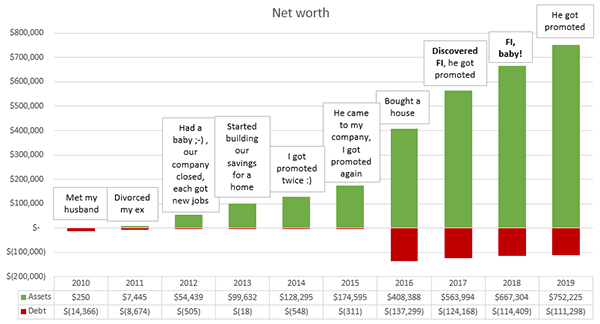

A reader sent me that nifty graph up there and thought it was worthy of passing along in case you want to add to your net worth tracking as well ;)

Such a cool idea adding life events to the history, right?

Since so much of it plays an active role in how our money turns out?

Here’s the words she sent along with it, but not nearly as fun to see than the picture :)

Hi J,

Here’s our story. :)

When my husband and I met in late 2010, we were earning $105k combined. We now earn $248k with additional bonus potential (“OMG!!” *faints* every time I do the math). Our salary increases are solely the result of hard work and dedication, as neither of us has college degrees. We are now in our third semester of taking online courses in the hopes of eventually crossing that off the list.

My husband has two kids from a previous marriage, and his ex receives *quite* a bit of his salary. While we are obviously supporting my wonderful step-daughters, nearly 20% of our gross income does not add to our net worth. We are saving for college for all three children, two of whom have minor special needs.

Both of our exes are CRAZY spenders, and those relationships were incredibly unhealthy in just about every way imaginable (lots of stories for another day!). Neither of us realized how much happier life could be with a supportive partner. 👫 I brought consumer debt into our marriage, and my husband brought a credit history of bankruptcy and a separate foreclosure.

It is possible to aim for FI, regardless of how many degrees you have, how many kids you support, or how much financial baggage you bring into the relationship. We have made a lot of changes to help us move down the path, and we know there is a ton more we can do to optimize our lives over the next several years. Let’s DO this!!

– Leila*

YES!! Very true on those last lines there! And what a powerful example of what happens when you PUT IN THE WORK even without degrees! Super inspirational…

I took a few minutes to mock up my own version of net worth/life events, and here’s what I came up with:

A bit messy, but you can get a good sense fast at what the major players are here, haha….

The stock market, website selling, and then all those babies popping out that effectively halts life until you can come up for air and figure out what the hell just happened to your wallet, haha… So glad we’re over that scary period!

But I gotta say – after 11 years of tracking this stuff, this is the first time I’ve actually seen such a descriptive snapshot like that all in one graph. Despite housing over 100+ updates in one main page as we’ve been doing… But again – a picture paints a thousand words! And they’re much more interesting to read than real ones ;)

So highly recommend giving this a shot and seeing what you come up with too… Bonus points for sharing it with all of us so we can ogle and be entertained as well!

Here are some other items you can add to your spreadsheets for even more sprucing up:

- Your FI Date

- Your credit scores

- Your cash flow projections

- Your insurance policies

- Your Lifetime Wealth Ratio™ (Net Worth ÷ Total Lifetime Income Earned)

- Your debt-to-income ratio

- Your car maintenance logs

- Your other assets you don’t include in your net worth

- And my personal favorite –> the years left until your expected death!

There’s always something you can add for more fun optimizing, haha…

What else do people track?? Tell us all your darkest spreadsheet secrets!! ;)

——-

*Name changed to protect the nerdy

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

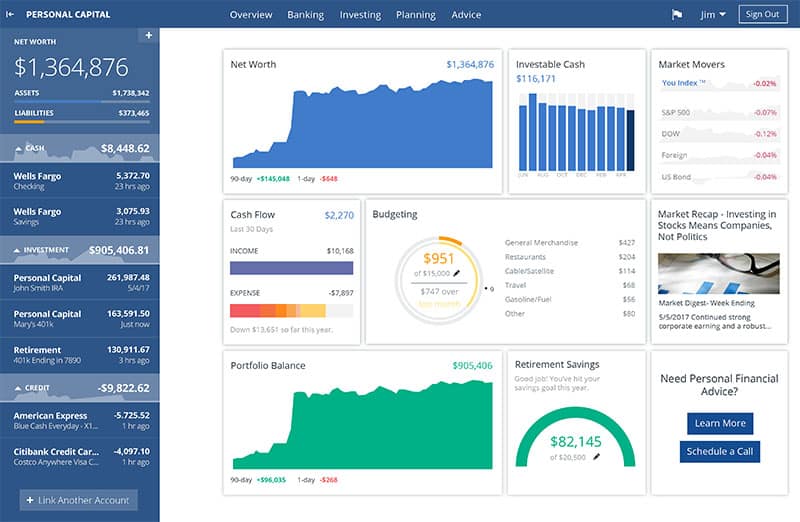

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Oh darn I wish I thought of that sooner myself! Definitely adding new memories to the net worth tracker. It feels very impersonal and always has when we looked at it. Great idea for improvements!! Thank you!

Excellent!!! Glad you like the idea!

Cool idea ! I think I will work on my own version this week and share it.

Just out of curiosity, which email subscription plugin do you use? I’m working more on my blog this year.

Cheers,

AAI

Send me a link if you do – would love to see it!

Plugins – I don’t use any for emails specifically as I go through a 3rd party service – ConvertKit – for my subscriptions, as well as Aweber for some other projects. I bet there are some good ones though, just not familiar with them – sorry :(

I did an animated timeline of everything key and money related from birth but I like it all on a chart like this. Nice and simple!

Did you really?? Haha…

That’s hardcore. And of course now I really want to see it :)

Timely — yesterday I started adding big expenditures to our spreadsheet (house-related expenses, vacations >$1000, that sort of thing) with Google Sheets’ “Insert note” option on the annual Net Worth field. Future me can now see at a glance why our savings didn’t go up as much each year in a roaring market… and also look back fondly on things like a warmer more efficient house, or time spent overseas living like locals, or a foundation that isn’t crumbling. The hits are a lot easier to take when I consider their outcomes!

Totally!!

Excellent items to add to your sheets… Just imagine how many notes you’ll have over the next 40-50 years :)

Our annotated net worth wouldn’t be nearly as interesting as these lol.

We track our giving in a spreadsheet. Each tab is a separate year and lists the organizations we gave to, the amount given to each org in the year, the percentage of our net and gross incomes we gave to each, and our total giving for the year, including the total percentage of our net and gross incomes we gave. It’s cool to look back at.

That is awesome :) And probably keeps going up over time too, I’d imagine? Just for being always inspired by yourselves!

Great idea! I would also like to add special bucket list trips like our Hawaiian honeymoon and our Cruise to Alaska when our first child graduated. This definitely goes in the assets even though it takes away money!

Agreed 100% :)

Just jumping into this tracking net worth thing. Would be interested in knowing what software or apps people are using?

Congrats!!! Your money will never be the same! ;)

I personally use spreadsheets as I love to manually update them myself (here’s a template I created: https://budgetsaresexy.com/budgets/j_budget_template.xls), but I know others obsess over Mint.com and Personal Capital.

Here’s a review of the latter we did here from a good friend of mine who was gracious enough to include real life screenshots :) –> Why I Use Personal Capital Almost Every Single Day.

Hope this helps!

I think it’s important to point out that getting a college degree is also hard work. Not everyone had funds from their parents or partied the whole way through.

100% true too!

I just did one like that a couple of days ago! Not nearly as detailed though. It’s a great way to humanize what is otherwise pretty impersonal numbers on a webpage.

Care to share or blog about? ;)

This is a great idea to see how the life events positively (or negatively) affected your overall net worth. Always nice to look back and relive the personal choices and circumstances that made big impacts in our lives.

This is fun! I keep notes with all my net worth updates (except that period I wasn’t publishing them between 2010-2014 I think) but major milestones would be a fun thing to add to the graph if I could do it neatly.

I think you should try it and see what happens ;)

I track when certain expenses drop off. Public school beginning, selling a second car, braces come off, reducing income to lower health insurance premiums… It certainly helps the slog :)

Haha I bet!!! Awesome.

Can some man tell me how this works out post divorce lmao lmao lmao