Got this note this morning and had to share it ;)

Not every day you accomplish something so big like this!

MWAHAHAHAHAHAHA WE’RE DONE WITH OUR STUDENT LOANS!!!!!!!

My husband and I finished grad school with something like a combined $330k… and today, I hit the button to pay off the last of them. I could not be more excited!!! Also, to be truly honest, I kinda teared up when I clicked it. After 9 years (for me) and 10 years (for him), we’re finally done.

I started getting serious about paying down the loans at the end of 2015 (December 28, to be exact), with a grand total of $246,301.18. I finally got sick of having this debt hanging over my head and calculated that if we lived cheaply, we could seriously be done with them after 5 years or so. We figured out a way to live off one income and basically put the other into loans. After almost 3.5 years of paying over $5000 a month into loans…we’re done ahead of schedule!

Please excuse me while I go cry and laugh and force-hug my cat. :D

Haha…

Humor and debt-freedom, how does it get better? :)

I had to follow up with a “HOWWW??” though and pry a little further, and our friend here was kind enough to oblige and recap their journey for us…

I’m sure some people will write it off the second they see “6 figure incomes”, but remember that it takes a lot more than just money to tackle such things, and it was all those 6 figure *loans* that got them to this level to begin with!

So way to go, Jana & husband! Enjoy this next chapter of your lives, and congrats on your new found freedom!!

*******

The 10 year journey:

- We graduated pharmacy school 1 year apart from each other, with a combined total of around $330k. Both of us were in denial (and for pharmacy school kids, this is apparently normal), so we blissfully paid the minimums and went about our lives, buying $7 cereal in Hawaii and eating out almost daily.

- End of 2012: We moved to Seattle from Hawaii, reducing our tax burden (due to lack of state tax in Washington state). We moved, deciding to live off of 1 salary and put the rest towards the loans – this was simple to do as we both made in the low 6 figures, but it was an adjustment for me to be given an “allowance” each month. Luckily my pride got in the way of asking myself for more money, so no matter how hard that last week of the month got, I refused to go over budget!

- A year and a half after this decision, we decided to buy a condo due to rising rent prices in Seattle. We paused the loans for 3 months to save up a down payment and revamp our financial duties (made possible due to our early payments pushing out our next due dates), but our 3 month pause really turned into 6 months as we bought furniture for the condo, etc etc. In December of 2015, I decided to add up all the loans…

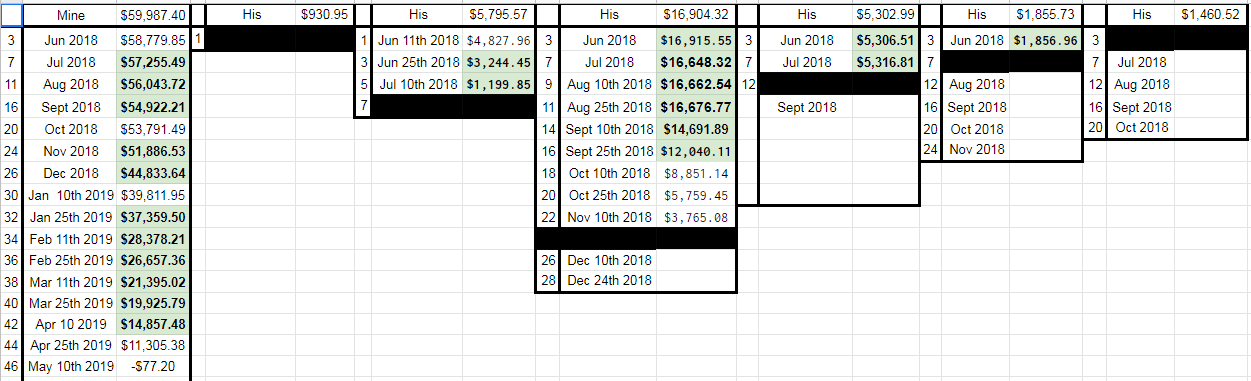

- December 28, 2015: I added our loans up and wanted to cry. $248,301.18 to pay off. We decided to really focus. And by we, I mean *I* got super anal about it and put myself on a strict budget!

- Many (OMG MANY) spreadsheets were made. And sure, I went over budget a number of times, but the focus was always on the loans. I made sure that I paid the loans on payday so I couldn’t give myself an excuse to put less into it, but always made sure to keep a $500 buffer in my checking account in case of forgotten auto-debited items (in addition to my emergency fund in savings).

- I refinanced with Sofi, bringing my interest down from 6.8% to 3.75%. Why didn’t I do this earlier?!

- I got a raise in 2016, letting me put even more into the loans (from $6k/month to about $8k/month), until 2018 when I decided to change jobs (and take a $33k pay decrease for better quality of life). I cashed out my vacation from the old job and dumped an $8k lump sum into the loans. I was still able to spend about $1.5k on stuff outside of these payments (not including the HOA), so I didn’t really feel deprived. I got addicted to watching the principle drop on my loans every payday!

- A few of my friends definitely felt weird about me making 6 figures and living off what amounted to about $18k a year, but they soon learned that I would come and hang out, but would decline pricey meals out… Unless it was the beginning of the month. Please keep in mind that when I took the $33k drop in pay, I still ended up in the low 6 figures. We still put 4% (for him) and $530/month (for me) into our respective 401k/403b plans.

- We picked a combination of the avalanche and snowball methods. We started the pay down process before we were married, but we’d also been together for about 8 years by then. We figured we were in it for the long haul. To make it fair, I planned it out so that we would alternate paying on our loans, but I had consolidated a number of mine so by far mine were the biggest chunk. We combined methods for 1) practicality and 2) positive reinforcement to help fuel our (read: my) obsession.

- We were due to be done originally in December 2019… then extra payments were made (from taxes, vacation payouts, holiday and/or OT pay) and it moved slowly to September. Then August. Then July. Finally, we were to be done in June… until I said “I’M DONE WITH THESE LOANS” and raided my emergency fund to pay off the last $6k. I’m losing 2.2% interest on that $6k (thanks, Barclay’s!) but am gaining wayyyyyy more peace of mind!

- Next goal…RETIREMENT! We are planning to max out all plans and contribute to a taxable account so we can retire early… And I’ve already got the spreadsheets made ;)

******

And that’s how the sausage is made!

It looks so easy when you bullet point it all out like that, and when someone ELSE is doing all the sacrificing, haha… But we all know it’s a bit more involved than that, and it surely doesn’t happen overnight.

But boy do things speed up when you FOCUS LIKE MAD! They went from $80,000 paid off in 5 years going with the flow (and a decent feat in itself!), and then hit *turbocharge* and tripled their payments in well under the same amount of time…

Pretty incredible!

Now of course we ALL can’t duplicate such drastic comebacks unfortunately, however we can take charge of the key ingredients here that works wonders in any journey:

- Making things a *top* priority

- Living on LESS than you’re bringing in

- Trying out different payoff methods

- Refinancing whenever you’re able to/it makes sense

- Automatically sending in payments on paydays!!

- Keeping a buffer zone in case you screw up

- Tracking your progress however motivates you (coloring charts? :))

- Throwing in as much of your *extra* money as you can get (raises/bonuses/overtime)

- And then of course doing whatever it takes to stick to it until the bitter end…

Not exactly easy, but pretty straightforward once you make the commitment to yourself. (And barring any unfortunate events)

So well done again, guys… Thanks for taking the time to share with us today, and tonight I shall raise a cold one in your honor! Cheers!

*******

More debt loving articles you might like:

- 4 Tricks to Save More, Spend Less, and Pay Off Debt

- Proof That Getting Out of Debt is VERY Possible

- The 15 Questions of Debtors Anonymous

- Resource of The Month: Debt Free Coloring Charts!

Get blog posts automatically emailed to you!

Hey! Congratulations guys! What an achievement. In my country we pay for our student loans through the taxation system where a % of income is taken out of your wages each month until it’s paid off. When I sold my first apartment my income for that year (the profit on the sale) was such that I had to pay the whole remainder off in one fell swoop. In fairness, it wasn’t US student loan levels… Like 10% of US student loan levels! But regardless, I still remember how happy I was when I received my statement = $0! Good luck on the next goal!

How interesting!

What country do you hail from? :)

Sounds like it could be Australia.

Here, once you reach above a certain pay level… (maybe 50K/year?? Something like that), then your loan repayments start to come out of your pay.

You can also pay extra if you want to get rid of it. I think the loans go up by CPI every year – no interest charged as such.

Yes! Australia! It’s such a great system! When I started working I was still living like a student (the natural progression of lifestyle creep hadn’t started creeping yet!) so I didn’t notice the payments coming out of my fortnightly paypacket. And when I got sick for a year and stopped working the payments stopped. I

ahhh! what’s the end of that story?! your comment stopped too! haha…

Wow, this one hit home. My wife and I are also two pharmacists so I know EXACTLY, and I do mean EXACTLY, what it’s like to get those loans paid off. And as I’ve told J before, we have used our same aggressive strategy to turn our 30 year mortgage into a 6 year. Congratulations fellow pharmacists!

Ballers!

Thank you!!! I did a happy dance after I hit the submit button, for sure!!!

If I had to do it all over again (…and if I hadn’t scored a 2 on the AP chem test back in 11th grade) pharmacy school seems like a solid pursuit. I’ve got a few in-laws who went that route and have since retired quite happily.

Way to grind that debt away in astounding form — and mad props for taking a significant pay cut in exchange for cranking up your quality of life!

It usually is ranked pretty high on “top career” lists whenever I stumble across them… And good thing too if you have to take on that much debt to get there!

You’re not missing out. Yes, salary is good but job satisfaction is not. Retail pharmacy is a very toxic work environment. Trust me.

Oh damn, sorry to hear that!

I hear you. My mother-in-law worked at a retirement community and it suited her perfectly; other relatives worked for LLY in Indy from roughly the 1940s to the 1990s and made out like bandits. I’m bummed to hear the big retail pharmacy outfits are treating people that way.

I had made it to middle management level when I took the pay cut for better QoL…it was definitely worth it.

While pharmacists currently make a good salary, I can see it slowly going down. When I got out of pharmacy school (2010), it was the last of the good years. There were really no more sign on bonuses by then and you kinda of had to work your way in for a good job…and jobs started paying quite a bit lower than they previously did. Now, the market is flooded with pharmacists, with another 14k pharmies graduating EVERY YEAR. It’s a little intense. And what the retail chains expect out of their pharmies increases every year, so there’s almost always stress.

I took my demotion because I had 2 phones and was CONSTANTLY stressed about work – who would call out tomorrow, who would QUIT unexpectedly, what customer complaints would I get, am I on track to hit my forecasted numbers, will my boss call me for something that’s due 1hr later?? It was definitely worth the pay cut……..but I will say that after the drama of middle management, being back in a pharmacy gets a little boring…

But hey, if I focus I can retire in 10 years. Can’t complain about that, right??

Exactly! I got out in 2005 and they were literally throwing money at us because the demand was so high. Then like you said, more and more pharmacy schools popped up to fill the demand and now it is tight. New grad starting salary now is what I started at 14 years ago. I absolutely understand why you would step down. I too am in management and once I hit that FI I am looking at Part-Time (if there is any) or just dip out. I feel bad for the students I Precept choosing this career. Wish I had “met” J, MMM, and ERE in 2005 :-) I would have been able to get out that much sooner.

From a DPM position standpoint, we shield our teams as best we can…but sometimes the Powers That Be really need something to happen (or…dictate something to happen) and we can only roll with it the best we can. The Seattle Market is so tight right now (especially with 2 schools in state) that there’s basically no jobs within 30 miles of Seattle. Part time positions have basically been eliminated…and even staff positions are SUPER hard to come by, since no one wants to manage these days.

I wish I hadn’t wasted those years before hunkering down and getting serious about the loans, but you live and you learn right? I’ve learned that not spending as much really doesn’t affect my happiness level. If anything, I was trying to buy happiness before!

That last part there is the key to it all! And not something everyone comes to realize!

Congratulations!!!

Congratulations, Jana and husband! Thank you for sharing your story. This was really motivating, as we’re still in the thick of our debt free journey (law and medicine, rather than pharmacy, but similar debt levels). Looking forward to getting on your level! :D

You can definitely do it!!! My friends sure thought I was weird, but I NEEDED to be done with them…! Luckily my husband agreed :)

So weird to read this story as we just finished paying off over $250k of student loans about a month ago. We were not making dual six figure incomes, and we’ve had two kids during the last seven years while focusing on paying this down. I felt the exact same way when I got to that last two months. We raided our savings and just got rid of that last little bit of debt! Feels so amazing — almost like starting your life over with the freedom to pursue our dreams again.

I would have to agree that doing that WITH KIDS and less salaries is pretty damn impressive – congrats :) What’s the next big hairy goal you’re tackling?!

We’re trading in our 9-5 jobs for remote freelance work so that we can travel the country in search of a cheaper cost of living and a community we enjoy. We both grew up in the DMV (DC, Maryland, Virginia area) so starting work by 5 a.m., sitting in traffic for hours, and paying almost $2000 for a one bedroom apartment is what we’re used to. We’re converting an old sprinter van and planning on traveling for about a year before settling somewhere. We may go international, too, if an opportunity presents itself.

THAT IS INCREDIBLE!! GOOD FOR YOU GUYS!!! As someone currently typing this from the DMV I completely get that 100% haha… What an adventure!! :)

I can’t imagine knocking it out with kiddos to support. CONGRATS!!! That must’ve been a hard slog, but YOU DID IT!!!! :D

Congrats! Great job paying off that huge loan. It’s almost like another mortgage. Yikes!

It basically was my mortgage – we bought in Seattle for $360k (and only put down $18k) so our starting mortgaged amount was only $12k off from the loan amount…

Congrats! I made a goal to pay off my 6 figure student loans within 5 yrs of graduation for my masters degree. It was awesome when it was paid off. Like Pharm D above, I would like to pay off my mortage in 6 years. Fingers crossed!

Nice!!! But what are you going to do once you no longer have any debts to pay off?!! ;)

Hopefully Nat will do the same as I plan. The month following the last mortgage payment, the same amount will go straight into the Index Fund without skipping a beat. (Insert William Wallace…Freeeeeeeeedom!!!!!)

Hahaha…. J$ approves…

Amazing and inspiring! Congratulations!! Those are some big numbers even with big salaries. I love the stories that take a whole lot of years because they’re much more realistic for most of us.

Congrats Jana and husband! Love stories like these where folks share their real life experiences. While we may not be able to fully duplicate it, there are always valuable takeaways (great list of them provided by J).

Yup! You’re right on that!

Cheers! That’s so impressive. A quarter million gobbled up in less than 4 years.

That’s great. This will be in a couple of years.

Very well done.

I remember when I paid off my first mortgage after 17 years of slogging away at it as a single parent. I saw that I had $10 more in my savings than I had on the mortgage balance. It was more than flesh and blood could stand. I had to pay it off!!

As a single parent too – incredible!! Pretty much doing EVERYTHING as a single parent for that matter, haha… I give y’all mad respect after knowing what it’s like with kids! :)

Congratulations! I cannot wait until I have my student loans paid off (my husband has his gone already). I had about $68k combined from my undergrad + grad school (most of grad school was funded with scholarships, which is now $65.8k. I’ve really started to hit them hard this year due to us mostly living off my husband’s income; hopefully they’ll be wiped out in a few years.

Well done snagging those scholarships!! And getting that grad degree too!

That’s INCREDIBLE. Over 330K in debt? I don’t care if they make six figures +, that’s a crazy achievement and they should be PROUD! Good job, guys!

So many kudos!

Jules

Nice work and congratulations. I hope the cat is okay from all that force hugging : ) Only one of our cats allow that kind behavior, the other will retaliate. I agree, a six figure income is no reason to write off stories like this.

The cat will put up with it for a little bit before she’ll try to fight me off. ;)

Way to go! Congratulations! Your story is very inspirational, thank you for sharing. I hope you celebrate in a big way, you deserve it!

I missed reading yesterday, but had to comment on this, because we are now without student loans as of a week ago! I paid off my loans (I think I had something like $70k between college and grad school). One day, I realized I had like $70k in short term savings (saving for a house downpayment) and $35k in debt (after paying for a solid 15 years). It made no damn sense. I was fortunate to have consolidated them at a low low rate, but my savings interest was still lower. So, I got the payoff amount and made that lump sum payment. IT FELT SO GOOD. That was about 2 years ago give or take.

Then I married $30k of additional student debt. The real crime is that that was for a 2 year tech degree that doesn’t pay nearly enough to warrant the cost. When he sold his condo (nearly 6 months after we bought the house) we had equity, which when he asked what we should do, I said DEBT. So…we now have no student loan debt, and it’s great. Way greater than paying mine off until something like 2040!

Love it!! And I would have done the same thing! There’s power in that freedom!!