A few years ago, I went into my local bank branch to do a wire transfer. I wrote my name on the check-in sheet and helped myself to a free cup of coffee in the waiting area.

After a few minutes, a well-groomed young fellow in a suit and tie came over to greet me. As he reached to shake my hand, I noticed his eyes looking me up and down, studying my old t-shirt, dirty jeans, and worn-down Crocs.

The banker led me to his cubicle while making small talk. He seemed like a cool guy, cracking jokes and calling me “dude.” He was very relaxed and casual.

Then something weird happened.

As he took my drivers license and looked up my account information, his facial expressions started to change. His computer screen showed I had $220,000 in my checking account, 3 mortgages on rental properties, 2 business accounts, and 5 credit cards open with the bank. (I had just sold some real estate — that’s the reason for the high cash balance at the time)

Like the flick of a switch, the banker’s character completely changed. He straightened his posture, looked me in the eyes and started calling me “Mr. O’Leary.” What began as a friendly and casual interaction quickly turned into a professional and robotic business meeting. I felt really awkward being treated differently once he found out I had “wealth.”

This is one of the reasons I’m a fan of practicing stealth wealth. I don’t like being treated differently because of money or financial status.

What Is Stealth Wealth?

It’s basically wealth that’s hidden in plain sight, either intentionally or unintentionally. It’s money, assets, or income that are kept private, revealed only when necessary.

Stealth wealth is also the art of being logical and frugal, even though your money can afford to buy more. It’s the opposite of showing off wealth and success. Flaunting your financial status often comes with disadvantages, so practicing stealth wealth is a good way to avoid public or personal scrutiny.

If you have a higher than normal income, net worth, or even a wealthy family heritage, people may treat you differently compared to someone with a lower economic profile. With stealth wealth, a millionaire (or even a billionaire) would look and act the exact same as someone with no money at all.

Why Keep Your Wealth Private?

Sadly, some people treat you differently when they find out how much money or wealth you have (or don’t have)! Just like in my bank visit story, I felt like I was being treated less like a person and more like a number after the guy looked at my bank account. Keeping your wealth hidden can keep interactions more genuine when meeting new people.

Sometimes wealthy people can become targets for harassment or unwelcomed offers. If you appear to have excess income or wealth, businesses or opportunistic individuals may try to take advantage of you. On the other hand, acting like you don’t have anything of value could make you less of a target.

Certain social pressures can be put on you if people think you are “rich.” Your peers might influence you to buy a luxury car or expensive clothes or to donate money to charities just to fit the typical profile of a wealthy person. Keeping your money status hidden can keep social pressures away.

Spending Money for the Wrong Reasons

Conspicuous consumption (buying luxury goods for the sole purpose of public display) has never made much sense to me. I can’t understand why people would sacrifice so much effort to accumulate money, only to spend it all trying to impress others.

I don’t know about you, but when I see people with an excess of fancy items on display, I usually am the opposite of impressed. Being ostentatious is an indicator that someone probably has a lower net worth than they are portraying. That’s what Thomas J. Stanley’s research found in the book The Millionaire Next Door:

“Allocating time and money in the pursuit of looking superior often has a predictable outcome: inferior economic achievement. What are three words that profile the affluent? FRUGAL FRUGAL FRUGAL”

From what I understand, the most wealthy Americans are the ones you would never suspect. They may like and buy nice things, but it’s never in excess or flaunted around.

How to Practice Stealth Wealth

First off, it helps tremendously if you stop worrying about what other people think of you. People want to hang around you because of your attractive personality, not because of how you look or the stuff you have.

As your income grows, keep your expenses the same. Lifestyle inflation (spending more money just because you’re earning more money) doesn’t grow wealth – it actually puts you further away from financial independence and early retirement. Lifestyle inflation hurts your retirement saving. Investing all excess income is what the stealth wealth peeps do. :)

Think and act pragmatically. Keanu Reeves catches the subway – even though he can afford to take a helicopter (or any expensive car he wanted) – because the subway is an efficient and convenient way to get around. Same reason Larry Page drives an old Toyota Prius when he can afford to buy any fancy new car he wants.

Buy stuff because YOU like it. It’s totally OK to like and buy fancy things! Just make sure you’re doing it because you see value, not because you think others will find it cool or your close friend has one. One way you can test this is to ask yourself before you buy something, “If you were the last person left in the whole world, would you still buy and use this?”

Use Family Trusts and LLC’s. Putting your larger assets into a business name or family trust is a good way to disassociate your personal name and hide your wealth. Many real estate investors use LLCs to mask their identity and protect their personal liability. Trusts can also be a great way to transfer wealth from parents to kids.

Financial Independence and Stealth Wealth

In the personal finance community, we do a lot of public money talk. We share our net worth, talk about our income and celebrate each other’s financial success. In a way it’s kind of contradictory to stealth wealth, because our assets are far from hidden!

But, there’s a difference between talking about money and boasting about money. People pursuing financial freedom are less concerned with looking like a rich person, and more concerned about the freedom and experiences that true wealth provides.

So if you’re a personal finance nerd, keep up the money talk! Just be mindful of how you’re sharing information. Keep it classy. And keep it stealthy in real life!

*****This was supposed to be the end of the post, but I left my computer unattended and came back to find my wife had read everything and added a note! So I’m including it below :)*****

My wife’s take on this stealth wealth stuff ;)

Growing up I used to feel uncomfortable about being frugal and living a minimalist lifestyle. I’m from West LA, where people promote a lot of excess and trade their souls for the appearance of lavish lifestyles in upscale neighborhoods. Especially on social media. But finding the FI community has made me become very comfortable in my frugality. I can openly share good deals, free stuff I found, or general opinions on the excess that our local community promotes. Recently what I found really interesting is that the majority of people still don’t like my frugality, they see me as “cheap.” While yes, this hurts my feelings a bit, it makes me double down on this Stealth Wealth idea; sometimes shutting my mouth when talking to the average person with different mindsets works out for the better. It’s a hard thing to swallow, at least for me, since I truly believe in education at all levels of life. How can I get the people around me to dump the luxury items? I’ve found staying true to my own sensible lifestyle and leading by example is the best I can do sometimes. My 2 cents.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

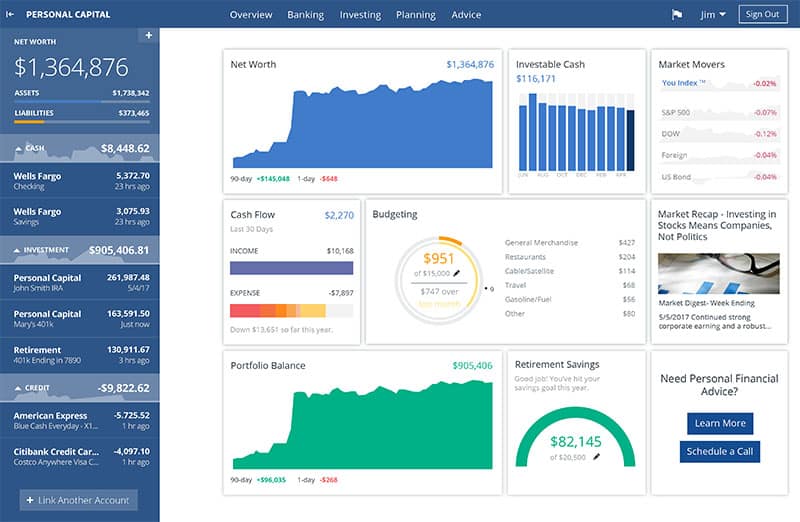

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Joel,

What a great example of stealth wealth… going into the bank dressed as someone who is not wealthy only to be wealthier than likely most of the well-dressed young professionals that come into the bank.

I mirror the ideology of stealth wealth 100% – once my net worth increases to a considerable amount, I plan to see how people treat me and my husband if we drive around with a truck from the 1990’s versus a luxury car. I think such an experiment would be quite telling of who your true friends are and who your greedy and materialistic friends are.

Thanks for sharing!

The Millennial Money Woman

I heard Richard Branson used to go barefoot to his bank a lot back in the day. I thought I was dressing up by at least wearing my crocs. :)

Your point of buy stuff because YOU like it, is exactly right. When I was younger I used to care more about what people thought but today I am not worried about what other people think of me.

Another great way to practice stealth wealth is if you really like brand names such as Gucci, Louis Vuitton, Hermes, etc. depending on who you are with if you don’t want them to treat you differently you can say you got it as a fake. People change when you say that as well.

Also, I love your bank example and I am glad to hear other people have similar experiences there.

Thanks Fred. Yeah I’ve heard of people claiming their stuff is fake to downplay their tastes. Personally, I’m ok admitting I have something expensive, because usually it’s only one nice thing I own haha. Plus, I’m horrible at lying so people would see right through me anyway :)

I don’t think I ever cared about what people think of me based on what I was wearing except when it came to my profession.

Wearing designer clothing and accessories always seemed to me to be free advertisement so I seldom buy anything that has a brand name displayed no matter how much I like the designers’ products. Much like self checkout – grocery stores don’t pay me for that so why do it same with wearing designer clothes they are not paying me to advertise.

What’’s the flip side of your post where a wealthy person dressed down or is hiding their wealth looks at others who are doing the same – how are they treating those people? Do they assume they are not as wealthy and thus treat them in a way they wouldn’t treat someone dressed better or displaying a wealthy appearance. Even when dressed down or driving a 10 year old car knowing they have a hefty net worth – how are they treating people?

And dare I add race into the conversation? Take your story – a black or brown person dressed as you were may not have even gotten helped much less taken to someone’s cubicle and even if they were would the bank employee have reacted the same after discovering the person was wealthy?

Hey Robin, I hear ya! It’s a double standard for sure. Trying to downplay or pretend that you’re poor is the same act as people trying to class up or pretend that they’re rich. Both are trying to be something that they’re not – which is a sad way to live. I certainly try to treat people the same no matter what they look/dress like, and be myself no matter who I’m around. I went into the bank wearing shit clothes because I wear shit clothes every day :)

Great post & I 100% agree w stealth wealth. If you and your wife have some insight into great deals, you are more than welcome to share with me. There is no judgement here. For me, finding a good deal is most of the fun in shopping for something anyways.

If I do get something nice and get asked about it, I just say I am in debt up to my eyeballs & going through financial rehab by reading budgetsaresexy…. then send them your way!

K-Money, I think you should buy the domain financialrehab.com and start blogging there about your journey. I will be your first subscriber!

Smart man to include the wife’s addendum! For me a big part about talking about money among fellow personal finance enthusiasts is so that I’m not tempted to discuss money issues in some of my own circles that may not be as receptive to those conversations. I’ll talk net worth on the internet so that I am not tempted to spend shame friends for their new trucks!

Good point. Get all the crazy money talk and ideas out with online friends who appreciate it :) As for the wife comments, I’m thinking I should add a “Wife’s 2 cents” section at the bottom of each blog post. People are seeming to like her comments more than mine anyway haha.

Poor people act rich and rich people act poor. When my friends say, “Oh he must be rich.” I say, “No, he’s probably just in a lot of debt.” Perceptive is not always reality just like your bank story.

I love the term “stealth wealth.” I’ll have to start using that.

Good stuff Joel!

Looks can be deceiving that’s for sure! Cheers Jason – have a great week :)

This is my husband and me. In my experience, Real Estate agents are the best (worst) for judgement and a seismic shift once they figure out you have money.

The only person who has treated us like “rich people” from before we even considered ourselves well-off was the accountant. He must know potential haha

Yes, your accountant is a smart guy! :)

It really all depends on what you value. Easier to be modest in regards to “displaying” wealth if your values are in other things. For the most part we are frugal and shiny things don’t impress us. But they impress some people, for all of the wrong reasons.

We are very content with living below our means and focusing on happiness. That’s why I enjoy this community where it’s ok to go against what society displays as valuable. When they really have no true value at all.

Yes it comes easier to some vs. others. I’m in the same boat as you – my values are mostly focused on experiences and happiness, not so much physical things.

Great article. Thanks for sharing. I like your comment about keeping expenses even as income grows. I’ve practiced this and it has worked so far.

No need trying to impress people who don’t really care about you. Buy things you like and are of value to you.

“Lifestyle creep” is another name for it. When people just start spending more as they earn more – usually without even noticing! That’s why it’s important to track all the spending and question when things rise :) Thanks for reading and have a great week!

My ex-wife and I belonged to an investment club. A few of the members would brag about how they did with their investments. When it came time to brag, I would always say something Humorous and deflect the situation away from our finances. On the investment front, we did well. My ex-wife would get upset and say to me later ‘why don’t you speak up?” I explained because I do not want anyone but her and I to know what we have.

I’m curious… Did anyone brag about their losses? If I joined an investment club I’d be more curious about what *not* to do. I learn a bunch from failures!

I think the banker is a cool guy though. He didn’t treat you badly before finding out about your wealth. Instead, he was friendly and cracking jokes to break the ice. That’s someone I’d like to work with. It’d be a differently story if he had treated you coldly before looking at your bank account. Thanks for sharing! I’m a big fan of stealth wealth too ^.^

Yeah, he’s actually a really cool guy. The next time I walked in the bank he recognized me quickly, and gave me a nod from across the room. The time after that he asked if he could pick my brain about some real estate questions he had. And, just a few months ago he got a promotion at the branch. I’m becoming a big fan of his and I really think he’ll do well in his career, and life! No harm – no foul. He never treated me poorly, just differently.

Only some good friends and our parents know our assets.

As far as it goed for the rest of the world…I dont think they have a clue what we do (FIRE) or what we have (Some real estate projects).

Dont really care about that.

Even our bank-guy doesnt really have a clue because we keep our money and our mortgages in seperate banks (thats pure coincidence btw, but I kinda like it this way now). So, when I go to our bank guy once a year to get some tax-papers, the dude always looks at me with a bit of a question mark in his eyes, because we have 3 or 4 mortgages and almost no money on that account Oh well, as long as everything gets paid in time I guess its ok for them.

That’s great to have your assets and stuff spread around and diversified. Next step, a Swiss bank account that nobody knows about! :)

I agree that FIRE is still being defined and most people have no clue what it is we do. That’s why we need to keep slowly spreading the word and leading by example.

So true Joel!

It’s funny how some people treat you once they know how much money you have. Unfortunately, it’s just part of our culture. I see it all the time. Even with friends and family.

Being showy and flaunting money can definitely make people targets. This is one of the reasons why I continue the type of lifestyle that I have. To me, it’s not about money and stuff. It’s about lifestyle. Though, not everyone feels that way.

One of my past mentors once told me, “The key to being wealthy is to have no expenses and to increase your income.” So true! And this is from a very wealthy person. But you wouldn’t be able to tell as they too practiced stealth wealth.

Great reminder of what’s important in life. I enjoyed your story!

Lifestyle > stuff! This is music to my ears ;)

“If you were the last person left in the whole world, would you still buy and use this?”

That is a very powerful statement that really helps keeping yourself on track.

This is the first blogpost I read on your site after finding your site through your podcast with Paula. I like your energy. Thanks for bringing Sexy (budgets) Back! ;) I’m lovin’ it.

Wooohoo! Welcome! Actually, the original dude with Paula on the Podcast was J. Money… He’s still involved on the backend of the site but as of about 6 months ago I started writing the new posts. Cheers for reading!

Love this! Thanks for sharing.

Seems to me that one of the best ways to NOT have wealth is conspicuous consumption.

Keeping up with the Joneses often leads you to be broke… like the Joneses

Yep – buying things just to appear wealthy often has a predictable outcome :)

People always treat you based on appearance and how you dress. That said, wealthy people are treated differently. But I also think that the banker treated you differently because you had a lot of products with them.

Probably! And they’re always trying to sell me more :)