Good morning, money lovers!

Welcome to net worth report #14!

Every month, my process is the same… I log into all our investment and bank accounts (both mine and wife’s) and tally up the totals for all the assets we own, as well as credit card balances and any liabilities. The total at the end is our current “net worth” — It’s one of the most important numbers to track regularly on the path to financial independence. 🔥

The reason I share all this stuff publicly is to a) give you a transparent view of how investments grow over time in real life and b) encourage you to stay on top of tracking your own stuff! The specific numbers in any single report don’t matter too much (sometimes they’re up, sometimes down), it’s more about the continual monitoring of your financial health and making sure it trends upwards over time!

If any of you have questions or need help figuring out how to calculate your net worth — check out this mega post — or hit reply to this email with any questions. The more we help each other stay on track, the richer we grow together!

Without further adieu, here’s how we kicked ass last month…

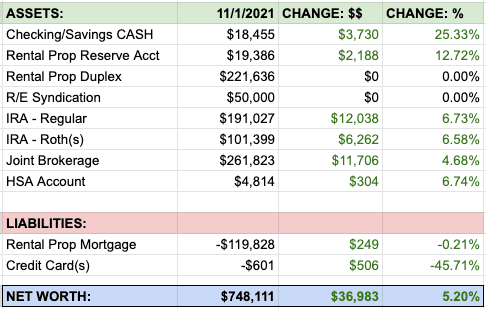

Nov 1, 2021 Net Worth: $748,111

Woohoo! Look at all that GREEN! Almost $37k of growth from rental income, dividends, stock growth and personal income. We are firing on all cylinders!

Unexpected Income & Stand Out Expenses

Here are some irregular things that happened in October:

- Our real estate syndication paid a quarterly dividend ($875) as well as an early capital return ($6,000)… More details on this below in the asset breakdown.

- We received another stimulus check ($600!) from the State of California. Honestly, I had no idea this was even coming and almost threw the letter away without opening it! *gasp!* Any of y’all still getting stimulus checks!?

- We had a “perfect” month at the rental property with zero repairs or maintenance 🏡🤑

- Wife and I spent about ~$200 on new beds/cribs for our spare room to pass yet another home inspection as part of the LA foster/adopt process (I’ll give you all a longer update on all that stuff another time. In short: No, we haven’t been matched with kids yet.)

- Got wifey’s bike professionally serviced for $110… Can’t put a price on safety! 🤓

- We invested into a private start-up company (more details here). The reason I’m not sharing/tracking this one publicly is because a) it’s a private partnership and b) it could literally be worth nothing and there’s no good way to accurately value equity in start-ups.

- Lastly (and sadly), we made zero dollars from side hustles last month. This is the first month in a while that I haven’t spotted a flip deal or pulled some extra income from work. Oh well, I’m gonna just have to bust my ass twice as hard in November! :)

Detailed Account Breakdown

Cash Accounts: $18,455 (+$3,730): This is the total cash my wife and I have in our checking accounts. It serves as a small emergency fund and float for monthly cash flow. Looking into November and December we typically have higher expenses due to travel and gifts so it’s ok that this is higher than we need. If we can keep a high balance through the end of the year, we might be able to fund our Roths from this account come Jan 1st!

Rental Property + Reserve Account: $241,022 (+$2,188): This is the total property value and reserve account *without* accounting for mortgage. (The mortgage is tracked as a separate liability below.)

Here is how the rental made money last month:

$1,975 — Incoming rent

(-$140) — Property mgmt fees

(-$661) — Mortgage principal + interest

$1,174 — Total rental gain this month

We also received a +$200 refund for overpayment on an A/C replacement in Septmeber. And an additional $814 from an insurance claim we’re working on which will wash out in November.

Real Estate Syndication: $50,000: It’s been ~7 months since owning this asset and it’s already paid out $1,750 in dividends (equal to a ~7% annual preferred return). This should continue in the coming year as rental rates remain extremely strong. Reports say the complex is sitting at 99% occupancy, with a waiting list for new available units. Woot woot!

Because the project is overperforming so much, in addition to rental dividends, the management company issued a return of 12% of investors’ original capital. Since I invested $50k, this meant a $6k return to me — with no dilution of share ownership. It’s pretty rare that this happens so quickly after purchasing a new investment, so we’re thrilled.

You might be wandering, “If you invested $50k, and they returned $6k, shouldn’t you track this asset now with a value of $44k going forward?”

Technically, the answer is Yes, because the payment to me was a “return of capital.” But, since the apartment complex didn’t drop in value at all (in fact, it’s only risen in value), my equity position hasn’t really gone down. If the entire asset were to be sold today, I would receive our $50k back, as well as some growth on top probably. So I’ll keep this placeholder value at $50k for now until we get any other exact figures from the partnership.

IRA – Rollover: $191,027 (+$12,038): Hot dang! This was a ~6.7% return for last month, which made up for all the September losses, and then some more goodness on top!

IRA – Roths: $101,399 (+$6,262): We crossed the $100k mark for our favorite tax-free accounts! Can’t wait to fund these again in January. :)

Joint Brokerage Account: $261,823 (+$11,706): The increase this past month was all organic growth. This account has less volatility than the IRAs due to some bond positions, but it’s still mostly invested in VTI.

HSA: $4,814 (+$304): No contributions or withdrawals for this account last month, just some sweet sweet growth from the market climbing.

Breakdown of Liabilities

Rental Property Mortgage: -$119,828 (+$249): Sweet! This month we broke under the $120k debt barrier. Only 23.5 more years to go and this mortgage will be paid off! Haha. Just kidding, we’ll probably refi or pay the full debt off before then.

Credit Card Balances: -$601 (+$506): This is our current balance, not a rolling balance carried from month to month. We pay our credit cards off each month (auto-pay!) before any interest kicks in.

My wife and I have no other debts at this time. 😎

How’d you all do for October? Anyone cross any big milestones last month!?!?!

Happy Friday!

– Joel

Get blog posts automatically emailed to you!

Wow….$37K jump in a month is huge and something to be proud of. You should certainly cross the million dollar networth mark by Q1 of next year, the stock market permitting. Our number tracks closely with yours and it will be interesting to see who crosses first…lol. Great to see you are in the foster/adopt process. We have two biological kids but also going through the process to add one or two more and we have had to spend to adjust some stuff to pass inspection as well. Looking forward to you providing more details on this in future.

Few questions for you, are you getting your property value from zillow, redfin or any of the others out there? We used both zillow/others and the government appraisal and arrive at a value in the middle when we average. Do you have a specific website recommendation for the real estate syndication? We would love to try our hands on this soon. Your brokerage account, do you invest in individual stocks as well or just strictly ETFs? We started seriously dabbling into our brokerage account but going the individual stock route since we have ETFs in our 401K/Roth. our plan is to buy 5 to 10 stocks and just keep accumulating those. We are not timing the market just going the long term route of accumulating same stocks for the next 5 years or so. Would love to know your thoughts on this stock strategy.

Hey Julius! Congrats on going through the process to help more kids! Definitely interested in swapping stories on this stuff. :)

For the duplex property value, as of right now i’m using the 2021 tax appraised value. I find that redfin/zillow aren’t great at estimating multi-family residences. I will probably order a CMA from my realtor soon to get a more calculated value — I’m thinking it’s probably gone up 5-10k this year.

For syndication stuff, I mention a few places in this post here. Before I invested in my first deal I sat on many conference calls, pitches, and reviewed a ton of prospectus decks. Good to do a lot of research before dedicating a huge chunk of capital to a deal. Shoot me an email if you have more questions on this stuff, i’d love to help! (FYI – many of the big syndication players require you to be an accredited investor.)

For brokerage accounts — We have no individual stock positions. All ETFs. (VTI, VXUS and BND). I’d prefer to match the market returns with no effort vs. beat the market with picking/research/monitoring. I used to find that stuff fun, but the older I get the more I realize it’s best to just play the safe average game :)

Last note — My wife and I have a few co-owned properties and private investments that are not tracked within this public net worth report… So truth be told we have already crossed the millie mark. But, for this set of assets it’d be awesome to cross over $1m in Q1 next year! Not sure if the market will play along but I certainly hope it does and hope you get there shortly too! Cheers!!

Was kind of surprised at the milestone crossed this month…over $1million in assets ($851k net worth).

That does include an increase in home value, so if I keep the value of the house exactly the same as it was a year ago, the numbers change to $954k in assets/801k net worth.

This compares to assets of $704k and net worth of $541 exactly ONE YEAR ago.

Without counting house appreciation, net worth has grown $260k in 1 year on income of <$160k (2 FT jobs and a few side hustles). Over $100k gained in market growth – ROTH 401k, ROTH IRA, 529's, HSA, etc. Recognize that some of the "non-income" $ was stimulus checks or child tax credits which where mostly all invested, not spent.

I would love to reach the milestone of having my net worth grow 2x more than my income. In other words—$160k income from jobs and $160k income from our accounts.

It has been so valuable to track net worth monthly! Thanks for the inspiration. For reference, household of 5 and we are both 39.

CONGRATS!!!!! That’s a huge milestone. Even without the home increase, what a massive difference the last year has made. I love the new goal of having your investments outpace your income. Gets easier and easier the higher your NW grows.

Thank you for sharing and inspiring others also!

Joel

Awesome net worth jump, and congrats on getting close to the $750K mark!

Speaking of syndications, I’ve just had a syndication exit and have gotten a windfall. I’m in 2 other syndications but those don’t look like they’re exiting that soon. On the upside, it’s a lot more pleasant investing in syndications than it is to management my own single family rentals.

Congrats on the exit and windfall. What are you doing with the proceeds? I 100% agree about no stress in management of physical rentals — that’s why i’m selling them and buying into more syndications :)