That time again! Another month, another net worth report while being another month OLDER as well! Haha… I swear I still feel like the same 28 year old when I first started tracking these, do you??? :)

Three juicy things that went down this month:

- The markets continued its crashing (which you already knew)

- I had to withdraw our ROTH IRA contributions as it turned out we weren’t allowed to contribute (!!!)

- I tried bitcoin and hated it!

We’ll skip item #1 up there since it’s nothing we haven’t covered here before (i.e. just avert your eyes and keep going with the plan!), but let’s talk a little about events #2 and #3:

#2. Roth IRA boo-boo

You know how I always wait until Tax Time each year to max out our IRAs after meeting with our accountant? Which I’ve faithfully done for the past decade and it’s been working like a charm? Well, for whatever reason I decided to go rogue this time around and max it out three months early, and of course its the ONE TIME I mess it all up, haha…

Turns out we made too much money last year to be able to contribute *anything* to our Roths (due to the Rockstar sale), and so the $5,500 we each put towards maxing it out had to be reversed unless we wanted to do a dance with the devil. A good problem to have, but still a problem no less, and is why you see such a large cash infusion up there in our net worth graph this month :)

It wasn’t because we were straight up hustling – it was because we straight up made a mistake!

I eventually got it all cleared up (had to file two “Correction of excess contribution” forms, which then gets it withdrawn + any profits it made), and now we just await to see how much we’re gonna get dinged for the honor of making this mistake ;) The good thing is that we caught it *before* the tax year ends which should help, but I’ll report back once I know more when I get the details…

If you ever come across more money than you’re used to though, don’t be like me and excitedly start maxing stuff out! Make sure you’re playing inside the rules! :)

#3. Bitcoin Experimenting

This was another one that threw me for a loop this month… For years I just ignored and ignored and ignored the crypto craze and told everyone who asked me, “No! Stay away!” but when a good friend of mine started getting into it I couldn’t help but get sucked in… And before I knew it I had my entire spavings fund ($2,300+) dumped in Bitcoin et al seeing what it was all about!

Whelp, it was fun for a little bit, but my pea brain just couldn’t get into it *long term* like I had originally planned, and as fast as I had “invested” it I had gone in and cashed it all out, haha… I couldn’t stop staring at the screens every day wondering where it would bounce to next!! Even though I kept telling myself it’s a long play and to stop doing it!

Interestingly I did end up coming away with an extra $332.61 when it was said and done (and re-invested into that same spavings fund – which is why it’s up larger than normal this month), but it was by pure accident and literally the next week it all crashed harder than the stock markets…

I’m glad I gave it a shot though because I hadn’t tried any new experiments in a while, and it only reinforced my love for “regular” investments, haha… And I have to give mad respect to all y’all who are invested long term as well, because I really do think it’ll be around for a while – even if it looks different – and if you’re better than I at averting your eyes and focusing on its strengths, I’m sure you’ll be handsomely rewarded later (if you haven’t been already). My friend is very much still “in”, and I have a feeling he’ll be rubbing it in my nose years from now :)

Here are some other quick notes from my experience:

- I used Coinbase to do all my buying/selling – it was so easy!! Loved having it all in one “wallet,” and seems to be the popular choice for people (though you’re limited to what types of digital currency you can buy there). UPDATE: See Jake’s note in the comments section on why using places like this could be bad!

- I bought three types of cryptocurrency: Bitcoin, Ethereum, and Litecoin. Of which all but Ethereum made money, though I think they’ll be the clear winner when all the dust settles…

- I spent way too much time reading – and laughing – about Cryptokitties!

- And there’s about 1,000 new articles on bitcoin and company every day so you’ll never get bored :) One of the more feistier ones came from Mr. Money Mustache, though it still didn’t stop me from experimenting on my own, haha… “Why Bitcoin is Stupid“

Would love to hear how many of you are invested in it, and what your experience has been so far? Have you been involved for a while, or just recently started out? Any good articles/resources you can share with our community here?

So yeah, a wild month this round! And that’s on top of packing up all our stuff, moving to our new house, and then un-packing all our stuff while prepping for a new human in our lives :) But more on that in a bit.

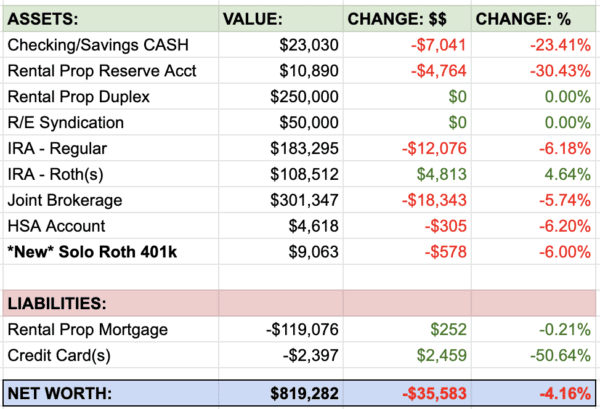

Onto March’s Net Worth Breakdown…

[As always, these reports are shared to keep things transparent and start great convos around money. Sometimes we’re up, sometimes we’re down, and sometimes we’re just plain boring – but whatever the case, we disclose it all and hope it helps you in your journey too!]

CASH SAVINGS (+$14,261.41): You already learned the trick to this on (just contribute money to your IRAs when you’re not supposed to, and then take it all back! ;)), but there is $3,000 or so that was on top of that which was great… We’re definitely out of the cash flow problems we were once in while the wife was finishing up grad school…

SPAVINGS FUND! (+$366.97): Another nice boost here, mainly due to the bitcoin experimenting as noted above, as well as some other little finds scattered around (like saving $20 from tweaking our renter’s insurance policy). You can learn more about the “spavings” idea here.

THRIFT SAVINGS PLAN (TSP) (+$421.07): The only shining light in our “investments” section! Haha… Mainly because the pot isn’t big enough yet to consume any contributions being made to it on a regular basis ;) At some point they’ll just be drops in the overall bucket, but we’ve still got a ways to go for that to happen as this one’s relatively new (two years).

ROTH IRAs (-$14,195.89): A big drop, where $11,000 of it came from withdrawing 2017’s maxed out contributions… Though it wouldn’t have stopped the funds from being in the red anyways this month!

SEP IRA (-$10,553.80): Same here – when the market moves, the market moves. Although in April we WILL be contributing money to this account after triple checking with our accountant this time ;)

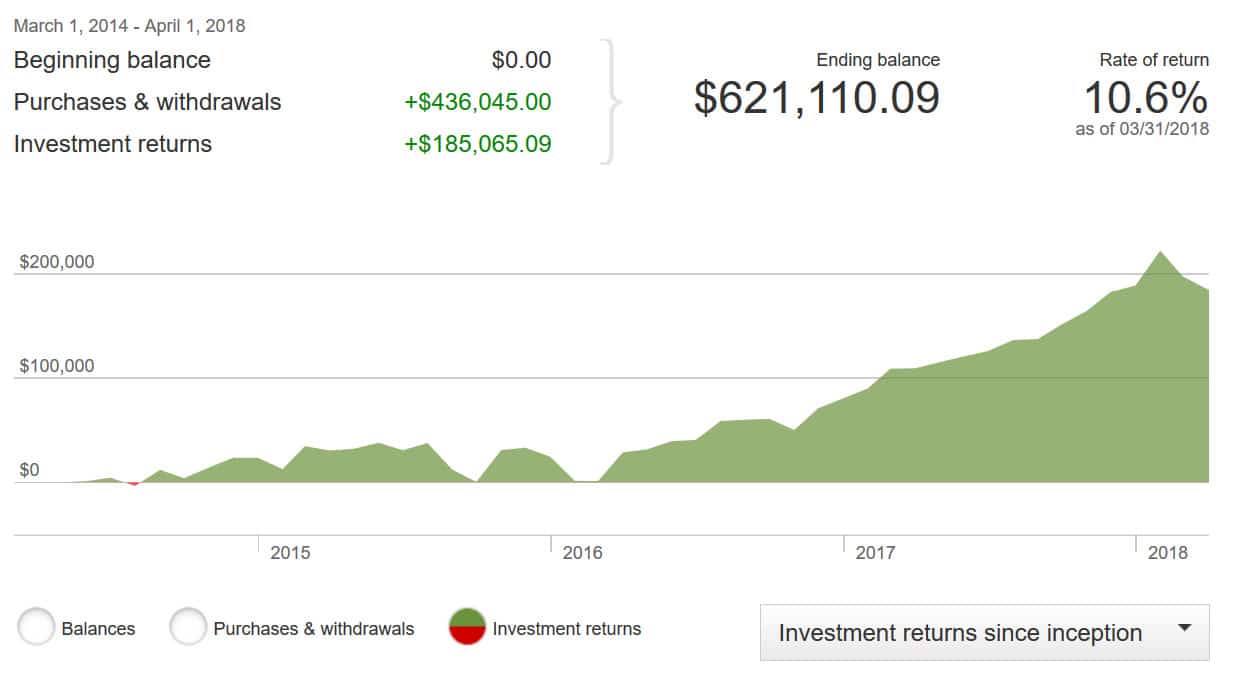

Here’s a snapshot of how this account has progressed since switching to Vanguard:

(PS: Everything’s in VTSAX over at Vanguard – a “total market” index fund)

CAR VALUES (-$163.00): Nothing too crazy here – just the cars doing what they do… Here are their values per Kelly Blue Book:

- Lexus RX350: $9,565.00

- Toyota Corolla: $3,022.00

Total change in net worth this month: –$10,195.85

At least we beat last month’s $30,000 drop! That’s something! :)

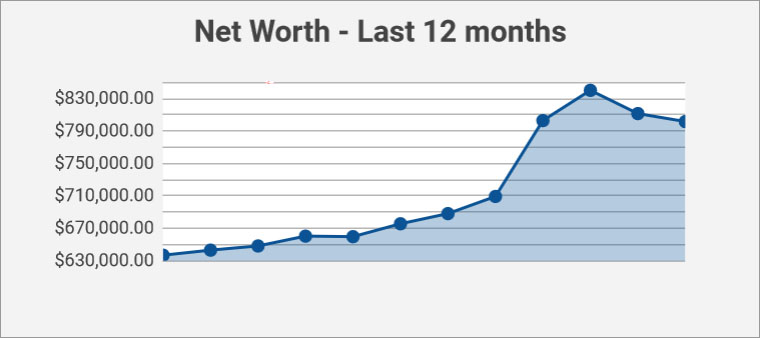

And here’s a look at how the past 12 months have gone, to put things into even better perspective:

Overall we’re definitely up from this time last year!

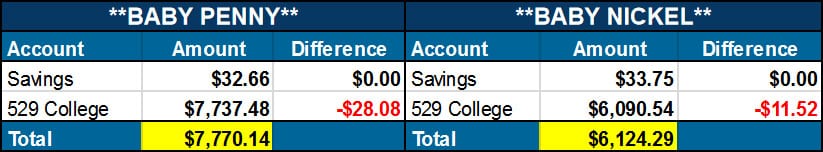

And now onto our kids’ net worths… which hopefully they appreciate one day :)

So that’s March! How about you?? Anything good happen?

In “life” news — something we’ve started adding to these reports — here’s what’s been going on:

1) We moved!!! All boxes in and about 70% unpacked already – not too bad :) It was the first time I’ve ever had to move just a mile down the street (here’s why), and WOW was it much easier than in the past. Because we were so close and had a two week overlapping of homes, we were able to do the following:

- Make daily car trips to move some of the fragile/fluffy/weird-shaped items from one house to the next

- Make bigger moves over two weekends using friends’ trucks and trailers

- And then renting one 16 ft van for a few hours to move over all remaining furniture

It took a lot of *time*, but much easier/smoother doing it over the course of two weeks than all in one main day. And it barely disrupted my kids/pregnant wife’s lives too :)

2) THE BABY IS COMING THIS MONTH!!! I don’t know when, but I know it’s coming and just praying towards the END of the month vs in the beginning/middle, haha… I’m ready, but not that ready.

3) I’m finally fine, and enjoying, my freedom from a billion and one projects :) And I don’t even want to start a new one anytime soon – imagine that?? My trick of trying to do the *least* amount of work possible every day, while still doing work and being effective, is starting to pay off, and I only hope I don’t lose my hustle bone as the months tick by, haha…

4) Lastly, if you ever come across a box of old coins in your attic or from family members, feel free to mail them over to me and I will value them and liquidate for you! I jokingly said I’d do that for a friend the other day as it’s something I really have done over the years, and not only did he take me up on it but it should be arriving to my house any day now!!! I CANNOT WAIT!!!! It doesn’t even matter if there’s junk inside – it’s the thrill of the unknown that gets every collector trembling with joy, haha… So thanks, Anthony! You made this nerd’s entire month!

And that’s all I got for y’all today :)

This month’s Life Meter: 80% Happy / 10% Busy / 10% anxiously awaiting a new human.

How about you? Life/business/love/money?

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

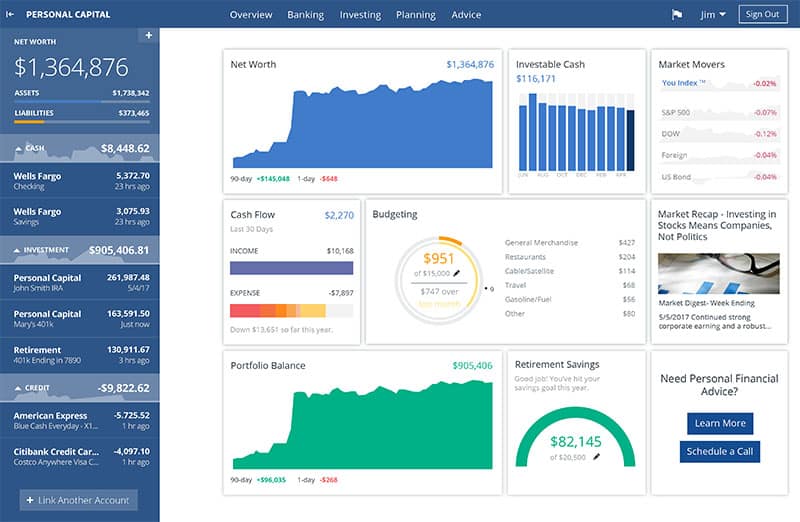

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!

Thanks for sharing, as always, J!

What formula did you use to calculate whether you were eligible to contribute to a Roth IRA? We still haven’t contributed for 2017, partially because I wasn’t sure how to calculate our eligibility.

Well I cheated and had my accountant run the #’s who told me we could not, but here’s a good description with info here: https://www.nerdwallet.com/blog/investing/roth-ira-contribution-limits/

It depends if you’re filing joint vs not and what your adjusted gross income is (AGI), etc. Here’s more info from the IRS too (though very boring :)): https://www.irs.gov/publications/p590a#en_US_2016_publink100025085

Thanks, J! We don’t have an accountant (DIY, eek!) so I’ve been a little unsure of myself on this. Thanks for the links! I also found this worksheet here in case it is helpful to others: https://www.irs.gov/pub/irs-pdf/p590a.pdf#en_US_2017_publink100025085

With regards to the cryptocurrency stuff, I’ll say that you should avoid keeping your coins on an exchange such as coinbase. A centralised place like this is where hackers will target, and you can have your coins stolen. Either use a desktop wallet, or even better, a hardware wallet such as Trezor or Nano Ledger. Theres a sentiment in crypto, if you dont have your private keys, its not your money. When the money is left on an exchange, the exchange is guarding your private keys, which somewhat defeats the purpose of crypto (which is managing your own money, being your own bank etc).

ack – thanks for the heads up!! good info!!

When you step back and realize you made too much money for something, it’s always a nice feeling. Even if it’s annoying in the moment. Congratulations!

No Bitcoin for me. I see some of the value of a Crypto but don’t get why I can expect one to be worth more in the future than it is today. As Warren says, “don’t invest in what you don’t understand.” I’m on the sidelines until I get it.

Smart stance :)

The markets have been crazy lately, which has made for some interesting net worth updates. I’m writing a series about bear markets next week and it might turn out to be perfect timing.

I love the kids net worth, I might have to start doing that. It’ll be the kick in the butt I need to start their college savings.

Thanks for sharing your results!

Congratulations on the move and good luck with the new baby.

As for your bitcoin experiment. I also tried the same, although with less money, and I concluded the same thing for myself. I don’t like it. It’s not for every people.

Can you not still do a backdoor Roth?

Hmm.. actually not sure? Haven’t looked into before but I will now :) Not sure if having my SEP IRA going will affect it at all, but worth the research!

Do you know if backdoor also has to be done before tax deadline? (apr 15-17)

Thanks

The first step of it, the Traditional IRA contribution, does and before you file your taxes so you can include form 8606. The second step, the conversion, can happen any time and is reported in the tax year that you do the conversion.

If you kept your crypto on Coinbase then it wasn’t in a wallet, it was on an exchange. It’s better to transfer your crypto to a wallet rather than leave on an exchange as in the past there have been instances of exchanges being hacked.

Sounds like you’ve got a good balance going on, right up until Baby #3 comes and destroys it! :) I know you guys are so excited. Newborns are so awesome.

haha yeah – a whole new game once we’re into zone coverage!

Like you I’ve been tempted to dip my toes in the crypto world but my lack of knowledge has scared me away. I know the exchanges can be hacked and I think if you download them into your personal wallet, there may be passwords to remember?? Reading that Wozniak lost a bunch of money cured me. Just curious though, were the trading and storage fees high?

you need to save a recovery seed, which is 12/24 words, so that you can recover your funds if your computer dies or whatever and you cant access your wallet. there is private keys that you could keep yourself, but the point of the desktop wallet is to store the keys for you (and sign transactions for you, etc)

Storage was free with coinbase, and transactions only cost a few bucks to buy/sell. It was based on a % on the amounts being bought/sold which was nice since I wasn’t putting in too much :)

Do you plan on making a big lump sum deposit into Baby Dime’s account to catch up significantly to Penny & Nickel? Obviously #3 will have more years between now and college, but it may well cost more than the older kiddos college, because we all know those prices just keep going up!

Either way, congrats on the move and being “ready but not that ready” for #3

Good question! Yes – we’ll probably throw in $5k-$6k to catch up, similarly how I did with #2 when he came out too… And then will have to remember to set up the $50/mo auto-deposits too – thanks for the reminder!

Sounds like an eventful month! I’m glad you and your family are settling in at the New place. Moving can be a lot of work.

You are sooo close to the 1M mark. The market is just doing some random dance here and there. You will join the million dollar club in no time.

I have money in crypto but….I only put in what I wont miss if I never see it again…. general rule of thumb, do not invest if you need that money for other things. I’m basically not taking it out unless its a life changing event (i.e. enough to pay off my house) but I’m sure if that ever happened it would take a long long time, more likely the scenario is, I lose money and withdrawal a pittance of what I could have had at the top… either way, I’m only putting in what I can stand to lose.

Yup – excellent way to go about it. And what I thought I was doing too since my Spavings money is pretty much FREE money and I wouldn’t miss it, only it turned out that I *would* miss it once it was in practice, haha…. oops.

Well, I finally crossed $400,000 this month, after three months of getting close and then getting farther away.

I got up to $410,000 before ending the month at $405,000.

Because it was Marchmas, I got $14,000 in additional cash (above my normal income), and I only finished the month up $12,000. So without Marchmas, I would have ended down $2,000.

The markets are up all my paychecks plus $2,000. I hope it can’t go down much farther. It’s like sports. It doesn’t have any impact on my daily life, but I still cheer for my team, and I hate when they lose.

Marchmass!! What is that – I want to join?!

Marchmas is like Christmas, but better. There’s no relatives, and all the gifts are in cash.

There’s tax refund, three paychecks, and my yearly performance pay.

Haha… that is better! :)

I over contributed to my IRA and recharacterized the extra amount as 2018 tax year. You probably could have done that too if you’re certain you won’t make as much income this year.

Our net worth went down a bit in March as well. It’s not that bad. Market volatility looks like it will continue. Oh well…

I did look into that, but from what I read you’re still penalized a bit on the earnings? Plus yeah – no idea what my income will be by the end of the year. I seem to be liking big moves here lately :)

Gees, J$ sells Rockstar and immediately becomes a Bitcoin Day Trader? Whoda thunk?? Great timing on the exit, tho. That Fire’s too hot for this guy. Great win with the $332 Spavings add, tho, and a fun little test. You should go in with 100% of your savings, you’ve got this Bitcoin thing figured out!

Stay away, J. Just. Stay. Away.

i do wish sometimes I was as ballsy as I used to be :) i’ve turned way too conservative in my old man/daddy age haha… I now collect coins as a hobby instead of hitting parties – what is going on???!

I dropped $10,000 into crypto. Today it’s down big (it’s worth $4,000) … that’s a buying opportunity, right?!

WOWWW is it really that low now?? That’s incredible… Like I said above, i give y’all mad respect for playing the long game on it :) I wish i could trick my brain into being okay with it as I really do think there’s a future in it…

I worded that poorly. My $10K investment is worth $4,000 (I’m down 60%). BTC is hovering around $7k or so.

Ahhhhh damn. Good thing you’re in it for the long haul :)

I love that you at least tried the bitcoin thing to get it out of your system. :) Nice spavings boost! Is the sex of baby #3 still a secret for you? Praying for a safe and wonderful delivery!

No longer a secret nope, my wife pretty much gave it away without meaning to give it away (or maybe she did mean to??? ;))

I have $100 in Bitcoin. Actually, it’s probably about $80 right. Only because of Ty at Camp FIRE Finance. It is THE WORST. I thought I was a white-knuckle investor before. Hahaha.

AND OMG THE BABY! Wishing your family the very best on arrival day and beyond. Yay for baby snuggles!

thank you!!! i shall upload pics once the day comes! don’t buy me anything until your bitcoin goes back to $100+ ;)

You only lose if you sell, Penny! ;) Hold on to that bitcoin!!

I “invested” about $300 in Coinbase on all 4 cryptocurrencies. It’s down now, but I’m just going to let it sit in there for the long-term. It may be a big win down the road or do nothing.. I just put in an amount I wasn’t too concerned if I lost. We’ll see what it does… BTW I feel your pain on the net worth. I hope this market correction is short lived.

Congrats on the little one whose on the way!!!

It did make me laugh to see you get in on Bitcoin because I knew your previous stance on it, but I am happy to see you got your itch out of the way hahaha. I had to talk an old buddy off the ledge recently when he told me he wanted to invest his entire savings in Bitcoin…

As much as I have been wanting the market to tank so that I can buy on the LOW, I have to admit…It is hard to watch in the short-term :/

HIS ENTIRE SAVINGS??? Wow… Some people like to go big or not at all i guess haha…

Love that you’re rounding third and heading towards the $1mn mark. Once this tariff stuff blows over and the market rebounds, you’ll be well on your way.

I’m surprised at the crypto investment. Was it more of an itch that had to be scratched or did you/do you think that there was some legitimate long-term value there? Glad that you got out with an extra couple of hundred!

A bit of both :) I read probably 30 articles on it over two months and had multiple discussions with my friend on it and what we liked, what we didn’t like, and then it got to the point where we got tired of researching and just wanted to start testing it out :) If it wasn’t for him i probably woudn’t have done it as it’s more fun to do with others sometimes, but i’m glad we did just so i can experience it. And he’s still very much invested and for the long haul! we both think there’s *something* there, but what it turns into neither of us have a clue… It would have been interesting though if we started the research now and snatched up stuff while it’s superrrrr low. Would i have cashed out if it were double or triple?? Emotions are a funny thing :)

Sounds like a great time to slow down on the project front, with the unexpected move and baby Dime about to arrive. Best of luck! No box of old coins, in the attic. I’ll check my basement. :)

Lucky you, my TSP was down big time last month by more than 16k. Ouch! Just today I decided to make changes to my fund distribution. Move 50% to G fund. It’s 50/50 G and C fund for me as of today.

oh wow!! you’re not afraid of a come back and not recouping as much?

if you lost $16k you must have a nice chunk :)

It has grown much better than I expected in the last 8 years.

RE: Cryptos. Last summer, I decided to put a little money into Cryptos. I put some money into Bitcoin, Ethereum and Litecoin. I invested $20 a pop through coinbase, once per paycheck. Then the climb happened, and I backed off. Near the peak for each of them, I sold a good portion of those assets. I didn’t sell everything, thinking I would hold onto some value in case it continued to rise. Eventually, on the downswing, I sold the remainder.

In the end, I sold enough to get my $200 back plus about $450 in profit. That hadn’t been my plan – my goal was to keep them for the long term. But more than doubling my money was too tempting, and especially after it started to drop, I thought I would cash out and buy more once it hits bottom.

I read MMM’s post about Bitcoin, and I kind of agree, but I look at it this way: Treat it like someone might gambling. Put in only what you are willing to lose, and NEVER treat it as a major asset. I also think a lot of reporting on cryptos is flawed and short-sighted — reporters talk about the drop in price like it’s the end of bitcoin and cryptos, but they forget it’s still up over last year’s prices, and even still somewhat above the prices when I bought last summer. It’s volatile, that’s for sure. But it most certainly isn’t “dead.”

yup yup!! excellent way of thinking about it. And something i apparently was wrong on myself with thinking I could be fine losing it all when in fact i wasn’t ;) that’s the thing with all this though – hardly anyone will “buy low” and then keep it forever as it quadruples and then some as it’s just so tempting to cash out and call it a win. Exactly why it drives me crazy when people say “I wish i had bought apple 20 years ago – i’d be rich by now!” — Only if you held tight the entire time, which is very unlikely!

That’s a good point, and definitely food for thought. My original plans were to hold on to these coins, on the presumption that on a very long term (or even not so long) the price would in aggregate climb over time (despite all the news about how cryptos are in the tank, BTC, ETH and LTC are all still significantly higher than they were a year ago, and still even higher than when I bought them last summer). In fact, if Apple shares shot up the way cryptos did, it might be wise to sell them off for a big time profit. (One big difference though – Apple would pay dividends, making them a decent investment even now.) I wouldn’t say I was sure, because of course no one could be sure, but I hedged my bets that the dramatic increase was a short term bubble that would burst, which it did. I first sold enough to pay back my original investment, and as the price continued to rise, I sold enough ensure a profit. I sold the rest on the downswing — less than I could have made had I sold at peak, but still much higher per coin than I had originally bought at (about double). I plan to buy again once they drop to around the price I originally bought them at. I do think over time they will increase, because of built in scarcity and especially because a coin like Ethereum has outside applications in micro-contracting that software developers are starting to incorporate. Most of my investment will be in ETH in the future because of this.

I think a lot of people succumbed to the “I wish I had…” with cryptocurrencies, inspiring a surge of buying after the price went high. It was too late. I cringed when I heard people taking out loans to buy cryptos. That’s like taking out a loan to play the slots in Vegas!

Ugh yeah – people are crazy man… If only they knew how much EASIER it was just to start saving and investing regularly!! They could have all the $$$$ they want if they just start now and stay patient!

I do like that you keep cashing out in waves to lock in initial investment, then profit, etc… Very smart way to do things :)

The funny thing is I was just talking with a friend last night, who does a little more speculative investing than I, who basically did the same thing with Facebook stock. I just stick with my Wealthfront index funds, myself. I know I can’t beat the market (cryptos aside lol).

You can’t do a Backdoor Roth IRA since you have the SEP IRA, but unless your wife has a Traditional IRA you aren’t disclosing to us, she should still be able to do a Backdoor Roth IRA!

ahhh interesting! she does not have any iras outside of the roth, no, haha… you know i show everything! :)

Great Post.. always looking forward to your posts..I am also planning to move some of my $$ to VTSAX

Backdoor IRA also has to be done by tax deadline? (apr 17)?

oh good! we love VTSAX here!

(no idea on the backdoor stuff though, sorry… still on my list to investigate)

I’m not interested in Bitcoin at the moment but it’s interesting to read about others experience. Great planning with the move!

Re overcontributing to the Roth:

I experienced the same thing this year. My preference was for it to remain a Roth, so my tax advisor suggested that I first recharacterize the $5500 as a traditional IRA, then convert it to a Roth. This sounds like a pain but it was achieved by two quick calls to Vanguard. They also recommended going forward that I contribute to a traditional first, then shortly after convert whatever amount to a Roth. That way there is not time for earnings to accrue which you have to pay taxes on. There is also the option to convert to a Roth and then repeat the process (recharacterize then convert) if need be, but then you pay taxes on earnings.

Good work!!! There could have been a better way for us to handle it too, but started getting nervous on the timing and everything else going on around me (moving, prepping for baby, etc) that i went with the simplest option and the one I was okay with :) I hate all this tax stuff so much, haha…

Congrats on the move! And so exciting, coming down to the wire on baking that baby!

I still need to do the research on the Backdoor IRA as well, I haven’t ironed out the details for myself yet but I would really like to figure that out this year. Apparently it’s enough number crunching that I’m procrastinating.

March was decent to us – we did a lot of stuff and survived the month pretty well, and it was even a decently inexpensive month. Which we of course immediately blew the first week of April :)

You gotta take the good with the bad, the markets are on sale which is good. But net worth looks bad, which it is not. Its all psychology or something in reverse. HAHA. Good job with the move, I think moving is hard, but fun in the end. New place new beginnings. Good luck

I think this is just a correction and not the start of a bear market. The economy continues to improve, which is a long term bullish factor for the stock market.

I would hope that is your stance with a blog name like that :)

I was always tempted to test the water with crypto but always got too scared and would bail every time. Nice gain you got!

Congrats and good luck with the newborn. My second one is coming in 5.5 months. Time really seems to fly…….I hope I will be just as ready but not that ready as you are :)

Early congrats to you too then! Two kids is SUCH a fun time, especially for your other kid who will now have a best friend and play buddy :) I was more excited for my boy than I was for myself having another! They love each other sooooo much!

Good to see you on the crypto train, at least for awhile J $, or should I call you J Bitcoin, or J Satoshi?? ;)

Nothing wrong with sticking to your traditional investments! I think fiat currency and crypt will coexist for quite some time. I’ve been through the ups and recently the downs. I am contemplating on “buying the dip” tonight actually!

Good time to buy if there was any :)

I haven’t been tempted to try BItcoin – but my nephew was. He’s in his 2nd year of university – away from home – and he took his money for 2nd term and invested in Bitcoin. You can imagine how his parents felt! When they found out, they got him to get right out again. He casually mentioned to me that he’d only lost $1,000. It could have been a lot worse.

All the best as you await baby #3. Looking forward to hearing the big announcement!

Wowww – now that’s gutsy! Though I’d still be pissed if he did it with any other investments too, even index funds :) Can’t mess around with education $$$!

Jay,

I have an entire set of Indian head cents all graded by NGC. Most are MS-63 & 64, I have one that is MS-67 and my rarest, key date is AU-59. I accumulated this entire set back in 1992-1995. I’ll need to get these appraised just to see if I’ve made any capital appreciation on this set at all. It was fun acquiring the coins, but I simply put them away and almost forgot about them.

NICE!!! Coin values have mostly gone up since them, so i’m sure you’ll be pleased with them :) Will you email me later and let me know what you find out? Would love to see a spreadsheet with the inventory! (I’d even make you famous over on CoinThrill.com – hah)

Awesome. Congrats on the kid and looks like not the worst month for NW. I am a long-time stalker, first time commenter. I appreciate the frank convo about funds. If only we were all like that, then there would be a lot less financial stress in the country. Although there would probably also be a major downturn in our debt-fueled economy as well. But whatever.

And I had the same itch as you this year as far as crypto. I bought about $1,000 for kicks and went NUTS watching it every day so I stopped. I also loved Coinbase, but now I just leave it there. It could be worth $10,000 or more likely $10. But I also believe in the idea of crypto long-term so who knows, maybe in 25yrs there will be a bit of extra something. Or, I will have forgot it ever existed. Either way, I gave it a shot.

Thanks for keeping us all motivated and our eyes on the prize! – FS

You’re just like 50 Cent then, only you actually DO own bitcoin :)

“Turns out 50 Cent isn’t a surprise bitcoin millionaire after all”

https://www.marketwatch.com/story/turns-out-50-cent-isnt-a-surprise-bitcoin-millionaire-after-all-2018-02-27

(Thanks for coming out of hiding and saying hello, btw!!)

I got $5 worth of bitcoin several years ago for downloading some app. Since the money was free it has been fun to watch it bounce around. Heck even if it went to zero I am still out nothing.

heyyyy that’s cool! how much bitcoin did $5 represent back then?

I bought some crypto back in August – I think it’s pretty cool, but now I’m sitting here waiting for the next leg up.

I love me some Litecoin personally, and it’s fascinating how it is growing each day. It will be very interesting to see how banks work around, with, or fight these things!

You still have too much sh*t going on.

Hugs!

Cubert

Now that you have your recharacterized Roth contributions, it might be time to start your taxable VTSAX account. Dividends and Capital Gains are taxed at a lower rate than earned income.

It’s def. on my consideration list! Not going to want to keep holding this much cash long term for sure…. just enjoying it for a bit longer :)

Long-time reader, first time commenter!

Just wanted to say thanks for your ten years of NW updates! Heading towards FI is a long road, and it’s nice to see others on the ups and downs too :)

And good luck with your new tiny person!

Hey thanks! Really appreciate you taking the time to say so :) Hope your journey is going well too!

Do you have any thoughts on filing taxes for the money you gained for selling your cryptos? Imagine a lot of people are in the same boat as you.

Oh, yeah – i’m totally reporting it during the next tax season. Anytime you make profit on this sorta stuff you’re supposed to (although of course not everyone always does ;)). It’s possible that CoinBase reports it as well, but I never take any chances as I like my life as smooth as possible.. Great question though :)

Second Cubert – you still have loads of $hit going on! I think I learned about the Raptitude Depth Year article from your site… and I was like “YES! That makes SO MUCH SENSE”.

1 month later, I’m like “also, this year I should start a blog, learn Spanish, and DO ALL THE THINGS”.

It’s tough for hustlers to slow down, I guess ;)

Depth Year – yes!! Killer article and mentality!

Interestingly enough I actually DO feel like I’m still going down that path since Budgets Are Sexy is still my only major project going on (and coin collecting my only main hobby), but you’re right that I/we like to dabble around in life despite trying to keep the blinders on :) I feel like if you’re chasing stuff that you’re super interested/passionate about though and don’t *overdo* it (i.e. add stress to your life) then it can still fit in nicely w/ depth years… You can’t just focus on one thing with every waking hour :)

I’m just excited that I paid taxes and it was way less than I thought it would be. After inheriting the farm shares and farm land I expected a crazy amount of taxes to be owed.This was also my first experience with starting to pay quarterly taxes so I just did my first payment of those. We get to put money into our Roth this year but the wife just got a new teaching job at another school district and we’ll be earning 10k more a year so we’ll have to wait on 2018 contributions.

Farm land! Very cool! Is your family actually farming on it or renting it out to others? What is that world like?

Just got back from a 11-day Caribbean cruise, my first vacation in 3 years and the first big vacation that did NOT go on credit! Everything cash, so yay me! I always felt like most people do in January after getting the Christmas bills, and that is no way to feel after a vacation. Now to plan and save for the next one…..maybe Iceland.

After attempting to do my own taxes (hahahaha! Maniacal laugh!), I outsourced them yet again and I’m glad I did, because she found a mistake someone else made on *last* year’s taxes and after we file and amended return, I’m looking at an additional $800 back from Uncle Sam for an overfunded HSA penalty that I shouldn’t have had.

That was the good stuff. Bad stuff: it appears I’m no longer eligible for a mortgage even though I’ve been doing everything right. It’s a blessing in disguise, though. I feel like it freed up my options considerably. I’ve been under a lot of pressure to buy (buy! Buy! BUY!!) and now that I can’t, well…less stress. Shifting my search to a decent, reasonably-priced rental.

Good luck and blessings on the upcoming baby!

You’re the third person to mention the pressure of buying a home to me this week – why are people so adamant of pushing this stuff on us?? Weird that you’re not eligible now (though not sure I know what you mean? Like for getting a good/particular mortgage?), but I’m glad you’re feeling relieved :) Nothing wrong with renting AT ALL if that makes you feel more comfortable and secure… Let others live their lives, and we’ll live ours! The world will not end!

So….I talked to a mortgage guy at a bank and he pulled my credit. Two of my three scores came back as “not enough current information to calculate a score.” Basically, they zeroed out, he said. I had never heard of this as an outcome of having no lines of credit, loans, etc. I thought the score just kept slowly going down. I have not yet gotten a second opinion….and frankly I may not. Again, blessing in disguise. The third score was 767. My score a year ago was 790. 790 to zero in a year. =0 I’m currently working to establish and maintain healthy lines of credit to get back to (or surpass?!?!) that 790.

The thing that bothers me is I did everything right. In order to get a good mortgage rate, I didn’t open any new lines of credit. This is what I read in every source I checked and the advice everyone gave me – even when I said I didn’t currently HAVE any lines of credit. They said “if anything, that will look good for you. You have no debt!” Apparently not the case?

Ugh, I know…. the ones avoiding debt altogether get screwed with scores because they like seeing lots of action going on! What I’ve just done is left allll my credit lines opened (and jacked the max limits up high so my utilization rates look super good), and then that’s pretty much it. Outside of paying $hit on time and what not… It really is a messed up way of tracking stuff, though of course the only times you need high scores is when you’re about to take on debt (like a house! the biggest one!). I think you should just save it all up and then walk into closing with a briefcase full of cash :) That would be baller.