INSIDE: Here’s a financial snapshot of a woman who shares some great graphs & spreadsheets on how she manages it all. Great thing to do early on!

[Morning! Here’s a financial snapshot of one of our readers of the blog, Corrine – who also fancies herself a good spreadsheet (or four) like any good finance nerd out there ;) What a beautiful thing to have your epiphany *early on* in life! Congrats Corrine!!]

******

Hi J. Money!

I really enjoy seeing these financial snapshots… they are super inspiring!

I’d like to share a financial snapshot of my own. It’s my experience tracking money as a young person who is just obsessed with all things finance. I’m 24, and I graduated college somewhat recently (May 2017), but I did work part-time through most of college. I am extremely lucky that I graduated debt-free thanks to my scholarships combined with my part-time work and the generosity/financial planning of my wonderful parents.

I started officially working full time in May 2017 and have been tracking my net worth diligently since December 2017. I currently make $50,000 (up from $38,000 this time last year!) after a recent raise in August and this is the most I have ever made.

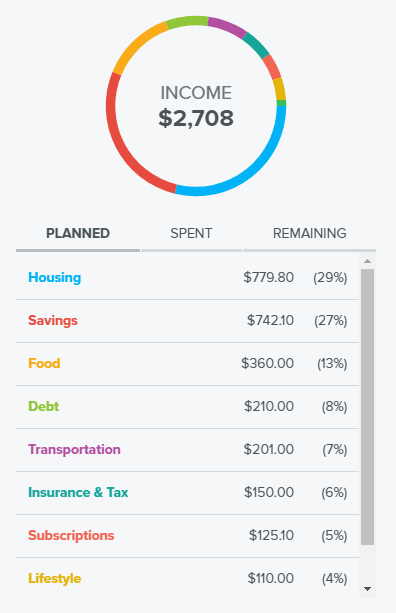

I am at a post-tax savings rate of about 27%, with 13% of my post-tax income currently going to my ROTH IRA and the rest going to my other savings goals (future house, travel fund, emergency fund). I also contribute 10% pretax to my company’s SIMPLE IRA with an additional 3% employer match, and I contribute $50 per month to my HSA.

Before tracking my net worth, I had been working part time for 4 years and had only ~$4,000 to show for it (I also had very few expenses in college — I have no idea where all my money went, lol). Once I started really looking at what I was doing with my money, I doubled my net worth in ~6 months. My current net worth is $35,000.

I currently live with my boyfriend of 3 years, and we share expenses such as groceries and rent 50-50. We are planning to rent until we get married and figure out exactly where we want to live long term (we plan to buy a house and settle into a permanent location within the next 2-3 years).

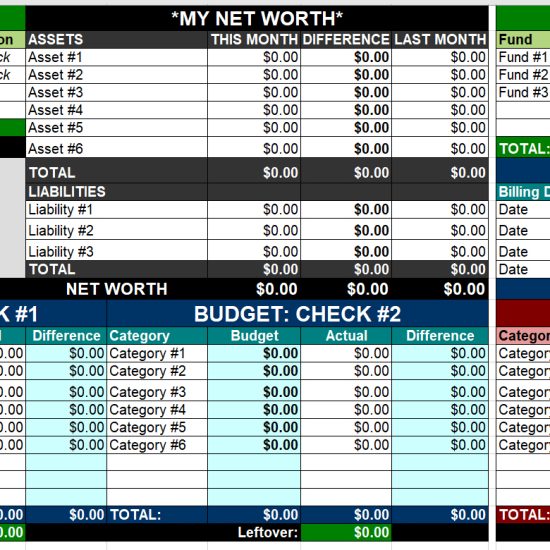

Financial Snapshot Spreadsheet

I am a huge fan of spreadsheets and wanted to provide a little explanation of the trackers I use:

(click to blow up bigger)

My “Financial Summary” is essentially where I track my net worth at any given time. It’s a true financial snapshot. Anything is green is an asset, and anything in red is a liability… and anything that is black is an account that fluctuates frequently (such as my primary checking) so I don’t include it in my overall calculations.

I keep a balance in my checking (“Spending”) that is always higher than my cumulative credit card balance, since I pay for everything on credit cards to collect rewards. I have never paid interest on any of my credit cards since I have all bills set to auto pay from my spending account.

My “Net Worth Over Time” tracker is really just so I can ensure that I am consistently moving up! I really enjoy looking back at it to see how far I’ve come. I received an inheritance of sorts ($10,000) in October 2018 which accounts for the big jump there which I threw into a 2 year CD for my future down payment on a house. I also got a bonus at work that month which accounts for the rest of the jump, and needless to say, that was a wonderful month!

The only dip in net worth I have had in my entire duration of tracking was when I bought Hamilton tickets for my boyfriend and I in June 2018… it was a pretty big splurge that I dipped into my travel account for, but I have absolutely no regrets since that is what it is there for. Why earn money if you can’t treat yourself sometimes? The other one was when I bought my new-to-me car in April 2019 (and subsequently forgot to add the car’s value to my net worth, lol – I fixed it the next month).

The “Wealth Ratio” came from you! I saw you do it in a blog post quite some time ago and loved the idea. I’ve been tracking it since and I find that it really helps hold me accountable.

[Editor’s Note: The Lifetime Wealth Ratio tells you how much money you’ve saved over your lifetime compared to how much you’ve *earned* ;) You can get a quick estimate of this by dividing your Net Worth by your Total Income found on your Social Security Statements. The closer to 100%, the better!]

I also recently started using EveryDollar to track my spending so I have a screenshot of my budget from there. The only thing that didn’t fit in the screenshot was the $30 (~1%) I donate to a rotation of my favorite charities each month.

I’m currently working on getting my emergency fund to 6 months of expenses and increasing my post-tax retirement contributions to 15%. I would also like to be able to max out my HSA in the next year or so.

That’s it for me, thanks for reading!

******

Not too bad right? Especially at 24?! I had approximately $4.00 to my name at that stage and couldn’t care less about finances, haha… It wasn’t until 3 years later when it finally dawned on me that I should probably be paying attention ;)

So good job, Corrine! And thanks for sharing with us today!

——-

To share YOUR financial journey with us, pass me a note and we’ll try making you famous too ;) In the meantime, here are some other snapshots we’ve featured in recent months – hope they help!

- Jimmy’s History of Personal Finance

- Jana’s 10 Year Journey to Debt Freedom

- Miguel’s Multi-Millionaire Journey as an Immigrant

Get blog posts automatically emailed to you!

This is awesome and keep up the good work. I hope your progress inspires others.

My first job after college paid $51,000. That was back in 2008, so that starting salary is like $60,000 today according to the DollarTime inflation calculator. At age 22, that seemed like I was a millionaire until I had to start paying back my student loans. Once I paid off my student loans and a car loan, I had a 50% savings rate (after taxes, 401k contribution, etc.) for two years.

My wife and I stashed that cash away so I could afford to change career paths. The old job was very family-unfriendly but a good experience for a 20-something. Being disciplined in my 20s is how I was able to open doors of opportunity so my 30s have a better work-life balance.

Hell yeah…

If you can get this stuff down in your 20s you are SET FOR LIFE.

It was so wonderful to read about someone more in the same income and phase of life category as me!

I’m glad :)

This is incredible Corrine! You are off to an amazing start and at this rate will have so many years of freedom and options available to you in your lifetime. Congratulations and well done on taking charge!!

You’re doing great, Corrine! It’s been nice to see so many younger folk becoming financially aware these days. Like J Money, I think I had about $4 to my name when I was 24 (and though I was always reasonably smart with money in the traditional sense, I definitely wasn’t FIRE minded until my mid-30s). Well done, keep it up!

This is awesome! Way to go. When I was 24 I was worth $-85k. There are a lot of people that are in the negative at that age due to debt. You’ll never have to worry for money if you get this down at your age.

#TRUTH

Great blog post. Thanks for sharing. You are focused in a young age and this is just the beginning!! Keep going :-)