!

What an awesome time for your parents!

I can tell you from firsthand experience that although it is a weird transition, once you get used to it is very relaxing and you have plenty of time to try new things! If they ever get bored you could always recommend they start a blog, haha.

Now that would be something, haha…

I love it I love it I love everything about that post!!! :D I’m not actually sure what a pension is either, how did they get 3?

J, as a Mohawked child, did you or your siblings ask for stuff often? What was the rough ratio of yes/no in response to those requests? Now I’m certain your parents are the classic millionaires next door so they must have spoiled you guys occasionally? Xmas? Birthdays?

Glad you liked!

Oh yes, I’d say we asked for about 5 things a week and maybe – if we got lucky and if the thing was cheap – we’d get 1 :) Always got a lot of things for Xmas and birthdays though, because my mom was great at finding bargains and had a whole year to look for them! haha… and as a kid you just liked getting a LOT of things vs just a cple nice things, so we never complained at all even if most of the things we got prob cost like $3 haha…

This is awesome! How funny that your parents always said, “We can’t afford that!” Apparently my grandparents did the same thing to my mom and she was convinced they were poor until she was in her 20s! They retired in 1991 with a million bucks in the bank, a fancy paid-off home in Charleston, SC, and a pension–94% of my grandfather’s pre-retirement income. Gotta love the pension. Where can I get one?

Congrats to your parents for a life well-planned, and a well-earned retirement!

Charleston!!! SO BEAUTIFUL!!!

My girlfriend told me that she thought my dad was a secret millionaire, and I adamantly denied it. We were beyond poor growing up and not provided for. But then I got to thinking. Military & government pension and no hobbies to spend money on. Lives on under $1500 a month. Owns a rusty old car and rents a trailer in a low COL area. The more I think about it, the more I think the girlfriend is right. (So often the case) If it is true, I will be mad he let us go hungry as children. Super mad.

Fascinating!!! Are you able to ask him and find out, or is he no longer around? I’d imagine the wealth would have to be somewhere right now if that’s true (and he’s gone)? I doubt he would have let you kids go hungry if so – prob didn’t accumulate it until everyone was out of the house as kids just eat through wealth ;) (at least mine do!)