Taking a break from all the heart pouring lately, and moving on to some financial sexiness today… With special attention on the latter ;)

Check out this clip I was emailed from Sam over at Honeyfi (who you might remember from our FinTech competition and apps review the other month). The truth finally comes out!!

We just conducted a survey of 500 committed couples, and I thought you’d be particularly interested in the results. Among other things, we found that couples who regularly track and discuss a household budget are (i) 50% more likely to report being “extremely happy” in their relationship, and (ii) over 33% more likely to report having a great sex life. In other words, science has finally proven what you’ve known for a long time: budgets truly are sexy.

Thank you, thank you – *takes a bow*. But we can do better, folks. 33% is a great start, but I want to see us at 100% budgeting and having even greater sex!!! And then greater budgeting with greater-er-er sex, all at the same time! Haha… Wait, that doesn’t work…

But it is better than this other stat I recently came across, from Varo Money:

“35% of people say they would rather vomit than make a spreadsheet of their finances”

Come on!! No way that’s true… #FAKENEWS #FAKENEWS #FAKENEWS

The only thing you should be vomiting is all of your expenses to make room for those scrumptious savings! Mmm mmm….. Nothing tastes better than a hearty early retirement cake! And this blog here gots all the fixin’s for it – heyo!!

Okay, I’ll stop haha…. might have had one too many espressos this morning ;)

But true fact: Budgets are sexy. And also, apparently kangaroos…

(This was trending on Twitter yesterday, haha… “A surprised tourist was stopped from using a public toilet in a national park near Perth because a kangaroo was striking a pose in the entrance.”)

Here are more random, yet slightly nauseating and entertaining,

financial stats

I’ve been collecting them for quite a while now… Feel free to bring them up at all the Spreadsheet Parties tonight:

**********

“The average American racked up $998 of post-holiday credit card debt.” (survey)

Ugh… but wait for it…

“…which will take the average respondent 10.28 months to repay (!!!)”

If anything is vomit-worthy, it’s that. Because guess what’s coming around again in another 10.28 months??? Oh that’s right – HELLO HOLIDAYS!!! Thus becoming the never-ending circle of debtness! Ho Ho, NO.

“Over 50% of men and women said they would feel successful if they employed a housekeeper” (study)

I don’t even know how to respond to this one, haha… I mean, yeah – I guess if I had enough money to hire a housekeeper (or chauffeur, door man, professional driver, chef, bat cave, island) I’d feel pretty successful too. But any idiot can pay for that and still be on the brink of bankruptcy. Success ≠ how you spend your money. Success = how you SAVE it.

“74% of parents assist their adult children in paying for their living expenses including rent, cellphone bill, utilities and transportation.” (poll)

I’m shaking my head on this one too, but Lord knows I’ll probably be doing the same for my kids when that dreaded age comes along, haha… You always want to help your kids out, but how do you do it so they learn and don’t need you anymore later in life? What’s the best way to teach them?? I’m really asking – these are not rhetorical questions, haha… I don’t want to lose any of my street cred here! ;)

“27% plan to opt out of home ownership in the next 5-10 years, an 8% increase from 2016” (link)

Now that stat I can get down with! Not because I’m against home ownership in any way, but because it means people aren’t as afraid to do what’s in their best interest anymore for themselves! Because spoiler alert – owning a home is not for everyone. In fact, I’d be leery at any stat that was hovering around the 100% mark of what people were doing to be honest… Unless of course it was around budgeting and/or spreadsheet parties ;)

“Doctors make way more than we think. They are perceived to make $125,000/year, however they actually make $200,000/year.”

Nice! Go docs! I guess that’s why y’all are popping up all over the early retirement scene lately, eh? Checkin’ to see that everyone’s treating their money with as much respect as their patients? To make sure they’re all nice and financially healthy? That everyone’s wallets have a pulse? (One more, one more – That they all have emergency funds???? #NailedIt!)

“46% of married Americans die nearly broke, according to a recent study by the National Bureau of Economic Research” (GoBankingRates.com)

Damn. Though I don’t know why “married” had to be included in there? Shouldn’t that make the odds better that you wouldn’t die broke? Still, no bueno. Although, you wouldn’t be that different from many of our founding fathers back in the day… Both Thomas Jefferson and George Washington ended up dying deeply in debt! But at least they enjoyed their lifestyles going out at the end ;)

(I’m actually reading a pretty interesting book on G. Washington right now, and how one of his biggest expenses was entertaining the parade of guests that would stop by his home over his retirement years to pay their respects. Something he had a hard time turning down (also out of respect), but only added to his financial problems. This seemed to be the case for many notable figures in history which is kinda interesting… Do you think you’d be able to turn down all your adoring fans and colleagues?)

“D.C. metro area named worst city for earning six figures & still being broke” (link)

Yup, it’s bonkers out here… $500,000 will literally get you a door if you’re lucky, haha… No less an entire home with your own roof and bathroom! We pay $2,200 for a tiny 1,100 sq ft rambler, and that’s still 30 mins outside of the city… Two hours 30 minutes in rush hour.

“More than half (55%) of Americans think it is acceptable to purchase an engagement ring from a pawn shop.” (Ebates.com)

Hey – traditions gotta start somewhere? :) I’d personally prefer a family heirloom or handmade ring of some nature for anyone out there considering proposing to me anytime soon, however as the financially conscious guy I am, a pawn shop would certainly also do the trick. But only if it doesn’t come with a sad or creepy story as to why it’s there… I’m not about to score a bargain off of someone else’s loss. And I’m damn sure not playing around with any ghosts!

“32.6% have used Venmo to pay for drugs (marijuana, cocaine, adderall, etc.)” (poll)

I thought that was what Bitcoin was for? ;)

“21% of millennial respondents have used Venmo for betting or gambling.”

Oh wait, THAT’S what Bitcoin is for, bah-dum-ching… Although I’ll admit it – for the first time in 5 years I’m actually starting to get a little interested in it. Is that bad? Mainly just for experimental/learning purposes, but not a week goes by when someone doesn’t ask me my thoughts on it. And I’m getting tired of always responding with “I don’t know, go ask Mr. Money Mustache.” Haha… (Okay, I don’t actually do that, but his recent post I just linked to on it was pretty good…)

I’ll leave you with one more, just in case you were wondering…

Happy weekend everyone!

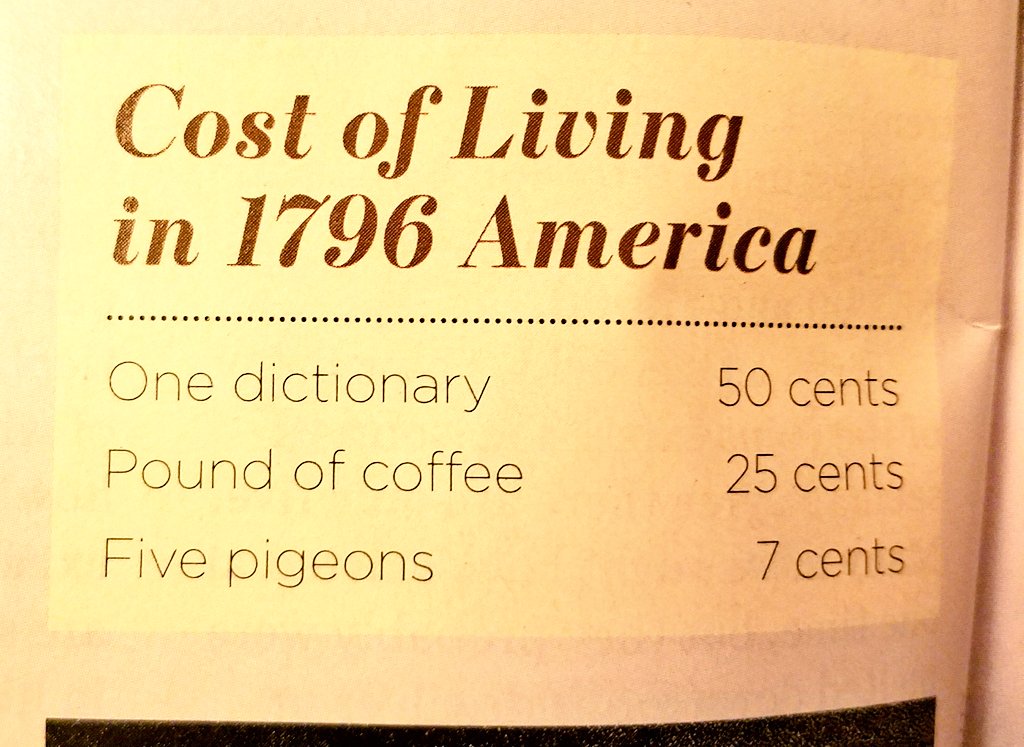

And to save you the look-up: “Homing pigeons can cost anywhere from approximately $50 up to several hundred dollars, depending on the pedigree and breeder. Keep in mind that in addition to the cost of the pigeons, you must also pay the cost of shipping.”

Get blog posts automatically emailed to you!

Finally science is backing you up! And also the fact that you are about to have your 3rd kid proves it :-))

Haha… yup, pretty much :)

We all already knew budgets are sexy. Nice job proving it!!! At least there is some hope of accomplishing my ultimate goal of dying broke. Who wants to end up saving too much? Let’s all go out with a bang by spending our last day skydiving and dumping out a bag full of whatever money we have left out of the plane before we jump…just for fun.

That is one way of looking at it, haha…

Well duh, you’ve been telling us this the whole time… why else have I been reading your blog since 2012?!? ;)

Haha, awesome round up and Happy Friday, J!

2012, nice!! that’s a lot of years of blog reading – I am honored :)

I partially blame you for my personal finance obsession and for starting a blog ;) Your site was one of the first I found after reading “Millionaire Next Door” and it opened the rabbit hole of personal finance for me (thank goodness!).

So SO cool… Totally copying and pasting this into my “happy” folder haha… (for real – i check it out anytime I’m feeling bad/sad!)

Oh my gosh…that kangaroo photo lol. I’m totally going to send it to Mrs. BD with a personally-crafted meme ;)

While the proof of budgets is quite interesting, I found the miscellaneous stats more intriguing. Some of those are depressing to see, but even more motivating because of that reason.

Thanks for the post, J.

Besides the absurdity of home prices here in the DC region as you stated, the whole region is a lifestyle inflation nightmare. Washington DC is about power. Lobbyists. Influence. And nothing says power more than a nice $50,000 Mercedes. Or a $6000 suit with $800 shoes to match. At least that’s how Americans think.

I kinda of enjoy flaunting my ghetto-ness here :)

Haha… Same.

A friend & I were just talking about two other co-workers (both men) whose kids stopped by the office yesterday wanting $$ – and they both got it!!! Both kids – a son & a daughter – are young adults & neither seemed a bit ashamed of announcing they were there to get money from their dad!! I don’t get it.

Where do your co-workers work? I want to stop by and ask for some too :)

According to several websites, in the US the Personal savings rate is about 3%. Very low value, in my humble opinion. According to Eurostat, the household saving rate is down to 12.0% in the euro area*.

Both of them are steadily declining. Bad news if you ask me. In my opinion, the saving rate should be at least 30%. To invest in companies and personal stability.

Love the Kangaroo! And that was a fun list of stats! I fully admit we could technically be on that list of millennials getting financial help from their parents. My husband’s cell phone is on my parents’ family plan, but we do pay for his line. Sometimes I think they undercharge us…either way, even if we are paying the full amount they are helping us financially, because going off the family plan would give us a worse phone plan for at least $5/month.

Check out RepublicWireless.com – I’ve been rocking them for about three years now and love ’em… (for whenever you do end up disconnecting ;))

Hubby and I have never had a detailed budget. But we always have one in our minds.

And one thing I know for sure: I probably wouldn’t love hubby as much or even marry him if he weren’t frugal. The truth hurts sometimes ;)

You don’t have to apologize to this crowd! We get it!

74% of parents assisted their adult children to pay for their daily expenses? The only thing that I will be assisting my kids is paying for a post secondary education. I will let them know that if they graduate, then they will not need to pay back any money. If they don’t graduate, they will need to pay back every penny, with interest. It pays to be responsible.

Oh yeah, I think that I will be one of those 26% of parents that won’t be paying for my adult children’s daily expenses.

HAH! I like that idea!

Man 5 pigeons for 7 cents sounds like a great deal.

Haha, some of the stats here are surprising, some not. I’m honestly not shocked that couples who are on the same page with money are happier and have a better sex life. Glad there’s a little bit of research to support it now! :p

“74% of parents assist their adult children in paying for their living expenses including rent, cellphone bill, utilities and transportation.”

About this one….I wish that there were some qualifiers here. How many of those are students? How much of it is something like a cellphone because they’re still on a contract? that number seems high to me, but I guess I was 22 before I was totally cut off from my parents, and it was only because I got a job and could stop being on their health insurance.

But at 18 I was on my own for everything except tuition (thank you mom and dad) and health insurance.

Yup yup…. I think I was around 22 too until I was off all my parents’ stuff. Although they still hooked me up with things here and there if I really needed something. Guess the stat is a bit too broad, especially as “adult children” could still mean those in their 40s, 50s, 60s, and even 70s if you’re still alive! :)

Thanks for the shoutout to the doctors in this space! You can’t click too far without coming across one of us — two of the three posts on Rockstar today are guest posts written by radiologists. I thought they were better are reading screens than writing on them. Who knew?

It’s true that a lot of physicians make $200k or more per year, but after living and paying taxes, it can be a challenge to pay off the $200k or more in student loans that nearly half finish medical school with. Once you get that out of the way, though, you can make quick work towards FI, even if you start with a net worth of zero in your mid-thirties.

I never knew 35 pigeons would cost less than a dictionary. That’s a surprising ratio.

Cheers!

-PoF

Haha… good analyzation :)

And totally on the student loans – people often forget about those for sure and just focus on all that $$$$$ income.

“D.C. metro area named worst city for earning six figures & still being broke”

One of the truest statements I’ve ever seen… F this area. I paid $580K to live in a 28 year old 2400 sq ft home… Its a nice house but still, for that price it would be double the size (or more) in most other parts of the country.

Also, I was shocked what rental prices were around here. I was helping my SIL look for a place…man….apartments now start at a minimum of $1700 it seems. I guess we’ve been out of the rental scene for about 11 years now but wow, we were paying $1100 on the top end. I suppose some of the counties further out are cheaper but they are also much less desirable in many ways, especially if you have children. The President may even describe them as $h..holes.

Sounds about right :)

“D.C. metro area named worst city for earning six figures & still being broke” That doesn’t surprise me one bit! The single homes being built across the street from us in our Northern Virginia suburb (25 minutes outside of D.C.) are now on “sale” starting at the low 900’s…………..

That might be the reason why we have a master 3 year plan that will eventually place us further down south;)

Engagement ring from a pawn shop?

I find that so interesting and guess I can’t blame them LOL

Kangaroo photo made my morning!

WOO! I can quit now!

“74% of parents assist their adult children in paying for their living expenses including rent, cellphone bill, utilities and transportation.”

Wow. You asked, so I will tell you what we are doing with our kids (11 and 7). We first purchased them piggy banks, one with 4 compartments (save, spend, invest and donate). Then we started giving them an allowance, one in which they put money in each compartment. If they want something, they have to save it in their spend and then they can buy it. Our 11 year started investing in stocks at 7. Our other child is the spender in the family (we think he came from the milkman! j/k). He never has any money to spend. Once they get a job, they will no longer get an allowance. The allowance is not tied to any chores. Chores they have to do because they are part of the family an everyone has to help out. We are fortunate that we can give the kids an allowance and they can learn about money.

As for when they are adults, we have mae it clear that we are raising them to become independent adults who can function in society. This is not just a money thing, but parents have started doing EVERYTHING for the kids. A good book to read about this is “How to Raise an Adult: Break Free from the Overparenting Trap and Prepare Your Kid for Success” by Julie Lythcott-Haims

Good luck! It’s crazy out there!

Rock on – this is great, thank you! I’m digging those 4-compartment piggy banks – I think I know what Santa and/or The Easter Bunny and/or The Tooth Fair will be bringing them next ;)

I will fess up to being one of those millenials. I am 25 and am on my parents’ cell phone plan, which they don’t ask me to pay for. But I also live on my own in another state and have been employed since graduation and have no debt. I think it has become pretty typical, at least in upper middle class families, to keep the adult children on the cell phone bill for a while. On the other hand, I have also seen friends quit their jobs without anything else lined up, so I think it is important to make sure you are actually helping your kids and not teaching them they don’t have to work!

I’m one of those Millennials too, but I’m 35! I’ve been on my parents family plan since 2002, but I pay the whole bill every few months (and mom gets mad at me for it!)

I do also have my own house in Florida, and they come here to visit a few times per year at no cost, so I think it is a wash…

Love the kangaroo!!!

I was surprised to learn about the holiday debt. It really is a viscous cycle. You pay it off just in time to accrue the debt again…wow!

You were on fire today…glad to see docs are making some good cash, but we also spend it like it’s our job…so many docs end up living paycheck to paycheck. Sad indeed.

I do agree, budget’s are sexy, but spreadsheets of net worth are sexier…

Indeed… net worths turn me on pretty good.

Sadly that stat on helping adult children does not surprise me. It’s tough to say no to your kids when they’re not succeeding on their own, but subsidizing a lifestyle they didn’t earn will only make things worse.

I’m also not surprised on that “budgets are sexy” stat. Arguing about money is a major problem in marriages, and when you don’t have that issue, things are a lot sexier. I’m glad my wife and I are both spreadsheet fans and budget lovers!

Regarding transitioning your children to adulthood……in WA State we have a program called Running Start. Both of our kids graduated hs with their AA degree courtesy of this program. The whole time they were enrolled we told them that the following two years of college were on them. Work-work-work and save-save-save while you’re living at home for free. When the time came for them to move on, BOTH kids turned to us and said “wait a minute, you were serious about that??!!” Moral to the story…..you can model good behavior and lecture/talk to your teens until you’re blue in the face but they’re going to do what they’re going to do. Remember: they’re all-knowing teenagers and you’re nothing but a dumb old dinosaur – ha!

HAH! That does not surprise one bit :) I might have to lower my expectations then and just be pleasantly surprised if things pan out as planned!

The marriage stat may need some clarification. If it is upon the death of the first spouse, that just means that the other spouse has everything – which would lead to an approximately 50% number – as generally all assets will pass to the surviving spouse. Now the survivor is no longer married and doesn’t qualify to be counted in the statistic.

This was hilarious!! Sooooo did they NOT pay shipping in 1796?

I just envision them flying to all the homes themselves a la Harry Potter owls :)

Loved all the financial stats, and I also go to learn what Venmo was! Thanks J$

Here’s another fun fact: Paypal owns Venmo!

If there were stats in Canada I would totally be one of those 27% that wants to sell their house in the next 5-10 years. I want to have freedom, less costs, ability to travel for extended lengths and of course free up that equity to put into my savings.

As for paying for children, I’m not necessarily paying for my son’s cost of living but he is still at home :) He graduated this past year from trade school and now has a full time job as a journeyman apprentice. He still lives at home with us and I am totally cool with it but I keep pushing money lessons on him the best I can.

Nice work trying to find a way to put a kangaroo in your post today lol

Haha… I was pretty proud of that one, not gonna lie.

Aha, I see myself paying for my grown kids too. (Not that we have any) Hopefully they’ll be happy adults but it is what it is. I’m not against that. If I brought them here, I gotta be responsible for them at any age. The job of a parent is never done. If you think you’re done at 18…dude you’re not that considerate of a parent.

“D.C. metro area named worst city for earning six figures & still being broke”

I’ve noticed that too because a lot of PF bloggers are on the East Coast. DC has similar wage and housing prices like Seattle but DC has higher taxes than the state of Washington and higher cost of living.

Do adult kids that take living exenses from their parents have no shame? I can’t believe so many adults accept money for living expenses off their parents. Consider my flabber ghasted!

What I don’t see in that parents paying for adult kids stat is how many of those kids are in college still. I suspect the numbers would be a lot different for what people are paying for if the kids are 18-22 and in school vs. 22 or older and out of school.

I have a plethora of former military friends who got out to go make big bucks in DC only to find out that the paychecks weren’t the only thing that got inflated. Of the high cost of living places that has to be one of the worst places to experience it!

Also, HoneyFi sure is thorough with their questions. If I didn’t already know what they were about I’d be worried about who wants to know about my money and sex habits. #ITSATRAP

Haha yup… And they’re apparently great at marketing too because look – here we are talking about them off a single email!

My adult kids are still on the family mobile phone plan. They buy their own phones when they need one. We cover their plans as one of their Christmas gifts which brings a lot of joy and appreciation for Mom & Dad.

Oh hell yeah – now that’s a good Christmas gift! 10x better than more “stuff”!

I’m still technically on my parents cell plan, but I pay my portion of the bill for 6 months in advance (kinda like car insurance) so I don’t know if that counts :)

One outstanding agreement my parents have with my siblings and I is that they would allow us to stay rent free at their house for 3-6 months after graduation (if we had not found a job yet). After that they would begin charging us “rent” which would be about 1/2 – 3/4 of what the average rent prices in the area would be.

I kinda like this as it provides incentive to get out a get a job to pay for your expenses, but its not like you throw them out on the streets… Just thought I’d share! :)

Agreed all the way. I’d even let my kids live with us WITH jobs for a certain amount of time, but only if they *save all their money* while there… Imagine how fast that would accumulate if you had no mortgage or utility or food bills for X number of months?? Man… I’d move in with MY parents for a bit if I could! Haha….

Very interesting stats. Great Kangaroo model. I have no kids sucking me dry. Just the

opposite. My son pays my LIfe Lease, gave me a car. i pay the maint and rent.

If I have anything left (now 87) he is supposed to get most of it. Sisters to share.

Must look after his mother.

Hah! Nice!!

Love it that you’re on $$$ blogs too at 87 – you must really enjoy this stuff :)

Love this! The percentage of parents helping their adult children is SHOCKING! We are raising a 4 year-old in Chicago and I read Smart Money, Smart Kids by Dave Ramsey and his daughter. We follow that with our son because I ain’t raising no man-child. He has a 2 column chart on the fridge. Things he does for free (make his bed, clean up toys, keep a neat room, etc.) and things he can get paid a dollar for (get the small trash cans to help with trash, help unload the dishwasher, etc). These lists evolve as he gets older. With the money he makes, he can save up and buy toys. When he turns 5, we’ll start dividing up spending, saving, and teach him charitable giving.

Damn! You’re whipping me – i don’t have anything like that set up for either of my boys (3 and 5). Will have to check out that book the next time at library – thanks :) Sounds like a cool system.

What a fun and sexy list. Great jokes on the docs! lol

Considering the fact that I just sent my mom $$, it’s not the next generation I’m worried about.

But that kangaroo though. **DEAD**

Good post J$. Of course, for this science to be applicable to all couples, both of them must believe in it! It’s not easy if only one does – the same Science in that case may predict a split or a lifelong difficult marriage.

Stop it, party pooper ;)

Budgets and growth in net worth are the best aphrodisiacs out there, hands down! Great post!

Glad you liked :)

I love the stats. Home ownership certainly isn’t for everyone, though we sure like it. I think the rent vs. buy debate is so polarizing that it’s hard to have a non-emotional discussion a lot of the time. I think in the short and medium term, renting has some HUGE advantages (mobility that can be leveraged for new job opportunity, can invest downpayment money for better long term return) but that housing, if you stay in the same house for more than a decade, has some obvious advantages in cost control.

But as you said — not for everyone.

And like everyone else, yeah, I love that kangaroo!

Haha… he (she?) stole the whole show ;)

In DC, even if you want the tiniest least convenient condo ever, you’ll be paying 200-300K. Sigh.