I just learned about a cool new bank called HMBradley. It could be a great tool if you are currently building up an emergency fund, saving up a down payment for a house, OR, if you want to earn a decent interest rate on an existing pile of cash!

HMBradley offer a 3% interest rate on a regular checking account (increased to 3.5% if you carry/use their credit card also!). Pretty dang good in today’s climate where the average high yield savings account get’s you ~0.5%.

BUT, to qualify for the incentive, you gotta have at least a 20% savings rate.

First off, what I love most is that this is the first time I’ve seen a bank link their incentive program to a “savings rate,” which as you probably know, is one of the most important factors in calculating your time to financial independence!

Most of my friends (actually I’m guessing most people in the U.S.) still don’t know what a savings rate is! So it’s exciting to see financial institutions start using the same language us FIRE peeps use, and actually encouraging good personal finance practices. I hope other new fintech banks will start following suit, and continue spreading the 🔥🔥🔥🔥🔥🔥

**By the way… I’m not getting compensated to write this HM Bradley review, or to recommend any HMBradley services. I’m just sharing cool info that I come across. In fact, I learned about this bank from a random guy I met surfing who works there!**

First, I’ll explain how the bank works and how the savings rate is calculated. Then I’ll talk about some good use case scenarios to take advantage of the 3% interest on your cash.

HMBradley Review

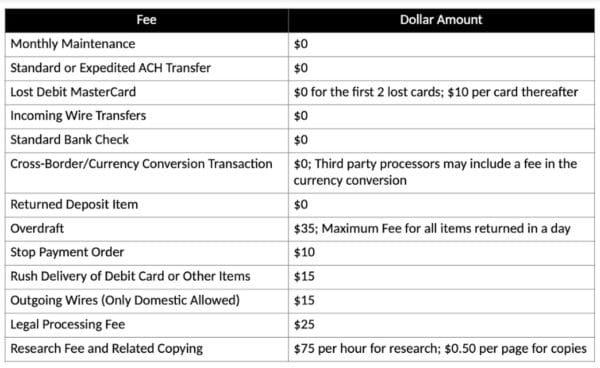

I spent some time on the HMB website (and I even signed up for an account to start playing around). The savings account has no monthly fees, no account minimum, and no min/max number of transactions. They don’t have separate “savings” and “checking” accounts… It’s all the same stuff just bundled into 1 single account.

Here’s the fee schedule from their user agreement:

Couple other things to note:

- All accounts are FDIC insured, so it’s a legit bank. There’s no risk storing money there (up to $250k)

- You get a debit card, and can do digital transfers, but there are no physical checkbooks or checks available.

- They have a mobile app, which seems easy to use and you can manage all your stuff from the app.

- I was easily able to link them to my Mint.com account for translation tracking. I assume it’s available for Personal Capital too!

Savings Tier and Interest Rate %

First, you can set up a direct deposit to have your work paycheck deposited there. (If you are self employed, or have other income sources, that seems OK too, as long as you flag these transactions as income deposits with customer service.) You gotta have at least 1 direct deposit per month.

The bank adds up all your monthly deposits, then minuses all the withdrawals. The leftover figure is used to determine your overall savings tier, based on the rate you are saving at. This analysis is done on a quarterly basis, and the interest rate you qualify for is applied to the following quarter.

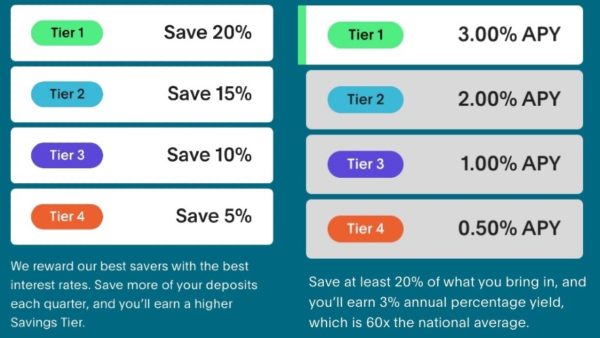

Here are the interest rate tiers, which apply to the entire account balance:

Saving 20% of income gets you earning 3% interest. Saving 15% gets you 2%, etc. etc…

So for example: Someone depositing $5,000 per month, then withdrawing $4,000 per month, would qualify for Savings Tier 1 (3%APY) based on saving 20% of their income. Woohoo!

It’s important to understand though, that the bank only sees the money coming in/out of this specific account – not your overall financial profile. So they don’t take into account taxes, pre-tax paycheck withdrawals, or other earnings/spending outside of this bank account. The savings tier is solely determined on the transactions it processes.

This is a smart move by HMBradley, because it means the account has to keep growing and growing in size. (But, it also gives room for a loophole, which I’ll explain more below in use case #3 below!)

Saving Rate vs. Investing Rate

In the FIRE world when we talk about our savings rate, we are really referring to our investment rate . Any money we “save” each month, we usually transfer right away to our investment accounts, putting the money to work for us immediately. Our savings are rarely kept all in cash if we already have a full emergency fund.

So in the case that someone invests all of their saved money, HMBradley would see an equal amount of incoming deposits as outgoing withdrawals. The system would assess this as 0% savings, because there’s no *new* money leftover in the account each month.

BUT, there are a couple of scenarios where people are building up their cash pile, and in these situations HMB could be a great account. Here are the use cases I can see being a good fit:

Use Case #1: Someone Building an Emergency Fund

Whether you’re starting a new emergency fund, or growing an existing one, HMB could be a great option instead of a regular savings account. As long as you’re planning to keep the savings in cash, you may as well try to earn as much interest as possible.

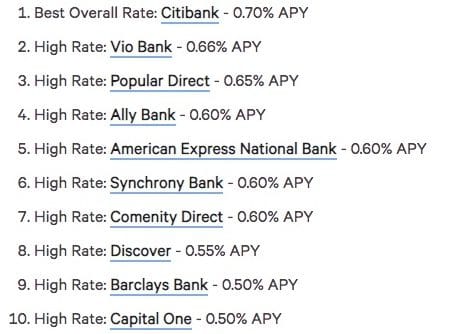

Earning 3% is rare for a checking account! Most of the big banks and money market accounts right now offer less than 1%.

As a comparison, here’s a list of “highest APY interest accounts” I found on Bankrate (as of Nov 2020). There are other outliers out there that pay a higher interest rate, but most cap the amount you can save.**

If you have your paycheck deposited into an account at HMBradley, and only withdraw 80% of the funds, you’ll qualify for earning 3% interest on the entire account balance. As you keep saving and saving, you can rest knowing your money is earning a great interest rate while saving up your emergency fund.

**Earlier this year I opened an account with Chime. These guys right now offer 1% interest on savings accounts with no hoops to jump through, and no annual fee. This was part of my churning bank accounts, and my wife and I both got $50 signup bonuses.**

Use Case #2: Someone Saving for a Down Payment on a House

One of the biggest mistakes I made when saving up for my rental property was just using a regular checking account to store my cash pile. I saved about $60k, and it took me 7 years to accumulate.

During this 7 year period, I made a total of $0 in bonus interest. In fact, my money was losing value due to inflation each year!

Instead, if I had the option to earn 3% interest on my savings (provided I qualified for the rate), my $60k in savings over the years could have earned an additional ~$5,000 in interest! Oh, how I’d love an extra 5k right now 🤦♂️.

Remember checking/savings accounts are federally insured, so there’s no risk you’ll lose your savings contributions. This is one of the reasons people prefer to save housing down payments in cash vs. investing in the stock market for a short term.

**The 3% interest is available on amounts up to $100,000 at this bank. So if you’re saving more than that for your house downpayment, you gotta work something else out :)**

Use Case #3: Earn 3% on Your Existing Cash (Using an Artificial Savings Rate)

As some of you know from my last net worth report, I have about $40k sitting in cash right now, which is our emergency fund. I’m earning next to 0% interest on this money (well, that’s not entirely true because I’m using it for churning bank accounts, but if the money did just sit there it would be earning 0%).

Unfortunately, my wife and I don’t have a 20% after tax savings rate currently. So transferring this $40k over to HMBradley wouldn’t do me much good because I wouldn’t qualify for even their lowest tier incentive.

But here’s where the loophole could help… Since HMBradly only looks at the incoming deposits and outgoing withdrawals from their accounts only, I could create my own savings rate. I would do this by using my regular bank for all my usual transactions just like I do today, and only deposit or withdraw money to the new HMBradley account that meets the savings rate qualifications.

For example: Let’s say I asked my work payroll to divide my paycheck up into 2 separate deposits, sending $100 every month to HMBradley, and the remainder to my regular bank as usual. Then, let’s say I just left the new account untouched, making no withdrawals…

The system would see $100 in deposits, $0 in withdrawals, and treat this as a 100% savings rate. I could leave this set up for years, and the account would just grow slowly staying at the highest 3% interest rate tier.

Since they give 3% interest *on your entire account balance*, as long as I have my $40k sitting there from the get go, I would earn a 3% return going forward. That’s over $1,200 in interest I’d be earning a year, vs. the $0 I get now.

Actually, this trick could be used with the other 2 use cases if you don’t qualify for the highest tier. Just treat the account like a 1-way street. Only direct deposit small amounts of money in and never take any out.

I realize the bank probably didn’t create the account to be used this way, but there’s nothing that prevents it. 🤷🏻♂️ And, if I took this route I wouldn’t feel too bad, knowing that HMBradley is probably lending my money out somewhere and making a higher return for themselves!

One last note: HMBank also offers a credit card – only for existing clients. Using the HMBradly credit card adds another 0.5% onto your checking account earnings. So potentially, you can earn 3.5% APY total! But, they use your total monthly deposits to determine your credit card approval (as well as your credit score obviously), so if you’re using the smaller deposits trick you might not get approved.

The HMBradly credit card has a $60 annual fee (waived for the first year) and you have to use it for at least $100 of spending each month to qualify for the higher rate.

Final Thoughts on HMBradley

I’m excited about the traditional banking industry getting shaken up by new fintech companies. It seems that new banks like HMBradley are offering better and better incentives for savers, as well as making things quicker and easier to use.

While this bank might not suit everyone’s situation, you can’t deny that earning 3% interest on a checking account is hard to beat! And the fact that they’re helping people better understand savings rates and encourage improvement … I’m a fan 😍.

What cool new banks and fintech offerings are you coming across?

Get blog posts automatically emailed to you!

Joel,

This is an awesome bank. I actually was surprised to see that they can offer a 3% savings rate!

My first question was what about moving the savings amount into an investment account, but you already answered that :)

It does, however, make sense to keep your money at HMB if you can save 20% or more – especially for an emergency savings fund!

Great information as always.

Thanks for sharing!

The Millennial Money Woman

Yeah I really wish I knew about stuff like this when saving for real estate purchases.

I reached out to to HM Bradley Bank today to see if they would allow automatic deposits from a small business LLC as monthly income deposits. I am a small business owner with rental property LLCs. A representative from HMBradley responded that this type of income deposit would not meet their requirements to qualify for their savings tiers.

Excerpt from HM Bradley:

“We do not consider deposits to an account that are made by an individual using online banking or other payment provider such as PayPal or Venmo as direct deposits.

So unless you have direct deposits set up, your account will not qualify for our Savings Tiers. Though we’re considering alternatives to the payroll direct deposit for situations such as yours, we do not have a timeline in the near future for a solution. In the meantime, there are multiple ways to set up direct deposits for self-employed individuals/business owners by using one of many payroll providers (such as Gusto, Wave, or Quickbooks).”

Unfortunately, the above applications are simply not cost effective to gain the saving rates discussed. Too bad. Would’ve liked to had a 3% return on our cash account. Will just stay with Synchrony HYS account for now.

Thanks for sharing this! I know there’s a feature where you can “dispute” transactions and prove that they are technically payroll related. But, I think this needs to be done every single month, and it’s approved at their discression.

I agree that if it’s too much of a hassle (or required additional paid software) it isn’t really worth it! Churning is an option (many other banks unofficially approve ACH transfers as payroll deposits).

Hey I would check out Porte Bank. Although it says direct deposit $1000 each month to earn 3%. A normal deposit works.

T-Mobile money also offers a checking that gives 1% APY. If you’re a T-Mobile customer you can get up to 4% on the first $3k after making 10 debit transactions a month and 1% on the rest.

One finance bank also offers a 1% savings up to $5k without doing anything.

We both got Chime accounts earlier in the year for the $50 bonuses. I just saw that they dropped the savings account rate down to 0.50% though. Would love to do something like HM Bradley. But I am not sure I can get a consistent enough true direct deposit to work. Would be nice if online bank transfers counted. Thanks for sharing!

Chime is a good one! SoFi is the other one my wife and I did recently. I think it’s $50 for those also, very similar to Chime. (Pretty sure my Chase ACH counted as a DD FYI).

Chase work as DD for HMBradley or u referring to SoFi & Chime. TIA.

This is good info. It’s such a bloodbath at the online savings bank accounts that I recently pulled out of Ally and am just keeping it in my more accessible checking account (and investing some of it in the market).

Ally was crushing it for so long, but I know many people that are pulling out now and looking elsewhere too. I think there’s gonna be a good shift over the next few years if these new fintech banks can offer good rates like this.

I’ll be honest, even though I do have quite a bit of cash, I don’t have a lot of trust in most fintechs. Some of them are starting to offer accounts that are FDIC insured by partnering with existing banks, or maybe by qualifying on their own. However, it doesn’t seem as clear to me that they are regulated by the FDIC and/or Federal Reserve. I would really prefer that oversight as it can protect my information and data security more than “suggested best practices” that are often shorted in order to meet shareholder/investor/owner value goals. The banks (online and traditional) that are regulated don’t just put in stringent systems and controls to protect their reputations, they do it because they have to in order to keep being a bank. That doesn’t mean fintechs won’t one day get there. That being said, your suggested trick with the deposits is a good one. Especially if you can get your employer to split the pay check. I’m sure there is some fine print about the deposit needing to come from payroll vs being a bank to back transfer initiated by the customer. Thanks for keeping an eye out for new ideas.

Definitely needs to be a paycheck vs. just an ACH transfer from bank –> bank to qualify. Most employers allow a split of paychecks to a few different banks. Either a % split, or sometimes a specific dollar amount.

I know what you mean about the security and insurance aspect. As with any start-up, fintech banks are probably mostly concerned with meeting the minimum possible regulations first to get their product out the door. Any additional effort/money spent on security might be overkill for a company just starting out.

That is a question, btw, lol – Did Chase bank ACH txfer work for HMB? …thx.

I personally haven’t tried it, but from what I hear from others, NO it doesn’t. They have a pretty strict sensor on what qualifies, and sometimes even REAL DD’s from employers don’t trigger and you need to open a ticket *each month* to correct it. Pretty killer interest rate though still if you can swing it.