Morning!

Been emailing with a new reader of this blog, and in the middle of it he shot me his entire financial/career life story which I thought you’d love to see too as voyeurs ;) Always something so raw and beautiful about this type of stuff – no one ever shares in the real word!

The clip’s below, along with some follow up questions I squeezed in while the iron was hot… Not sure how much you’ll learn from it, but there are some hidden lessons scattered about.

And again – REAL LIFE NUMBERS AND STORY!! Gimme all day long, please!

********

J. Money – I would say that from what I know of you from your pretty recent blog posts and the Money Show‘s first 15 podcast episodes, we have very similar money philosophies. I lean a bit more towards the Mustachian approach of reducing expenses than you, and I hate real estate a little less than you.

That said, you might get a kick out of our recent financial journey. If you don’t have time or interest to read it, no big deal. It was good to prepare as I am sharing my “life-story” this evening to a small group in our church.

TLDR Version = Life’s crazy, I would do a few things a bit differently if I had a do-over, but then again, I enjoy the lessons I’ve learned. I am definitely in the “rent” camp at the moment, as buying and selling 3 houses in less than 5 years is wack!

July 2008 — Start internship w/ Northwestern Mutual – primarily selling insurance while finishing my degree at University.

May 2009 — I graduate, move home w/my folks, obtain investment licenses and continue building my clientele with Northwestern Mutual.

June 2010 — After moving out I realize that I’m not really making a lot of money and we mutually decide, after I flake out for a few days to a week, that it wasn’t/isn’t the best timing for me to build this biz.

July 2010 — Move to a similar role with State Farm for a few months. Big difference was I was serving existing clients, and had a base salary. But my heart still wasn’t in it.

September 2010 — Spent a few weeks going door to door signing people up for a new garbage collection provider. Funniest thing here was that I got one sale on my first day, and never got another sale again!

Mid-September 2010 — Tried my hand playing online poker for a few weeks. I think I made money, but my hourly rate was ~$2.50 an hour. Clearly not worth it!

[Editor’s note: we once had a professional poker player stop by the blog to share what it’s like to live that lifestyle full-time! Pretty interesting if you ever want to check it out: Confessions of a poker player (pt 1), A day in the life of a poker player (pt 2)]

November 2010 — Offered a contract position with Wells Fargo call center, then 4 weeks later moved to Ameriprise because it was a permanent/full-time job (this was a good call to make since Wells shut down that call center about 5 months later)

December 2010 – December 2015 — Worked in two roles at the Ameriprise corporate headquarters starting at $42,000, ending at $75,000 – and earned the CFP® designation while I was there.

December 2011 — I met my beautiful wife Tory at a local townie bar in the small town we grew up in. We knew each other by name/face as we were in the same graduating class in high school, but never had as much as a single conversation before.

October 2012 — We got married and moved into an apartment. Rent was just under $800/mo for a 1 bedroom 700 sq. foot apartment. This was plenty of space, but we didn’t like hearing our neighbors.

September 2013 — We purchase our first home and the mortgage is roughly $1,500/mo PITI. Our combined income is roughly $80,000. Tory has hardly any assets at this point, and ~$65,000 of student loans.

December 2013 — We get our first roommate to have some extra cushion.

August 2014 — We now have 3 other roommates that are covering our mortgage! My wife does not like having roommates, and I don’t blame her, but I push us/her to save and pay down debt.

March 2015 — My wife leaves her job as it requires handling conflict which she doesn’t deal well with, or lend itself to growing a family (she had to work a fair amount of nights). She nannies until 1 month before our son is born and then becomes a full-time stay-at-home-mom.

August 2015 — We purchase a smaller house that is 6 blocks away from our first home, and turn our first home into a full-fledged rental. Our new mortgage payment is under $1,100/mo PITI.

September 2015 — Our son Xavier is born (accidentally in our home! This is a story for another time!)

December 2015 — I leave my corporate gig paying me $75K + great benefits for a role as an Associate Financial Advisor with one of the top 100 (out of ~8,000) Ameriprise practices. This pays me $80,000 with some benefits, but the total compensation + benefits is probably about $5,000 less than the corporate gig.

June 2016 — We sell our second home without the help of a realtor and it turns out that when all is said and done, it cost us ~$1,400/month to “rent” the place we owned for ~10 months. Two days later we purchased a home that is closer to my new office.

August 2016 — I find out that the “script” I was being asked to deliver to my/our clients at this practice on why we were increasing their investment advisory costs was a lie – and I resign. This is 6 weeks after we purchased our home!

September 2016 — I start working with another Ameriprise Franchise office, but this time, I’m building my clientele from scratch again, with no base salary.

September 2017 — We decide to move up our timeline for baby #2 a bit after learning that Tory’s mom has cancer.

January 2018 — We move in with my in-laws to dramatically improve our cash-flow, and be with Tory’s ailing mother.

February 2018 — Tory’s mom passes away. We knew our time with her was limited, but we thought that we at least had a few more months. We were so glad we got ~4 weeks living with her before she passed.

Late-February 2018 — We sell our primary residence (the one we purchased in June 2016)

March 2018 — 3 of our 4 tenants move out, and I’m currently negotiating with the 4th to offer them an incentive to move out. She, unlike you, does not have children or a spouse, and will be moving in with her folks, so other than convenience, there is no real reason to delay the inevitable. Also, I’m trying to complete as many things as possible prior to my wife giving birth again!

Our cash flow is super manageable, but the rest of 2018 will be about even, and then in 2019, we’ll be able to pay down some debts/start saving. We intend to move out, and I will push for renting in 2020 or 2021 :)

***********

Fun to read, right?? :) I then asked what type of church meeting this is as that’s a looooot of info to be giving out, haha, and thinking maybe it was some sort of Dave Ramsey class relating to finances or something? But nope:

***********

The church is only 2-3 years old and this is a group of 6 people participating in a 7 week group where week one, we all gave super brief introductions and established guidelines and expectations for the group. Then weeks 2 – 7 we each get our turn sharing our life story.

Although I don’t think you are a “church” person, this church is awesome! The pastor is a gay person of color, and technically speaking, the denomination doesn’t ordain gay people. OOOOHHHHH SCANDALOUS!

[Editor’s Note: I am a church person, but been neglecting our attendance ever since having kids :( So much harder to concentrate! Haha…. But I do very much want to get back to it again.]

***********

While we were on a roll here, I then asked if he was cool sharing his current financial snapshot with us so we can get an even better idea of his money…. Even though we’re all strangers here! Haha… Although after this post, not so much ;) He delivers on that too:

***********

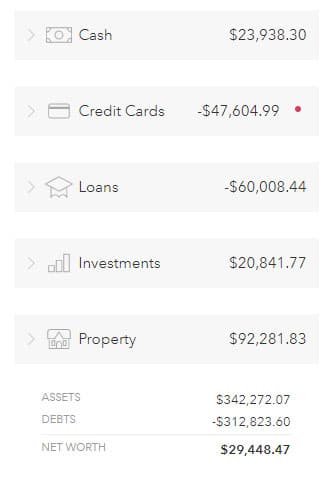

My Net Worth Snapshot from Mint along with more details filled in.

- Credit Cards actually includes $33,000 on Lines of Credit at ~10.5% interest, $4,950 on a Card at 9.75% interest, and the remainder on 0% balance transfer cards.

- We have excess cash at the moment since we’ll need to cover the last month’s rent, return the security deposit to our tenants, put in carpet, professionally clean the rental, and a few other things + pay the mortgage until it sells. Fortunately our real estate market here is super hot!

- It cost me $12,500 to bring my clients over to my new practice.

- My annual biz expenses are ~$25,000.

- My net income growth rate over the last ~18 months (my time with this practice), has been ~$2,000/month. So, there’s hope!

- Also, my wife earned $5,000 as a part-time professional Organizer @ $50/hour w/pretty much $0 overhead. With baby two due in May, 2018 will be another lean year, but I think that her income will pick up a bit in 2019, and even more in 2020.

- Regardless, I’m doing our planning under the assumption that she will never need to work again.

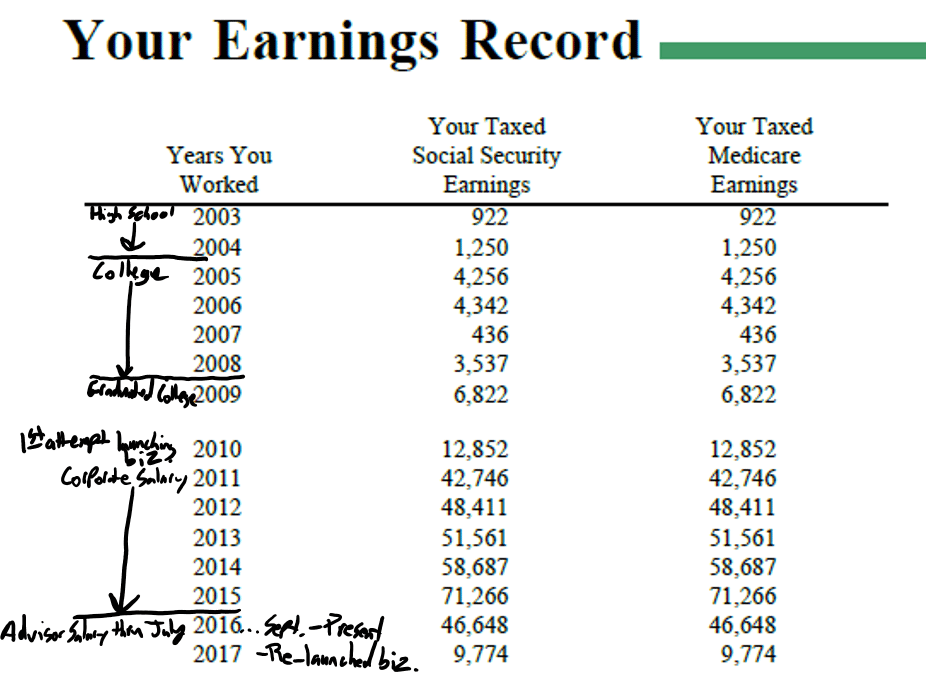

My lifetime earnings per Social Security Statement:

***********

It was at this point I asked if I could share this with everyone as I was just fascinated by it all :) And as you can see, he said yes! (Thanks man!)

Got me really good with that last snapshot too as I’m a sucker for lifetime earning stuff… Did you know you can grab your own at any time yourself too? Without having to wait for the yearly statement to come either?? –> https://www.ssa.gov/myaccount/

Just log in/sign up over at the social security website up there and you can access your data whenever you want. And then use it to calculate your Lifetime Wealth Ratio™ I made up to see how you’re doing overall! ;)

Since the Social Security Administration would have no idea how much you’re saving in comparison to this income, we’re left to come up with our own means of figuring how good we’re doing or not. So today I introduce to you the newly coined term – and future buzzword – the “Lifetime Wealth Ratio™”

Which is calculated like this: Net Worth ÷ Total Income Earned

…I would suggest rankings as so:

- 0%-10% – Meh

- 10%-25% – Now we’re cooking!

- 25-50% – You’re on fire, baby! Give me your number!

- 50-100% – Marry me.

- 100%-1,000% – How do I get into your will?

I remember being hocked up on A LOT of coffee writing that one ;) Looks like the last time I ran it here on the blog though I came in at 54% and my lifetime earnings up to that point looked as so:

At a coffee shop right now and don’t want to log on to the social security site while here, but guestimating real quick our present ratio is probably hovering around the 65% mark ($811,570.54 / $1,250,000).

So we’re getting better!

And of course there’s wayyy more that goes into your *true* lifetime earnings as the SS stuff only factors in *taxable* income and probably omits other variables as well, but the ratio still gives you a decent idea of how you’re doing in the overall grand scheme of things. And plus, it’s just fun to calculate ;)

So there you have it! Numbers and rawness everywhere today! Take from it what you will, and feel free to share your own journey with us either publicly below, or privately via email (j @ budgets are sexy (dot) com).

I promise not to share it with the masses unless you want me to ;)

Hope you enjoyed this today! And remember that there are no straight lines to our dreams! We have to go through all kinds of ups and downs and all arounds, but it’s all worth it in the end!! And you’re smack in the middle of the journey right this very second – take a second to appreciate that!

*****

Names have been changed to protect the innocent.

Get blog posts automatically emailed to you!

For a second I thought I was reading J$’s history and got so confused haha. I was like “oh, I didn’t realize J$ had a CFP! Or played poker for fun. How cool.”

Good for him for quitting when he found out about the lie! Integrity will get him further in life. Pretty interesting story. I guess it shows the different paths you can go in life!

Haha yeah – I think I’d get kicked out of that CFP status STAT with the stuff I blog about here ;) I very much like the freedom to write whatever I want without worrying about compliance!

Man this guy is positively human sunshine. Sometimes rundowns gives me chills, it’s a decade condensed into a few bullet points on all of life’s zigs and zags. Rawness indeed.

“human sunshine” – i like that :)

I need a follow-up about the accidental birth in his home!

Hi there! I’m the accidental home birth lady in the story!

The short version is this:

-We had never had a baby before!!!!

-We wanted a natural birth and wanted to labor at home for as long as possible.

-We took a birth class and were told that first time moms labor for 12-24 hours.

-My labor was 7 hours, from start to birth.

-My contractions were never consistent, except toward the end.

-We we’re getting ready to head to the hospital when our son made his entrance into the world.

-A woman’s body is AMAZING and can do amazing things! I cried every time I got shots until COLLEGE. I’m not some super strong and tough woman…unless I’m giving birth, I guess! I’ve had to pass kidney stones and I’d 100% prefer giving birth over those.

-Since I’m currently pregnant and due in ~10 weeks, we’re planning to have health care professionals present at this birth. We’re also 5 minutes from a hospital and plan to head in as soon as *anything* happens.

-Honestly, I’d do the same thing again if I had the option. It was a calm labor (still HARD though!), and our son came into the world in a very calm way.

Way to go mama! Good luck on your birth journey for #2!

Hey!!! Thanks for jumping in!! And for letting your husband share your family’s finances with the world today :)

Holy crap, I wanted to ask but thought it was too personal. Incredible story!

What a great financial journey! If I was in his shoes I would work on decreasing the debt to level more close to 65%/70%… Ideally, of course, is ZERO.

Innocent: You should start your own blog.

Regards,

GTRetire.

Life can take you down a windy path! It’s crazy to peak through a decade of living and working. Makes you kind of think twice about how you are spending your life when two sentences can summarize it…hmm, what do I want my synopsis to say?

Exactly right! A good exercise is to bullet point out your “life story” too, featuring all the highs and the lows, and then sit back and reflect on it for a while :) I did the same for my biz/blog stuff here from the past 10 years and it’s just mind blowing to see it all condensed like that. Also makes for a good easy way to tell people/journalists your “story” too, haha…

http://jmoney.biz/story/

Interesting exercise down memory lane:

Work Year Taxed Social Security Earnings

2017 $108,264.00

2016 $104,185.00

2015 $101,749.00

2014 $99,002.00

2013 $94,466.00

2012 $95,652.00

2011 $94,516.00 Same job but ended Northrop Grumman employment and moved to Federal (GS) employment

2010 $83,726.00

2009 $72,378.00 Retired from U.S. Air Force (EXACTLY 20 years to the day!), Started with U.S. Dept of Energy (Northrop Grumman)

2008 $45,637.00

2007 $43,498.00

2006 $38,482.00 MSgt Promotion

2005 $34,549.00

2004 $33,159.00 Deployed to Iraq for 6 months

2003 $31,342.00 TSgt Promotion

2002 $26,319.00

2001 $29,159.00 Moved to Colorado, get divorced/re-married (wife + 3 boys), Deployed to Kuwait for 6 months (in that order) (5 boys total)

2000 $35,753.00

1999 $33,548.00 U.S. Air Force and PT job

1998 $29,514.00

1997 $18,564.00 SSgt Promotion, Move to Nebraska

1996 $16,250.00

1995 $15,667.00 Move to Germany

1994 $14,878.00

1993 $14,210.00 Son #2 born

1992 $12,549.00 SrA Promtion

1991 $10,923.00

1990 $9,868.00 Move to New Mexico, Son #1 born

1989 $5,779.00 Join the U.S. Air Force, get married

1988 $3,208.00 Graduated HS, Worked for a drywall and small telecom company

1987 $511.00 Restaurant, News Paper, Gas Station, Christmas Tree farm, Drywall Work

1986 $682.00 Restaurant, Christmas Tree Farm work

$1,357,987.00

$573,099.00 Personal Capital Net Worth

42% Lifetime Wealth Ratio

BOOM!

Love that jump from military to civilian life too, haha…. And that’s all top of that juicy pension too – gotta love it :)

Everyone’s story is unique and I love learning from them all! I want to hear about the story of them accidentally having Xavier in their home. Haha!

He’ll never regret (no matter if it caused some financial stress temporarily) getting those four weeks with his Mother-in-law. He sounds like someone who puts his family first. Money stuff may take some time to untangle, but when it comes down to the heart of it – he’s got his priorities straight. :)

Totally :) And much easier to say than to do too! Imagine moving in with your in-laws right now??

Ha, that would definitely be a labor of love…. ;)

Wow what a story! Thank you so much for sharing your story and all the numbers. I hope the 4th tenant will move out so that you can put the house on the market and enter the rental market as you’d like. Having a baby is stressful enough, not to mention selling a house. But I think you two will pull it off. Best of luck! :)

What a story!!

Thanks for sharing the details and the numbers to us. I have tried poker in the past, and although I was young and got in trouble by my parents, I made money lol!

My father played online for awhile, but it was banned by the time I was ready to play. Nowadays, I have a strict no gambling policy anyway, but would bet on things I know 100% I could win :D

Sounds like there have been some ups and downs in life which is, well, typical! My own timeline is wonky too. But I just wanted to pop in to say thank you for being so candid. Something that is NOT typical these days in PF blogs! Life doesn’t always have this straight ladder straight to the top. And I’m not a church-goer, but that one does sound kind of cool. lol!

I think maybe you should share your story in one massive post too next ;) I’d love to read it!

A windy path for sure, but family first and in a good church group. Sounds like you are headed in the right direction. I think we all had some speed bumps along the way, all about how you navigate them.

I love this! I stopped mid post to see my lifetime earnings on the SS website. I was shocked to see that I’ve made over a million in my life so far. My lifetime wealth ratio is only 20%. That’s not surprising since I’ve raided my old 401K a time or three and wasn’t saving as aggressively when I was younger.

Seeing how much money I’ve earned in my life increases my confidence that I can always be a high earner no matter what I’m doing. Tell your anonymous reader that I said thank you for his candor. He’s got me thinking.

Will do! And awesome you’ve been able to make so much over the years! I bet your ratio only goes up now that you know what you’re doing with it all :)

So, you net worth is a family net worth but you only count you earning when you calculate your Lifetime Wealth Ratio?

The Lifetime Wealth Ratio was set up just for one person, so that’s why I edited the #’s to reflect more accurately. However, I suppose you can run a *family* LWR too, you’d just need access to your spouse’s lifetime earnings as well through Social Security in that case :)

My LWR is about 66 2/3%. I suspect my wife’s would be over 100%. Net Worth only includes investments and cash, I ignore house net value as that is too sketch to identify accurately. Zillow has crazy high values in my neighborhood. Not one house in my area has sold near or above the Zillow estimated value over the last 3 years.

Your readers story has a lot of positives, but he sure needs to get rid of some of that debt. That is some pretty high interest rates 10.5% and 9.75%. Starting a business that requires capital has you paying some high interest rates as you get started. Hopefully his NW can double or triple in 2018.

Totally agree with Zillow – I never went by it either when we used to own. Instead we just had our realtor run comps for us every year or so and then just based the value on that. Ended up selling within $1,000 of the estimate when it came time!

I was shocked to see those debt interest rates too! I’d be hard pressed to find any investments earning more than that interest rate, and if I was losing money on my investments vs debt Id cash it out in a quick hurry! They could be non liquid of course though.

THESE are the kinds of stories I miss reading in the PF world!

The SSA has my SSN on lockdown and won’t let me create an account – wonder if I should be worried! Also I like that I can choose to lock it down myself in case of shady characters (cough, Dad) trying to get my info. Once I get control back of my account, I’m going to do that.

Very strange?? You’ll have to come back and let us know what it is once you’re in :) Or better yet – blog about it and help me make the Lifetime Wealth Ratio go viral! Haha….

Wow I can’t believe they are able to make it on that income with kids. God bless small towns/places with such low costs of living. This coming from someone living in metro Vancouver, BC, Canada which has one of the highest costs of living in the world and my mortgage is $4,500 per month… let’s see whose eyes pop out of their head now :)

Holy $hit! You are not joking! Haha… Consider my eyes out of my head and rolling down the street :)

i know! Caveats are that we live in a brand new 4,000 sq. ft. custom home that we built.. and earn approximately 300k a year combined. it’s all relative I guess!

that does make me feel better, yes :)

Such transparency in this article. I need to make a timeline, myself. But, my memory would surely fail me. I know for sure I’m failing in the Lifetime Wealth Ratio(TM).

Do it!!! You can work on it slowly over time as well and just update it from time to time :) It’ll put things in SUCH perspective – try it!

Great article — the LWR is an interesting concept, although heavily skewed by investments and time in the market. Gotta love those folks who bought what they knew in the ’90s and invested in, for example, the Starbucks IPO. The returns from something like that are really mind boggling — $10,000 turning into $1.9 million if you never touched it (a big if!!)

Haha yeah – people like to beat themselves up on that (“if only I invested in XyZ!”) but the odds of them staying in for the long haul are so small that they would have just beaten themselves up more even if they *did* invest (“if only I waiting 5 more years to cash out!!”) :) This is partly why I just stick to my index funds so I can be invested in all of it long term and not tempted to do any more timing of the markets… I’m too old for that now, haha…

Chelsea- my eyes are bugging as well….

Accidental Home Birth- So glad you got through that without major hiccups! Makes a great conversation starter…….I do have to say that your financial journey made me need to take a moment of silence…. And just send happy thoughts and good wishes your way. I hope the house sells, the new baby is healthy, the business grows and that 2018 is better than you expected.

I used to play online texas hold’em poker when it was really popular in the late 2000s. It was mainly for fun and didn’t really make a lot of money out of it.

Thanks for sharing your story and providing us your numbers.

Hey, you know what Steve Jobs says: you can only connect the dots looking backwards.

My life story has been nothing short of ordinary either. It’s been a long and tiring journey, but certainly worth it so far.

Just read your bio on your site – sounds like it! Welcome to the land of peace now though it seems, at least career-wise :)

Update from the author:

We sold our rental property last week and walked away with ~$60,000 in proceeds after the mortgage was paid. So, our sole remaining debt is a student loan for ~$42,000! No personal lines of credit, no credit cards, and no car loans remain!

Woohoo!!! I know that I’m blowing my cover, but I’m an open book!

Baby boy #2 should be here anytime in the next few days to few weeks!

Life is good, brother! Thanks for always being so open with this stuff. We need more people talking about finances in real life :)