Morning guys!

Got another financial history report to share today!

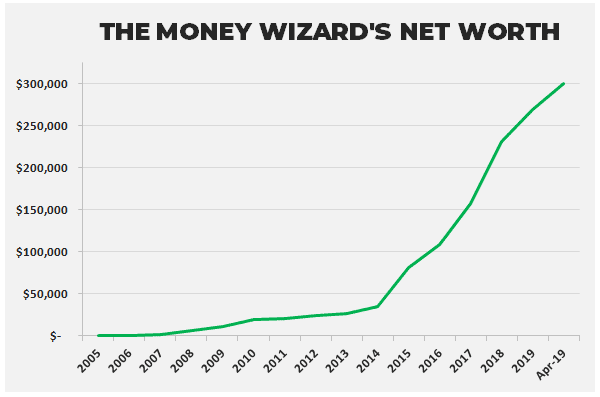

This time from fellow reader-turned-blogger, The Money Wizard, who tells us how he’s amassed $300,000+ before he’s even turned 30. Or put another way, about 4.4x my own net worth of $68,061.80 at his age! Haha… So he def. knows what he’s talking about over there :) Hope it inspires you in some small way today!

*******

I can safely say that if it weren’t for J. Money, my life would look pretty different.

That’s because I’ve been a regular Budgets are Sexy lurker since around when he started the site, all the way back in 2008. At the time, his net worth updates were unlike anything I’d ever seen. After several years of following along, I was inspired enough to start my own blog, where I now publish my own net worth updates every month.

So, how does regular reading of Budgets are Sexy since you were a teenager impact your finances?

Well, in my case, it means a $100,000 net worth by the time you’re 25. And then $300,000 while you’re still in your 20s.

(As of this writing, I’m 29 years old with a net worth of $300,329.24. But who’s counting?)

When I saw J’s request for readers to divulge the nitty and gritty of their financial history, I thought it’d be great to tip my cap to a role model in the best way I know how – getting nerdy with money!

The Money Wizard’s Balance Sheet:

Here’s the breakdown of my net worth, as of last month’s update:

- Brokerage Account: $143,597

- 401k: $119,602

- Roth IRA: $35,601

- Cash: $5,338

- Liabilities: $3,809 between monthly rent and credit cards that I always pay in full.

Which, in the spirit of this series, doesn’t tell us a whole lot. We want to know *HOW* I got there. Time to spill the juicy details!

#1. I started investing as a teenager

Between the ages of 0-23, I probably invested $15-20,000 from teenage jobs and college side hustles. Nothing glamorous here. Mostly summer construction jobs, although at one point I did run a small baseball/softball bat flipping hustle. This gave my savings a nice head start and plenty of time to get the compound interest snowball started.

#2. I gave up on stock trading (and instead went with index investing)

I wasn’t perfect in my teenage investing though. Like most teenagers/early 20s, I was young and naïve and thought I could show the world who’s boss.

Luckily, I managed to contain those teenage dreams to a few bone-headed stock investments. (I thought for sure my Buffett-like value pick of Uranium stocks after the Fukushima nuclear disaster would make me a millionaire. It didn’t. I lost thousands.)

Thankfully, I learned this lesson early. Since then, I decided to move to a pretty simple 3 fund portfolio of index funds. It’s a decision that’s helped me earn over 7% in the stock market for the past several years, and more importantly, free up my time to do stuff a whole lot more fun than combing through financial statements.

#3. I avoided student loan debt

This was a mixture of a couple thousand dollars’ worth of GPA-related scholarships, part-time jobs, generous help from parents, and choosing a (relatively) affordable in-state public school.

#4. I took a well-paying job out of college

I was also fortunate to score a lucrative career out of college, although this wasn’t totally by accident.

I double majored in Finance and Economics, specifically because I knew they were some of the highest paying degrees. I’d have loved to major in something like English, but instead I decided to put that passion on the back-burner until I’d saved enough cash to retire early and do whatever I wanted. If I followed the money, I figured that date would come sooner rather than later.

The result? Coming out of school, I scored a $50,000 a year job in finance. And over the past few years, I’ve played the office politics game and worked like a dog, which scored two more meaningful promotions. I landed the first promotion after about 3 years, and it bumped my salary to around $70,000 a year. The second occurred more recently, as I approach my 6-year anniversary, and has me sitting around $90,000 in annual income moving forward.

#5. I took advantage of my above-average 401k match

Not quite an INSANE match, like J’s ridiculous free $16,500. But, solidly above average – my employer matches 7% of my salary at 100%. In other words, at my current pay, the first $6,300 I contribute is matched with an identical $6,300 contribution from my employer.

This wasn’t by accident either! During my second round of interviews, The Money Wizard, as a fresh-faced, not-yet college graduate, grilled the interviewers about the company’s 401k plan. They looked at me like I was a 60-year-old trapped in a 23-year-old’s body, and then relayed the news that ended up being a big factor in my job choice.

#6. I kept living like a college student for years

And I sort of still do…

For the first few years at my career, I spent no more than about $22-24,000 a year.

In part, that’s because I scrutinized every single expense I took on. If it was a monthly or annual subscription, it probably got cancelled, slashed, or at least negotiated. I also rented a modest 1-bedroom apartment away from downtown Denver. The way I saw it, all the Ubers in the world couldn’t match the increased cost of a trendy downtown place.

A few years ago, I moved in with my long-term girlfriend, and we now live in Minneapolis. The house is in her name, although I pay half of the mortgage, utilities, and maintenance every month. Another key fact, and this is definitely key, is that the house cost a whopping $180,000… a full 1/3 the price that Mint.com said we could afford.

That said, I do tend to splurge on dining out, entertainment, and travel. (What a typical millennial…)

In 2019, my goal is to spend less than $2,250 a month. If I manage that, I should save over $40,000 between my 401k, employer matching, IRA contributions, and Vanguard or Fidelity index funds.

Conclusion

One last thing I’d like to say, before J. Money realizes he accidentally let me on stage. ;)

I recognize my money situation is kind of weird. My inbox is filled with emails from readers at a different stage in this money journey, wondering how on earth a snot-nosed 20-something with $300,000 relates at all to their situation.

But consider this – with my current rate of savings, I’m on pace to reach complete financial freedom by the time I’m 35. Most likely, my corporate career won’t last a day longer than 12 short years, total. That’s a blip in the timeline of a normal working career, even if you’re starting entirely from zero.

So if you’re older, younger, or even still in debt, I hope my story shows the awesome possibilities for anyone who kicks debt to the curb, lives modestly, and invests heavily.

Thanks for having me J. Money!

******

Want to share your own financial journey with us? Hit me up!

For the past two in this mini-series:

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

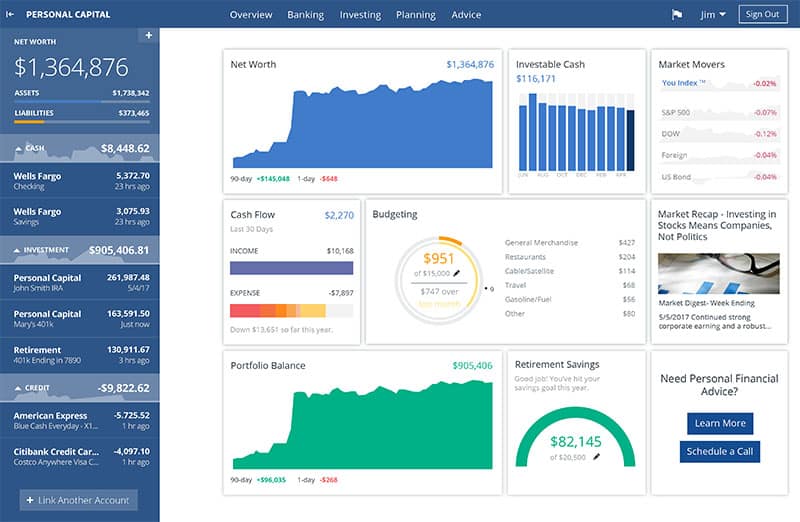

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

I’m now VERY early 40s and have a Net Worth of $567,091 and a lot of that is down to continuing to live like a college student a lot of the time. No Ubers or fancy food out for me. I take the subway and BBQ from the foreign equivalent of Trader Joe’s! Also, coincidently, my first apartment cost $180K also (and the deposit was paid for by my little $5/hour part time jobs during high school and collage!). And it was over half of what a mortgage broker told me I could borrow. Thank God I didn’t max out and get a fancy one as I would have lost it for sure when interest rates went through the roof in my home country in the mid to late Noughties.

(NB: My country (at the time) didn’t charge a huge amount to study which really helped my situation a lot.)

Cheers to the not listening to the mortgage brokers club! That’s awesome. Keeping those big fixed costs down is definitely huge.

Impressive net worth too!

I really hope you meant to put “Noughties” there, haha… I am dying over here!

Thanks for sharing! Congrats on your recent promotion you “snot-nosed” millennial! : ) I went more aggressive on the IRA vs. Roth in my 20’s, but looking at your 35k+ set to grow tax free at the age of 30 will feel pretty good! Your 401(K) match is more than double mine! Good luck!

Glad you liked it! Thanks, and good luck to you too!

You and The Money Wizard are the two financial bloggers that I follow…so this is basically my nirvana seeing you two together!

Awesome! Funny, J. Money is on my short list of favorite bloggers, so this is a bit of a dream come true for me too!

<< Insert blushing emoji here >>

Great job! Investing young makes a huge difference. You couldn’t save much, but you learn a ton. It’s best to get those mistakes out of the way when you don’t have much money.

Lifestyle inflation is a huge deal too. Nice job keeping it down. I lived like a college student for years too. Now, we spend a bit more, but still much less than people our age.

Keep at it!

Thanks Joe! So true about getting the mistakes out of the way early. I’m definitely glad I made those when it cost me a few thousand instead of a few hundred thousand.

First, congrats on making a plan and executing to such a high level.

But, I have to be honest, the part I want to hear more about is the baseball bat/softball bat flipping hustle, haha! I have been looking for a side hustle for my 9-year-old son and husband and never find anything they’d be interested in, but I feel like this could be a thing! I am tired of buying brand new bats for $80 each and know there would be a huge market for used bats that kids outgrow. Any tips for getting started? Have you written a post about that? Couldn’t find it on your site but enjoyed exploring the rest!

Haha! Definitely something I should write up a full post for.

Basically I’d snatch up bats whenever I found them at a great price, then would resell them for their usual going rate. I had a lot of luck shopping the online sales and then reselling the bats at their “MSRP” locally, either through craigslist or to other players at the fields. Also found some great deals at garage sales and used sporting goods stores.

It was all about knowing the most popular bats and how much the market was willing to pay for them.

Me Too!! I am the Canadian version of your story ;)

I was around $100,000 by the time I was 25 and am currently 29 and will fall just short of $300,000 by the time I’m 30 years old.

I did have some student loans accumulated by the time I was done school but I was able to pay approx. $45,000 in just over a year by picking up a ton of extra shifts and doing your point # 6 – Continuing to live like a college student. I was also able to start in a career where I was making above average income for my age right out of school.

This lifestyle was super important to me as it was a dream to be debt free. When I finally paid off my loans I just continued on and started putting more towards investments and savings instead.

Thanks for the great post! I haven’t related to a guest post this much before. It’s a nice reminder that all the sacrifices and hard work really do make a difference.

Wow! Those are some crazy similarities! And even more impressive with the student loans.

Congrats on killing it! Keep it up! Like you said, it makes a huge difference and is totally worth it.

I need to get my act together! I’m 43 with a negative checking account, maxed out credit cards, and no savings.

No more! This year, I’m turning everything around!

Good for you!! We will be cheering you on over here!!

Congratulations! I’m just a bit older, with a NW approx. 10% of that so far. So iI look up, I guess?

#1 is bygones be bygones for many of us, but #6 can be used by anyone anywhere anytime. I also try to put a ceiling on my spending, like your $2,250 (but mine is still too high for my taste…)

Btw I checked the link about the portfolio and it made me interested in reading more, so I may comment again there ;)

Nice work young man! Really impressive investing that early AND getting out of stocks and into index funds…also love the 401(k) story…as an HR professional, it is shocking how few people have a good grasp of tax advantaged investment vehicles and investing for the long term.

What’s the % of workers you typically see who contribute to their 401(k) vs those who don’t?

Millennials for the win! You’re awesome! Keep it up.